|

市場調查報告書

商品編碼

1885876

植物-動物混合蛋白系統市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Hybrid Plant-Animal Protein System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

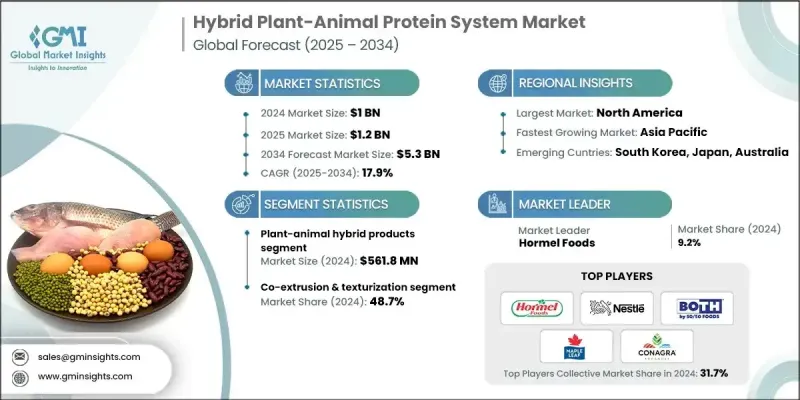

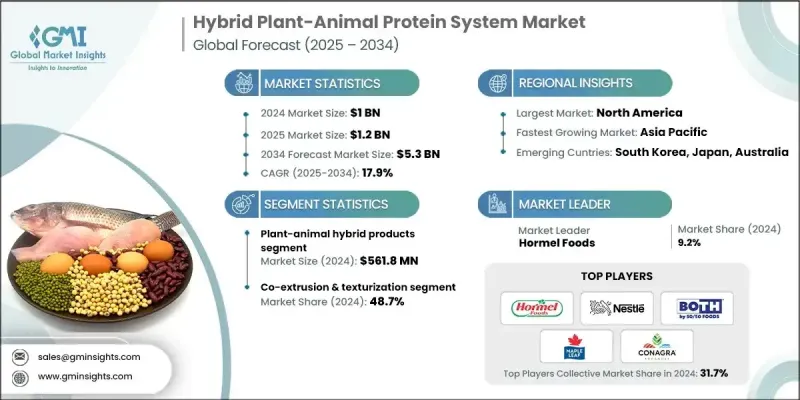

2024 年全球植物-動物混合蛋白系統市場價值為 10 億美元,預計到 2034 年將以 17.9% 的複合年成長率成長至 53 億美元。

這個市場的核心是混合蛋白系統,它將植物蛋白與動物性成分結合,旨在為未來的食品供應需求創造營養均衡、環境友善且可擴展的蛋白質來源。全球人口的成長和日益嚴峻的糧食安全壓力持續推動著人們對混合蛋白形式的興趣。世界各國政府都在推廣更環保的食品生產方式,以推動氣候目標,這進一步強化了對創新蛋白質解決方案的需求。消費者越來越傾向於靈活的飲食模式,減少肉類攝入,同時仍食用動物性產品,這使得混合蛋白成為頗具吸引力的折衷方案。目前,北美憑藉其先進的製造能力和監管支持,在混合蛋白的推廣應用方面處於領先地位;而亞太地區則在收入成長、城市生活方式轉變以及對永續發展挑戰日益增強的意識的推動下,正經歷著快速成長。消費者對兼具營養、感官享受和環境效益的食品的日益成長的需求,正引導著製造商致力於開發能夠提高效率、減少資源依賴並保持消費者熟悉度的混合蛋白創新產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 10億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 17.9% |

2024年,植物-動物雜交產品市場規模預計將達到5.618億美元。該市場佔據強勁地位,因為雜交產品配方靈活,能夠滿足消費者對永續性的需求,同時又不犧牲產品原有風味和口感。研發和加工技術的顯著進步正在提升雜交蛋白產品的感官和營養價值,使其在各類食品領域中廣泛應用。

到了2024年,共擠出和組織化流程佔48.7%的市場。這些加工方法之所以引領市場,是因為它們能夠生產出纖維狀、類似肉類的質地,並能高度還原傳統蛋白質的結構。它們能夠將植物性蛋白質和動物性蛋白質整合到具有凝聚力的高品質混合產品中,從而提升產品的感官表現。這些工藝的可擴展性以及對多成分配方的適用性,使其成為大規模生產商的首選技術。

預計2025年至2034年間,北美混合植物-動物蛋白系統市場將以17.9%的複合年成長率成長。消費者對永續採購、透明度和符合道德規範的食品生產的日益關注,推動了對兼具動物蛋白營養密度和植物蛋白環境優勢的混合產品的需求成長。彈性素食主義的興起以及消費者對天然、清潔標籤產品的偏好,促使企業不斷改進混合配方,以提升產品的風味、口感和功能性。

混合植物-動物蛋白系統市場的主要參與者包括嘉吉、ITC有限公司、楓葉食品、康尼格拉食品、JBS、泰森食品、Momentum Foods、Vion Food Group、Rugenwalder Muhle、50/50 Foods, Inc.、雀巢和荷美爾食品。各公司正透過擴大研發投入、推動加工技術以及與原料供應商和食品製造商建立策略聯盟,來鞏固其在混合植物-動物蛋白系統市場的地位。許多公司正在開發新一代的組織化和混合技術,以改善口感、營養均衡並確保產品品質的穩定性。對消費者研究的投入有助於公司根據不同地區的飲食偏好和永續發展需求,調整混合產品。製造商也在拓展產品組合,將混合產品納入肉類替代品、即食食品和零食等類別。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 全球蛋白質需求不斷成長及糧食安全問題

- 消費者轉向彈性素食和減量素食

- 永續發展與氣候變遷減緩目標

- 產業陷阱與挑戰

- 高昂的生產成本與溢價挑戰

- 消費者的懷疑與接受障礙

- 市場機遇

- 食品製造商的B2B配料系統

- 人工培育的肉類-植物雜交商業化

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 植物-動物雜交產品

- 人工培育的肉類-植物雜交產品

- 真菌蛋白-動物雜交產品

- 昆蟲-植物雜交產品

- 微生物發酵-動物雜交產品

- 其他

第6章:市場估算與預測:依生產流程分類,2021-2034年

- 主要趨勢

- 共擠出和紋理化

- 發酵

- 酵素修飾

- 其他

第7章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 全肌肉類似物混合物

- 牛排和菲力牛排的替代品

- 肉排和肉塊形式

- 其他

- 研磨/切碎的混合產品

- 漢堡肉餅

- 香腸和香腸串

- 肉丸和碎屑

- 其他

- 加工混合產品

- 雞塊和雞柳

- 成型肉餅和肉排

- 條狀和塊狀

- 其他

- 成分混合系統

- 蛋白質分離物和濃縮物

- 組織化植物蛋白(TVP)混合物

- 功能性蛋白質成分

- 其他

- 即食混合餐

- 冷凍食品形式

- 冷藏預製餐

- 常溫保存選項

- 餐點套裝

- 其他

- 其他

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- 50/50 Foods, Inc

- Cargill

- Conagra Brands

- Hormel Foods

- ITC Limited

- JBS

- Maple Leaf Foods

- Momentum Foods

- Nestle SA

- Rugenwalder Muhle

- Tyson Foods

- Vion Food Group

The Global Hybrid Plant-Animal Protein System Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 17.9% to reach USD 5.3 billion by 2034.

This market centers on blended protein systems that integrate plant proteins with animal-derived components to create nutritionally balanced, environmentally conscious, and scalable protein sources for future food supply needs. Growing global population levels and rising pressure on food security continue to push interest in hybrid protein formats. Governments around the world are promoting greener food production practices to advance climate goals, reinforcing demand for innovative protein solutions. Consumers are increasingly adopting flexible eating patterns that reduce meat intake while still incorporating animal-based products, making hybrid proteins an appealing compromise. North America currently leads adoption due to its advanced manufacturing capabilities and regulatory support, while Asia Pacific is witnessing rapid growth driven by higher incomes, urban lifestyle shifts, and rising awareness of sustainability challenges. This growing openness toward foods that balance nutrition, sensory appeal, and environmental benefits is steering manufacturers toward hybrid protein innovations that improve efficiency, reduce resource dependency, and maintain consumer familiarity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 17.9% |

The plant-animal hybrid products segment generated USD 561.8 million in 2024. This segment holds a strong position because hybrid offerings provide adaptable formulations and resonate with consumers who want sustainability without sacrificing recognizable flavors and textures. Substantial advancements in research and processing technologies are enhancing the organoleptic and nutritional attributes of hybrid protein options, allowing them to gain traction across diverse food categories.

The co-extrusion and texturization processes segment accounted for a 48.7% share in 2024. These processing methods lead the market due to their ability to produce fibrous, meat-like textures that closely replicate traditional protein structures. Their capability to integrate plant and animal proteins into cohesive, high-quality hybrid formats supports better sensory performance. The scalability of these processes and suitability for multi-ingredient formulations make them preferred techniques for manufacturers operating at large production volumes.

North America Hybrid Plant-Animal Protein System Market is forecast to grow at a CAGR of 17.9% between 2025 and 2034. Rising consumer interest in sustainable sourcing, transparency, and ethical food production is prompting greater demand for hybrid products that combine the nutritional density of animal proteins with the environmental advantages of plant proteins. Flexitarian dietary habits and increasing preference for natural, clean-label products are encouraging companies to refine hybrid formulations that offer improved flavor, texture, and functional benefits.

Major players in the Hybrid Plant-Animal Protein System Market include Cargill, ITC Limited, Maple Leaf Foods, Conagra Brands, JBS, Tyson Foods, Momentum Foods, Vion Food Group, Rugenwalder Muhle, 50/50 Foods, Inc., Nestle S.A., and Hormel Foods. Companies are strengthening their presence in the Hybrid Plant-Animal Protein System Market by expanding R&D initiatives, advancing processing technologies, and forming strategic alliances with ingredient suppliers and food manufacturers. Many firms are developing next-generation texturization and blending techniques to achieve improved taste, nutritional balance, and consistent product quality. Investments in consumer research help companies tailor hybrid offerings to meet regional dietary preferences and sustainability expectations. Manufacturers are also diversifying their product portfolios to include hybrid options across meat alternatives, ready meals, and snack categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Production process trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global protein demand & food security concerns

- 3.2.1.2 Consumer shift toward flexitarian & reducetarian diets

- 3.2.1.3 Sustainability & climate change mitigation goals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & price premium challenges

- 3.2.2.2 Consumer skepticism & acceptance barriers

- 3.2.3 Market opportunities

- 3.2.3.1 B2B ingredient systems for food manufacturers

- 3.2.3.2 Cultivated meat-plant hybrid commercialization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Plant-animal hybrid products

- 5.3 Cultivated meat-plant hybrid products

- 5.4 Mycoprotein-animal hybrid products

- 5.5 Insect-plant hybrid products

- 5.6 Microbial fermentation-animal hybrid products

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Production Process, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Co-extrusion & texturization

- 6.3 Fermentation

- 6.4 Enzymatic modification

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Whole muscle analog hybrids

- 7.2.1 Steak & fillet analogs

- 7.2.2 Cutlet & chop formats

- 7.2.3 Others

- 7.3 Ground / minced hybrid products

- 7.3.1 Burger patties

- 7.3.2 Sausages & links

- 7.3.3 Meatballs & crumbles

- 7.3.4 Others

- 7.4 Processed hybrid products

- 7.4.1 Nuggets & tenders

- 7.4.2 Formed patties & cutlets

- 7.4.3 Strips & bites

- 7.4.4 Others

- 7.5 Ingredient hybrid systems

- 7.5.1 Protein isolates & concentrates

- 7.5.2 Texturized vegetable protein (TVP) blends

- 7.5.3 Functional protein ingredients

- 7.5.4 Others

- 7.6 Ready-to-eat hybrid meals

- 7.6.1 Frozen meal formats

- 7.6.2 Refrigerated prepared meals

- 7.6.3 Shelf-stable options

- 7.6.4 Meal kit

- 7.6.5 Others

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 50/50 Foods, Inc

- 9.2 Cargill

- 9.3 Conagra Brands

- 9.4 Hormel Foods

- 9.5 ITC Limited

- 9.6 JBS

- 9.7 Maple Leaf Foods

- 9.8 Momentum Foods

- 9.9 Nestle S.A.

- 9.10 Rugenwalder Muhle

- 9.11 Tyson Foods

- 9.12 Vion Food Group