|

市場調查報告書

商品編碼

1766270

植物蛋白加工設備市場機會、成長動力、產業趨勢分析及2025-2034年預測Plant-Based Protein Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

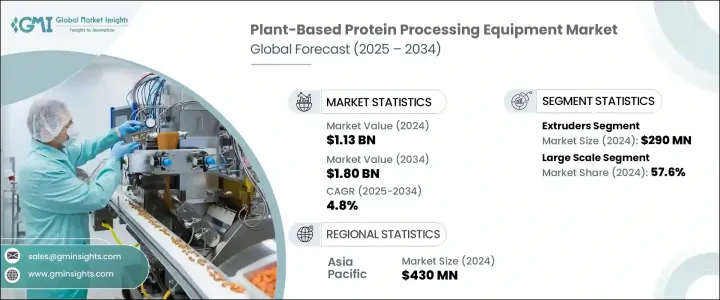

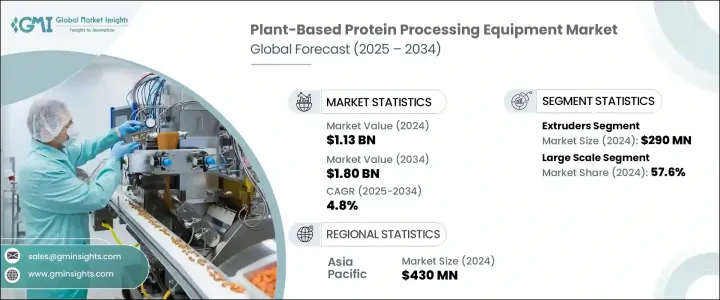

2024年,全球植物蛋白加工設備市場規模達11.3億美元,預計2034年將以4.8%的複合年成長率成長,達到18億美元。消費者行為向植物性飲食、健康生活方式和永續發展的轉變,正在推動對植物性食品的需求,並推動從豆類和穀物中提取功能性蛋白質的技術的投資。隨著食品生產商擴大經營規模,他們正在尋求能夠提供高效、產品一致性和營養完整性的設備。這些趨勢促使製造商採用專門的系統,以滿足不同蛋白質來源不斷變化的加工需求。

消費者對肉類替代品日益成長的興趣也影響著生產能力的擴張,尤其是在全球市場。然而,儘管潛力不斷成長,但由於建立和維護商業規模工廠需要大量的資本投入,該行業仍然面臨挑戰。擠壓、乾燥、發酵和組織化等製程需要符合嚴格衛生和安全標準的精密機械。對於規模較小的公司來說,購買、安裝和升級這些設備的成本往往成為一大障礙。在發展中地區,獲得資金支持和監管基礎設施的管道有限,進一步加劇了新進業者和新興企業面臨的挑戰。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11.3億美元 |

| 預測值 | 18億美元 |

| 複合年成長率 | 4.8% |

擠壓系統細分市場在2024年佔據最大佔有率,收入達2.9億美元。這些系統對於塑造各種食品應用中使用的組織化植物蛋白及其類似物至關重要。它們將大豆、小麥和豌豆蛋白加工成能夠複煞車物性食品質地和口感的產品。擠壓機能夠同時處理高水分和低水分擠壓工藝,適用於各種植物性食品應用,包括零食、肉餅和富含蛋白質的產品。其多功能性和高生產效率使其成為現代加工生產線的核心零件。

2024年,大規模生產佔了57.6%的市場。這一成長反映了消費者對植物蛋白需求的成長,以及由此給生產商帶來的在工業規模下穩定產出的壓力。主要製造商正在升級其設施,採用先進設備,例如高容量乾燥機、均質機、分離機和擠出機。這些投資有助於提高產量,減少人工勞動,並確保不同生產批次的一致性。高產出系統對於支援需要可靠供應鏈來供應各種蛋白質產品的大型品牌和零售商至關重要。

2024年,亞太地區植物蛋白加工設備產業產值達4.3億美元,佔38%的市佔率。該地區受益於植物蛋白的文化盛行和強勁的農業產量。亞太地區各國長期以來的飲食習慣都包含大豆和豆科植物製品,為植物性創新的採用奠定了堅實的基礎。快速的工業化、人口驅動的食品需求以及對永續性日益成長的關注,共同支撐著該地區加工設備的成長。政府的積極支持以及旨在促進食品創新和蛋白質採購自給自足的新舉措,正在進一步加速該地區市場的發展。

植物蛋白加工設備產業的主要參與者包括 Equinom、Clextral SAS、Hosokawa Micron BV、Alfa Laval、Netzsch-Feinmahltechnik GmbH、Flottweg SE、Bep International LLC、SPX FLOW Inc、Lyco Manufacturing、Koch Separation、ex International LLC、SPX FLOW Inc、Lyco Manufacturing、Koch Separation、exANDRITZ AG、Glater Group、Huht GroupHeler Group、Huhers Group、HANDRITZ。為了擴大市場佔有率,該領域的公司優先考慮對研發和先進自動化技術的策略性投資。許多公司正在與食品生產商和新創公司建立合作夥伴關係,共同開發符合新產品創新的客製化加工解決方案。全球製造商也正在透過在地化生產中心和服務網路擴大其在新興經濟體的影響力。為了滿足需求的可擴展性,領先的公司正在推出模組化、節能的系統,以靈活地處理各種植物蛋白。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 植物性食品需求不斷成長

- 各種食品中植物性蛋白質的採用

- 專注於替代蛋白質的新創企業的成長

- 產業陷阱與挑戰

- 初始資本投入高

- 擴大生產的複雜性

- 機會

- 供應鏈最佳化

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按應用

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 臥螺離心機和離心機

- 研磨機和破碎機

- 烘乾機

- 擠出機

- 過濾系統

- 包裝系統

- 其他

第6章:市場估計與預測:依生產能力,2021 年至 2034 年

- 主要趨勢

- 中小型

- 大規模

第7章:市場估計與預測:按蛋白質類型,2021 年至 2034 年

- 主要趨勢

- 大豆蛋白

- 豌豆蛋白

- 小麥蛋白

- 鷹嘴豆蛋白

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 粉末

- 分離株

- 濃縮物

- 組織化產品

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Alfa Laval

- ANDRITZ AG

- Bepex International LLC

- Buhler Group

- Clextral SAS

- Coperion GmbH

- Equinom

- Flottweg SE

- GEA Group

- Glatt Group

- Hosokawa Micron BV

- Koch Separation Solutions

- Lyco Manufacturing

- Netzsch-Feinmahltechnik GmbH

- SPX FLOW Inc

The Global Plant-Based Protein Processing Equipment Market was valued at USD 1.13 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 1.8 billion by 2034. Shifts in consumer behavior toward plant-forward diets, health-conscious living, and sustainability are fueling demand for plant-based foods, driving investment in technologies that extract functional proteins from legumes and grains. As food producers scale up their operations, they're seeking equipment capable of delivering efficiency, product consistency, and nutritional integrity. These trends are encouraging manufacturers to adopt specialized systems that meet the evolving processing requirements of diverse protein sources.

Increased consumer interest in meat alternatives is also influencing the expansion of manufacturing capabilities, particularly across global markets. However, despite the growing potential, the industry continues to face challenges due to the substantial capital investment needed to establish and maintain commercial-scale plants. Processes like extrusion, drying, fermentation, and texturization demand precision-engineered machinery that complies with strict hygiene and safety standards. For smaller companies, the costs associated with purchasing, installing, and upgrading this equipment often become a major hurdle. In developing regions, limited access to financial support and regulatory infrastructure further intensifies the challenge for new entrants and emerging firms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.13 Billion |

| Forecast Value | $1.8 Billion |

| CAGR | 4.8% |

Extrusion systems segment accounted for the largest share in 2024, with revenue of USD 290 million. These systems are essential in shaping textured plant proteins and analogs used in a variety of food applications. They process soy, wheat, and pea proteins into products that replicate the texture and mouthfeel of animal-based foods. With the ability to handle both high- and low-moisture extrusion methods, extruders provide adaptability for a wide array of plant-based food applications including snacks, patties, and protein-enriched products. Their versatility and production efficiency make them a core part of modern processing lines.

In 2024, the large-scale segment held 57.6% share. This growth reflects increased consumer demand for plant-derived proteins and the resulting pressure on producers to deliver consistent output at industrial volumes. Major manufacturers are upgrading their facilities with advanced equipment such as high-capacity dryers, homogenizers, separators, and extruders. These investments help enhance throughput, reduce manual labor, and ensure uniformity across production batches. High-output systems are vital in supporting large brands and retailers that require reliable supply chains for a wide range of protein-based products.

Asia Pacific Plant-Based Protein Processing Equipment Industry generated USD 430 million and held 38% share in 2024. The region benefits from both the cultural prevalence of plant proteins and strong agricultural output. Countries across Asia Pacific have long-standing dietary habits that incorporate soy and legume-based products, creating a solid base for the adoption of plant-based innovations. Rapid industrialization, combined with population-driven food demand and growing concerns about sustainability, are supporting the growth of processing equipment across this region. Favorable government support and new initiatives aimed at food innovation and self-sufficiency in protein sourcing are further accelerating market development in this region.

Major players in the Plant-Based Protein Processing Equipment Industry include Equinom, Clextral SAS, Hosokawa Micron B.V, Alfa Laval, Netzsch-Feinmahltechnik GmbH, Flottweg SE, Bepex International LLC, SPX FLOW Inc, Lyco Manufacturing, Koch Separation Solutions, ANDRITZ AG, Glatt Group, Coperion GmbH, GEA Group, and Buhler Group. To expand their market presence, companies in this space are prioritizing strategic investments in R&D and advanced automation technologies. Many are forming partnerships with food producers and startups to co-develop customized processing solutions that align with new product innovations. Global manufacturers are also increasing their footprint in emerging economies through localized production hubs and service networks. To meet demand scalability, leading firms are launching modular, energy-efficient systems that offer flexibility in handling various plant proteins.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for plant-based foods

- 3.2.1.2 Adoption of plant-based protein in various food products

- 3.2.1.3 Growth of startups focused on alternative proteins

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Complexity in scaling production

- 3.2.3 Opportunities

- 3.2.4 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By application

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Decanter and centrifuges

- 5.3 Grinders and crushers

- 5.4 Dryers

- 5.5 Extruders

- 5.6 Filtration systems

- 5.7 Packaging systems

- 5.8 Others

Chapter 6 Market Estimates and Forecast, By Production Capacity, 2021 – 2034 (USD Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Small and medium scale

- 6.3 Large scale

Chapter 7 Market Estimates and Forecast, By Protein Type, 2021 – 2034 (USD Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Soy protein

- 7.3 Pea protein

- 7.4 Wheat protein

- 7.5 Chickpea protein

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Powder

- 8.3 Isolates

- 8.4 Concentrates

- 8.5 Texturized products

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Alfa Laval

- 11.2 ANDRITZ AG

- 11.3 Bepex International LLC

- 11.4 Buhler Group

- 11.5 Clextral SAS

- 11.6 Coperion GmbH

- 11.7 Equinom

- 11.8 Flottweg SE

- 11.9 GEA Group

- 11.10 Glatt Group

- 11.11 Hosokawa Micron B.V

- 11.12 Koch Separation Solutions

- 11.13 Lyco Manufacturing

- 11.14 Netzsch-Feinmahltechnik GmbH

- 11.15 SPX FLOW Inc