|

市場調查報告書

商品編碼

1885856

工業碳權市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Industrial Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

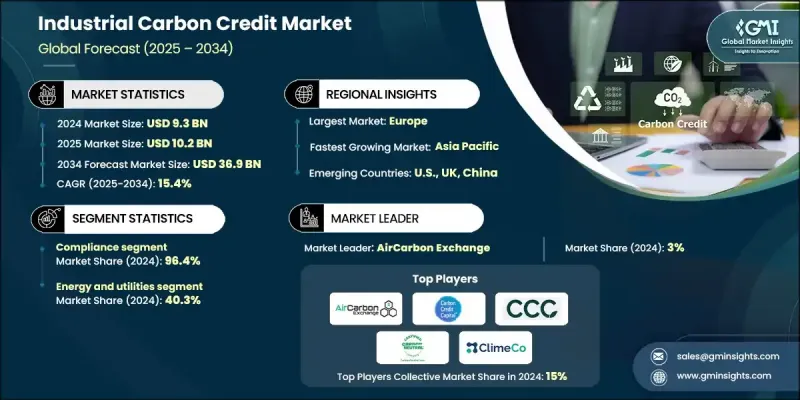

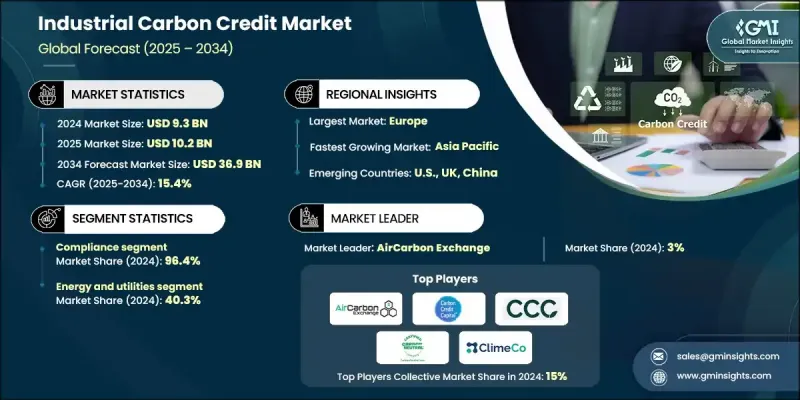

2024 年全球工業碳權市場價值為 93 億美元,預計到 2034 年將以 15.4% 的複合年成長率成長至 369 億美元。

全球氣候政策日益收緊和主要的國際氣候協議下各項機制的不斷完善,共同塑造了經濟成長。這些政策發展正在強化合規要求,明確核查程序,並鼓勵大型工業排放企業更積極參與跨國碳權交易。隨著企業努力實現國家和內部淨零排放承諾,碳權正成為企業氣候策略的核心組成部分。化學、水泥和鋼鐵等難以脫碳的產業越來越依賴碳權來應對現有技術尚無法消除的排放。投資者、客戶和監管機構對環境、社會和治理(ESG)期望的不斷提高,進一步凸顯了對可信、高誠信度碳權的需求。隨著新標準強調可衡量、額外且可核查的減排措施,以支持環境完整性並降低合規市場和自願市場的採用風險,市場信心持續增強。隨著各行業將長期轉型計劃與這些要求相協調,市場將受益於更穩定的基礎和不斷擴大的全球參與。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 93億美元 |

| 預測值 | 369億美元 |

| 複合年成長率 | 15.4% |

受旨在超越標準排放規定的企業推動,自願性工業碳權市場預計到2034年將以17.6%的複合年成長率成長。企業氣候計畫正利用自願性碳權來履行更廣泛的永續發展承諾,尤其是在直接減排措施仍然有限的領域。

2024年製造業佔25.4%,預計2034年將以16.3%的複合年成長率成長。其廣泛的排放足跡涵蓋汽車、電子、紡織和各種生產行業,使得碳權成為滿足監管和企業脫碳要求的重要工具。

2024年,美國工業碳權市場規模達12億美元。市場活動受到聯邦激勵措施、各州不同的碳排放計劃以及企業永續發展項目鼓勵的積極自願參與的影響。該地區受益於完善的二氧化碳運輸網路、巨大的地質封存潛力以及對碳管理技術的大量公共投資。

全球工業碳權市場的主要參與者包括Verra、Gold Standard Foundation、Climate Impact Partners、CarbonNeutral、AirCarbon Exchange、Carbon Credit Capital、Sylvera、ClimateTrade CarbonCredits、ClimateCare、Natural Capital Partners、South Pole、EcoAct、CarbonBlue、Clime、ClimateCare、Natural Capital Partners、South Pole、EcoAct、CarbonBlue、ClimeCo、Pachama、Mhotal Technologies、Coshotal、Mhotaal、CoalZ、Mhotal Technologies、Cosal、Mhotal,al Zal、Mhotal、Mhotal,alal、Mhotal、Mhotal、Mhotal、Mhotal、Mhotal、Mhotal、Mhotal、Mhotal,alal、Mhotal、Mhotal CarbonX Solutions Pvt Ltd。工業碳權市場的企業正透過投資驗證技術、擴展數位化監測平台以及開發符合新興全球標準的高誠信度信用組合來增強其競爭優勢。許多公司正與專案開發商建立合作關係,以確保長期供應,同時將信用類別多元化,涵蓋林業、再生能源、碳移除和工業減排等領域。領先的機構也在採用人工智慧驅動的驗證工具,以提高透明度並加快認證進程。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

- 新興機會與趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 策略舉措

- 競爭性標竿分析

- 戰略儀錶板

- 創新與技術格局

第5章:市場規模及預測:依類型分類,2021-2034年

- 主要趨勢

- 自願

- 遵守

第6章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 製造業

- 能源與公用事業

- 水泥與鋼鐵

- 化工及石油化工

- 其他

第7章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 丹麥

- 挪威

- 法國

- 瑞典

- 英國

- 亞太地區

- 中國

- 日本

- 印度

- 紐西蘭

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 阿根廷

- 智利

第8章:公司簡介

- AirCarbon Exchange

- Carbon Credit Capital

- Carbon Credits Consulting

- CarbonBlue

- CarbonNeutral

- Climate Impact Partners

- ClimateCare

- ClimateTrade CarbonCredits

- ClimeCo

- Core CarbonX Solutions Pvt Ltd

- Earthshot Labs

- EcoAct

- Gold Standard Foundation

- Mission Zero Technologies

- Natural Capital Partners

- Pachama

- South Pole

- Sylvera

- Terrapass

- Verra

The Global Industrial Carbon Credit Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 15.4% to reach USD 36.9 billion by 2034.

Growth is shaped by the tightening of global climate policies and the expanding implementation of mechanisms under major international climate agreements. These policy developments are strengthening compliance requirements, clarifying verification procedures, and encouraging large industrial emitters to participate more actively in cross-border credit trading. Carbon credits are becoming a central component of corporate climate strategies as companies work toward national and internal net-zero commitments. Hard-to-decarbonize industries including chemicals, cement, and steel are increasingly dependent on credits to address emissions that cannot yet be eliminated through existing technologies. Rising ESG expectations from investors, customers, and regulatory bodies further reinforce the need for credible, high-integrity credits. Market confidence continues to improve as new standards emphasize measurable, additional, and verifiable reductions that support environmental integrity and reduce adoption risk across both compliance and voluntary markets. As industries align long-term transition plans with these requirements, the market benefits from a more stable foundation and expanding global participation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $36.9 Billion |

| CAGR | 15.4% |

The voluntary industrial carbon credit segment is expected to grow at a CAGR of 17.6% through 2034, driven by organizations aiming to exceed standard emissions mandates. Corporate climate programs are using voluntary credits to address broader sustainability commitments, especially in areas where direct mitigation remains limited.

The manufacturing sector held a 25.4% share in 2024 and is projected to grow at a 16.3% CAGR through 2034. Its broad emissions footprint spanning automotive, electronics, textiles, and various production industries makes carbon credits an important tool for meeting regulatory and corporate decarbonization requirements.

U.S. Industrial Carbon Credit Market generated USD 1.2 billion in 2024. Market activity is influenced by federal incentives, diverse state-level carbon initiatives, and strong voluntary participation encouraged by corporate sustainability programs. The region benefits from established CO2 transport networks, significant geological storage potential, and considerable public investment in carbon management technologies.

Major participants in the Global Industrial Carbon Credit Market include Verra, Gold Standard Foundation, Climate Impact Partners, CarbonNeutral, AirCarbon Exchange, Carbon Credit Capital, Sylvera, ClimateTrade CarbonCredits, ClimateCare, Natural Capital Partners, South Pole, EcoAct, CarbonBlue, ClimeCo, Pachama, Earthshot Labs, Terrapass, Carbon Credits Consulting, Mission Zero Technologies, and Core CarbonX Solutions Pvt Ltd. Companies in the Industrial Carbon Credit Market are strengthening their competitive positions by investing in verification technologies, expanding digital monitoring platforms, and developing high-integrity credit portfolios that meet emerging global standards. Many firms are forming partnerships with project developers to secure long-term supply while diversifying credit categories across forestry, renewable power, carbon removal, and industrial abatement. Leading organizations are also adopting AI-driven validation tools to improve transparency and accelerate certification timelines.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.1.1 Business trends

- 2.1.2 Type trends

- 2.1.3 End use trends

- 2.1.4 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 Environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic initiatives

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Manufacturing

- 6.3 Energy & utilities

- 6.4 Cement & steel

- 6.5 Chemical & petrochemical

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Denmark

- 7.3.2 Norway

- 7.3.3 France

- 7.3.4 Sweden

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 New Zealand

- 7.5 Middle East & Africa

- 7.5.1 UAE

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Argentina

- 7.6.2 Chile

Chapter 8 Company Profiles

- 8.1 AirCarbon Exchange

- 8.2 Carbon Credit Capital

- 8.3 Carbon Credits Consulting

- 8.4 CarbonBlue

- 8.5 CarbonNeutral

- 8.6 Climate Impact Partners

- 8.7 ClimateCare

- 8.8 ClimateTrade CarbonCredits

- 8.9 ClimeCo

- 8.10 Core CarbonX Solutions Pvt Ltd

- 8.11 Earthshot Labs

- 8.12 EcoAct

- 8.13 Gold Standard Foundation

- 8.14 Mission Zero Technologies

- 8.15 Natural Capital Partners

- 8.16 Pachama

- 8.17 South Pole

- 8.18 Sylvera

- 8.19 Terrapass

- 8.20 Verra