|

市場調查報告書

商品編碼

1822609

再生能源碳權市場機會、成長動力、產業趨勢分析及2025-2034年預測Renewable Energy Carbon Credit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

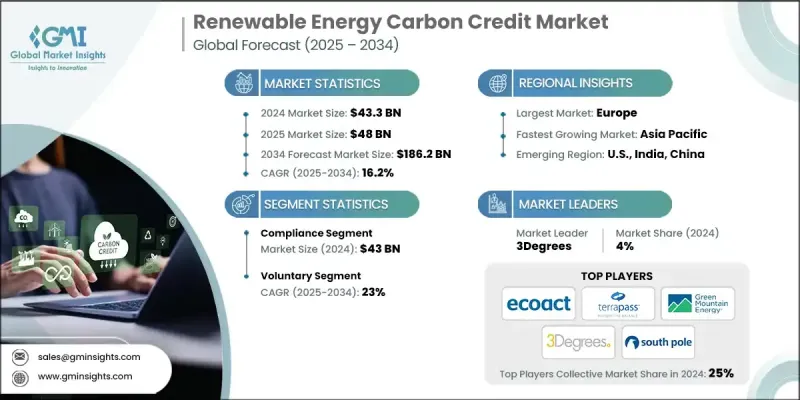

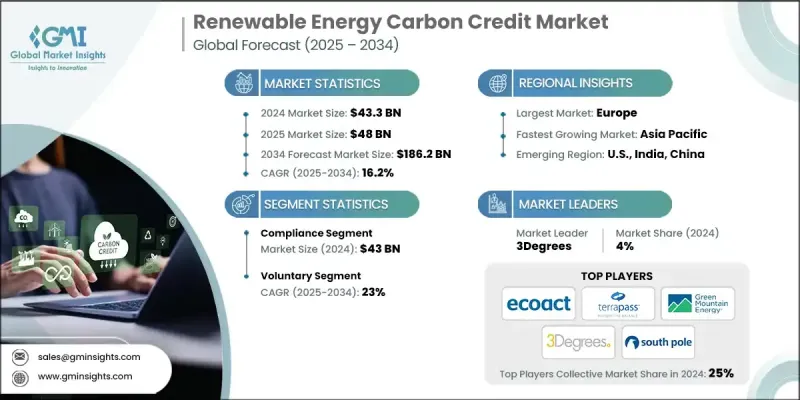

根據 Global Market Insights Inc. 發布的最新報告,2024 年全球再生能源碳權市場規模估計為 433 億美元,預計將從 2025 年的 480 億美元成長到 2034 年的 1862 億美元,複合年成長率為 16.2%。

世界各國政府和企業都在製定積極的淨零排放目標,這導致對再生能源專案產生的碳權額的需求激增。這些信用額度有助於彌補當前排放量與長期脫碳目標之間的差距。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 433億美元 |

| 預測值 | 1862億美元 |

| 複合年成長率 | 16.2% |

合規性獲得牽引力

在政府規定的減排目標和監管框架的推動下,合規領域在2024年佔據了顯著佔有率。根據限額與交易和再生能源組合標準等計劃,企業必須抵消部分排放,從而刺激了對認證再生能源信用額度的穩定需求。該領域受益於結構化的監管和標準化協議,為市場參與者提供了更高的可預測性。

自願群體採用率不斷上升

隨著企業、機構和個人在監管要求之外積極主動地邁向永續發展,自願性市場將在2025-2034年期間實現可觀的複合年成長率。企業正在購買再生能源碳權額,以展現其氣候領導力、實現內部淨零目標並增強ESG報告。該市場蓬勃發展,因為買家可以選擇符合其品牌價值的項目,例如社區太陽能發電場或小型風力發電項目。

區域洞察

歐洲將崛起為利潤豐厚的地區

2024年,在雄心勃勃的氣候政策、成熟的碳交易體係以及再生能源技術的廣泛應用的支持下,歐洲再生能源碳權市場創造了可觀的收入。該地區以歐盟排放交易體系(EU ETS)為主導的強大合規基礎設施,為碳定價和透明度樹立了全球標準。同時,隨著歐洲企業努力實現淨零排放承諾並尋求跨國清潔能源計畫融資,自願參與的人數也不斷增加。

再生能源碳權市場的主要參與者有 WayCarbon、Carbon Credit Capital, LLC.、TerraPass、Native Energy、Climate Impact Partners、Atmosfair、The Carbon Collective Company、Carbon Better、EcoAct、ClimeCo LLC.、South Pole、ALLCOT、Sterling Planet Inc.、PcoAct、ClimeCo LLC。

為了鞏固自身地位,再生能源碳權領域的公司正注重信譽、可擴展性和數位創新。許多公司直接與再生能源開發商合作,以確保新專案的長期信用供應,從而確保額外收入和未來收入來源。其他公司則投資於先進的監測和報告技術,包括衛星資料和人工智慧,以驗證信用影響並贏得買家的信任。市場領導者也與金融科技公司建立策略聯盟,以簡化交易平台並提高透明度。此外,一些公司正在國際擴張,根據當地氣候目標客製化信用產品,並與ICVCM和VCMI等全球標準接軌,提升聲譽和競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

- 新興機會和趨勢

- 數位化和物聯網整合

- 新興市場滲透

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 競爭基準測試

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依類型,2021 - 2034

- 主要趨勢

- 自願

- 遵守

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第7章:公司簡介

- 3Degrees

- Atmosfair

- ALLCOT

- Carbon Better

- Carbon Credit Capital, LLC.

- Carbon Direct

- ClimeCo LLC.

- Climate Impact Partners

- CarbonClear

- Ecosecurities

- EcoAct

- Green Mountain Energy Company

- Native Energy

- PwC

- Sterling Planet Inc.

- South Pole

- The Carbon Trust

- The Carbon Collective Company

- TerraPass

- WayCarbon

The global renewable energy carbon credit market was estimated at USD 43.3 billion in 2024 and is expected to grow from USD 48 billion in 2025 to USD 186.2 billion by 2034, at a CAGR of 16.2%, according to the latest report published by Global Market Insights Inc.

Governments and corporations worldwide are setting aggressive net-zero targets, creating a surge in demand for carbon credits generated through renewable energy projects. These credits help bridge the gap between current emissions and long-term decarbonization goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.3 Billion |

| Forecast Value | $186.2 Billion |

| CAGR | 16.2% |

Compliance to Gain Traction

The compliance segment held a notable share in 2024, driven by government-mandated emissions reduction targets and regulatory frameworks. Under programs like cap-and-trade and renewable portfolio standards, companies are required to offset a portion of their emissions, fueling steady demand for certified renewable energy credits. This segment benefits from structured oversight and standardized protocols, offering more predictability for market participants.

Rising Adoption Among the Voluntary Segment

The voluntary segment will grow at a decent CAGR during 2025-2034, as corporations, institutions, and individuals take proactive steps toward sustainability beyond regulatory mandates. Businesses are purchasing renewable energy carbon credits to demonstrate climate leadership, meet internal net-zero targets, and enhance ESG reporting. The segment thrives on flexibility, with buyers selecting projects that align with their brand values, such as community-based solar farms or small-scale wind developments.

Regional Insights

Europe to Emerge as a Lucrative Region

Europe renewable energy carbon credit market generated significant revenues in 2024, supported by ambitious climate policies, mature carbon trading systems, and widespread adoption of renewable technologies. The region's strong compliance infrastructure-led by the EU Emissions Trading System (EU ETS)-has set the global standard for carbon pricing and transparency. Simultaneously, voluntary participation is growing, as European corporations push toward net-zero commitments and seek to finance clean energy projects across borders.

Major players in the renewable energy carbon credit market are WayCarbon, Carbon Credit Capital, LLC., TerraPass, Native Energy, Climate Impact Partners, Atmosfair, The Carbon Collective Company, Carbon Better, EcoAct, ClimeCo LLC., South Pole, ALLCOT, Sterling Planet Inc., PwC, Green Mountain Energy Company, 3Degrees, CarbonClear, Ecosecurities, The Carbon Trust, Carbon Direct.

To strengthen their position, companies operating in the renewable energy carbon credit space are focusing on credibility, scalability, and digital innovation. Many are partnering directly with renewable energy developers to secure long-term credit supply from new projects, ensuring both additionality and future revenue streams. Others are investing in advanced monitoring and reporting technologies, including satellite data and AI, to validate credit impact and gain trust with buyers. Market leaders are also entering strategic alliances with fintech firms to streamline trading platforms and offer greater transparency. Additionally, some are expanding internationally by tailoring credit offerings to local climate goals and aligning with global standards such as ICVCM and VCMI to boost their reputation and competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technology factors

- 3.6.5 environmental factors

- 3.6.6 Legal factors

- 3.7 Emerging opportunities & trends

- 3.7.1 Digitalization and IoT integration

- 3.7.2 Emerging market penetration

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Voluntary

- 5.3 Compliance

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 North America

- 6.3 Europe

- 6.4 Asia Pacific

- 6.5 Middle East & Africa

- 6.6 Latin America

Chapter 7 Company Profiles

- 7.1 3Degrees

- 7.2 Atmosfair

- 7.3 ALLCOT

- 7.4 Carbon Better

- 7.5 Carbon Credit Capital, LLC.

- 7.6 Carbon Direct

- 7.7 ClimeCo LLC.

- 7.8 Climate Impact Partners

- 7.9 CarbonClear

- 7.10 Ecosecurities

- 7.11 EcoAct

- 7.12 Green Mountain Energy Company

- 7.13 Native Energy

- 7.14 PwC

- 7.15 Sterling Planet Inc.

- 7.16 South Pole

- 7.17 The Carbon Trust

- 7.18 The Carbon Collective Company

- 7.19 TerraPass

- 7.20 WayCarbon