|

市場調查報告書

商品編碼

1876642

食品包裝回收市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Food Packaging Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

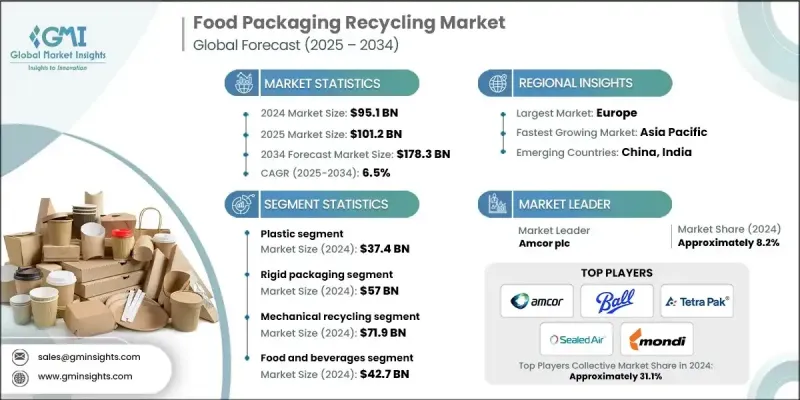

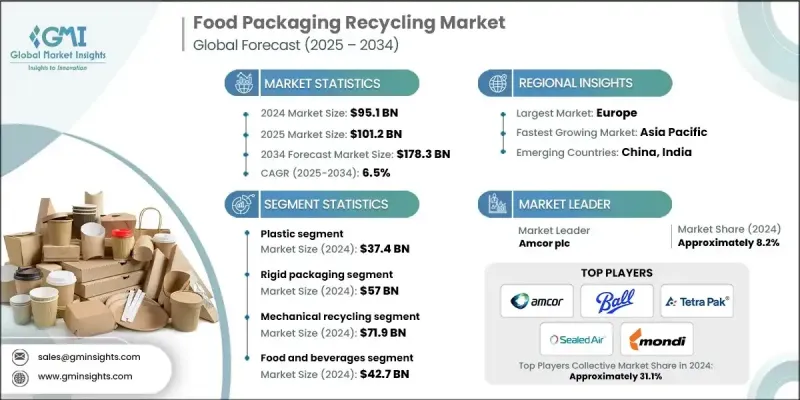

2024 年全球食品包裝回收市場價值為 951 億美元,預計到 2034 年將以 6.5% 的複合年成長率成長至 1,783 億美元。

市場擴張的驅動力來自日益成長的監管壓力和生產者延伸責任制(EPR)計劃的實施,這些措施促使製造商在其包裝中增加再生材料的使用。企業正積極履行雄心勃勃的永續發展承諾,從而增加對收集基礎設施、分類能力和先進回收技術的投資。同時,大眾環保意識的提高也增強了人們參與回收工作的積極性,進而強化了對可回收食品包裝形式和改良型加工系統的需求。機械和化學回收技術的創新正在加速這一進程,使以往難以回收的包裝材料(例如多層結構和軟性薄膜)能夠更有效地回收。簡化和統一包裝設計的努力也有助於提高回收率。因此,在技術應用、利害關係人合作加強以及食品包裝生態系統向循環經濟模式轉變的推動下,市場正保持穩定成長的勢頭。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 951億美元 |

| 預測值 | 1783億美元 |

| 複合年成長率 | 6.5% |

2024年塑膠市場規模達374億美元,預計2025年至2034年將以10.9%的複合年成長率成長。塑膠、紙張、玻璃和金屬的回收率不斷提高,推動了這一成長,因為各行業和監管機構都在努力減少廢棄物。由於塑膠用途廣泛且處理複雜,因此仍然是關注的焦點。對化學和機械回收的投資正在提高將PET和聚烯烴加工成食品級材料的能力。在強大的回收網路和纖維基替代品日益普及的推動下,紙張和紙板的市場佔有率持續成長。

2024年,硬質包裝市場規模達到570億美元,預計2034年將以6.5%的複合年成長率成長。玻璃罐、金屬罐、PET瓶和HDPE容器等硬質包裝材料都受惠於成熟的回收系統。食品和飲料生產商正在硬包裝中更多地使用回收材料,以滿足永續發展標準,同時,改進的清洗、造粒和去污系統也提高了材料品質。

北美食品包裝回收市場在2024年創造了282億美元的規模,並有望在預測期內保持強勁成長。該地區正透過支持性法規、企業社會責任措施和完善的廢棄物管理網路,不斷強化其回收體系。機械和化學回收能力的提升以及可回收性設計實踐的改進,正在推動各類包裝(尤其是硬質包裝)的閉迴路回收系統發展。

全球食品包裝回收市場的主要參與者包括安姆科公司(Amcor plc)、蒙迪集團(Mondi Group)、波爾公司(Ball Corporation)、利樂公司(Tetra Pak)和希悅爾公司(Sealed Air Corporation)。食品包裝回收市場的企業正在實施多項策略以增強其競爭優勢。許多公司正在增加對下一代回收技術的投資,包括先進的機械和化學系統,這些系統能夠提高回收品質並更好地處理複雜材料。企業也與廢棄物管理供應商和消費品品牌合作,建立閉迴路供應鏈,以提高材料回收率。擴大回收基礎設施,例如改善分類自動化和升級收集網路,是另一個重點工作。企業正在重新設計包裝,以提高其可回收性,同時符合監管要求和永續發展目標。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 加強實施生產者延伸責任制(EPR)政策

- 強而有力的企業永續發展和再生材料使用承諾

- 消費者對環境影響的意識日益增強

- 擴大回收基礎設施和產能

- 產業陷阱與挑戰

- 食品包裝廢棄物污染

- 多層和混合材料包裝的複雜性

- 隔離、收集和分類系統不足

- 市場機遇

- 擴大化學回收規模,以處理難以處理的包裝類型

- 建立穩健的食品級rPET和再生聚烯烴供應鏈

- 提供可回收設計諮詢及認證服務

- 對區域回收基礎設施的投資和併購

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依產品

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計(註:僅提供重點國家的貿易統計)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 塑膠

- PET(聚對苯二甲酸乙二酯)

- HDPE(高密度聚乙烯)

- 低密度聚乙烯(LDPE)

- PP(聚丙烯)

- 聚苯乙烯

- 多層塑膠

- 紙和紙板

- 瓦楞紙板

- 紙板

- 牛皮紙

- 金屬

- 鋁

- 鋼

- 玻璃

- 可生物分解/生物基材料

- PLA(聚乳酸)

- 澱粉基塑膠

- 其他

第6章:市場估價與預測:依包裝形式分類,2021-2034年

- 主要趨勢

- 硬質包裝

- 瓶子和罐子

- 托盤

- 罐頭

- 盒子

- 軟包裝

- 小袋

- 捲餅

- 電影

- 小袋

- 其他

第7章:市場估算與預測:依回收流程分類,2021-2034年

- 主要趨勢

- 機械回收

- 化學回收

- 熱解

- 解聚

- 生物回收

- 堆肥(用於可生物分解包裝)

- 能量回收

- 焚燒與能量捕獲

- 其他

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 食品和飲料

- 乳製品

- 烘焙和糖果

- 肉類、家禽和海鮮

- 即食餐

- 水果和蔬菜

- 飲料(非酒精飲料和酒精飲料)

- 餐飲服務

- 速食店(QSR)

- 自助餐廳

- 餐飲服務

- 零售與電子商務

- 機構使用

- 醫院

- 學校

- 政府設施

- 其他

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- Amcor plc

- Mondi Group

- Tetra Pak

- Sealed Air Corporation

- Ball Corporation

- Constantia Flexibles

- MULTIVAC Group

- Clear Path Recycling

- Clean Tech Incorporated

- CarbonLite Industries

- BioPak

- EcoEnclose

- Elevate Packaging

- TC Transcontinental Packaging

- International Paper Company

The Global Food Packaging Recycling Market was valued at USD 95.1 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 178.3 billion by 2034.

Market expansion is fueled by rising regulatory pressure and the implementation of Extended Producer Responsibility programs, which are prompting manufacturers to increase the use of recycled content in their packaging. Companies are pursuing ambitious sustainability commitments, leading to higher investments in collection infrastructure, sorting capabilities, and advanced recycling technologies. At the same time, public awareness of environmental concerns has strengthened participation in recycling efforts, reinforcing demand for recyclable food packaging formats and improved processing systems. Innovations in mechanical and chemical recycling are accelerating progress, enabling previously difficult packaging materials-such as multilayer structures and flexible films-to be recycled more effectively. Efforts to simplify and harmonize packaging designs are also supporting higher recovery rates. As a result, the market is experiencing steady momentum driven by technology adoption, stronger stakeholder collaboration, and a clear shift toward circularity in the food packaging ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $95.1 Billion |

| Forecast Value | $178.3 Billion |

| CAGR | 6.5% |

The plastic segment reached USD 37.4 billion in 2024 and is expected to grow at a 10.9% CAGR from 2025 to 2034. Growth is supported by the rising recovery of plastics, paper, glass, and metal as industries and regulators work toward minimizing waste. Plastics remain a primary focus due to their widespread use and the complexities of disposal. Investments in both chemical and mechanical recycling are improving the ability to process PET and polyolefins into food-grade materials. Paper and paperboard continue to gain market share, supported by strong recycling networks and increasing adoption of fiber-based alternatives.

The rigid packaging segment was valued at USD 57 billion in 2024 and is anticipated to grow at a 6.5% CAGR through 2034. Rigid formats benefit from well-established recycling streams for glass jars, metal cans, PET bottles, and HDPE containers. Food and beverage producers are incorporating more recycled inputs into rigid packaging to meet sustainability standards, supported by enhanced washing, pelletizing, and decontamination systems that improve material quality.

North America Food Packaging Recycling Market generated USD 28.2 billion in 2024 and is positioned for strong growth over the forecast period. The region is strengthening its recycling landscape through supportive regulations, corporate responsibility initiatives, and established waste management networks. Expanding mechanical and chemical recycling capacity and improved design-for-recyclability practices are advancing closed-loop systems across packaging categories, especially in rigid formats.

Key participants in the Global Food Packaging Recycling Market include Amcor plc, Mondi Group, Ball Corporation, Tetra Pak, and Sealed Air Corporation. Companies in the food packaging recycling market are implementing several strategies to reinforce their competitive advantage. Many firms are scaling investments in next-generation recycling technologies, including advanced mechanical and chemical systems that enable higher-quality output and better processing of complex materials. Organizations are also partnering with waste management providers and consumer goods brands to build closed-loop supply chains that enhance material recovery. Expansion of recycling infrastructure, such as improved sorting automation and upgraded collection networks, is another key priority. Businesses are redesigning packaging to improve recyclability while aligning with regulatory requirements and sustainability goals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Packaging Format

- 2.2.4 Recycling Process

- 2.2.5 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing implementation of Extended Producer Responsibility (EPR) policies

- 3.2.1.2 Strong corporate sustainability and recycled-content commitments

- 3.2.1.3 Rising consumer awareness of environmental impacts

- 3.2.1.4 Expansion of recycling infrastructure and capacity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Contamination of food packaging waste streams

- 3.2.2.2 Complexity of multilayer and mixed-material packaging

- 3.2.2.3 Insufficient segregation, collection, and sorting systems

- 3.2.3 Market opportunities

- 3.2.3.1 Scaling chemical recycling to process difficult packaging types

- 3.2.3.2 Developing robust supply chains for food-grade rPET and recycled polyolefins

- 3.2.3.3 Offering design-for-recycling advisory and certification services

- 3.2.3.4 Investment and M&A in regional recycling infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.2.1 PET (Polyethylene Terephthalate)

- 5.2.2 HDPE (High-Density Polyethylene)

- 5.2.3 LDPE (Low-Density Polyethylene)

- 5.2.4 PP (Polypropylene)

- 5.2.5 Polystyrene

- 5.2.6 Multi-layer plastics

- 5.3 Paper & Paperboard

- 5.3.1 Corrugated board

- 5.3.2 Boxboard

- 5.3.3 Kraft paper

- 5.4 Metal

- 5.4.1 Aluminum

- 5.4.2 Steel

- 5.5 Glass

- 5.6 Biodegradable/Bio-based Materials

- 5.6.1 PLA (Polylactic Acid)

- 5.6.2 Starch-based plastics

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Packaging Format, 2021 - 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid Packaging

- 6.2.1 Bottles & Jars

- 6.2.2 Trays

- 6.2.3 Cans

- 6.2.4 Boxes

- 6.3 Flexible Packaging

- 6.3.1 Pouches

- 6.3.2 Wraps

- 6.3.3 Films

- 6.3.4 Sachets

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By Recycling Process, 2021 - 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical Recycling

- 7.3 Chemical Recycling

- 7.3.1 Pyrolysis

- 7.3.2 Depolymerization

- 7.4 Biological Recycling

- 7.4.1 Composting (for biodegradable packaging)

- 7.5 Energy Recovery

- 7.5.1 Incineration with energy capture

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Food & Beverage

- 8.2.1 Dairy

- 8.2.2 Bakery & Confectionery

- 8.2.3 Meat, Poultry & Seafood

- 8.2.4 Ready-to-Eat Meals

- 8.2.5 Fruits & Vegetables

- 8.2.6 Beverages (non-alcoholic and alcoholic)

- 8.3 Foodservice

- 8.3.1 Quick Service Restaurants (QSRs)

- 8.3.2 Cafeterias

- 8.3.3 Catering Services

- 8.4 Retail & E-commerce

- 8.5 Institutional Use

- 8.5.1 Hospitals

- 8.5.2 Schools

- 8.5.3 Government Facilities

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Amcor plc

- 10.2 Mondi Group

- 10.3 Tetra Pak

- 10.4 Sealed Air Corporation

- 10.5 Ball Corporation

- 10.6 Constantia Flexibles

- 10.7 MULTIVAC Group

- 10.8 Clear Path Recycling

- 10.9 Clean Tech Incorporated

- 10.10 CarbonLite Industries

- 10.11 BioPak

- 10.12 EcoEnclose

- 10.13 Elevate Packaging

- 10.14 TC Transcontinental Packaging

- 10.15 International Paper Company