|

市場調查報告書

商品編碼

1876621

電動汽車電池管理晶片市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Electric Vehicle Battery Management Chips Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

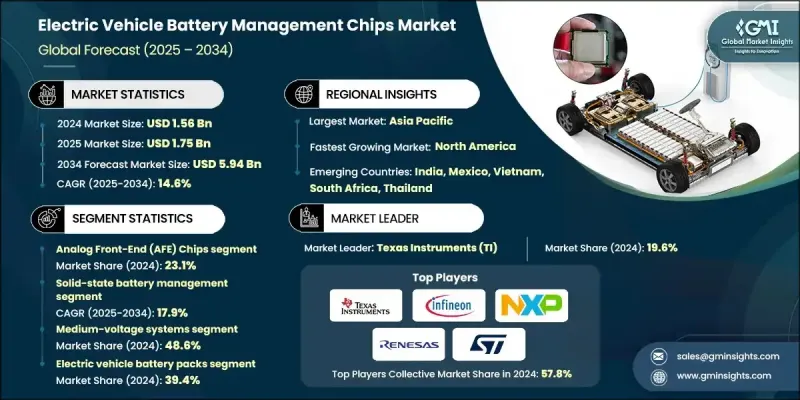

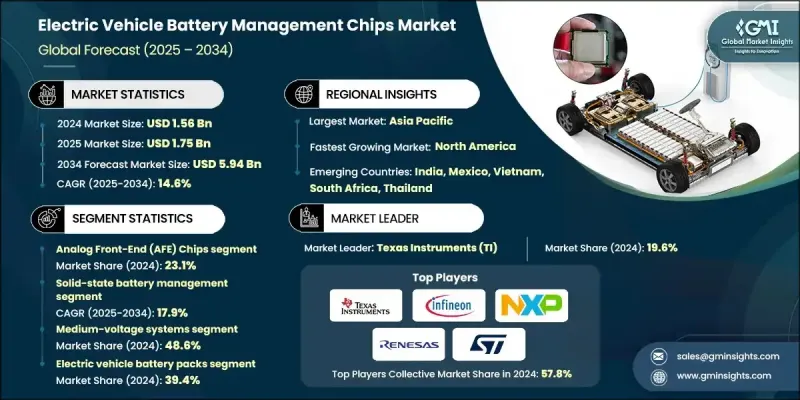

2024 年全球電動車電池管理晶片市場價值為 15.6 億美元,預計到 2034 年將以 14.6% 的複合年成長率成長至 59.4 億美元。

隨著製造商尋求降低過熱、短路和過充等風險,對電池安全性的日益重視持續推動著市場對電池管理晶片的需求。這些晶片持續監測電池組內的電芯狀態,確保可靠的性能和運作安全。隨著全球安全標準日益嚴格,汽車公司正大力投資研發新一代管理晶片,以增強保護性能、延長電池壽命並提升消費者信心。除了安全性的提升,受環保理念、政府激勵措施和減排指令的推動,電動車需求的快速成長仍然是市場發展的關鍵催化劑。電池管理晶片在最佳化電源效率、調節充電週期和預防故障方面發揮著至關重要的作用。先進監控功能和預測性維護系統的整合,正將電池管理轉變為高度數據驅動的過程。隨著連網汽車和自動駕駛汽車的興起,製造商正專注於能夠提供增強通訊、能量最佳化和診斷功能的晶片。安全性、效率和數位化這三者的融合,必將推動市場在預測期內持續擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 15.6億美元 |

| 預測值 | 59.4億美元 |

| 複合年成長率 | 14.6% |

2024年,類比前端(AFE)晶片市佔率為23.1%,預計2034年將以13.4%的複合年成長率成長。 AFE晶片作為電池單元和數位控制器之間的關鍵介面,能夠將電壓和溫度等類比訊號精確轉換為數位資料,從而實現精確的監控和控制。現代AFE組件需要極高的測量精度,以確保在各種電壓範圍和快速測量視窗內都能達到最佳性能和穩定性。

2025年至2034年,固態電池管理領域將以17.9%的複合年成長率成長。固態電池系統採用不易燃的固體電解質代替液態電解質,在安全性、能量密度、循環壽命和耐溫性方面均有顯著提升。這些電池的能量密度可超過400 Wh/kg,並擁有更長的使用壽命,因此需要能夠處理其獨特電氣特性的精密電池管理晶片。

預計到2024年,美國電動車電池管理晶片市場佔有率將達到87.4%。聯邦政府的支持性政策、稅收優惠以及旨在促進國內生產的各項舉措,顯著增強了美國的電動車生態系統。推動清潔能源和製造業創新的立法措施持續推動本地晶片研發,從而降低潛在的供應鏈中斷風險。美國製造商正將人工智慧和預測分析技術整合到電池管理系統中,以提高電池性能、增強即時監控並延長電池壽命,這進一步推動了產業轉型為智慧能源系統。

全球電動車電池管理晶片市場的主要參與者包括意法半導體(ST)、恩智浦半導體(NXP Semiconductors)、德州儀器(TI)、微芯科技(Microchip Technology)、英飛凌科技(Infineon Technologies)、ABLIC Inc.、羅姆株式會社(Rohm Co. Ltd)、日清紡電子(Recess)。這些領導企業正致力於產品創新、合作和策略擴張,以鞏固其市場地位。各公司正加大研發投入,設計高效率、低功耗的晶片,以提升能源管理水準並提高安全標準。與汽車OEM廠商和電池生產商的合作,使得下一代電動車的客製化晶片整合成為可能。許多企業正在採用人工智慧驅動的監控解決方案,以實現預測性診斷和即時最佳化。拓展區域製造中心和供應鏈垂直整合是確保可靠性和成本效益的關鍵策略。永續性和智慧能源管理是企業旨在增強競爭力並支持全球向電動出行轉型的重要舉措。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 價值鏈分析與產業結構

- 原料與晶圓製造

- BMS IC設計與開發

- 半導體製造與測試

- BMS模組組裝與整合

- 電池組整合與驗證

- OEM車輛整合與部署

- 售後市場及服務生態系統

- 報廢回收與永續性

- 價值鏈分析與產業結構

- 供應商格局

- 原物料供應商

- 零件製造商

- 電池製造商

- 系統整合商

- OEM

- 最終用途

- 產業影響因素

- 成長促進因素

- 電動車市場蓬勃發展

- 電池安全與監管要求

- 能量密度與效能最佳化需求

- 快速充電基礎設施建設

- 電網儲能市場成長

- 產業陷阱與挑戰

- 高昂的開發和資格認證成本

- 複雜的多細胞監測挑戰

- 市場機遇

- 固態電池技術整合

- 無線電池管理系統

- 人工智慧增強型電池最佳化

- 二次電池應用

- 成長促進因素

- 成長潛力分析

- 監管環境

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 目前技術

- 新興技術

- 專利分析

- 價格趨勢分析

- 依產品

- 按地區

- 成本分解分析

- 生產統計數據

- 生產中心

- 消費中心

- 進出口

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 市場成熟度與採納度分析

- 技術準備程度評估

- 區域採用成熟度比較

- 應用領域成熟度分析

- 生產準備度和規模評估

- 商業部署時程

- 總擁有成本 (TCO) 分析

- BMS晶片組件成本

- 系統整合與開發費用

- 汽車認證和測試成本

- 製造和部署費用

- 維護和更換生命週期成本

- 按技術類型分類的總擁有成本比較

- 整合複雜性與實施挑戰

- 多單元架構設計挑戰

- 高壓隔離和安全要求

- 通訊協定整合

- 熱管理與散熱

- 軟體整合與演算法開發

- 製造流程及品質控制分析

- 半導體製造及良率最佳化

- 汽車級測試與認證

- 品質保證與可靠性測試

- 供應鏈管理與採購

- 成本降低與流程最佳化

- 安全與功能安全框架分析

- ISO 26262 ASIL 合規性要求

- 電池安全標準與法規

- 失效模式分析與預防

- 冗餘與容錯設計

- 網路安全與資料保護

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 重要新聞和舉措

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- 模擬前端 (AFE) 晶片

- 細胞監測積體電路

- 電池平衡電路

- 保護積體電路

- 電池管理控制器

- 電流檢測積體電路

第6章:市場估計與預測:依電池類型分類,2021-2034年

- 主要趨勢

- 鋰離子電池管理

- 磷酸鐵鋰管理

- 固態電池管理

- 鎳氫化物管理

- 高級化學支持

第7章:市場估算與預測:依電壓範圍分類,2021-2034年

- 主要趨勢

- 低電壓系統

- 中壓系統

- 高壓系統

- 超高壓系統

第8章:市場估算與預測:以一體化程度分類,2021-2034年

- 主要趨勢

- 離散元件

- 整合解決方案

- 系統單晶片 (SoC)

- 模組化系統

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 電動車電池組

- 油電混合車系統

- 儲能系統

- 充電基礎設施

- 輔助電池系統

- 手提儲能

第10章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 乘用電動車

- 純電動車

- 插電式混合動力汽車

- 燃料電池電動車

- 商用電動車

- 范斯

- 純電動車

- 插電式混合動力汽車

- 公車

- 純電動車

- 燃料電池電動車

- 卡車

- 純電動車

- 燃料電池電動車

- 范斯

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 荷蘭

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 哥倫比亞

- 哥斯大黎加

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球參與者

- Texas Instruments Incorporated

- Analog Devices

- Infineon Technologies

- NXP Semiconductors

- STMicroelectronics

- Renesas Electronics

- Maxim Integrated Products (Analog Devices)

- ON Semiconductor Corporation

- Microchip Technology

- Regional Champions

- Tesla

- General Motors

- Ford Motor

- BYD

- Contemporary Amperex Technology (CATL)

- LG

- Panasonic

- Samsung

- 新興參與者和專家

- Monolithic Power Systems

- Linear Technology (Analog Devices)

- Intersil Corporation (Renesas)

- Richtek Technology Corporation

- Diodes Incorporated

- ROHM Semiconductor

- Cypress Semiconductor (Infineon)

- Semtech Corporation

The Global Electric Vehicle Battery Management Chips Market was valued at USD 1.56 billion in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 5.94 billion by 2034.

Growing emphasis on battery safety continues to fuel market adoption as manufacturers seek to reduce the risks associated with overheating, short-circuiting, and overcharging. These chips continuously monitor cell conditions within the battery pack, ensuring reliable performance and operational safety. As global safety standards become increasingly strict, automotive companies are investing heavily in next-generation management chips to enhance protection, extend battery life, and boost consumer confidence. In addition to safety improvements, the rapid surge in electric vehicle demand-driven by environmental priorities, government incentives, and emission reduction mandates-remains a crucial market catalyst. Battery management chips play a vital role in optimizing power efficiency, regulating charge cycles, and preventing failures. The integration of advanced monitoring capabilities and predictive maintenance systems is transforming battery management into a highly data-driven process. With the rise of connected and autonomous vehicles, manufacturers are focusing on chips that can deliver enhanced communication, energy optimization, and diagnostic features. This convergence of safety, efficiency, and digitalization is set to propel sustained market expansion throughout the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.56 Billion |

| Forecast Value | $5.94 Billion |

| CAGR | 14.6% |

The Analog Front-End (AFE) chips segment held a 23.1% share in 2024 and is expected to witness a CAGR of 13.4% through 2034. AFE chips serve as critical interfaces between battery cells and the digital controller, accurately converting analog signals such as voltage and temperature into digital data for precise monitoring and control. Modern AFE components demand high measurement accuracy, ensuring optimal performance and stability across voltage ranges and rapid measurement windows.

The solid-state battery management segment will grow at a CAGR of 17.9% from 2025 to 2034. Solid-state battery systems utilize non-flammable solid electrolytes instead of liquid ones, offering significant improvements in safety, energy density, cycle life, and temperature tolerance. These batteries can achieve energy densities exceeding 400 Wh/kg and provide longer operational lifespans, driving the need for sophisticated battery management chips capable of handling their unique electrical characteristics.

United States Electric Vehicle Battery Management Chips Market held an 87.4% share in 2024. Supportive federal policies, tax incentives, and initiatives aimed at advancing domestic production have significantly strengthened the country's EV ecosystem. Legislative measures promoting clean energy and manufacturing innovation continue to bolster local chip development, mitigating potential supply chain disruptions. U.S. manufacturers are integrating artificial intelligence and predictive analytics into their battery management systems to improve performance, enhance real-time monitoring, and extend the overall lifespan of batteries, which further supports the industry's evolution toward intelligent energy systems.

Major companies operating in the Global Electric Vehicle Battery Management Chips Market include STMicroelectronics (ST), NXP Semiconductors, Texas Instruments (TI), Microchip Technology, Infineon Technologies, ABLIC Inc., Rohm Co. Ltd, Nisshinbo Micro Devices, and Renesas Electronics. Leading companies in the Electric Vehicle Battery Management Chips Market are focusing on product innovation, collaboration, and strategic expansion to reinforce their market presence. Firms are investing in research and development to design high-efficiency, low-power chips that enhance energy management and improve safety standards. Partnerships with automotive OEMs and battery producers are enabling customized chip integration for next-generation electric vehicles. Many players are adopting AI-powered monitoring solutions to enable predictive diagnostics and real-time optimization. Expansion into regional manufacturing hubs and vertical integration within the supply chain are key strategies to ensure reliability and cost efficiency. Sustainability and smart energy management are central to corporate initiatives aimed at strengthening competitiveness and supporting the global transition toward electrified mobility.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology

- 2.2.2 Battery

- 2.2.3 Voltage range

- 2.2.4 Integration level

- 2.2.5 Application

- 2.2.6 Vehicle

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.1.1.1 Raw Materials & Wafer Fabrication

- 3.1.1.2 BMS IC Design & Development

- 3.1.1.3 Semiconductor Manufacturing & Testing

- 3.1.1.4 BMS Module Assembly & Integration

- 3.1.1.5 Battery Pack Integration & Validation

- 3.1.1.6 OEM Vehicle Integration & Deployment

- 3.1.1.7 Aftermarket & Service Ecosystem

- 3.1.1.8 End-of-Life Recycling & Sustainability

- 3.1.1 Value Chain Analysis & Industry Structure

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Battery manufacturers

- 3.2.4 System integrators

- 3.2.5 OEM

- 3.2.6 End use

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Electric Vehicle Market Proliferation

- 3.3.1.2 Battery Safety & Regulatory Requirements

- 3.3.1.3 Energy Density & Performance Optimization Demand

- 3.3.1.4 Fast Charging Infrastructure Development

- 3.3.1.5 Grid Energy Storage Market Growth

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High Development & Qualification Costs

- 3.3.2.2 Complex Multi-Cell Monitoring Challenges

- 3.3.3 Market opportunities

- 3.3.3.1 Solid-State Battery Technology Integration

- 3.3.3.2 Wireless Battery Management Systems

- 3.3.3.3 AI-Enhanced Battery Optimization

- 3.3.3.4 Second-Life Battery Applications

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East and Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technology

- 3.8.2 Emerging technology

- 3.9 Patent analysis

- 3.10 Price Trends Analysis

- 3.10.1 By product

- 3.10.2 By region

- 3.11 Cost Breakdown Analysis

- 3.12 Production staistics

- 3.12.1 Production hubs

- 3.12.2 Consumption hubs

- 3.12.3 Export and import

- 3.13 Sustainability and Environmental Aspects

- 3.13.1 Sustainable Practices

- 3.13.2 Waste Reduction Strategies

- 3.13.3 Energy Efficiency in Production

- 3.13.4 Eco-friendly Initiatives

- 3.13.5 Carbon Footprint Considerations

- 3.14 Market Maturity & Adoption Analysis

- 3.14.1 Technology Readiness Level Assessment

- 3.14.2 Regional Adoption Maturity Comparison

- 3.14.3 Application Domain Maturity Analysis

- 3.14.4 Manufacturing Readiness & Scale Assessment

- 3.14.5 Commercial Deployment Timeline

- 3.15 Total Cost of Ownership (TCO) Analysis

- 3.15.1 BMS Chip Component Costs

- 3.15.2 System Integration & Development Expenses

- 3.15.3 Automotive Qualification & Testing Costs

- 3.15.4 Manufacturing & Deployment Expenses

- 3.15.5 Maintenance & Replacement Lifecycle Costs

- 3.15.6 TCO Comparison by Technology Type

- 3.16 Integration Complexity & Implementation Challenges

- 3.16.1 Multi-Cell Architecture Design Challenges

- 3.16.2 High-Voltage Isolation & Safety Requirements

- 3.16.3 Communication Protocol Integration

- 3.16.4 Thermal Management & Heat Dissipation

- 3.16.5 Software Integration & Algorithm Development

- 3.17 Manufacturing Process & Quality Control Analysis

- 3.17.1 Semiconductor Fabrication & Yield Optimization

- 3.17.2 Automotive-Grade Testing & Qualification

- 3.17.3 Quality Assurance & Reliability Testing

- 3.17.4 Supply Chain Management & Sourcing

- 3.17.5 Cost Reduction & Process Optimization

- 3.18 Safety & Functional Safety Framework Analysis

- 3.18.1 ISO 26262 ASIL Compliance Requirements

- 3.18.2 Battery Safety Standards & Regulations

- 3.18.3 Failure Mode Analysis & Prevention

- 3.18.4 Redundancy & Fault Tolerance Design

- 3.18.5 Cybersecurity & Data Protection

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Analog Front-End (AFE) chips

- 5.3 Cell Monitoring ICs

- 5.4 Battery balancing circuits

- 5.5 Protection ICs

- 5.6 Battery management controllers

- 5.7 Current sensing ICs

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion battery management

- 6.3 Lithium iron phosphate management

- 6.4 Solid-state battery management

- 6.5 Nickel-metal hydride management

- 6.6 Advanced chemistry support

Chapter 7 Market Estimates & Forecast, By Voltage Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Low-voltage system

- 7.3 Medium-voltage system

- 7.4 High-voltage system

- 7.5 Ultra-high voltage system

Chapter 8 Market Estimates & Forecast, By Integration level, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Discrete component

- 8.3 Integrated solution

- 8.4 System-on-Chip (SoC)

- 8.5 Modular system

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Electric vehicle battery packs

- 9.3 Hybrid electric vehicle systems

- 9.4 Energy storage systems

- 9.5 Charging infrastructure

- 9.6 Auxiliary battery systems

- 9.7 Portable energy storage

Chapter 10 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Passenger EVs

- 10.2.1 BEV

- 10.2.2 PHEV

- 10.2.3 FCEV

- 10.3 Commercial EV

- 10.3.1 Vans

- 10.3.1.1 BEV

- 10.3.1.2 PHEV

- 10.3.2 Buses

- 10.3.2.1 BEV

- 10.3.2.2 FCEV

- 10.3.3 Trucks

- 10.3.3.1 BEV

- 10.3.3.2 FCEV

- 10.3.1 Vans

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Netherlands

- 11.3.8 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Vietnam

- 11.4.8 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Colombia

- 11.5.3 Costa Rica

- 11.5.4 Mexico

- 11.5.5 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Texas Instruments Incorporated

- 12.1.2 Analog Devices

- 12.1.3 Infineon Technologies

- 12.1.4 NXP Semiconductors

- 12.1.5 STMicroelectronics

- 12.1.6 Renesas Electronics

- 12.1.7 Maxim Integrated Products (Analog Devices)

- 12.1.8 ON Semiconductor Corporation

- 12.1.9 Microchip Technology

- 12.2 Regional Champions

- 12.2.1 Tesla

- 12.2.2 General Motors

- 12.2.3 Ford Motor

- 12.2.4 BYD

- 12.2.5 Contemporary Amperex Technology (CATL)

- 12.2.6 LG

- 12.2.7 Panasonic

- 12.2.8 Samsung

- 12.3 Emerging Players & Specialists

- 12.3.1 Monolithic Power Systems

- 12.3.2 Linear Technology (Analog Devices)

- 12.3.3 Intersil Corporation (Renesas)

- 12.3.4 Richtek Technology Corporation

- 12.3.5 Diodes Incorporated

- 12.3.6 ROHM Semiconductor

- 12.3.7 Cypress Semiconductor (Infineon)

- 12.3.8 Semtech Corporation