|

市場調查報告書

商品編碼

1846228

歐洲電動車電池管理系統:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Electric Vehicle Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

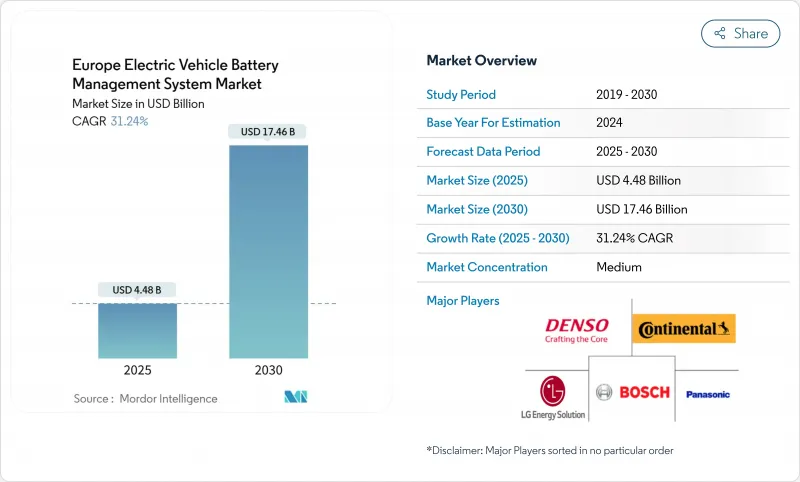

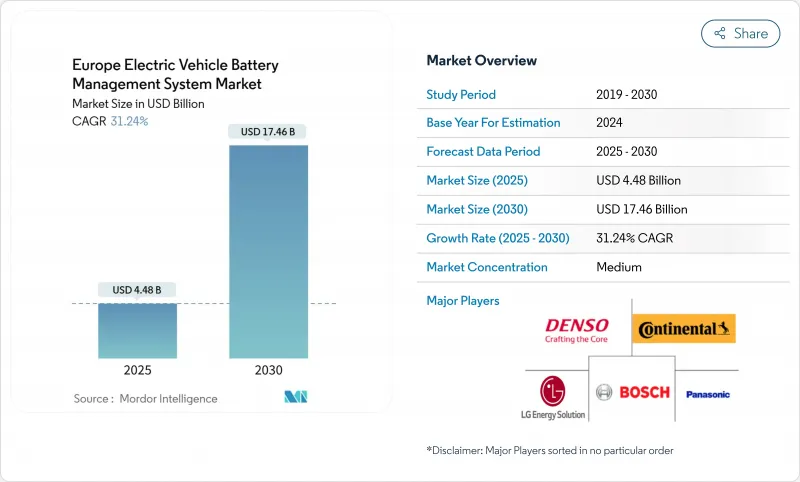

歐洲電動車電池管理系統市場預計到 2025 年將達到 44.8 億美元,到 2030 年將達到 174.6 億美元,年複合成長率為 31.24%。

此次市場擴張反映了歐盟嚴格的二氧化碳排放法規(要求所有新乘用車到2035年實現零排放)、高階市場向800V電動平台的活性化,以及中歐地區超級工廠的積極建設。此外,保險主導的電池可追溯性法規和電池護照的早期試點也推動了市場需求,促使原始設備製造商(OEM)採用更強大、網路安全性更高的電池管理軟體。模組化電池組架構降低了設計成本,並加速了多品牌電動平台的部署。儘管半導體供應和高壓認證流程仍面臨壓力,但大多數OEM仍優先考慮電池管理系統(BMS)的投資,以避免因熱失控事故而遭受巨額二氧化碳排放罰款和召回成本。

歐洲電動車電池管理系統市場趨勢與洞察

2035年電動車二氧化碳排放法規

歐盟強制要求在2035年實現100%零排放汽車銷售,並對每超標1克二氧化碳排放的汽車製造商處以95歐元的罰款,這將不可逆轉地刺激對先進電池管理系統(BMS)解決方案的需求。這個法律規範將促使製造商加快純電動車(BEV)的生產,使其市場基準值超過目前的13.5%,並要求年成長率達到14%,同時需要先進的電池管理能力來適應更大容量和更高能量密度的電池組。該法規的另一個影響是,保險公司正在強制要求安裝全面的電池監控系統,這為能夠證明其具備故障預測能力並能降低保固成本的BMS供應商創造了新的收益來源。高階汽車製造商正在積極回應,大力投資800V架構,這需要更先進的溫度控管和電池平衡演算法,從而直接惠及擁有先進電力電子技術的BMS供應商。合規期限造成了供應鏈瓶頸,其中BMS認證是關鍵環節,這使得擁有ISO 26262功能安全認證的現有供應商相對於新參與企業擁有顯著的競爭優勢。

OEM廠商正迅速轉向800V架構

汽車產業向800V電氣架構的轉型代表著一次根本性的變革,這需要全新的電池管理系統(BMS)設計,以應對更高的電壓差和更複雜的熱動態。 BMW與Rimac Technologies合作開發下一代電池組,沃爾沃與Vitesco Technologies合作,都表明高階汽車製造商正在優先考慮快速充電功能,而這需要先進的電壓監控和電池均衡演算法。對於缺乏高壓技術專長的BMS供應商而言,這種架構轉型構成了巨大的進入門檻,因為在800V運作等級下,ISO 26262認證的要求將呈指數級成長。雖然這種轉型使得充電10分鐘即可增加200英里的續航里程成為可能,但也為電池單元帶來了傳統BMS設計無法有效應對的極端熱應力,迫使供應商整合先進的冷卻演算法和預測性熱模型。歐洲汽車製造商正利用這項轉型來區別於主要使用400V系統的中國競爭對手,從而建造起暫時的技術護城河,使擁有先進電力電子技術的本土BMS供應商受益。

半導體供應鏈緊張

全球半導體短缺持續限制電池管理系統(BMS)的產能,導致汽車晶片的前置作業時間超過26週,並引發歐洲電動車生產計畫的連鎖延誤。這項限制對先進的BMS設計影響尤其顯著,因為這些設計需要專用的電源管理IC和微控制器,能夠支援800V架構和複雜的散熱演算法。歐洲BMS供應商面臨更大的壓力,他們與消費性電子產品製造商爭奪有限的晶片配額,並且由於其訂單量低於智慧型手機和運算應用,往往處於優先順序。這種短缺迫使製造商圍繞現有組件重新設計BMS架構,這可能會影響效能最佳化,並將開發週期延長12至18個月。供應鏈的韌性是至關重要的競爭因素,各公司正在維持策略庫存緩衝並建立替代採購關係,以確保生產的連續性。這項制約為歐洲半導體製造商從亞洲供應商手中奪取市場佔有率創造了機會。然而,這些措施需要大量的資本投資和2-3年的開發週期,可能無法滿足當前的供應需求。

細分市場分析

到2024年,純電動車將佔據72.48%的市場佔有率,並在2030年之前以32.86%的複合年成長率引領成長。這反映出市場正朝著純電動動力傳動系統發生決定性轉變,汽車製造商放棄了混合動力策略,轉而追求平台簡化。純電動車(BEV)的主導地位主要得益於歐盟二氧化碳排放法規的壓力,以及消費者對簡化用車體驗、避免插電式混合動力車複雜性帶來的里程焦慮的偏好。插電式混合動力車(PHEV)在營運靈活性至關重要的商業應用中仍然具有重要意義。然而,隨著製造商將研發資源轉向具有更優規模經濟效益的純電動車平台,對插電式混合動力車的投資正在減少。細分市場的動態變化揭示了一個關鍵的曲折點,即電池管理系統(BMS)的要求會因動力類型的不同而顯著變化。同時,插電式混合動力車需要複雜的功率仲裁演算法來實現雙動力傳動系統的協調。

面向純電動車 (BEV) 的先進電池管理系統 (BMS) 架構擴大採用機器學習演算法進行預測性熱建模。 LG Energy Solutions 的 B.around 平台分析超過 13 萬個電池單元的數據,以最佳化充電曲線並延長電池組壽命。這種技術上的複雜性為缺乏軟體專業知識的傳統汽車零件製造商設定了准入門檻,使得像 Munich Electrification 這樣的新興參與企業能夠透過專為 1500V 及以下能源儲存系統設計的 BMS 解決方案來搶佔市場佔有率。動力系統類型的細分日益反映出圍繞 BEV 平台的更廣泛的整合產業,這影響著 BMS 供應商,他們必須在迎合日漸萎縮的插電式混合動力汽車 (PHEV) 市場和大力投資下一代 BEV 技術之間做出選擇。

到2024年,乘用車將佔車輛總需求的67.91%。然而,受城市物流轉型和共用出行平台擴張的推動,二輪車和微型出行領域將呈現令人矚目的成長,到2030年複合年成長率將達到32.64%。商用車佔據著戰略性的中間位置,其電池管理系統(BMS)要求專注於耐久性和預測性維護,而非性能最佳化,這為能夠展現總擁有成本優勢的供應商創造了機會。微型出行的普及反映了城市交通模式的根本性變化,輕量化BMS設計必須在安全要求和成本限制之間取得平衡,以滿足共用車輛在高強度使用週期和多樣化環境條件下的需求。

車隊營運商對先進的電池分析技術的需求日益成長,以實現預測性維護和營運最佳化,這推動了雲端連接電池管理系統 (BMS) 解決方案的普及。此類解決方案能夠匯總整個車隊的性能數據,並在故障模式影響服務可用性之前識別出來。戴姆勒卡車與波蘭聯邦經濟合作暨發展部 (BMZ) 的電池系統合作,充分體現了商用車製造商如何優先選擇能夠提供全面生命週期管理的 BMS 供應商,而不是僅僅依賴獨立的硬體解決方案。乘用車 BMS 著重於性能和使用者體驗,而商用車系統則更注重可靠性和成本效益。同時,超小型行動應用需要採用超緊湊型設計,並具備無線連接功能,以實現車輛管理整合。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 2035年純電動車二氧化碳排放車隊法規

- OEM廠商迅速轉向800V架構

- 中歐超級工廠建設激增

- 網路安全的空中下載 (OTA) 電池管理系統 (BMS) 更新

- 保險公司強制要求的電池可追溯性平台

- 歐盟電池護照檢查(根據CSRD)

- 市場限制

- 半導體供應鏈緊張

- 高壓電池管理系統認證瓶頸

- 熱失控事故召回事件削弱了消費者信心

- 功能安全工程師短缺

- 價值/供應鏈分析

- 監管狀況

- 技術展望

- 五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 依推進類型

- 插電式混合動力汽車(PHEV)

- 純電動車(BEV)

- 按車輛類型

- 搭乘用車

- 商用車輛

- 摩托車和超小型移動車輛

- 電池化學

- 鋰離子

- 固態(預商業化)

- 其他化學

- 按拓撲學

- 集中

- 去中心化

- 模組化的

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 挪威

- 荷蘭

- 瑞典

- 其他歐洲國家

第6章 競爭情勢

- 市場集中度

- 策略舉措

- 市佔率分析

- 公司簡介

- Robert Bosch GmbH

- Denso Corporation

- LG Energy Solution

- Panasonic Holdings Corp.

- Marelli

- Continental AG

- Hitachi Astemo

- Mitsubishi Electric Corp.

- Lithium Balance

- Preh GmbH

- NXP Semiconductors

- Renesas Electronics

- Analog Devices Inc.

- Texas Instruments

- Infineon Technologies

- Sensata Technologies

- Johnson Matthey Battery Systems

- CATL(Europe)

- BYD Europe

- Rimac Technology

第7章 市場機會與未來展望

The Europe Electric Vehicle Battery Management System market is valued at USD 4.48 billion in 2025 and is forecast to reach USD 17.46 billion by 2030, advancing at a 31.24% CAGR.

This expansion reflects forceful EU CO2 fleet-emission limits that require all new passenger vehicles to be zero-emission by 2035, the premium segment's brisk conversion to 800 V electrical platforms, and vigorous gigafactory construction across Central Europe. Demand also benefits from insurance-led battery-traceability rules and early battery-passport pilots that push OEMs to install more capable, cyber-secure battery management software. Added momentum comes from modular battery-pack architectures that lessen design cost and speed the rollout of multi-brand electric platforms. Pressures remain in semiconductor availability and high-voltage certification queues, yet most OEMs prioritize BMS investments to avoid heavy CO2 penalties and recall costs tied to thermal runaway incidents.

Europe Electric Vehicle Battery Management System Market Trends and Insights

EV-only CO2-fleet Rules for 2035

The European Union's mandate requiring 100% zero-emission vehicle sales by 2035 creates an irreversible demand catalyst for sophisticated BMS solutions, as automakers face EUR 95 per gram penalties for exceeding CO2 thresholds. This regulatory framework forces manufacturers to accelerate BEV production beyond the current 13.5% market penetration, requiring a 14% annual growth rate that necessitates advanced battery management capabilities for larger pack sizes and higher energy densities. The regulation's secondary effect drives insurance companies to mandate comprehensive battery monitoring systems, creating additional revenue streams for BMS providers who can demonstrate predictive failure detection and warranty cost reduction. Premium automakers are responding by investing heavily in 800V architectures that require more sophisticated thermal management and cell balancing algorithms, directly benefiting BMS suppliers with advanced power electronics expertise. The compliance timeline creates a supply chain bottleneck where BMS certification becomes the critical path item, giving established players with ISO 26262 functional safety credentials significant competitive advantages over new entrants.

Rapid OEM Shift to 800-V Architectures

The automotive industry's migration to 800V electrical architectures represents a fundamental shift that demands entirely new BMS designs capable of managing higher voltage differentials and more complex thermal dynamics. BMW's partnership with Rimac Technology for next-generation battery packs and Volvo's collaboration with Vitesco Technologies demonstrate how premium manufacturers prioritize fast-charging capabilities requiring sophisticated voltage monitoring and cell balancing algorithms. This architectural transition creates significant barriers to entry for BMS suppliers lacking high-voltage expertise, as certification requirements under ISO 26262 become exponentially more complex at 800V operating levels. The shift enables 10-minute charging sessions for 200-mile range, but places extreme thermal stress on battery cells that traditional BMS designs cannot adequately manage, forcing suppliers to integrate advanced cooling algorithms and predictive thermal modeling. European automakers are leveraging this transition to differentiate from Chinese competitors who predominantly use 400V systems, creating a temporary technological moat that benefits local BMS suppliers with advanced power electronics capabilities.

Semiconductor Supply-chain Squeezes

The global semiconductor shortage continues to constrain BMS production capacity, with automotive-grade chips experiencing lead times exceeding 26 weeks and creating cascading delays across European EV manufacturing schedules. This constraint particularly impacts advanced BMS designs that require specialized power management ICs and microcontrollers capable of handling 800V architecture and complex thermal algorithms. European BMS suppliers face additional pressure as they compete with consumer electronics manufacturers for limited chip allocation, often losing priority due to lower volume commitments than smartphone and computing applications. The shortage forces manufacturers to redesign BMS architecture around available components, potentially compromising performance optimization and extending development cycles by 12-18 months. Supply chain resilience becomes a critical competitive factor, with companies maintaining strategic inventory buffers and developing alternative sourcing relationships to ensure production continuity. The constraint creates opportunities for European semiconductor manufacturers to capture market share from Asian suppliers. Still, it requires significant capital investment and 2-3 year development timelines that may not address immediate supply needs.

Other drivers and restraints analyzed in the detailed report include:

- Surging Gigafactory Build-out in Central Europe

- Cyber-secure Over-the-air (OTA) BMS Updates

- High-voltage BMS Certification Bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Battery Electric Vehicles command a 72.48% market share in 2024 and lead growth projections at 32.86% CAGR through 2030, reflecting the market's decisive shift toward pure electric powertrains as automakers abandon hybrid strategies in favor of platform simplification. The BEV segment's dominance stems from regulatory pressure under EU CO2 fleet rules and consumer preference for simplified ownership experiences without range anxiety associated with plug-in hybrid complexity. Plug-in Hybrid Electric Vehicles (PHEVs) maintain relevance in commercial applications where operational flexibility remains critical. Still, face declining investment as manufacturers reallocate R&D resources toward BEV platforms that offer superior economies of scale. The segment dynamics reveal a critical inflection point where BMS requirements diverge significantly between propulsion types, with BEVs demanding sophisticated thermal management for larger battery packs. At the same time, PHEVs require complex power arbitration algorithms for dual-powertrain coordination.

Advanced BMS architectures for BEVs increasingly incorporate machine learning algorithms for predictive thermal modeling. LG Energy Solution's B.around platform analyzes data from over 130,000 battery cells to optimize charging profiles and extend pack life. This technological sophistication creates barriers to entry for traditional automotive suppliers lacking software expertise, enabling new entrants like Munich Electrification to capture market share through specialized BMS solutions for energy storage systems up to 1500V. The propulsion type segmentation increasingly reflects broader industry consolidation around BEV platforms, with implications for BMS suppliers who must choose between serving declining PHEV markets or investing heavily in next-generation BEV technologies.

Passenger cars represent 67.91% of vehicle type demand in 2024. Still, the two-wheeler and micro-mobility segment exhibits a remarkable 32.64% CAGR growth through 2030, driven by urban logistics transformation and shared mobility platform expansion across European cities. Commercial vehicles occupy a strategic middle ground where BMS requirements emphasize durability and predictive maintenance over performance optimization, creating opportunities for suppliers who can demonstrate total cost of ownership advantages. The micro-mobility surge reflects fundamental changes in urban transportation patterns, where lightweight BMS designs must balance cost constraints with safety requirements for shared vehicle applications that experience intensive usage cycles and varied environmental conditions.

Fleet operators increasingly demand sophisticated battery analytics for predictive maintenance and operational optimization, driving the adoption of cloud-connected BMS solutions that aggregate performance data across vehicle populations and identify emerging failure patterns before they impact service availability. Daimler Truck's partnership with BMZ Poland for battery systems exemplifies how commercial vehicle manufacturers prioritize BMS suppliers who can provide comprehensive lifecycle management rather than standalone hardware solutions. The vehicle type segmentation reveals diverging technology requirements, where passenger car BMS focuses on performance and user experience while commercial vehicle systems emphasize reliability and cost efficiency. At the same time, micro-mobility applications demand ultra-compact designs with wireless connectivity for fleet management integration.

The Europe Electric Vehicle Battery Management System Market Report is Segmented by Propulsion Type (Plug-In Hybrid Electric Vehicle and Battery Electric Vehicle), Vehicle Type (Passenger Cars, Commercial Vehicles, and More), Battery Chemistry (Lithium-Ion, Solid-State, and More), Topology (Centralized, Distributed, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Robert Bosch GmbH

- Denso Corporation

- LG Energy Solution

- Panasonic Holdings Corp.

- Marelli

- Continental AG

- Hitachi Astemo

- Mitsubishi Electric Corp.

- Lithium Balance

- Preh GmbH

- NXP Semiconductors

- Renesas Electronics

- Analog Devices Inc.

- Texas Instruments

- Infineon Technologies

- Sensata Technologies

- Johnson Matthey Battery Systems

- CATL (Europe)

- BYD Europe

- Rimac Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-only CO2-fleet rules for 2035

- 4.2.2 Rapid OEM shift to 800-V architectures

- 4.2.3 Surging gigafactory build-out in Central Europe

- 4.2.4 Cyber-secure over-the-air (OTA) BMS updates

- 4.2.5 Insurance-mandated battery traceability platforms

- 4.2.6 EU battery passport pilots (under CSRD)

- 4.3 Market Restraints

- 4.3.1 Semiconductor supply-chain squeezes

- 4.3.2 High-voltage BMS certification bottlenecks

- 4.3.3 Thermal-runaway recalls hurting consumer trust

- 4.3.4 Scarcity of functional-safety engineers

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Propulsion Type

- 5.1.1 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.1.2 Battery Electric Vehicle (BEV)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.2.3 Two-Wheeler and Micro-mobility

- 5.3 By Battery Chemistry

- 5.3.1 Lithium-ion

- 5.3.2 Solid-state (pre-commercial)

- 5.3.3 Other Chemistries

- 5.4 By Topology

- 5.4.1 Centralized

- 5.4.2 Distributed

- 5.4.3 Modular

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Norway

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Denso Corporation

- 6.4.3 LG Energy Solution

- 6.4.4 Panasonic Holdings Corp.

- 6.4.5 Marelli

- 6.4.6 Continental AG

- 6.4.7 Hitachi Astemo

- 6.4.8 Mitsubishi Electric Corp.

- 6.4.9 Lithium Balance

- 6.4.10 Preh GmbH

- 6.4.11 NXP Semiconductors

- 6.4.12 Renesas Electronics

- 6.4.13 Analog Devices Inc.

- 6.4.14 Texas Instruments

- 6.4.15 Infineon Technologies

- 6.4.16 Sensata Technologies

- 6.4.17 Johnson Matthey Battery Systems

- 6.4.18 CATL (Europe)

- 6.4.19 BYD Europe

- 6.4.20 Rimac Technology

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment