|

市場調查報告書

商品編碼

1871185

酵素法食品加工解決方案市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Enzymatic Food Processing Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

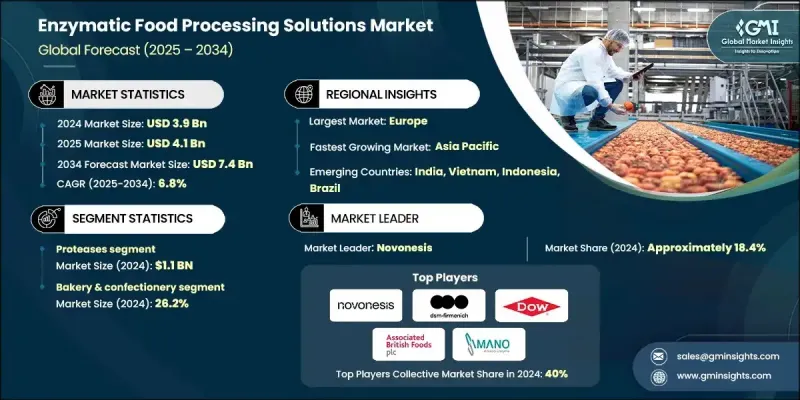

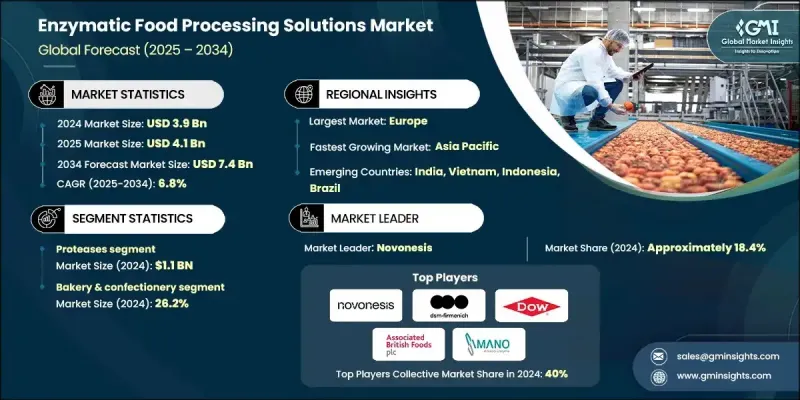

2024 年全球酵素法食品加工解決方案市值為 39 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長至 74 億美元。

隨著酵素在提升加工效率、產品品質和永續性方面發揮日益重要的作用,包括乳製品、澱粉和甜味劑、烘焙食品、飲料、植物性蛋白質以及油脂等多個食品類別,市場正經歷強勁成長。這些解決方案已從發揮基本功能性作用發展成為與數位化加工環境相契合的整合平台。消費者對清潔標籤產品的需求不斷成長、有利於天然加工助劑使用的監管框架以及精準發酵技術的廣泛應用,都進一步推動了市場成長。製造商還利用酵素系統來降低成本、延長保存期限和最佳化工藝,使這些解決方案成為工業食品生產線上的關鍵差異化因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 74億美元 |

| 複合年成長率 | 6.8% |

該行業的成長得益於標準化酶濃縮物和高價值客製化混合物的商業化,這些混合物可提供針對性的性能優勢。其中包括用於改善植物蛋白應用質地的蛋白酶和用於大規模生產的烘焙澱粉酶等成分。先進的配方,通常輔以酶活性最佳化和熱穩定性提升,使生產商能夠獲得更高的產量和產品一致性。供應商尤其關注價格敏感型買家的市場,提供多功能混合物,以取代合成添加劑,而無需增加投入成本。酵素作為加工助劑的監管定位,使得清潔標籤食品(尤其是在嚴格監管的市場中)能夠實現無縫配方調整。

轉谷氨醯胺酶、過氧化氫酶和葡萄糖氧化酶等細分領域酶製劑在2024年合計佔據15.3%的市場佔有率,預計到2034年將以7.2%的複合年成長率成長。這些專業酵素製劑可為複雜製程提供客製化解決方案,並擴大與客戶合作開發,以實現最佳的劑量精度、降低批次差異並增強操作控制。這些混合物憑藉其特殊的功能和配方的多樣性,具有卓越的價值。

2024年,飲料業佔據14.1%的市場佔有率,這主要得益於對果膠酶解決方案的需求。果膠酶能夠提高果汁、釀造和葡萄酒等產品的產量、透明度和加工速度。同時,植物蛋白領域也不斷成長,並持續採用蛋白酶和碳水化合物酶來克服常見的質地和溶解度問題,最終打造更具吸引力的終端產品。儘管酵素製劑的整體投入成本較低,但在大量生產中,它們卻能持續帶來可衡量的效率提升和產品性能改進,使其變得越來越不可或缺。

2024年美國酵素法食品加工解決方案市場規模為9.487億美元,預計將以6.7%的複合年成長率成長,到2034年達到18億美元。美國市場的成長得益於強勁的清潔標籤趨勢、先進的研發能力以及烘焙、乳製品和飲料等食品行業的廣泛自動化。市場正日益採用複雜的酵素系統,特別是多酵素混合物,以改善產品的一致性、柔軟度和貨架穩定性。人工智慧驅動的配方技術也在澱粉和烘焙生產中廣泛應用,提高了精準度和性能可預測性。

主導酵素製劑食品加工解決方案市場的關鍵企業包括 Codexis Inc.、Biocatalysts Ltd、Chr. Hansen Holding A/S、Kerry Group PLC、DSM-Firmenich、Novonesis、Dow、Amano Enzyme Inc.、Deerland Probiotics & Enzymes 和 Advanced Enme Technologies Ltd.。這些企業致力於客製化酵素製劑配方、先進的發酵技術和數位化流程整合,以提升產品性能。產業領導者正加大研發投入,開發適用於現代化加工環境的耐熱多功能酵素。與食品生產商建立策略合作夥伴關係,有助於客製化酵素製劑解決方案,以滿足具體的生產需求。此外,企業也利用人工智慧驅動的建模技術來最佳化用量、降低加工變異性並提高產量效率。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 市場機遇

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 價格趨勢

- 按地區

- 依酶類型

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利格局

- 貿易統計

- 主要進口國

- 主要出口國(註:僅提供重點國家的貿易統計)

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依酵素類型分類,2021-2034年

- 主要趨勢

- 蛋白酶

- 絲胺酸蛋白酶(枯草桿菌蛋白酶、胰凝乳蛋白酶)

- 天門冬胺酸蛋白酶(胃蛋白酶、凝乳酶/凝乳酶)

- 半胱氨酸蛋白酶(木瓜蛋白酶、鳳梨蛋白酶、無花果蛋白酶)

- 金屬蛋白酶(中性蛋白酶)

- 澱粉酶

- α-澱粉酶(內切酶,液化酶)

- BETA-澱粉酶(外切酶,糖化酶)

- 葡糖澱粉酶(葡萄糖生成)

- 普魯蘭酶(脫支酶)

- 脂肪酶

- 動物脂肪酶

- 微生物脂肪酶

- 磷脂酶

- 碳水化合物酶

- 果膠酶

- 纖維素酶和半纖維素酶

- 乳糖酶(BETA-半乳糖苷酶)

- 特化酶

- 轉谷氨醯胺酶

- 葡萄糖異構酶

- 過氧化氫酶和葡萄糖氧化酶

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 烘焙食品和糖果

- 麵團調理應用

- 防老化溶液

- 麩質改質技術

- 乳製品加工

- 乳酪生產應用

- 乳糖減量技術

- 蛋白質修飾方案

- 飲料生產

- 釀造應用

- 果汁加工解決方案

- 葡萄酒釀造技術

- 肉類和海鮮加工

- 招標申請

- 蛋白質結合溶液

- 產量提昇技術

- 澱粉和甜味劑生產

- 澱粉液化過程

- 糖化技術

- 異構化應用

- 植物性蛋白質和替代蛋白

- 蛋白質功能增強

- 紋理修改方案

- 提高消化率的技術

- 油脂加工

- 利息化應用

- 脫膠過程

- 風味開發解決方案

- 其他

第7章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Advanced Enzyme Technologies Ltd

- Amano Enzyme Inc.

- Aralez Bio

- Associated British Foods Plc

- Biocatalysts Ltd

- Cascade Biocatalysts Inc.

- Chr. Hansen Holding A/S

- Codexis Inc.

- Creative Enzymes

- Deerland Probiotics & Enzymes

- DSM-Firmenich

- Dow

- Dyadic International Inc.

- Enzyme Development Corporation

- Enzyme Research Laboratories Inc.

- Jiangsu Boli Bioproducts Co., Ltd

- Kerry Group PLC

- Novonesis

- Solugen Inc.

- Specialty Enzymes & Probiotics

The Global Enzymatic Food Processing Solutions Market was valued at USD 3.9 Billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 7.4 Billion by 2034.

The market is experiencing robust growth as enzymes play an increasingly central role in enhancing processing efficiency, product quality, and sustainability across multiple food categories, including dairy, starch and sweeteners, bakery, beverages, plant-based proteins, and oils and fats. These solutions have evolved from serving basic functional roles to becoming integrated platforms that align with digital processing environments. Growth is further supported by rising consumer demand for clean-label products, favorable regulatory frameworks promoting natural processing aids, and the expanding use of precision fermentation technologies. Manufacturers are also leveraging enzyme systems for cost reduction, shelf life extension, and process optimization, making these solutions a key differentiator across industrial food lines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $7.4 Billion |

| CAGR | 6.8% |

Growth in this sector is fueled by the commercialization of both standardized enzyme concentrates and high-value, customized blends that deliver targeted performance benefits. These include ingredients like proteases designed to improve texture in plant protein applications and baking amylases used for large-scale production. Advanced formulations, often supported by enzyme activity optimization and thermostability, allow producers to achieve higher yields and product consistency. Suppliers are particularly focused on markets with price-sensitive buyers by offering multi-functional blends that replace synthetic additives without increasing input costs. Regulatory positioning of enzymes as processing aids enables seamless reformulation in clean-label foods, especially within tightly regulated markets.

The niche categories, such as transglutaminases, catalases, and glucose oxidases, collectively held a 15.3% share in 2024 and will grow at a CAGR of 7.2% through 2034. These specialized enzymes deliver customized solutions for complex processes and are increasingly co-developed with clients to achieve optimal dosing precision, reduced batch variability, and enhanced operational control. These blends offer premium value due to their specialized functionality and formulation versatility.

The beverages segment held 14.1% share in 2024, driven by demand for pectinase-based solutions that improve yield, product clarity, and processing time across categories like fruit juices, brewing, and wine production. In parallel, the growing segment of plant-based proteins continues to adopt proteases and carbohydrases to overcome common texture and solubility issues, ultimately creating more appealing end products. Despite low overall input cost, enzymatic solutions consistently deliver measurable efficiency gains and product enhancements in high-volume manufacturing, making them increasingly indispensable.

US Enzymatic Food Processing Solutions Market generated USD 948.7 million in 2024 and is projected to grow at a CAGR of 6.7%, hitting USD 1.8 Billion by 2034. Growth in the US is supported by strong clean label trends, advanced research and development capabilities, and widespread automation across food sectors like bakery, dairy, and beverages. The market is witnessing increased adoption of complex enzyme systems, particularly multi-enzyme blends, to improve product consistency, softness, and shelf stability. AI-driven formulation techniques are also gaining ground across starch and bakery operations, enhancing precision and performance predictability.

Key companies shaping the Enzymatic Food Processing Solutions Market include Codexis Inc., Biocatalysts Ltd, and Chr. Hansen Holding A/S, Kerry Group PLC, DSM-Firmenich, Novonesis, Dow, Amano Enzyme Inc., Deerland Probiotics & Enzymes, and Advanced Enzyme Technologies Ltd. Companies in the enzymatic food processing solutions market are focusing on custom enzyme formulation, advanced fermentation techniques, and digital process integration to enhance product performance. Leaders are strengthening R&D investments to develop thermostable and multi-functional enzymes suitable for modern processing environments. Strategic partnerships with food manufacturers help tailor enzyme solutions to meet exact production needs. Firms are also leveraging AI-driven modeling to optimize dosage, reduce processing variability, and boost yield efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 enzyme type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By enzyme type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Enzyme Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Proteases

- 5.2.1 Serine proteases (subtilisin, chymotrypsin)

- 5.2.2 Aspartic proteases (pepsin, rennet/chymosin)

- 5.2.3 Cysteine proteases (papain, bromelain, ficin)

- 5.2.4 Metalloproteases (neutral proteases)

- 5.3 Amylases

- 5.3.1 Α-amylases (endo-acting, liquefaction)

- 5.3.2 Β-amylases (exo-acting, saccharification)

- 5.3.3 Glucoamylases (glucose production)

- 5.3.4 Pullulanases (debranching enzymes)

- 5.4 Lipases

- 5.4.1 Animal lipases

- 5.4.2 Microbial lipases

- 5.4.3 Phospholipases

- 5.5 Carbohydrases

- 5.5.1 Pectinases

- 5.5.2 Cellulases & hemicellulases

- 5.5.3 Lactases (β-galactosidase)

- 5.6 Specialized enzymes

- 5.6.1 Transglutaminases

- 5.6.2 Glucose isomerases

- 5.6.3 Catalases & glucose oxidases

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Bakery & confectionery

- 6.2.1 Dough conditioning applications

- 6.2.2 Anti-staling solutions

- 6.2.3 Gluten modification technologies

- 6.3 Dairy processing

- 6.3.1 Cheese production applications

- 6.3.2 Lactose reduction technologies

- 6.3.3 Protein modification solutions

- 6.4 Beverage production

- 6.4.1 Brewing applications

- 6.4.2 Juice processing solutions

- 6.4.3 Wine making technologies

- 6.5 Meat & seafood processing

- 6.5.1 Tenderization applications

- 6.5.2 Protein binding solutions

- 6.5.3 Yield enhancement technologies

- 6.6 Starch & sweetener production

- 6.6.1 Starch liquefaction processes

- 6.6.2 Saccharification technologies

- 6.6.3 Isomerization applications

- 6.7 Plant-based & alternative proteins

- 6.7.1 Protein functionality enhancement

- 6.7.2 Texture modification solutions

- 6.7.3 Digestibility improvement technologies

- 6.8 Oil & fat processing

- 6.8.1 Interesterification applications

- 6.8.2 Degumming processes

- 6.8.3 Flavor development solutions

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Advanced Enzyme Technologies Ltd

- 8.2 Amano Enzyme Inc.

- 8.3 Aralez Bio

- 8.4 Associated British Foods Plc

- 8.5 Biocatalysts Ltd

- 8.6 Cascade Biocatalysts Inc.

- 8.7 Chr. Hansen Holding A/S

- 8.8 Codexis Inc.

- 8.9 Creative Enzymes

- 8.10 Deerland Probiotics & Enzymes

- 8.11 DSM-Firmenich

- 8.12 Dow

- 8.13 Dyadic International Inc.

- 8.14 Enzyme Development Corporation

- 8.15 Enzyme Research Laboratories Inc.

- 8.16 Jiangsu Boli Bioproducts Co., Ltd

- 8.17 Kerry Group PLC

- 8.18 Novonesis

- 8.19 Solugen Inc.

- 8.20 Specialty Enzymes & Probiotics