|

市場調查報告書

商品編碼

1871138

超音波食品加工技術市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Ultrasonic Food Processing Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

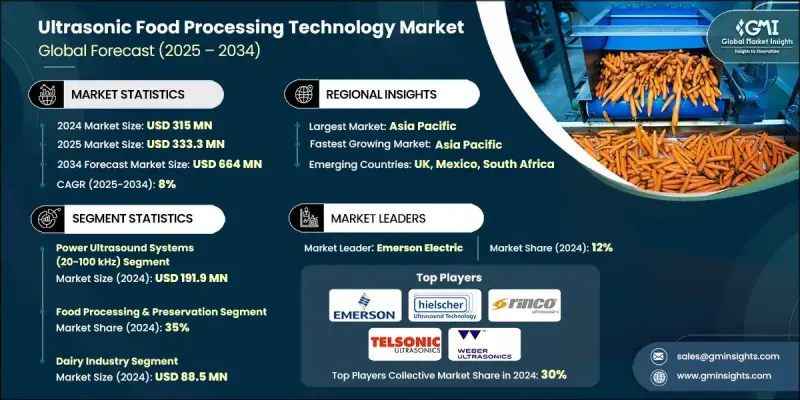

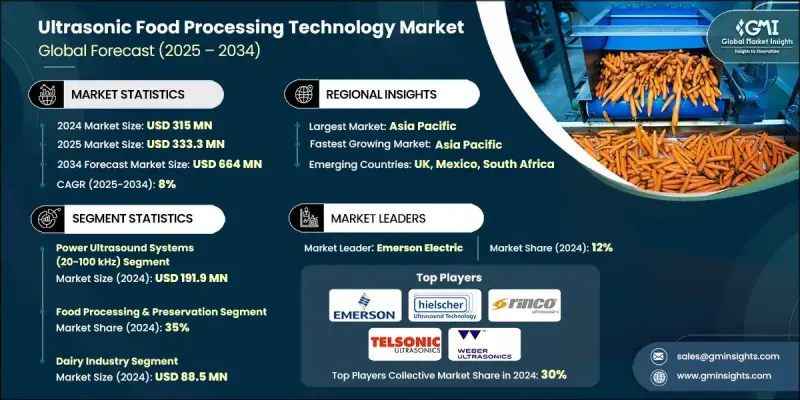

2024 年全球超音波食品加工技術市場價值為 3.15 億美元,預計到 2034 年將以 8% 的複合年成長率成長至 6.64 億美元。

隨著消費者在不犧牲品質的前提下,更加重視食品安全、營養和保存期限,非熱加工方法的日益普及正在重塑食品製造的趨勢。超音波加工、高壓處理和脈衝電場等技術因其能夠在滿足監管安全標準的同時保持食品的感官和營養特性而得到更廣泛的認可。隨著消費者對食品污染的擔憂日益加劇,以及對可追溯和衛生加工食品的需求不斷成長,製造商正在投資開發符合嚴格全球安全準則的創新加工系統。為了應對不斷變化的出口標準和消費者期望,生產商擴大採用超音波技術來提高生產效率並確保合規性。這些系統有助於滿足產業對清潔標籤產品、更高加工效率和永續生產實踐日益成長的需求。將超音波設備整合到更廣泛的食品技術生態系統中,也正在簡化生產線的營運,尤其是在擁有先進食品製造基礎設施的地區。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.15億美元 |

| 預測值 | 6.64億美元 |

| 複合年成長率 | 8% |

2024年,工作頻率在20-100 kHz範圍內的功率超音波系統市場規模達到1.919億美元。這些系統在乳化、均質和萃取等傳質操作中發揮著至關重要的作用。超音波系統利用空化效應,促進有價值的生物活性化合物、營養成分和風味物質的釋放,使其在植物和動物性原料的加工中高效發揮作用。尤其在生產高產乳化產品方面,超音波系統的優勢更為顯著,因為此類產品的一致性和品質至關重要。

2024年,食品加工和保藏領域佔35%的市場。隨著製造商優先採用能夠保持食品營養完整性和理想感官特性的技術,該領域正在快速成長。隨著消費者需求轉向最少加工、功能性豐富的食品,超音波處理、冷凍乾燥和真空包裝等方法正日益普及。這些技術有助於延長保存期限,同時保留原料的功能價值。

2024年,美國超音波食品加工技術市場佔75.6%的市場佔有率,市場規模達8,380萬美元。這一領先地位源自於美國對食品創新、數位轉型以及遵守食品安全法規的高度重視。隨著北美地區不斷採用自動化和數位追蹤解決方案,大型和中型食品生產企業對先進加工技術的需求日益成長。該地區對清潔標籤產品開發和延長保存期限的關注,正促使製造商轉向非熱加工方法以增強競爭力。

全球超音波食品加工技術市場的主要參與者包括Dukane、Telsonic、FoodTools、Cavitus、Emerson Electric、Herrmann Ultrasonics、Weber Ultrasonics、Hielscher Ultrasonics、AERZEN、Marchant Schmidt、Ultrasonic Power、MS Ultrasonic Technology Group、Innovative Ultrasonics、RerialO ULSSON、SSONS、VN週,Ojexsonics、RerialO ULSchanges。為了鞏固其在超音波食品加工技術市場的地位,領導企業正致力於開發針對不同食品類別的特定應用超音波系統。許多企業正在拓展全球分銷網路,增加製造商數量,並與原始設備製造商 (OEM) 和食品製造商建立戰略合作夥伴關係,同時投資於自動化整合,以實現工廠的無縫運作。此外,企業也著重提升空化控制和功率效率,以最大限度地提高產量和一致性。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 對非熱加工的需求不斷成長

- 食品安全與衛生要求

- 植物性及功能性食品的成長

- 產業陷阱與挑戰

- 高昂的初始投資成本

- 可擴展性問題

- 機會

- 與自動化和智慧製造的整合

- 拓展至植物性與功能性食品領域

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依技術類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依技術類型分類,2021-2034年

- 主要趨勢

- 功率超音波系統(20-100 kHz)

- 聲化學系統(100 kHz-1 MHz)

- 診斷超音波系統(1-10 MHz)

- 混合超音波系統

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 食品加工與保藏

- 萃取與分離

- 均質化和乳化

- 切割和密封

- 清潔與消毒

- 品質控制與分析

第7章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 乳製品業

- 肉類和海鮮加工

- 飲料業

- 烘焙食品和糖果

- 包裝產業

- 食品配料和添加劑

第8章:市場估算與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Cavitus

- Dukane

- Emerson Electric

- FoodTools

- Herrmann Ultrasonics

- Hielscher Ultrasonics

- Innovative Ultrasonics

- Marchant Schmidt

- MS Ultrasonic Technology Group

- RINCO ULTRASONICS

- Sonics & Materials

- Sonimat

- Telsonic

- Ultrasonic Power

- Weber Ultrasonics

The Global Ultrasonic Food Processing Technology Market was valued at USD 315 million in 2024 and is estimated to grow at a CAGR of 8% to reach USD 664 million by 2034.

The growing popularity of non-thermal processing methods is reshaping food manufacturing trends, as consumers prioritize food safety, nutrition, and shelf life without compromising on quality. Technologies such as ultrasonic processing, high-pressure treatment, and pulsed electric fields are becoming more widely accepted due to their ability to maintain sensory and nutritional properties while meeting regulatory safety standards. With rising consumer concerns over contamination and the demand for traceable and hygienically processed food, manufacturers are investing in innovative processing systems that meet strict global safety guidelines. In response to evolving export standards and consumer expectations, producers are increasingly turning to ultrasonic technology to improve productivity and ensure compliance. These systems help meet the industry's growing need for clean-label products, enhanced processing efficiency, and sustainable production practices. The integration of ultrasonic equipment into broader food tech ecosystems is also streamlining operations across production lines, especially in regions with advanced food manufacturing infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $315 Million |

| Forecast Value | $664 Million |

| CAGR | 8% |

The power ultrasound systems operating within the 20-100 kHz range segment generated USD 191.9 million in 2024. These systems play a critical role in boosting mass transfer operations such as emulsification, homogenization, and extraction. By leveraging cavitation effects, ultrasonic systems facilitate the release of valuable bioactive compounds, nutrients, and flavors, making them highly effective in processing plant- and animal-based materials. Their benefits are especially notable in producing high-yield emulsified products, where consistency and quality are key.

The food processing and preservation segment held 35% share in 2024. This segment is expanding rapidly as manufacturers prioritize techniques that preserve nutritional integrity and maintain desirable sensory attributes in food products. As consumer demand shifts toward minimally processed, functionally rich foods, methods like ultrasonic treatment, freeze-drying, and vacuum packaging are gaining ground. These techniques are instrumental in extending shelf life while retaining the functional value of ingredients.

U.S. Ultrasonic Food Processing Technology Market held 75.6% share and generated USD 83.8 million in 2024. This leadership position stems from a strong emphasis on food innovation, digital transformation, and compliance with food safety mandates. As North America continues to embrace automation and digitized tracking solutions, demand for advanced processing technologies is rising across both large-scale and mid-tier food production facilities. The region's focus on clean-label product development and longer shelf stability is pushing manufacturers toward non-thermal methods for enhanced competitiveness.

Key players operating in the Global Ultrasonic Food Processing Technology Market include Dukane, Telsonic, FoodTools, Cavitus, Emerson Electric, Herrmann Ultrasonics, Weber Ultrasonics, Hielscher Ultrasonics, AERZEN, Marchant Schmidt, Ultrasonic Power, MS Ultrasonic Technology Group, Innovative Ultrasonics, RINCO ULTRASONICS, Sonimat, and Sonics & Materials. To strengthen their position in the Ultrasonic Food Processing Technology Market, leading companies are focusing on developing application-specific ultrasonic systems tailored to different food product categories. Many are expanding global distribution networks, net manufacturers and strategic partnerships with OEMs and food manufacturers and investing in automation integration for seamless plant operations. Emphasis is also placed on advancing cavitation control and power efficiency to maximize yield and consistency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-thermal processing

- 3.2.1.2 Food safety & hygiene requirements

- 3.2.1.3 Growth in plant-based & functional foods

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Scalability issues

- 3.2.3 Opportunities

- 3.2.3.1 Integration with automation & smart manufacturing

- 3.2.3.2 Expansion into plant-based and functional foods

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By technology type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Power ultrasound systems (20-100 khz)

- 5.3 Sonochemistry systems (100 khz-1 mhz)

- 5.4 Diagnostic ultrasound systems (1-10 mhz)

- 5.5 Hybrid ultrasonic systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Food processing & preservation

- 6.3 Extraction & separation

- 6.4 Homogenization & emulsification

- 6.5 Cutting & sealing

- 6.6 Cleaning & sanitization

- 6.7 Quality control & analysis

Chapter 7 Market Estimates and Forecast, By End use Industry, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Dairy industry

- 7.3 Meat & seafood processing

- 7.4 Beverage industry

- 7.5 Bakery & confectionery

- 7.6 Packaging industry

- 7.7 Food ingredients & additives

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Cavitus

- 9.2 Dukane

- 9.3 Emerson Electric

- 9.4 FoodTools

- 9.5 Herrmann Ultrasonics

- 9.6 Hielscher Ultrasonics

- 9.7 Innovative Ultrasonics

- 9.8 Marchant Schmidt

- 9.9 MS Ultrasonic Technology Group

- 9.10 RINCO ULTRASONICS

- 9.11 Sonics & Materials

- 9.12 Sonimat

- 9.13 Telsonic

- 9.14 Ultrasonic Power

- 9.15 Weber Ultrasonics