|

市場調查報告書

商品編碼

1871105

矽光子技術在汽車通訊領域的市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Silicon Photonics for Vehicle Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

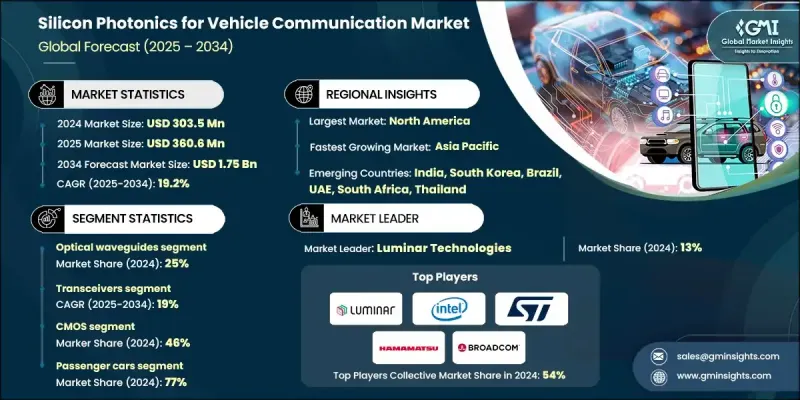

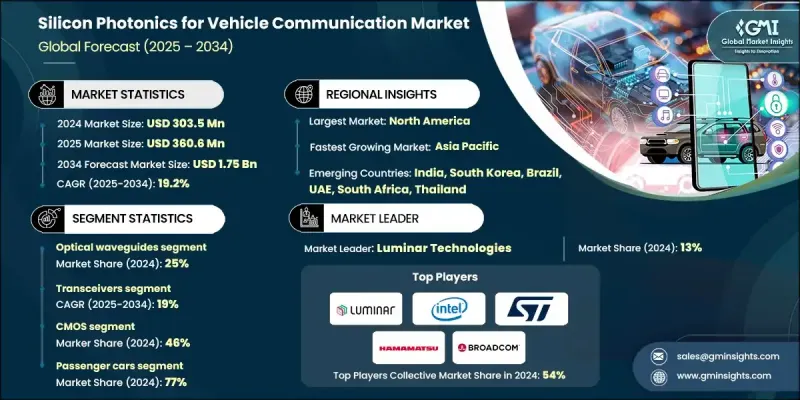

2024 年全球用於汽車通訊的矽光子學市場價值為 3.035 億美元,預計到 2034 年將以 19.2% 的複合年成長率成長至 17.5 億美元。

市場成長主要得益於矽光子技術在先進汽車通訊系統中的日益普及。矽光子技術將雷射、探測器和調製器等光基組件整合到矽晶片上,從而實現更快、更有效率、更節能的資料傳輸。在現代汽車中,這些技術在車對車 (V2V)、車對基礎設施 (V2I) 和車對萬物 (V2X) 通訊系統中發揮核心作用。它們還支援雷射雷達 (LiDAR) 和高速車載資料網路,而這些對於先進駕駛輔助系統(ADAS) 和自動駕駛至關重要。半自動駕駛和全自動駕駛汽車的廣泛應用正在加速矽光子技術的普及,因為它們需要高頻寬、低延遲的通訊和感測。基於矽光子的雷射雷達系統因其卓越的測距精度和比傳統系統更有效率的速度測量能力而備受青睞。此外,隨著汽車電子產品的發展,高清攝影機、智慧感測器和資訊娛樂設備的普及,製造商正在從銅基佈線轉向光子互連,光子互連可提供更大的資料容量、更輕的重量和更好的訊號完整性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.035億美元 |

| 預測值 | 17.5億美元 |

| 複合年成長率 | 19.2% |

2024年,光波導市佔率達到25%,預計到2034年將以19.7%的複合年成長率成長。波導在晶片組件間引導和限制光訊號方面發揮著至關重要的作用。在汽車應用中,緊湊性、性能和可靠性至關重要,而波導能夠實現高效、低損耗的通訊鏈路。它們被廣泛整合到高速車內通訊系統和基於雷射雷達的感測解決方案中,為連網車輛的即時資料傳輸提供更高的頻寬和更優異的光效率。

2024年,收發器市佔率達到40%,預計2025年至2034年將以19%的複合年成長率成長。由於收發器在實現高速、無干擾資料交換方面發揮重要作用,因此在矽光子車載通訊市場佔據主導地位。隨著車輛互聯程度的提高和感測器數量的增加,它們會產生大量訊息,這些資訊必須快速可靠地傳輸。傳統的銅纜系統面臨頻寬限制、訊號衰減和電磁干擾等挑戰,因此基於光子的收發器是下一代車輛架構的更優選擇。

北美矽光子汽車通訊市場佔據34%的市場佔有率,預計2024年市場規模將達到1.028億美元。該地區的領先地位源於其強大的創新生態系統、先進的半導體基礎設施以及新興汽車技術的廣泛應用。政府措施、大學研究計畫以及領先的光子和半導體製造商的存在進一步鞏固了北美的市場地位。持續的研發投入以及汽車和科技產業的合作正在加速該地區矽光子通訊系統的商業化進程。

全球矽光子車載通訊市場的主要參與者包括博通、英特爾、英飛凌科技、英偉達、思科系統、Marvell Technology、高通、義法半導體、恩智浦半導體和格羅方德。為了鞏固其在矽光子車載通訊市場的地位,各大公司正採取一系列策略舉措,重點在於創新、可擴展性和合作。領先企業正大力投資研發,以開發具有更高頻寬、更低延遲和更高能源效率的下一代光子晶片。他們正與汽車OEM廠商和科技公司建立策略合作夥伴關係,以加速系統整合,並將光子通訊技術應用於量產車。此外,各公司也正在擴大製造能力,並探索電子和光子元件的混合整合,以最佳化性能和成本效益。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預報

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 不斷發展的ADAS和自動駕駛系統需要高速資料傳輸。

- V2X 和車載網路需要低延遲、高可靠性的鏈路

- 對於電動車和連網汽車而言,節能高效的通訊至關重要。

- 整合技術的進步使得強大的汽車級解決方案成為可能。

- CASE(互聯、自動駕駛、共享、電動)趨勢擴大了需求

- 不斷發展的安全和性能標準推動了技術的應用。

- 產業陷阱與挑戰

- 高昂的研發和製造成本阻礙了規模化發展

- 惡劣車輛環境下的整合性和可靠性挑戰

- 市場機遇

- LiDAR整合可提升性能並降低成本。

- 光互連可以簡化車輛架構

- 共封裝光學元件可實現緊湊、節能的設計。

- 監管機構和消費者的推動促進了需求成長。

- 成長促進因素

- 成長潛力分析

- 專利分析

- 波特的分析

- PESTEL 分析

- 成本細分分析

- 技術格局

- 當前技術趨勢

- 矽光子製造製程成熟度

- 光學相控陣性能基準測試

- 高速調製器和偵測器功能

- 包裝和整合解決方案

- 新興技術

- 下一代矽光子平台

- 量子增強光通訊

- AI/ML最佳化的光子系統

- 當前技術趨勢

- 監管環境

- AEC-Q100 可靠度要求與測試規程

- ISO 26262 功能安全合規框架

- V2X 通訊標準(IEEE 802.11p、5G NR-V2X)

- LiDAR安全標準(IEC 60825-1)

- ISO/SAE 21434 汽車網路安全標準

- GDPR 與區域資料隱私合規性

- 價格趨勢

- 按地區

- 依產品

- 永續性和環境方面

- 環境影響評估

- 矽光子學生命週期碳足跡

- 製造過程對環境的影響

- 環境績效指標

- 社會影響評估和社區效益

- 綠色製造流程實施

- 投資與融資趨勢分析

- 成本細分分析

- 矽光子學成本結構分解

- 製造成本促進因素和最佳化

- 成本降低策略及實施

- 最終使用者行為分析

- 汽車OEM決策過程

- 技術採納行為分析

- 影響購買決策的因素

- 市場阻力與障礙分析

- 顛覆性技術的威脅與機遇

- 替代光通訊技術

- 競爭性的感測和LiDAR方法

- 材料科學的突破性進展

- 系統級架構創新

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 光波導

- 光電探測器

- 數據機

- 光源/雷射

- 過濾器

- 其他

第6章:市場估算與預測:依產品分類,2021-2034年

- 主要趨勢

- 收發器

- 開關

- 電纜

- 感應器

- 其他

第7章:市場估計與預測:依技術分類,2021-2034年

- 主要趨勢

- CMOS

- 混合矽光子學

- 絕緣體上矽(SOI)光子學

- 氮化矽光子學

第8章:市場估算與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第9章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 泰國

- 韓國

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Broadcom

- Cisco Systems

- GlobalFoundries

- Infineon Technologies

- Intel

- Marvell Technology

- Nvidia

- NXP Semiconductors

- Qualcomm

- STMicroelectronics

- Synopsys

- Texas Instruments

- TSMC

- 區域玩家

- Anello Photonics

- Foxconn Technology

- LIGENTEC

- Lumentum

- Silicon Austria Labs

- Valeo

- Xanadu Quantum Technologies

- 新興參與者/顛覆者

- Aeva Technologies

- Ayar Labs

- Baraja

- Lightmatter

- Rockley Photonics

The Global Silicon Photonics for Vehicle Communication Market was valued at USD 303.5 million in 2024 and is estimated to grow at a CAGR of 19.2% to reach USD 1.75 Billion by 2034.

Market growth is propelled by the increasing deployment of silicon photonics in advanced automotive communication systems. Silicon photonics integrate light-based components such as lasers, detectors, and modulators onto silicon chips, enabling faster, more efficient, and energy-saving data transmission. In modern vehicles, these technologies play a central role in vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-everything (V2X) communication systems. They also support LiDAR and high-speed in-vehicle data networks, which are critical for advanced driver assistance systems (ADAS) and autonomous driving. The expanding use of semi-autonomous and fully autonomous vehicles is accelerating adoption as they require high-bandwidth, low-latency communication and sensing. Silicon photonics-based LiDAR systems are gaining traction due to their superior range accuracy and ability to measure velocity more effectively than traditional systems. Moreover, as automotive electronics evolve with a rise in HD cameras, smart sensors, and infotainment devices, manufacturers are shifting from copper-based wiring to photonic interconnects that offer greater data capacity, lighter weight, and improved signal integrity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $303.5 Million |

| Forecast Value | $1.75 Billion |

| CAGR | 19.2% |

The optical waveguides segment held a 25% share in 2024 and is expected to grow at a CAGR of 19.7% through 2034. Waveguides play a crucial role in directing and confining optical signals among chip components. In automotive applications, where compactness, performance, and reliability are critical, waveguides enable efficient, low-loss communication links. They are widely integrated into high-speed intra-vehicle communication systems and LiDAR-based sensing solutions, providing enhanced bandwidth and superior optical efficiency for real-time data transmission in connected vehicles.

The transceivers segment held a 40% share in 2024 and is estimated to register a CAGR of 19% from 2025 to 2034. Transceivers dominate the silicon photonics for vehicle communication market due to their role in enabling high-speed, interference-free data exchange. As vehicles become more connected and sensor-rich, they generate massive amounts of information that must be transmitted rapidly and reliably. Conventional copper-based systems face challenges such as bandwidth constraints, signal degradation, and electromagnetic interference, making photonics-based transceivers a superior alternative for next-generation vehicle architectures.

North America Silicon Photonics for Vehicle Communication Market held 34% share and generated USD 102.8 million in 2024. The region's leadership stems from its strong innovation ecosystem, advanced semiconductor infrastructure, and high adoption of emerging automotive technologies. Government initiatives, university research programs, and the presence of leading photonic and semiconductor manufacturers further strengthen North America's position. Continuous R&D investments, along with collaboration across automotive and tech sectors, are accelerating the commercialization of silicon photonics-based communication systems across the region.

Key companies operating in the Global Silicon Photonics for Vehicle Communication Market include Broadcom, Intel, Infineon Technologies, Nvidia, Cisco Systems, Marvell Technology, Qualcomm, STMicroelectronics, NXP Semiconductors, and GlobalFoundries. To reinforce their position in the Silicon Photonics for Vehicle Communication Market, major companies are adopting a mix of strategic initiatives focused on innovation, scalability, and collaboration. Leading players are heavily investing in R&D to develop next-generation photonic chips with higher bandwidth, lower latency, and better energy efficiency. Strategic partnerships with automotive OEMs and technology firms are being formed to accelerate system integration and bring photonic-enabled communication to production vehicles. Companies are also expanding their manufacturing capabilities and exploring hybrid integration of electronic and photonic components to optimize performance and cost efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Product

- 2.2.4 Technology

- 2.2.5 Vehicle

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing ADAS and autonomous systems need high-speed data transfer

- 3.2.1.2 V2X and in-vehicle networks require low-latency, high-reliability links

- 3.2.1.3 Power-efficient communication is critical for EVs and connected cars

- 3.2.1.4 Advancements in integration enable robust automotive-grade solutions

- 3.2.1.5 CASE (Connected, Autonomous, Shared, Electric) trends expand demand

- 3.2.1.6 Evolving safety and performance standards push tech adoption

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs hinder scalability

- 3.2.2.2 Integration and reliability challenges in harsh vehicle environments

- 3.2.3 Market opportunities

- 3.2.3.1 LiDAR integration offers performance and cost improvements

- 3.2.3.2 Optical interconnects can simplify vehicle architecture

- 3.2.3.3 Co-packaged optics enable compact, energy-efficient designs

- 3.2.3.4 Regulatory and consumer push boosts demand

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Cost breakdown analysis

- 3.8 Technology landscape

- 3.8.1 Current technological trends

- 3.8.1.1 Silicon photonics manufacturing maturity

- 3.8.1.2 Optical phased array performance benchmarks

- 3.8.1.3 High-speed modulator and detector capabilities

- 3.8.1.4 Packaging and integration solutions

- 3.8.2 Emerging technologies

- 3.8.2.1 Next-generation silicon photonics platforms

- 3.8.2.2 Quantum-enhanced optical communication

- 3.8.2.3 AI/ML-optimized photonic systems

- 3.8.1 Current technological trends

- 3.9 Regulatory landscape

- 3.9.1 AEC-Q100 reliability requirements and testing protocols

- 3.9.2 ISO 26262 functional safety compliance framework

- 3.9.3 V2X communication standards (IEEE 802.11p, 5G NR-V2X)

- 3.9.4 LiDAR safety standards (IEC 60825-1)

- 3.9.5 ISO/SAE 21434 automotive cybersecurity standards

- 3.9.6 GDPR and regional data privacy compliance

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Sustainability and environmental aspects

- 3.11.1 Environmental impact assessment

- 3.11.2 Silicon photonics lifecycle carbon footprint

- 3.11.3 Manufacturing process environmental impact

- 3.11.4 Environmental performance indicators

- 3.11.5 Social impact assessment and community benefits

- 3.11.6 Green manufacturing process implementation

- 3.12 Investment & funding trends analysis

- 3.13 Cost breakdown analysis

- 3.13.1 Silicon photonics cost structure decomposition

- 3.13.2 Manufacturing cost drivers and optimization

- 3.13.3 Cost reduction strategies and implementation

- 3.14 End use behavior analysis

- 3.14.1 Automotive OEM decision-making processes

- 3.14.2 Technology adoption behavior analysis

- 3.14.3 Purchase decision influencing factors

- 3.14.4 Market resistance and barrier analysis

- 3.15 Disruptive technology threats and opportunities

- 3.15.1 Alternative optical communication technologies

- 3.15.2 Competing sensing and LiDAR approaches

- 3.15.3 Breakthrough material science developments

- 3.15.4 System-level architecture innovations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Optical waveguides

- 5.3 Photodetectors

- 5.4 Modulators

- 5.5 Light sources/lasers

- 5.6 Filters

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Transceivers

- 6.3 Switches

- 6.4 Cables

- 6.5 Sensors

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 CMOS

- 7.3 Hybrid silicon photonics

- 7.4 Silicon-on-insulator (SOI) photonics

- 7.5 Silicon nitride photonics

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchback

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Broadcom

- 10.1.2 Cisco Systems

- 10.1.3 GlobalFoundries

- 10.1.4 Infineon Technologies

- 10.1.5 Intel

- 10.1.6 Marvell Technology

- 10.1.7 Nvidia

- 10.1.8 NXP Semiconductors

- 10.1.9 Qualcomm

- 10.1.10 STMicroelectronics

- 10.1.11 Synopsys

- 10.1.12 Texas Instruments

- 10.1.13 TSMC

- 10.2 Regional Players

- 10.2.1 Anello Photonics

- 10.2.2 Foxconn Technology

- 10.2.3 LIGENTEC

- 10.2.4 Lumentum

- 10.2.5 Silicon Austria Labs

- 10.2.6 Valeo

- 10.2.7 Xanadu Quantum Technologies

- 10.3 Emerging Players / Disruptors

- 10.3.1 Aeva Technologies

- 10.3.2 Ayar Labs

- 10.3.3 Baraja

- 10.3.4 Lightmatter

- 10.3.5 Rockley Photonics