|

市場調查報告書

商品編碼

1822660

藻類蛋白市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Algae Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

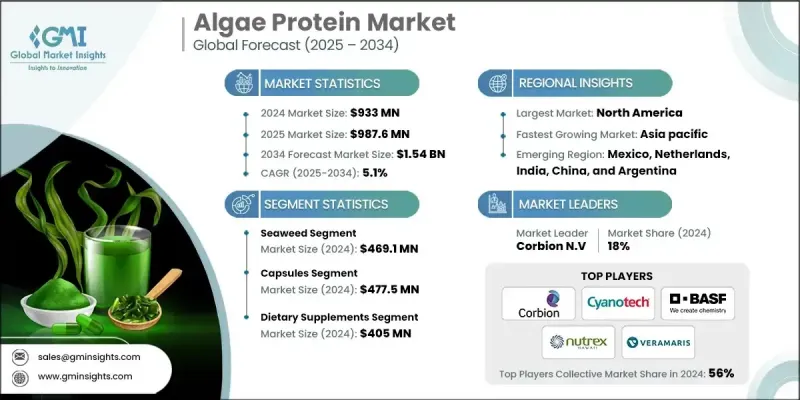

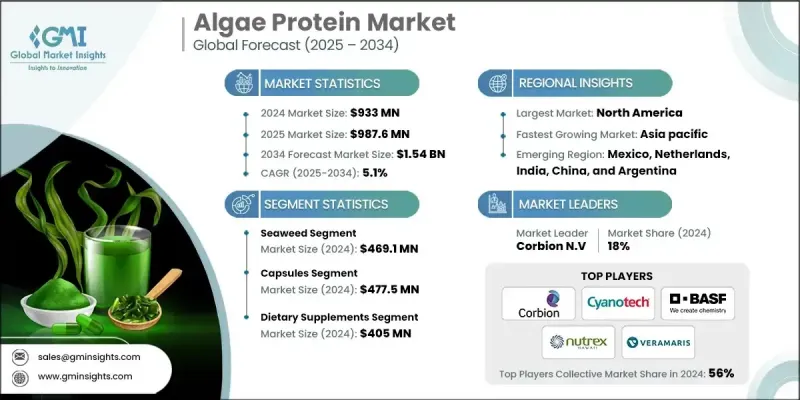

根據 Global Market Insights, Inc. 發布的最新報告,2024 年全球藻類蛋白市場價值為 9.33 億美元,預計將從 2025 年的 9.876 億美元成長到 2034 年的 15.4 億美元,複合年成長率為 5.1%。全球向植物性飲食、永續來源產品和藻類產品的功能性健康益處的轉變是決定市場方向的關鍵力量。

海藻和微藻蛋白,尤其是來自螺旋藻和小球藻的蛋白,在食品飲料、膳食補充劑和營養保健品中越來越常見。它們是生物利用度最高的蛋白質之一,營養全面,富含必需胺基酸,有益於增強免疫力、提升能量和肌肉。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.33億美元 |

| 預測值 | 15.4億美元 |

| 複合年成長率 | 5.1% |

關鍵促進因素:

- 以植物為基礎的純素食生活方式正變得越來越普遍:人們正在積極尋求永續的、無殘忍的和全蛋白質的食物。

- 藻類蛋白的實際益處:藻類成分支持能量、新陳代謝和免疫系統功能,並具有抗發炎作用。

- 培養和極小的空間使用:藻類的生產需要更少的自然資源,這符合全球永續發展計劃。

- 在食品飲料和膳食補充劑應用中的用途增加:藻類蛋白在膠囊、粉末和強化食品生產中的用途大幅增加,特別是在運動和營養健康應用中。

關鍵參與者:

藻類蛋白市場由前 7 大公司主導:Corbion NV、Cyanotech Corporation、BASF SE、Nutrex Hawaii Inc.、Veramaris、ENERGYbits Inc. 和 Roquette Freres,它們在 2024 年共佔據約 56% 的市場佔有率,面臨以下主要挑戰:

主要挑戰:

- 某些地區消費者意識較低:提高消費者對藻類的健康和永續性益處的認知是需要克服的關鍵挑戰。

- 風味與質地:某些藻類蛋白質具有泥土或海洋風味,有時不適合某些食品應用。

- 地理監管的複雜性:在某些地區,藻類被歸類為新型食品,這阻礙了它在市場上的發展。

1. 依來源分類-海藻佔據市場主導地位

海藻蛋白因其天然普遍性、永續生產以及在食品和營養保健領域的多種應用,將在2024年引領藻類蛋白市場。紅藻和褐藻都富含蛋白質和生物活性成分,有助於促進代謝健康。

2. 依劑型分類-膠囊維持強勁佔有率

膠囊已成為藻類蛋白補充品市場的寵兒。膠囊具有便利性、更長的保存期限和精準的劑量,這些優勢能夠提升消費者的信任度,並促進他們堅持健康養生。

3. 依應用分類-膳食補充品領先

膳食補充劑在 2024 年佔據了最大的應用。藻類蛋白作為天然產品和濃縮營養素不斷引入營養領域,在複合維生素、免疫增強劑和運動營養方面開闢了更多的應用。

4. 按地區分類-北美市場佔據主導地位;

北美地區仍然是藻類蛋白的主要區域市場,因為消費者的健康意識不斷增強,對清潔標籤和永續產品的需求不斷成長,以及藻類補充劑品牌在零售和電子商務中的存在感不斷增強。

藻類蛋白質產業的主要參與者包括 AlgalR NutraPharms Pvt Ltd、BASF SE、Corbion、Cyanotech Corporation、ENERGYbits Inc、Far East Bio-Tec Co. Ltd、福清金達姆薩螺旋藻有限公司、Heliae Development LLC、JUNE Spirulina、Nutrex Hawaii 和 Verquette Fres。

現有企業正在投資研發、地理擴張和垂直整合,以提高藻類培養、萃取技術和產品品質。 Roquette Freres 和 Veramaris 專注於基於永續性的海藻種植和用於補充劑級用途的優質蛋白質提取。 ENERGYbits Inc. 和 Cyanotech Corporation 正在為運動員和健康愛好者開發膠囊產品。與食品科技企業的合作以及將藻類納入即食產品形式,進一步提升了市場佔有率。

目錄

第1章:方法論與範圍

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 全球對永續和環保蛋白質來源的需求不斷成長。

- 素食主義和植物性飲食日益普及。

- 政府採取措施促進藻類產品生產。

- 產業陷阱與挑戰

- 藻類蛋白質培養的生產成本高且可擴展性有限。

- 消費者對藻類營養的認知度低且了解有限。

- 市場機會

- 對永續和植物性蛋白質替代品的需求不斷成長。

- 生物技術和栽培技術的進步。

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按來源,2021 - 2034 年

- 主要趨勢

- 海藻

- 褐藻

- 綠藻

- 紅藻

- 微藻

- 螺旋藻(藍綠藻)

- 小球藻(綠藻)

- 其他

第6章:市場估計與預測:按劑型,2021 - 2034

- 主要趨勢

- 膠囊

- 液體

- 粉末

- 其他

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 膳食補充劑

- 食品和飲料

- 烘焙和糖果

- 蛋白質飲料

- 早餐麥片

- 小吃

- 動物飼料

- 化妝品

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第9章:公司簡介

- AlgalR NutraPharms Pvt Ltd

- BASF SE

- Corbion

- Cyanotech Corporation

- ENERGYbits Inc

- Far East Bio-Tec Co. Ltd

- Fuqing King Dnarmsa Spirulina Co., Ltd

- Heliae Development LLC

- JUNE Spirulina

- Nutrex Hawaii Inc

- Roquette Freres

- Veramaris

The global algae protein market was valued at USD 933 million in 2024 and is projected to grow from USD 987.6 million in 2025 to USD 1.54 billion by 2034, expanding at a CAGR of 5.1%, according to the latest report published by Global Market Insights, Inc. The global movement toward plant-based diets, sustainably sourced products, and the functional health benefits of algae-based products are the key forces defining the direction of the market.

Seaweed and microalgal protein-especially from spirulina and chlorella-are increasingly commonplace in food and beverage, dietary supplements, and nutraceuticals. It has one of the highest bioavailable proteins, is nutritionally complete with essential amino acids, and benefits immunity, energy, and muscle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $933 Million |

| Forecast Value | $1.54 Billion |

| CAGR | 5.1% |

Key Drivers:

- The plant-based and vegan way of life is becoming increasingly common: Individuals are actively seeking sustainable, cruelty-free, and whole protein foods.

- The real-world benefits of algae protein: Algae ingredients support energy, metabolism, and immune system function and have anti-inflammatory effects.

- Cultured and very minimal space use: Algae needs fewer natural resources to produce, which aligns with global sustainability initiatives.

- Increased uses in food & beverage and dietary supplement applications: Algae protein has substantially increased uses in the production of capsules, powders, and fortified foods, especially in applications for sports and nutritional health.

Key Players:

The algae protein market is dominated by the top 7 players: Corbion N.V, Cyanotech Corporation, BASF SE, Nutrex Hawaii Inc., Veramaris, ENERGYbits Inc. and Roquette Freres, which together comprise approximately 56% of the market share in 2024, with the following key challenges:

Key Challenges:

- Low consumer awareness in certain geography: Raising consumer awareness of the health and sustainability benefits of algae is a key challenge to overcome.

- Flavor and texture: Certain algae proteins have earthy or oceanic flavors that are sometimes unsuitable for certain food applications.

- Geographical regulatory complexities: Algae is classified as a novel food in some geographies, and this is holding it up in the market.

1. By Source - Seaweed Dominates the Market

Seaweed proteins lead the algae protein market in 2024 because of their natural prevalence, sustainable production and multiple applications in food and nutraceutical sectors. Both red and brown seaweeds are particularly rich in protein and bioactive components that assist in metabolic health.

2. By Dosage Form - Capsules Maintain Strong Share

Capsules became the favored format in the algae protein supplement market. Capsules provide convenience, improved shelf life, and precise dosing-drivers of consumer trust and adherence to wellness regimens.

3. By Application - Dietary Supplements Lead

Dietary supplements held the largest application share in 2024. The continual introduction of algae protein into the nutrition space as a natural product and concentrated nutrients has opened even more applications in multivitamins, immunity boosters and sports nutrition.;

4. By Region - North America Topped the Market;

The North America region remains the leading regional market for algae protein because of the growing health-conscious consumer segment, the rising demand for clean-label and sustainable products, and the growing presence of algae-based supplement brands in retail and e-commerce.

Key players in the algae protein industry are AlgalR NutraPharms Pvt Ltd, BASF SE, Corbion, Cyanotech Corporation, ENERGYbits Inc, Far East Bio-Tec Co. Ltd, Fuqing King Dnarmsa Spirulina Co., Ltd, Heliae Development LLC, JUNE Spirulina, Nutrex Hawaii Inc, Roquette Freres, and Veramaris.

Incumbent players are investing in R&D, geographic expansion, and vertical integration to increase algae culture, extraction technologies, and product quality. Roquette Freres and Veramaris are emphasizing seaweed cultivation based on sustainability and protein quality extraction for supplement-grade usage. ENERGYbits Inc. and Cyanotech Corporation are developing capsule product offerings for athletes and health enthusiasts. Collaborations with food tech ventures and the inclusion of algae in ready-to-consume formats are further driving market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Dosage Form

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing global demand for sustainable and eco-friendly protein sources.

- 3.2.1.2 Rising prevalence of veganism and plant-based diets.

- 3.2.1.3 Government initiatives to boost algae products production.

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and scalability limitations in algae protein cultivation.

- 3.2.2.2 Low consumer awareness and limited familiarity with algae-based nutrition.

- 3.2.3 Market opportunities

- 3.2.3.1 Rising demand for sustainable and plant-based protein alternatives.

- 3.2.3.2 Advancements in biotechnology and cultivation techniques.

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Seaweed

- 5.2.1 Brown algae

- 5.2.2 Green algae

- 5.2.3 Red algae

- 5.3 Micro algae

- 5.3.1 Spirulina (blue-green algae)

- 5.3.2 Chlorella (green algae)

- 5.3.3 Others

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Capsules

- 6.3 Liquid

- 6.4 Powder

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dietary supplements

- 7.3 Food & beverage

- 7.3.1 Bakery & confectionery

- 7.3.2 Protein drinks

- 7.3.3 Breakfast cereals

- 7.3.4 Snacks

- 7.4 Animal feed

- 7.5 Cosmetics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 AlgalR NutraPharms Pvt Ltd

- 9.2 BASF SE

- 9.3 Corbion

- 9.4 Cyanotech Corporation

- 9.5 ENERGYbits Inc

- 9.6 Far East Bio-Tec Co. Ltd

- 9.7 Fuqing King Dnarmsa Spirulina Co., Ltd

- 9.8 Heliae Development LLC

- 9.9 JUNE Spirulina

- 9.10 Nutrex Hawaii Inc

- 9.11 Roquette Freres

- 9.12 Veramaris