|

市場調查報告書

商品編碼

1801900

冷凍烘焙添加劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Frozen Bakery Additives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

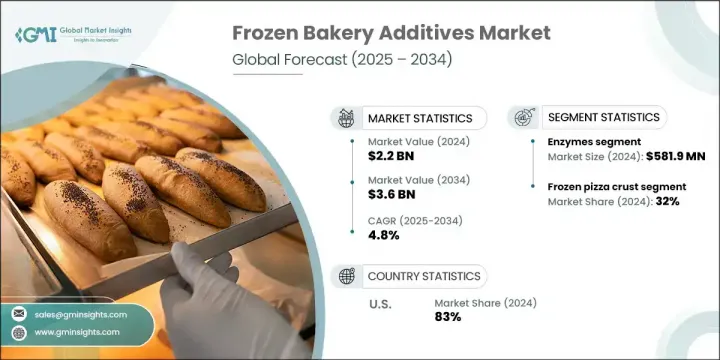

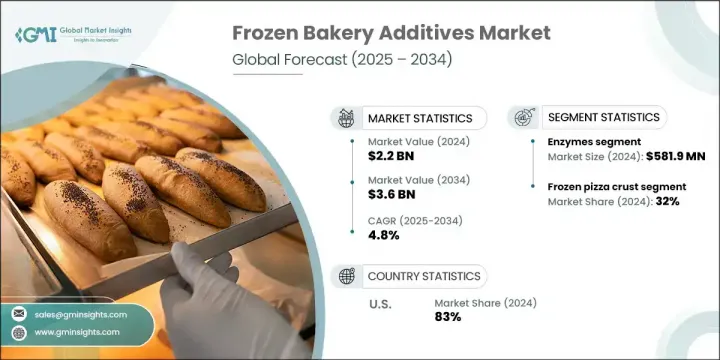

2024年,全球冷凍烘焙添加劑市場規模達22億美元,預計2034年將以4.8%的複合年成長率成長至36億美元。城市生活方式的日益成長以及消費者對快速即食食品解決方案的青睞是推動該市場發展的主要因素。隨著消費者在不犧牲品質和風味的前提下,越來越注重便利性,冷凍烘焙產品在家庭廚房和商業餐飲服務領域變得越來越重要。這些產品只需極少的準備工作,即可輕鬆享用新鮮烘焙的美味,這與現代消費者快節奏的日常生活相得益彰。人們對烘焙食品的創新、多樣性和縱享體驗的需求,也提升了對先進添加劑解決方案的需求,以維持產品吸引力。

人們對高階、健康及特色烘焙食品的興趣日益濃厚,大大推動了冷凍烘焙添加劑市場的發展。從無麩質麵包到精緻糕點,這些產品都需要特定的添加劑來保持風味、結構和貨架穩定性。添加劑對於提供均勻的體驗至關重要,確保最終產品即使在冷凍和烘焙後也能保持其理想的質地和口感。製造商正在使用這些成分來滿足人們對每一口都擁有一致性和優質品質日益成長的期望。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 4.8% |

2024年,酵素製劑的價值達5.819億美元,這得益於其在增強麵團柔韌性、提升產品柔軟度和延長保存期限方面的功能優勢。針對特定烘焙食品量身訂製的酵素製劑創新正在幫助製造商實現更好的一致性。然而,成本因素和對加工條件的敏感度可能會限制其在某些應用領域的應用。

冷凍披薩餅皮市場在2024年佔據最大佔有率,達到32%,預計到2034年將以4.8%的複合年成長率成長。該領域使用的添加劑側重於實現理想的餅皮質地、風味保留和增強新鮮度。提升酥脆度和儲存性能的研發也推動了該類別的持續成長。

美國冷凍烘焙添加劑市場佔83%的市場佔有率,2024年市場規模達7.205億美元。高度組織化的烘焙業、大規模的食品生產設施以及完善的物流網路,支撐著美國各地對添加劑的廣泛應用。製造商依靠先進的冷凍烘焙解決方案來滿足不斷變化的消費者需求,而尖端原料的供應也進一步加速了該地區市場的成長。

全球冷凍烘焙添加劑市場的主要公司包括 Corbion、Tate Lyle PLC、Puratos、Archer Daniels Midland Company (ADM)、Lesaffre、Palsgaard、Kerry Group、Novozymes、Cargill、DowDuPont、Ingredients、Lonza Group 和 Ashland。冷凍烘焙添加劑市場的領導者正在透過策略性產品開發、合併和地理擴張來加強其全球影響力。各公司正在投資研發,以開發能夠在不影響風味或安全性的情況下延長保存期限、改善質地和營養成分的添加劑。與大型烘焙製造商的合作使這些公司能夠將創新直接融入產品線中。客製化和清潔標籤趨勢也促使公司開發在保持性能的同時減少人工成分的解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 衝擊力

- 成長動力

- 冷凍烘焙領域的新產品的推出有望擴大該行業。

- 日益增強的健康意識正在推動對無麩質產品的需求。

- 可支配收入的增加推動了對簡便食品的需求。

- 陷阱/挑戰

- 嚴格的食品安全法規可能會帶來挑戰。

- 高生產成本可能會限制獲利能力。

- 一些添加劑的保存期限有限會影響品質。

- 機會

- 簡便食品的需求不斷增加。

- 無麩質和健康產品越來越受歡迎。

- 向新興市場擴張。

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 按產品

- 未來市場趨勢

- 技術和創新格局

- 專利態勢

- 貿易統計資料(HS 編碼)(註:僅提供主要國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按產品,2021-2034

- 主要趨勢

- 調味劑和增味劑

- 自然的

- 人造的

- 氧化劑

- 著色劑

- 自然的

- 合成的

- 酵素

- 防腐劑

- 還原劑

- 抗壞血酸

- L-半胱氨酸

- 山梨酸

- 膨鬆劑

- 抗壞血酸

- L-半胱氨酸

- 乳化劑

- 單甘油酯、雙甘油酯及其衍生物

- 卵磷脂

- 硬脂醯乳酸酯

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 冷凍麵包

- 冷凍餅乾和曲奇

- 冷凍蛋糕和糕點

- 冷凍披薩餅皮

- 冷凍麵團

第7章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- MEA

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第8章:公司簡介

- Cargill, Inc.

- Corbion

- Kerry Group

- Archer Daniels Midland Company (ADM)

- Novozymes

- DowDuPont

- Palsgaard

- Lonza Group

- Lesaffre

- Puratos

- Ingredients

- Ashland

- Tate Lyle PLC

The Global Frozen Bakery Additives Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 3.6 billion by 2034. The growing influence of urban lifestyles and the shift toward quick, ready-to-bake food solutions are major factors driving this market forward. As consumers continue to prioritize convenience without compromising on quality or flavor, frozen bakery products have become more prominent in both home kitchens and commercial foodservice sectors. These offerings provide the comfort of freshly baked goods with minimal preparation, aligning well with the fast-paced routines of modern consumers. The need for innovation, variety, and indulgence in baked goods has elevated demand for advanced additive solutions to maintain product appeal.

The increased interest in high-end, health-conscious, and specialty baked items has significantly fueled the frozen bakery additives segment. From gluten-free breads to gourmet pastries, these products require specific additives to maintain flavor, structure, and shelf stability. Additives are essential in delivering a uniform experience, ensuring the end product retains its desired texture and taste even after freezing and baking. Manufacturers are using these ingredients to address growing expectations for consistency and premium quality in every bite.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 4.8% |

In 2024, the enzymes were valued at USD 581.9 million due to their functional benefits in enhancing dough flexibility, improving product softness, and extending shelf life. Enzyme innovations tailored to specific baked goods are helping manufacturers achieve better consistency. However, the cost factor and sensitivity to processing conditions may limit their adoption in some applications.

The frozen pizza crusts segment held the largest share at 32% in 2024 and is set to grow at a CAGR of 4.8% through 2034. Additives used in this segment focus on achieving the ideal crust texture, flavor retention, and enhanced freshness. Developments that improve crispiness and storage performance are contributing to continued growth in this category.

U.S. Frozen Bakery Additives Market held 83% share and generated USD 720.5 million in 2024. The presence of a highly organized bakery sector, large-scale food production facilities, and an established logistics network supports strong additive adoption across the country. Manufacturers rely on advanced frozen bakery solutions to meet evolving consumer demands, and the availability of cutting-edge ingredients further accelerates market growth in the region.

Key companies in the Global Frozen Bakery Additives Market include Corbion, Tate Lyle PLC, Puratos, Archer Daniels Midland Company (ADM), Lesaffre, Palsgaard, Kerry Group, Novozymes, Cargill, DowDuPont, Ingredients, Lonza Group, and Ashland. Top players in the frozen bakery additives market are strengthening their global presence through strategic product development, mergers, and geographic expansion. Companies are investing in R&D to create additives that enhance shelf life, texture, and nutritional content without compromising on flavor or safety. Partnerships with large-scale bakery manufacturers allow these firms to integrate innovations directly into product pipelines. Customization and clean-label trends have also pushed companies to develop solutions with fewer artificial ingredients while maintaining performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Impact forces

- 3.2.1 Growth driver

- 3.2.1.1 New product launches in the frozen bakery segment are expected to expand the industry.

- 3.2.1.2 Rising health awareness is boosting demand for gluten-free products.

- 3.2.1.3 Increasing disposable income is driving the demand for convenient food options.

- 3.2.2 Pitfalls/challenge

- 3.2.2.1 Strict food safety regulations can pose challenges.

- 3.2.2.2 High production costs may limit profitability.

- 3.2.2.3 Limited shelf life of some additives can affect quality.

- 3.2.3 Opportunities

- 3.2.3.1 Growing demand for convenience foods.

- 3.2.3.2 Rising popularity of gluten-free and health-focused products.

- 3.2.3.3 Expansion into emerging markets.

- 3.2.1 Growth driver

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key) countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Flavors & enhancers

- 5.2.1 Natural

- 5.2.2 Artificial

- 5.3 Oxidising agents

- 5.4 Colorants

- 5.4.1 Natural

- 5.4.2 Synthetic

- 5.5 Enzymes

- 5.6 Preservatives

- 5.7 Reducing agents

- 5.7.1 Ascorbic acid

- 5.7.2 L-cysteine

- 5.7.3 Sorbic acid

- 5.8 Leavening agents

- 5.8.1 Ascorbic acid

- 5.8.2 L-cysteine

- 5.9 Emulsifier

- 5.9.1 Mono, di-glycerides & derivatives

- 5.9.2 Lecithin

- 5.9.3 Stearoyl lactylates

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Frozen bread

- 6.3 Frozen biscuits & cookies

- 6.4 Frozen cake & pastry

- 6.5 Frozen pizza crust

- 6.6 Frozen dough

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 MEA

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Cargill, Inc.

- 8.2 Corbion

- 8.3 Kerry Group

- 8.4 Archer Daniels Midland Company (ADM)

- 8.5 Novozymes

- 8.6 DowDuPont

- 8.7 Palsgaard

- 8.8 Lonza Group

- 8.9 Lesaffre

- 8.10 Puratos

- 8.11 Ingredients

- 8.12 Ashland

- 8.13 Tate Lyle PLC