|

市場調查報告書

商品編碼

1773375

乘用車座艙監控系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Passenger Vehicle Cabin Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

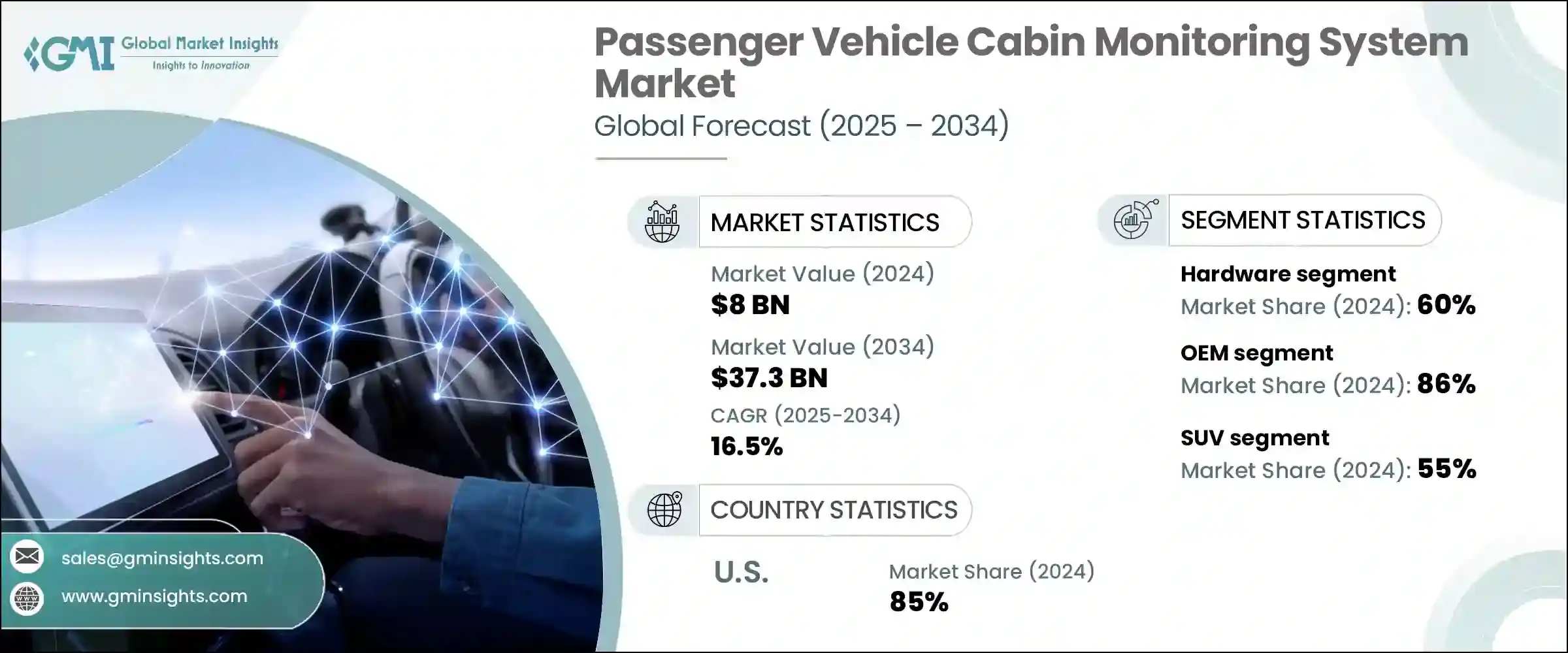

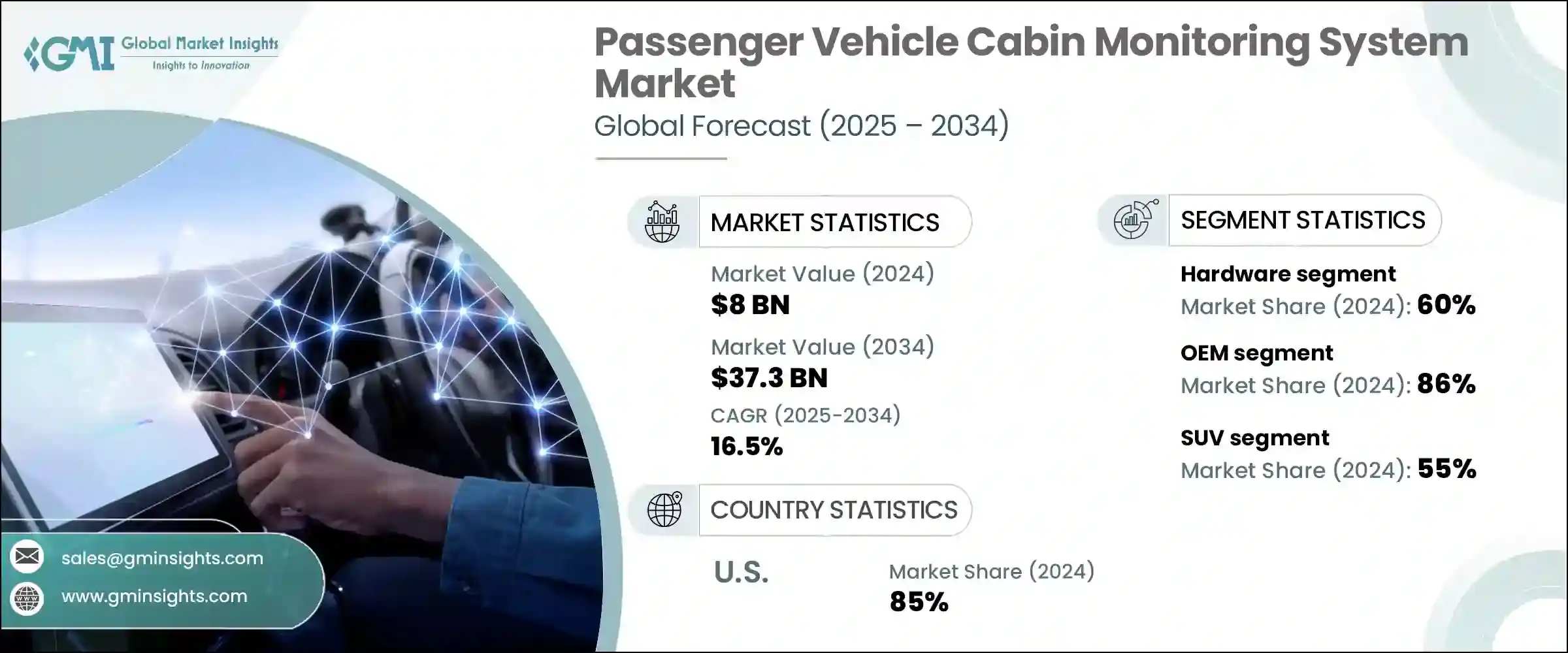

2024年,全球乘用車座艙監控系統市場規模達80億美元,預計2034年將以16.5%的複合年成長率成長,達到373億美元。汽車製造商和消費者對乘員安全、舒適性和智慧座艙技術的日益關注是推動這一成長的關鍵因素。隨著汽車自動駕駛技術的日益成熟,整合式座艙監控系統(包括生命徵象偵測、乘員識別和駕駛員監控)正成為現代汽車設計的標準配備。

這些系統依靠多種感測器和人工智慧演算法來監測駕駛員的警覺性、偵測乘客,甚至分析生物特徵資料,從而支援諸如困倦警報、自適應安全氣囊展開和緊急干預等功能。隨著主要汽車市場的監管機構強制要求配備先進的安全功能,以及買家對個人化和主動式座艙體驗的強烈需求,智慧座艙監控解決方案市場有望快速成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 80億美元 |

| 預測值 | 373億美元 |

| 複合年成長率 | 16.5% |

這些系統已超越概念階段,成為識別乘員、評估駕駛員注意力和確保兒童安全的關鍵,鞏固了其在日常車輛中的作用。受監管要求和消費者期望變化的雙重驅動,這些曾經被視為高階或未來功能的功能如今已成為一項標準要求。先進的座艙監控系統現已整合,可檢測生命徵象、監測疲勞程度並即時響應緊急情況,從而提升了便利性和車內安全性。它們還支援智慧功能,例如基於乘員的自動空調和基於生物識別的個人化服務。

2024年,硬體市場佔據了60%的佔有率,預計在2025-2034年期間的複合年成長率將達到16%。硬體仍然是乘用車座艙監控系統的基石,包括攝影機、雷達感測器、紅外線模組和嵌入式電子設備。隨著汽車製造商專注於打造更智慧的內飾,對堅固耐用、響應迅速的硬體的需求至關重要。這些組件提供必要的即時資料,以支援追蹤駕駛員警覺性、乘客存在和生物特徵指標的人工智慧演算法,因此它們對於系統性能至關重要。

2024年,OEM)市場佔據了86%的市場佔有率,這得益於汽車產業對感測器驅動、原廠安裝安全解決方案的大力推動。越來越多的汽車製造商選擇在生產過程中直接整合座艙和駕駛員監控系統,以確保與空調、ADAS 和資訊娛樂系統等其他車載技術無縫相容。 OEMOEM可以提高系統的準確性、可靠性和消費者信任度,使其成為該市場首選的交付方式。

北美乘用車座艙監控系統市場佔85%的市場佔有率,2024年市場規模達24億美元。由於汽車行業成熟、安全標準嚴格以及對創新的強烈渴望,美國在該領域的應用處於領先地位。汽車製造商正積極將生物辨識追蹤、乘員偵測和疲勞監測等功能納入新車型的標準配置。這種需求加上監管支持,使美國成為該領域的主導力量。

乘用車座艙監控系統產業的知名公司包括麥格納國際公司、松下公司、羅伯特·博世有限公司、大陸集團、法雷奧公司、電裝公司和偉世通公司。為了鞏固在乘用車座艙監控系統市場的地位,各公司正在採取多項關鍵策略。創新是重中之重,在研發方面投入了大量資金,以提高感測器精度、人工智慧功能以及與車輛架構的系統整合。與汽車製造商的協作和策略夥伴關係加速了新技術的採用,並有助於根據特定的OEM需求客製化解決方案。各公司也專注於透過在地化生產和客戶支援來擴大其全球影響力,以服務不同的市場。增強網路安全功能和提高系統可靠性是建立消費者對安全系統的信心的優先事項。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預測模型

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 在政府獎勵措施的支持下,電動車在全球的普及率不斷提高

- 輕量化和智慧軸承技術的進步提高了效率和耐用性

- 新興市場電動車製造的擴張

- 透過感測器軸承整合預測性維護

- 產業陷阱與挑戰

- 初始成本高

- 安裝維護複雜

- 市場機會

- 全球電動車產量激增

- 研發以及與原始設備製造商的共同開發

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利分析

- 價格趨勢

- 按地區

- 按組件

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 相機

- 感應器

- 顯示單位

- 控制單元

- 軟體

- 服務

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 掀背車

- 轎車

- 越野車

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 駕駛員監控系統

- 眼動追蹤

- 臉部辨識

- 頭部位置監測

- 睡意檢測

- 分心檢測

- 乘員監測系統 (OMS)

- 乘客存在檢測

- 安全帶監控

- 兒童檢測

- 乘客行為分析

- 其他

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 原始設備製造商

- 售後市場

第9章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 基於相機

- 基於感測器

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aptiv

- Autoliv

- Caaresys

- Continental

- Denso

- Faurecia SA

- Gentex

- Harman International Industries, Inc.

- Hyundai Mobis

- Magna International

- Omron

- Panasonic

- Robert Bosch

- Seeing Machines

- Smart Eye AB

- Tobii

- Valeo SA

- Vayyar Imaging

- Visteon

- ZF Friedrichshafen

The Global Passenger Vehicle Cabin Monitoring System Market was valued at USD 8 billion in 2024 and is estimated to grow at a CAGR of 16.5% to reach USD 37.3 billion by 2034. The rising focus on occupant safety, comfort, and smart in-cabin technology by both car manufacturers and consumers is a key driver of this growth. As vehicles become increasingly autonomous, the integration of cabin monitoring systems-including vital sign detection, occupant identification, and driver monitoring-is becoming standard in modern car designs.

These systems rely on a mix of sensors and AI-powered algorithms to monitor driver alertness, detect passengers, and even analyze biometric data, supporting functions such as drowsiness alerts, adaptive airbag deployment, and emergency interventions. With regulatory agencies in major automotive markets mandating advanced safety features and buyers showing strong demand for personalized and proactive cabin experiences, the market for intelligent cabin monitoring solutions is poised for rapid growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8 Billion |

| Forecast Value | $37.3 Billion |

| CAGR | 16.5% |

These systems have moved beyond the concept stage to become essential in identifying occupants, assessing driver attention, and ensuring child safety, solidifying their role in everyday vehicles. What was once viewed as a premium or futuristic feature is now becoming a standard requirement, driven by both regulatory mandates and shifting consumer expectations. Advanced cabin monitoring systems are now integrated to detect vital signs, monitor fatigue levels, and respond to emergencies in real-time, enhancing both convenience and in-vehicle security. They also support intelligent functions like automatic climate adjustment based on occupancy and biometric-based personalization.

In 2024, the hardware segment held a 60% share and is forecasted to grow at a CAGR of 16% during 2025-2034. Hardware remains the cornerstone of cabin monitoring systems in passenger vehicles, consisting of cameras, radar sensors, infrared modules, and embedded electronics. As automakers focus on smarter interiors, the need for robust and responsive hardware is critical. These components provide the real-time data necessary to fuel AI algorithms that track driver vigilance, passenger presence, and biometric indicators, making them indispensable for system performance.

The OEM segment held an 86% share in 2024, driven by the automotive industry's push toward sensor-enabled, factory-installed safety solutions. Vehicle manufacturers increasingly opt to integrate cabin and driver monitoring systems directly during production, ensuring seamless compatibility with other in-car technologies like climate control, ADAS, and infotainment systems. OEM installation enhances system accuracy, reliability, and consumer trust, making it the preferred method of delivery in this market.

North America Passenger Vehicle Cabin Monitoring System Market held an 85% share and generated USD 2.4 billion in 2024. The country leads adoption due to a mature automotive sector, stringent safety standards, and a strong appetite for innovation. Automakers are proactively incorporating features such as biometric tracking, occupant detection, and fatigue monitoring as standard across new vehicle models. This demand, combined with regulatory support, positions the U.S. as a dominant force in this segment.

Prominent companies in the Passenger Vehicle Cabin Monitoring System Industry include Magna International Inc., Panasonic Corporation, Robert Bosch GmbH, Continental AG, Valeo S.A., Denso Corporation, and Visteon Corporation. To strengthen their foothold in the passenger vehicle cabin monitoring system market, companies are adopting several key strategies. Innovation is at the forefront, with significant investment in research and development to advance sensor accuracy, AI capabilities, and system integration with vehicle architectures. Collaborations and strategic partnerships with automakers accelerate the adoption of new technologies and help tailor solutions to specific OEM needs. Companies are also focusing on expanding their global reach through localized production and customer support to serve diverse markets. Enhancing cybersecurity features and improving system reliability are prioritized to build consumer confidence in safety systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicle

- 2.2.4 Technology

- 2.2.5 Sales channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global adoption of electric vehicles supported by government incentives

- 3.2.1.2 Advancements in lightweight and smart bearing technologies improve efficiency and durability

- 3.2.1.3 Expansion of EV manufacturing in emerging markets

- 3.2.1.4 Integration of predictive maintenance through sensor-enabled bearings

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Complex installation and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Surging global EV production

- 3.2.3.2 R&D and co-development with OEMs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Cameras

- 5.2.2 Sensors

- 5.2.3 Display Units

- 5.2.4 Control Units

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hatchback

- 6.3 Sedan

- 6.4 SUV

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Driver monitoring system

- 7.2.1 Eye-Tracking

- 7.2.2 Facial recognition

- 7.2.3 Head position monitoring

- 7.2.4 Drowsiness detection

- 7.2.5 Distraction detection

- 7.3 Occupant Monitoring System (OMS)

- 7.3.1 Occupant presence detection

- 7.3.2 Seat belt monitoring

- 7.3.3 Child detection

- 7.3.4 Passenger behavior analysis

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Camera based

- 9.3 Sensor based

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Autoliv

- 11.3 Caaresys

- 11.4 Continental

- 11.5 Denso

- 11.6 Faurecia S.A.

- 11.7 Gentex

- 11.8 Harman International Industries, Inc.

- 11.9 Hyundai Mobis

- 11.10 Magna International

- 11.11 Omron

- 11.12 Panasonic

- 11.13 Robert Bosch

- 11.14 Seeing Machines

- 11.15 Smart Eye AB

- 11.16 Tobii

- 11.17 Valeo S.A.

- 11.18 Vayyar Imaging

- 11.19 Visteon

- 11.20 ZF Friedrichshafen