|

市場調查報告書

商品編碼

1721614

專用商用車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Specialty Commercial Vehicle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

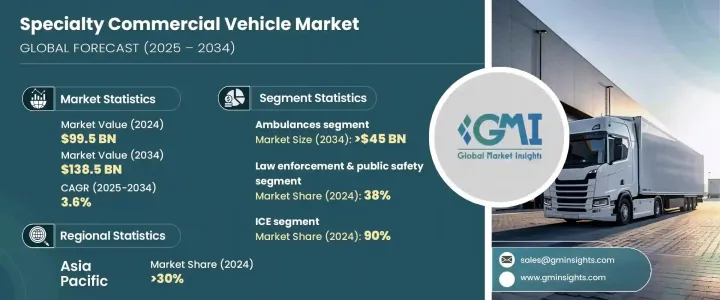

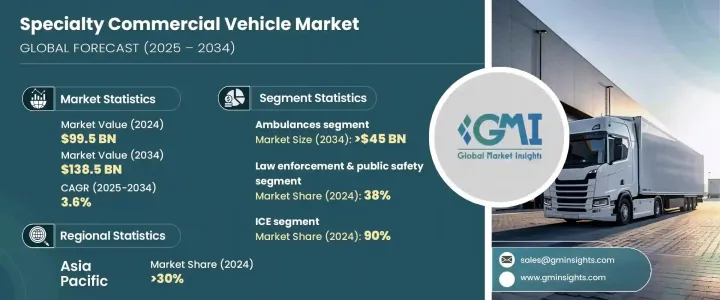

2024 年全球專用商用車市場價值為 995 億美元,預計到 2034 年將以 3.6% 的複合年成長率成長,達到 1,385 億美元。該市場的成長軌跡受到針對緊急應變、醫療保健和公共安全的專業運輸解決方案不斷成長的需求的推動。隨著城市化進程的加速和醫療保健系統的發展,人們越來越依賴能夠直接為社區提供基本服務的行動醫療單位。政府和私人組織正在擴大其車隊,以提高可及性和回應能力,特別是在服務不足和偏遠地區。慢性病負擔加重、老齡化人口不斷增加以及對預防保健的日益重視,促使當局投資配備智慧醫療功能的車輛。此外,在後疫情時代,感染控制和遠端診斷已成為核心考慮因素,進一步刺激了對符合現代醫療標準的專用車輛的需求。從高科技救護車到行動診所和消防救援隊,全球市場正在經歷由創新、技術整合以及向分散護理和公共安全營運的更廣泛轉變所推動的轉型。

隨著對先進緊急應變系統(包括下一代救護車和行動醫療單位)的投資不斷增加,對專用車輛的需求持續上升。公眾健康意識的增強,加上向農村和偏遠地區提供醫療服務的再度推動,正在推動移動 ICU 車和護理車輛的部署。感染控制協議和遠距醫療工具的日益普及進一步加速了全球市場對現代專用車輛的需求。同時,天災和氣候引發的緊急情況日益頻繁,促使各國加強消防隊和公共安全車輛基礎設施。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 995億美元 |

| 預測值 | 1385億美元 |

| 複合年成長率 | 3.6% |

2024 年,救護車佔全球市場的 40%,預計到 2034 年將創造 450 億美元的市場價值。政府和私人醫療保健營運商優先考慮縮短緊急應變時間,並為車輛配備最先進的通訊系統、5G 連接和即時病患監控解決方案。這些創新實現了醫院在運輸過程中的無縫協調和更好的患者治療效果。隨著數位醫療的不斷發展,智慧救護車技術有望在下一代緊急應變策略中發揮關鍵作用。

2024 年,執法和公共安全車輛佔據了 38% 的市場佔有率,承擔著從移動診斷實驗室到偏遠地區治療單位等多種角色。隨著醫療保健服務模式日益分散,提供診斷、門診護理和透析的行動服務發展勢頭強勁。這些車輛支援家庭護理服務並增強了資源匱乏地區的醫療服務,推動了專用車輛設計的新一輪創新浪潮。

到 2024 年,亞太地區將佔全球市場的 30%,這主要得益於中國快速的基礎建設和對智慧移動的投資。受政府支持清潔、永續車隊的激勵政策推動,該地區對救護車、消防車和多用途貨車的需求不斷成長。

Farber Specialty Vehicles、Mercedes-Benz、Volvo、五十鈴、Traton、Pierce、REV、LDV、Oshkosh Corporation 和 NFI 等主要參與者正在透過電氣化、模組化設計和人工智慧診斷突破極限。與市政當局和醫療保健提供者的策略合作正在幫助這些公司加強當地影響力並滿足各地區日益成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件供應商

- 製造商

- 服務提供者

- 經銷商

- 最終用途

- 川普政府關稅的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 需求面影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 價格趨勢

- 成本細分分析

- 衝擊力

- 成長動力

- 全球緊急醫療服務需求不斷成長

- 增加政府對災害應變的投資

- 遠程工業活動日益增多

- 休閒旅遊激增

- 產業陷阱與挑戰

- 初始成本高且生產週期長

- 嚴格的監管和認證要求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 救護車

- 消防車

- 移動式燃油運輸油罐車

- 其他

第6章:市場估計與預測:以推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

- 純電動車

- 油電混合車

- 插電式混合動力

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 醫療保健

- 執法與公共安全

- 休閒車

- 市政服務

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Arctic Cat

- Cargotec

- Case New Holland

- Demers Ambulances

- Eicher

- Emergency One

- Farber Specialty Vehicles

- Hino Motors

- Isuzu

- LDV

- Matthews Specialty Vehicles

- Mercedes-Benz

- NFI

- Oshkosh Corporation

- Pierce

- REV

- Rosenbauer International

- Specialty Vehicles

- Traton

- Volvo

The Global Specialty Commercial Vehicle Market was valued at USD 99.5 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 138.5 billion by 2034. The growth trajectory of this market is being driven by rising demand for specialized transportation solutions tailored to emergency response, healthcare delivery, and public safety. As urbanization accelerates and healthcare systems evolve, there is a growing reliance on mobile units that can bring essential services directly to communities. Governments and private organizations are expanding their fleets to enhance accessibility and responsiveness, particularly in underserved and remote regions. The growing burden of chronic illnesses, a rising aging population, and the increasing emphasis on preventive care are pushing authorities to invest in vehicles equipped with smart healthcare capabilities. Moreover, in the post-pandemic landscape, infection control and remote diagnostics have become core considerations, further fueling demand for specialty vehicles that align with modern healthcare standards. From high-tech ambulances to mobile clinics and fire-rescue units, the global market is witnessing a transformation driven by innovation, technology integration, and a broader shift toward decentralized care and public safety operations.

The demand for specialized vehicles continues to rise as investments pour into advanced emergency response systems, including next-generation ambulances and mobile healthcare units. Heightened awareness around public health, combined with a renewed push to deliver medical services to rural and hard-to-reach areas, is propelling the deployment of mobile ICU vans and paramedic vehicles. Infection control protocols and the growing adoption of telemedicine tools are further accelerating the demand for modern specialty vehicles across global markets. In parallel, the increasing frequency of natural disasters and climate-induced emergencies is driving nations to bolster their firefighting fleets and public safety vehicle infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $99.5 Billion |

| Forecast Value | $138.5 Billion |

| CAGR | 3.6% |

Ambulances accounted for a 40% share of the global market in 2024 and are projected to generate USD 45 billion by 2034. Governments and private healthcare operators are prioritizing shorter emergency response times and are outfitting vehicles with state-of-the-art communication systems, 5G connectivity, and real-time patient monitoring solutions. These innovations enable seamless hospital coordination and better patient outcomes during transport. As digital healthcare continues to evolve, smart ambulance technology is expected to play a critical role in next-gen emergency response strategies.

Law enforcement and public safety vehicles captured a 38% market share in 2024, fulfilling diverse roles from mobile diagnostic labs to treatment units in remote zones. As the healthcare delivery model becomes more decentralized, there is strong momentum behind mobile services offering diagnostics, outpatient care, and dialysis. These vehicles support home-based care delivery and enhance access in under-resourced areas, driving a new wave of innovation in specialty vehicle design.

Asia Pacific represented 30% of the global market in 2024, led by China's rapid infrastructure development and investment in smart mobility. Rising demand for ambulances, fire trucks, and utility vans in the region is backed by government incentives favoring clean, sustainable vehicle fleets.

Major players such as Farber Specialty Vehicles, Mercedes-Benz, Volvo, Isuzu, Traton, Pierce, REV, LDV, Oshkosh Corporation, and NFI are pushing the envelope through electrification, modular designs, and AI-powered diagnostics. Strategic collaborations with municipalities and healthcare providers are helping these companies strengthen local footprints and meet rising demand across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component suppliers

- 3.2.3 Manufacturers

- 3.2.4 Service providers

- 3.2.5 Distributors

- 3.2.6 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade volume disruptions

- 3.3.2 Retaliatory measures

- 3.3.3 Impact on the industry

- 3.3.4 Supply-side impact

- 3.3.5 Demand-side impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Price trends

- 3.10 Cost breakdown analysis

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising demand for emergency medical services across the globe

- 3.11.1.2 Increasing government investments in disaster response

- 3.11.1.3 Growing remote industrial activities

- 3.11.1.4 Surge in recreational travel

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost and long production lead times

- 3.11.2.2 Stringent regulatory and certification requirements

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Ambulances

- 5.3 Fire extinguishing trucks

- 5.4 Mobile fuel carrying tankers

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.3.1 BEV

- 6.3.2 HEV

- 6.3.3 PHEV

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Medical & healthcare

- 7.3 Law enforcement & public safety

- 7.4 Recreational vehicles

- 7.5 Municipal services

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Arctic Cat

- 9.2 Cargotec

- 9.3 Case New Holland

- 9.4 Demers Ambulances

- 9.5 Eicher

- 9.6 Emergency One

- 9.7 Farber Specialty Vehicles

- 9.8 Hino Motors

- 9.9 Isuzu

- 9.10 LDV

- 9.11 Matthews Specialty Vehicles

- 9.12 Mercedes-Benz

- 9.13 NFI

- 9.14 Oshkosh Corporation

- 9.15 Pierce

- 9.16 REV

- 9.17 Rosenbauer International

- 9.18 Specialty Vehicles

- 9.19 Traton

- 9.20 Volvo