|

市場調查報告書

商品編碼

1740791

硝化抑制劑及脲酶抑制劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nitrification and Urease Inhibitors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

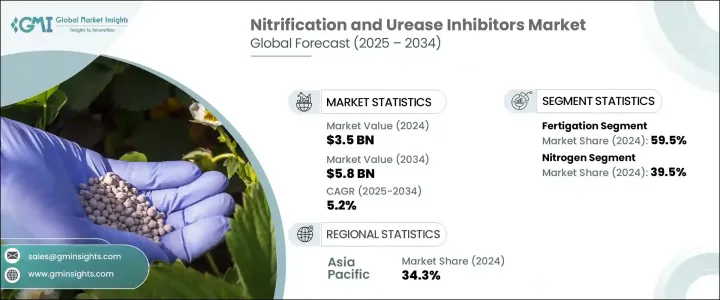

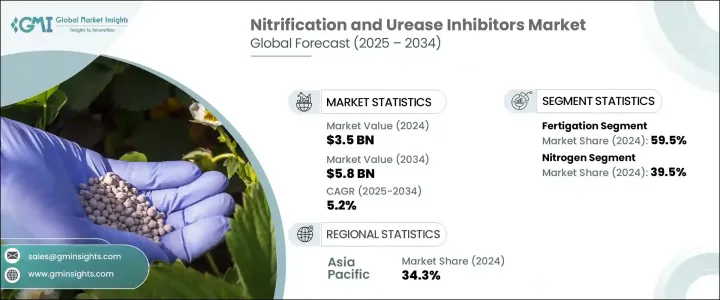

2024年,全球硝化抑制劑和脲酶抑制劑市場規模達35億美元,預計2034年將以5.2%的複合年成長率成長,達到58億美元。這得益於農業領域對提高氮肥利用效率日益成長的需求以及向永續農業實踐的轉變。環境和經濟壓力迫使農業部門採取更有效率的養分管理策略,該市場正呈現強勁成長動能。隨著全球人口成長和可耕地日益稀缺,農民正在尋找創新工具,以最佳化投入品使用,同時又不影響作物產量。硝化抑制劑和脲酶抑制劑正成為關鍵的解決方案,它們能夠增強肥料性能,並有助於防止氮素因淋溶和揮發而流失。這些抑制劑不僅因其能夠改善土壤健康和水質,還因其能夠透過減少浪費和提高單位面積產量來提高盈利能力而日益受到青睞。此外,全球對溫室氣體排放和水污染的擔憂進一步推動了需求,使這些產品成為現代精準農業系統中不可或缺的一部分。隨著該產業持續投資於更智慧、更能適應氣候的技術,市場將受益於永續發展目標和經濟可行性的融合,為農業企業和小規模農戶創造機會。

多年來,農民面臨氮素揮發和淋溶造成的損失這一嚴峻挑戰,不僅降低了肥料利用率,也對環境造成了危害。為此,農業部門正在迅速採用抑制劑,以改善養分保留並減少有害排放。北美和亞太等主要農業地區的政府正積極支持這項轉變,透過補貼和永續發展措施推廣氮穩定劑的使用。這些努力旨在創造一個更具韌性、對環境更負責的農業體系。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 35億美元 |

| 預測值 | 58億美元 |

| 複合年成長率 | 5.2% |

對於注重成本的農民來說,這些抑制劑能夠在不增加投入成本的情況下最大限度地提高作物產量,這是一項極具吸引力的投資。肥沃農田的競爭日益激烈,加上人們對土壤退化和水污染的擔憂日益加劇,可靠的氮肥管理解決方案的重要性日益凸顯。除了環境效益外,這些產品還與不斷發展的農藝實踐相契合,例如客製化肥料混合物以及葉面噴施和水肥一體化等先進的施用方法,從而促進了其在各種農業環境中的廣泛應用。

2024年,灌溉施肥佔了59.5%的市場佔有率,這反映出其作為首選施肥方法的受歡迎程度。這種方法將施肥與灌溉結合,實現了精準且一致的養分分配。灌溉施肥在自動化農業系統以及高價值作物種植者中尤其受歡迎,因為在這些領域,效率和一致性至關重要。用於灌溉施肥的抑制劑的水溶性、穩定性以及對pH值和溫度變化的響應能力日益增強,使其成為精準農業應用的理想選擇。

在不同類型的養分中,氮抑制劑在2024年佔據了最大的市場佔有率,佔總市場佔有率的39.5%。這一強勁表現凸顯了最佳化氮肥利用和抑制養分流失到環境的關鍵性。這些抑制劑能夠使氮在土壤中保持更長時間的有效性,從而幫助作物更有效地吸收養分,提高產量,同時減少對水體和生態系統的負面影響。因此,氮抑制劑現已成為全球永續養分管理策略的核心要素。

2024年,亞太地區引領全球市場,佔據34.3%的市場佔有率,這得益於該地區農業活動的活躍、積極的政府政策以及對先進農業實踐日益成長的需求。在強而有力的政策框架和激勵措施的支持下,該地區各國正在大力推廣能夠最大程度減少氮流失並提高作物產量的技術。同時,在嚴格的環境法規和精準農業技術的廣泛應用的推動下,北美和歐洲市場繼續保持穩健成長。

索爾維公司、巴斯夫公司、陶氏化學、科氏化肥公司和杜邦等產業領導者正積極拓展市場,開發針對區域農業需求的客製化解決方案。這些公司正在與化肥製造商和農業科技公司建立合作夥伴關係,投資於持久有效的生物基技術,並支持農民教育計畫。透過創新與合作,他們在塑造永續農業的未來方面發揮著至關重要的作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 供應方影響(原料)

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 抑制劑與先進肥料技術的整合

- 對永續和生態友善農業的需求不斷成長

- 生物基和雙功能配方的創新

- 產業陷阱與挑戰

- 農民的認知與採用有限

- 產品成本高且可近性有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依方法,2021 年至 2034 年

- 主要趨勢

- 水肥一體化

- 葉面

第6章:市場估計與預測:按營養成分,2021 年至 2034 年

- 主要趨勢

- 氮

- 氨

- 硝酸鹽

- 尿素

- 其他

第7章:市場估計與預測:依作物類型,2021 年至 2034 年

- 主要趨勢

- 糧食作物

- 經濟作物

- 園藝

- 纖維作物

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- BASF SE

- Dow

- DuPont

- Solvay SA

- Koch Fertilizers LLC

- Evonik

- National Fertilizers Limited

- Nico Orgo Manures

- Compo Expert GmbH

- Eco Agro

The Global Nitrification and Urease Inhibitors Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.8 billion by 2034, driven by the growing urgency to enhance nitrogen use efficiency in agriculture and the increasing shift toward sustainable farming practices. This market is witnessing strong momentum as both environmental and economic pressures compel the agricultural sector to adopt more efficient nutrient management strategies. As the global population rises and arable land becomes scarcer, farmers are looking for innovative tools to optimize input usage without compromising crop yields. Nitrification and urease inhibitors are emerging as critical solutions, offering enhanced fertilizer performance and helping prevent nitrogen loss through leaching and volatilization. These inhibitors are gaining traction not only for their ability to support soil health and water quality but also for their role in improving profitability by reducing waste and boosting yield per acre. Moreover, global concerns over greenhouse gas emissions and water pollution have further propelled demand, making these products essential in modern precision agriculture systems. As the industry continues to invest in smarter, climate-resilient technologies, the market is set to benefit from the convergence of sustainability goals and economic viability, creating opportunities for both agribusinesses and small-scale farmers.

Over the years, farmers have faced significant challenges with nitrogen loss caused by volatilization and leaching, which not only reduce fertilizer efficiency but also harm the environment. In response, the agriculture sector is rapidly adopting inhibitors that improve nutrient retention and reduce harmful emissions. Governments in major agricultural regions like North America and Asia Pacific are actively supporting this shift through subsidies and sustainability initiatives that promote the use of nitrogen stabilizers. These efforts aim to create a more resilient and environmentally responsible agricultural system.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.2% |

For cost-conscious farmers, the ability to maximize crop yield without inflating input costs makes these inhibitors a highly attractive investment. The growing competition for fertile farmland, coupled with rising concerns about soil degradation and water contamination, has elevated the importance of reliable nitrogen management solutions. In addition to environmental benefits, these products align with evolving agronomic practices such as customized fertilizer blends and advanced delivery methods like foliar sprays and fertigation, encouraging widespread adoption across diverse farming environments.

In 2024, the fertigation segment accounted for a dominant 59.5% share of the market, reflecting its popularity as a preferred application method. This approach integrates fertilizer delivery with irrigation, allowing for precise and consistent nutrient distribution. Fertigation is especially popular in automated farming systems and among growers of high-value crops, where efficiency and consistency are critical. Inhibitors designed for fertigation are becoming increasingly water-soluble, stable, and responsive to varying pH levels and temperatures, making them ideal for precision agriculture applications.

Among the different nutrient types, nitrogen inhibitors captured the largest market share in 2024, holding 39.5% of the total. This strong performance underscores the critical importance of optimizing nitrogen use and curbing nutrient losses to the environment. By keeping nitrogen available in the soil for longer periods, these inhibitors help crops absorb nutrients more efficiently, boosting productivity while reducing negative impacts on water bodies and ecosystems. As a result, nitrogen inhibitors are now a central element in sustainable nutrient management strategies around the world.

The Asia Pacific region led the global market in 2024, securing a 34.3% share, thanks to its high agricultural activity, proactive government policies, and increasing demand for advanced farming practices. Countries across the region are pushing for technologies that minimize nitrogen runoff and improve crop performance, backed by strong policy frameworks and incentives. Meanwhile, markets in North America and Europe continue to demonstrate solid growth, driven by strict environmental regulations and widespread adoption of precision farming technologies.

Leading industry players such as Solvay S.A., BASF SE, Dow, Koch Fertilizers LLC, and DuPont are actively expanding their market reach by developing customized solutions tailored to regional agricultural needs. These companies are forging partnerships with fertilizer manufacturers and agri-tech firms, investing in long-lasting, bio-based technologies, and supporting farmer education programs. Through innovation and collaboration, they are playing a crucial role in shaping the future of sustainable agriculture.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Impact on trade

- 3.1.8 Trade volume disruptions

- 3.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.4 Demand-Side impact (Selling Price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and Future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Integration of inhibitors with advanced fertilizer technologies

- 3.12.1.2 Rising demand for sustainable and eco-friendly agriculture

- 3.12.1.3 Innovation in bio-based and dual-function formulations

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 Limited awareness and adoption among farmers

- 3.12.2.2 High product cost and limited accessibility

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fertigation

- 5.3 Foliar

Chapter 6 Market Estimates and Forecast, By Nutrient, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nitrogen

- 6.3 Ammonia

- 6.4 Nitrate

- 6.5 Urea

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Crop Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food crop

- 7.3 Cash crop

- 7.4 Horticulture

- 7.5 Fibre crop

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Dow

- 9.3 DuPont

- 9.4 Solvay S.A

- 9.5 Koch Fertilizers LLC

- 9.6 Evonik

- 9.7 National Fertilizers Limited

- 9.8 Nico Orgo Manures

- 9.9 Compo Expert GmbH

- 9.10 Eco Agro