|

市場調查報告書

商品編碼

1693507

中國控制釋放肥料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Controlled Release Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

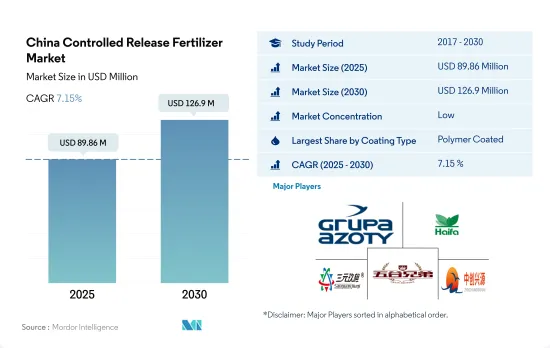

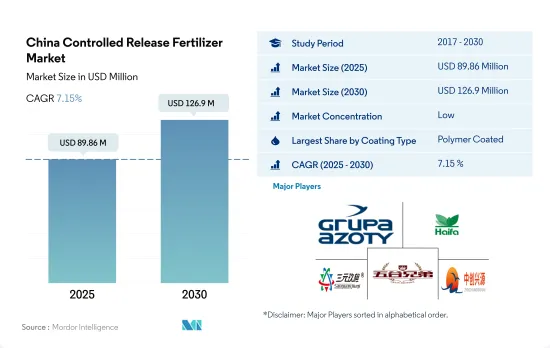

預計 2025 年中國控制釋放肥市場規模為 8,986 萬美元,到 2030 年將達到 1.269 億美元,預測期內(2025-2030 年)的複合年成長率為 7.15%。

聚合物包膜尿素因其含量高,是日本使用最廣泛的控釋肥。

- 2022年,控制釋放肥料(CRF)僅佔中國專用肥料市場的0.6%。然而,CRF 市場規模在過去一直呈現持續上升趨勢,預計 2023 年至 2030 年期間將保持穩定的 6.9% 複合年成長率。

- 在控釋肥中,聚合物包膜尿素是我國的主導品種。這主要是因為其氮含量高、覆蓋層薄、易分解、釋放期長。它被廣泛用作水稻、玉米、小麥等主要作物的基肥。 2022 年,含尿素的聚合物包衣肥料佔據了控釋肥領域的 75.9% 的佔有率。值得注意的是,聚合物包覆所採用的具體技術因製造商而異,並受包覆材料和製程選擇的影響。

- 富含硫的聚合物包衣肥料因其對作物品質和恢復力有正面影響而受到青睞。硫和氮的協同效應增加了作物中的硝酸鹽含量,從而改善了作物的整體品質。氮肥是聚合物硫包衣肥料的子集,到 2022 年,它在該領域佔據了 59.7% 的主導佔有率。

- 除了化學塗層外,肥料的生物基塗層也呈現成長趨勢,包括生物基聚氨酯、環氧樹脂和聚烯蠟複合材料。在政府需求不斷成長的推動下,這些塗料在「其他」類別中尤其突出。 2022年,「其他」部分將佔中國控制釋放肥料市場的5.4%。

- 考慮到這些獨特的優勢和不斷發展的趨勢,預計未來幾年對包膜控制釋放肥料的需求將大幅成長。

中國控制釋放肥市場趨勢

耕地面積的擴大是由於糧食需求的增加以及國家實現主糧自給的目標。

- 中國田間作物種植面積將從2017年的1.305億公頃增加到2021年的1.278億公頃,佔耕地總面積的71.4%。田間作物中,玉米所佔比例最大,為34.2%,其次為水稻,為23.6%,小麥為18.3%。預計耕地面積的增加將增加該國對肥料的需求。

- 在該國,田間作物通常生長兩個季節:夏季/春季(四月至九月)和冬季。春季作物主要有早玉米、早稻、早麥、棉花等。冬季作物包括冬小麥和油菜籽。然而,稻米和玉米是中國最重要的作物,佔中國糧食產量的三分之一。它是世界上最大的稻米生產國,預計2022年稻米種植面積將達3,000萬公頃,稻米產量將達2.1億噸。中國水稻主產區包括黑龍江、湖南、江西、湖北、江蘇、四川、廣西、廣東和昆明。受玉米豐收影響,2022-23年度中國玉米產量預計將達2.772億噸,比去年增加460萬噸。玉米主產區為東北黑龍江、吉林、內蒙古三省。

- 日本的主要生長季節是春季,但受到6月和7月高溫的輕微影響。例如,米是中國數百萬人的主食。高溫和低降水會增加土壤中礦物質的流失,因此需要增加施肥量。這種乾旱的天氣條件也會限制作物的產量。

全球約28%的氧化亞氮排放排放中國的農業用地。

- 主要營養物質可增強植物體內酵素的活性等生化過程,促進植物細胞的生長。主要營養素的缺乏會影響植物的健康、發育和作物產量。 2022年田間作物氮鉀磷平均施用量為159.9公斤/公頃,田間作物主要養分平均施用量為氮65.23%、磷28.07%、鉀6.68%。

- 氮是植物新陳代謝所必需的元素,是葉綠素和胺基酸的組成部分,因此在主要營養元素中居首位。平均施氮量為279.65公斤/公頃。其次是鉀肥,施用量為每公頃 105.3 公斤,磷肥,施用量為每公頃 94.9 公斤(2022 年)。人們認為,地表水和地下水受到氮和磷的污染是由於沒有提供農民足夠的施肥建議。全球約28%的氧化亞氮排放排放中國的農業用地。

- 2022年平均養分施用量最高的作物是棉花(255.41公斤/公頃)、小麥(232.25公斤/公頃)、玉米(198.44公斤/公頃)和水稻(157.76公斤/公頃)。中國是世界上最大的棉花生產國、消費國和進口國,預計2022年棉花產量將達640萬噸。全球消費的棉花約有20%產自中國,其中84%產自新疆維吾爾自治區。

- 擴大農業生產對於滿足不斷成長的人口的需求至關重要,因此,預計2023年至2030年間田間作物的主要養分施用量將會增加。

中國控制釋放肥產業概況

中國控制釋放肥市場細分化,前五大企業佔19.69%。該市場的主要企業有Grupa Azoty SA(Compo Expert)、海法集團、河北三元九七化肥、河北沃澤五豐生物科技、中創興源化工科技等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 主要作物種植面積

- 田間作物

- 園藝作物

- 平均養分施用量

- 主要營養素

- 田間作物

- 園藝作物

- 主要營養素

- 法律規範

- 價值鍊和通路分析

第5章市場區隔

- 塗層類型

- 聚合物塗層

- 聚合物硫塗層

- 其他

- 作物類型

- 田間作物

- 園藝作物

- 草坪和觀賞植物

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Grupa Azoty SA(Compo Expert)

- Haifa Group

- Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

- Hebei Woze Wufeng Biological Technology Co., Ltd

- Zhongchuang xingyuan chemical technology co.ltd

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 數據包

- 詞彙表

The China Controlled Release Fertilizer Market size is estimated at 89.86 million USD in 2025, and is expected to reach 126.9 million USD by 2030, growing at a CAGR of 7.15% during the forecast period (2025-2030).

Polymer-coated urea is the most adopted CRF in the country due to its higher content

- In 2022, controlled-release fertilizers (CRFs) represented a mere 0.6% of China's specialty fertilizer market. However, the market value of CRFs exhibited a consistent upward trajectory in the past and is projected to maintain a robust CAGR of 6.9% from 2023 to 2030.

- Among CRFs, polymer-coated urea stands out as the dominant variant in China. This is primarily due to its high nitrogen (N) content, thin coating, easy degradability, and extended release period. It finds extensive use as a basal fertilizer for staple crops like rice, corn, and wheat. Polymer-coated fertilizers, including urea, commanded a significant 75.9% share of the CRF segment in 2022. Notably, the specific technologies employed in polymer coatings vary across manufacturers, influenced by the choice of coating material and process.

- Polymer-sulfur-coated fertilizers, enriched with sulfur, are preferred for their positive impact on crop quality and resilience. The synergistic effect of sulfur and nitrogen enhances crop nitrate levels and overall quality. Nitrogenous fertilizers, a subset of polymer-sulfur-coated fertilizers, held a dominant 59.7% share in this segment in 2022.

- Besides chemical coatings, there is a rising trend of biobased coatings on fertilizers, including biobased polyurethane, epoxy resin, and polyolefin wax composites. These coatings, driven by heightened demand from governments, particularly stand out in the "others" category. In 2022, the "others" segment accounted for 5.4% of China's controlled-release fertilizer market.

- Given these distinct advantages and evolving trends, the demand for coated controlled-release fertilizers is poised for significant growth in the coming years.

China Controlled Release Fertilizer Market Trends

The expansion of the cultivation area is driven by increasing demand for food and the country's goal to achieve self-sufficiency in staple food

- The cultivation area of field crops in China increased from 130.5 million ha in 2017 to 127.8 million ha in 2021, accounting for 71.4% of the total area under cultivation. Among field crops, corn occupied the maximum share of 34.2%, followed by rice and wheat, accounting for 23.6% and 18.3%, respectively. The rising area under cultivation is expected to increase the need for fertilizer usage in the country.

- The country usually grows field crops in two seasons: summer/spring (April-September) and winter. Spring crops mainly include early corn, early rice, early wheat, and cotton. Winter crops include winter wheat and rapeseed. However, rice and corn are the most important crops grown in China, accounting for one-third of the grain production in China. It is the world's largest rice producer and utilized 30 million hectares of land for rice farming in 2022, producing a harvest of 210 million tonnes. The major rice-producing regions in China include Heilongjiang, Hunan, Jiangxi, Hubei, Jiangsu, Sichuan, Guangxi, Guangdong, and Yunnan. Corn production in China for 2022-23 was expected to reach 277.2 million tonnes, which was 4.6 million tonnes higher than last year due to a better harvest. The major corn-growing regions are in the Northeast provinces of Heilongjiang, Jilin, and Inner Mongolia.

- Although spring is the main cropping season in the country, it is slightly affected by high heat in June and July. For instance, rice is the staple food for millions in China. High temperatures and low precipitation increase the loss of minerals in the soil, leading to the need for a higher application of fertilizers to the soil. These dry weather conditions may also limit the yield of the crops.

About 28% of nitrous oxide emissions from cropland in the world are from Chinese agricultural lands

- Primary nutrients enhance biochemical processes such as enzyme activity in plants and promote plant cell growth. Deficiencies in primary nutrients can affect plant health, development, and crop production output. The average application rate of nitrogen, potassium, and phosphorus combined in field crops was 159.9 kg/hectare in 2022. The average primary nutrient application in field crops accounted for 65.23% nitrogen, 28.07% phosphorous, and 6.68% potassium.

- Nitrogen ranks first among primary nutrients, as it is essential for plant metabolism and is a component of chlorophyll and amino acids. Nitrogen had an average application rate of 279.65 kg/hectare. Potash followed with 105.3 kg/hectare and phosphorous with 94.9 kg/hectare in 2022. The contamination of surface and groundwater with nitrogen and phosphorus has been considered a result of inadequate advice given to farmers regarding fertilizer application rates. About 28% of nitrous oxide emissions from cropland in the world are from China's agricultural lands.

- In 2022, crops with the highest average nutrient application rates were cotton (255.41 kg/hectare), wheat (232.25 kg/hectare), corn (198.44 kg/hectare), and rice (157.76 kg/hectare). In 2022, cotton production accounted for 6.4 million metric tons, making China the world's largest producer, consumer, and importer of cotton. Around 20% of the cotton consumed worldwide is produced in China, and 84% of that production comes from Xinjiang.

- To meet the demands of a growing population, boosting crop production is essential; as a result, the application of primary nutrients in field crops is expected to grow between 2023 and 2030.

China Controlled Release Fertilizer Industry Overview

The China Controlled Release Fertilizer Market is fragmented, with the top five companies occupying 19.69%. The major players in this market are Grupa Azoty S.A. (Compo Expert), Haifa Group, Hebei Sanyuanjiuqi Fertilizer Co., Ltd., Hebei Woze Wufeng Biological Technology Co., Ltd and Zhongchuang xingyuan chemical technology co.ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Primary Nutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.1 Primary Nutrients

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Coating Type

- 5.1.1 Polymer Coated

- 5.1.2 Polymer-Sulfur Coated

- 5.1.3 Others

- 5.2 Crop Type

- 5.2.1 Field Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Grupa Azoty S.A. (Compo Expert)

- 6.4.2 Haifa Group

- 6.4.3 Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

- 6.4.4 Hebei Woze Wufeng Biological Technology Co., Ltd

- 6.4.5 Zhongchuang xingyuan chemical technology co.ltd

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms