|

市場調查報告書

商品編碼

1721584

黃麻市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Jute Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

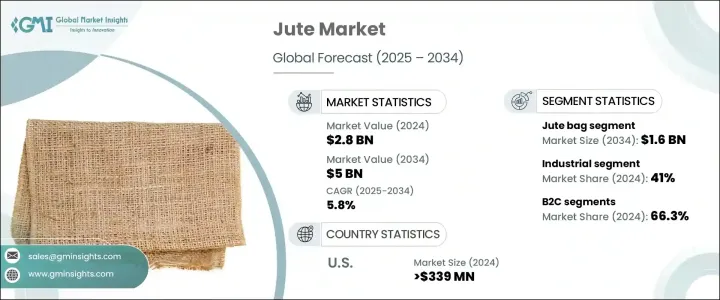

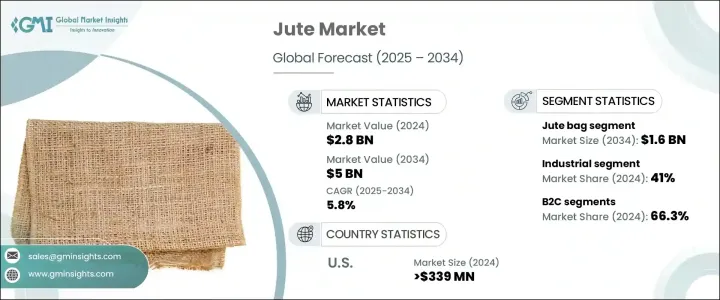

2024 年全球黃麻市場價值為 28 億美元,預計年複合成長率為 5.8%,到 2034 年將達到 50 億美元,這得益於日益成長的環境問題以及全球推動用永續替代品取代塑膠的努力。黃麻是一種可生物分解和可再生材料,因其環保特性和跨行業的卓越多功能性而迅速受到人們的關注。隨著全球永續發展意識的增強,企業、政策制定者和消費者正在積極尋求更環保的解決方案。黃麻對環境的影響小、資源消耗少、符合循環經濟原則,使其成為包裝、建築、農業和汽車產業的首選。

隨著各行業重新調整材料策略以優先考慮環境管理,市場需求正出現強勁成長。世界各國政府採取的舉措,例如禁止使用一次性塑膠、鼓勵採用永續材料以及推廣綠色包裝的法規,進一步加速了黃麻的普及。隨著 ESG 目標成為企業議程的核心,以及消費者對環保產品的需求日益成長,黃麻已準備好利用這種範式轉移。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 50億美元 |

| 複合年成長率 | 5.8% |

消費者的偏好正迅速轉變為既注重功能性又注重環境責任的選擇。黃麻具有可生物分解、可再生、資源投入低等特點,持續受到各行各業的關注。世界各國政府正在透過更嚴格的法規、稅收優惠和激勵措施來加強這種轉變,鼓勵使用永續包裝和紡織品,為黃麻日益成長的重要性鋪平了道路。

各行各業正迅速地用黃麻替代品取代合成的、不可生物分解的材料。這種轉變在包裝、農業、汽車和家居裝飾領域表現得非常明顯。黃麻能夠融入循環經濟模式(材料可以重複使用、回收或安全地返回環境),這使其成為努力實現碳中和目標和永續發展承諾的公司極具吸引力的選擇。

光是黃麻袋市場在 2024 年就創造了 9.655 億美元的產值,預計到 2034 年將達到 16 億美元。黃麻袋以其可生物分解性、耐用性和可重複使用性而聞名,在時尚和包裝領域越來越受歡迎。各大品牌正在利用黃麻袋來展示其環保意識,並融入吸引現代消費者的時尚設計和印花。隨著企業致力於減少塑膠足跡並增強其永續發展敘述,促銷用途也迅速擴大。

在最終用戶中,工業部門在 2024 年佔據 41% 的佔有率,這得益於土木工程、包裝和汽車行業對黃麻材料的使用。對永續材料的監管支持繼續推動黃麻複合材料的創新和應用。尤其是土木工程項目,由於其成本效益、可生物分解性和實用效率而採用黃麻地工布。

2024 年美國黃麻市場產值達 3.39 億美元,反映出對永續包裝的需求不斷成長以及黃麻製品進口量的增加。美國是印度黃麻出口的主要市場,這得益於美國消費者環保意識的不斷增強以及政府對減少塑膠垃圾(尤其是印刷黃麻袋領域)的重視。

影響全球黃麻市場的領導者包括 Cheviot、Bangalore Fort Farms、Budge Budge Company、AI Champdany Industries 和 Premchand Jute & Industries。這些公司強調產品創新、黃麻解決方案多樣化、擴大出口,並大力投資研發以創造優質的混紡黃麻布料。策略性全球合作夥伴關係和自動化技術的採用正在幫助這些公司擴大營運規模、削減成本並提高品質標準,以滿足日益成長的市場需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 合成材料對環境的擔憂

- 政府監管

- 來自合成材料的競爭

- 產業陷阱與挑戰

- 價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依產品類型,2021 - 2034

- 主要趨勢

- 黃麻袋

- 黃麻工藝品

- 黃麻紡織品

- 黃麻服裝

- 黃麻家具

- 其他黃麻製品

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第7章:市場規模及預測:按配銷通路,2021 - 2034

- 主要趨勢

- B2B

- B2C

- 大型超市和超市

- 專賣店

- 線上

- 其他

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Aarbur

- AI Champdany Industries

- Bangalore Fort Farms

- Budge Budge Company

- Cheviot

- Gloster Limited

- Hitaishi-KK

- Howrah Mills Co. Ltd.

- Ludlow Jute & Specialities

- Premchand Jute Industries

- Shree Jee International India

The Global Jute Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 5 billion by 2034, driven by rising environmental concerns and the global push to replace plastic with sustainable alternatives. Jute, a biodegradable and renewable material, is gaining rapid traction for its eco-friendly properties and exceptional versatility across industries. As global awareness around sustainability intensifies, businesses, policymakers, and consumers are actively seeking greener solutions. Jute's low environmental impact, minimal resource consumption, and compatibility with circular economy principles make it a preferred choice across packaging, construction, agriculture, and automotive sectors.

The market is witnessing a strong surge in demand as industries realign their material strategies to prioritize environmental stewardship. Government initiatives worldwide, such as bans on single-use plastics, incentives for sustainable material adoption, and regulations promoting green packaging, are further accelerating jute's adoption. With ESG goals becoming central to corporate agendas and consumers increasingly demanding eco-conscious products, jute is well-positioned to capitalize on this paradigm shift.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5 Billion |

| CAGR | 5.8% |

Consumer preferences are evolving quickly toward choices that emphasize both functionality and environmental responsibility. Jute, being biodegradable, renewable, and requiring low resource input, continues to capture attention across a wide spectrum of industries. Governments around the world are reinforcing this shift by introducing stricter regulations, tax benefits, and incentives that encourage the use of sustainable packaging and textiles, paving the way for jute's growing relevance.

Industries are swiftly replacing synthetic, non-biodegradable materials with jute-based alternatives. This transition is clearly visible in packaging, agriculture, automotive, and home furnishings. Jute's ability to integrate into circular economy models-where materials are reused, recycled, or safely returned to the environment-makes it a highly attractive choice for companies striving to meet carbon neutrality targets and sustainability commitments.

The jute bag segment alone generated USD 965.5 million in 2024 and is projected to reach USD 1.6 billion by 2034. Known for their biodegradability, durability, and reusability, jute bags are gaining popularity in both fashion and packaging sectors. Brands are leveraging jute bags to showcase eco-conscious branding, incorporating trendy designs and prints that appeal to modern consumers. Promotional use is also expanding rapidly as businesses aim to reduce their plastic footprint while enhancing their sustainability narratives.

Among end-users, the industrial segment commanded a 41% share in 2024, fueled by the use of jute-based materials in civil engineering, packaging, and automotive industries. Regulatory backing for sustainable materials continues to drive innovation and adoption of jute composites. Civil construction projects, in particular, are adopting jute geotextiles for their cost-effectiveness, biodegradability, and practical efficiency.

The United States Jute Market generated USD 339 million in 2024, reflecting rising demand for sustainable packaging and increasing imports of jute-based products. The US stands as a key market for Indian jute exports, driven by a growing eco-conscious consumer base and intensified governmental focus on reducing plastic waste, especially in printed jute bag segments.

Leading players shaping the Global Jute Market include Cheviot, Bangalore Fort Farms, Budge Budge Company, AI Champdany Industries, and Premchand Jute & Industries. These companies are emphasizing product innovation, diversifying jute-based solutions, expanding exports, and investing heavily in R&D to create superior, blended jute fabrics. Strategic global partnerships and the adoption of automation technologies are helping these firms scale operations, cut costs, and elevate quality standards to meet growing market demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Trade volume disruptions

- 3.2.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-side impact (raw materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.2 Demand-side impact (selling price)

- 3.3.2.1 Price transmission to end markets

- 3.3.2.2 Market share dynamics

- 3.3.2.3 Consumer response patterns

- 3.3.1 Supply-side impact (raw materials)

- 3.4 Key companies impacted

- 3.5 Strategic industry responses

- 3.5.1 Supply chain reconfiguration

- 3.5.2 Pricing and product strategies

- 3.5.3 Policy engagement

- 3.6 Outlook and future considerations

- 3.7 Supplier landscape

- 3.8 Profit margin analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Environmental concern for synthetic material

- 3.11.1.2 Government regulation

- 3.11.1.3 Competition from synthetic material

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Fluctuating prices

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Jute bags

- 5.3 Jute handicrafts

- 5.4 Jute textile

- 5.5 Jute apparel

- 5.6 Jute furnishings

- 5.7 Other jute products

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 B2B

- 7.3 B2C

- 7.3.1 Hypermarkets and supermarkets

- 7.3.2 Specialty stores

- 7.3.3 Online

- 7.3.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aarbur

- 9.2 AI Champdany Industries

- 9.3 Bangalore Fort Farms

- 9.4 Budge Budge Company

- 9.5 Cheviot

- 9.6 Gloster Limited

- 9.7 Hitaishi-KK

- 9.8 Howrah Mills Co. Ltd.

- 9.9 Ludlow Jute & Specialities

- 9.10 Premchand Jute Industries

- 9.11 Shree Jee International India