|

市場調查報告書

商品編碼

1721462

甘蔗包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Sugarcane Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

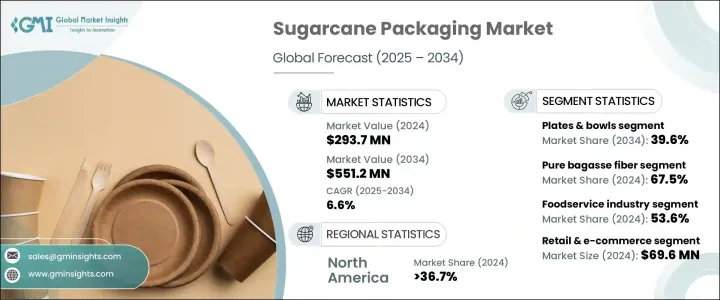

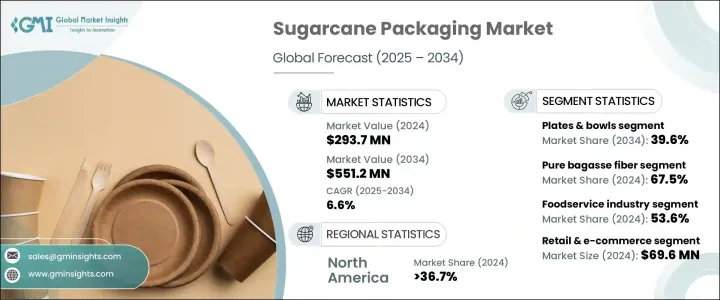

2024 年全球甘蔗包裝市場價值為 2.937 億美元,預計到 2034 年將以 6.6% 的複合年成長率成長,達到 5.512 億美元。這一成長軌跡反映了全球在包裝方面向永續和環保替代品的轉變,其驅動力包括監管變化、消費者行為變化和企業環境策略。由於氣候變遷和環境議題仍然備受關注,企業正積極以可再生、可堆肥的包裝材料取代石油基包裝。隨著甘蔗渣基材料在各行業的普及,市場呈現強勁勢頭。消費者現在更傾向於支持符合綠色價值觀的產品,而企業也透過優先考慮強化其 ESG 承諾的包裝解決方案來回應。隨著世界各國紛紛限制一次性塑膠的使用,並向各行業施壓,要求它們減少浪費,甘蔗包裝已成為一種創新、經濟高效的解決方案,既符合性能目標,又符合永續發展目標。

甘蔗渣是甘蔗榨汁後剩下的纖維副產品,也是這種環保包裝轉變的核心。這種材料由纖維素、木質素和半纖維素組成,可自然生物分解和堆肥。隨著纖維素奈米纖維和生物複合材料研究的不斷發展,製造商正在開發具有更強耐用性和更廣泛應用潛力的先進包裝選擇。改進的結構完整性、多功能性和環境效益吸引了從食品服務到零售等各行業的興趣。這些創新不僅最大限度地減少了對環境的影響,而且還幫助公司遵守不斷提高的永續發展基準和消費者期望。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.937億美元 |

| 預測值 | 5.512億美元 |

| 複合年成長率 | 6.6% |

在食品服務領域,盤子和碗在 2024 年佔據了最大的收入佔有率,創造了 1.164 億美元的收入。這些產品受到餐廳、餐飲服務和食品配送供應商的廣泛青睞,因為它們具有防潮和防油的功能,同時又不影響可堆肥性。隨著對便利、環保包裝的需求不斷成長,預計該領域將持續擴張。消費者和企業都在尋找既不犧牲品質又能為日常使用提供永續性的替代方案。

2024 年杯子和杯蓋市場價值為 6,680 萬美元,反映出速食連鎖店、咖啡店和活動服務提供商對可堆肥飲料容器的快速採用。甘蔗杯具有強大的耐熱性和防漏能力,適合盛裝冷熱飲品。隨著消除塑膠垃圾的呼聲日益高漲,整個飯店業的企業正在轉向可生物分解的飲具,這將推動預測期內該領域的成長。

2024 年,美國甘蔗包裝市場產值達到 8,820 萬美元,並且正在獲得顯著發展勢頭,到 2034 年的複合年成長率將達到 6.3%。加州和紐約州等已實施一次性塑膠禁令的州的監管發展正在加速可堆肥替代品的採用。隨著永續採購成為核心業務重點,美國正在鞏固其作為甘蔗包裝高潛力市場的地位。

推動全球市場成長的關鍵參與者包括 Ecolates、Huhtamaki、Pactiv Evergreen、Dart Container Corporation、Detmold Group 和 Berry Global Inc. 這些公司正在大力投資擴大其可堆肥產品組合、加強分銷網路,並與快餐連鎖店和零售品牌合作以確保長期合約。他們還專注於本地化製造和推進可生物分解材料研究,以有效擴大生產規模並滿足不同的監管和客戶需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商矩陣

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 產業衝擊力

- 成長動力

- 日益成長的 ESG(環境、社會和治理)優先事項

- 政府措施和激勵措施

- 消費者環保意識不斷增強

- 提升品牌形象與市場差異化

- 增加對研發和永續製造的投資

- 產業陷阱與挑戰

- 生產成本高

- 供應鏈和可擴展性問題

- 成長動力

- 波特的分析

- PESTEL分析

- 未來市場趨勢

- 監管格局

第4章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 包包和小袋

- 盤子和碗

- 杯子和蓋子

- 蛤殼/容器

- 其他

第5章:市場估計與預測:依材料類型,2021 年至 2034 年

- 主要趨勢

- 純甘蔗渣纖維

- 混合甘蔗渣

第6章:市場估計與預測:依最終用途產業,2021 年至 2034 年

- 主要趨勢

- 餐飲業

- 零售與電子商務

- 醫療保健領域

- 消費品

- 工業應用

第7章:市場估計與預測:按地區,2021–2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 日本

- 中國

- 印度

- 韓國

- 澳新銀行

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 中東和非洲其他地區

第8章:公司簡介

- Berry Global Inc.

- BioPak

- Dart Container Corporation

- Detmold Group

- ECO Guardian

- Ecolates

- good natured Products Inc.

- Good Start Packaging

- GreenLine Paper Co.

- Huhtamaki

- Material Motion, Inc.

- Packman

- Pactiv Evergreen

- PAKKA

- Pappco Greenware

- TedPack Company Limited

- Vegware Ltd

The Global Sugarcane Packaging Market was valued at USD 293.7 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 551.2 million by 2034. This growth trajectory reflects a global shift toward sustainable and eco-conscious alternatives in packaging, driven by regulatory changes, changing consumer behavior, and corporate environmental strategies. As climate change and environmental concerns remain front and center, businesses are actively replacing petroleum-based packaging with renewable, compostable options. The market is seeing robust momentum as sugarcane bagasse-based materials gain ground across industries. Consumers are now more inclined to support products that align with green values, and enterprises are responding by prioritizing packaging solutions that reinforce their ESG commitments. With countries around the world adopting restrictions on single-use plastics and putting pressure on industries to cut down waste, sugarcane packaging has emerged as an innovative, cost-effective solution that aligns with both performance and sustainability goals.

Bagasse, the fibrous byproduct left after juice extraction from sugarcane, is at the core of this eco-friendly packaging shift. Comprising cellulose, lignin, and hemicellulose, this material is naturally biodegradable and compostable. As research continues to evolve around cellulose nanofibers and bio-composite materials, manufacturers are developing advanced packaging options with enhanced durability and broader application potential. The improved structural integrity, versatility, and environmental benefits are attracting interest from industries ranging from food service to retail. These innovations are not only minimizing environmental impact but also helping companies comply with rising sustainability benchmarks and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $293.7 Million |

| Forecast Value | $551.2 Million |

| CAGR | 6.6% |

In the food service sector, plates and bowls accounted for the largest revenue share in 2024, generating USD 116.4 million. These products are widely favored by restaurants, catering services, and food delivery providers because they offer moisture and grease resistance without compromising compostability. As the demand for convenient, eco-friendly packaging continues to grow, this segment is expected to witness consistent expansion. Consumers and businesses alike are looking for alternatives that do not sacrifice quality while delivering sustainable performance for everyday use.

The cups and lids segment was valued at USD 66.8 million in 2024, reflecting a rapid uptake of compostable beverage containers by fast food chains, coffee shops, and event service providers. The strong heat resistance and leak-proof capabilities of sugarcane-based cups make them suitable for both hot and cold beverages. With a growing push to eliminate plastic waste, businesses across the hospitality sector are transitioning to biodegradable drinkware, fueling segment growth over the forecast period.

The United States Sugarcane Packaging Market generated USD 88.2 million in 2024 and is gaining significant traction, expanding at a CAGR of 6.3% through 2034. Regulatory developments in states like California and New York, which have implemented bans on single-use plastics, are accelerating the adoption of compostable alternatives. As sustainable procurement becomes a core business focus, the U.S. is solidifying its position as a high-potential market for sugarcane-based packaging.

Key players driving growth in the global market include Ecolates, Huhtamaki, Pactiv Evergreen, Dart Container Corporation, Detmold Group, and Berry Global Inc. These companies are heavily investing in expanding their compostable product portfolios, strengthening distribution networks, and partnering with fast-food chains and retail brands to secure long-term contracts. They're also focusing on localized manufacturing and advancing biodegradable material research to scale production efficiently and meet diverse regulatory and customer demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Vendor matrix

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news and initiatives

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing ESG (Environmental, Social, and Governance) Priorities

- 3.7.1.2 Government Initiatives and Incentives

- 3.7.1.3 Growing Consumer Environmental Awareness

- 3.7.1.4 Enhanced Brand Image and Market Differentiation

- 3.7.1.5 Increased Investment in R&D and Sustainable Manufacturing

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production Costs

- 3.7.2.2 Supply Chain and Scalability Issues

- 3.7.1 Growth drivers

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Regulatory landscape

Chapter 4 Market Estimates and Forecast, By Product Type, 2021 – 2034 (USD Mn & kilotons)

- 4.1 Key trends

- 4.2 Bags & Pouches

- 4.3 Plates & Bowls

- 4.4 Cups & Lids

- 4.5 Clamshells/Containers

- 4.6 Others

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Mn & kilotons)

- 5.1 Key trends

- 5.2 Pure bagasse fiber

- 5.3 Blended bagasse

Chapter 6 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Mn & kilotons)

- 6.1 Key trends

- 6.2 Foodservice industry

- 6.3 Retail & E-Commerce

- 6.4 Healthcare sector

- 6.5 Consumer goods

- 6.6 Industrial applications

Chapter 7 Market Estimates and Forecast, By Region, 2021– 2034 (USD Mn & kilotons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 ANZ

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 UAE

- 7.6.3 Saudi Arabia

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 Berry Global Inc.

- 8.2 BioPak

- 8.3 Dart Container Corporation

- 8.4 Detmold Group

- 8.5 ECO Guardian

- 8.6 Ecolates

- 8.7 good natured Products Inc.

- 8.8 Good Start Packaging

- 8.9 GreenLine Paper Co.

- 8.10 Huhtamaki

- 8.11 Material Motion, Inc.

- 8.12 Packman

- 8.13 Pactiv Evergreen

- 8.14 PAKKA

- 8.15 Pappco Greenware

- 8.16 TedPack Company Limited

- 8.17 Vegware Ltd