|

市場調查報告書

商品編碼

1721448

生物塑膠豪華包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bioplastic Luxury Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

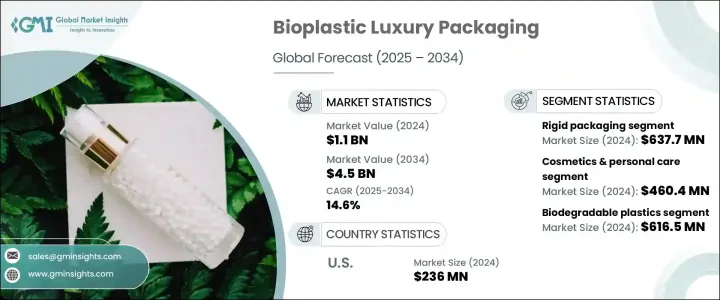

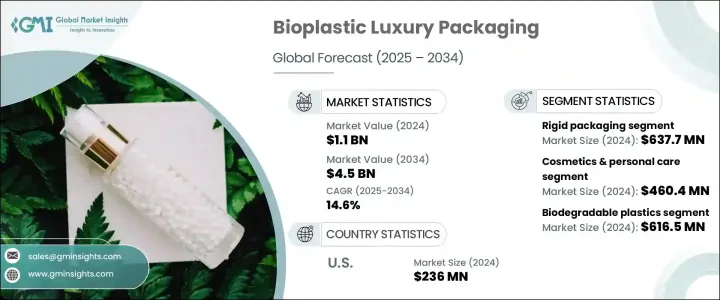

2024 年全球生物塑膠豪華包裝市場價值為 11 億美元,預計到 2034 年將以 14.6% 的複合年成長率成長,達到 45 億美元。隨著永續性成為消費者和監管機構的核心優先事項,全球各地的奢侈品牌正迅速轉向環保解決方案。這一勢頭主要得益於對生物基原料生產的投資不斷增加以及塑膠禁令和環境法規的不斷加強。各地區政府都在執行更嚴格的永續發展規定,迫使品牌探索既能減少環境影響又不損害品牌聲譽的替代方案。

生物塑膠包裝正在成為這一轉變的有力答案,它將奢華的美學與環境責任的價值融為一體。消費者對永續、高效能包裝解決方案的需求不斷成長,正在加速該領域的創新。隨著奢侈品消費者積極尋求環保選擇,品牌正在透過提供優質包裝解決方案來適應,這些解決方案不僅可以保護產品,還可以引起環保意識的買家的共鳴。因此,生物塑膠豪華包裝正迅速成為全球奢侈品領域的主導趨勢,推動對傳統塑膠的可回收、可堆肥和生物基替代品的需求激增。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 14.6% |

生物塑膠豪華包裝市場分為硬質包裝和軟質包裝形式。硬質包裝憑藉其堅固的設計、視覺吸引力以及可再填充應用的適用性,在該領域佔據領先地位,預計到 2024 年將創造 6.377 億美元的市場價值。香水、化妝品和珠寶盒等高階產品擴大使用生物PET、PHA和甘蔗衍生塑膠等剛性生物基材料。歐盟的一次性塑膠指令和生產者延伸責任 (EPR) 計畫等監管框架進一步強化了這種轉變,這些框架正在推動奢侈品牌採用可回收和可生物分解的替代品。

從終端使用產業來看,化妝品和個人護理產品佔據生物塑膠豪華包裝市場的最大佔有率,2024 年的價值為 4.604 億美元。美容和護膚品牌在永續包裝創新方面處於領先地位,並專注於符合環境標準和消費者偏好的可再填充容器和可生物分解薄膜。生物基 PET、PHA 和纖維素基薄膜等材料通常用於高階護膚品、化妝品和香水的包裝,確保產品完整性,同時增強視覺吸引力。

預計到 2024 年,光是美國生物塑膠豪華包裝市場就將創造 2.36 億美元的產值,這得益於消費者意識的不斷增強,以及美國《塑膠管理法案》和《EPR》授權等監管措施的加強。隨著對環保包裝的需求持續飆升,品牌正在迅速採用可生物分解和可回收的解決方案,以保持領先於環境合規性和市場預期。

全球市場領先的公司包括 Bio Futura、Biome Bioplastics、NatureWorks LLC、FKuR、Tetra Pak International SA、Stora Enso、Sealed Air Corporation、Constantia flexibles、Corbion、Genpak、Walki Group Oy、ITC Packaging、Novamont SpA、J. Landura Company、門長實業有限公司。這些參與者正在積極投資研發,擴大生物基材料的採用,並建立合作關係以開拓尖端、永續的包裝創新。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 擴大生物基原料生產

- 循環經濟與回收創新投資

- 塑膠禁令和政府法規推動生物塑膠需求

- 生物基聚合物的進展

- 消費者對永續包裝的偏好日益成長

- 產業陷阱與挑戰

- 生產成本高

- 性能限制

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料類型,2021 - 2034 年

- 主要趨勢

- 可生物分解塑膠

- 生物基、不可生物分解塑膠

第6章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 硬質包裝

- 軟包裝

第7章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 化妝品和個人護理

- 時尚與配件

- 食品和飲料

- 消費性電子產品

- 奢侈品零售和禮品

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Amcor plc

- Bio Futura

- Biome Bioplastics

- Constantia Flexibles

- Corbion

- FKuR

- Futamura Group

- Genpak

- IIC AG

- ITC Packaging

- J. Landworth Company

- NatureWorks LLC

- Novamont SpA

- Sealed Air Corporation

- Stora Enso

- Tetra Pak International SA

- TIPA LTD

- Walki Group Oy

- Xiamen Changsu Industrial Co., Ltd.

The Global Bioplastic Luxury Packaging Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 14.6% to reach USD 4.5 billion by 2034. As sustainability becomes a core priority for both consumers and regulators, luxury brands across the globe are rapidly pivoting toward eco-conscious solutions. This momentum is largely driven by increasing investments in bio-based raw material production and the mounting wave of plastic bans and environmental regulations. Governments across regions are enforcing stricter sustainability mandates, compelling brands to explore alternatives that reduce their environmental footprint without compromising brand prestige.

Bioplastic packaging is emerging as a compelling answer to this shift, blending the aesthetics of luxury with the values of environmental responsibility. Growing consumer demand for sustainable, high-performance packaging solutions is accelerating innovation in the sector. With luxury consumers actively seeking eco-friendly options, brands are adapting by offering premium packaging solutions that not only protect products but also resonate with environmentally aware buyers. As a result, bioplastic luxury packaging is fast becoming a defining trend in the global luxury landscape, driving a surge in demand for recyclable, compostable, and bio-based alternatives to traditional plastic.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 14.6% |

The bioplastic luxury packaging market is segmented into rigid and flexible packaging formats. Rigid packaging leads the segment, generating USD 637.7 million in 2024, thanks to its sturdy design, visual appeal, and suitability for refillable applications. High-end products such as perfumes, cosmetics, and jewelry boxes increasingly use rigid bio-based materials like bio-PET, PHA, and sugarcane-derived plastics. This transition is further reinforced by regulatory frameworks like the European Union's Single-Use Plastics Directive and Extended Producer Responsibility (EPR) programs, which are pushing luxury brands to adopt recyclable and biodegradable alternatives.

On the basis of end-use industries, the cosmetics and personal care segment commands the largest share of the bioplastic luxury packaging market, valued at USD 460.4 million in 2024. Beauty and skincare brands are leading the charge in sustainable packaging innovation, with a strong focus on refillable containers and biodegradable films that align with both environmental standards and consumer preferences. Materials such as bio-based PET, PHA, and cellulose-based films are commonly used in the packaging of high-end skincare items, cosmetics, and perfumes, ensuring product integrity while enhancing visual appeal.

The U.S. Bioplastic Luxury Packaging Market alone is expected to generate USD 236 million in 2024, driven by growing awareness among consumers and reinforced by regulatory initiatives such as the U.S. Plastic Regulation Act and EPR mandates. As demand for eco-friendly packaging continues to soar, brands are rapidly adopting biodegradable and recyclable solutions to stay ahead of environmental compliance and market expectations.

Leading companies in the global market include Bio Futura, Biome Bioplastics, NatureWorks LLC, FKuR, Tetra Pak International S.A., Stora Enso, Sealed Air Corporation, Constantia Flexibles, Corbion, Genpak, Walki Group Oy, ITC Packaging, Novamont S.p.A., J. Landworth Company, Xiamen Changsu Industrial Co., Ltd., TIPA LTD, and Futamura Group. These players are actively investing in R&D, scaling up bio-based material adoption, and forming partnerships to pioneer cutting-edge, sustainable packaging innovations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of bio-based raw material production

- 3.2.1.2 Investment in circular economy & recycling innovation

- 3.2.1.3 Plastic bans & government regulations driving bioplastic demand

- 3.2.1.4 Advances in bio-based polymers

- 3.2.1.5 Growing consumer preference for sustainable packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Performance limitations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Biodegradable plastics

- 5.3 Bio-based, non-biodegradable plastics

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.3 Flexible packaging

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Cosmetics & personal care

- 7.3 Fashion & accessories

- 7.4 Food & beverages

- 7.5 Consumer electronics

- 7.6 Luxury retail & gifting

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amcor plc

- 9.2 Bio Futura

- 9.3 Biome Bioplastics

- 9.4 Constantia Flexibles

- 9.5 Corbion

- 9.6 FKuR

- 9.7 Futamura Group

- 9.8 Genpak

- 9.9 IIC AG

- 9.10 ITC Packaging

- 9.11 J. Landworth Company

- 9.12 NatureWorks LLC

- 9.13 Novamont S.p.A.

- 9.14 Sealed Air Corporation

- 9.15 Stora Enso

- 9.16 Tetra Pak International S.A.

- 9.17 TIPA LTD

- 9.18 Walki Group Oy

- 9.19 Xiamen Changsu Industrial Co., Ltd.