|

市場調查報告書

商品編碼

1721517

電動車母線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

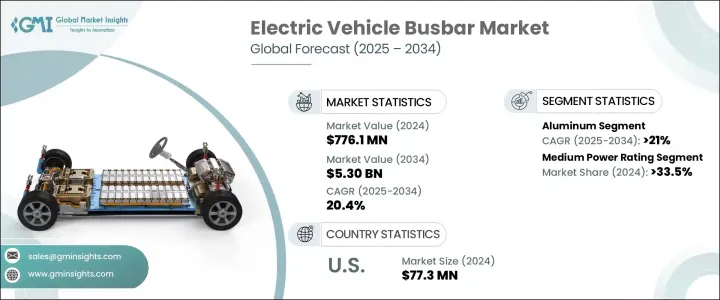

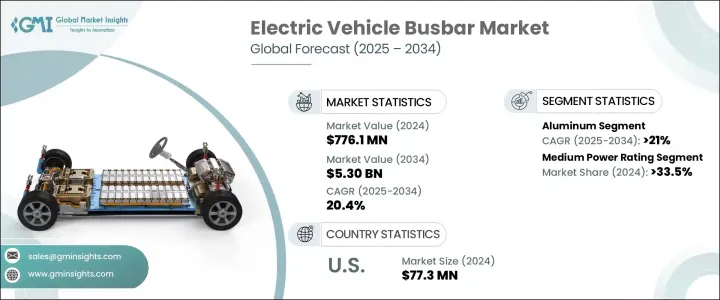

2024 年全球電動車母線市場價值為 7.761 億美元,預計到 2034 年將以 20.4% 的複合年成長率成長,達到 53 億美元。電動車普及率的快速成長推動了對高效配電系統的強勁需求,而母線正在成為這一轉變中的關鍵組成部分。隨著汽車產業向電氣化轉變,母線因其能夠確保簡化的電力傳輸和最佳的能源效率而在電動車電池系統中變得不可或缺。隨著電動車在全球範圍內受到環境法規、燃油經濟性目標和碳中和承諾的推動,汽車製造商正在整合需要高性能母線的更先進的電氣系統。由於電池結構和車輛設計的技術快速進步,以及電動車製造規模的持續努力,市場也正在經歷成長的動力。此外,電動車基礎設施的擴張,特別是快速充電網路的擴張,繼續推動對能夠承受高電壓和極端溫度的先進母線解決方案的需求。

全球範圍內電動車充電站安裝量的不斷增加對擴大電動車母線市場發揮關鍵作用。這些組件對於管理高壓電力傳輸至關重要,尤其是在目前需求量大的超快速充電系統中。隨著電動車的普及,對快速、可靠和高效充電裝置的需求也在成長,這進一步提升了對強大的母線技術的需求,這種技術可以增強電流流動,同時最大限度地減少能量損失。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.761億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 20.4% |

市場依材料細分,主要分為銅和鋁。鋁母線預計到 2034 年將實現 21% 的複合年成長率,這得益於其重量輕和成本優勢,使其成為重量和可負擔性至關重要的緊湊型電動車車型的理想選擇。同時,銅母線憑藉其優異的導電性和熱性能在豪華和高性能電動車中佔據主導地位。這些特性使得銅成為功率密度和能源效率至關重要的應用中的必不可少的材料。

依功率等級分類,市場包括低、中、高三個類別。 2024 年,中等功率部分佔 33.5% 的佔有率,這得益於對快速加速、快速充電和可靠能源輸送的電動跑車和高階汽車的需求不斷成長。隨著電池設計的創新和消費者對高階電動車興趣的不斷增加,這一領域有望實現穩步成長。

2024 年,美國電動車母線市場產值為 7,730 萬美元。通貨膨脹削減法案 (IRA) 是推動這一成長的關鍵因素,該法案通過對使用母線等國產零件的汽車提供稅收優惠,推動了電動車的需求。這項政策正在推動製造商投資美國製造的先進、高效的母線系統,進一步增強美國在全球電動車供應鏈中的地位。

全球電動車母線市場的主要參與者包括西門子、施耐德電氣、泰科電子、美爾森、英飛凌科技股份公司、羅格朗、力特爾菲斯公司、安費諾公司、三菱電機公司、魏德米勒介面有限公司、EAE 集團、EG 電子、EMS 集團和羅傑斯公司。這些公司正在大力投資研發、擴大生產規模並建立策略合作夥伴關係,以提供適合下一代電動車的高性能母線系統。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依資料,2021 - 2034 年

- 主要趨勢

- 銅

- 鋁

第6章:市場規模及預測:依功率等級,2021 - 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 挪威

- 德國

- 法國

- 荷蘭

- 英國

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH & Co. KG

The Global Electric Vehicle Busbar Market was valued at USD 776.1 million in 2024 and is estimated to grow at a CAGR of 20.4% to reach USD 5.3 billion by 2034. The rapid acceleration in electric vehicle adoption is fueling a robust demand for efficient power distribution systems, and busbars are emerging as a critical component in this transition. As the automotive sector shifts toward electrification, busbars are becoming indispensable in EV battery systems for their ability to ensure streamlined power transfer and optimal energy efficiency. With EVs gaining momentum globally-driven by environmental regulations, fuel economy goals, and carbon neutrality commitments-automakers are integrating more advanced electrical systems that require high-performance busbars. The market is also witnessing increased traction due to rapid technological advancements in battery architecture and vehicle design, as well as ongoing efforts to scale EV manufacturing. Furthermore, the expansion of EV infrastructure, particularly in fast-charging networks, continues to boost demand for advanced busbar solutions that can withstand high voltage and extreme temperatures.

The rising installation of EV charging stations globally plays a key role in expanding the electric vehicle busbar market. These components are vital for managing high-voltage power transfers, especially in ultra-fast charging systems, which are now in high demand. As EV adoption grows, so does the requirement for fast, reliable, and efficient charging setups-further elevating the need for robust busbar technologies that enhance current flow while minimizing energy losses.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $776.1 Million |

| Forecast Value | $5.3 Billion |

| CAGR | 20.4% |

The market is segmented by material, primarily into copper and aluminum. Aluminum busbars are expected to witness a CAGR of 21% through 2034, owing to their lightweight nature and cost benefits, making them ideal for compact EV models where weight and affordability are critical. Meanwhile, copper busbars maintain dominance in luxury and high-performance EVs due to their superior conductivity and thermal performance. These attributes make copper an essential material in applications where power density and energy efficiency are paramount.

Segmented by power rating, the market includes low, medium, and high categories. The medium power rating segment held a 33.5% share in 2024, driven by rising demand for electric sports cars and high-end vehicles that require rapid acceleration, fast charging, and reliable energy delivery. With innovations in battery design and increasing consumer interest in premium EVs, this segment is poised to witness steady growth.

The U.S. Electric Vehicle Busbar Market generated USD 77.3 million in 2024. A key contributor to this growth is the Inflation Reduction Act (IRA), which has propelled EV demand through tax incentives for vehicles using domestically produced components like busbars. This policy is pushing manufacturers to invest in advanced, high-efficiency busbar systems made within the U.S., further enhancing the nation's role in the global EV supply chain.

Key players in the global EV busbar market include Siemens, Schneider Electric, TE Connectivity, Mersen SA, Infineon Technologies AG, Legrand, Littelfuse, Inc., Amphenol Corporation, Mitsubishi Electric Corporation, Weidmuller Interface GmbH & Co. KG, EAE Group, EG Electronics, EMS Group, and Rogers Corporation. These companies are heavily investing in R&D, scaling up production, and forming strategic partnerships to deliver high-performance busbar systems tailored to next-generation electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Power Rating, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Norway

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 UK

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Singapore

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Amphenol Corporation

- 8.2 Brar Elettromeccanica SpA

- 8.3 EAE Group

- 8.4 EG Electronics

- 8.5 EMS Group

- 8.6 Infineon Technologies AG

- 8.7 Legrand

- 8.8 Littelfuse, Inc.

- 8.9 Mersen SA

- 8.10 Mitsubishi Electric Corporation

- 8.11 Rogers Corporation

- 8.12 Schneider Electric

- 8.13 Siemens

- 8.14 TE Connectivity

- 8.15 Weidmuller Interface GmbH & Co. KG