|

市場調查報告書

商品編碼

1766298

中功率母線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medium Power Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

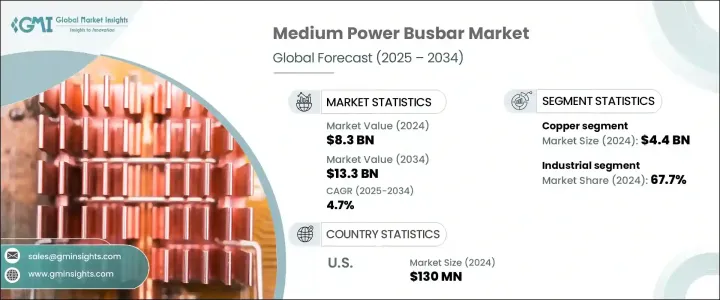

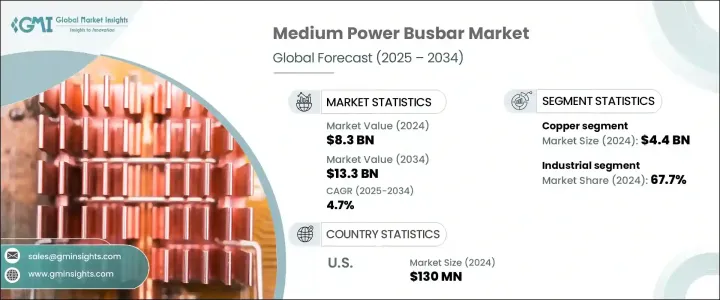

2024年,全球中功率母線市場規模達83億美元,預計2034年將以4.7%的複合年成長率成長,達到133億美元。中功率母線在確保現代基礎設施和工業環境可靠能源分配方面發揮著日益重要的作用。它們能夠不間斷地輸送電力,同時最大限度地減少能源損耗,使其成為最佳化能源效率和營運成本的有效解決方案。隨著全球電力需求的持續成長,對高可靠性和節能配電系統的需求也不斷成長。母線提供了一種簡化且經濟高效的方式來處理高電力負載,同時降低功率損耗,這使其成為工業應用的實用且永續的選擇。

清潔能源的快速普及進一步加速了能夠有效地將太陽能和風能發電設施的電力輸送至電網的母線槽的需求。此外,隨著交通運輸和工業領域向電氣化轉型,對包括母線槽在內的高彈性和可擴展電力基礎設施的需求持續成長。這些組件如今已成為提升能源性能和滿足未來能源需求的核心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 83億美元 |

| 預測值 | 133億美元 |

| 複合年成長率 | 4.7% |

預計到2034年,鋁母線市場將以4.6%的複合年成長率成長,這得益於對經濟高效且環境永續的配電解決方案日益成長的需求。鋁母線以其卓越的導電性重量比而聞名,使其成為大規模安裝的首選,因為在此類安裝中,降低成本和系統重量至關重要。其耐腐蝕性和熱性能也使其在惡劣環境和高負荷應用中日益普及。隨著永續性持續影響基礎設施發展,鋁的可回收性和較低的碳足跡使其成為優先考慮綠色建築實踐和能源效率目標的項目的理想材料。

在住宅領域,預計到2034年,中等功率市場將以4%的複合年成長率成長。城鎮化和高密度住宅區的建設正在推動對緊湊、安全且空間最佳化的電力系統的需求。中等功率母線槽憑藉其模組化、易於安裝和增強的安全特性,滿足了這些需求。其強大的性能和流線型外形使其非常適合空間受限且系統效率至關重要的現代多單元建築。

2024年,美國中功率母線市場規模達1.3億美元。為推動老化電網基礎設施的現代化改造和能源可靠性的提升,推動了對先進配電技術的大量投資。母線憑藉其低能耗、高載流能力和可擴展性,正日益取代傳統佈線。在工業和公用事業應用中,母線為支援分散式能源系統、備用電源框架和高負載工業運作提供了高效的解決方案。隨著美國持續優先發展再生能源併網和智慧電網,母線正成為建構更具韌性、更有效率、面向未來的電網的關鍵要素。

一些引領全球中功率母線市場發展的領導企業包括西門子股份公司、施耐德電氣、羅傑斯公司、C&S電氣公司、伊頓公司、羅格朗公司、ABB公司、維諦技術集團公司、Friedhelm Loh集團、威圖有限公司、通用電氣、美爾森公司、泰科電子和正泰集團。為了鞏固市場地位,中功率母線產業的企業正在推行各種策略舉措,包括擴大產品組合以滿足多樣化的應用需求、投資研發節能環保解決方案,以及建立策略聯盟或進行收購以擴大全球影響力。此外,企業也致力於最佳化製造流程,以降低生產成本並提高可擴展性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 戰略儀表板

- 策略舉措

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依資料,2021 - 2034 年

- 主要趨勢

- 銅

- 鋁

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 荷蘭

- 瑞典

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- C&S Electric Company

- Chint Group

- Eaton

- Friedhelm Loh Group

- General Electric

- Legrand SA

- Mersen SA

- Rittal GmbH & Co. KG

- Rogers Corporation

- Schneider Electric

- Siemens AG

- TE Connectivity

- Vertiv Group Corp

The Global Medium Power Busbar Market was valued at USD 8.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 13.3 billion by 2034. Medium-power busbars are playing an increasingly vital role in ensuring dependable energy distribution for modern infrastructure and industrial settings. Their capacity to deliver uninterrupted electricity while minimizing energy loss makes them a valuable solution for optimizing energy efficiency and operational costs. As the global appetite for electricity continues to expand, the demand for highly reliable and energy-efficient distribution systems is also on the rise. Busbars offer a streamlined, cost-effective way to handle high electrical loads while reducing power loss, which makes them a practical and sustainable option for industrial applications.

The rapid adoption of clean energy sources is further accelerating the demand for busbars capable of efficiently transferring electricity from solar and wind installations to the grid. Moreover, as both the transportation and industrial sectors move toward electrification, the need for resilient and scalable power infrastructure, including busbars, continues to grow. These components are now central to efforts aimed at boosting energy performance and meeting future energy demands.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.3 Billion |

| Forecast Value | $13.3 Billion |

| CAGR | 4.7% |

The aluminum busbar segment is forecasted to grow at a CAGR of 4.6% through 2034, driven by the increasing demand for cost-effective, efficient, and environmentally sustainable power distribution solutions. Aluminum busbars are known for their excellent conductivity-to-weight ratio, making them a preferred option for large-scale installations where reducing both cost and system weight is essential. Their corrosion resistance and thermal performance also contribute to their growing popularity in harsh environments and high-load applications. As sustainability continues to shape infrastructure development, aluminum's recyclability and lower carbon footprint make it an attractive material for projects prioritizing green building practices and energy efficiency goals.

In the residential segment, the medium power segment is projected to grow at a CAGR of 4% through 2034. Urbanization and the construction of high-density housing complexes are driving demand for compact, safe, and space-optimized electrical systems. Medium power busbars meet these requirements with modularity, ease of installation, and enhanced safety features. Their robust performance and streamlined form factor make them suited for modern multi-unit buildings, where space constraints and system efficiency are critical.

United States Medium Power Busbar Market was valued at USD 130 million in 2024. The push to modernize aging grid infrastructure and enhance energy reliability is driving significant investment in advanced power distribution technologies. Busbars are increasingly replacing traditional wiring due to their lower energy loss, high current-carrying capacity, and scalability. In both industrial and utility applications, they offer an efficient solution for supporting distributed energy systems, backup power frameworks, and high-load industrial operations. As the country continues to prioritize renewable energy integration and smart grid development, busbars are becoming a key element in building more resilient, efficient, and future-ready electrical networks.

Some of the leading companies shaping the Global Medium Power Busbar Market include Siemens AG, Schneider Electric, Rogers Corporation, C&S Electric Company, Eaton, Legrand S.A., ABB, Vertiv Group Corp, Friedhelm Loh Group, Rittal GmbH & Co. KG, General Electric, Mersen S.A., TE Connectivity, and Chint Group. To strengthen their market position, companies in the medium power busbar industry are pursuing a variety of strategic initiatives. These include expanding product portfolios to cover diverse application needs, investing in R&D for energy-efficient and eco-friendly solutions, and forming strategic alliances or acquisitions to widen global reach. Firms are also focusing on optimizing manufacturing processes to reduce production costs and increase scalability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (Kilo Tons, USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (Kilo Tons, USD Million)

- 6.1 Key trends

- 6.2 Residential

- 6.3 Commercial

- 6.4 Industrial

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (Kilo Tons, USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Netherlands

- 7.3.5 Sweden

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 C&S Electric Company

- 8.3 Chint Group

- 8.4 Eaton

- 8.5 Friedhelm Loh Group

- 8.6 General Electric

- 8.7 Legrand S.A.

- 8.8 Mersen S.A.

- 8.9 Rittal GmbH & Co. KG

- 8.10 Rogers Corporation

- 8.11 Schneider Electric

- 8.12 Siemens AG

- 8.13 TE Connectivity

- 8.14 Vertiv Group Corp