|

市場調查報告書

商品編碼

1750600

高功率電動車母線市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

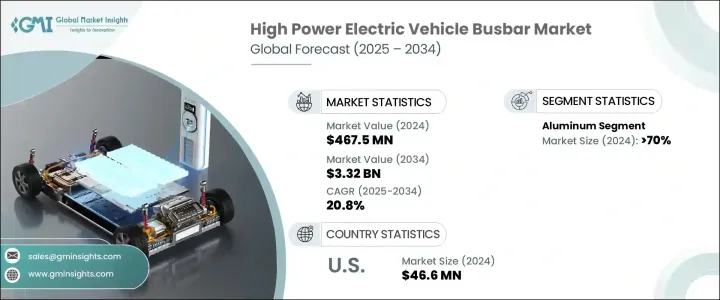

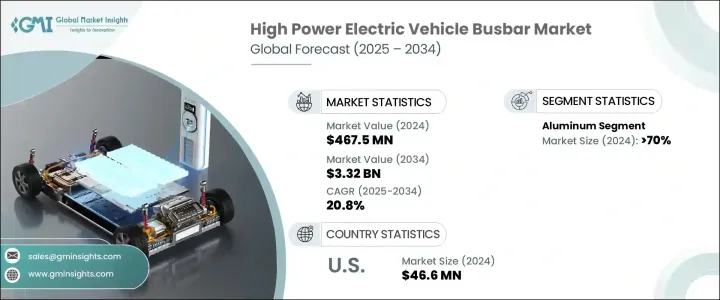

2024年,全球高功率電動車母線市場規模為4.675億美元,預計2034年將以20.8%的複合年成長率成長,達到33.2億美元。這主要得益於全球電動車普及率的不斷提高,以及對高效耐用配電組件(尤其是高性能電動車母線)的需求。各地區政府都在執行嚴格的排放法規,同時提供誘因以加速電動車的生產和普及。這種監管勢頭正推動汽車製造商和供應商投資於先進的電動車架構,而母線在車輛動力總成和電池系統的高效能傳輸中發揮關鍵作用。都市化趨勢以及電動二輪車、送貨車隊和公共交通巴士的興起,擴大了市場的覆蓋範圍。

高功率電動車母線對於管理和引導電池單元、驅動單元和電子控制系統之間的電流至關重要。其性能直接影響電動車的效率、安全性和耐用性。材料創新——尤其是鋁和銅的整合——顯著提高了母線的可靠性和導電性。銅因其卓越的熱穩定性和高導電性而日益受到青睞,成為先進電動車平台的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.675億美元 |

| 預測值 | 33.2億美元 |

| 複合年成長率 | 20.8% |

鋁材持續引領高功率電動車母線市場,憑藉其優異的重量、導電性和價格優勢,到2024年將佔70%的市場佔有率。隨著汽車製造商優先考慮輕量化設計以提高能源效率和續航里程,鋁材成為電動車配電系統大規模應用最實用的材料。除了輕量化之外,鋁材還具備良好的導熱性和導電性,能夠滿足現代電動車(尤其是在商用和高容量乘用車領域)的性能需求。

2024年,美國大功率電動車母線市場規模達4,660萬美元,這得益於電動車銷量的激增,這得益於全國範圍內充電基礎設施的大規模投資以及政府旨在減少碳排放的激勵措施。快速充電系統的日益整合以及對增程式電動車日益成長的需求,推動了對堅固耐用、高容量母線解決方案的需求。隨著北美轉向更清潔的交通生態系統,先進的電氣元件正成為消費和商用車平台的優先考慮因素。

影響高功率電動車母線市場的關鍵參與者包括魏德米勒介面有限公司 (Weidmuller Interface GmbH & Co. KG)、英飛凌科技股份公司 (Infineon Technologies AG)、羅傑斯公司 (Rogers Corporation)、EAE 集團 (EAE Group)、美爾森公司 (Mersen SA)、EMS ESD 集團 (EMS Group)、西門子 (Siemens)、Braruens、At. Connectivity)、安費諾公司 (Amphenol Corporation)、三菱電機株式會社 (Mitsubishi Electric Corporation)、羅格朗 (Legrand)、施耐德電氣 (Schneider Electric)、Littelfuse Inc. 和 EG Electronics。這些公司正在採取多種策略方法來鞏固其市場地位。這些措施包括擴大生產能力、投資研發以提高導電性和熱性能,以及與電動車製造商合作提供整合設計解決方案。許多公司專注於輕量化、高效材料,並探索模組化母線系統,以支援跨不同車型領域的可擴展電動車平台。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供應方影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:2024 年競爭格局

- 介紹

- 戰略儀表板

- 策略舉措

- 公司市佔率

- 競爭基準測試

- 創新與技術格局

第5章:市場規模及預測:依資料,2021 - 2034 年

- 主要趨勢

- 銅

- 鋁

第6章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 挪威

- 德國

- 法國

- 荷蘭

- 英國

- 瑞典

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH & Co. KG

The Global High Power Electric Vehicle Busbar Market was valued at USD 467.5 million in 2024 and is estimated to grow at a CAGR of 20.8% to reach USD 3.32 billion by 2034, driven by the rising adoption of electric vehicles worldwide and the demand for efficient and durable power distribution components, especially high-performance EV busbars. Governments across regions are enforcing strict emission regulations while providing incentives to accelerate EV production and adoption. This regulatory momentum is pushing automakers and suppliers to invest in advanced electric vehicle architecture, with busbars playing a key role in efficient energy transfer within the vehicle's powertrain and battery systems. Urbanization trends and the rise of electric two-wheelers, delivery fleets, and public transit buses expand the market's reach.

High-power EV busbars are essential in managing and directing electric currents between battery cells, drive units, and electronic control systems. Their performance directly impacts the efficiency, safety, and durability of EVs. Innovations in materials-specifically the integration of aluminum and copper-are significantly boosting their reliability and conductivity. Copper is gaining traction due to its superior thermal stability and high electrical conductivity, making it ideal for advanced EV platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $467.5 Million |

| Forecast Value | $3.32 Billion |

| CAGR | 20.8% |

The aluminum segment continues to lead the high-power EV busbar market in volume, accounting for a 70% share in 2024 attributed to its favorable weight, conductivity, and affordability. As automakers prioritize lightweight vehicle designs to improve energy efficiency and range, aluminum emerges as the most practical material for large-scale application in EV power distribution systems. Beyond just its lightness, aluminum offers sufficient thermal and electrical conductivity to meet the performance demands of modern electric vehicles, particularly in commercial and high-volume passenger segments.

United States High Power Electric Vehicle Busbar Market was valued at USD 46.6 million in 2024, driven by the surge in EV sales supported by expansive investments in nationwide charging infrastructure and government-backed incentives aimed at reducing carbon emissions. The increasing integration of fast-charging systems and the growing demand for extended-range EVs drive the need for robust and high-capacity busbar solutions. As North America shifts toward a cleaner transportation ecosystem, advanced electrical components are becoming a priority in consumer and commercial vehicle platforms.

Key players shaping the High Power Electric Vehicle Busbar Market include Weidmuller Interface GmbH & Co. KG, Infineon Technologies AG, Rogers Corporation, EAE Group, Mersen SA, EMS Group, Siemens, Brar Elettromeccanica SpA, TE Connectivity, Amphenol Corporation, Mitsubishi Electric Corporation, Legrand, Schneider Electric, Littelfuse Inc., and EG Electronics. These companies are adopting several strategic approaches to solidify their market position. Efforts include expanding production capabilities, investing in R&D to enhance conductivity and thermal performance, and collaborating with EV manufacturers for integrated design solutions. Many are focusing on lightweight, high-efficiency materials and exploring modular busbar systems to support scalable EV platforms across various vehicle segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1.1 Introduction

- 4.1.2 Strategic dashboard

- 4.1.3 Strategic initiative

- 4.1.4 Company market share

- 4.1.5 Competitive benchmarking

- 4.1.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.3.6 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Singapore

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Israel

- 6.5.4 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 EAE Group

- 7.4 EG Electronics

- 7.5 EMS Group

- 7.6 Infineon Technologies AG

- 7.7 Legrand

- 7.8 Littelfuse, Inc.

- 7.9 Mersen SA

- 7.10 Mitsubishi Electric Corporation

- 7.11 Rogers Corporation

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 TE Connectivity

- 7.15 Weidmuller Interface GmbH & Co. KG