|

市場調查報告書

商品編碼

1716544

非處方寵物藥品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測OTC Pet Medication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

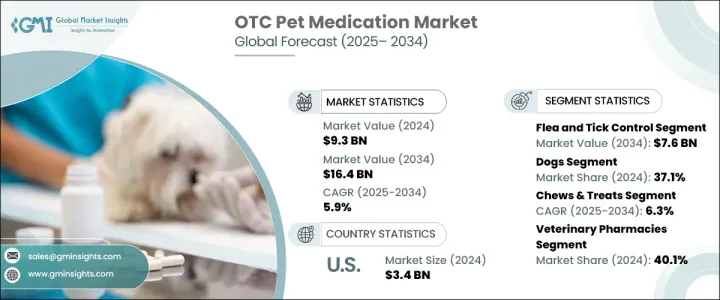

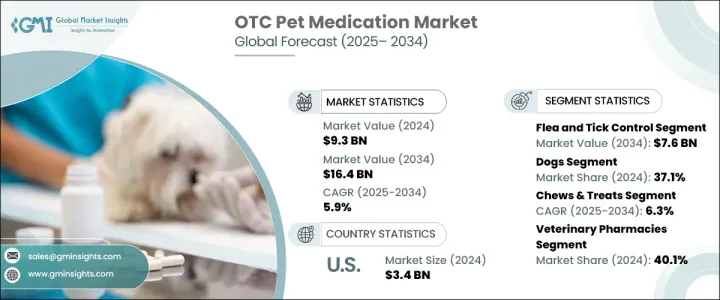

2024 年全球非處方寵物藥物市場規模達到 93 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.9%。市場的成長主要得益於寵物主人數量的增加和寵物人性化趨勢的上升。這種轉變導致對更好的醫療保健解決方案和預防性保健產品的需求增加。寵物主人更積極地尋求高品質、方便且有效的非處方 (OTC) 藥物來改善寵物的整體健康狀況。預防保健意識的不斷增強和易於管理的藥物的普及極大地促進了市場擴張。

隨著寵物主人越來越了解潛在的健康風險,他們正在投資解決常見疾病(如關節炎、皮膚過敏和消化問題)的產品。這一趨勢在已開發地區尤其明顯,這些地區的可支配收入較高且對寵物健康的高度重視推動了寵物保健支出的增加。此外,包括調味藥片和咀嚼片在內的藥物配方創新正在提高依從性和治療效果,進一步刺激市場需求。電子商務平台的日益普及也使得這些產品更容易獲得,為全球寵物主人提供了便利和更廣泛的選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 93億美元 |

| 預測值 | 164億美元 |

| 複合年成長率 | 5.9% |

隨著寵物遇到越來越多的健康問題,包括寄生蟲感染、皮膚病和關節痛,對非處方藥的需求也不斷增加。骨關節炎是寵物中最常見的疾病之一,尤其是在老年狗和貓中,影響著相當一部分寵物群體。預計關節相關健康問題的高發性將推動對關節補充劑和其他治療藥物的持續需求。此外,人們對預防性醫療保健(如寄生蟲控制和皮膚保護)的日益關注也促進了非處方藥市場的成長。寵物主人正在採用自然療法和順勢療法來解決輕微的健康問題,從而進一步豐富了可用的非處方藥產品範圍。

2024 年,跳蚤和蜱蟲控制領域的市場規模為 42 億美元。跳蚤和蜱蟲傳播的媒介傳播疾病的日益流行,刺激了對有效控制藥物的需求。寵物收養率的上升,加上人們對疾病預防的日益關注,推動了這一領域的快速成長。製造商正在開發先進的配方,提供持久的保護,同時確保易於應用,有助於該領域繼續佔據主導地位。

非處方寵物藥物市場根據寵物類型進行分類,包括狗、貓、鳥、魚、爬行動物等。 2024 年,狗佔據了 37.1% 的市場。狗的健康問題發生率很高,加上醫療支出增加和戶外活動使它們更容易受到寄生蟲感染,這促使製造商優先開發適合犬類健康的藥物。寵物主人擴大尋求解決方案來確保他們的狗保持健康,從而推動該領域的持續成長。

2024 年美國非處方寵物藥物市場價值為 34 億美元,預計在整個預測期內仍將是最大的市場。人們對寵物護理和寵物人性化的認知不斷提高是美國市場成長的主要驅動力,寵物主人變得更加警惕和積極主動地尋求先進的解決方案來維護寵物的健康和福祉。創新配方的出現以及電子商務平台的日益普及使得非處方寵物藥物更加容易獲得,確保了未來幾年強勁的市場表現。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物擁有率上升

- 越來越重視寵物的預防性醫療保健

- 人畜共通傳染病的盛行率不斷上升

- 電子商務與網路零售的擴張

- 動物保健支出不斷成長

- 產業陷阱與挑戰

- 嚴格的監管標準

- 潛在的副作用和誤用

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類型,2021 年至 2034 年

- 主要趨勢

- 跳蚤和蜱蟲控制

- 驅蟲藥和殺寄生蟲藥

- 止痛藥和過敏藥

- 皮膚和毛髮護理

- 牙科護理

- 營養補充品

- 行為和焦慮緩解藥物

- 其他藥物類型

第6章:市場估計與預測:按寵物類型,2021 年至 2034 年

- 主要趨勢

- 狗

- 貓

- 鳥類

- 魚類和爬蟲類

- 其他寵物類型

第7章:市場估計與預測:按劑型,2021 年至 2034 年

- 主要趨勢

- 咀嚼物和零食

- 膠囊

- 噴霧劑

- 軟膏

- 其他劑型

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 獸醫藥房

- 寵物專賣店

- 線上零售商

- 其他分銷管道

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AdvaCare Pharma

- Bimeda

- Boehringer Ingelheim International

- Ceva Sante Animale

- Dechra

- Elanco Animal Health

- Heska Corporation

- Merck & Co.

- Norbrook

- Nutramax Laboratories Consumer Care

- PetIQ

- Phibro Animal Health

- Vetenex Animal Health

- Vetoquinol

- Virbac

- Zoetis

The Global OTC Pet Medication Market reached USD 9.3 billion in 2024 and is expected to grow at a CAGR of 5.9% between 2025 and 2034. The market's growth is primarily fueled by the increasing number of pet owners and the rising trend of pet humanization. This shift has led to heightened demand for better healthcare solutions and preventive wellness products. Pet owners are more proactive in seeking high-quality, accessible, and effective over-the-counter (OTC) medications to improve their pets' overall health. Growing awareness of preventive care and the availability of easy-to-administer medications have significantly contributed to the market expansion.

As pet owners become increasingly informed about potential health risks, they are investing in products that address common conditions such as arthritis, skin allergies, and digestive issues. This trend is particularly prominent in developed regions, where higher disposable income and a strong emphasis on pet well-being drive higher spending on pet healthcare. Moreover, innovations in medication formulations, including flavored tablets and chewables, are enhancing compliance and treatment effectiveness, further boosting market demand. The growing presence of e-commerce platforms has also made these products more accessible, offering convenience and a broader range of options for pet owners globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $16.4 Billion |

| CAGR | 5.9% |

As pets encounter a growing range of health issues, including parasitic infections, skin disorders, and joint pain, the need for OTC medications continues to rise. Osteoarthritis is one of the most prevalent conditions in pets, particularly in aging dogs and cats, affecting a significant portion of the pet population. The high incidence of joint-related health problems is expected to drive sustained demand for joint supplements and other therapeutic medications. Additionally, the increasing focus on preventative healthcare, such as parasite control and skin protection, is contributing to the growing market for OTC solutions. Pet owners are turning to natural and homeopathic remedies to address minor health concerns, further diversifying the range of available OTC products.

The flea and tick control segment accounted for USD 4.2 billion in 2024. The increasing prevalence of vector-borne diseases transmitted by fleas and ticks has fueled the demand for effective control medications. Rising pet adoption rates, coupled with growing concerns about disease prevention, are driving this segment's rapid growth. Manufacturers are developing advanced formulations that offer long-lasting protection while ensuring ease of application, contributing to the segment's continued dominance.

The OTC pet medication market is categorized based on pet type, including dogs, cats, birds, fish, reptiles, and others. Dogs accounted for 37.1% of the market share in 2024. The high prevalence of health issues in dogs, combined with increased healthcare spending and outdoor exposure that makes them more vulnerable to parasitic infections, has led manufacturers to prioritize developing medications tailored to canine health. Pet owners are increasingly seeking solutions to ensure their dogs remain healthy, driving sustained growth in this segment.

The U.S. OTC pet medication market was valued at USD 3.4 billion in 2024 and is expected to remain the largest market throughout the forecast period. Growing awareness about pet care and the humanization of pets are key drivers of market growth in the U.S. Pet owners are becoming more vigilant and proactive in seeking advanced solutions to maintain the health and well-being of their pets. The availability of innovative formulations and increasing access to e-commerce platforms are making OTC pet medications more accessible, ensuring strong market performance in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Growing emphasis on preventive healthcare for pets

- 3.2.1.3 Increasing prevalence of zoonotic diseases

- 3.2.1.4 Expansion of e-commerce & online retailing

- 3.2.1.5 Growing animal healthcare expenditure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory standards

- 3.2.2.2 Potential side effects & misuse

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Medication Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flea and tick control

- 5.3 Dewormers & parasiticides

- 5.4 Pain relievers & allergy medications

- 5.5 Skin and coat care

- 5.6 Dental care

- 5.7 Nutritional supplements

- 5.8 Behavioral & anxiety relief medications

- 5.9 Other medication types

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fishes & reptiles

- 6.6 Other pet types

Chapter 7 Market Estimates and Forecast, By Dosage Form, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Chews & treats

- 7.3 Capsules

- 7.4 Sprays

- 7.5 Ointments

- 7.6 Other dosage forms

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary pharmacies

- 8.3 Pet specialty stores

- 8.4 Online retailers

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AdvaCare Pharma

- 10.2 Bimeda

- 10.3 Boehringer Ingelheim International

- 10.4 Ceva Sante Animale

- 10.5 Dechra

- 10.6 Elanco Animal Health

- 10.7 Heska Corporation

- 10.8 Merck & Co.

- 10.9 Norbrook

- 10.10 Nutramax Laboratories Consumer Care

- 10.11 PetIQ

- 10.12 Phibro Animal Health

- 10.13 Vetenex Animal Health

- 10.14 Vetoquinol

- 10.15 Virbac

- 10.16 Zoetis