|

市場調查報告書

商品編碼

1808961

6G通訊:RIS (可重構智慧表面) 材料及硬體設備的市場與技術 (2026~2046年)6G Communications: Reconfigurable Intelligent Surface RIS Materials and Hardware Markets, Technology 2026-2046 |

||||||

摘要

6G通訊中的RIS(可重構智慧表面)有望成為最大的超表面市場,創造數十億美元的商機。然而,生產增值材料和硬體的公司在理解RIS的機會時面臨困境。研究人員往往沉浸在晦澀難懂的理論研究中,使用各種互相混淆的術語,而開發RIS系統的公司也往往諱莫如深。因此,傳統的市場調查在這樣一個快速發展的領域中顯得蒼白無力。

深入了解最新動態

本報告旨在改變這一現狀。這份591頁的綜合報告主要關注預計在2025年出現的大量新研究和企業近期活動。報告著重於商業視角,包含10項SWOT分析、11個章節、25條涵蓋2026年至2046年的預測線、30條關鍵結論、41張新資訊圖表以及106家公司的報告。此外,報告還重點介紹了隨著2030年6G的推出,5G頻段內或附近的RIS的優先事項,以及非對角、變形、透明和全向RIS、有源RIS、航空航天RIS和大面積RIS等新興領域的最新突破。

目錄

第1章 摘要整理·總論·藍圖·預測

- 本書的目標

- 研究方法

- RIS 背景

- 6G 所需的各種 RIS 類型

- 關於 6G 通訊的 10 個關鍵結論

- 資訊圖表:6G 系統的關鍵目標

- 關於 6G RIS 材料和組件機會的 7 個關鍵結論

- 關於 6G RIS 成本問題的 7 個關鍵結論

- 關於 6G RIS 和反射陣列製造技術的 6 個關鍵結論

- SWOT 評估

- 5G 和 6G RIS 路線圖(4 行)

- 6G RIS 和反射陣列市場預測

- 6G RIS 市場規模

- 6G RIS 銷售區域

- 6G RIS 平均價格(工廠出口基準,含電子元件)

- 6G RIS 市場價值:主動 RIS 與四種半無源 RIS,按頻率劃分

- 6G RIS 銷售區域 vs. 平均面板面積、面板銷售量和總部署面板

- 6G RIS 市場價值:基地台 vs. 傳播路徑

- 全球 RIS 硬體市場價值(按地區劃分)

- 半無源 RIS 與主動 RIS 市場(0.1-1 THz vs. 非 6G THz 電子設備)

- 6G 全被動超材料反射陣列市場

- 補充訊息

第二章:引言

- 概述

- RIS 的功能與優勢—詳細考量

- 6G RIS 相關標準組織及其影響者活動

- 6G 及 6G RIS 目標的擴展與縮減,智慧無線環境

- 術語氾濫

- 不斷變化的產業和研究趨勢

- 提升高頻頻段覆蓋範圍:軌跡工程

- 其他 18 篇研究進展分析

- 6G 全球架構方案及補充系統

第三章:終極 6G RIS 硬體工具包:隱形、廣域、自供電、自學習、自適應、自修復、自清潔、無處不在、自主、長壽命、支援 AI、動態頻譜共享,以及更多

- 概述

- 隱形 RIS-透明或隱形形態

- 大規模智慧表面 (LIS) 和超大規模天線陣列 (ELAA),包括廣域 RIS

- RIS 正在實現自供電,並支援零能耗客戶端設備。

- 長壽命:自修復材料無需安裝後維護

- RIS 的人工智慧和機器學習:優化、自學習、自適應和自主性

- 多模/多頻、動態頻譜共享 (DSS)、6G 及其 RIS

第四章:超越對角 (BD) RIS 架構解決 6G RIS 限制:到 2025 年將取得快速進展

- 定義、材料挑戰與適用性

- BD-RIS 的潛在優勢

- BD-RIS 硬體挑戰

- 實務與改進的需求

第五章:多功能與多模 RIS,包括 STAR RIS、ISAC 和 SWIPT

- 概述與研究、產業回顧2025 年的趨勢與機會

- STAR:同時傳輸與反射 RIS

- 其他多功能/多模 RIS

第六章:基地台、UM-MIMO、天空塔 (HAPS) 和其他無人機 RIS

- 概述

- UM-MIMO 的進展

- 支援 RIS 的自主式超大規模 6G UM-MIMO 基地台設計

- 大規模 MIMO 基地台的 RIS:清華大學、艾默生

- 作為小型蜂巢式基地台的 RIS

- 2025 年支援 RIS 的 MIMO 和基地台的其他關鍵進展

- 衛星和無人機如何支援 6G RIS 並從中受益:2025 年的進展

- 關鍵進展2024

- 平流層大規模HAPS RIS

第七章 RIS 調諧硬體目標及至2025年的研究進展

- 總結

- RIS 調諧研究的經驗教訓:2025年以前

- 單一調諧組件進展的詳細分析

- 優先考慮調諧材料,以取代6G RIS中0.1-1 THz和近紅外線(Near-IR)波段的分立元件

- 大規模RIS及其他市場空白

第八章 6G光無線通訊 (ORIS):至2025年的關鍵發展

- 為什麼RIS頻段的OWC對6G來說是個有吸引力的補充

- 光RIS (ORIS)機會與挑戰-SWOT分析

- ORIS實施步驟

- 長距離、地下、水下和空間光無線通訊 (OWC) 及RIS:2025年前的研究進展

- 短距離和室內光無線通訊 (OWC) 及其RIS:2025年前的研究進展

- 6G光學材料潛力

- 6G超透鏡(包括2025年前的研究進展)

- 鏡陣列ORIS設計

第九章:6G變形柔性智慧超表面 (FIM)、6G超表面與超材料基礎

- 總結

- 2025年前6G相關超材料研究關鍵進展評估

- 基礎超材料

- 超表面基礎知識

- 超材料整體的長期展望

- GHz、THz、紅外線和光學超材料的新應用

- 熱超材料

- 超材料和超表面整體的SWOT評估

- 變形FIM的基礎知識以及2025年的研究進展

第10章 RIS和反射陣列的製造、檢測、測試和成本細分

- 薄膜和透明電子領域的尖端技術

- 從分立基板和層壓薄膜到全智慧材料整合的趨勢

- 柔性、分層與二維能量收集與感測的重要性

- 6G RIS在光學、低THz和高THz領域製造技術的差異頻段

- 6G RIS 檢測與測試:2025 年的新進展

- RIS 成本分析

第11章 6G RIS企業:產品,計劃,專利,由於Zhar的評估 (2025~2026年)

- 概要與專利取得

- AGC Japan

- Alcan Systems Germany

- Alibaba China

- Alphacore USA

- China Telecom China Mobile, China Unicom, Huawei, ZTE, Lenovo, CICT China collaboration

- Ericsson Sweden

- Fractal Antenna Systems USA

- Greenerwave France

- Huawei China

- ITOCHU Japan

- Kymeta Corp. USA

- Kyocera Japan

- Metacept Systems USA

- Metawave USA

- NEC Japan

- Nokia Finland with LG Uplus South Korea

- NTT DoCoMo and NTTJapan

- Orange France

- Panasonic Japan

- Pivotal Commware USA

- Qualcomm USA

- Samsung Electronic South Korea

- Sekisui Japan

- SensorMetrix USA

- SK Telecom South Korea

- Sony Japan

- Teraview USA

- Vivo Mobile Communications China

- VTT Finland

- ZTE China

Summary

Reconfigurable Intelligent Surfaces RIS for 6G Communications may become the largest market for metasurfaces. Billion-dollar businesses will be created providing them. However, companies making added-value materials and hardware face a dilemma when seeking to understand their RIS opportunities. Researchers largely indulge in obscure theoretical studies using many terms to mean the same thing. Companies developing RIS systems are understandably secretive and old market research is useless in such a fast-moving subject.

Deep understanding of latest realities

To the rescue comes the new, readable Zhar Research report, "6G Communications: Reconfigurable Intelligent Surface RIS Materials and Hardware Markets, Technology 2026-2046". It concentrates mostly on the flood of new research through 2025 and latest company activity, with 591 pages to cover all aspects. Commercially oriented, it has 10 SWOT appraisals, 11 chapters, 25 forecast lines 2026-2046, 30 key conclusions, 41 new infograms and it covers 106 companies. There is much on the current priority of RIS at or near 5G frequencies for 6G launch in 2030 and recent breakthroughs in exciting emerging sectors such as beyond-diagonal, morphing, transparent all-round RIS, active RIS, aerospace RIS and large area RIS.

Quick read

The Executive Summary and Conclusions takes 73 pages to clearly present the 30 conclusions, the main SWOT reports, analysis of which materials and technologies will matter, roadmaps and forecasts as tables and graphs with explanation. Learn how RIS will be essential, later vanishing into the fabric of society yet assisting in the provision of stellar, ubiquitous performance involving multiple additional user benefits. All subsequent chapters are boosted by detail on the many research advances and initiatives through 2025. Miss those and you are misled.

Main report

Chapter 2. Introduction (100 pages) gives RIS definitions, clarifying the terminology thicket, design basics and future evolution to become smart materials, smart windows and more. Understand the disruptive, very-challenging 6G Phase Two essential for most of the promised 6G paybacks and benefits to society. RIS aspects introduced here include improved spatial coverage, macro-diversity, capacity enhancement, green communications, enabling large scale Internet of Things, reliability enhancement, sensing and localization. Grasp RIS from the systems and security viewpoint and the activities of standards bodies and influencers related to 6G RIS.

Chapter 3 takes 51 pages to cover the "Ultimate 6G RIS hardware toolkit: invisible, wide area, self-powered, self-learning, self-adaptive, self-healing, self-cleaning, ubiquitous, autonomous, everlasting, AI enabled, dynamic spectrum sharing, other". Importantly, it clarifies most of what can and should be achieved before looking at progress towards it in the rest of the report. Many new infograms and SWOT appraisals make it easy to grasp. Examples include routes to self-powered infrastructure, unpowered client devices, artificial intelligence for both RIS design and operation, spectrum sharing.

Chapter 4 covers the new realisation that RIS has only been designed to operate in a small subset of what is possible. This chapter is called "Beyond diagonal RIS architecture tackles 6G RIS limitations: Surge in advances through 2025" (26 pages). These more advanced options can provide more range, reach around obstructions and other benefits.

Chapter 5. "Multifunctional and multi-mode RIS including STAR-RIS, ISAC, SWIPT" covers these other emerging priorities, most of which can work with BD-RIS where appropriate. Learn how RIS will often be multi-mode such as with both active and semi-passive tiles, simultaneous transmission and reflection, multiple frequencies. Transparent STAR-RIS will give all-round coverage and there is now huge interest in integrating sensing and communication ISAC with RIS. Simultaneous Wireless Information and Power Transfer SWIPT is rather like Radio Frequency identification RFID backscatter on steroids, leading to similarly unpowered and sometimes battery-free devices.

We next move beyond RIS enhancing the propagation path to it enhancing transmission and the allied topic of assisting and using drones. Chapter 6. "Base station, UM-MIMO, Tower in the Sky HAPS and other UAV RIS" (36 pages) includes the RIS prospects with High Altitude Pseudo Satellites HAPS that have cost and other advantages over satellites. These solar drones can be repaired, repositioned, hold position, give faster response by being nearer and maybe eventually stay aloft for almost as long as a LEO satellite.

Chapter 7. "RIS tuning hardware objectives and progress with research through 2025" (71 pages) goes much deeper into this vital aspect, importantly with many new research advances assessed through 2025. What materials opportunities? Progress from discrete components to tuning materials in the metamaterial pattern? Problems that are your gaps in the market?

Chapter 8. Optical Wireless Communications ORIS for 6G: major progress through 2025 (65 pages) covers a RIS aspect often ignored in market surveys but increasingly in focus for later 6G. Learn why infrared and visible light are best optical options on current evidence and how they are complementary. See ORIS theory and practice.

Chapter 9. "6G Morphing Flexible Intelligent Metasurfaces FIM, 6G hypersurfaces, metamaterial basics" (49 pages) explains these, mostly new options that enjoyed a great surge of research advances through 2025. They are another way of providing much superior performance even at GHz and mmWave frequencies. They may be a route to reversing the reduced enthusiasm for THz frequency in 6G by making it viable outdoors when combined with other new approaches covered earlier.

Chapter 10. "RIS and reflect-array manufacture, inspection, testing, cost breakdown" (14 pages) covers these aspects, including recent changes of direction. Chapter 11. "6G RIS companies : products, plans, patents, Zhar appraisals: 2025-6" then closes the report with RIS-related work of 30 companies being separately assessed.

Essential source

The Zhar Research report, "6G Communications: Reconfigurable Intelligent Surface RIS Materials and Hardware Markets, Technology 2026-2046" is your essential reference as you address this emerging market of billions of dollars. It is constantly updated so you always get the latest information.

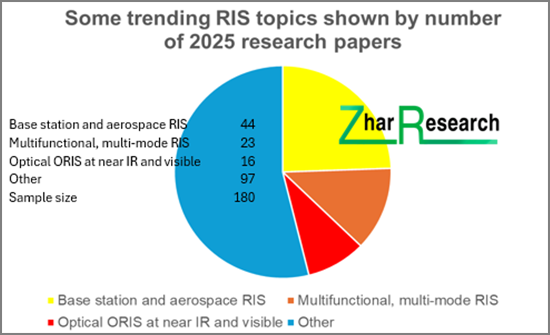

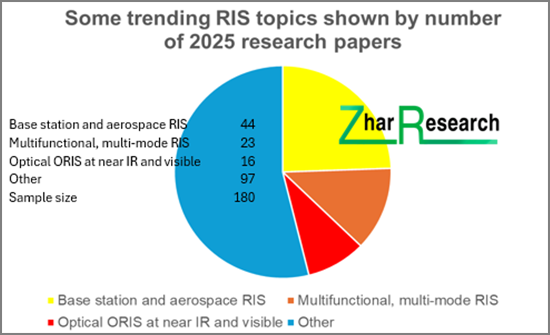

Caption: Some trending RIS topics shown by number of 2025 research papers. Source: Zhar Research report, "6G Communications: Reconfigurable Intelligent Surface RIS Materials and Hardware Markets, Technology 2026-2046".

Table of Contents

1. Executive summary and conclusions with roadmap and forecast lines 2026-2046

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Background to RIS

- 1.3.1. Useful for 5G but essential for 6G

- 1.3.2. RIS Google and research paper trends, trending RIS topics through 2025

- 1.3.3. Dreams of RIS everywhere: infograms

- 1.4. Many types of RIS needed for 6G

- 1.5. Ten key conclusions concerning 6G Communications generally

- 1.6. Infogram: Primary 6G systems objectives with major hardware opportunities starred

- 1.7. Seven key conclusions concerning 6G RIS materials and component opportunities

- 1.8. Seven key conclusions concerning 6G RIS cost issues

- 1.9. Six key conclusions concerning 6G RIS and reflect-array manufacturing technology

- 1.10. Eight SWOT appraisals

- 1.10.1. 6G RIS SWOT appraisal

- 1.10.2. SWOT appraisal of 6G adding sub-THz, THz, near infrared and visible frequencies

- 1.10.3. SWOT appraisal of BD-RIS for 6G

- 1.10.4. STAR-RIS SWOT appraisal

- 1.10.5. SWOT appraisal of 6G RIS for OWC

- 1.10.6. SWOT appraisal of visible light communication VLC

- 1.10.7. SWOT appraisal for metamaterials and metasurfaces generally

- 1.10.8. SWOT appraisal of morphing Flexible Intelligent Metasurfaces FIM

- 1.11. 5G and 6G RIS roadmaps in four lines 2026-2046

- 1.12. 6G RIS and reflect-array market forecasts 2026-2046

- 1.12.1. 6G RIS value market 2027-2046 $ billion with explanation

- 1.12.2. 6G RIS area sales yearly billion square meters 2027-2046 with explanation

- 1.12.3. Average 6G RIS price $/ square m. ex-factory including electronics 2028-2046 with explanation

- 1.12.4. 6G RIS value market $ billion: active vs four semi-passive categories by frequency 2026-2046 with explanation

- 1.12.5. 6G RIS area sales vs average panel area, panels sales number and total panels deployed cumulatively 2027-2046 with explanation

- 1.12.6. 6G RIS value market, base station vs propagation path $ billion 2027-2046

- 1.12.7. Percentage share of global RIS hardware value market by four regions 2029-2046

- 1.12.8. Market for semi-passive vs active RIS 0.1-1THz vs non-6G THz electronics 2027-2046

- 1.12.9. 6G fully passive metamaterial reflect-array market $ billion 2029-2046

- 1.13. Supporting information

- 1.13.1. Smartphone billion units sold globally 2024-2046 if 6G is successful

- 1.13.2. Market for 6G vs 5G base stations units millions yearly 2025-2046

- 1.13.3. Market for 6G base stations market value $bn if 6G successful 2029-2046

- 1.13.4. Location of primary 6G material and component activity worldwide 2026-2046

2. Introduction

- 2.1. Overview

- 2.1.1. Definitions and context

- 2.1.2. RIS operation modes, some key issues in providing planned 6G benefits

- 2.1.3. Important trend from moving parts to smart materials

- 2.1.4. Diverse functionalities and applications of RIS and allied intelligent metasurfaces

- 2.1.5. Examples of current approaches to RIS design and capability

- 2.1.6. Unique features of RIS vs traditional approaches and combinations through 2025

- 2.1.7. Transitional product towards RIS is liquid crystal phased array

- 2.1.8. RIS competing with traditional approaches

- 2.1.9. How 6G systems will mix and match many technologies in the propagation path

- 2.1.10. Active RIS becomes important: different envisaged potential and advances through 2025

- 2.2. RIS functionality and usefulness - a closer look

- 2.2.1. Improved spatial coverage and macro-diversity

- 2.2.2. Capacity enhancement, green communications and Internet of Things

- 2.2.3. Physical layer security, anti-jamming, and reliability enhancement

- 2.2.4. Enabling Large-Scale IoT Network Deployment

- 2.2.5. Wireless Sensing and Localization, HRIS, ISAC

- 2.2.6. RIS from the systems and security viewpoint with 2025 advances

- 2.3. Activities of standards bodies and influencers related to 6G RIS

- 2.4. Broadening vs retrenching 6G and 6G RIS objectives, smart radio environments

- 2.5. Terminology thicket

- 2.6. Changing industrial and research trends through 2025

- 2.6.1. Broadening theoretical studies useful but relative neglect of hardware is not

- 2.6.2. Backtracking on frequencies compromises capability at launch

- 2.6.3. 2025 research focussed on broadly 5G frequencies: GHz and mmWave for 6G through 2025

- 2.6.4. 0.1THz to 3THz 6G RIS research through 2025

- 2.7. Improving reach at the higher frequencies: trajectory engineering

- 2.8. Analysis of 18 other research advances through 2025

- 2.9. 6G global architecture proposals, complementary systems

3. Ultimate 6G RIS hardware toolkit: invisible, wide area, self-powered, self-learning, self-adaptive, self-healing, self-cleaning, ubiquitous, autonomous, everlasting, AI enabled, dynamic spectrum sharing, other

- 3.1. Overview

- 3.1.1. Some options to make RIS more acceptable, deployable and useful

- 3.1.2. Synergistic combination of advanced physical and RIS properties

- 3.2. Invisible RIS - transparent or out of sight

- 3.2.1. Potential transparent RIS capabilities

- 3.2.2. Transparent 6G RIS in 2025-6: companies, universities, ambitions

- 3.2.3. Transparent reflect arrays: Sekisui and others

- 3.3. Large Intelligent Surfaces LIS and Extremely Large-scale Antenna Array ELAA 2025 research including wide area RIS

- 3.3.1. Definitions and benefits

- 3.3.2. Large Intelligent Surfaces LIS RIS enhancing security, range, error reduction

- 3.3.3. Advances in protective coatings for wide area energy harvesting and RIS in 2025

- 3.4. RIS will become self-powered and enable zero energy client devices

- 3.4.1. Overview

- 3.4.2. Maturity of primary ZED enabling technologies in 2025

- 3.4.3. Ranking of most popular 6G ZED compounds and carbon allotropes in research

- 3.4.4. Context of ZED: overlapping and adjacent technologies and examples of long-life energy independence

- 3.4.5. SWIPT, STIIPT, AmBC and CD-ZED objectives and latest progress

- 3.4.6. 13 harvesting technologies for 6G ZED infrastructure and client devices 2026-2046

- 3.4.7. 6G active RIS and UM MIMO base station power demands matched to energy harvesting options

- 3.4.8. SWOT appraisal of batteryless storage technologies for ZED RIS and more

- 3.4.9. SWOT appraisal of circuits and infrastructure that eliminate storage

- 3.5. Long life: self-healing materials for fit-and-forget

- 3.6. Artificial intelligence and machine learning for optimising, self-learning, self-adaptive , autonomous RIS: Progress through 2025

- 3.7. Multimode and multifrequency, dynamic spectrum sharing DSS 6G and its RIS

4. Beyond diagonal RIS architecture tackles 6G RIS limitations: Surge in advances through 2025

- 4.1. Definitions, material challenges, applicability

- 4.1.1. Significance

- 4.1.2. The simple description

- 4.1.3. SWOT appraisal of BD-RIS for 6G

- 4.1.4. Coverage in this chapter and your opportunities

- 4.2. Potential benefits of BD-RIS

- 4.3. BD-RIS hardware challenges

- 4.4. Practical implementations and requirement for improvement

- 4.4.1. The challenge

- 4.4.2. First practical demonstrations of BD-RIS claimed in 2025

- 4.4.3. Terrestrial BD-RIS progress through 2025: many other advances and appraisals

- 4.4.4. Improving RIS in non terrestrial networks NTN

5. Multifunctional and multi-mode RIS including STAR RIS, ISAC, SWIPT

- 5.1. Overview with review of 2025 research, industrial trends and possibilities

- 5.2. Simultaneous transmissive and reflective STAR RIS

- 5.2.1. Overview

- 5.2.2. STAR-RIS optimisation

- 5.2.3. STAR-RIS-ISAC integrated sensing and communication system

- 5.2.4. TAIS Transparent Amplifying Intelligent Surface and SWIPT active STAR-RIS

- 5.2.5. STAR-RIS with energy harvesting and adaptive power

- 5.2.6. STAR RIS SWOT appraisal

- 5.3. Other multifunctional and multi-mode RIS

- 5.3.1. Overview

- 5.3.2. Multifunctional RIS: solid-state cooling functionality

- 5.3.3. Integrated sensing and communication ISAC

- 5.3.4. Multimode RIS ensuring system security: combined semi-passive and active RIS

6. Base station, UM-MIMO, Tower in the Sky HAPS and other UAV RIS

- 6.1. Overview

- 6.2. Progress to UM-MIMO

- 6.3. RIS-enabled, self-powered ultra-massive 6G UM-MIMO base station design

- 6.4. RIS for massive MIMO base station: Tsinghua University, Emerson

- 6.5. RIS as small cell base station

- 6.6. Other important advances in RIS-enabled MIMO and base stations in 2025

- 6.7. How satellites and UAVs will aid and sometimes benefit from 6G RIS: advances through 2025

- 6.8. Important advances in 2024

- 6.9. Large stratospheric HAPS RIS

- 6.1. Overview

- 6.2. Progress to UM-MIMO

- 6.3. RIS-enabled, self-powered ultra-massive 6G UM-MIMO base station design

- 6.4. RIS for massive MIMO base station: Tsinghua University, Emerson

- 6.5. RIS as small cell base station

- 6.6. Other important advances in RIS-enabled MIMO and base stations in 2025

- 6.7. How satellites and UAVs will aid and sometimes benefit from 6G RIS: advances through 2025

- 6.8. Important advances in 2024

- 6.9. Large stratospheric HAPS RIS

7. RIS tuning hardware objectives and progress with research through 2025

- 7.1. Overview

- 7.1.1. Primitive to advanced tuning

- 7.1.2. Tuning mechanisms in context

- 7.1.3. Examples of RIS external control stimuli used in research and trials

- 7.1.4. RIS tuning hardware options compared

- 7.1.5. Infogram: The Terahertz Gap demands different tuning materials and devices

- 7.2. Lessons from research carried out on RIS tuning: 2025 and earlier

- 7.2.1. Changing focus

- 7.2.2. Electrical and optical tuning and higher frequencies favoured

- 7.3. Detailed analysis of progress with discrete tuning components

- 7.3.1. General

- 7.3.2. Schottky diode RIS tuning vs other diodes

- 7.3.3. High-Electron Mobility Transistor HEMT RIS tuning

- 7.3.4. Less successful other options with reasons

- 7.4. Prioritisation of tuning materials replacing discretes for 6G RIS 0.1-1THz and NearIR

- 7.4.1. Winners on current evidence

- 7.4.2. Options for integrated tuning materials for higher frequency 6G

- 7.4.3. Vanadium dioxide: rationale and major progress through 2025, 2024

- 7.4.4. Chalcogenide phase change materials notably GST and GeTe

- 7.4.5. Graphene: rationale and major progress through 2025, 2024

- 7.4.6. Liquid crystal rationale and progress through 2025, 2024

- 7.5. Large RIS and other gaps in the market

8. Optical Wireless Communications ORIS for 6G: major progress through 2025

- 8.1. Why OWC including RIS at its frequencies is an attractive addition for 6G

- 8.1.1. Optical Wireless Communications OWC and subset Visible Light Communications VLC

- 8.1.2. The case for multi-frequency 6G Phase Two including optical "so one gets through"

- 8.1.3. Parameter comparison of Free Space Optical FSO with 3-300GHz communication

- 8.2. The potential and the challenges of Optical RIS ORIS with SWOT appraisals

- 8.2.1. Overview

- 8.2.2. ORIS benefits and the Distributed RIS DRIS option

- 8.2.3. ORIS challenges

- 8.2.4. SWOT appraisal of 6G RIS for OWC

- 8.2.5. SWOT appraisal of visible light communication

- 8.3. ORIS implementation procedures

- 8.4. Long range, underground, underwater and space OWC: RIS: research advances 2025 and earlier

- 8.4.1. General

- 8.4.2. RIS enhanced OWC vehicular networks and mobile environments

- 8.4.3. Hybrid RF-FSO RIS

- 8.4.4. Underwater UOWC systems

- 8.4.5. Underground OWC needing RIS

- 8.4.6. Laser stratospheric and space communications with RIS technology

- 8.5. Short range and indoor OWC and its RIS: research advances through 2025 and earlier

- 8.5.1. Indoors and short range in air

- 8.5.2. Leveraging other indoor and short-range outdoor systems such as LiFi with RIS

- 8.6. Potentially 6G optical materials

- 8.7. Metalenses for 6G including advances through 2025

- 8.8. Mirror array ORIS design

9. 6G Morphing Flexible Intelligent Metasurfaces FIM, 6G hypersurfaces, metamaterial basics

- 9.1. Overview

- 9.2. Appraisal of 6G-related metamaterial research major advances through 2025

- 9.2.1. New advances in metamaterial design

- 9.2.2. Hypersurfaces, stacked intelligent metasurfaces, swarms, bifunctional metasurfaces

- 9.2.3. Optimal metamaterial substrates and low loss, 6G glass TIRS

- 9.2.4. Optimal metamaterial substrates including transparent 6G glass

- 9.3. Metamaterial basics

- 9.3.1. The meta-atom and patterning options

- 9.3.2. Material and functional families

- 9.3.3. Metamaterial reflect-arrays for 5G and 6G Communications

- 9.3.4. Metamaterial patterns and materials

- 9.3.5. Six formats of communications metamaterial with examples

- 9.4. Metasurface basics

- 9.4.1. Metasurface design, operation and RIS

- 9.4.2. How metamaterial RIS hardware operates

- 9.4.3. RIS and reflect-array construction and potential capability

- 9.4.4. All dielectric and non-linear dielectric metasurfaces

- 9.5. The long-term picture of metamaterials overall

- 9.6. Emerging applications of GHz, THz, infrared and optical metamaterials

- 9.7. Thermal metamaterials

- 9.8. SWOT appraisal for metamaterials and metasurfaces generally

- 9.9. Morphing Flexible Intelligent Metasurfaces FIM basics and their research through 2025

- 9.9.1. Basics

- 9.9.2. FIM network topology and potential applications targetted

- 9.9.3. Many FIM research advances through 2025 assessed

- 9.9.4. SWOT appraisal of 6G FIM

10. RIS and reflect-array manufacture, inspection, testing, cost breakdown

- 10.1. Thin film and transparent electronics state-of-the-art

- 10.2. Trend from discrete boards, stacked films to full smart material integration

- 10.3. Importance of flexible, laminar and 2D energy harvesting and sensing

- 10.4. How manufacturing technologies differ for 6G RIS optical, low or high THz

- 10.4.1. Candidates: nano-imprinting, nano-lithography, lithography, gravure, inkjet, screen, flexo, spray, other

- 10.4.2. Special case: 3D printing with electron beam evaporation

- 10.4.3. Ultra-fast laser system

- 10.5. 6G RIS inspection and testing: new advances in 2025

- 10.5.1. Testing challenges

- 10.5.2. Progress in RIS inspection in 2025

- 10.6. RIS cost analysis

- 10.6.1. General assessment

- 10.6.2. NEC and other costed case studies

- 10.6.3. Outdoor semi-passive and active RIS cost analysis at high areas of deployment

- 10.6.4. Indoor semi-passive RIS cost analysis at volume

11. 6G RIS companies : products, plans, patents, Zhar appraisals: 2025-6

- 11.1. Overview and patenting

- 11.1.1. Rapidly changing situation 2025-6

- 11.1.2. RIS patenting and literature trends

- 11.2. AGC Japan

- 11.3. Alcan Systems Germany

- 11.4. Alibaba China

- 11.5. Alphacore USA

- 11.6. China Telecom China Mobile, China Unicom, Huawei, ZTE, Lenovo, CICT China collaboration

- 11.7. Ericsson Sweden

- 11.8. Fractal Antenna Systems USA

- 11.9. Greenerwave France

- 11.10. Huawei China

- 11.11. ITOCHU Japan

- 11.12. Kymeta Corp. USA

- 11.13. Kyocera Japan

- 11.14. Metacept Systems USA

- 11.15. Metawave USA

- 11.16. NEC Japan

- 11.17. Nokia Finland with LG Uplus South Korea

- 11.18. NTT DoCoMo and NTTJapan

- 11.19. Orange France

- 11.20. Panasonic Japan

- 11.21. Pivotal Commware USA

- 11.22. Qualcomm USA

- 11.23. Samsung Electronic South Korea

- 11.24. Sekisui Japan

- 11.25. SensorMetrix USA

- 11.26. SK Telecom South Korea

- 11.27. Sony Japan

- 11.28. Teraview USA

- 11.29. Vivo Mobile Communications China

- 11.30. VTT Finland

- 11.31. ZTE China