|

市場調查報告書

商品編碼

1920862

人類微生物組市場(第五版):產業趨勢及全球預測(至 2035 年)-依產品類型、生物製劑類型、給藥途徑、藥物製劑、目標適應症、目標治療領域及地區劃分Human Microbiome Market (5th Edition): Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Product, Type of Biologic, Route of Administration, Drug Formulation, Target Indication, Target Therapeutic Area and Geographical Regions |

||||||

人類微生物組市場:概述

根據 Roots Analysis 的研究,人類微生物組市場預計將從目前的 8.5 億美元增長到 2035 年的 32.7 億美元,預測期內(至 2035 年)的複合年增長率 (CAGR) 為 16%。

人類微生物組市場:成長與趨勢

人類微生物組由多種微生物群落組成,包括細菌、古菌、病毒和真菌,它們棲息於人體各個部位,包括皮膚、腸道、口腔和其他組織。對人類微生物組多樣性的研究可以追溯到17世紀80年代,當時安東尼·範·列文虎克觀察了口腔和糞便微生物組樣本。目前,人類微生物組的組成高度動態,研究顯示其在免疫、代謝,甚至癌症、發炎和神經退化性疾病中都發揮著重要作用。美國食品藥物管理局(FDA)已批准兩種糞便微生物組療法用於預防復發性艱難梭菌感染(rCDI)。值得注意的是,由Ferring Pharmaceutical開發的REBYOTA於2022年11月成為首個獲準的人類微生物組療法,而由Seres Therapeutics開發的VOWST也於2023年4月獲準用於口服給藥。值得一提的是,雀巢健康科學在2024年6月收購了VOWST在美國和全球的權益,進一步鞏固了其商業成功。

鑑於DNA定序、生物資訊學和分析工具的不斷進步正在加深我們對人類微生物組與健康和疾病之間關係的理解,預計該領域在不久的將來將實現兩位數的市場增長。

市場擴張的策略驅動因素

微生物組分析技術的進步,例如下一代定序和宏基因組學,使得對微生物群落的深入分析成為可能,從而加速了診斷和治療。此外,製藥公司、生技公司和創投公司的投資增加,正在支持針對胃腸道疾病、代謝性疾病和癌症等疾病的臨床研發管線的擴展。此外,人們對微生物組在健康中的作用日益關注,對個人化益生菌的需求,預防醫學,以及新創企業與學術機構之間的合作,都在推動人類微生物組市場的擴張。

市場挑戰:發展面臨的重大障礙

儘管全球人類微生物組市場正經歷顯著成長,但仍存在一些限制因素,可能會阻礙該產業的發展。人類微生物組市場研發和商業化成本高昂,包括需要符合GMP標準的活微生物設施以及複雜的臨床試驗,這些都阻礙了其規模化和廣泛應用。嚴格的監管要求、缺乏標準化指南以及微生物菌株的多樣性,都會延遲審批流程,並增加各地區的進入門檻。公眾認知不足、對微生物組操作的倫理擔憂以及證據不一致等問題,也阻礙了患者和醫療保健提供者接受該技術。

人類微生物組市場:主要發現

本報告分析了人類微生物組市場的現狀,並指出了該行業潛在的成長機會。主要發現包括:

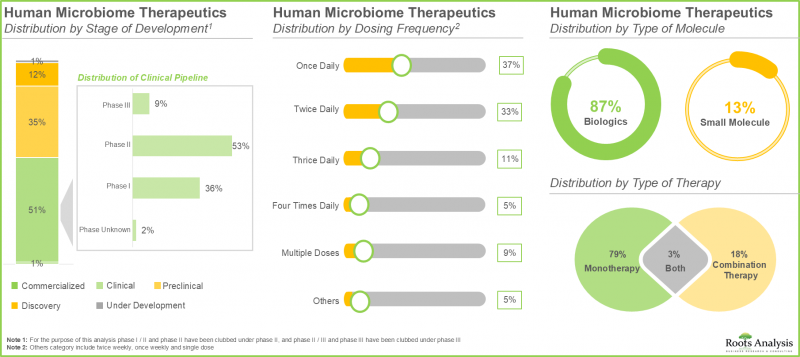

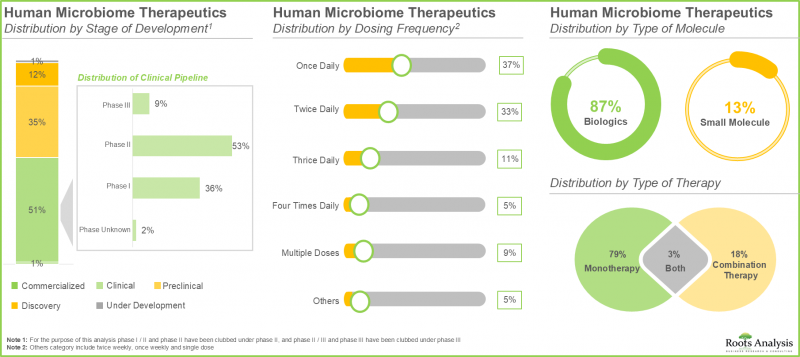

- 目前,約有 55 家研發公司開發了近 215 種人類微生物組療法,這些療法已獲批准或處於不同的研發階段,旨在治療多種疾病。

- 超過 50% 的人類微生物組療法正處於臨床開發階段。值得注意的是,大多數藥物/治療項目都集中在生物製劑的開發上,主要是活體生物製劑。

- 75 家公司正在開發約 140 種人類微生物組診斷測試。 值得注意的是,這些公司中約有 55% 成立於 2015 年後。

- 約 80% 的公司提供旨在分析微生物組組成和功能的人類微生物組診斷服務,其中 55% 的公司使用定序/宏基因組學技術進行診斷。

- 大多數糞便微生物組療法研發公司成立於 2000 年至 2015 年間。超過 65% 的這類公司總部位於北美,其次是歐洲(約佔 35%)。

- 糞便細菌療法是指將從健康個體採集的糞便細菌移植/注射到患者的胃、大腸或小腸。這些療法中大多數(50%)處於臨床階段。

- 迄今為止,已有近 205 項臨床試驗註冊,用於評估各種糞便微生物療法的安全性和有效性。這些研究大多在歐洲的各個試驗中心進行。

- 近年來,新創公司採取了多項措施來加強其微生物組治療和診斷產品組合。其中大多數旨在治療潰瘍性結腸炎。

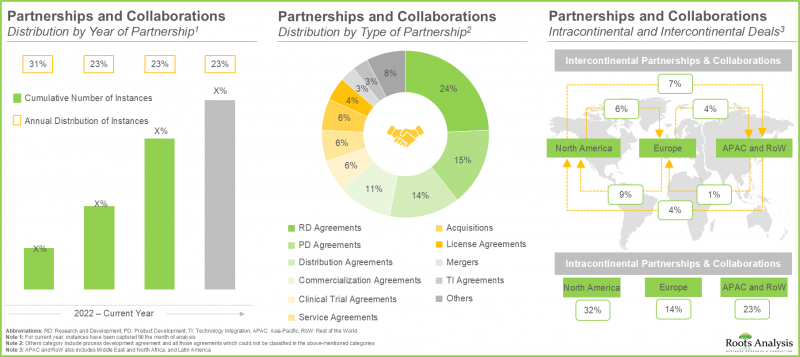

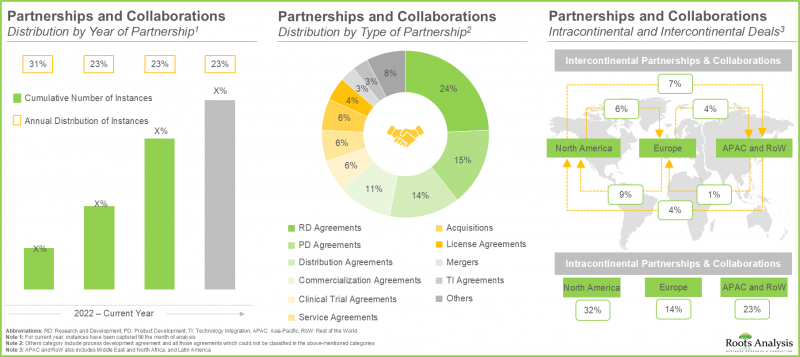

- 近年來,各利害關係人之間建立了多種多樣的合作關係,這也反映了市場對該領域的日益增長的興趣。事實上,超過 45% 的交易是在過去兩年內達成的。

- 自 2022 年以來,預計該領域將獲得超過 12 億美元的融資。特別是,撥款和獎勵已成為微生物組藥物開發商採用的主要融資模式。

- 市場影響分析概述了影響整體市場發展的潛在因素,並可用於識別特定領域的驅動因素、限制因素、機會和挑戰。

- 在消費者對腸道健康意識的提高、慢性病發病率的上升以及微生物組測序技術的進步的推動下,預計市場將繼續穩步增長。

- 在各種給藥途徑中,口服給藥目前佔最大的市場佔有率(55%),這得益於其安全性、便利性以及適用於直接在口腔內進行治療幹預。

- 由於人類微生物組療法在治療傳染病方面具有顯著療效,預計今年傳染病細分市場將佔整體市場的大部分佔有率。 值得注意的是,在各個地區中,預計北美將在預測期內主導整個人類微生物組市場。 由於北美人類微生物組定序技術的快速發展,預計該地區今年將佔整個人類微生物組市場的重要佔有率。 在領先美國公司開發的已獲批准的微生物組療法快速成功的推動下,人類微生物組療法市場預計將以穩定的複合年增長率成長。

人類微生物組市場

市場規模和機會分析基於以下參數進行細分:

依產品類型

- 治療藥物

- 診斷試劑

- 糞便微生物組療法

依生物製劑類型

- 生物製劑

- 其他

依給藥途徑

- 口服

- 直腸給藥

依藥物劑型

- 膠囊

- 混懸劑

- 灌腸劑

- 粉劑

按適應症

- 艱難梭菌感染

- 壞死性腸炎

- 腸躁症

- 急性移植物抗宿主疾病

- 糖尿病

- 腸躁症

- 大腸直腸癌

依治療領域

- 傳染病

- 胃腸道疾病

- 罕見疾病

- 代謝性疾病

- 腫瘤

按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 西班牙

- 其他地區歐洲 亞太地區 澳洲 中國 印度 日本 拉丁美洲 巴西 中東和北非 以色列 沙烏地阿拉伯

人類微生物組市場:主要細分市場

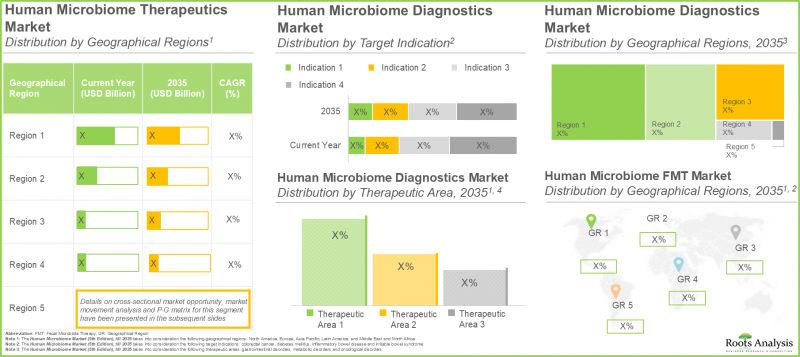

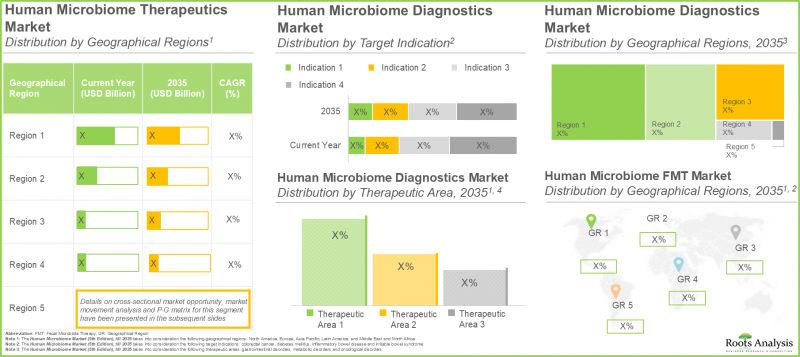

依產品類型劃分的市場佔有率:診斷領域佔最大佔有率

根據 "人類微生物組市場報告" ,今年診斷領域佔了最大的市場佔有率(約45%),這主要得益於以微生物組為中心的診斷測試在早期檢測各種疾病(包括代謝紊亂和癌症相關疾病)方面的應用日益廣泛。預計在預測期內,治療領域將顯著成長32%。這主要歸功於個人化療法研發的持續深入、現有療法(例如糞便微生物移植 (FMT))對某些疾病的有效性,以及正在研發的新藥和療法。

基於人類微生物組的療法市場佔有率洞察

以生物製劑類型劃分的市場佔有率:生物製劑佔最大佔有率

目前,由於標靶微生物組的療法在治療包括胃腸道疾病、代謝紊亂和癌症相關疾病在內的多種疾病方面的應用日益廣泛,生物製劑佔了整個人類微生物組療法市場。尤其值得注意的是,其他細分市場(包括噬菌體生物製劑、疫苗和其他抗體)預計在預測期內將以 64% 的複合年增長率 (CAGR) 實現顯著增長。

依給藥途徑劃分的市佔率:口服給藥途徑佔最大市佔率

今年,口服給藥途徑在人類微生物組療法市場中佔了最大的市場佔有率 (55%)。值得注意的是,口服給藥途徑在預測期內有望達到 38% 的顯著複合年增長率。這與其安全性、便利性以及透過口腔內直接的治療作用實現全身療效的能力密切相關。

按劑型劃分的市場佔有率:混懸液細分市場將以更高的複合年增長率成長

在各個細分市場中,預計到2025年,膠囊劑型將佔人類微生物組療法市場最大的佔有率(55%),這主要得益於以膠囊劑型為主的微生物組療法強大的臨床試驗管線。值得注意的是,懸浮劑型預計將在整個預測期內以更高的複合年增長率(38%)增長。這主要歸功於懸浮劑型能夠維持活性微生物製劑的活性和穩定性,便於劑量調整,以及其在多種治療應用中的悠久歷史。

依目標適應症劃分的市佔率:艱難梭菌感染領域領先

目前,艱難梭菌感染領域佔了整個人類微生物組療法市場最大的佔有率。這主要是由於艱難梭菌感染的發生率和嚴重程度不斷上升,以及抗生素引起的腸道菌叢紊亂與該感染之間存在明確的關聯。

此外,針對急性移植物抗宿主疾病 (AGVHD) 的治療市場預計將在 2027 年至 2035 年間以相對較高的複合年增長率 (CAGR) (35%) 增長。這主要歸功於 MaaT013 (Xervyteg®) 的預期獲批。 MaaT013 是一種開創性的基於微生物組的療法,旨在滿足胃腸道急性移植物抗宿主疾病 (GVHD) 患者的未滿足醫療需求。該疾病目前的存活率極低,且尚無核准的替代療法。

依治療領域劃分的市場佔有率:傳染病領域佔主導地位

目前,傳染病領域佔了人類微生物組治療市場 100% 的佔有率,預計這一趨勢將保持不變。這主要歸功於微生物組直接參與免疫功能和病原體防禦,以及基於微生物組的療法在治療復發性艱難梭菌感染等疾病方面已被證實的有效性。尤其值得注意的是,罕見疾病領域預計在2027年至2035年間將以相對較高的複合年增長率(35%)成長。

按地區劃分的市場佔有率:北美將佔最大佔有率

根據我們的預測,到2025年,北美將佔人類微生物組療法市場的大部分佔有率(95%)。這主要得益於該地區先進的醫療基礎設施,使研發人員能夠進行大量臨床試驗並滿足監管要求。值得注意的是,預計歐洲市場在 2025 年至 2032 年間將以相對較高的複合年增長率 (CAGR) (75%) 成長。

人類微生物組市場主要參與者

- 貝克頓‧迪金森公司 (Becton, Dickinson and Company)

- Biome Diagnostics

- Ferring Pharmaceuticals

- GoodGut

- Infant Bacterial Therapeutics

- MaaT Pharma

- Microbiomik

- NutriPATH

- Seres Therapeutics

- Tiny Health

- OxThera

- Vedanta Bisociements

- Zybio

人類微生物組市場:研究範圍

- 市場規模和機會分析:本報告對人類微生物組市場進行了詳細分析,重點關注關鍵細分市場: [A] 產品類型,[B] 生物製劑類型,[C] 給藥途徑,[D] 藥物製劑,[E] 目標適應症,[F] 目標治療領域,以及 [G] 地理區域。

- 人類微生物組療法 - 市場概況:包括對當前人類微生物組療法市場概況的詳細概述,以及以下方面的資訊:[A] 研發階段,[B] 分子類型,[C] 生物製劑類型,[D] 目標適應症,[E] 治療領域,[F] 給藥途徑,[G] 製劑,[H] 治療年份,[H] 類型,[K] 劑量,[K] 製劑。總部所在地,以及 [M] 最活躍的公司。

- 人類微生物組診斷和篩檢/分析測試 - 市場概況 2:詳細概述了各種診斷、篩檢和分析測試的當前市場概況,以及以下相關參數的資訊:[A] 研發階段,[B] 分析物類型,[C] 篩檢技術類型,[D] 目標適應症,[E] 治療領域,[F] 測試領域,[F] 地點,[G] 公司規模。

- 人類微生物組糞便微生物療法 (FMT) - 市場概況 3:詳細概述了 FMT 療法其他相關方面的當前市場概況,以及以下相關參數的信息:[A] 研發階段,[B] 分析樣本類型,[C] 篩檢技術類型,[D] 目標適應症,[E] 治療領域,[F] 測試領域,[H] 測試公司規模[H] 公司目的,以及公司治療領域,。

- 公司和藥物概況:基於[A]成立年份、[B]總部所在地、[C]基於微生物組的藥物組合、[D]近期進展和[E]未來展望,對開發微生物組療法、微生物組診斷和篩檢/分析測試以及糞便微生物療法的關鍵公司進行詳細概況分析。

- 臨床試驗分析:基於[A]試驗註冊年份、[B]入組患者人數、[C]患者性別、[D]試驗階段、[E]試驗狀態、[F]治療領域、[G]申辦方/合作方類型、[H]研究設計、[I]最活躍的公司(基於臨床試驗數量)和[J],對已完成糞便的微生物進行分析。吸引力與競爭力分析:基於九宮格AC矩陣框架,我們對所研究的各個治療領域的關鍵適應症進行了深入的商業組合分析。本分析也包括對最常見疾病適應症的相對市場吸引力和現有競爭格局的探討。

- 合作關係:我們基於相關參數,對人類微生物組開發公司之間的合作關係進行了詳細分析,這些參數包括:[A] 合作年份,[B] 合作類型,[C] 目標適應症,[D] 治療領域,[E] 合作夥伴類型,以及 [F] 最活躍的公司(按合作數量排名)。

- 融資和投資:我們基於以下相關參數,對該領域的融資和投資情況進行了詳細分析:[A] 融資年份,[B] 融資類型,[C] 投資金額,[D] 融資目的,[E] 目標適應症,[F] 治療領域,[G] 地區,[H] 最活躍的公司,以及 [I] 主要投資者。

- 案例研究 1:我們對微生物組療法的開發和生產的每個步驟進行了詳細分析,並提供了合約生產組織 (CMO) 的參考名單。報告提供了每家公司的詳細信息,包括成立年份、總部所在地、公司規模、業務規模、生產的產品類型和製劑類型。此外,報告還重點介紹了選擇 CMO/CRO 合作夥伴時需要考慮的關鍵因素。

- 案例研究 2:評估了大數據的新興作用,重點介紹了致力於開發和實施各種演算法/工具以分析微生物組研究產生的數據的工作,並提供了富有洞察力的谷歌趨勢分析,表明在過去十年中,利益相關者對利用大數據工具支持微生物組研究的興趣日益濃厚。

目錄

第一章:引言

第二章:研究方法

第三章:市場動態

- 章節概述

- 預測研究法

- 市場估值框架

- 預測工具與技術

- 關鍵考慮因素

- 局限性

第四章:宏觀經濟指標

第五章:摘要整理

第六章:引言

- 章節概述

- 微生物群和微生物組的概念

- 腸道菌叢簡介

- 微生物組及其相關因素疾病

- 微生物群對藥物動力學的影響

- 微生物群對治療結果的影響

- 微生物組療法

- 人類微生物組計畫 (HMP)

- 活體生物製品 (LBP) 監管指南

- 微生物組療法研發的關鍵挑戰

- 未來展望

第七章:人類微生物組療法:市場概況

- 章節概述

- 人類微生物組療法:市場概況

- 人類微生物組療法:研究發現狀

第八章:人類微生物組診斷與篩檢/分析測試:市場概況

- 章節概述

- 微生物組診斷與篩檢/分析測試:市場概況

- 微生物組診斷與篩檢/分析測試:供應商概況

第九章:人類糞便微生物組療法:市場概況

- 章節概述

- 糞便微生物組療法 (FMT) 簡介

- 歷史概述

- 糞便微生物組療法:流程與臨床意義

- 糞便微生物組療法監管指南

- 糞便微生物組療法的報銷範圍

- 糞便微生物組療法:市場概況

第十章:人類微生物組療法:公司與藥物概況

- 章節概述

- Ferring Pharmaceuticals

- Infant Bacterial Therapeutics

- MaaT製藥

- Mikrobiomik

- Seres Therapeutics

- OxThera

- Vedanta Biosciences

- 智益生物科技

第11章:微生物組診斷與篩檢/分析檢測提供者:公司簡介

- 章節概述

- Becton, Dickinson and Company

- Biome Diagnostics

- GoodGut

- NutriPATH

- Tiny Health

第12章:臨床試驗分析

- 章節概述

- 研究範圍與方法

- 糞便微生物療法:臨床試驗分析

第13章:吸引力與競爭力矩陣

第十四章:新創企業健康指標

- 章節概述

- 研究範圍與方法

- 新創企業基準分析

第十五章:個案研究:關鍵治療領域

- 章節概述

- 代謝性疾病

- 消化和胃腸道疾病

- 腫瘤適應症

- 皮膚病

- 傳染病

第十六章:合作與夥伴關係

第十七章:融資與投資

第十八章:案例研究:微生物組療法和生物製劑的合約服務

第十九章:個案研究

Human Microbiome Market: Overview

As per Roots Analysis, the human microbiome market is estimated to grow from USD 0.85 billion in the current year to USD 3.27 billion by 2035, at a CAGR of 16% during the forecast period, till 2035.

Human Microbiome Market: Growth and Trends

The human microbiome consists of a variety of microorganisms, such as bacteria, archaea, viruses, and fungi, that inhabit different regions of the human body, including the skin, gut, mouth, and other tissues. The investigation into the diversity of the human microbiome dates back to the 1680s, when Antonie van Leeuwenhoek examined his oral and fecal microbiota samples. The existing human microbiome landscape is extremely dynamic, with studies emphasizing its crucial function in immunity, metabolism, and conditions like cancer, inflammatory diseases, and even neurodegenerative disorders. The US FDA has authorized two fecal microbiota treatments to prevent recurring C. difficile infection (rCDI). Significantly, REBYOTA (created by Ferring Pharmaceutical) became the first human microbiome therapy to gain approval in November 2022, with VOWST (developed by Seres Therapeutics) also receiving approval for oral administration in April 2023. Notably, the commercial triumph of VOWST has been strengthened by Nestle Health Science's purchase of its US and worldwide rights in June 2024.

Given the continuous advancements in DNA sequencing, bioinformatics, and analytical tools that enhance our comprehension of the human microbiome in relation to health and diseases, we anticipate that this sector is poised for double-digit market growth in the near future.

Growth Drivers: Strategic Enablers of Market Expansion

Advancements in microbiome sequencing technologies, such as next-generation sequencing and metagenomics, enable deeper analysis of microbial communities, accelerating diagnostics and therapies. Further, rising investments from pharma, biotech firms, and venture capital supports expanding clinical pipelines for conditions like gastrointestinal disorders, metabolic diseases, and cancer. In addition, increasing awareness of microbiomein health, coupled with demand for personalized probiotics, preventive healthcare, and collaborations between startups and academia, further propels human microbiome market expansion.

Market Challenges: Critical Barriers Impeding Progress

While the global human microbiome market is experiencing substantial growth, there are certain restraints that can hinder the growth of this industry. High R&D and commercialization costs in the human microbiome market space including GMP facilities for live organisms and complex clinical trials, hinder scalability and adoption Stringent regulatory requirements, lack of standardized guidelines, and variability in microbial strains delay approvals and increase entry barriers across regions. Limited public understanding, ethical concerns over microbiome manipulation, and slow patient / provider adoption due to inconsistent evidence also impede progress.

Human Microbiome Market: Key Insights

The report delves into the current state of the human microbiome market and identifies potential growth opportunities within industry. Some key findings from the report include:

- Currently, close to 215 human microbiome therapeutics developed by ~55 developers are approved / being investigated across various stages of development for treating a myriad of disorders.

- Over 50% of the human microbiome therapeutics are in clinical stages of development; notably, most of the drugs / therapy programs are focused on the development of biologics, primarily live biotherapeutics.

- Close to 140 human microbiome diagnostic tests are being developed by 75 players in this domain; notably, around 55% of the developers were established post-2015.

- Around 80% of the companies are offering human microbiome diagnostics for analysis of microfloral composition and function; 55% of players are employing sequencing / metagenomics techniques for the diagnosis.

- Majority of fecal microbiota therapy developers were established between 2000-2015; of these, more than 65% are headquartered in North America, followed by Europe (~35%).

- Fecal bacteriotherapy involves the transplantation / infusion of fecal bacteria from healthy individuals to the stomach, colon / small intestine of patients; majority (50%) of these therapies are in clinical stages.

- Close to 205 clinical trials have been registered till date to evaluate the safety and efficacy of various fecal microbiota therapies; majority of these studies have been conducted across various trial sites in Europe.

- Over the last few years, start-ups have undertaken multiple initiatives to enhance their microbiome therapeutics and diagnostics portfolio; majority of the initiatives were undertaken for the treatment of ulcerative colitis.

- The rising interest in this market is reflected from the diverse partnerships established among various stakeholders in the recent past; in fact, more than 45% of the deals were inked in the last two years.

- Since 2022, more than USD 1.2 billion has been raised in this domain; notably, grants / awards are also a very prominent funding model adopted by microbiome drug developers.

- The market impact analysis outlines the potential factors that influence the evolution of the overall market; it can be employed to determine the growth drivers, restraints, opportunities and challenges within a specific domain.

- Driven by the increasing consumer awareness gut health, the rising prevalence of chronic diseases and advancements in microbiome sequencing technologies, the market is poised for a steady growth in the future.

- Currently, amongst various routes of administration, oral route captures the highest share (55%) of the market owing to its safety, convenience and the suitability for direct therapeutic intervention within the oral cavity.

- The infectious diseases sub-segment is estimated to capture of the overall market share in the current year, owing to the effectiveness of human microbiome therapeutics in the treatment of such diseases.

- Notably, amongst various geographical regions, North America is expected to dominate the overall human microbiome market during the forecast period.

- North America is expected to capture a significant share of the overall human microbiome market in the current year owing to the rapid innovations within human microbiome sequencing technologies in the region.

- Driven by the rapid success of approved microbiome therapeutic drugs developed by prominent players in the US, the human microbiome therapeutics market is expected to grow at a steady CAGR.

Human Microbiome Market

The market sizing and opportunity analysis has been segmented across the following parameters:

By Type of Product

- Therapeutics

- Diagnostics

- Fecal Microbiota Therapies

By Type of Biologic

- Live Biotherapeutics

- Others

By Route of Administration

- Oral Route

- Rectal Route

By Drug Formulation

- Capsule

- Suspension

- Enema

- Powder

By Target Indication

- Clostridium Difficile Infection

- Necrotizing Enterocolitis

- Irritable Bowel Syndrome

- Acute Graft Versus Host Disease

- Diabetes Mellitus

- Irritable Bowel Disease

- Colorectal Cancer

By Target Therapeutic Area

- Infectious Disorders

- Gastrointestinal Disorders

- Rare Disorders

- Metabolic Disorders

- Oncological Disorders

By Geographical Regions

- North America

- US

- Canada

- Europe

- Germany

- France

- Italy

- UK

- Spain

- Rest of the Europe

- Asia-Pacific

- Australia

- China

- India

- Japan

- Latin America

- Brazil

- Middle East and North Africa

- Israel

- Saudi Arabia

Human Microbiome Market: Key Segments

Market Share by Type of Product: Diagnostics Segment Hold the Largest Share

In the current year, the diagnostics segment occupies the highest market share (~45%), as per human microbiome market report, driven by increased adoption of microbiome-centered diagnostic tests for the early identification of various conditions, such as metabolic disorders and cancer-related problems. The therapeutics segment is projected to see a significant growth rate of 32% during the forecast period. This increased research and development in personalized therapies, the effectiveness of existing treatments like Fecal Microbiota Transplantation (FMT) for particular illnesses, and new drugs and therapies under development.

Human Microbiome-based Therapeutics Market Share Insights

Market Share by Type of Biologic: Live Biotherapeutics Segment Holds the Largest Market Share

Currently, the live biotherapeutics segment occupies the entire human microbiome market share (for therapeutics) owing to the increasing application of microbiome-targeted treatments for treating various conditions, such as digestive problems, metabolic disorders, and cancer-related issues. Notably, the others segment (which includes phage biologics, vaccines, and additional antibodies) is expected to experience a remarkable growth rate, with a CAGR of 64% during the forecast period.

Market Share by Route of Administration: Oral Route Segment Holds the Largest Revenue

In the current year, the oral route occupies the highest market share (55%) of human microbiome therapeutics market. It is worth noting that the therapies administered via oral route are likely to witness a substantial CAGR of 38% during the forecast period. This is associated to the safety, user-friendliness, and the ability for direct therapeutic interaction in the oral cavity to accomplish desired systemic effects.

Market Share by Drug Formulation: Suspension Segment to Grow at a Higher CAGR

Among the various segments, the capsule segment occupies the highest human microbiome therapeutics market share (55%) in 2025. This results from the strong clinical trial pipeline of microbiome-centered therapies in capsule form. It is important to highlight that the suspension segment market is expected to expand at a notably higher CAGR (38%) throughout the forecast period. This arises from its ability to maintain the viability and stability of living microbial formulations, facilitate straightforward dosage adjustments, and its long-standing application history in diverse therapeutic uses.

Market Share by Target Indication: Clostridium Difficile Infection Segment Domina

Currently, the clostridium difficile infection segment occupies the entire human microbiome therapeutics market size. This is due to the rising frequency and intensity of clostridium difficile infections, coupled with the established link between antibiotic-induced gut dysbiosis and the infection.

Further, the market for therapies targeting acute graft versus host disease is likely to grow at a relatively higher CAGR (35%), during the period 2027-2035. This is attributed to the expected endorsement of MaaT013 (Xervyteg(R)), a pioneering microbiota-centered therapy designed to meet a significant unmet need in patients suffering from GI-involved acute graft versus host disease, where existing survival rates are dangerously low and no alternative approved therapy exists.

Market Share by Target Therapeutic Area: Infectious Disorders Segment Dominates the Market

Currently, the infectious diseases segment occupies the entire human microbiome therapeutics market size (with a share of 100%) and this trend is unlikely to change in the future. This is attributed to its direct involvement in immune function and pathogen defense, along with the demonstrated effectiveness of microbiome-based treatments, such as those addressing recurrent Clostridium difficile infections. Notably, the rare disorders segment is expected to experience a comparatively higher CAGR (35%) from 2027 to 2035.

Market Share by Geographical Regions: North America with Highest Revenue

According to our projections, North America is likely to capture the majority (95%) of the human microbiome therapeutics market share in 2025, as the advanced healthcare infrastructure in North America enables developers to conduct a large number of clinical trials, in order to meet the regulatory guidelines of the approval bodies. It is worth highlighting that the market in Europe is likely to grow at a relatively higher CAGR (75%), during the period 2025-2032.

Primary Research Overview

The opinions and insights presented in the market report were also influenced by discussions held with senior stakeholders in the industry. The market report includes detailed transcripts of interviews conducted with the following individuals:

- Former Senior Manager, Corporate Development, Mid-Sized Company, UK

- Co-founder and Chairman, Small Company, US

- Chief Executive Officer, Small Company, US

- Senior Scientist, Large Company, US

- President, Small Company, Taiwan

- Vice President, Business Development, Small Company, US

- Chief Business Officer, Mid-sized Company, Israel

- Former Vice President, Sales and Business Development, Small Company, US

- Co-founder and Chief Executive Officer, Small Company, Belgium

- Co-founder and Chief Executive Officer, Small Company, US

- Co-founder and Chief Executive Officer, Small Company, US

- Ex-Co-founder and Vice President of Innovation, Mid-sized Company, US

- Vice President & Chief Operating Officer, Small Company, US

- Former Vice President, Operations, Mid-sized Company, US

- Former President and Chief Executive Officer, Small Company, US

- Former Chief Scientific Officer and Vice President, Research, Small Company, US

- Former Chief Strategy Officer, Small Company, France

Example Players in Human Microbiome Market

- Becton, Dickinson and Company

- Biome Diagnostics

- Ferring Pharmaceuticals

- GoodGut

- Infant Bacterial Therapeutics

- MaaT Pharma

- Microbiomik

- NutriPATH

- Seres Therapeutics

- Tiny Health

- OxThera

- Vedanta Bisociences

- Zybio

Human Microbiome Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the human microbiome market, focusing on key market segments, including [A] type of product, [B] type of biologic, [C] route of administration, [D] drug formulation, [E] target indication, [F] target therapeutic area, and [G] geographical regions.

- Human Microbiome Therapeutics - Market Landscape: A detailed overview of the current market landscape of human microbiome therapeutics, along with information on several relevant parameters, such as [A] stage of development, [B] type of molecule, [C] type of biologic, [D] target indication, [E] therapeutic area, [F] route of administration, [G] type of formulation, [H] dosage frequency, [I] type of therapy, [J] year of establishment, [K] company size, [L] location of headquarters, and [M] most active players.

- Human Microbiome Diagnostics And Screening / Profiling Tests - Market Landscape 2: A detailed overview of the current market landscape of various types of diagnostic and screening / profiling tests, along with information on several relevant parameters, such as [A] stage of development, [B] type of sample analyzed, [C] type of screening technique, [D] target indication, [E] therapeutic area, [F] purpose of test, [G] year of establishment, [H] company size, and [I] location of headquarters.

- Human Microbiome Fecal Microbiota Therapies - Market Landscape 3: A detailed overview of the current market landscape of other relevant aspects of FMT therapies, along with information on several relevant parameters, such as [A] stage of development, [B] type of sample analyzed, [C] type of screening technique, [D] target indication, [E] therapeutic area, [F] purpose of test, [G] year of establishment, [H] company size, and [I] location of headquarters.

- Company and Drug Profiles: In-depth profiles of key players engaged in the development of microbiome therapeutics, microbiome diagnostics and screening / profiling tests and fecal microbiota therapy based on [A] year of establishment, [B] location of headquarters, [C] microbiome-based drug portfolio, [D] recent developments and [E] an informed future outlook.

- Clinical Trial Analysis: An in-depth analysis of completed and ongoing clinical studies of fecal microbiota therapy, based on various relevant parameters, such as [A] trial registration year, [B] number of patients enrolled, [C] patient gender, [D] trial phase, [E] trial status, [F] therapeutic area, [G] type of sponsor / collaborator, [H] study design, [I] most active players (in terms of number of clinical trials), and [J] geography.

- Attractiveness Competitiveness Analysis: An insightful business portfolio analysis of top indications, across various therapeutic areas under investigation, based on the 9-box AC matrix framework. It further includes a discussion on the relative market attractiveness and existing competition across the most popular disease indications.

- Partnerships and Collaborations: An in-depth analysis of the partnerships and collaborations that have been inked by human microbiome developers, based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C] target indication, [D] therapeutic area, [E] type of partner and [F] most active players (in terms of number of partnerships).

- Funding and Investments: A detailed analysis of the funding and investments made in this domain, based on several relevant parameters, such as [A] year of funding, [B] type of funding, [C] amount invested, [D] purpose of funding, [E] target indication, [F] therapeutic area, [G] geography, [H] most active players and [I] leading investors.

- Case Study 1: An elaborate discussion on the various steps involved in the development and manufacturing of microbiome therapeutics, along with an indicative list of contract manufacturers, along with details on year of establishment, location of headquarters, company size, scale of operation, type of product manufactured and type of formulation. In addition, the chapter highlights key consideration for selecting a CMO / CRO partner.

- Case Study 2: assessment of the emerging role of big data, highlighting efforts focused on the development and implementation of various algorithms / tools to analyze data generated from microbiome research along with an insightful google trends analysis to demonstrate the rising interest of stakeholders in using big data tools to support microbiome research over the past decade.

Key Questions Answered in this Report

- Which are the leading companies in human microbiome market?

- Which region dominates the human microbiome market?

- What are the key trends observed in the human microbiome market?

- What factors are likely to influence the evolution of this market?

- What are the primary challenges faced by human microbiome providers?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

- The report can aid businesses in identifying future opportunities in any sector. It also helps in understanding if those opportunities are worth pursuing.

- The report helps in identifying customer demand by understanding the needs, preferences, and behavior of the target audience in order to tailor products or services effectively.

- The report equips new entrants with requisite information regarding a particular market to help them build successful business strategies.

- The report allows for more effective communication with the audience and in building strong business relations.

Additional Benefits

- Complementary PPT Insights Pack

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

- 5.1. Executive Summary: Market Landscape

- 5.2. Executive Summary: Market Trends

- 5.3. Executive Summary: Market Forecast and Opportunity Analysis

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Concept of Microbiota and Microbiome

- 6.2.1. Discovery of Human Microbiome

- 6.2.2. Functions of Human Microbiome

- 6.3. Overview of Gut Flora

- 6.3.1. Role of Gut Flora in Human Health

- 6.3.2. Factors Affecting Gut Flora

- 6.3.2.1. Antibiotic Consumption

- 6.3.2.2. Age and Pregnancy

- 6.3.2.2.1. Mode of Childbirth

- 6.3.2.2.2. Type of Feeding

- 6.3.2.2.3. Antibiotic Consumption by Mother

- 6.3.2.3. Stress-related Factors

- 6.3.2.4. Dietary Factors

- 6.3.2.5. Impact of Lifestyle

- 6.4. Microbiome and Associated Diseases

- 6.4.1. Cancer

- 6.4.2. Inflammatory Bowel Disease (IBD)

- 6.4.3. Obesity

- 6.4.4. Parkinson's Disease

- 6.4.5. Type 2 Diabetes

- 6.4.6. Other Disease Indications

- 6.5. Impact of Microbiota on Drug Pharmacokinetics

- 6.6. Impact of Microbiota on Therapeutic Outcomes

- 6.7. Microbiome Therapeutics

- 6.7.1. Probiotics

- 6.7.1.1. Beneficial Bacterial Strains

- 6.7.1.1.1. Lactobacilli

- 6.7.1.1.2. Bifidobacteria

- 6.7.1.1.3. Others

- 6.7.1.2. Key Therapeutic Areas

- 6.7.1.2.1. Antibiotic-Associated Diarrhea (AAD)

- 6.7.1.2.2. Bacterial Vaginosis

- 6.7.1.2.3. High Blood Pressure

- 6.7.1.2.4. Hypercholesterolemia

- 6.7.1.2.5. Infectious Childhood Diarrhea (ICD)

- 6.7.1.2.6. Inflammatory Bowel Disease (IBD)

- 6.7.1.2.7. Lactose Intolerance

- 6.7.1.2.8. Vitamin Production

- 6.7.1.2.9. Weight Management

- 6.7.1.3. Side Effects of Probiotics

- 6.7.1.1. Beneficial Bacterial Strains

- 6.7.2. Prebiotics

- 6.7.2.1. Sources of Prebiotics

- 6.7.2.2. Types of Prebiotics

- 6.7.2.2.1. Fructo-Oligosaccharides (FOS)

- 6.7.2.2.2. Galacto-Oligosaccharides (GOS)

- 6.7.2.2.3. Inulin

- 6.7.2.3. Key Therapeutic Areas

- 6.7.2.3.1. Antibiotic Associated Diarrhea (AAD)

- 6.7.2.3.2. Constipation

- 6.7.2.3.3. Gastrointestinal Diseases

- 6.7.2.3.4. Dysbiosis

- 6.7.2.4. Side Effects of Prebiotics

- 6.7.1. Probiotics

- 6.8. The Human Microbiome Project (HMP)

- 6.8.1. Project Approach

- 6.8.2. Project Initiatives

- 6.8.3. Project Achievements

- 6.9. Regulatory Guidelines for Live Biotherapeutic Products (LBPs)

- 6.10. Key Challenges Associated with the Development of Microbiome Therapeutics

- 6.11. Future Perspectives

7. HUMAN MICROBIOME THERAPEUTICS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Human Microbiome Therapeutics: Overall Market Landscape

- 7.2.1. Analysis by Stage of Development

- 7.2.2. Analysis by Type of Molecule

- 7.2.3. Analysis by Stage of Development and Type of Molecule

- 7.2.4. Analysis by Type of Biologic

- 7.2.5. Analysis by Target Indication

- 7.2.6. Analysis by Therapeutic Area

- 7.2.7. Analysis by Route of Administration

- 7.2.8. Analysis by Type of Formulation

- 7.2.9. Analysis by Dosage Frequency

- 7.2.10. Analysis by Type of Therapy

- 7.3. Human Microbiome Therapeutics: Developer Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Location of Headquarters (Region)

- 7.3.4. Analysis by Location of Headquarters (Country)

- 7.3.5. Most Active Players: Analysis by Number of Microbiome Therapeutics

8. HUMAN MICROBIOME DIAGNOSTICS AND SCREENING / PROFILING TESTS: MARKET LANDSCAPE

- 8.1. Chapter Overview

- 8.2. Overview of Microbiome Diagnostics and Screening / Profiling Tests

- 8.3. Microbiome Diagnostics and Screening / Profiling Tests: Overall Market Landscape

- 8.3.1. Analysis by Stage of Development

- 8.3.2. Analysis by Type of Sample Analyzed

- 8.3.3. Analysis by Type of Screening Technique

- 8.3.4. Analysis by Target Indication

- 8.3.5. Analysis by Therapeutic Area

- 8.3.6. Analysis by Purpose of Test

- 8.4. Microbiome Diagnostic and Screening / Profiling Tests: Provider Landscape

- 8.4.1. Analysis by Year of Establishment

- 8.4.2. Analysis by Company Size

- 8.4.3. Analysis by Location of Headquarters (Region)

- 8.4.4. Analysis by Location of Headquarters (Country)

- 8.4.5. Most Active Players: Analysis by Number of Microbiome Tests

9. HUMAN MICROBIOME FECAL MICROBOTA THERAPIES: MARKET LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Introduction to Fecal Microbiota Therapies (FMT)

- 9.3. Historical Overview

- 9.4. Fecal Microbiota Therapies: Procedure and Clinical Relevance

- 9.4.1. Donor Selection

- 9.4.2. Administration Procedure

- 9.4.3. Routes of Administration

- 9.4.4. Consequences and Adverse Events

- 9.4.5. Clinical Guidelines Associated with FMT

- 9.5. Regulatory Guidelines Related to Fecal Microbiota Therapies

- 9.6. Insurance Coverage for Fecal Microbiota Therapies

- 9.7. Fecal Microbiota Therapies: Overall Market Landscape

- 9.7.1. Marketed / Development Pipeline

- 9.7.1.1. Analysis by Application Area

- 9.7.1.2. Analysis by Status of Development

- 9.7.1.3. Analysis by Target Indication

- 9.7.1.4. Analysis by Therapeutic Area

- 9.7.1.5. Analysis by Route of Administration

- 9.7.2. Fecal Microbiota Therapies: Developer Landscape

- 9.7.2.1. Analysis by Year of Establishment

- 9.7.2.2. Analysis by Company Size

- 9.7.2.3. Analysis by Location of Headquarters (Region)

- 9.7.2.4. Analysis by Location of Headquarters (Country)

- 9.7.1. Marketed / Development Pipeline

10. HUMAN MICROBIOME THERAPEUTICS: COMPANY AND DRUG PROFILES

- 10.1. Chapter Overview

- 10.2. Ferring Pharmaceuticals

- 10.2.1. Company Overview

- 10.2.2. Financial Information

- 10.2.3. Microbiome-Based Product Portfolio

- 10.2.3.1. REBYOTA

- 10.2.3.1.1. Drug Overview

- 10.2.3.1.2. Current Status of Development

- 10.2.3.1.3. Clinical Studies

- 10.2.3.1. REBYOTA

- 10.2.4. Recent Developments and Future Outlook

- 10.3. Infant Bacterial Therapeutics

- 10.4. MaaT Pharma

- 10.5. Mikrobiomik

- 10.6. Seres Therapeutics

- 10.7. OxThera

- 10.8. Vedanta Biosciences

- 10.9. Zhiyi Biotech

11. MICROBIOME DIAGNOSTIC AND SCREENING / PROFILING TEST PROVIDERS: COMPANY PROFILES

- 11.1. Chapter Overview

- 11.2. Becton, Dickinson and Company

- 11.2.1. Company Overview

- 11.2.2. Financial Information

- 11.2.3. Microbiome Diagnostic Test Portfolio

- 11.2.4. Recent Developments and Future Outlook

- 11.3. Biome Diagnostics

- 11.4. GoodGut

- 11.5. NutriPATH

- 11.6. Tiny Health

12. CLINICAL TRIAL ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope and Methodology

- 12.3. Fecal Microbiota Therapies: Clinical Trial Analysis

- 12.3.1. Analysis by Trial Registration Year

- 12.3.2. Analysis of Enrolled Patient Population by Trial Registration Year

- 12.3.3. Analysis by Trial Status

- 12.3.4. Analysis of Enrolled Patient Population by Trial Status

- 12.3.5. Analysis by Trial Registration Year and Trial Status

- 12.3.6. Analysis by Trial Phase

- 12.3.7. Analysis of Enrolled Patient Population by Trial Phase

- 12.3.8. Analysis by Type of Sponsor / Collaborator

- 12.3.9. Analysis by Study Design

- 12.3.10. Analysis by Gender

- 12.3.11. Leading Industry Players: Analysis by Number of Registered Trials

- 12.3.12. Leading Non-industry Players: Analysis by Number of Registered Trials

- 12.3.13. Analysis by Trial Status, Trial Phase and Geography

- 12.3.14. Analysis by Geography

- 12.3.15. Analysis by Trial Status and Geography

- 12.3.16. Analysis of Enrolled Patient Population by Trial Status and Geography

13. ATTRACTIVENESS COMPETITIVENESS (AC) MATRIX

- 13.1. Chapter Overview

- 13.2. AC Matrix: An Overview

- 13.2.1. Strong Business Units

- 13.2.2. Average Business Units

- 13.2.3. Weak Business Units

- 13.3. AC Matrix: Analytical Methodology

- 13.4. AC Matrix: Plotting the Information

- 13.5. AC Matrix: Analyzing the Data

- 13.5.1. Strong Business Units

- 13.5.2. Average Business Units

- 13.5.3. Weak Business Units

- 13.6. Concluding Remarks

14. START-UP HEALTH INDEXING

- 14.1. Chapter Overview

- 14.2. Scope and Methodology

- 14.3. Benchmarking of Start-ups

- 14.3.1. Analysis by Portfolio Strength

- 14.3.2. Analysis by Pipeline Maturity

- 14.3.3. Analysis by Indication Diversity

- 14.3.4. Analysis by Funding Amount

- 14.3.5. Analysis by Partnership Activity

- 14.3.6. Start-up Health Indexing: Roots Analysis Perspective

- 14.3.7. Start-up Health Indexing: Leading Companies

15. CASE STUDY: KEY THERAPEUTIC AREAS

- 15.1. Chapter Overview

- 15.2. Metabolic Disorders

- 15.2.1. Diabetes

- 15.2.1.1. Disease Description

- 15.2.1.2. Associated Health Risks / Complications

- 15.2.1.3. Epidemiology

- 15.2.1.4. Disease Diagnosis

- 15.2.1.5. Current Treatment Options

- 15.2.1.5.1. Insulin Therapies

- 15.2.1.5.2. Non-Insulin Therapies

- 15.2.1.6. Side Effects of Current Treatment Options

- 15.2.1.7. Microbiome Therapeutics for Diabetes

- 15.2.2. Lactose Intolerance

- 15.2.2.1. Disease Description

- 15.2.2.2. Epidemiology

- 15.2.2.3. Current Treatment Options

- 15.2.2.4. Microbiome Therapeutics for Lactose Intolerance

- 15.2.3. Nonalcoholic Steatohepatitis (NASH)

- 15.2.3.1. Disease Description

- 15.2.3.2. Epidemiology

- 15.2.3.3. Current Treatment Options

- 15.2.3.4. Microbiome Therapeutics for NASH

- 15.2.4. Primary Hyperoxaluria

- 15.2.4.1. Disease Description

- 15.2.4.2. Epidemiology

- 15.2.4.3. Current Treatment Options

- 15.2.4.4. Microbiome Therapeutics for Primary Hyperoxaluria

- 15.2.5. Obesity

- 15.2.5.1. Disease Description

- 15.2.5.2. Epidemiology

- 15.2.5.3. Current Treatment Options

- 15.2.5.4. Side Effects of Current Treatment Options

- 15.2.5.5. Microbiome Therapeutics for Obesity

- 15.2.1. Diabetes

- 15.3. Digestive and Gastrointestinal Disorders

- 15.3.1. Crohn's Disease

- 15.3.1.1. Disease Description

- 15.3.1.2. Epidemiology

- 15.3.1.3. Current Treatment Options

- 15.3.1.4. Side Effects of Current Treatment Options

- 15.3.1.5. Microbiome Therapeutics for Crohn's Disease

- 15.3.2. Irritable Bowel Syndrome (IBS)

- 15.3.2.1. Disease Description

- 15.3.2.2. Epidemiology

- 15.3.2.3. Current Treatment Options

- 15.3.2.4. Microbiome Therapeutics for IBS

- 15.3.3. Ulcerative Colitis

- 15.3.3.1. Disease Description

- 15.3.3.2. Epidemiology

- 15.3.3.3. Current Treatment Options

- 15.3.3.4. Side Effects of Current Treatment Options

- 15.3.3.5. Microbiome Therapeutics for Ulcerative Colitis

- 15.3.1. Crohn's Disease

- 15.4. Oncological Indications

- 15.4.1. Colorectal Cancer

- 15.4.1.1. Disease Description

- 15.4.1.2. Epidemiology

- 15.4.1.3. Current Treatment Options

- 15.4.1.4. Side Effects of Current Treatments

- 15.4.1.5. Microbiome Therapeutics for Colorectal Cancer

- 15.4.2. Lung Cancer

- 15.4.2.1. Disease Description

- 15.4.2.2. Epidemiology

- 15.4.2.3. Current Treatment Options

- 15.4.2.4. Side Effects of Current Treatment Options

- 15.4.2.5. Microbiome Therapeutics for Lung Cancer

- 15.4.1. Colorectal Cancer

- 15.5. Dermatological Disorders

- 15.5.1. Acne Vulgaris

- 15.5.1.1. Disease Description

- 15.5.1.2. Epidemiology

- 15.5.1.3. Current Treatment Options

- 15.5.1.4. Side Effects of Current Treatment Options

- 15.5.1.5. Microbiome Therapeutics for Acne Vulgaris

- 15.5.1. Acne Vulgaris

- 15.6. Infectious Diseases

- 15.6.1. Clostridium Difficile Infections (CDIs)

- 15.6.1.1. Disease Description

- 15.6.1.2. Epidemiology

- 15.6.1.3. Disease Diagnosis

- 15.6.1.4. Current Treatment Options

- 15.6.1.5. Side Effects of Current Treatment Options

- 15.6.1.6. Microbiome Therapeutics for CDI

- 15.6.2. Bacterial Vaginosis

- 15.6.2.1. Disease Description

- 15.6.2.2. Epidemiology

- 15.6.2.3. Current Treatment Options

- 15.6.2.4. Side Effects of Current Treatment Options

- 15.6.2.5. Microbiome Therapeutics for Bacterial Vaginosis

- 15.6.1. Clostridium Difficile Infections (CDIs)

16. PARTNERSHIPS AND COLLABORATIONS

- 16.1. Chapter Overview

- 16.2. Partnership Models

- 16.3. Human Microbiome: List of Partnerships and Collaborations

- 16.4. Analysis by Year of Partnership

- 16.5. Analysis by Type of Partnership

- 16.6. Analysis by Year and Type of Partnership

- 16.7. Analysis by Target Indication

- 16.8. Analysis by Therapeutic Area

- 16.9. Analysis by Type of Partnership and Therapeutic Area

- 16.10. Analysis by Type of Partner

- 16.11. Most Active Players: Analysis by Number of Partnerships

- 16.12. Analysis by Geography

- 16.12.1. Local and International Deals

- 16.12.2. Intracontinental and Intercontinental Deals

17. FUNDING AND INVESTMENTS

- 17.1. Chapter Overview

- 17.2. Funding Models

- 17.3. Human Microbiome: List of Funding and Investments

- 17.3.1. Analysis of Funding Instances by Year of Funding

- 17.3.2. Analysis of Amount Invested by Year of Funding

- 17.3.3. Analysis by Type of Funding

- 17.3.4. Analysis by Year and Type of Funding

- 17.3.5. Analysis by Amount Invested and Type of Funding

- 17.3.6. Analysis by Purpose of Funding

- 17.3.7. Analysis by Target Indication

- 17.3.8. Analysis by Therapeutic Area

- 17.3.9. Analysis by Geography

- 17.3.10. Most Active Players: Analysis by Number of Instances

- 17.3.11. Most Active Players: Analysis by Amount Invested

- 17.3.12. Leading Investors: Analysis by Number of Instances

- 17.3.13. Funding and Investment Summary

18. CASE STUDY: CONTRACT SERVICES FOR MICROBIOME THERAPEUTICS AND LIVE BIOTHERAPEUTICS

- 18.1. Chapter Overview

- 18.2. Manufacturing Microbiome Therapeutics

- 18.2.1. Key Steps Involved

- 18.2.2. Associated Challenges

- 18.2.3. Growing Demand for Contract Manufacturing Services

- 18.2.4. Contract Manufacturing Organizations (CMOs)

- 18.2.4.1. Introduction to Contract Manufacturing

- 18.2.5. Microbiome Therapeutics: List of Contract Manufacturing Providers

- 18.2.5.1. Analysis by Year of Establishment

- 18.2.5.2. Analysis by Company Size

- 18.2.5.3. Analysis by Location of Headquarters

- 18.2.5.4. Analysis by Scale of Operation

- 18.2.5.5. Analysis by Type of Product Manufactured

- 18.2.5.6. Analysis by Type of Formulation

- 18.2.5.7. Analysis by Scale of Operation and Type of Formulation

- 18.3. Key Considerations for Selecting a CMO / CRO Partner

19. CASE STUDY: BIG DATA AND MICROBIOME THERAPEUTICS

- 19.1. Chapter Overview

- 19.2. Introduction to Big Data

- 19.3. Internet of Things (IoT)

- 19.4. Growing Interest in Big Data: Google Trends Analysis

- 19.5. Key Application Areas

- 19.6. Big Data in Microbiome Research

- 19.6.1. Microbiome Data and Personalized Medicine

- 19.6.2. Microbiome-related Data Management Challenges

- 19.6.3. National Microbiome Data Center

- 19.7. Big Data Services for Microbiome Research: List of Companies

- 19.8. Big Data Services for Microbiome Research: Profiles of Key Players

- 19.8.1. Human Longevity

- 19.8.1.1. Company Overview

- 19.8.1.2. Technology and Service Portfolio

- 19.8.1.3. Recent Developments and Future Outlook

- 19.8.2. Resilient Biotics

- 19.8.2.1. Company Overview

- 19.8.2.2. Technology and Service Portfolio

- 19.8.2.3. Recent Developments and Future Outlook

- 19.8.3. Resphera Biosciences

- 19.8.3.1. Company Overview

- 19.8.3.2. Technology and Service Portfolio

- 19.8.3.3. Recent Developments and Future Outlook

- 19.8.1. Human Longevity

20. HUMAN MICROBIOME THERAPEUTICS MARKET

- 20.1. Chapter Overview

- 20.2. Assumptions and Methodology

- 20.3. Global Human Microbiome Therapeutics Market: Forecasted Estimates (till 2035)

- 20.4. Human Microbiome Market: Distribution by Type of Product

- 20.4.1. Therapeutics: Forecasted Estimates (till 2035)

- 20.4.2. Diagnostics: Forecasted Estimates (till 2035)

- 20.4.3. Fecal Microbiota Therapies: Forecasted Estimates (till 2035)

- 20.4.4. Scenario Analysis

- 20.4.4.1. Conservative Scenario

- 20.4.4.2. Optimistic Scenario

- 20.5. Key Market Segmentations

21. HUMAN MICROBIOME THERAPEUTICS MARKET, BY TYPE OF BIOLOGIC

- 21.1. Chapter Overview

- 21.2. Assumptions and Methodology

- 21.3. Distribution by Type of Biologic

- 21.3.1. Live Biotherapeutics: Forecasted Estimates (till 2035)

- 21.3.2. Others: Forecasted Estimates (till 2035)

- 21.4. Data Triangulation and Validation

22. HUMAN MICROBIOME THERAPEUTICS MARKET, BY ROUTE OF ADMINISTRATION

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Distribution by Route of Administration

- 22.3.1. Oral Route: Forecasted Estimates (till 2035)

- 22.3.2. Rectal Route: Forecasted Estimates (till 2035)

- 22.4. Data Triangulation and Validation

23. HUMAN MICROBIOME THERAPEUTICS MARKET, BY DRUG FORMULATION

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Distribution by Drug Formulation

- 23.3.1. Capsules: Forecasted Estimates (till 2035)

- 23.3.2. Suspensions: Forecasted Estimates (till 2035)

- 23.3.3. Enemas: Forecasted Estimates (till 2035)

- 23.3.4. Powders: Forecasted Estimates (till 2035)

- 23.4. Data Triangulation and Validation

24. HUMAN MICROBIOME THERAPEUTICS MARKET, BY TARGET INDICATION

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Distribution by Target Indication

- 24.3.1. Clostridium Difficile Infection

- 24.3.2. Necrotizing Enterocolitis

- 24.3.3. Irritable Bowel Syndrome

- 24.3.4. Acute Graft Versus Host Disease

- 24.4. Data Triangulation and Validation

25. HUMAN MICROBIOME THERAPEUTICS MARKET, BY TARGET THERAPEUTIC AREA

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Distribution by Therapeutic Area

- 25.3.1. Infectious Diseases

- 25.3.2. Gastrointestinal Disorders

- 25.3.3. Rare Disorders

- 25.4. Data Triangulation and Validation

26. HUMAN MICROBIOME THERAPEUTICS MARKET, BY GEOGRAPHICAL REGIONS

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Distribution by Geographical Regions

- 26.3.1. North America

- 26.3.2. Europe

- 26.3.3. Asia-Pacific

- 26.3.4. Latin America

- 26.3.5. Middle East and North Africa

- 26.4. Market Dynamics Assessment

- 26.4.1. Penetration Growth (P-G) Matrix

- 26.4.2. Market Movement Analysis

- 26.5. Data Triangulation and Validation

27. HUMAN MICROBIOME DIAGNOSTICS MARKET

- 27.1. Chapter Overview

- 27.2. Assumptions and Methodology

- 27.3. Global Human Microbiome Diagnostics Market: Forecasted Estimates (till 2035)

- 27.3.1. Scenario Analysis

- 27.4. Key Market Segmentations

28. HUMAN MICROBIOME DIAGNOSTICS MARKET, BY TARGET INDICATION

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Market Distribution by Target Indication

- 28.3.1. Diabetes Mellitus: Forecasted Estimates (till 2035)

- 28.3.2. Irritable Bowel Syndrome: Forecasted Estimates (till 2035)

- 28.3.3. Irritable Bowel Disease: Forecasted Estimates (till 2035)

- 28.3.4. Colorectal Cancer: Forecasted Estimates (till 2035)

- 28.4. Data Triangulation and Validation

29. HUMAN MICROBIOME DIAGNOSTICS MARKET, BY TARGET THERAPEUTIC AREA

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Market Distribution by Therapeutic Area

- 29.3.1. Gastrointestinal Disorders: Forecasted Estimates (till 2035)

- 29.3.2. Metabolic Disorders: Forecasted Estimates (till 2035)

- 29.3.3. Oncological Disorders: Forecasted Estimates (till 2035)

- 29.4. Data Triangulation and Validation

30. HUMAN MICROBIOME DIAGNOSTICS MARKET, BY GEOGRAPHICAL REGIONS

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Market Distribution by Geographical Regions

- 30.3.1. North America: Forecasted Estimates (till 2035)

- 30.3.2. Europe: Forecasted Estimates (till 2035)

- 30.3.3. Asia-Pacific: Forecasted Estimates (till 2035)

- 30.3.4. Latin America: Forecasted Estimates (till 2035)

- 30.3.5. Middle East and North Africa: Forecasted Estimates (till 2035)

- 30.4. Data Triangulation and Validation

- 30.5. Market Dynamics Assessment

- 30.5.1. Penetration Growth (P-G) Matrix

- 30.5.2. Market Movement Analysis

- 30.6. Data Triangulation and Validation

31. HUMAN MICROBIOME FECAL MICROBIOTA THERAPIES MARKET

- 31.1. Chapter Overview

- 31.2. Assumptions and Methodology

- 31.3. Global Market: Forecasted Estimates (till 2035)

- 31.3.1. Scenario Analysis

- 31.3.1.1. Conservative Scenario

- 31.3.1.2. Optimistic Scenario

- 31.3.1. Scenario Analysis

- 31.4. Key Market Segmentations

32. HUMAN MICROBIOME FECAL MICROBIOTA THERAPIES MARKET, BY GEOGRAPHIC REGIONS

- 32.1. Chapter Overview

- 32.2. Key Assumptions and Methodology

- 32.3. Distribution by Geographic Regions

- 32.3.1. North America

- 32.3.2. Europe

- 32.3.3. Asia-Pacific

- 32.3.4. Latin America

- 32.3.5. Middle East and North Africa

- 32.4. Data Triangulation and Validation

- 32.5. Market Dynamics Assessment

- 32.5.1. Penetration Growth (P-G) Matrix

- 32.5.2. Market Movement Analysis

- 32.6. Data Triangulation and Validation

33. HUMAN MICROBIOME THERAPEUTICS MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 33.1. Market Distribution by Type of Biologic

- 33.2. Market Distribution by Route of Administration

- 33.3. Market Distribution by Drug Formulation

- 33.4. Market Distribution by Target Indication

- 33.5. Market Distribution by Target Therapeutic Area

34. HUMAN MICROBIOME THERAPEUTICS MARKET OPPORTUNITY ANALYSIS: EUROPE

- 34.1. Market Distribution by Type of Biologic

- 34.2. Market Distribution by Route of Administration

- 34.3. Market Distribution by Drug Formulation

- 34.4. Market Distribution by Target Indication

- 34.5. Market Distribution by Target Therapeutic Area

35. HUMAN MICROBIOME THERAPEUTICS MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 35.1. Market Distribution by Type of Biologic

- 35.2. Market Distribution by Route of Administration

- 35.3. Market Distribution by Drug Formulation

- 35.4. Market Distribution by Target Indication

- 35.5. Market Distribution by Target Therapeutic Area

36. HUMAN MICROBIOME THERAPEUTICS MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 36.1. Market Distribution by Type of Biologic

- 36.2. Market Distribution by Route of Administration

- 36.3. Market Distribution by Drug Formulation

- 36.4. Market Distribution by Target Indication

- 36.5. Market Distribution by Target Therapeutic Area

37. HUMAN MICROBIOME THERAPEUTICS MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 37.1. Market Distribution by Type of Biologic

- 37.2. Market Distribution by Route of Administration

- 37.3. Market Distribution by Drug Formulation

- 37.4. Market Distribution by Target Indication

- 37.5. Market Distribution by Target Therapeutic Area

38. HUMAN MICROBIOME DIAGNOSTICS MARKET OPPORTUNITY ANALYSIS: NORTH AMERICA

- 38.1. Distribution by Target Indication

- 38.2. Distribution by Target Therapeutic Area

39. HUMAN MICROBIOME DIAGNOSTICS MARKET OPPORTUNITY ANALYSIS: EUROPE

- 39.1. Distribution by Target Indication

- 39.2. Distribution by Target Therapeutic Area

40. HUMAN MICROBIOME DIAGNOSTICS MARKET OPPORTUNITY ANALYSIS: ASIA-PACIFIC

- 40.1. Distribution by Target Indication

- 40.2. Distribution by Target Therapeutic Area

41. HUMAN MICROBIOME DIAGNOSTICS MARKET OPPORTUNITY ANALYSIS: LATIN AMERICA

- 41.1. Distribution by Target Indication

- 41.2. Distribution by Target Therapeutic Area

42. HUMAN MICROBIOME DIAGNOSTICS MARKET OPPORTUNITY ANALYSIS: MIDDLE EAST AND NORTH AFRICA

- 42.1. Distribution by Target Indication

- 42.2. Distribution by Target Therapeutic Area

43. CONCLUDING INSIGHTS

44. EXECUTIVE INSIGHTS

- 44.1. Chapter Overview

- 44.2. Company A (Mid-sized Company, UK)

- 44.2.1. Company Snapshot

- 44.2.2. Interview Transcript: Former Senior Manager, Corporate Development

- 44.3. Company B (Small Company, US)

- 44.3.1. Company Snapshot

- 44.3.2. Interview Transcript: Co-founder and Chairman

- 44.4. Company C (Small Company, US)

- 44.4.1. Company Snapshot

- 44.4.2. Interview Transcript: Chief Executive Officer

- 44.5. Company D (Large Company, US)

- 44.5.1. Company Snapshot

- 44.5.2. Interview Transcript: Senior Scientist

- 44.6. Company E (Small Company, Taiwan)

- 44.6.1. Company Snapshot

- 44.6.2. Interview Transcript: President

- 44.7. Company F (Small Company, US)

- 44.7.1. Company Snapshot

- 44.7.2. Interview Transcript: Vice President, Business Development

- 44.8. Company G (Mid-sized Company, Israel)

- 44.8.1. Company Snapshot

- 44.8.2. Interview Transcript: Chief Business Officer

- 44.9. Company H (Small Company, US)

- 44.9.1. Company Snapshot

- 44.9.2. Interview Transcript: Former Vice President, Sales and Business Development

- 44.10. Company I (Small Company, Belgium)

- 44.10.1. Company Snapshot

- 44.10.2. Interview Transcript: Co-founder and Chief Executive Officer

- 44.11. Company J (Small Company, US)

- 44.11.1. Company Snapshot

- 44.11.2. Interview Transcript: Co-founder and Chief Executive Officer

- 44.12. Company K (Small Company, US)

- 44.12.1. Company Snapshot

- 44.12.2. Interview Transcript: Co-founder and Chief Executive Officer

- 44.13. Company L (Mid-sized Company, US)

- 44.13.1. Company Snapshot

- 44.13.2. Interview Transcript: Ex-Co-founder and Vice President of Innovation

- 44.14. Company M (Small Company, US)

- 44.14.1. Company Snapshot

- 44.14.2. Interview Transcript: Vice President & Chief Operating Officer

- 44.15. Company N (Mid-sized Company, US)

- 44.15.1. Company Snapshot

- 44.15.2. Interview Transcript: Former Vice President, Operations

- 44.16. Company O (Small Company, US)

- 44.16.1. Company Snapshot

- 44.16.2. Interview Transcript: Former President and Chief Executive Officer

- 44.17. Company P (Small Company, US)

- 44.17.1. Company Snapshot

- 44.17.2. Interview Transcript: Former Chief Scientific Officer and Vice President, Research

- 44.18. Company Q (Small Company, France)

- 44.18.1. Company Snapshot

- 44.18.2. Interview Transcript: Former Chief Strategy Officer

45. APPENDIX I: TABULATED DATA

46. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Types of Microbiota in the Gastrointestinal Tract

- Table 6.2 Common Instances of Misuse of Antibiotics

- Table 6.3 Impact of Antibiotics on Intestinal Microflora

- Table 6.4 List of Microorganisms Classified as Class I Carcinogens by the IARC

- Table 6.5 Relationship Between Microbiome and Disease Progression

- Table 6.6 Impact of Drug-Microbiome Interactions

- Table 6.7 List of Foods Containing Prebiotics

- Table 7.1 Microbiome Therapeutics: Information on Type of Molecule and Route of Administration

- Table 7.2 Microbiome Therapeutics: Additional Information

- Table 7.3 Microbiome Therapeutics: List of Drug Developers

- Table 8.1 Microbiome Diagnostics and Screening / Profiling Tests: Marketed and Development Pipeline

- Table 8.2 Microbiome Diagnostics and Screening / Profiling Tests: List of Developers

- Table 9.1 Comparison between Various Routes of Administration of FMT

- Table 9.2 FMT: Summary of Clinical Guidelines

- Table 9.3 FMT: Summary of Insurance Coverage Payer

- Table 9.4 FMT: Marketed and Development Pipeline

- Table 9.5 FMT: List of Developers

- Table 10.1 Ferring Pharmaceuticals: Company Overview

- Table 10.2 Ferring Pharmaceuticals: Microbiome-Based Product Portfolio

- Table 10.3 REBYOTA: Current Status of Development

- Table 10.4 REBYOTA: Clinical Studies

- Table 10.5 Ferring Pharmaceuticals: Recent Developments and Future Outlook

- Table 10.6 Infant Bacterial Therapeutics: Company Overview

- Table 10.7 Infant Bacterial Therapeutics: Microbiome-Based Product Portfolio

- Table 10.8 IBP-9414: Current Status of Development

- Table 10.9 IBP-9414: Clinical Studies

- Table 10.10 Infant Bacterial Therapeutics: Recent Developments and Future Outlook

- Table 10.11 MaaT Pharma: Company Overview

- Table 10.12 MaaT Pharma: Microbiome-Based Product Portfolio

- Table 10.13 MaaT013: Current Status of Development

- Table 10.14 MaaT013: Clinical Studies

- Table 10.15 MaaT Pharma: Recent Developments and Future Outlook

- Table 10.16 Mikrobiomik: Company Overview

- Table 10.17 Mikrobiomik: Microbiome-Based Product Portfolio

- Table 10.18 MBK-01: Current Status of Development

- Table 10.19 MBK-01: Clinical Studies

- Table 10.20 Mikrobiomik: Recent Developments and Future Outlook

- Table 10.21 Seres Therapeutics: Company Overview

- Table 10.22 Seres Therapeutics: Microbiome-Based Product Portfolio

- Table 10.23 SER-109 / VOWST: Current Status of Development

- Table 10.24 SER-109 / VOWST: Clinical Studies

- Table 10.25 Seres Therapeutics: Recent Developments and Future Outlook

- Table 10.26 OxThera: Company Overview

- Table 10.27 OxThera: Microbiome-Based Product Portfolio

- Table 10.28 Oxabact: Current Status of Development

- Table 10.29 Oxabact: Clinical Studies

- Table 10.30 OxThera: Recent Developments and Future Outlook

- Table 10.31 Vedanta Biosciences: Company Overview

- Table 10.32 Vedanta Biosciences: Microbiome-Based Product Portfolio

- Table 10.33 VE303: Current Status of Development

- Table 10.34 VE303: Clinical Studies

- Table 10.35 Vedanta Biosciences: Recent Developments and Future Outlook

- Table 10.36 Zhiyi Biotech: Company Overview

- Table 10.37 Zhiyi Biotech: Microbiome-Based Product Portfolio

- Table 10.38 SK08: Current Status of Development

- Table 10.39 SK08: Clinical Studies

- Table 10.40 Zhiyi Biotech: Recent Developments and Future Outlook

- Table 11.1 Becton, Dickinson and Company: Company Overview

- Table 11.2 Becton, Dickinson and Company: Microbiome Test Portfolio

- Table 11.3 Becton, Dickinson and Company: Recent Developments and Future Outlook

- Table 11.4 Biome Diagnostics: Company Overview

- Table 11.5 Biome Diagnostics: Microbiome Test Portfolio

- Table 11.6 Biome Diagnostics: Recent Developments and Future Outlook

- Table 11.7 GoodGut: Company Overview

- Table 11.8 GoodGut: Microbiome Test Portfolio

- Table 11.9 GoodGut: Recent Developments and Future Outlook

- Table 11.10 NutriPATH: Company Overview

- Table 11.11 NutriPATH: Microbiome Test Portfolio

- Table 11.12 NutriPATH: Recent Developments and Future Outlook

- Table 11.13 Tiny Health: Company Overview

- Table 11.14 Tiny Health: Microbiome Test Portfolio

- Table 11.15 Tiny Health: Recent Developments and Future Outlook

- Table 12.1 Fecal Microbiota Transplant: List of Registered Clinical Trials

- Table 15.1 Diabetes: Current Treatment Options

- Table 15.2 Diabetes: Side Effects of Current Treatment Options

- Table 15.3 Microbiome Therapeutics Candidates for Diabetes

- Table 15.4 Microbiome Therapeutics Candidates for Lactose Intolerance

- Table 15.5 Microbiome Therapeutics Candidates for NASH

- Table 15.6 Microbiome Therapeutics Candidates for Primary Hyperoxaluria

- Table 15.7 Obesity: Side Effects of Current Treatment Options

- Table 15.8 Microbiome Therapeutic Candidates for Obesity

- Table 15.9 Crohn's Disease: Current Treatment Options

- Table 15.10 Crohn's Disease: Side Effects of Current Treatment Options

- Table 15.11 Microbiome Therapeutics Candidates for Crohn's Disease

- Table 15.12 IBS: Current Treatment Options

- Table 15.13 Microbiome Therapeutics Candidates for IBS

- Table 15.14 Ulcerative Colitis: Current Treatment Options

- Table 15.15 Ulcerative Colitis: Side Effects of Current Treatment Options

- Table 15.16 Microbiome Therapeutics Candidates for Ulcerative Colitis

- Table 15.17 Colorectal Cancer: Side Effects of Current Treatment Options

- Table 15.18 Microbiome Therapeutics Pipeline for Colorectal Cancer

- Table 15.19 Lung Cancer: Current Treatment Options

- Table 15.20 Lung Cancer: Side Effects of Current Treatment Options

- Table 15.21 Microbiome Therapeutics Candidates for Lung Cancer

- Table 15.22 Acne Vulgaris: Current Treatment Options

- Table 15.23 Acne Vulgaris: Side Effects of Current Treatment Options

- Table 15.24 Microbiome Therapeutics Candidates for Acne Vulgaris

- Table 15.25 CDI: Diagnostic Testing

- Table 15.26 CDI: Severity Scoring System and Treatment Options

- Table 15.27 CDI: Side Effects of Current Treatment Options

- Table 15.28 Microbiome Therapeutics Candidates for CDI

- Table 15.29 Bacterial Vaginosis: Current Treatment Options

- Table 15.30 Bacterial Vaginosis: Side Effects of Current Treatment Options

- Table 15.31 Microbiome Therapeutics Candidates for Bacterial Vaginosis

- Table 16.1 Human Microbiome: List of Partnerships and Collaborations, Since 2022

- Table 17.1 Human Microbiome: Funding and Investments, Information on Funding Type, Year, Amount and Investor, Since 2022

- Table 17.2 Human Microbiome: Funding and Investments, Information on Type of Product, Target Indication and Focus Area, Since 2022

- Table 17.3 Human Microbiome: Funding and Investments, Information on Type of Investor and Location of Headquarters, Since 2022

- Table 18.1 Microbiome Contract Manufacturers: Information on Year of Establishment, Headquarters, Company Size, Accreditation Received and Scale of Operation

- Table 18.2 Microbiome Contract Manufacturers: Information on Type of Product Manufactured

- Table 18.3 Microbiome Contract Manufacturers: Information on Type of Formulation

- Table 18.4 Comparison of Key Factors for the Selection of Contract Service Providers: Harvey Ball Analysis

- Table 19.1 List of Companies Using Big Data for Microbiome Research

- Table 19.2 Human Longevity: Partnerships and Collaborations

- Table 19.3 Human Longevity: Venture Capital Funding

- Table 19.4 Resilient Biotics: Venture Capital Funding

- Table 20.1 List of Companies Engaged in the Development of Microbiome Products for Other Applications

- Table 20.2 Pipeline of Microbiome Based Consumer Products, Medical Foods and Supplements

- Table 44.1 Company A: Company Snapshot

- Table 44.2 Company B: Company Snapshot

- Table 44.3 Company C: Company Snapshot

- Table 44.4 Company D: Company Snapshot

- Table 44.5 Company E: Company Snapshot

- Table 44.6 Company F: Company Snapshot

- Table 44.7 Company G: Company Snapshot

- Table 44.8 Company H: Company Snapshot

- Table 44.9 Company I: Company Snapshot

- Table 44.10 Company J: Company Snapshot

- Table 44.11 Company K: Company Snapshot

- Table 44.12 Company L: Company Snapshot

- Table 44.13 Company M: Company Snapshot

- Table 44.14 Company N: Company Snapshot

- Table 44.15 Company O: Company Snapshot

- Table 44.16 Company P: Company Snapshot

- Table 44.17 Company Q: Company Snapshot

- Table 45.1 Microbiome Therapeutics: Distribution by Stage of Development

- Table 45.2 Microbiome Therapeutics: Distribution by Type of Molecule

- Table 45.3 Microbiome Therapeutics: Distribution by Stage of Development and Type of Molecule

- Table 45.4 Microbiome Therapeutics: Distribution by Type of Biologic

- Table 45.5 Microbiome Therapeutics: Distribution by Target Indication

- Table 45.6 Microbiome Therapeutics: Distribution by Therapeutic Area

- Table 45.7 Microbiome Therapeutics: Distribution by Route of Administration

- Table 45.8 Microbiome Therapeutics: Distribution by Type of Formulation

- Table 45.9 Microbiome Therapeutics: Distribution by Dose Frequency

- Table 45.10 Microbiome Therapeutics: Distribution by Type of Therapy

- Table 45.11 Microbiome Therapeutic Developers: Distribution by Year of Establishment

- Table 45.12 Microbiome Therapeutic Developers: Distribution by Company Size

- Table 45.13 Microbiome Therapeutic Developers: Distribution by Location of Headquarters (Region)

- Table 45.14 Microbiome Therapeutic Developers: Distribution by Location of Headquarters (Country)

- Table 45.15 Microbiome Therapeutic Developers: Distribution by Most Active Players

- Table 45.16 Microbiome Diagnostics and Screening / Profiling Tests: Distribution by Stage of Development

- Table 45.17 Microbiome Diagnostics and Screening / Profiling Tests: Distribution by Type of Sample Analyzed

- Table 45.18 Microbiome Diagnostics and Screening / Profiling Tests: Distribution by Type of Screening Technique

- Table 45.19 Microbiome Diagnostics and Screening / Profiling Tests: Distribution by Target Indication

- Table 45.20 Microbiome Diagnostics and Screening / Profiling Tests: Distribution by Therapeutic Area

- Table 45.21 Microbiome Diagnostics and Screening / Profiling Tests: Distribution by Purpose of Test

- Table 45.22 Microbiome Diagnostic and Screening / Profiling Test Providers: Distribution by Year of Establishment

- Table 45.23 Microbiome Diagnostic and Screening / Profiling Test Providers: Distribution by Company Size

- Table 45.24 Microbiome Diagnostic and Screening / Profiling Test Providers: Distribution by Location of Headquarters (Region)

- Table 45.25 Microbiome Diagnostic and Screening / Profiling Test Providers: Distribution by Location of Headquarters (Country)

- Table 45.26 Microbiome Diagnostic and Screening / Profiling Test Providers: Distribution by Most Active Players

- Table 45.27 Fecal Microbiota Therapies: Distribution by Application Area

- Table 45.28 Fecal Microbiota Therapies: Distribution by Status of Development

- Table 45.29 Fecal Microbiota Therapies: Distribution by Target Indication

- Table 45.30 Fecal Microbiota Therapies: Distribution by Therapeutic Area

- Table 45.31 Fecal Microbiota Therapies: Distribution by Route of Administration

- Table 45.32 Fecal Microbiota Therapy Developers: Distribution by Year of Establishment

- Table 45.33 Fecal Microbiota Therapy Developers: Distribution by Company Size

- Table 45.34 Fecal Microbiota Therapy Developers: Distribution by Location of Headquarters (Region)

- Table 45.35 Fecal Microbiota Therapy Developers: Distribution by Location of

Headquarters (Country)

- Table 45.36 Ferring Pharmaceuticals: Financial Information, Since 2021 (USD Million)

- Table 45.37 Infant Bacterial Therapeutics: Financial Information, Since 2021 (USD Million)

- Table 45.38 MaaT Pharma: Financial Information, Since 2021 (USD Million)

- Table 45.39 Microbiomik: Financial Information, Since 2021 (USD Million)

- Table 45.40 Seres Therapeutics: Financial Information, Since 2021 (USD Million)

- Table 45.41 OxThera: Financial Information, Since 2021 (USD Million)

- Table 45.42 Vedanta Biosciences: Financial Information, Since 2021 (USD Million)

- Table 45.43 Zhiyi Biotech: Financial Information, Since 2021 (USD Million)

- Table 45.44 Becton, Dickinson and Company: Financial Information, Since 2021 (USD Million)

- Table 45.45 Biome Diagnostics: Financial Information, Since 2021 (USD Million)

- Table 45.46 GoodGut: Financial Information, Since 2021 (USD Million)

- Table 45.47 NutriPATH: Financial Information, Since 2021 (USD Million)

- Table 45.48 Tiny Health: Financial Information, Since 2021 (USD Million)

- Table 45.49 Clinical Trial Analysis: Scope and Methodology

- Table 45.50 Clinical Trial Analysis: Distribution by Trial Status

- Table 45.51 Clinical Trial Analysis: Cumulative Distribution by Trial Registration Year, Since 2021

- Table 45.52 Clinical Trial Analysis: Distribution by Trial Registration Year and Enrolled Patient Population, Since 2021

- Table 45.53 Clinical Trial Analysis: Distribution by Trial Registration Year and Trial Recruitment Status

- Table 45.54 Clinical Trial Analysis: Distribution by Trial Phase and Number of Patients Enrolled

- Table 45.55 Clinical Trial Analysis: Distribution by Study Design

- Table 45.56 Leading Industry Players: Distribution by Number of Registered Trials

- Table 45.57 Leading Non-industry Players: Distribution by Number of Registered Trials

- Table 45.58 Clinical Trial Analysis: Analysis by Trial Location

- Table 45.59 Clinical Trial Analysis: Analysis by Trial Status and Geography

- Table 45.60 Start-up Health Indexing: Portfolio Strength

- Table 45.61 Start-up Health Indexing: Pipeline Maturity

- Table 45.62 Start-up Health Indexing: Indication Diversity

- Table 45.63 Start-up Health Indexing: Funding Amount

- Table 45.64 Start-up Health Indexing: Partnership Activity

- Table 45.65 Obese Population: Distribution by Key Regions

- Table 45.66 Partnerships and Collaborations: Distribution of Cumulative Year-wise Trend, Since 2022

- Table 45.67 Partnerships and Collaborations: Distribution of Type of Partnership

- Table 45.68 Partnerships and Collaborations: Distribution of Year and Type of Partnership, Since 2022

- Table 45.69 Partnerships and Collaborations: Distribution of Target Indication

- Table 45.70 Partnerships and Collaborations: Distribution of Therapeutic Area

- Table 45.71 Partnerships and Collaborations: Distribution by Type of Partnership and Therapeutic Area

- Table 45.72 Partnerships and Collaborations: Distribution by Type of Partner

- Table 45.73 Most Active Players: Distribution by Number of Partnerships

- Table 45.74 Partnerships and Collaborations: Local and International Deals