|

市場調查報告書

商品編碼

1766295

人類微生物組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Human Microbiome Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

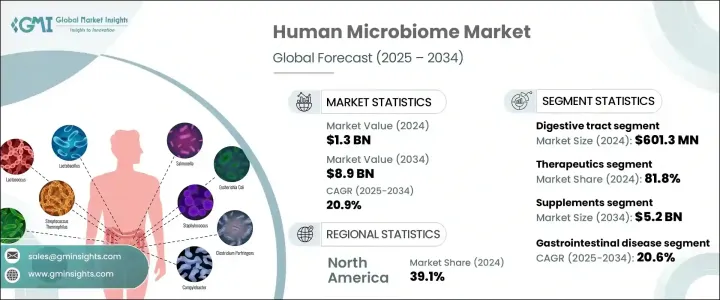

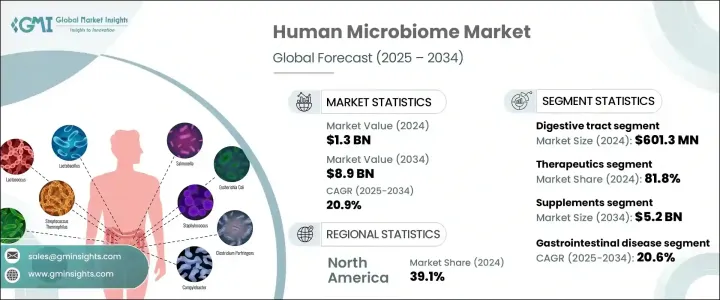

2024年,全球人體微生物組市場規模達13億美元,預計2034年將以20.9%的複合年成長率成長,達到89億美元。市場擴張的動力主要源自於全球日益認知到微生物組在維持人類健康和預防疾病的關鍵作用。人體內的微生物群落現已被公認為各種生物過程的基礎,包括消化、免疫,甚至神經平衡。隨著新的科學突破揭示了這些微生物如何影響整體健康,對基於微生物組的產品的需求正在加速成長。

人們對人類微生物組日益成長的興趣正在改變醫療保健模式。一個關鍵促進因素是精準醫療的興起,精準醫療依賴於根據患者獨特的微生物組特徵量身定做治療方案。這種個人化方法使基於微生物組的診斷和治療更加有效,並推動了其應用範圍的擴大。對標靶治療的需求正推動製藥公司、生物技術公司和研究機構之間的合作,進一步推動創新和商業成長。定序技術和生物資訊學的進步也提高了微生物組繪圖能力,促進了新型治療方案的開發,並使數據驅動的藥物開發和疾病預防方法成為可能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 89億美元 |

| 複合年成長率 | 20.9% |

在研究的各類微生物組應用解剖部位中,消化道佔據了相當大的佔有率,2024 年的市值為 6.013 億美元。由於腸道中微生物的高密度和多樣性,消化道將繼續佔據主導地位。這些腸道微生物在消化功能管理、新陳代謝調節、免疫功能支持和抵抗有害病原體方面發揮重要作用。腸道微生物組與代謝紊亂、自體免疫疾病和神經退化性疾病等慢性健康狀況密切相關,使其成為持續研究和產品開發的重點。人們對腸道健康的廣泛關注,催生了益生菌、益生元、後生元和基於微生物組的療法等針對性解決方案的推出。

在應用方面,市場細分為治療和診斷,其中治療在2024年佔據主導地位,佔據81.8%的市場。這種主導地位歸因於越來越多的健康狀況與微生物組紊亂有關,包括代謝症候群、胃腸道疾病和神經系統疾病。活體生物治療產品、基於微生物組的移植以及微生物組調節藥物等創新正在加強這一領域。隨著越來越多的醫療保健提供者根據個別微生物組特徵採用個人化治療,微生物組產品的治療價值不斷提升,為各種疾病提供量身定做且更有效率的解決方案。

依疾病類型,市場可分為胃腸道疾病、內分泌及代謝性疾病、傳染病、癌症、中樞神經系統疾病等。預計胃腸道疾病領域在預測期內的複合年成長率將達到20.6%。腸道菌群紊亂與腸躁症、潰瘍性結腸炎和克隆氏症等疾病的關聯性日益增強。由於針對微生物組的干涉措施提供了侵入性更低、針對性更強的治療方案,因此對此類干預措施的需求正在成長。患者對恢復菌叢平衡的解決方案的偏好日益成長,預計將顯著促進該領域的擴張。

按產品類型評估,市場包括藥品、補充劑、診斷測試和其他產品。補充劑類別在2024年佔據市場主導地位,預計2034年將達到52億美元。這種主導地位源於人們對預防保健和健康日益成長的興趣,這促使消費者轉向支持腸道和免疫健康的非處方選擇。益生菌和益生元補充劑易於取得且被廣泛接受,這促進了其消費的成長。此外,隨著消費者尋求量身定做的健康解決方案,包括合生元和個人化補充劑混合物在內的定製配方的出現,進一步刺激了這一領域的需求。

從區域來看,北美在2024年佔據39.1%的市場佔有率,佔據市場主導地位。光是美國市場就從2023年的4.002億美元成長到2024年的4.766億美元。高昂的醫療支出、不斷上升的慢性病發病率以及強大的研究基礎設施支撐了這一區域主導地位。監管機構的支持和領先市場參與者的存在進一步加速了其在臨床和商業應用中的普及。

阿徹丹尼爾斯米德蘭公司 (Archer Daniels Midland Company)、輝凌公司 (Ferring) 和 Seres Therapeutics, Inc. 等主要參與者合計佔據全球約 40% 的市場佔有率。這些公司正在積極推行策略聯盟、合併和研究合作等策略,以擴大其業務範圍,進入新市場,並在不斷發展的微生物組格局中增強其競爭地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 生活方式相關疾病負擔加重,老年人口不斷增加

- 增加資助計劃和政府項目

- 精準醫療需求不斷成長

- 產業陷阱與挑戰

- 監理途徑長,開發成本高

- 道德和安全問題

- 市場機會

- 擴大治療應用

- 益生菌和益生元產品的需求不斷成長

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 當前的技術趨勢

- 新興技術

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與協作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按站點,2021 - 2034 年

- 主要趨勢

- 消化道

- 肺

- 生殖腔

- 皮膚

- 其他網站

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 療法

- 診斷

第7章:市場估計與預測:按疾病,2021 - 2034 年

- 主要趨勢

- 傳染病

- 胃腸道疾病

- 內分泌代謝疾病

- 癌症

- 中樞神經系統 (CNS) 疾病

- 其他疾病

第8章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 藥物

- 補充品

- 益生菌

- 益生元

- 合生元

- 診斷測試

- 其他產品

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Archer Daniels Midland Company

- Biohm Technologies

- BioGaia

- Biome Diagnostics

- BiomeBank

- Ferring

- Intralytix

- OptiBiotix

- Pendulum Therapeutics

- Prescient Metabiomics

- Seres Therapeutics

- Seed Health

- The BioArte

- Vedanta Biosciences

- Viome Life Sciences

The Global Human Microbiome Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 20.9% to reach USD 8.9 billion by 2034. Market expansion is largely fueled by the increasing global awareness about the critical role of microbiomes in maintaining human health and preventing disease. Microbial communities in the human body are now recognized as fundamental to various biological processes, including digestion, immunity, and even neurological balance. With new scientific breakthroughs uncovering how these microbes influence overall health, demand for microbiome-based products is accelerating.

Growing interest in the human microbiome is transforming the healthcare landscape. A key driver is the rising shift toward precision medicine, which relies on tailoring treatments to a patient's unique microbial profile. This personalization approach is making microbiome-based diagnostics and therapeutics more effective, driving increased adoption. The demand for targeted therapies is encouraging collaborations between pharmaceutical firms, biotech companies, and research institutes, further fueling innovation and commercial growth. Advancements in sequencing technologies and bioinformatics are also improving microbiome mapping capabilities, encouraging the development of novel treatment solutions, and enabling a data-driven approach to drug development and disease prevention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 20.9% |

Among the various anatomical sites studied for microbiome applications, the digestive tract segment held a substantial share, with a market value of USD 601.3 million in 2024. This segment continues to dominate due to the high density and diversity of microbes found in the gut. These gut microorganisms are instrumental in managing digestion, regulating metabolism, supporting immune function, and defending against harmful pathogens. The gut microbiome's involvement in chronic health conditions such as metabolic disorders, autoimmune diseases, and neurodegenerative issues has positioned it as a central focus for ongoing research and product development. The widespread interest in gut health has led to the launch of targeted solutions like probiotics, prebiotics, postbiotics, and microbiome-based therapeutics.

In terms of application, the market is segmented into therapeutics and diagnostics, with therapeutics taking the lead in 2024 by capturing an 81.8% share. This dominance is attributed to the increasing number of health conditions now linked to disruptions in the microbiome, including metabolic syndromes, gastrointestinal diseases, and neurological disorders. Innovations such as live biotherapeutic products, microbiota-based transplants, and microbiome-modulating drugs are strengthening this segment. As more healthcare providers adopt personalized treatments based on individual microbiome profiles, the therapeutic value of microbiome products continues to expand, offering tailored and more efficient solutions across various diseases.

By disease type, the market is categorized into gastrointestinal disease, endocrine and metabolic diseases, infectious disease, cancer, central nervous system disorder, and others. The gastrointestinal disease segment is projected to grow at a CAGR of 20.6% over the forecast period. Disruptions in the gut microbiota are increasingly associated with conditions like irritable bowel syndrome, ulcerative colitis, and Crohn's disease. The demand for microbiome-targeted interventions is rising as these therapies offer less invasive and more focused treatment alternatives. Growing patient preference for solutions that restore microbiota balance is expected to significantly contribute to the expansion of this segment.

When evaluated by product type, the market includes drugs, supplements, diagnostic tests, and other offerings. The supplements category led the market in 2024 and is forecasted to reach USD 5.2 billion by 2034. This dominance stems from rising interest in preventive care and wellness, which is pushing consumers toward non-prescription options that support gut and immune health. Probiotic and prebiotic supplements are readily available and widely accepted, contributing to their growing consumption. Additionally, the emergence of customized formulations, including synbiotics and personalized supplement blends, is further boosting demand in this segment as consumers seek tailored health solutions.

Regionally, North America led the market with a commanding share of 39.1% in 2024. The U.S. market alone grew from USD 400.2 million in 2023 to USD 476.6 million in 2024. This regional dominance is supported by high healthcare spending, rising incidences of chronic illnesses, and strong research infrastructure. Regulatory backing and the presence of leading market players have further accelerated adoption across clinical and commercial applications.

Key participants such as Archer Daniels Midland Company, Ferring, and Seres Therapeutics, Inc. collectively account for around 40% of the global market share. These companies are actively pursuing strategies such as strategic alliances, mergers, and research collaborations to expand their footprint, gain access to new markets, and enhance their competitive positioning in the evolving microbiome landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Site

- 2.2.3 Application

- 2.2.4 Disease

- 2.2.5 Product

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing burden of lifestyle-related diseases and the growing geriatric population

- 3.2.1.2 Increasing funding initiatives and government programs

- 3.2.1.3 Increasing demand for precision medicine

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Long regulatory pathways and high development costs

- 3.2.2.2 Ethical and safety concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding therapeutic applications

- 3.2.3.2 Growing demand for probiotic and prebiotic products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Site, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Digestive tract

- 5.3 Lung

- 5.4 Reproductive cavity

- 5.5 Skin

- 5.6 Other sites

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Therapeutics

- 6.3 Diagnostics

Chapter 7 Market Estimates and Forecast, By Disease, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Infectious diseases

- 7.3 Gastrointestinal diseases

- 7.4 Endocrine and metabolic diseases

- 7.5 Cancer

- 7.6 Central nervous system (CNS) disorder

- 7.7 Other diseases

Chapter 8 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Drugs

- 8.3 Supplements

- 8.3.1 Probiotics

- 8.3.2 Prebiotics

- 8.3.3 Synbiotics

- 8.4 Diagnostic tests

- 8.5 Other products

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Archer Daniels Midland Company

- 10.2 Biohm Technologies

- 10.3 BioGaia

- 10.4 Biome Diagnostics

- 10.5 BiomeBank

- 10.6 Ferring

- 10.7 Intralytix

- 10.8 OptiBiotix

- 10.9 Pendulum Therapeutics

- 10.10 Prescient Metabiomics

- 10.11 Seres Therapeutics

- 10.12 Seed Health

- 10.13 The BioArte

- 10.14 Vedanta Biosciences

- 10.15 Viome Life Sciences