|

市場調查報告書

商品編碼

1911825

印尼數位廣告市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Digital Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

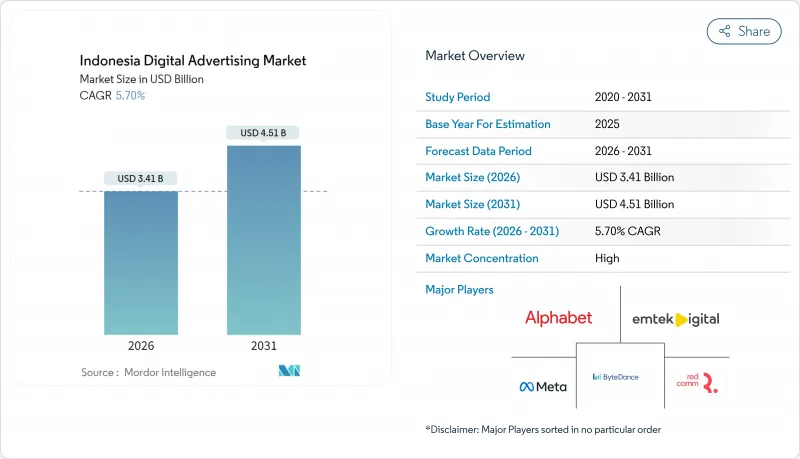

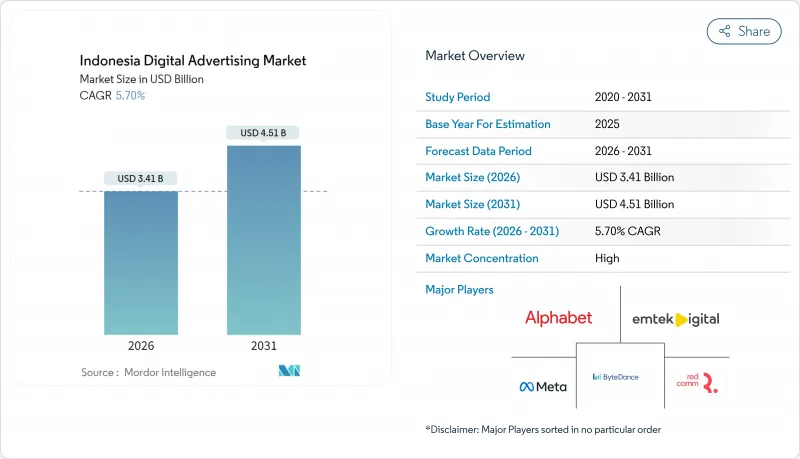

預計印尼數位廣告市場將從 2025 年的 32.3 億美元成長到 2026 年的 34.1 億美元,到 2031 年將達到 45.1 億美元,2026 年至 2031 年的複合年成長率為 5.70%。

寬頻智慧型手機的日益普及、與社群電商的融合以及影片為中心的消費模式,持續重塑著媒體預算格局;與此同時,隨著品牌對可衡量結果的需求日益成長,效果驅動型模式也愈發強勁。超級應用程式之間活性化的整合談判、政府主導的人工智慧投資以實現創新的大規模在地化,以及日益嚴格的資料隱私法規,都在共同重塑平台經濟和競爭策略。此外,聯網電視的擴展和直播電商的貨幣化正在釋放新的廣告資源,並推動全通路策略的發展,從而實現跨裝置的品牌認知與轉換。同時,品牌安全標準的加強和情境檢驗工具的普及,在不影響品牌觸達率的前提下,有效維護了品牌聲譽。

印尼數位廣告市場趨勢與洞察

智慧型手機的普及和行動網際網路的快速發展

印尼向行動優先策略的轉型正在加速廣告預算的轉移。智慧型手機普及率預計將從2025年的86%上升到2028年的91.3%。目前,用戶每日應用程式使用時間超過5小時,4G網路覆蓋了96.48%的人口密集區域,即使在城市邊緣地區也能實現可靠的程式化廣告觸達。以Telkomsel、Indosat和XL Axiata為主要通訊業者的集中式網路提供了大規模的廣告資源和確定性的受眾數據。 Telkomsel的TADEX平台也整合了來自數千家發布商的優質廣告曝光率。預計到2024年,行動流量將年增17.99%,因此,在可預見的未來,印尼的數位廣告市場必將繼續依賴行動螢幕。

預算從傳統媒體轉向數位媒體

面對線性電視收視率的下滑和分散式戶外廣告成效的日益減弱,行銷人員正逐步提高網路廣告在其總支出中的佔比。在投資報酬率的顯著提升以及傳統媒體無法實現的精準定位的推動下,印尼全國性廣告商計劃在2023年至2025年間將7個百分點的預算從傳統媒體轉向數位媒體。這項轉變主要由總部位於雅加達的跨國公司主導,但區域性品牌也正透過效果行銷培訓迅速採納最佳實踐。因此,印尼的數位廣告市場正受益於多種形式的嘗試,動態創新最佳化和系列故事行銷宣傳活動正在取代靜態的大眾廣告。

廣告詐欺和品牌安全問題

今年大選期間,假訊息氾濫,大多數消費者認為假新聞是一個嚴重的問題。為了應對這個問題,品牌方選擇與能夠對頁面層級內容進行分類的檢驗合作夥伴合作,而不是採用關鍵字屏蔽等更廣泛的方法。對廣告曝光率量級透明度的需求日益成長,而發布商品質的差異以及直播的複雜性推高了監控成本。在檢驗標準成熟之前,印尼部分數位廣告市場可能會面臨供應方定價壓力。

細分市場分析

到2025年,影片廣告將佔印尼數位廣告支出的34.02%,佔印尼數位廣告市場最大佔有率,每月OTT觀看時間將超過35億小時。高完成率和改進的衡量工具吸引了來自快速消費品、汽車和通訊業的預算,而六秒貼片廣告即使在頻寬有限的頻寬連線下也能保障用戶體驗。同時,社群媒體預計將以6.11%的複合年成長率實現最快成長,這主要得益於TikTok 1.576億的用戶基數以及其與Tokopedia整合後打造的便捷購物結帳流程。儘管社群電商監管日益嚴格,但可見的品牌內容和第一方數據的可獲取性支撐了其穩定的業績表現和持續的市場佔有率成長。

展示廣告和橫幅廣告格式正在向響應式設計演進,以最佳化垂直影片串流,而搜尋廣告對於高意圖轉換仍然至關重要,尤其是在旅遊和金融服務行業。音訊廣告提供了一個品牌安全的敘事環境,其播客每週覆蓋率高達 42.6%。原生廣告和電子郵件行銷流程則有助於提升廣告曝光率。隨著廣告商不斷豐富創新以適應消費者行為的細微變化,這些協同效應正在推動印尼數位廣告市場的擴張。

這顯示智慧型手機正在推動印尼數位廣告市場佔有率的成長。到2025年,行動裝置廣告支出將佔印尼廣告總支出的68.10%,SIM卡普及率將超過人口總數,67%的電商支付將透過行動裝置完成。輕量級SDK能夠壓縮低頻寬環境下的創新,在不增加延遲的情況下擴大廣告覆蓋範圍。同時,聯網電視廣告支出預計將以6.72%的複合年成長率成長,將客廳螢幕轉化為可導向廣告位。隨著訂閱影片服務用戶數量超過付費電視用戶,動態廣告插入和家庭級頻次限制成為可能,這對於傳統上依賴樣本組研究的品牌提升研究而言是一項重大進步。

持續的桌面端宣傳活動將繼續用於B2B意向收集和深入研究,而平板電腦將提升教育和兒童內容的廣告曝光率。泗水和棉蘭的下一代5G網路部署將進一步減少緩衝,並支援結合QR碼和影像的互動式購物廣告。光纖到府覆蓋率已達該地區97.86%,確保尖峰時段的網路品質穩定。隨著印尼數位廣告市場的日趨成熟,這些基礎設施的提升將為全設備廣告計畫提供支援。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧型手機的普及和行動網際網路的快速發展

- 預算從傳統媒體轉向數位媒體

- 電子商務和社交電商的快速成長

- OTT/短影片消費的快速成長

- 政府「印尼4.0」中小企業數位化促進措施

- 利用叫車和銷售點數據實現人工智慧驅動的超當地語系化定向

- 市場限制

- 廣告詐欺和品牌安全問題

- 碎片化的測量和歸因

- 《個人資料保護法》(PDP) 合規負擔

- 區域城市寬頻環境的異質性

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 廣告格式

- 展示廣告/橫幅廣告

- 影片

- 社群媒體

- 搜尋

- 音訊/播客

- 原生廣告

- 電子郵件

- 透過裝置

- 行動裝置

- 桌上型電腦/筆記型電腦

- 聯網電視

- 平板電腦及其他

- 按行業

- 快速消費品(日用消費品)

- 溝通

- 醫療和藥品

- 媒體與娛樂

- 金融服務

- 旅遊

- 電子商務與市場

- 其他行業部門

- 按購買模式

- 每次點擊費用 (CPC)

- 廣告曝光率成本 (CPM)

- 每次獲客成本 (CPA)

- 每次觀看成本(CPV)

- 混合/其他購買模式

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- PT Google Indonesia(Alphabet Inc.)

- Meta Platforms Inc.

- ByteDance Ltd.(TikTok Indonesia)

- PT GoTo Gojek Tokopedia Tbk(GoTo Ads)

- PT Shopee Internasional Indonesia(Sea Ltd.)

- PT Telekomunikasi Indonesia Tbk(IndiHome Ads)

- PT Bukalapak.com Tbk

- PT Traveloka Digital Indonesia

- Dentsu Group Inc.(PT Dentsu Indonesia)

- WPP plc(GroupM Indonesia)

- Omnicom Group Inc.(OMD/PHD Indonesia)

- Publicis Groupe SA(Publicis Indonesia)

- Havas Group SA(Havas Indonesia)

- PT Emtek Digital

- PT ADA Asia(ADA Indonesia)

- PT RedComm Indonesia

- PT HeartMedia Digital(IDN Media)

- PT Verizon Media Indonesia(Yahoo Ads)

- PT InMobi Indonesia

- PT Revindo Jakarta(Reevo)

- PT Kantar Indonesia

- PT Comscore Indonesia

- PT MOLOCO Indonesia

- PT Samsung Ads Indonesia

第7章 市場機會與未來展望

The Indonesia digital advertising market is expected to grow from USD 3.23 billion in 2025 to USD 3.41 billion in 2026 and is forecast to reach USD 4.51 billion by 2031 at 5.70% CAGR over 2026-2031.

Rising broadband smartphone adoption, social-commerce integration, and video-first consumption patterns continue to redefine media budgets, while performance-oriented models gain traction as brands demand measurable outcomes. Intensifying consolidation talks among super-apps, sovereign AI investments that localize creative at scale, and stricter data-privacy enforcement collectively reshape platform economics and competitive tactics. Meanwhile, connected-TV expansion and live-commerce monetization unlock fresh inventory, encouraging omnichannel strategies that link awareness to conversion across devices. In parallel, higher brand-safety standards and contextual verification tools protect reputation without eroding reach.

Indonesia Digital Advertising Market Trends and Insights

Smartphone penetration and mobile internet boom

Indonesia's mobile-first transition accelerates advertising-budget shifts as smartphone ownership is forecast to climb from 86% in 2025 to 91.3% by 2028. Daily app usage now exceeds 5 hours, and 4G coverage blankets 96.48% of populated areas, enabling reliable programmatic reach even in peri-urban zones. Operator concentration around Telkomsel, Indosat, and XL Axiata provides scaled inventory and deterministic audience data, while Telkomsel's TADEX platform packages premium impressions across thousands of publishers. Rising mobile traffic, up 17.99% YoY in 2024, ensures that the Indonesia digital advertising market remains anchored to handheld screens for the foreseeable future.

Budget shift from traditional to digital media

Marketers allocate progressively larger shares of total spend online as linear-TV ratings wane and OOH fragmentation dilutes impact. National advertisers moved 7 percentage-points of budget from analog to digital between 2023-2025, spurred by compelling ROI evidence and granular targeting unavailable on legacy channels. The shift is led by Jakarta-based multinationals, yet regional brands quickly replicate best practices through performance-marketing workshops. The Indonesia digital advertising market consequently benefits from multi-format experimentation, with dynamic creative optimization and sequential-storytelling campaigns replacing static mass-reach placements.

Ad-fraud and brand-safety concerns

Election-year misinformation surged, with most of consumers perceiving fake news as severe. Brands thus tighten controls, opting for verification partners that classify content at page level rather than blunt keyword blocks. Demand for impression-level transparency grows, yet fragmented publisher quality and livestream complexity raise monitoring costs. Until verification standards mature, pockets of the Indonesia digital advertising market may face supply-side pricing pressure.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce and social-commerce surge

- OTT / short-form video consumption spike

- Personal-Data Protection Law compliance burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Video ads represented 34.02% of spend in 2025, capturing the largest slice of the Indonesia digital advertising market size as OTT viewership soared beyond 3.5 billion monthly hours. High completion rates and improved measurement tools attracted FMCG, automotive, and telco budgets, while six-second bumper ads safeguarded user experience on constrained bandwidth connections. Social media, however, is poised for the quickest ascent at a 6.11% CAGR, buoyed by TikTok's 157.6 million users and frictionless commerce checkout journeys forged after its Tokopedia merger. Even with stricter social-commerce rules, branded-content labeling and first-party data access underpin performance consistency, ensuring continued share gains.

Display and banner formats evolve with responsive designs optimized for vertical video feeds, whereas search remains indispensable for high-intent conversions, especially within travel and financial-services categories. Audio ads benefit from a weekly podcast reach of 42.6%, providing brand-safe storytelling environments. Native integrations and email nurture flows add complementary frequency touches. Collectively, these dynamics keep the Indonesia digital advertising market expanding as advertisers diversify creative to match nuanced consumer moments.

Mobile handsets absorbed 68.10% of expenditure in 2025, underlining the Indonesia digital advertising market share leadership of smartphones in a country where SIM penetration exceeds population and 67% of e-commerce checkouts occur on handhelds. Lightweight SDKs that compress creatives for low-bandwidth regions drive incremental reach without compromising latency. Simultaneously, connected-TV spending is forecast to grow at 6.72% CAGR, turning living-room screens into addressable inventory. Subscription-video households surpass pay-TV, enabling dynamic ad insertion and household-level frequency capping, a boon for brand-lift studies that previously relied on panel-based measurement.

Desktop campaigns persist for B2B intent harvesting and long-form research journeys, while tablets furnish incremental impressions across education and children's content. Next-generation 5G rollouts across Surabaya and Medan further reduce buffering, allowing interactive shoppable ads that merge QR codes with broadcast visuals. Fiber-to-home coverage reaching 97.86% of districts cushions peak-time quality. These infrastructure upgrades reinforce omni-device planning as the Indonesia digital advertising market matures.

The Indonesia Digital Advertising Market Report is Segmented by Advertising Format (Display/Banner, Video, and More), Device (Mobile Handset, Desktop/Laptop, and More), Industry Vertical (FMCG, Telecom, Healthcare and Pharma, and More), Buying Model (Cost-Per-Click, Cost-Per-Mille, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- PT Google Indonesia (Alphabet Inc.)

- Meta Platforms Inc.

- ByteDance Ltd. (TikTok Indonesia)

- PT GoTo Gojek Tokopedia Tbk (GoTo Ads)

- PT Shopee Internasional Indonesia (Sea Ltd.)

- PT Telekomunikasi Indonesia Tbk (IndiHome Ads)

- PT Bukalapak.com Tbk

- PT Traveloka Digital Indonesia

- Dentsu Group Inc. (PT Dentsu Indonesia)

- WPP plc (GroupM Indonesia)

- Omnicom Group Inc. (OMD/PHD Indonesia)

- Publicis Groupe SA (Publicis Indonesia)

- Havas Group SA (Havas Indonesia)

- PT Emtek Digital

- PT ADA Asia (ADA Indonesia)

- PT RedComm Indonesia

- PT HeartMedia Digital (IDN Media)

- PT Verizon Media Indonesia (Yahoo Ads)

- PT InMobi Indonesia

- PT Revindo Jakarta (Reevo)

- PT Kantar Indonesia

- PT Comscore Indonesia

- PT MOLOCO Indonesia

- PT Samsung Ads Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smartphone penetration and mobile internet boom

- 4.2.2 Budget shift from traditional to digital media

- 4.2.3 E-commerce and social-commerce surge

- 4.2.4 OTT / short-form video consumption spike

- 4.2.5 Govt "Making Indonesia 4.0" SME digitization incentives

- 4.2.6 AI-driven hyper-local targeting via ride-hailing and POS data

- 4.3 Market Restraints

- 4.3.1 Ad-fraud and brand-safety concerns

- 4.3.2 Measurement and attribution fragmentation

- 4.3.3 Personal-Data Protection Law (PDP) compliance burden

- 4.3.4 Uneven broadband outside tier-1 cities

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Advertising Format

- 5.1.1 Display/Banner

- 5.1.2 Video

- 5.1.3 Social Media

- 5.1.4 Search

- 5.1.5 Audio/Podcast

- 5.1.6 Native

- 5.1.7 Email

- 5.2 By Device

- 5.2.1 Mobile Handset

- 5.2.2 Desktop / Laptop

- 5.2.3 Connected TV

- 5.2.4 Tablet and Others

- 5.3 By Industry Vertical

- 5.3.1 FMCG

- 5.3.2 Telecom

- 5.3.3 Healthcare and Pharma

- 5.3.4 Media and Entertainment

- 5.3.5 Financial Services

- 5.3.6 Travel and Tourism

- 5.3.7 E-commerce and Marketplaces

- 5.3.8 Others Industry Verticals

- 5.4 By Buying Model

- 5.4.1 Cost-Per-Click (CPC)

- 5.4.2 Cost-Per-Mille (CPM)

- 5.4.3 Cost-Per-Acquisition (CPA)

- 5.4.4 Cost-Per-View (CPV)

- 5.4.5 Hybrid / Other Buying Models

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PT Google Indonesia (Alphabet Inc.)

- 6.4.2 Meta Platforms Inc.

- 6.4.3 ByteDance Ltd. (TikTok Indonesia)

- 6.4.4 PT GoTo Gojek Tokopedia Tbk (GoTo Ads)

- 6.4.5 PT Shopee Internasional Indonesia (Sea Ltd.)

- 6.4.6 PT Telekomunikasi Indonesia Tbk (IndiHome Ads)

- 6.4.7 PT Bukalapak.com Tbk

- 6.4.8 PT Traveloka Digital Indonesia

- 6.4.9 Dentsu Group Inc. (PT Dentsu Indonesia)

- 6.4.10 WPP plc (GroupM Indonesia)

- 6.4.11 Omnicom Group Inc. (OMD/PHD Indonesia)

- 6.4.12 Publicis Groupe SA (Publicis Indonesia)

- 6.4.13 Havas Group SA (Havas Indonesia)

- 6.4.14 PT Emtek Digital

- 6.4.15 PT ADA Asia (ADA Indonesia)

- 6.4.16 PT RedComm Indonesia

- 6.4.17 PT HeartMedia Digital (IDN Media)

- 6.4.18 PT Verizon Media Indonesia (Yahoo Ads)

- 6.4.19 PT InMobi Indonesia

- 6.4.20 PT Revindo Jakarta (Reevo)

- 6.4.21 PT Kantar Indonesia

- 6.4.22 PT Comscore Indonesia

- 6.4.23 PT MOLOCO Indonesia

- 6.4.24 PT Samsung Ads Indonesia

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment