|

市場調查報告書

商品編碼

1911820

馬來西亞建築化學品市場-佔有率分析、產業趨勢與統計、成長預測(2026-2031)Malaysia Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

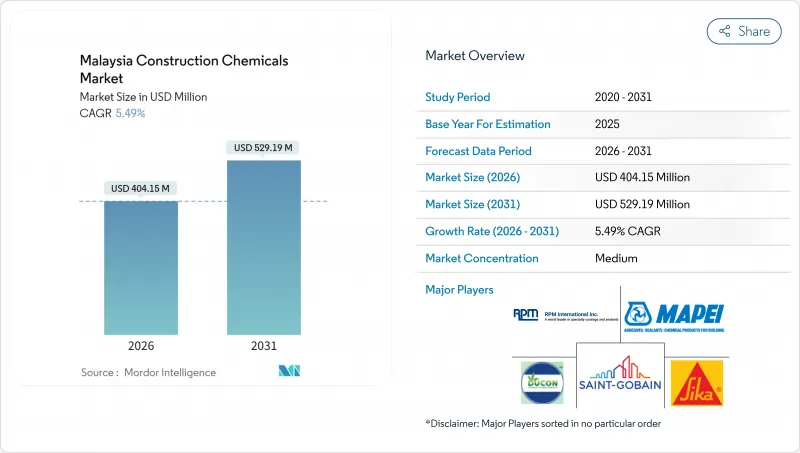

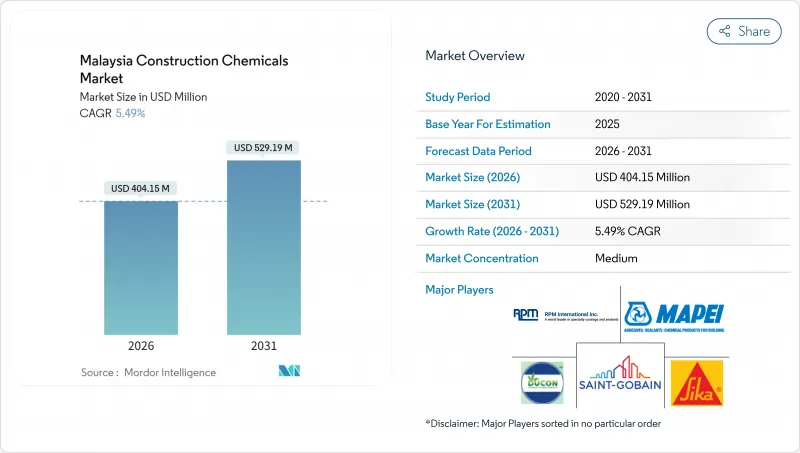

預計馬來西亞建築化學品市場將從 2025 年的 3.8312 億美元成長到 2026 年的 4.0415 億美元,到 2031 年將達到 5.2919 億美元,2026 年至 2031 年的複合年成長率為 5.49%。

持續的基礎設施投資勢頭,包括2024年1月至11月期間授予的1837億元人民幣計劃,正支撐著市場銷量的穩步成長,因為開發商指定使用高性能外加劑、防水卷材和防護塗料。諸如2025年1月簽署的柔佛-新加坡經濟特區等大型企劃,預計將加速對適用於海洋和高濕度環境的耐用化學品的需求。馬來西亞建築化學品市場也受惠於政府強制要求公共工程中90%採用BIM(建築資訊模型)的政策,這有利於能夠與自動化施工流程無縫整合的精密工程產品。同時,綠建築認證的推進也推動了低VOC(揮發性有機化合物)和可回收配方的應用,使製造商能夠在抓住永續性機會的同時,獲得更高的溢價。

馬來西亞建築化學品市場趨勢與洞察

加速永續的公共和私人基礎設施投資

馬來西亞強勁的基礎設施發展計畫(2024年合約總額:人民幣1837億元)推動了橋樑、隧道和城市軌道交通系統專用防水卷材、聚合物改性水泥漿和防腐蝕塗料的需求成長。光是柔佛-新加坡經濟特區就計劃在五年內完成50個跨境計劃,這將帶動對耐鹹水環境的海洋密封劑和碳酸鹽阻隔劑的需求。包括特斯拉和英特爾等製造巨頭公私合營,進一步提高了性能標準,並促進了靜電耗散型地板樹脂和耐化學腐蝕牆面塗料規範的發展。道路、港口和數位化管道的改善吸引了更多配套商業計劃,從而在馬來西亞建築化學品市場中形成良性循環,促進產品需求成長。

低收入住宅政策推動了住宅化學品消耗

國家住宅計畫加速推進補貼住宅,規範了預拌混凝土和預製牆板的使用,擴大了外加劑的使用範圍,並提高了品質標準。低收入住宅開發商自願採用綠色建築標準,推動了對水性丙烯酸密封劑和低VOC瓷磚黏合劑的需求,這些產品符合綠色建築指數設定的碳減排目標。該計劃擴展到怡保和古晉等區域城市,擴大了分銷網路,促使供應商採用小包裝並配備行動技術服務團隊。對成本敏感的計劃正在採用耐用且價格具有競爭力的化學品,而本地製造商正在擴大自動化生產線規模,以確保批次品質的穩定性。

原物料價格波動限制了市場擴張。

進口聚合物、特殊溶劑和高性能添加劑佔高階配方原料成本的60%之多,使得製造商極易受到外匯波動和油價飆升的影響。儘管馬來西亞國家石油公司(Petronas)已簽訂了到2026年的遠期供應協議,但規模較小的企業通常以現貨方式採購,這在原料成本上漲時會為其息EBITDA獲利率)帶來壓力。位於邊佳蘭(Pengerang)的價值35億美元的石化綜合體自2025年中期開始建設,將進一步整合本地供應,但預計要到2028年才能達到設計產能。在此之前,市場波動可能會加速產業整合,因為資金短缺的企業會將市場佔有率拱手讓給一體化跨國公司。

細分市場分析

到2025年,防水解決方案將佔據馬來西亞建築化學品市場48.42%的佔有率,這主要得益於吉隆坡和新山高層建築計劃對屋頂和裙樓平台防水的強制性規範。雖然瀝青改質防水卷材在銷售方面仍保持領先地位,但聚合物-水泥混合產品因其在地下工程中快速固化的特性而日益受到青睞。隨著交通導向開發項目、港口、資料中心和需要在潮濕環境中長期使用的地下設施的建設,馬來西亞防水領域建築化學品市場的規模預計將持續擴大。

預計到2031年,表面處理化學品將以6.78%的複合年成長率實現最高成長,這主要得益於先進的固化劑和專為預製外牆板最佳化的脫模乳液的推動。防塗鴉密封劑和疏水性矽烷凝膠預計將受到市政基礎設施項目的青睞,這些項目旨在降低維護成本。創新正朝著奈米工程顆粒的方向發展,這些顆粒能夠在不增加VOC含量的情況下提高耐磨性,同時滿足綠建築認證標準。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 基礎建設計劃中永續的公私合作投資

- 透過推廣低成本住宅來增加住宅開工量

- 綠建築認證推動對低揮發性有機化合物、耐用化學品的需求

- 預拌混凝土快速攤舖及預製外加劑滲透性提高

- 透過經濟特區(SEZ)的稅收優惠實現特種化學品生產的本地化

- 市場限制

- 原料價格波動會對生產商的利潤率帶來壓力。

- 遵守環境、健康和安全 (EHS) 法規(禁止使用揮發性有機化合物 (VOC) 和有害溶劑)的成本不斷上升

- 能夠操作先進化學技術的熟練工人短缺

- 價值鏈分析

- 監管環境

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 黏合劑

- 熱熔膠

- 反應性

- 溶劑型

- 水溶液

- 錨栓和水泥漿

- 水泥基固定劑

- 樹脂固定

- 混凝土外加劑

- 加速器

- 空氣引射器

- 高效減水劑

- 緩速器

- 收縮抑制劑

- 黏度調節劑

- 塑化劑

- 其他

- 混凝土保護塗層

- 丙烯酸纖維

- 醇酸樹脂

- 環氧樹脂

- 聚氨酯

- 其他

- 地板樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚天門冬胺酸

- 聚氨酯

- 其他

- 修復和修復化學產品

- 纖維纏繞系統

- 壓漿

- 微型混凝土砂漿

- 改質砂漿

- 鋼筋保護材料

- 密封劑

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽

- 其他

- 表面處理化學品

- 固化劑

- 釋放劑

- 其他

- 防水解決方案

- 化學品

- 防水膜

- 黏合劑

- 透過使用

- 商業的

- 工業和公共設施

- 基礎設施

- 住宅

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- ARDEX-QUICSEAL SINGAPORE

- Arkema(Bostik)

- Cementaid International

- Dribond Construction Chemicals

- Ducon Construction Chemicals

- Henkel AG & Co. KGaA

- MAPEI SpA

- MC-Bauchemie

- PENETRON MALAYSIA SDN BHD.

- RPM International

- Saint-Gobain

- Sika AG

- Terraco Holdings Ltd.

第7章 市場機會與未來展望

The Malaysia Construction Chemicals Market is expected to grow from USD 383.12 million in 2025 to USD 404.15 million in 2026 and is forecast to reach USD 529.19 million by 2031 at 5.49% CAGR over 2026-2031.

Sustained infrastructure momentum, including RMB 183.7 billion in projects awarded during the first 11 months of 2024, underpins steady volume growth as developers specify higher-performance admixtures, waterproofing membranes, and protective coatings. Mega-projects, such as the Johor-Singapore Special Economic Zone, signed in January 2025, are expected to accelerate demand for durable chemistries suited to marine and high-humidity environments. The Malaysia construction chemicals market also benefits from the government's 90% BIM adoption mandate for public works, which favors precision-engineered products that integrate seamlessly with automated construction workflows. In parallel, the momentum for green-building certification stimulates the uptake of low-VOC and recyclable formulations, enabling manufacturers to command premium price points while capturing sustainability-driven opportunities.

Malaysia Construction Chemicals Market Trends and Insights

Sustainable Public and Private Infrastructure Investment Acceleration

Malaysia's robust infrastructure pipeline, valued at RMB 183.7 billion in contracts awarded during 2024, sustains growth for specialty waterproofing membranes, polymer-modified grouts, and corrosion-inhibiting coatings used in bridges, tunnels, and urban rail systems. The Johor-Singapore Special Economic Zone alone aims to target 50 cross-border projects within five years, thereby amplifying demand for marine-grade sealants and anti-carbonate admixtures that can withstand brackish conditions. Public-private partnerships that include manufacturing giants such as Tesla and Intel further elevate performance benchmarks, driving the development of specifications for electrostatic-dissipative flooring resins and chemical-resistant wall coatings. Upgraded roads, ports, and digital pathways attract secondary commercial projects, reinforcing a virtuous cycle of product demand across the Malaysian construction chemicals market.

Affordable Housing Programs Driving Residential Chemical Consumption

The National Housing Policy's accelerated rollout of subsidized units standardizes the use of ready-mix concrete and prefabricated wall panels, expanding admixture volumes while tightening quality tolerances. Developers engaged in low-income housing voluntarily adopt green building criteria, fueling demand for water-based acrylic sealants and low-VOC tile adhesives that align with carbon reduction goals outlined by the Green Building Index. The policy's geographic spread into secondary cities, such as Ipoh and Kuching, enlarges distribution networks, prompting suppliers to introduce small-pack formulations and mobile technical service teams. Cost-sensitive projects rely on high-durability yet price-competitive chemistries, incentivizing local manufacturers to scale automated production lines for consistent batch quality.

Feedstock Price Volatility Constraining Market Expansion

Imported polymers, specialty solvents, and performance additives account for up to 60% of the raw material cost in premium formulations, exposing manufacturers to currency fluctuations and crude oil price spikes. PETRONAS has locked in forward supply contracts through 2026, but small and mid-sized players purchase on spot terms, eroding EBITDA margins when feedstock costs rise. The Pengerang-based USD 3.5 billion petrochemical complex, under construction since mid-2025, will enhance local supply integration but is not expected to reach nameplate output before 2028. Until then, volatility may accelerate consolidation as under-capitalized firms cede share to integrated multinationals.

Other drivers and restraints analyzed in the detailed report include:

- Green Building Certification Momentum Reshaping Chemical Specifications

- Ready-Mix Concrete and Prefabrication Technology Integration

- Environmental Health and Safety Compliance Cost Escalation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing solutions captured 48.42% of the Malaysian construction chemicals market share in 2025, driven by mandatory rooftop and podium deck specifications in high-rise developments across Kuala Lumpur and Johor Bahru. Bitumen-modified membranes retain their leadership in volume, while polymer-cementitious hybrids gain favor for their rapid-setting underground applications. The Malaysian construction chemicals market size for waterproofing is projected to expand in lockstep with transit-oriented developments, ports, and data center basements that require a long service life in humid conditions.

Surface-treatment chemicals are expected to register the fastest 6.78% CAGR through 2031, driven by advanced curing agents and mold-release emulsions optimized for precast facade panels. Anti-graffiti sealers and hydrophobic silane gels enjoy rising demand from municipal infrastructure programs aimed at reducing maintenance costs. Innovation is pivoting toward nano-engineered particles that enhance abrasion resistance without increasing VOC levels, aligning with green-building credits.

The Malaysia Construction Chemicals Market Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, Surface-Treatment Chemicals, and Waterproofing Solutions) and End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, Residential). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ARDEX-QUICSEAL SINGAPORE

- Arkema (Bostik)

- Cementaid International

- Dribond Construction Chemicals

- Ducon Construction Chemicals

- Henkel AG & Co. KGaA

- MAPEI S.p.A.

- MC-Bauchemie

- PENETRON MALAYSIA SDN BHD.

- RPM International

- Saint-Gobain

- Sika AG

- Terraco Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainable public and private investments in infrastructure projects

- 4.2.2 Affordable-housing push expanding residential starts

- 4.2.3 Green-building certification fueling demand for low-VOC and durable chemistries

- 4.2.4 Rapid adoption of ready-mix concrete and prefab raising admixture penetration

- 4.2.5 SEZ tax breaks localising specialty-chemical production

- 4.3 Market Restraints

- 4.3.1 Feedstock price volatility squeezing producer margins

- 4.3.2 Rising EHS compliance costs (VOC, hazardous solvent bans)

- 4.3.3 Shortage of trained applicators for advanced chemistries

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-Melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious Fixing

- 5.1.2.2 Resin Fixing

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-Entraining

- 5.1.3.3 Super-plasticizer

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-Reducer

- 5.1.3.6 Viscosity-Modifier

- 5.1.3.7 Plasticizer

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-Wrapping Systems

- 5.1.6.2 Injection Grouting

- 5.1.6.3 Micro-concrete Mortars

- 5.1.6.4 Modified Mortars

- 5.1.6.5 Rebar Protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-Treatment Chemicals

- 5.1.8.1 Curing Compounds

- 5.1.8.2 Mold-Release Agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 ARDEX-QUICSEAL SINGAPORE

- 6.4.2 Arkema (Bostik)

- 6.4.3 Cementaid International

- 6.4.4 Dribond Construction Chemicals

- 6.4.5 Ducon Construction Chemicals

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 MAPEI S.p.A.

- 6.4.8 MC-Bauchemie

- 6.4.9 PENETRON MALAYSIA SDN BHD.

- 6.4.10 RPM International

- 6.4.11 Saint-Gobain

- 6.4.12 Sika AG

- 6.4.13 Terraco Holdings Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment