|

市場調查報告書

商品編碼

1907244

北美建築化學品市場-佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

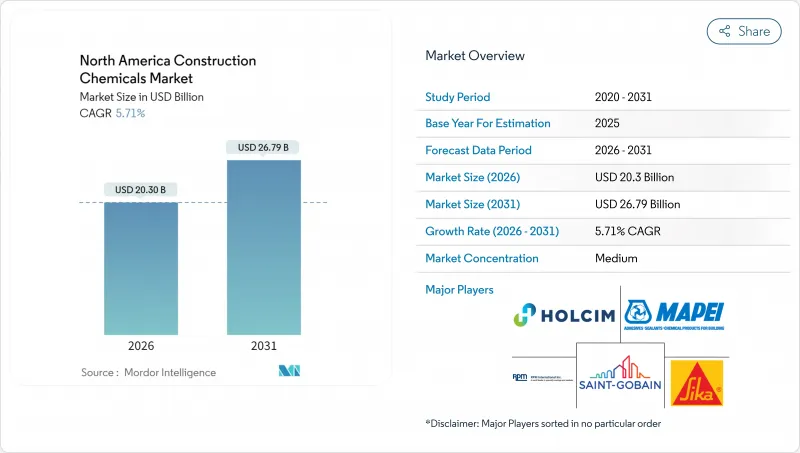

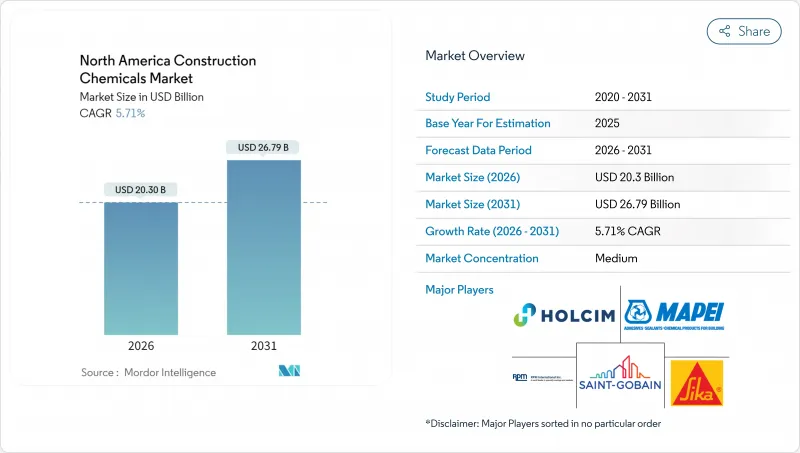

預計到 2025 年,北美建築化學品市場價值將達到 192 億美元,到 2026 年將成長至 203 億美元,到 2031 年將成長至 267.9 億美元,預測期(2026-2031 年)的複合年成長率為 5.71%。

基礎設施現代化專案、清潔採購法規以及人工智慧驅動的混合料設計平台的興起,正共同推動產品需求成長,並重新定義產品規格的製定路徑。由《基礎設施投資與就業法案》(IIJA)資助的公路、橋樑和水利基礎設施維修,為大批量混凝土應用創造了穩定的需求基礎,這就需要高效的混凝土外加劑,以延長使用壽命並抵消不斷上漲的原料價格。各州的碳含量法規促使買家更傾向於低全球暖化潛勢(GWP)的防水卷材和水泥基增強外加劑,從而為經認證的永續化學品創造了高階市場。資料中心和半導體大型企劃正在推動防火塗料、精密密封劑和快速固化劑的快速應用。同時,日益嚴格的能源效率標準也推動了對先進外牆系統的高性能黏合劑的需求。儘管石油基樹脂價格波動和技術純熟勞工短缺仍然是成本方面的阻力,但垂直整合的供應商和擁有簡化施工技術的公司正在降低利潤風險。

北美建築化學品市場趨勢與洞察

對基礎建設計劃的大規模投資

由《基礎設施投資與就業法案》(IIJA)資金籌措的眾多交通基礎設施改善和橋樑維修項目,對防護塗料、修補砂漿和水處理化學品的需求持續旺盛。成本上漲(例如2022年公路建設指數的上漲)降低了購買力,促使各機構轉向以性能為導向、強調全生命週期耐久性的規範。加拿大聯邦和省級計畫與美國的發展趨勢相符,尤其是在設計用於承受凍融循環的防水系統方面。能夠證明其產品在加速老化測試通訊協定下可延長資產使用壽命的供應商,將獲得多年期框架合約。原物料採購的垂直整合正逐漸成為應對競標價格波動的一種手段,使生產商能夠在原物料價格波動的情況下履行固定價格承諾。

嚴格的節能標準推動了高性能外加劑的發展

加州建築規範第24條、IECC和各州能源規範的融合提高了牆體和屋頂的最低保溫要求,推動了先進密封劑和黏合劑系統在連續保溫結構中的應用。同時,這些計劃也要求減少碳排放,從而對既能降低水泥用量又不犧牲強度的蘊藏量提出了雙重要求。混凝土生產商擴大指定使用高效減水劑,以提高飛灰和礦渣的替代率,並在某些情況下添加奈米二氧化矽混合物以達到更高的模量目標。在公共部門競標中,提供從搖籃到大門的環境產品聲明(EPD)和技術建模支援的化學品供應商正在取代大宗商品供應商。在商業建築中,能源建模工具將熱性能和結構性能模擬相結合,從而在更薄的樓板截面中實現更嚴格的化學性能容差。

石油基樹脂價格波動

美國國際貿易委員會(USITC)啟動反傾銷調查後,環氧樹脂現貨價格飆升,擠壓了依賴高純度雙酚A原料的特種塗料的利潤空間。在墨西哥灣沿岸設有工廠的製造商享有運輸成本優勢,但仍面臨颶風導致停產的風險。避險策略包括從亞洲雙重採購以及建造本地倉儲設施以平抑供應衝擊。終端用戶正在嘗試使用混合系統,以生物基環氧樹脂取代石油基成分,但這些混合產品仍然價格較高,且規格核准有限。多年期供應合約通常包含動態定價條款,以將原物料價格波動的影響轉嫁給用戶。

細分市場分析

至2025年,防水解決方案將佔北美建設化學品市場的32.62%,預計2031年將以6.09%的複合年成長率成長。這反映出,由於日益嚴格的防潮標準,人們對建築圍護結構的完整性越來越重視。由於液態防水膜的廣泛應用,預計該細分市場的成長速度將高於整體市場。液態防水膜可縮短施工時間,並能適應複雜的幾何形狀,取代傳統的片材系統。為了在節能建築中實現雙重性能目標,製造商正在將聚合物改質瀝青與反應性矽烷混合,以在保持蒸氣滲透性的同時提高延展性。採用地工織物增強液態防水膜的混合系統價格高於標準產品。表面處理劑和固化劑正著重於改善脫模和水化控制,這與預製構件生產商的趨勢類似,旨在提高工廠的生產效率。同時,混凝土外加劑生產商正在將收縮控制劑納入綜合防水方案中,使承包商能夠在單一保固範圍內獲得多功能解決方案。

混凝土外加劑仍然是重要的產品類別,這主要得益於高效減水劑,其在以50%的波特蘭水泥替代率下即可達到25 MPa的強度,這對於低碳競標是一項關鍵性能指標。由於老舊橋樑存量不斷增加,包括纖維包裹環氧樹脂和超快凝砂漿在內的修復和加固化學品的需求日益成長,許多聯邦計劃已指定使用這些系統進行橋面覆蓋。對黏合劑、密封劑和地板樹脂的需求保持穩定,這主要得益於商業建築幕牆維修和高客流量零售場所的整修。持續的VOC法規和NFPA 285合規要求正迫使複合材料生產商轉向低溶劑或水性化學品,從而調整其原料組合和利潤結構。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對基礎建設計劃的大規模投資

- 嚴格的節能標準推動了對高性能外加劑的需求。

- 預拌混凝土和預製構件施工方法的快速普及

- 循環經濟政策促進低碳建築材料的使用。

- 人工智慧驅動的混合設計平台,可提高化學品計量精度

- 市場限制

- 石油基樹脂價格波動

- 由於勞動力短缺,新計畫啟動延遲

- 消防法規的變更限制了溶劑型化學品的使用。

- 價值鏈分析

- 監管環境

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 產業間競爭

第5章 市場規模與成長預測

- 依產品

- 黏合劑

- 熱熔膠

- 反應性

- 溶劑型

- 水溶液

- 錨栓和水泥漿

- 水泥基固定材料

- 樹脂固定

- 混凝土外加劑

- 加速器

- 空氣引射器

- 高效減水劑

- 緩速器

- 收縮抑制劑

- 黏度調節劑

- 塑化劑

- 其他

- 混凝土保護塗層

- 丙烯酸纖維

- 醇酸樹脂

- 環氧樹脂

- 聚氨酯

- 其他樹脂

- 地板樹脂

- 丙烯酸纖維

- 環氧樹脂

- 聚天門冬胺酸樹脂

- 聚氨酯

- 其他樹脂

- 維修和維修化學品

- 纖維纏繞系統

- 壓漿

- 微型混凝土砂漿

- 改質砂漿

- 鋼筋保護材料

- 密封劑

- 丙烯酸纖維

- 環氧樹脂

- 聚氨酯

- 矽酮

- 其他樹脂

- 表面處理化學品

- 固化劑

- 釋放劑

- 其他

- 防水解決方案

- 化學品

- 防水膜

- 黏合劑

- 按最終用戶類別

- 商業的

- 工業和公共設施

- 基礎設施

- 住宅

- 按地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- ARDEX Americas

- Arkema(Bostik)

- Ashland

- Dow

- Henkel AG & Co. KGaA

- Holcim Group

- Kingspan Group

- LATICRETE International, Inc

- MAPEI SpA

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Xypex USA

第7章 市場機會與未來展望

第8章:執行長面臨的關鍵策略挑戰

The North America Construction Chemicals Market was valued at USD 19.20 billion in 2025 and estimated to grow from USD 20.3 billion in 2026 to reach USD 26.79 billion by 2031, at a CAGR of 5.71% during the forecast period (2026-2031).

Infrastructure modernization programs, buy-clean procurement rules, and the rise of AI-enabled mix-design platforms are simultaneously expanding product demand and redefining specification pathways. Highway, bridge, and water-infrastructure upgrades funded by the Infrastructure Investment and Jobs Act (IIJA) fuel a steady pipeline of large-volume concrete applications that require high-efficiency admixtures capable of extending service life while offsetting raw material inflation. State-level embodied-carbon mandates are steering buyers toward low-GWP waterproofing membranes and supplementary-cementitious-material-compatible admixtures, creating premium pricing niches for verified sustainable chemistries. Data-center and semiconductor megaprojects drive the rapid adoption of fire-resistant coatings, precision sealants, and quick-turn curing compounds, while energy-efficiency codes increase demand for high-performance adhesives within advanced envelope systems. Petro-derived resin price swings and skilled-labor shortages remain cost headwinds; however, suppliers with vertically integrated feedstock positions and simplified application technologies are mitigating margin risk.

North America Construction Chemicals Market Trends and Insights

Substantial investments in infrastructure projects

Many transportation improvements and bridge repairs, financed by the IIJA, are translating into consistent, high-volume demand for protective coatings, repair mortars, and water treatment chemicals. Cost inflation-characterized by growth in highway-construction indices during 2022-has eroded purchasing power, prompting agencies to shift toward performance-based specifications that emphasize lifecycle durability. Canadian federal and provincial programs mirror the U.S. momentum, particularly for waterproofing systems engineered to withstand freeze-thaw cycles. Suppliers that can document extended asset life under accelerated-aging protocols are winning multi-year framework contracts. Vertical integration in raw material sourcing is emerging as a hedge against bid volatility, allowing producers to honor fixed-price commitments despite fluctuations in feedstock prices.

Stringent energy-efficiency codes spurring high-performance admixtures

Convergence of Title 24, IECC, and provincial energy codes has elevated the minimum thermal performance required of walls and roofs, driving adoption of advanced sealants and adhesive systems that support continuous-insulation assemblies. The same projects must now also demonstrate lower embodied carbon, creating dual pressure for admixtures that reduce cement content without compromising strength. Concrete producers increasingly specify superplasticizers that allow higher fly-ash or slag substitution ratios, and some are integrating nano-silica blends to meet stringent modulus targets. Chemical suppliers offering cradle-to-gate EPDs and technical modeling support are displacing commodity providers in public-sector bids. In commercial buildings, energy modeling tools are linking thermal and structural simulations, further tightening tolerances on chemical performance at thinner slab profiles.

Volatility in petro-derived resin prices

Epoxy resin spot prices spiked after USITC launched an antidumping inquiry, squeezing margins in specialty coatings that rely on high-purity bisphenol-A feedstock. Manufacturers with Gulf-Coast plants enjoy freight advantages but remain vulnerable to hurricane-related outages. Hedging strategies include dual-sourcing from Asia and building on-site tank storage to smooth supply shocks. End-users are trialing hybrid systems that replace petro content with bio-based epoxies, but these blends still command price premiums and face limited code approvals. Dynamic pricing clauses have become standard in multi-year supply contracts to pass through feedstock price fluctuations.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of ready-mix and precast methods

- Circular economy mandates favoring low-carbon construction materials

- Labor shortages slowing new project starts

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing Solutions accounted for 32.62% of the North America construction chemicals market in 2025 and is projected to grow at a 6.09% CAGR through 2031, reflecting heightened focus on building-envelope integrity under stricter moisture-management codes. The segment outpaces overall market expansion as liquid-applied membranes replace sheet systems to cut labor hours and accommodate complex geometries. Manufacturers are blending polymer-modified asphalt with reactive silanes to achieve elongation while maintaining vapor permeability, meeting dual performance targets in energy-efficient assemblies. Hybrid systems that reinforce fluid membranes with geo-textile fabrics command premiums over standard products. Surface-treatment chemicals and curing compounds follow the same trend as precast producers, who emphasize release cleanliness and hydration control to accelerate plant throughput. Meanwhile, concrete-admixture suppliers are incorporating shrinkage-reducing additives into integrated waterproofing packages, enabling contractors to source multi-functional solutions under a single warranty.

Concrete Admixtures remain a significant product group, driven by superplasticizers that deliver 25 MPa strength at 50% replacement levels of portland cement-a critical capability for low-carbon bids. Repair and rehabilitation chemicals, including fiber-wrapping epoxies and ultra-rapid-setting mortars, benefit from the aging bridge stock, with many federal projects already specifying these systems for deck overlays. Adhesives, sealants, and flooring resins maintain steady demand tied to commercial facade upgrades and high-traffic retail refurbishments. VOC restrictions and NFPA 285 compliance continue to push formulators toward low-solvent or water-borne chemistries, reshaping raw-material portfolios and margin profiles.

The North America Construction Chemicals Market Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, and More), End-User Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- 3M

- ARDEX Americas

- Arkema (Bostik)

- Ashland

- Dow

- Henkel AG & Co. KGaA

- Holcim Group

- Kingspan Group

- LATICRETE International, Inc

- MAPEI S.p.A.

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Xypex USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Substantial investments in infrastructure projects

- 4.2.2 Stringent energy-efficiency codes spurring high-performance admixtures

- 4.2.3 Rapid adoption of ready-mix and precast methods

- 4.2.4 Circular economy mandates favouring low-carbon construction materials

- 4.2.5 AI-enabled mix-design platforms boosting chemical dosage accuracy

- 4.3 Market Restraints

- 4.3.1 Volatility in petro-derived resin prices

- 4.3.2 Labor shortages slowing new project starts

- 4.3.3 Fire-safety rule changes curbing solvent-borne chemistries

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-Melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious Fixing

- 5.1.2.2 Resin Fixing

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-Entraining

- 5.1.3.3 Super-plasticizer

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-Reducer

- 5.1.3.6 Viscosity-Modifier

- 5.1.3.7 Plasticizer

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-Wrapping Systems

- 5.1.6.2 Injection Grouting

- 5.1.6.3 Micro-concrete Mortars

- 5.1.6.4 Modified Mortars

- 5.1.6.5 Rebar Protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-Treatment Chemicals

- 5.1.8.1 Curing Compounds

- 5.1.8.2 Mold-Release Agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-User Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 ARDEX Americas

- 6.4.3 Arkema (Bostik)

- 6.4.4 Ashland

- 6.4.5 Dow

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Holcim Group

- 6.4.8 Kingspan Group

- 6.4.9 LATICRETE International, Inc

- 6.4.10 MAPEI S.p.A.

- 6.4.11 RPM International Inc.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 Xypex USA

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment