|

市場調查報告書

商品編碼

1911795

自由職業平台:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Freelance Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

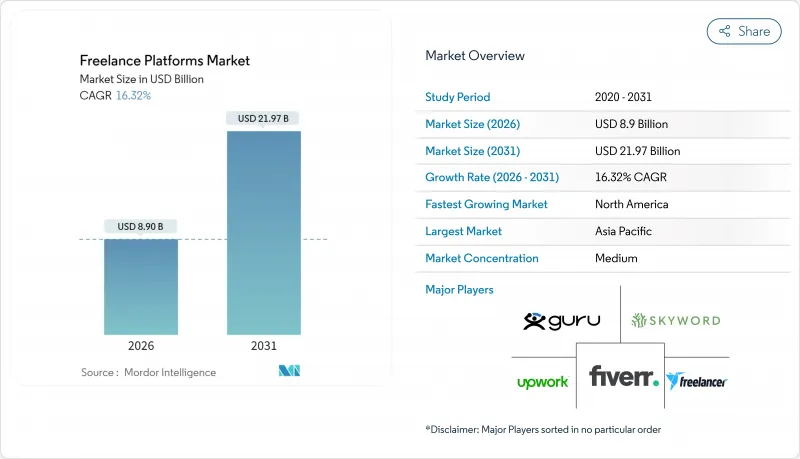

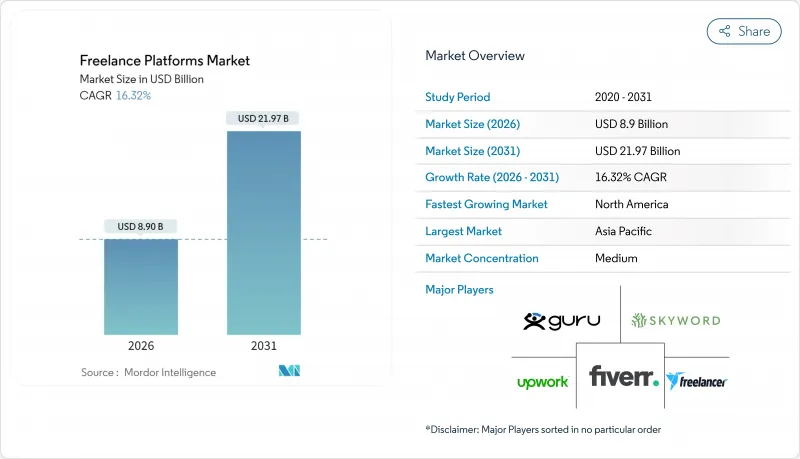

預計到 2026 年,自由職業平台市場規模將達到 89 億美元,高於 2025 年的 76.5 億美元。

預計到 2031 年將達到 219.7 億美元,2026 年至 2031 年的複合年成長率為 16.32%。

混合辦公模式的興起、對小眾數位技能日益成長的需求以及成本最佳化壓力不斷增加,都極大地推動了自由職業平台市場的成長。企業買家越來越傾向於透過能夠確保合規性、提供靈活成本結構並能快速獲取專業技能的平台來利用人才。人工智慧驅動的配對和生產力工具如今已成為競爭優勢的基礎,而新興的跨境發票規則正在減少全球支付摩擦。從區域來看,北美在採用率方面保持主導,而亞太地區則隨著企業加速推動數位轉型計畫而發展最為迅速。

全球自由職業平台市場趨勢與洞察

向混合靈活辦公模式過渡

美國勞工部於2024年發布了關於承包商分類的明確規定,為企業以合規的方式融合內部和外部人才鋪平了道路,此後平台的使用率迅速提升。一家全球廣告集團透過將諮詢費轉移到託管市場,一年內節省了960萬美元的成本。如今,大型企業正將臨時勞動力規劃納入其核心策略,並利用平台以比傳統招募週期更快的速度獲取新興技能人才。受訪企業報告稱,自疫情爆發以來,非僱員人才的使用量增加了84%。因此,自由職業平台市場受益於勞動力預算的結構性而非週期性重新分配。

對專業數位技能的需求日益成長

對人工智慧、機器學習和高階程式設計技能的需求年增了60%,推動自由工作者的時薪比平台平均高出44%。在日本,Go語言專家的月收入約為85.2萬日圓(約5,680美元),而Ruby專家的月收入約為83.9萬日圓(約5,593美元)。企業重視能夠將技術建構與業務價值結合的跨職能專家,而該平台也努力提高人工智慧配對的準確性,以挖掘特定領域的專業人才。高定價權加上供不應求,維持了高價位的收費系統,從而增強了自由職業平台市場的成長前景。

對可靠性和支付安全性的擔憂

對於向支付基礎設施薄弱地區擴張的平台而言,擔保交易工具和雙因素認證如今已成為基本要求。儘管像 Guru 這樣的服務在 SafePay 的實施方面有所改進,但詐騙手段仍在不斷演變,因此需要持續投資於合規和反洗錢措施。因此,信任問題在短期內仍將對自由職業平台市場構成阻礙。

細分市場分析

平台收入主要來自於以交易量線性成長的收費模式,預計到2025年,平台收入將佔自由職業平台市場佔有率的59.72%。 Upwork和Freelancer等平台依賴網路效應,隨著用戶群的不斷擴大,主導地位也日益鞏固。同時,在企業對確保合規性和計劃成果的託管解決方案的需求推動下,服務業正以18.05%的複合年成長率加速成長。

像CXC Global這樣的託管服務供應商每月管理超過12,000名用戶,這顯示市場對承包人才營運服務有著旺盛的需求。混合模式如今融合了市場平台的靈活性和精心策劃的服務層級,為大規模買家打造分級產品。這種發展趨勢表明,自由職業平台產業在整個人才管理生命週期中不斷拓展價值獲取的範圍。

到 2025 年,計劃管理工具將佔自由職業平台市場規模的 23.12%,反映出對跨職能敏捷執行的普遍需求;而網頁和平面設計領域將以 18.78% 的複合年成長率成長,這得益於人工智慧輔助的創新工作流程,降低了尋求高品質視覺效果的中小型企業的準入門門檻。

軟體開發工作在新興技術領域的預算中仍然佔據主導地位,但隨著企業轉向基於績效的合約模式,銷售和行銷領域的自由工作者也日益重要。 「其他應用」還包括法律合規和財務建模等細分領域,凸顯了垂直專業化的機會。在每個應用層內進行更深入專業化的平台將獲得更高的客戶佔有率和留存率。

區域分析

亞太地區預計將以18.22%的複合年成長率領跑,這主要得益於快速的數位化以及諸如ViDA電子帳單等簡化跨境交易的政策框架。日本企業通常每月向技術嫻熟的自由工作者支付超過5000美元的報酬,這表明他們願意為頂尖人才支付高薪。東南亞的成長速度也同樣迅猛,當地企業正在克服傳統的招募限制。

北美地區憑藉著成熟的基礎設施和早期採用者的文化,在收入方面保持領先地位,市佔率高達32.64%。美國的法規環境雖然複雜,但其清晰的聯邦框架有利於承包商合規開展業務。在加拿大,各省推出的遠距辦公課稅政策支援性指導方針正在推動遠距辦公市場的成長。

在歐洲,符合GDPR的資料保護措施提升了信任度,而計畫於2030年實施的ViDA指令將確保歐盟內部的無縫結算,從而推動自由工作者市場的穩定成長。在拉丁美洲,貨幣波動是一項挑戰,但該地貨幣錢包能夠有效促進自由工作者的招募。中東和非洲仍處於發展初期,但展現出巨大的潛力,尤其是在波灣合作理事會(GCC)等科技中心,這些地區的政府創新政策正在推動對專業零工人才的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場促進因素

- 向混合靈活辦公模式過渡

- 對專業數位技能的需求日益成長

- 公司內部面臨最佳化成本的壓力

- 跨境電子帳單法規簡化了自由工作者的付款流程。

- 生成式人工智慧副駕駛提昇平台員工生產力

- 借助人工智慧匹配演算法提高招募速度

- 市場限制

- 對可靠性和支付安全性的擔憂

- 關於工人分類的規定含糊不清

- 算法偏見訴訟增加合規成本

- 數位廣告管道的客戶獲取成本不斷上升

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業生態系分析

- 主要用例和案例研究

- 宏觀經濟趨勢評估

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 平台

- 服務

- 透過使用

- 計劃管理

- 銷售與行銷

- 資訊科技和軟體

- 網頁和平面設計

- 其他用途

- 最終用戶

- 雇主(大企業和小企業)

- 自由工作者

- 按組織規模

- 主要企業

- 小型企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 新加坡

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Upwork Inc.

- Fiverr International Ltd.

- Freelancer Limited

- Toptal LLC

- Guru.com LLC

- PeoplePerHour.com Ltd.

- DesignCrowd Pty Ltd.

- Contently Inc.

- WorkGenius GmbH

- WorkMarket, Inc.

- Catalant Technologies, Inc.

- 99designs by Vista

- Behance(Adobe Inc.)

- TaskRabbit, Inc.

- Amazon Mechanical Turk(Amazon.com, Inc.)

- UpStack Technologies, Inc.

- Workana Inc.

- Gigster LLC

- Aquent LLC

- FlexJobs Corporation

第7章 市場機會與未來展望

Freelance platforms market size in 2026 is estimated at USD 8.9 billion, growing from 2025 value of USD 7.65 billion with 2031 projections showing USD 21.97 billion, growing at 16.32% CAGR over 2026-2031.

Shifts toward hybrid work, rising demand for niche digital skills, and growing cost-optimization pressures keep the momentum strong for the freelance platforms market. Enterprise buyers increasingly favor platform-mediated talent engagement because it delivers compliance, variable cost structures, and rapid access to specialized capabilities. AI-powered matching and productivity tools now underpin most competitive differentiation, while emerging cross-border invoicing rules reduce friction in global payments. Geographically, North America retains leadership in penetration rates, yet Asia-Pacific is expanding fastest as enterprises in the region accelerate digital transformation plans.

Global Freelance Platforms Market Trends and Insights

Shift toward hybrid and flexible workforce models.

Platform adoption accelerated after the U.S. Department of Labor's 2024 rule clarified contractor classification, giving enterprises a compliant path to blend internal and external talent . A global advertising group saved USD 9.6 million in one year by shifting consultant spend to a managed marketplace. Large corporations now bake contingent workforce planning into core strategy, using platforms to secure emerging skills faster than conventional hiring cycles allow. Surveyed firms report an 84% jump in non-employee talent use since the pandemic. The freelance platforms market, therefore, benefits from a structural rather than cyclical re-allocation of labor budgets.

Rising demand for specialized digital skills

Demand for AI, machine learning, and advanced programming skills rose 60% year-over-year, pushing freelance hourly rates up 44% above platform averages. Japanese data shows Go and Ruby specialists commanding monthly pay near JPY 852,000 (USD 5,680) and JPY 839,000 (USD 5,593), respectively. Enterprises prize cross-functional experts who can connect technology build-outs with business value, motivating platforms to refine AI-driven matching to surface niche talent. High pricing power and scarce supply combine to sustain premium fee structures, reinforcing growth prospects for the freelance platforms market.

Trust and payment-security concerns

Escrow tools and two-factor identity verification now form baseline requirements for platforms expanding into geographies with weak payment rails. SafePay adoption on Guru and similar services shows improvement, yet fraud techniques continue to evolve, forcing ongoing investment in compliance and anti-money-laundering safeguards. Trust issues therefore remain a near-term drag on the freelance platforms market.

Other drivers and restraints analyzed in the detailed report include:

- Cost-optimization pressure on enterprises

- Generative-AI copilots boost platform worker productivity.

- Algorithm-bias lawsuits are increasing compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform revenue streams captured 59.72% of the freelance platforms market share in 2025 on the strength of commission-based models that scale with transaction volume. Marketplaces such as Upwork and Freelancer rely on network effects, reinforcing their lead as user rolls deepen. The services component, however, is outpacing at an 18.05% CAGR, propelled by enterprise demand for managed solutions that guarantee compliance and project outcomes.

Managed service providers like CXC Global administer over 12,000 contractors monthly, showcasing an appetite for turnkey workforce orchestration. Hybrid models now blend marketplace agility with curated service layers, creating tiered offerings for large buyers. This evolution signals that the freelance platforms industry is widening its value capture along the full talent-management lifecycle.

Project management tools held 23.12% of the freelance platforms market size in 2025, reflecting universal demand for agile execution across functions. Yet web and graphic design is expanding at 18.78% CAGR, fueled by AI-assisted creative workflows that lower entry barriers for SMEs seeking premium visuals.

Software development assignments continue to command premium budgets in emerging tech stacks, while sales and marketing freelancers gain ground as firms migrate to performance-linked contracts. Niche domains such as legal compliance and financial modeling surface within "other applications," underscoring opportunities for vertical specialization. Platforms that deepen expertise within each application tier stand to capture higher wallet share and retention.

Freelance Platforms Market Report is Segmented by Component (Platform and Services), Application (Project Management, Sales and Marketing, IT and Software, Web and Graphic Design, and Other Applications), End-User (Employers, and Freelancers), Organization Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific posted the highest 18.22% CAGR outlook, underpinned by rapid digitalization and policy frameworks such as ViDA electronic invoicing that simplify cross-border transactions. Companies in Japan routinely pay skilled freelancers more than USD 5,000 monthly, signaling a robust willingness to pay for top talent . Growth in Southeast Asia is likewise accelerating as local firms leapfrog traditional hiring constraints.

North America remains the revenue leader with a 32.64% share, supported by mature infrastructure and an early-adopter enterprise culture. The U.S. regulatory environment, though complex, offers clear federal frameworks that encourage compliant contractor engagement. Canada adds momentum with supportive provincial guidelines around remote work taxation.

Europe sustains steady expansion as GDPR-aligned data safeguards increase trust and as the forthcoming 2030 ViDA mandate ensures seamless intra-EU invoicing. In Latin America, currency volatility poses challenges, yet localized wallets prove effective at promoting freelance adoption. The Middle East and Africa present nascent but promising pockets, especially among tech hubs in the Gulf Cooperation Council, where government innovation agendas boost demand for specialized gig talent.

- Upwork Inc.

- Fiverr International Ltd.

- Freelancer Limited

- Toptal LLC

- Guru.com LLC

- PeoplePerHour.com Ltd.

- DesignCrowd Pty Ltd.

- Contently Inc.

- WorkGenius GmbH

- WorkMarket, Inc.

- Catalant Technologies, Inc.

- 99designs by Vista

- Behance (Adobe Inc.)

- TaskRabbit, Inc.

- Amazon Mechanical Turk (Amazon.com, Inc.)

- UpStack Technologies, Inc.

- Workana Inc.

- Gigster LLC

- Aquent LLC

- FlexJobs Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward hybrid and flexible workforce models

- 4.2.2 Rising demand for specialised digital skills

- 4.2.3 Cost-optimisation pressure on enterprises

- 4.2.4 Cross-border e-invoicing regulation simplifying freelancer payments

- 4.2.5 Generative-AI copilots boosting platform worker productivity

- 4.2.6 AI-powered matching algorithms improving hire speed

- 4.3 Market Restraints

- 4.3.1 Trust and payment-security concerns

- 4.3.2 Regulatory ambiguity on worker classification

- 4.3.3 Algorithm-bias lawsuits increasing compliance costs

- 4.3.4 Escalating customer-acquisition costs on digital ad channels

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Project Management

- 5.2.2 Sales and Marketing

- 5.2.3 IT and Software

- 5.2.4 Web and Graphic Design

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Employers (Enterprises and SMBs)

- 5.3.2 Freelancers

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Upwork Inc.

- 6.4.2 Fiverr International Ltd.

- 6.4.3 Freelancer Limited

- 6.4.4 Toptal LLC

- 6.4.5 Guru.com LLC

- 6.4.6 PeoplePerHour.com Ltd.

- 6.4.7 DesignCrowd Pty Ltd.

- 6.4.8 Contently Inc.

- 6.4.9 WorkGenius GmbH

- 6.4.10 WorkMarket, Inc.

- 6.4.11 Catalant Technologies, Inc.

- 6.4.12 99designs by Vista

- 6.4.13 Behance (Adobe Inc.)

- 6.4.14 TaskRabbit, Inc.

- 6.4.15 Amazon Mechanical Turk (Amazon.com, Inc.)

- 6.4.16 UpStack Technologies, Inc.

- 6.4.17 Workana Inc.

- 6.4.18 Gigster LLC

- 6.4.19 Aquent LLC

- 6.4.20 FlexJobs Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment