|

市場調查報告書

商品編碼

1911500

歐洲暖通空調服務市場:市佔率分析、產業趨勢與統計、成長預測(2026-2031年)Europe HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

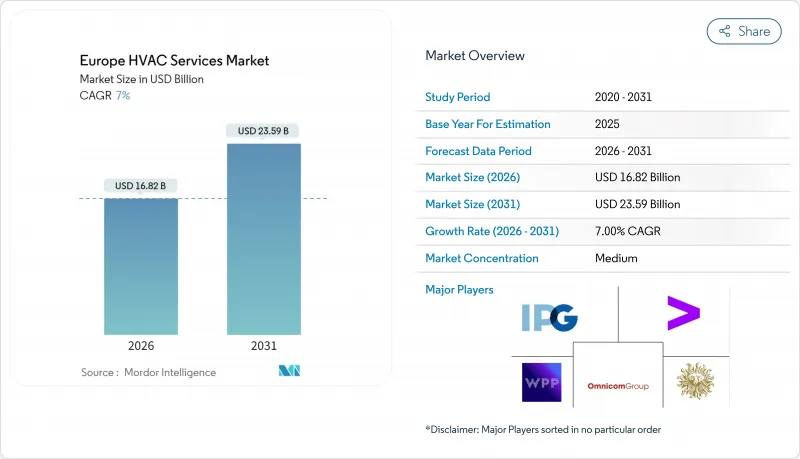

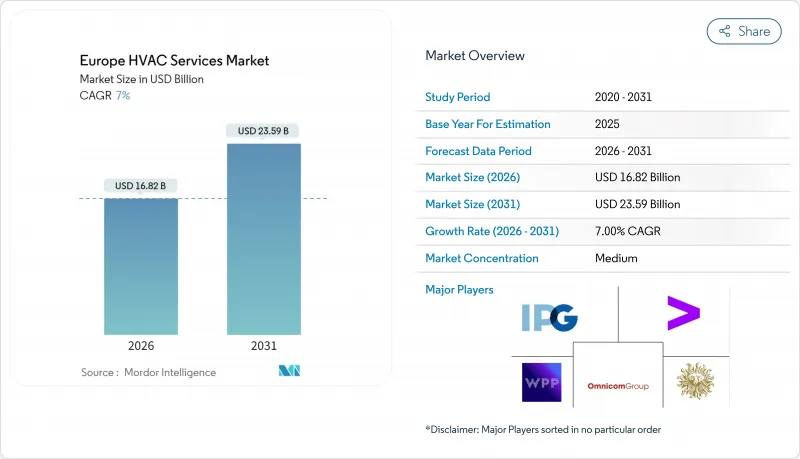

歐洲暖通空調服務市場預計將從 2025 年的 157.2 億美元成長到 2026 年的 168.2 億美元,預計到 2031 年將達到 235.9 億美元,2026 年至 2031 年的複合年成長率為 7.0%。

這一成長動能主要得益於旨在強制脫碳的立法力度加大、熱泵的日益普及以及對預測性維護需求的不斷成長,以降低能源消耗和停機時間。更嚴格的氟碳排放法規、不斷上漲的銅價以及區域勞動力短缺都帶來了成本壓力,與此同時,資產所有者正在加速採用數位化服務,以尋求精簡營運預算的方法。博世以81億美元收購江森自控-日立合資企業後,競爭持續加劇,此次收購重組了博世在歐洲的住宅和小規模商業服務網路。成長機會主要集中在與歐盟維修計劃「翻新浪潮」(Renovation Wave)相關的維修項目、北歐地區的區域供熱系統升級以及為超大規模資料中心提供的精密冷卻契約,這些契約優先考慮的是保證運作而非成本最小化。

歐洲暖通空調服務市場趨勢與洞察

歐盟強制維修計畫推動了對服務需求的加速成長

「維修浪潮」政策要求成員國在2030年前對能源效率最低的16%的非住宅建築維修,並要求在2024年12月前在290千瓦以上的設施中安裝建築自動化控制系統。這項監管措施迫使業主從被動維護轉向基於績效的服務契約,以確保節能效果。將能源審核、資金籌措援助和數位化性能追蹤納入日常暖通空調工作的承包商正在贏得長期多年合約。德國和荷蘭的領先採用者報告稱,由於客戶優先考慮承包規方案而非低小時費率,他們的利潤率更高。

熱泵更換熱潮重塑了服務組合要求

到2024年,歐洲的熱泵安裝量將超過2,150萬台,每次更換都需要經過A2L冷媒和智慧家庭整合訓練的技術人員。服務內容也從燃燒安全檢查轉向冷媒洩漏檢測和韌體更新。自1990年代以來,瑞典已將建築供暖排放減少了95%,這表明熱泵的廣泛應用如何在幾十年內徹底改變服務模式。為了脫穎而出,供應商現在提供遠端監控和五年保固的組合服務,從而提升每位客戶的終身價值。

合格冷媒氣體技術人員短缺限制了應變能力。

將於2025年生效的新規將要求所有使用R-454B或R-32冷媒的現場技術人員必須持有有效的認證。然而,歐盟目前仍缺少8萬名技術人員。這項短缺導致荷蘭等需求旺盛地區的人事費用上漲了15%至20%,並造成部分計劃因找不到合格人員而延誤數週。儘管博世等公司目前正在贊助速成課程和行動訓練實驗室,但技能缺口不太可能在2027年之前得到彌補。

細分市場分析

預計到2025年,維護和維修領域將佔歐洲暖通空調服務市場的53.55%,其主要收入來源是對超出負載運轉能力的系統進行強制性檢查。雖然穩定的裝置容量能夠帶來持續的收入,但利潤來源正逐漸轉向軟體平台。只有當感測器分析偵測到性能異常時,才會派遣技術人員。智慧互聯的運維正以10.38%的複合年成長率成長,並利用邊緣設備提前數天預測故障,從而減少高達25%的技術人員上門服務。供應商正在投資數位雙胞胎技術,以可視化氣流和能源負荷,並提供運轉率保證,從而獲得遠高於傳統服務費用的利潤率。儘管對傳統維護的需求依然旺盛,但其成長速度未能跟上通貨膨脹的步伐,促使供應商轉向提供打包服務,例如遠端監控、零件物流和合規性報告。

預測性維護也在改變勞動力組成。現場團隊現在配備了數據分析師,他們會在派遣機械專家之前分析異常警報。這種新模式集中管理軟體授權、現場存取和監管文件,從而提高了每位客戶的收入佔有率。更深入的訂閱合約降低了客戶流失率,鎖定了穩定的收入來源,提升了掌握互聯技術的服務公司的價值。同時,那些仍堅持傳統故障維修模式的公司面臨價格侵蝕和被數位化競爭對手收購的風險,這些競爭對手正在迅速整合歐洲暖通空調服務市場。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟維修波指令

- 熱泵更換熱潮

- 節能維修的需求日益成長

- 資料中心冷卻需求快速成長

- 碳排放金融計劃

- 利用數位雙胞胎進行預測性維護

- 市場限制

- 氟碳氣體認證工程師短缺

- 物聯網維修舊有系統成本高

- 冷媒供應鏈波動

- 連網暖通空調系統的網路安全隱患

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按服務類型

- 維護/修理

- 安裝

- 智慧互聯運維

- 按實現類型

- 新建工程

- 現有建築物的維修

- 按最終用戶行業分類

- 住宅

- 非住宅

- 商業的

- 產業

- 公共和公共機構

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 丹麥

- 挪威

- 瑞典

- 芬蘭

- 冰島

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Johnson Controls International PLC

- Carrier Corporation

- Daikin Industries Ltd

- Vaillant Group

- Aggreko PLC

- Aermec SpA

- Trane Technologies plc

- Bosch Thermotechnology GmbH

- Siemens Building Technologies

- Honeywell International Inc.

- BDR Thermea Group

- Ingersoll Rand PLC

- Crystal Air Holdings Limited

- Klima Venta

- IAC Vestcold AS

- Airedale International Air Conditioning Ltd

- Envirotec Limited

- Kospel SA

- Spectrum Engineering Limited

- Pentair Inc.

第7章 市場機會與未來展望

The Europe HVAC services market is expected to grow from USD 15.72 billion in 2025 to USD 16.82 billion in 2026 and is forecast to reach USD 23.59 billion by 2031 at 7.0% CAGR over 2026-2031.

Momentum comes from binding decarbonization laws, widespread heat-pump rollouts, and growing demand for predictive maintenance that lowers both energy use and service downtime. Tightening F-gas regulations, record copper prices, and regional labour shortages add cost pressure, yet they simultaneously accelerate digital service uptake as asset owners look for ways to stretch operating budgets. Competitive intensity keeps rising after Bosch's USD 8.1 billion purchase of the Johnson Controls-Hitachi JV, which reshapes residential and light-commercial service networks across the continent. Growth opportunities concentrate in retrofit packages tied to the EU Renovation Wave, district-heating upgrades in the Nordics, and precision-cooling contracts for hyperscale data centers that value guaranteed uptime over cost minimization.

Europe HVAC Services Market Trends and Insights

EU Renovation Wave mandates drive service demand acceleration

The Renovation Wave compels member states to refurbish the worst-performing 16% of non-residential buildings by 2030 and to install building-automation controls in sites above 290 kW by December 2024. Compliance pushes owners to shift from reactive maintenance toward outcome-based service contracts that guarantee energy savings. Contractors that layer energy audits, financing support, and digital performance tracking onto routine HVAC tasks lock in long multiyear deals. Early adopters in Germany and the Netherlands report higher margins because clients value turnkey compliance more than low hourly rates.

Heat-pump replacement boom reshapes service portfolio requirements

Europe's installed base surpassed 21.5 million units in 2024, and each replacement calls for technicians trained on A2L refrigerants and smart-home integration. Service visits shift from combustion safety checks to refrigerant leak detection and firmware updates. Sweden's 95% cut in building-heating emissions since the 1990s shows how widespread heat-pump adoption can transform service patterns for decades. Vendors now bundle remote monitoring and five-year warranties to differentiate, raising per-customer lifetime value.

Shortage of F-gas-certified technicians constrains capacity

New 2025 rules force every field technician who handles R-454B or R-32 to carry updated certification, yet 80,000 vacancies remain unfilled across the bloc. Backlogs push labour rates up 15-20% in hot spots such as the Netherlands, and some projects stall for weeks until a licensed crew becomes available. Companies including Bosch now sponsor accelerated courses and mobile training labs, but the skills gap is unlikely to close before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Growing demand for energy-efficient retrofits transforms business models

- Data-center cooling surge creates a specialized service niche

- High IoT retrofit costs limit smart-service adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Maintenance and repair held 53.55% of Europe HVAC services market share in 2025, anchored by mandatory inspections on systems above specified capacity thresholds. The stable installed base delivers recurring revenue, yet profit pools shift toward software-enabled platforms that dispatch technicians only when sensor analytics flag performance drift. Smart-connected operations and maintenance, expanding at 10.38% CAGR, leverages edge devices that predict faults days in advance and trims labour truck rolls by up to 25%. Vendors invest in digital twins to visualize airflow and energy loads so they can offer uptime guarantees that boost margins far above traditional service rates. While the legacy maintenance cohort remains sizable, its growth lags inflation, nudging providers to bundle remote monitoring, parts logistics, and compliance reporting.

Predictive maintenance also changes workforce composition. Field teams now include data analysts who interpret anomaly alerts before dispatching mechanical specialists. The new model increases wallet share per client because a single provider manages software licenses, on-site visits, and regulatory paperwork. As subscription arrangements deepen, customer churn rates fall, locking revenue streams and raising enterprise valuations for service firms that master connectivity. Conversely, companies that cling to break-fix models face eroding prices and potential acquisition by digitally enabled rivals eager to consolidate the Europe HVAC services market.

The Europe HVAC Services Market Report is Segmented by Type of Service (Maintenance and Repair, Installation, Smart-Connected OandM), Implementation Type (New Construction, Retrofit Buildings), End-User Industry (Residential, Non-Residential Including Commercial, Industrial, Public and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Johnson Controls International PLC

- Carrier Corporation

- Daikin Industries Ltd

- Vaillant Group

- Aggreko PLC

- Aermec SpA

- Trane Technologies plc

- Bosch Thermotechnology GmbH

- Siemens Building Technologies

- Honeywell International Inc.

- BDR Thermea Group

- Ingersoll Rand PLC

- Crystal Air Holdings Limited

- Klima Venta

- IAC Vestcold AS

- Airedale International Air Conditioning Ltd

- Envirotec Limited

- Kospel SA

- Spectrum Engineering Limited

- Pentair Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Renovation Wave mandates

- 4.2.2 Heat-pump replacement boom

- 4.2.3 Growing demand for energy-efficient retrofits

- 4.2.4 Data-center cooling demand surge

- 4.2.5 Carbon-linked financing schemes

- 4.2.6 Digital twin-driven predictive maintenance

- 4.3 Market Restraints

- 4.3.1 Shortage of F-gas-certified technicians

- 4.3.2 High IoT retrofit costs for legacy systems

- 4.3.3 Refrigerant supply-chain volatility

- 4.3.4 Cyber-security concerns in connected HVAC

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Service

- 5.1.1 Maintenance and Repair

- 5.1.2 Installation

- 5.1.3 Smart-connected OandM

- 5.2 By Implementation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit Buildings

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.3.2.1 Commercial

- 5.3.2.2 Industrial

- 5.3.2.3 Public and Institutional

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Nordic

- 5.4.6.1 Denmark

- 5.4.6.2 Norway

- 5.4.6.3 Sweden

- 5.4.6.4 Finland

- 5.4.6.5 Iceland

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Johnson Controls International PLC

- 6.4.2 Carrier Corporation

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Vaillant Group

- 6.4.5 Aggreko PLC

- 6.4.6 Aermec SpA

- 6.4.7 Trane Technologies plc

- 6.4.8 Bosch Thermotechnology GmbH

- 6.4.9 Siemens Building Technologies

- 6.4.10 Honeywell International Inc.

- 6.4.11 BDR Thermea Group

- 6.4.12 Ingersoll Rand PLC

- 6.4.13 Crystal Air Holdings Limited

- 6.4.14 Klima Venta

- 6.4.15 IAC Vestcold AS

- 6.4.16 Airedale International Air Conditioning Ltd

- 6.4.17 Envirotec Limited

- 6.4.18 Kospel SA

- 6.4.19 Spectrum Engineering Limited

- 6.4.20 Pentair Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment