|

市場調查報告書

商品編碼

1911473

印尼汽車租賃市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indonesia Car Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

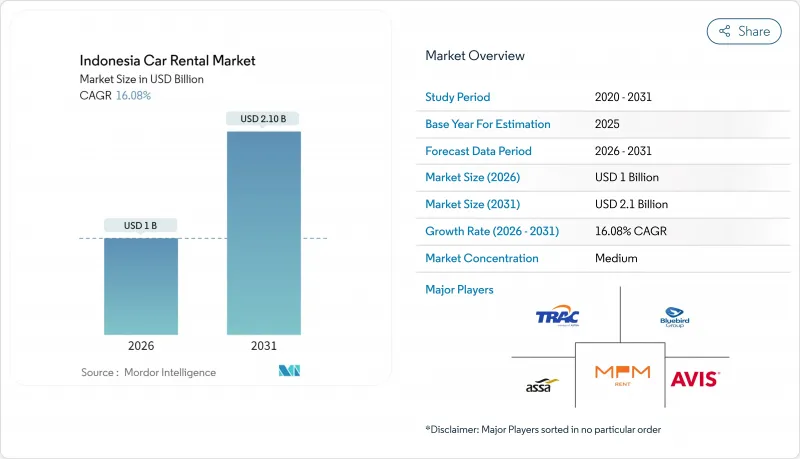

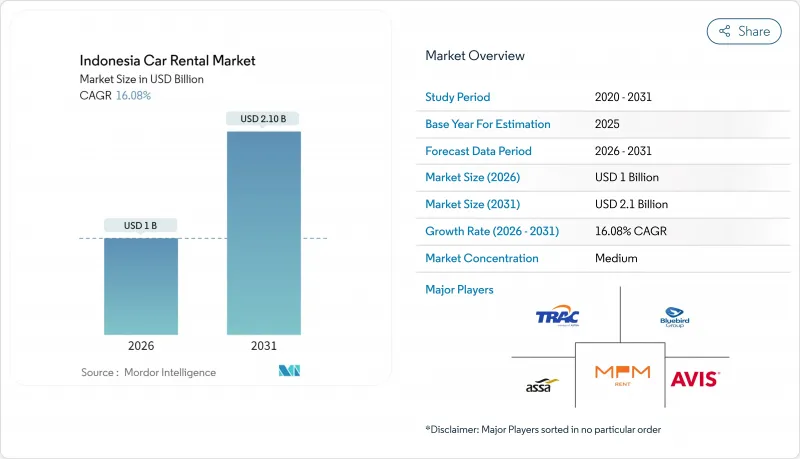

預計到2026年,印尼汽車租賃市場規模將達到10億美元,高於2025年的8.6億美元。預計到2031年,該市場規模將達到21億美元,2026年至2031年的複合年成長率為16.08%。

可支配收入的成長、中產階級旅行預算的擴大以及智慧型手機的普及,預計將為未來五年印尼旅遊業持續兩位數成長創造有利條件。政府設定的2025年接待外國遊客1460萬至1600萬人次的目標(高於2024年的1390萬人次)表明,即使商務旅行在印尼2024年GDP增長5.05%的推動下復甦,旅遊需求依然強勁。線上平台正在重新定義消費者對透明度、按需服務和數位支付的期望。同時,針對電池式電動車(BEV)的新激勵措施正將電氣化定位為未來的收入來源。隨著基於應用程式的出行生態系統模糊了叫車和日常租賃之間的界限,競爭壓力日益加劇,迫使傳統營運商加快車隊現代化和數據驅動定價策略的實施。

印尼汽車租賃市場趨勢與洞察

國際和國內遊客數量不斷增加

2024年,印尼接待了約1,390萬國際觀光和超過10億人次的國內旅行,顯示隨著邊境限制的放寬,旅遊業迅速復甦。旅遊部預測,在落地簽計畫的擴大和「峇裡島十大新目的地」推廣的推動下,2025年遊客人數將增加至1,460萬至1,600萬。對科莫多和龍目島等區域機場的大規模資本投資增加了座位容量,使旅客來源不再局限於爪哇島。世界旅遊及旅行理事會(WTTC)預測,2025年旅遊業將佔印尼國內生產毛額(GDP)的4.6%。不斷擴大的遊客群體直接推動了對租車和專車服務的需求,尤其是在公共交通不便的島嶼上。

數位優先預訂平台的激增

預計到2024年,印尼數位經濟規模將達到900億美元,並在電子商務交易激增的推動下持續成長。到2024年,線上預訂將佔總交易額的很大一部分,並且隨著消費者湧向提供即時比價、無現金支付和會員獎勵的超級應用程式,線上預訂量將逐年顯著成長。像Bluebird Taxi與Gojek這樣的合作模式,讓現有車輛業者能夠觸及全國的基本客群,同時降低獲客成本。聚合平台正在利用其豐富的數據來最佳化動態定價、提高車輛運轉率,並即時追加銷售提升銷售和輔助服務。

叫車超級應用正在蠶食短期租賃市場。

2024年,Grab和Gojek佔據了印尼絕大多數的隨選旅遊市場。提案的Grab-GoTo合作預計將透過將配送、支付和共乘整合到一個錢包中,進一步深化網路效應。都市區消費者更傾向於選擇上門接送服務而非自駕租車,以避免堵塞費和停車位短缺的問題。商務旅客也透過費用管理平台預訂共乘服務,以避免前往傳統的機場接送櫃檯。為了保持競爭力,租車公司正在探索按小時計費的套餐、與航空公司建立忠誠度合作關係,以及為那些不太容易被應用程式商業化所影響的小眾市場推出高階SUV車型。

細分市場分析

至2025年,線上通路將佔印尼汽車租賃市場收入的68.84%,年複合成長率達16.85%。這一主導地位反映了智慧型手機的高普及率、無現金支付的快速成長以及消費者對整合行程規劃、地圖和電子錢包等功能的超級應用程式的親和性。印尼的線下汽車租賃市場仍將以線下旅行社門市為主導,到2025年仍將保持可觀的收入,但隨著小規模業者擴大將車輛上線聚合平台以吸引價格敏感型遊客,其市場佔有率將會下降。

超級應用生態系統整合了叫車、外送和數位銀行服務,以促進日常租賃套餐的交叉銷售。現有品牌正在引入基於雲端的預訂引擎、推播通知折扣和人工智慧客服聊天機器人,以提供與科技平台媲美的用戶體驗。線上收集的數據可以根據國籍、旅行目的和消費金額進行細分,使營運商能夠進行里程限制的A/B測試或捆綁銷售Wi-Fi路由器以提高收入。

預計到2025年,短期租賃(1-30天)將佔印尼汽車租賃市場57.88%的佔有率,主要受季節性旅遊高峰的推動。長期租賃合約預計也將在2025年成為該市場的主要收入來源,年複合成長率將達到17.12%。各公司正採用經營性租賃的方式來節省資金,並將維護責任轉移給服務供應商。

長期租賃方案通常包含駕駛人薪資、定期檢查和全額保險,從而保障客戶免受殘值波動的影響。車隊管理人員正在應用遠端資訊處理技術來監控消費量和預防性維護,從而減少運作。這一趨勢也催生了二手車處置管道,車齡超過三到五年的車輛會被競標或出售給網約車司機,相比點對點轉售,這種方式能更快地收回成本。

構成比到2025年,旅遊業將佔印尼總收入的63.74%,而商務出行將成為下一個成長引擎,年複合成長率將達到17.62%。印尼的投資合格評級和快速的許可證核准流程正鼓勵國際公司遷址,增加了對高階主管接送、計劃現場接送以及外籍員工家屬交通的需求。此外,工廠工人的通勤套餐和業務流程外包(BPO)員工的共乘麵包車也擴大了潛在需求。

旅遊預訂主要集中在峇裡島、日惹和龍目島,自駕遊套裝行程包含精心設計的行程和多語言GPS導航。印尼的群島地形和缺乏城際列車網路,使得租車公司能夠充分利用這一優勢,提供機場接送服務、優先SIM卡套餐安排和24小時道路救援系統等客製化服務。同時,企業合約也日益多元化,有助於緩解季節性波動,並確保車輛運轉率的可預測性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 國際和國內遊客數量不斷增加

- 數位優先預訂平台的激增

- 企業對長期營業性租賃的需求日益成長

- 政府電動車藍圖加速車隊電氣化進程

- 清真旅遊套餐推動了小眾租賃需求。

- 區域機場連通性擴展方面取得快速進展

- 市場限制

- 共享旅遊超級應用程式正在蠶食短期租賃市場。

- 現有業者之間日益激烈的價格競爭

- 都市區的交通擁擠和停車位不足會抑制私家車的使用。

- 區域許可製度分散以及稅收合規負擔

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按預訂類型

- 線上

- 離線

- 按租賃期限

- 短期(少於30天/30天內)

- 中期(1個月至12個月)

- 長期(12個月或以上)

- 透過使用

- 旅遊休閒

- 日常通勤

- 企業車隊/商務旅遊

- 機場接送

- 按車輛類型

- 經濟型/掀背車

- 多用途汽車(MPV)

- 運動型多用途車(SUV)

- 豪華/行政

- 按燃料類型

- 內燃機(ICE)-汽油車

- 內燃機(ICE)- 柴油

- 油電混合車

- 電池式電動車(BEV)

- 最終用戶

- 對於企業

- 個人

- 透過租賃管道

- 聚合平台

- 直接面對消費者(汽車租賃公司)

- 超應用程式捆綁包

- 按地區

- Java

- 雅加達都會區 (Jabodetabek)

- 西爪哇(不包括雅加達)

- 中爪哇和東爪哇

- 峇裡島和努沙登加拉

- 蘇門答臘

- 加里曼丹

- 蘇拉威西

- 巴布亞馬魯古群島

- Java

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Blue Bird Group

- TRAC Astra Rent A Car

- Adi Sarana Armada(ASSA Rent)

- Mitra Pinasthika Mustika Rent

- The Hertz Corporation

- Avis Budget Group

- Europcar Indonesia

- Indorent(PT Indomobil Multi Jasa)

- Globe Rent a Car

- Otomo

- Grab Rentals

- GoCar Rental(Gojek)

- DOcar

- Movic

- Easyrent

- Tiket.com Car Rental

- Traveloka Car Rental

第7章 市場機會與未來展望

The Indonesian car rental market size in 2026 is estimated at USD 1.0 billion, growing from 2025 value of USD 0.86 billion with 2031 projections showing USD 2.1 billion, growing at 16.08% CAGR over 2026-2031.

Over the next five years, rising disposable incomes, expanding middle-class travel budgets, and widespread smartphone adoption set a favorable backdrop for sustained double-digit growth. The government's target of welcoming between 14.6 and 16 million foreign visitors in 2025, up from 13.9 million in 2024, signals resilient tourism demand even as business travel rebounds on the back of Indonesia's 5.05% GDP growth in 2024. Online platforms are redefining customer expectations around transparency, on-demand availability, and digital payments, while new incentives for battery-electric vehicles (BEVs) position electrification as a future profit pool. Competitive pressure intensifies as app-based mobility ecosystems blur the line between ride-hailing and daily rentals, prompting traditional operators to accelerate fleet modernization and data-driven pricing strategies.

Indonesia Car Rental Market Trends and Insights

Rising International and Domestic Tourist Arrivals

In 2024, Indonesia welcomed around 13.9 million international visitors and recorded over 1 billion domestic journeys, marking a swift rebound in its tourism sector following the easing of border restrictions. The Ministry of Tourism projects inbound visitors will rise to between 14.6 and 16 million in 2025, supported by visa-on-arrival expansion and marketing of the "10 New Balis" destinations. Significant capital investment in Komodo, Lombok, and other regional airports increases seat capacity and disperses travel flows beyond Java. The World Travel & Tourism Council projects the sector will contribute 4.6% to GDP in 2025. A larger tourist base directly lifts self-drive rentals and chauffeured packages, particularly in islands where public transport is limited.

Surge in Digital-First Booking Platforms

In 2024, Indonesia's digital economy hit the USD 90 billion mark, buoyed by a surge in e-commerce transactions, with projections indicating further growth. Online rental bookings accounted for a substantial share of the overall transactions in 2024 and are growing significantly annually as consumers gravitate to super-apps offering instant price comparison, cashless payments, and loyalty rewards. Partnerships like Blue Bird taxis integrating with Gojek allow legacy fleets to unlock a nationwide customer base while cutting acquisition costs. Aggregators use rich data to fine-tune dynamic pricing, optimize fleet utilization, and upsell insurance or ancillary services in real time.

Ride-Hailing Super-Apps Cannibalizing Short-Term Rentals

Grab and Gojek processed a significant number of on-demand rides in Indonesia during 2024. A proposed Grab-GoTo tie-up could deepen network effects, bundling deliveries, payments, and ride-sharing into a single wallet. Urban consumers prefer door-to-door rides over self-drive rentals to avoid congestion fees and parking scarcity. Corporate travelers also book ride-hailing through expense-management dashboards, bypassing traditional airport pickup counters. To stay relevant, rental firms are exploring hourly packages, loyalty linkage with airlines, and premium SUVs to serve niches less exposed to app-based commoditization.

Other drivers and restraints analyzed in the detailed report include:

- Growing Corporate Demand for Long-Term Operational Leasing

- Government EV Roadmap Accelerating Fleet Electrification

- Intensifying Price-Led Competition Among Incumbents

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Online channels generated 68.84% of the Indonesian car rental market revenue in 2025, climbing at a 16.85% CAGR. The dominance reflects deep smartphone penetration, a cashless payment boom, and consumer comfort with super-apps integrating trip planning, mapping, and digital wallets. Indonesia's car rental market size, attributed to offline travel-agency counters, remained at significant revenue in 2025 but is losing share as small operators list fleets on aggregator portals to reach price-sensitive tourists.

Super-app ecosystems combine ride-hailing, food delivery, and digital banking, encouraging cross-selling day-long rental packages. Legacy brands adopt cloud-based reservation engines, push-notification discounts, and AI-enabled customer-service chatbots to match the user experience of tech platforms. Data captured online allows segmentation by nationality, trip purpose, and spend, enabling operators to A/B test mileage caps or bundle Wi-Fi routers for incremental revenue.

Short-term bookings, defined as rentals lasting 1-30 days, held a 57.88% share in the Indonesian car rental market in 2025 due to seasonal tourism peaks. Long-term contracts surpassed the noteworthy revenue i the Indonesian car rental market in 2025 and are projected to expand at a 17.12% CAGR. Corporations adopt operating leases to preserve capital and shift maintenance responsibilities to service providers.

Long-term packages typically include driver salaries, periodic servicing, and full insurance, insulating clients from residual-value swings. Fleet managers deploy telematics to monitor fuel consumption and preventive maintenance, reducing downtime. The trend also anchors used-vehicle disposal channels, where cars aged three to five years are auctioned or sold to ride-hailing drivers, recouping capital faster than private resales.

Tourism accounted for 63.74% of revenue in 2025; however, business mobility is on course to become the next growth engine, expanding at an 17.62% CAGR. Indonesia's investment-grade rating and quick licensing approvals spur multinational relocations, raising demand for executive transfers, project-site shuttles, and expatriate family transport. Daily commuting packages for factory staff and shared vans for BPO workers also widen addressable volumes.

Tourism bookings concentrate in Bali, Yogyakarta, and Lombok, where self-drive packages include itinerary curation and GPS navigation in multiple languages. Car rental firms tailor airport meet-and-greet services, fast-track SIM card kits, and 24/7 roadside assistance, leveraging Indonesia's archipelagic geography and limited inter-city rail. In parallel, corporate contracts diversify income, cushioning seasonality and yielding predictable fleet-utilization ratios.

The Indonesia Car Rental Market Report is Segmented by Booking Type (Online and Offline), Rental Duration (Short-Term, Medium-Term and Long-Term), Application (Tourism and Leisure, Daily Commuting, and More), Vehicle Type (Economy/Hatchback and More), Fuel Type (ICE-Petrol, ICE-Diesel, and More), End-User (Corporate and Individual), Rental Channel, and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Blue Bird Group

- TRAC Astra Rent A Car

- Adi Sarana Armada (ASSA Rent)

- Mitra Pinasthika Mustika Rent

- The Hertz Corporation

- Avis Budget Group

- Europcar Indonesia

- Indorent (PT Indomobil Multi Jasa)

- Globe Rent a Car

- Otomo

- Grab Rentals

- GoCar Rental (Gojek)

- DOcar

- Movic

- Easyrent

- Tiket.com Car Rental

- Traveloka Car Rental

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising International and Domestic Tourist Arrivals

- 4.2.2 Surge in Digital-First Booking Platforms

- 4.2.3 Growing Corporate Demand for Long-Term Operational Leasing

- 4.2.4 Government EV Roadmap Accelerating Fleet Electrification

- 4.2.5 Halal-Friendly Tourism Packages Boosting Niche Rentals

- 4.2.6 Rapid Expansion of Secondary-Airport Connectivity

- 4.3 Market Restraints

- 4.3.1 Ride-Hailing Super-Apps Cannibalizing Short-Term Rentals

- 4.3.2 Intensifying Price-Led Competition Among Incumbents

- 4.3.3 Urban Congestion and Parking Scarcity Deterring Self-Drive

- 4.3.4 Fragmented Regional Licensing and Tax Compliance Burden

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Booking Type

- 5.1.1 Online

- 5.1.2 Offline

- 5.2 By Rental Duration

- 5.2.1 Short-term (Less than/Equals 30 days)

- 5.2.2 Medium-term (1 to 12 months)

- 5.2.3 Long-term (Above 12 months)

- 5.3 By Application

- 5.3.1 Tourism and Leisure

- 5.3.2 Daily Commuting

- 5.3.3 Corporate Fleet / Business Mobility

- 5.3.4 Airport Transfer

- 5.4 By Vehicle Type

- 5.4.1 Economy / Hatchback

- 5.4.2 Multi-Purpose Vehicle (MPV)

- 5.4.3 Sports Utility Vehicle (SUV)

- 5.4.4 Luxury / Executive

- 5.5 By Fuel Type

- 5.5.1 ICE - Petrol

- 5.5.2 ICE - Diesel

- 5.5.3 Hybrid-Electric

- 5.5.4 Battery-Electric (BEV)

- 5.6 By End-user

- 5.6.1 Corporate

- 5.6.2 Individual

- 5.7 By Rental Channel

- 5.7.1 Aggregator Platforms

- 5.7.2 Direct-to-Consumer (Rental Co.)

- 5.7.3 Super-App-Based Bundles

- 5.8 By Region

- 5.8.1 Java

- 5.8.1.1 Greater Jakarta (Jabodetabek)

- 5.8.1.2 West Java (ex-Jakarta)

- 5.8.1.3 Central and East Java

- 5.8.2 Bali and Nusa Tenggara

- 5.8.3 Sumatra

- 5.8.4 Kalimantan

- 5.8.5 Sulawesi

- 5.8.6 Papua and Maluku

- 5.8.1 Java

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Blue Bird Group

- 6.4.2 TRAC Astra Rent A Car

- 6.4.3 Adi Sarana Armada (ASSA Rent)

- 6.4.4 Mitra Pinasthika Mustika Rent

- 6.4.5 The Hertz Corporation

- 6.4.6 Avis Budget Group

- 6.4.7 Europcar Indonesia

- 6.4.8 Indorent (PT Indomobil Multi Jasa)

- 6.4.9 Globe Rent a Car

- 6.4.10 Otomo

- 6.4.11 Grab Rentals

- 6.4.12 GoCar Rental (Gojek)

- 6.4.13 DOcar

- 6.4.14 Movic

- 6.4.15 Easyrent

- 6.4.16 Tiket.com Car Rental

- 6.4.17 Traveloka Car Rental

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment