|

市場調查報告書

商品編碼

1911458

直流馬達:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Direct Current (DC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

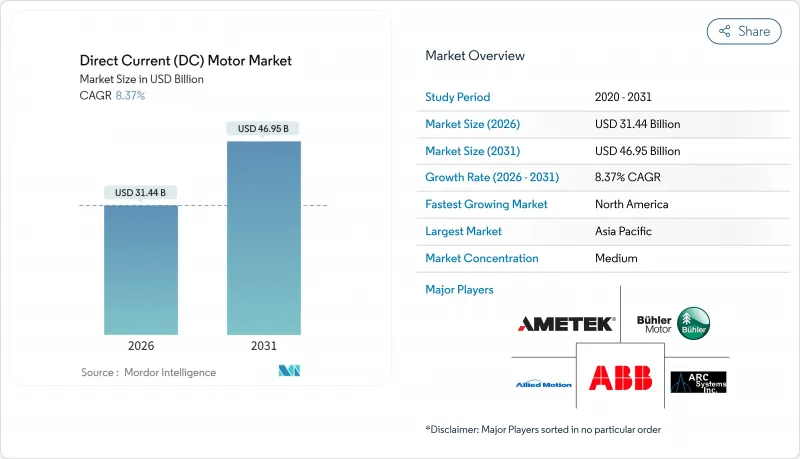

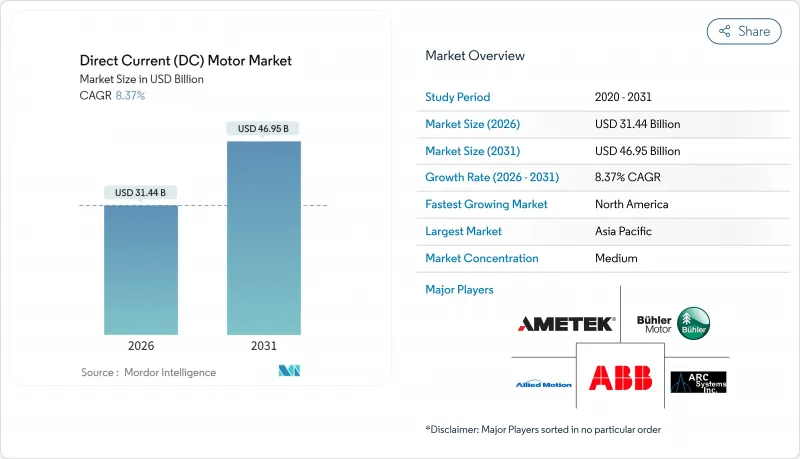

預計到2026年,直流馬達市場規模將達到314.4億美元,高於2025年的290.1億美元。預計到2031年,該市場規模將達到469.5億美元,2026年至2031年的複合年成長率為8.37%。

DC馬達市場的強勁成長得益於電動車的廣泛普及、工業4.0自動化以及可再生能源的日益普及。無刷直流馬達(BLDC)因其維護成本更低、效率更高以及支援智慧控制功能等優勢,正在逐步取代有刷馬達。製造商正在嘗試使用鐵氧體替代材料來控制成本,同時加強其稀土元素磁鐵供應鏈。對48V汽車系統、物聯網驅動的預測性維護以及用於風能和太陽能追蹤系統的高功率驅動裝置的策略性投資,正在推動直流馬達市場的發展。亞太地區憑藉其集中的製造業和政策支持,在DC馬達市場佔據主導地位;而南美洲則憑藉公用事業規模的太陽能和風能發電設施,實現了最快的收入成長。

全球直流馬達市場趨勢與洞察

加速推廣電動車

隨著電池式電動車和混合動力汽車產量的快速成長,DC馬達的需求正在轉變,牽引、溫度控管和輔助系統正逐步向無刷直流馬達(BLDC)設計過渡,以實現更精確的扭矩控制和高功率密度。特斯拉的永磁馬達策略已展現成本和效率優勢,促使各大汽車製造商紛紛效法。歐洲的碳減排法規正在加速這一轉型,而中國則透過對整合馬達和傳動系統的補貼來增強國內產能。稀土資源供應仍然是一個令人擔憂的問題,但比亞迪的垂直整合以及美國《通膨控制法案》下的供應激勵計畫緩解了短期風險。這些因素共同推動DC馬達市場快速電氣化。

向節能型工業自動化轉型

擁抱工業4.0的製造商正在投資智慧型直流驅動器,這些驅動器可將運作中健康數據傳輸到工廠雲端。在西門子MindSphere部署方案中,無刷直流馬達將振動和溫度資料傳輸到預測性維護演算法,將計劃外停機時間減少高達30%。 ABB的改裝智慧感測器擴大了可覆蓋的安裝基數,並實現了超越新設備銷售的全生命週期最佳化。亞洲不斷上漲的人事費用,加上歐盟排放嚴格的排放法規,進一步強化了這些價值提案。同時,IEC 62443等網路安全標準要求韌體從設計之初就具備安全性。隨著工廠向無人營運轉型,直流馬達市場受益於許多交流電機所不具備的精細控制優勢。

與交流感應馬達相比,初始成本較高

直流馬達解決方案的購置成本通常比同類交流感應馬達高出15%至30%,這在資金預算緊張的環境中難以推廣應用。新興經濟體的中小型企業優先考慮短期融資,而兩年的投資回收期阻礙了許多無刷直流馬達改造計劃。儘管供應商推出了與節能檢驗掛鉤的月租模式,但這些模式依賴可靠的智慧電錶數據和長期契約,這引起了部分客戶的抵觸情緒。經濟放緩加劇了客戶的猶豫不決,也成為限制直流馬達市場擴張的最新阻力。

細分市場分析

預計到2025年,無刷直流馬達(BLDC)將佔直流馬達市場62.75%的佔有率,並在2031年之前以10.02%的複合年成長率成長,鞏固其穩固的市場主導地位。內環式設計在冷卻風扇、燃油泵和機器人等領域佔據主導地位,可實現緊湊的尺寸和高轉速性能。外轉子式設計則透過降低變速箱損耗和提高可靠性,在直驅式空調和輪轂馬達應用中具有優勢。隨著稀土元素供應趨於穩定,永久磁鐵的優勢超過了成本風險,確保其在高階應用中的持續普及。

在對成本要求較高的家用電器、起動馬達和電動工具領域,有刷馬達仍然很受歡迎,因為其簡單的驅動電子元件和豐富的維修經驗仍然具有吸引力。然而,電刷磨損會限制關鍵任務環境中的運作,促使原始設備製造商 (OEM) 將產品升級藍圖轉向無感測器無刷直流馬達 (BLDC)。 48V 車載輔助系統的日益普及推動了能夠利用再生能量的電子換向設計的發展。電動車幫浦和線控轉向系統持續採用無刷馬達設計,正穩步推動直流馬達市場向無刷技術創新轉型。

額定功率為 75-750W 的馬達廣泛應用於輸送機、暖通空調鼓風機和小型工業泵浦等眾多領域,預計到 2025 年將佔DC馬達市場規模的 46.05%。標準化的封裝尺寸和全球通用的 IEC 法蘭提高了相容性,並降低了原始設備製造商 (OEM) 的換型成本。大批量訂單使製造商能夠最佳化自動化並降低成本,從而鞏固了該細分市場的領先地位。

功率超過75kW的馬達正以9.51%的複合年成長率高速成長,這主要得益於電動車驅動裝置、大型太陽能追蹤系統以及需要精確、高扭力控制的重型工業伺服等應用。整合式編碼器、溫度感測器和碳化矽逆變器帶來的效率提升,使其價格溢價物有所值。同時,功率低於75W的馬達則主要應用於消費性電子產品領域,在這些領域,小型化、低噪音和電池最佳化比絕對能量轉換效率的提升更為重要。整體而言,各個功率頻寬的趨勢都支撐著直流馬達市場的強勁成長。

區域分析

亞太地區將繼續保持領先地位,預計到2025年將佔全球收入的44.00%。在中國,大型垂直整合企業正在自主生產磁鐵、繞組和逆變器。在印度,與生產掛鉤的激勵政策正在吸引汽車和工業電機的新產能,而日本和韓國則憑藉其在精密工程領域的聲譽,為電子和機器人行業供應微型電機。這些結構性優勢將確保該地區在預測期後仍將是DC馬達市場的關鍵區域。

北美正經歷穩定成長,這得益於聯邦政府對清潔能源製造業的稅額扣抵以及旨在擴大國內電機生產線的回流計劃。墨西哥的汽車產業走廊正在吸收近岸零件外包項目,從而加強跨境供應鏈。加拿大的礦業和能源產業正在滿足特殊需求,指定使用堅固耐用的無刷直流驅動裝置用於遠端作業。

到2031年,南美洲將以9.18%的複合年成長率引領市場成長。巴西和阿根廷正在運作大型太陽能和風力發電廠,這些電廠需要高扭力直流馬達用於迴轉驅動裝置和變槳控制系統。巴西的工業現代化計畫將促進自動化計劃,而在地採購政策也將鼓勵新建電機工廠。歐洲市場仍將效率放在第一位。德國正在推動機械出口採用IE4+標準,北歐國家則在離岸風力發電引入高壓無刷直流馬達。區域差異疊加,為直流馬達市場的相關人員帶來了不同的風險。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速推廣電動車

- 向節能型工業自動化轉型

- 暖通維修改造對無刷直流風扇和鼓風機的需求不斷成長

- 政府對高效率馬達的激勵措施

- 輕型車輛48V電氣系統結構

- 支援物聯網的智慧型DC馬達模組

- 市場限制

- 與交流感應馬達相比,初始成本較高

- 稀土元素磁鐵供應鏈波動

- 高開關頻率驅動裝置中的EMC/EMI合規性挑戰

- 緊湊型高功率設計中的溫度控管局限性

- 產業價值/價值鏈分析

- 監管現狀和標準

- 技術展望(邊緣運算和人工智慧分析)

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過電機技術

- 有刷直流電機

- 分支纏繞

- 串聯繞組

- 複合繞組

- 永磁直流 (PMDC)

- 無刷直流(BLDC)電機

- 內環無刷直流電機

- 外轉子無刷直流電機

- 有刷直流電機

- 透過輸出

- 小於75瓦

- 75-750 W

- 0.75-75 kW

- 超過75千瓦

- 按電壓等級

- 低於60伏

- 60-300 V

- 超過300伏

- 按最終用途行業分類

- 汽車/運輸設備

- 工業機械及自動化

- 空調和冷凍

- 家用電子電器和家用電器

- 醫療和醫療設備

- 石油、天然氣和採礦

- 水和污水處理

- 可再生能源系統

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Allied Motion Technologies Inc.

- AMETEK Inc.

- Arc Systems Inc.

- Buhler Motor GmbH

- Delta Electronics Inc.

- FAULHABER Group

- Franklin Electric Co., Inc.

- Johnson Electric Holdings Limited

- Maxon Motor AG

- MinebeaMitsumi Inc.

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Portescap SA

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Siemens AG

- Toshiba International Corporation

- WEG SA

- Yaskawa Electric Corporation

第7章 市場機會與未來展望

DC motor market size in 2026 is estimated at USD 31.44 billion, growing from 2025 value of USD 29.01 billion with 2031 projections showing USD 46.95 billion, growing at 8.37% CAGR over 2026-2031.

This robust DC motor market growth rides on electric-vehicle penetration, Industry 4.0 automation, and widening renewable-energy deployments. Brushless DC (BLDC) motors are displacing brushed designs because they cut maintenance, elevate efficiency, and support smart-control functions. Manufacturers strengthen supply chains for rare-earth magnets while experimenting with ferrite alternatives to contain costs. Strategic investments in 48 V automotive systems, IoT-enabled predictive maintenance, and high-power drives for wind and solar tracking broaden adoption opportunities. Asia-Pacific dominates the DC motor market thanks to its manufacturing concentration and policy support, whereas South America registers the fastest revenue acceleration due to utility-scale solar and wind installations.

Global Direct Current (DC) Motor Market Trends and Insights

Accelerating Adoption of Electric Vehicles

Soaring battery-electric and hybrid production reshapes DC motor demand as traction, thermal-management, and auxiliary systems switch to BLDC designs for tighter torque control and higher power density. Tesla's permanent-magnet strategy validated cost and efficiency advantages and prompted mainstream OEMs to follow suit. European carbon-reduction rules intensify the shift, while China bolsters domestic capacity through subsidies for integrated motor-drive lines. Although rare-earth sourcing remains a vulnerability, vertical integration by BYD and supply-reward programs under the U.S. Inflation Reduction Act mitigate immediate risks. Combined, these forces keep the DC motor market on a steep electrification trajectory.

Transition to Energy-Efficient Industrial Automation

Manufacturers embracing Industry 4.0 invest in intelligent DC drives that feed live health metrics into plant clouds. Siemens MindSphere deployments show unplanned downtime cuts of up to 30% when BLDC motors stream vibration and temperature data into predictive-maintenance algorithms. ABB retrofittable smart sensors widen addressable installed bases, enabling lifecycle optimization beyond new-equipment sales. The combination of rising labor costs in Asia and stricter emission rules in the EU strengthens value propositions, while cybersecurity standards such as IEC 62443 dictate secure-by-design firmware. As factories target lights-out operations, the DC motor market benefits from control granularity unavailable in many AC alternatives.

Higher Upfront Cost vs. AC Induction Alternatives

DC solutions often command 15-30% higher purchase prices than comparable AC induction units, impeding uptake where capital budgets are tight. Small and midsize enterprises in emerging economies prioritize near-term cash preservation, so two-year payback hurdles rule out many BLDC retrofits. Vendors introduce leasing models tying monthly fees to verified energy savings, yet these structures depend on reliable smart-meter data and long contracts that some customers resist. Economic slowdowns amplify hesitancy, creating short-term headwinds that temper the DC motor market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Growing HVAC Retrofit Demand for BLDC Fans and Blowers

- Government Incentives for High-Efficiency Motors

- Supply-Chain Volatility of Rare-Earth Magnets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The BLDC segment claimed 62.75% of the DC motor market in 2025 and is tracking toward a 10.02% CAGR up to 2031, underscoring its entrenched leadership. Inner-rotor variants dominate cooling fans, fuel pumps, and robotics, delivering compact form factors and high rpm ceilings. Outer-rotor architectures conquer direct-drive HVAC and wheel-motor roles by slashing gearbox losses and boosting reliability. As rare-earth supply stabilizes, permanent-magnet strengths outnumber cost risks, which sustains premium adoption.

Brushed motors linger in cost-sensitive appliances, starter motors, and workshop tools where simple drive electronics and ample service expertise still appeal. Even so, brush wear limits uptime in mission-critical environments, steering OEM roadmaps toward sensorless BLDC upgrades. The push toward 48 V automotive auxiliaries shines a spotlight on electronically commutated designs able to exploit regenerative energy. Continuous design wins in EV pumps and steer-by-wire systems keep the DC motor market tilted firmly toward brushless innovations.

Motors rated 75-750 W captured 46.05% of the DC motor market size in 2025, thanks to ubiquity across conveyors, HVAC blowers, and small industrial pumps. Standardized footprints and global IEC flanges ease interchangeability, shrinking switching costs for OEMs. High-volume orders help manufacturers optimize automation and squeeze cost curves, reinforcing segment dominance.

Motors above 75 kW show a leading 9.51% CAGR as EV traction, utility-scale trackers, and heavy industrial servos request precise high-torque control. Integrated encoders, thermal sensors, and SiC-based inverters extract additional efficiency, justifying premium prices. At the other end, sub-75 W designs serve consumer electronics where miniaturization, low noise, and battery optimization trump absolute energy-conversion gains. Altogether, diverse power-band dynamics safeguard a resilient DC motor market.

The Direct Current (DC) Motor Market Report is Segmented by Motor Technology (Brushed DC Motors, and Brushless DC Motors), Power Rating (Less Than 75W, 75-750W, 0. 75-75kW, and More), Voltage Class (Less Than 60V, 60-300V, and Greater Than 300V), End-Use Industry (Automotive, Industrial, HVAC, Consumer Electronics, Healthcare, Water Treatment, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retains the crown with 44.00% of 2025 revenue as China's vertically integrated giants internalize magnet, winding, and inverter production. Production-linked incentives in India invite fresh capacity for automotive and industrial motors, while Japan and South Korea leverage precision-engineering reputations to supply micro-motors for electronics and robotics. These structural advantages ensure the region remains the anchor of the DC motor market well beyond the forecast horizon.

North America posts steady gains amid federal credits for clean-energy manufacturing and reshoring moves that expand domestic motor lines. Mexico's automotive corridor absorbs nearshored parts programs, strengthening the cross-border supply chain. Canada's mining and energy sectors specify rugged BLDC drives for remote operations, underpinning specialized demand.

South America leads growth at a 9.18% CAGR into 2031 as Brazil and Argentina commission utility-scale solar and wind arrays that require slew drives and pitch systems using high-torque DC motors. Industrial modernization programs in Brazil add automation projects, and local content rules encourage greenfield motor plants. Europe remains an efficiency-first market; Germany pushes IE4+ adoption in machinery exports, while Nordic countries deploy high-voltage BLDC units in offshore wind farms. Collectively, regional nuances diversify risk for DC motor market stakeholders.

- ABB Ltd.

- Allied Motion Technologies Inc.

- AMETEK Inc.

- Arc Systems Inc.

- Buhler Motor GmbH

- Delta Electronics Inc.

- FAULHABER Group

- Franklin Electric Co., Inc.

- Johnson Electric Holdings Limited

- Maxon Motor AG

- MinebeaMitsumi Inc.

- Nidec Corporation

- Oriental Motor Co., Ltd.

- Portescap SA

- Regal Rexnord Corporation

- Robert Bosch GmbH

- Siemens AG

- Toshiba International Corporation

- WEG S.A.

- Yaskawa Electric Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating adoption of electric vehicles

- 4.2.2 Transition to energy-efficient industrial automation

- 4.2.3 Growing HVAC retrofit demand for BLDC fans and blowers

- 4.2.4 Government incentives for high-efficiency motors

- 4.2.5 48-V electrical architectures in light-duty vehicles

- 4.2.6 IoT-enabled smart DC motor modules

- 4.3 Market Restraints

- 4.3.1 Higher upfront cost vs. AC induction alternatives

- 4.3.2 Supply-chain volatility of rare-earth magnets

- 4.3.3 EMC/EMI compliance hurdles for high-switch-frequency drives

- 4.3.4 Thermal-management limits in compact high-power designs

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook (Edge and AI analytics)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Motor Technology

- 5.1.1 Brushed DC (BDC) Motors

- 5.1.1.1 Shunt Wound

- 5.1.1.2 Series Wound

- 5.1.1.3 Compound Wound

- 5.1.1.4 Permanent-Magnet DC (PMDC)

- 5.1.2 Brushless DC (BLDC) Motors

- 5.1.2.1 Inner-Rotor BLDC

- 5.1.2.2 Outer-Rotor BLDC

- 5.1.1 Brushed DC (BDC) Motors

- 5.2 By Power Rating (Output)

- 5.2.1 Less than 75 W

- 5.2.2 75 - 750 W

- 5.2.3 0.75 - 75 kW

- 5.2.4 Greater than 75 kW

- 5.3 By Voltage Class

- 5.3.1 Less than 60 V

- 5.3.2 60 - 300 V

- 5.3.3 Greater than 300 V

- 5.4 By End-Use Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Industrial Machinery and Automation

- 5.4.3 HVAC and Refrigeration

- 5.4.4 Consumer Electronics and Appliances

- 5.4.5 Healthcare and Medical Devices

- 5.4.6 Oil, Gas and Mining

- 5.4.7 Water and Wastewater

- 5.4.8 Renewable Energy Systems

- 5.4.9 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Allied Motion Technologies Inc.

- 6.4.3 AMETEK Inc.

- 6.4.4 Arc Systems Inc.

- 6.4.5 Buhler Motor GmbH

- 6.4.6 Delta Electronics Inc.

- 6.4.7 FAULHABER Group

- 6.4.8 Franklin Electric Co., Inc.

- 6.4.9 Johnson Electric Holdings Limited

- 6.4.10 Maxon Motor AG

- 6.4.11 MinebeaMitsumi Inc.

- 6.4.12 Nidec Corporation

- 6.4.13 Oriental Motor Co., Ltd.

- 6.4.14 Portescap SA

- 6.4.15 Regal Rexnord Corporation

- 6.4.16 Robert Bosch GmbH

- 6.4.17 Siemens AG

- 6.4.18 Toshiba International Corporation

- 6.4.19 WEG S.A.

- 6.4.20 Yaskawa Electric Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment