|

市場調查報告書

商品編碼

1911321

電動自行車馬達:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)E-bike Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

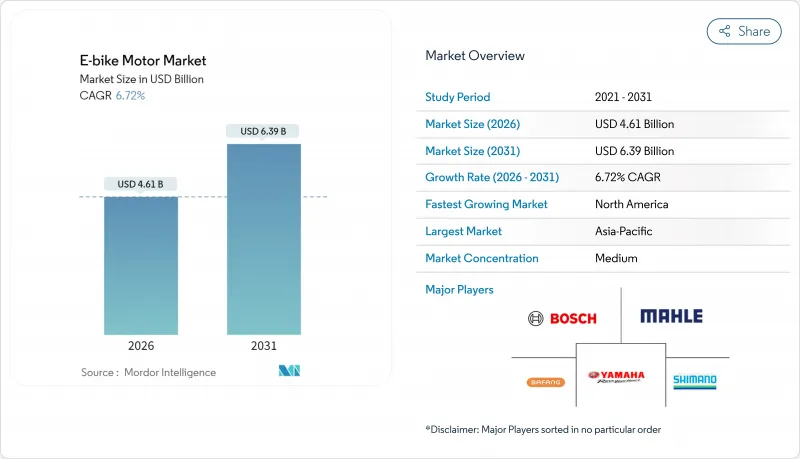

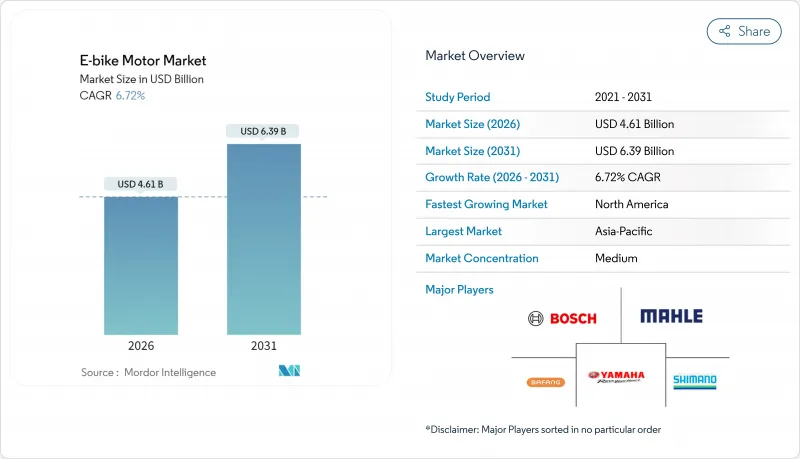

2025年電動自行車馬達市場價值為43.2億美元,預計到2031年將達到63.9億美元,高於2026年的46.1億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 6.72%。

隨著都市區碳減量法規日益嚴格、物流公司車輛電氣化程度不斷提高以及原始設備製造商 (OEM) 擴大採用軟體定義驅動單元,市場需求正在加速成長。雖然電動自行車馬達市場受益於電池價格的下降,但由於稀土元素磁鐵價格波動,其利潤率面臨壓力,迫使供應商考慮使用氮化鐵和鐵氧體等替代材料。產業整合的加速,例如Yamaha與 Bros 的合作以及博世智慧系統產品組合的擴展,標誌著產業正向垂直整合解決方案轉型,這種解決方案結合了硬體和空中軟體更新 (OTA)。儘管亞太地區仍然是主要的生產中心,但北美對高功率、帶油門控制功能的車型的需求正在推動對當地組裝的新投資。

全球電動自行車馬達市場趨勢與洞察

城市通勤者的需求迅速成長

企業自行車租賃專案正在創造巨大且可預測的需求,並提高馬達供應商的最低品質標準。稅收優惠政策使終端用戶成本降低高達 40%,並促使消費者偏好配備車載互聯功能的優質驅動單元。隨著租賃業務在法國和北歐國家的擴張,電動自行車馬達市場基於 3-4 年的車隊更新週期,擁有穩定且類似年金的銷售量。馬達製造商正利用這種穩定性來證明增加研發投入的合理性,尤其是在能夠減少停機時間的基於人工智慧的診斷技術方面。主要城市通勤專用電動自行車道的普及進一步鞏固了市場需求。

歐盟和中國收緊二氧化碳排放目標

歐洲車輛排放氣體法規和中國GB 17761-2024標準的變更迫使供應商將重點放在提高每公斤效率而非峰值功率。博世鎂合金機殼的Performance Line CX Gen 5馬達在保持85牛頓米扭矩的同時,重量減輕了100克。中國現在要求整合電池管理系統、防篡改硬體和衛星定位系統,這為擁有先進軟體技術的企業提供了激勵,同時也對價格分佈組裝提出了懲罰。這些法規正在加速產業從鉛酸電池向鋰電池的轉型,並鞏固了對相應馬達電子產品的需求。雖然合規成本增加,但領先採用者獲得了領先優勢,並能進入高度監管的市場,從而提升了其在電動自行車馬達市場的品牌價值。

依賴釹磁鐵

中國加工了全球約85%的稀土元素產量,這使得電機整車製造商極易受到出口限制和現貨價格飆升的影響。在中國境外建立加工設施需要多年的資本投資和環境核准,進一步延長了這種脆弱性。此外,應對複雜的法規結構和確保永續的供應鏈也加劇了這項挑戰。由於磁鐵供應波動帶來的利潤風險,電動自行車馬達市場正翹首期盼氮化鐵和鐵氧體等替代材料的規模化應用,這些材料有望在長期內提供更穩定、更具成本效益的解決方案。

細分市場分析

到2025年,輪轂式馬達將憑藉低成本、即插即用安裝便利性和廣泛普及等優勢,保持其在電動自行車馬達市場67.58%的佔有率。然而,中置馬達預計將以8.36%的複合年成長率成長,並憑藉更最佳化的重量分配和傳動系統協同效應,重塑高階市場格局。輪轂式馬達創新者正積極應對,推出諸如無離合器滑行和密封多速變速箱等創新功能,以期在經濟型城市自行車市場繼續保持競爭力。

零件採購方式的變化凸顯了這個趨勢。汽車級供應商正在引入專有的扭矩感測器堆疊和基於ASIC的控制器,以提高中置馬達的效率。韌體更新將使用戶能夠選擇功率映射,進一步提升個人化程度。輪轂馬達系統將在入門級市場和共享出行車隊中佔據主導地位,而高利潤的中置馬達平台將攫取巨額利潤,加劇電動自行車馬達市場的分化。

到2025年,城市通勤自行車將佔電動自行車總銷量的42.86%,並將持續到2020年代中期,成為電動自行車馬達市場規模的支柱。地方政府建造專用車道以及提高對雇主的稅收優惠政策,是推動市場基本需求的主要因素。同時,電動山地自行車(e-MTB)的出貨量將以8.02%的複合年成長率(CAGR)實現最快成長,這主要得益於其高牽引扭力、自適應懸吊以及29吋底盤標準。專為山地自行車設計的馬達配備了氣壓感測器,可根據坡度調節功率輸出,從而提高電池效率。城市車隊車型則強調耐候性和預測性維護警報功能,有助於減少配送公司的停機時間。

這兩個細分市場的價格彈性不同,電動山地自行車的平均售價約為通勤車型的1.7倍,證明了高性能馬達的必要性。城市平台推動了大規模生產,降低了電子元件的單位成本,進而對高性能電動山地自行車產生了積極影響。這種良性循環維持了兩個細分市場的銷售成長,並增強了電動自行車馬達市場的整體實力。

區域分析

亞太地區將在2025年佔據全球市場78.05%的佔有率,這主要得益於中國從稀土元素礦開採到最終組裝的完整供應鏈。預計到2024年,中國電動二輪車出口額將超過400億元人民幣(約55億美元),充分展現了該地區強大的生產能力。日本提供高品質的動力傳動系統技術,而印度則透過與武藏精密等公司的合資企業,迅速崛起為組裝中心。區域性優惠政策(例如降低增值稅和都市區堵塞附加稅)正在推動國內市場的發展,提升出口競爭力,鞏固亞太地區作為電動自行車動力傳動系統市場基地的地位。

到2031年,北美將維持9.14%的最高成長率,這主要得益於消費者偏好轉向高功率、油門控制的車型。聯邦政府的獎勵策略和各州政府的補貼計畫支持國內製造業,推動了產能擴張,例如eBliss Global在紐約的工廠。各州監管政策的差異為可自訂韌體和模組化控制器設計創造了利基市場。企業車隊的電氣化和不斷擴大的越野車道進一步豐富了需求結構,提升了該地區在電動自行車馬達市場的重要性。

歐洲是一個成熟且充滿創新活力的市場。儘管受宏觀經濟不利因素影響,預計2024年銷量將有所下降,但憑藉其嚴格的EN 15194認證要求,該地區仍保持著技術主導。德國的租賃計劃正在整個地區擴展,推動了對高規格驅動系統的穩定訂單。供應鏈本地化舉措,包括在匈牙利建立電池工廠和在波蘭建立驅動單元工廠,旨在減少對亞洲的依賴。在政策制定者討論統一限速標準之際,歐洲原始設備製造商(OEM)正在提升250W功率範圍內的馬達效率,從而鞏固其在全球電動自行車馬達市場的高階品牌地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 城市通勤者迅速接受電動自行車

- 歐盟和中國嚴格的二氧化碳排放目標推動輕型電動推進系統的發展

- 披薩外送和小包裹配送車隊迅速轉向電動自行車

- OEM廠商對整合智慧馬達和感測器組件的需求

- 為貨運和山地自行車Start-Ups創業融資

- 創新磁性材料可減少稀土元素用量40%

- 市場限制

- 馬達和電池組合的初始成本較高

- 釹鐵硼磁鐵供應鏈中的脆弱性

- 消防安全召回導致保費上漲

- 各國電動自行車限速政策的差異導致平台推出延遲。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依馬達類型

- 輪轂式馬達

- 中置馬達

- 電動自行車

- 城市/都市區

- 電動山地自行車/EMTB

- E-Cargo

- 按額定輸出

- 小於250瓦

- 250~500 W

- 500瓦或以上

- 按銷售管道

- 原始設備製造商/工廠設備

- 售後市場/維修

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bafang Electric(Suzhou)Co., Ltd.

- Robert Bosch GmbH

- Shimano Inc.

- Yamaha Motor Co., Ltd.

- TDCM Corporation Limited

- Panasonic Holdings Corporation

- Nidec Corporation

- Mahle GmbH

- Suzhou Xiongda Electric Machine Co., Ltd.

- Jiangsu Dapu Motor Co., Ltd.

- TranzX

- Ananda Drive Techniques(Shanghai)Co., Ltd.

- Yadea Technology Group Co., Ltd.

- SportTech GmbH

- Valeo SA

- Polini Motori SpA

- Fazua GmbH

- TQ-Systems GmbH

- Wuxi Truckrun Motor Co., Ltd.

第7章 市場機會與未來展望

The e-bike motor market was valued at USD 4.32 billion in 2025 and estimated to grow from USD 4.61 billion in 2026 to reach USD 6.39 billion by 2031, at a CAGR of 6.72% during the forecast period (2026-2031).

Demand accelerates as cities tighten carbon-reduction mandates, logistics firms electrify fleets, and OEMs roll out software-defined drive units. The e-bike motor market benefits from falling battery prices, yet faces margin pressure from rare-earth magnet volatility that prompts suppliers to explore iron-nitride and ferrite alternatives. Intensifying consolidation-the Yamaha-Brose deal and Bosch's expanding smart-system portfolio-signals a shift toward vertically integrated offerings that blend hardware with over-the-air software. Asia-Pacific remains the primary production hub, but North America's appetite for high-power, throttle-enabled models drives fresh investment in local assembly lines.

Global E-bike Motor Market Trends and Insights

Soaring Urban-Commuter Uptake

Corporate bike-leasing programs fuel predictable, bulk demand that raises minimum quality thresholds for motor suppliers. Tax incentives lower end-user costs by up to 40%, channeling consumer preference toward premium drive units with onboard connectivity. As leasing spreads to France and the Nordics, the e-bike motor market secures an annuity-like volume stream anchored by fleet replacement cycles of three to four years. Motor makers leverage this stability to justify higher R&D outlays, especially for AI-based diagnostics that cut downtime. The growth of commuter e-bike lanes in major cities further reinforces baseline demand.

Stricter EU and China CO2 Targets

Revised European vehicle-emission rules and China's GB 17761-2024 standard press suppliers to maximize efficiency per kilogram, rather than peak wattage. Bosch's magnesium-housing Performance Line CX Gen 5 trims 100 g in weight yet maintains 85 Nm torque. China now mandates embedded battery-management systems, anti-tamper hardware, and satellite positioning, rewarding firms with advanced software stacks and penalizing low-end assemblers. These rulebooks also accelerate the industry's shift from lead-acid to lithium packs, cementing demand for compatible motor electronics. Compliance costs rise, but early movers gain a head start and access to high-regulation markets, reinforcing their brand equity in the e-bike motor market.

Dependence on NdFeB Magnets

China processes roughly 85% of global rare-earth output, leaving motor OEMs vulnerable to export restrictions and spot-price spikes. Setting up processing facilities beyond China's borders demands years of capital investment and environmental approvals, extending the period of vulnerability. This challenge is compounded by the complexities of navigating regulatory frameworks and securing sustainable supply chains. As the e-bike motor market grapples with margin risks linked to magnet supply fluctuations, it awaits the scaling of iron-nitride or ferrite alternatives, which could provide a more stable and cost-effective solution in the long term.

Other drivers and restraints analyzed in the detailed report include:

- OEM Push for Smart Integrated Systems

- Electrification of Delivery Fleets

- Speed-Cap Policy Divergence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hub motors retained a 67.58% e-bike motor market share in 2025, underpinned by low cost, plug-and-play installation, and widespread availability. Yet mid-drive units, projected to register an 8.36% CAGR, are reshaping premium categories through improved weight distribution and drivetrain synergy. Hub innovators answer back with features such as clutch-free coasting and sealed multi-speed gearboxes, prolonging their relevance in budget city bikes.

Shifts in component sourcing underscore the trajectory. Automotive-grade suppliers bring in IP-protected torque-sensor stacks and ASIC-based controllers that elevate mid-drive efficiency. Firmware updates enable user-selectable power maps, furthering personalization. While hub systems will dominate volume for entry-level and shared-mobility fleets, margin-rich mid-drive platforms will capture outsized profit pools, reinforcing the two-tier structure within the e-bike motor market.

Urban commuting bikes accounted for 42.86% of sales in 2025 and remain the anchor of the e-bike motor market size through mid-decade. City authorities add protected lanes and extend employer tax perks, magnifying baseline demand. At the same time, e-MTB shipments exhibit the fastest 8.02% CAGR as high-traction torque and adaptive suspension merge with 29-inch chassis standards. Motors designed for mountain bikes integrate barometric sensors to modulate power based on gradient, improving battery utilization. Fleet urban models emphasize weather sealing and predictive maintenance alerts that cut downtime for couriers.

The two segments differ on price elasticity; e-MTBs command ASPs approximately 1.7 times that of commuter units, justifying richer motor features. Urban platforms drive scale production, pushing down per-unit electronics cost, which then trickles into performance-oriented e-MTBs. This virtuous loop helps sustain volume growth across both segments, reinforcing the the overall robustness of the e-bike motor market.

The E-Bike Motor Market Report is Segmented by Motor Type (Hub Motor and Mid-Drive Motor), E-Bike Type (Urban/City, E-Mountain/EMTB, and E-Cargo), Power Rating (Below 250W, 250-500W, and Above 500W), Sales Channel (OEM/Factory-fit and Aftermarket/Retrofit), and Geography (North America, South America, Europe, Asia-Pacific, and the Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 78.05% share in 2025 due to China's end-to-end supply chain that spans rare-earth mining to final assembly. Chinese electric two-wheeler exports exceeded CNY 40 billion (USD 5.5 billion) in 2024, underscoring regional capacity. Japan contributes premium drivetrain engineering, and India emerges as a fast-growing assembly node via joint ventures such as Musashi Seimitsu's partnership for integrated powertrains. Regional incentives-reduced VAT and urban congestion levies-bolster domestic ownership and export competitiveness, solidifying Asia-Pacific as the cornerstone of the e-bike motor market.

North America exhibits the fastest 9.14% CAGR through 2031 as consumer preferences tilt toward high-power, throttle-enabled models. Federal stimulus for domestic manufacturing and state-level rebates spur capacity additions like eBliss Global's New York plant. Regulatory heterogeneity across states creates niches for adaptable firmware and modular controller designs. Corporate fleet conversions and expanding trail access further diversify demand profiles, enhancing regional significance to the e-bike motor market.

Europe presents a mature but innovation-rich arena. Although unit sales tapered in 2024 amid macro headwinds, the continent remains technology-leading due to rigorous EN 15194 certification requirements. German leasing programs expand across the bloc, funneling steady orders for high-spec drive systems. Supply-chain localization efforts, notably battery-cell plants in Hungary and drive-unit factories in Poland, aim to offset Asian dependencies. As policymakers debate speed-cap harmonization, European OEMs refine motor efficiency within 250 W boundaries, reinforcing their premium brand cachet in the global e-bike motor market.

- Bafang Electric (Suzhou) Co., Ltd.

- Robert Bosch GmbH

- Shimano Inc.

- Yamaha Motor Co., Ltd.

- TDCM Corporation Limited

- Panasonic Holdings Corporation

- Nidec Corporation

- Mahle GmbH

- Suzhou Xiongda Electric Machine Co., Ltd.

- Jiangsu Dapu Motor Co., Ltd.

- TranzX

- Ananda Drive Techniques (Shanghai) Co., Ltd.

- Yadea Technology Group Co., Ltd.

- SportTech GmbH

- Valeo S.A.

- Polini Motori S.p.A.

- Fazua GmbH

- TQ-Systems GmbH

- Wuxi Truckrun Motor Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring Urban-Commuter Adoption of E-Bikes

- 4.2.2 Stricter EU and China CO2 Targets Favoring Lightweight Electric Propulsion

- 4.2.3 Rapid Transition of Pizza/Parcel Delivery Fleets To E-Bikes

- 4.2.4 OEM Demand for Integrated Smart-Motor and Sensor Packages

- 4.2.5 Venture Funding into Mid-Drive Start-Ups for Cargo and MTB Niches

- 4.2.6 Magnet-Material Breakthroughs Cut Rare-Earth Use by 40%

- 4.3 Market Restraints

- 4.3.1 High Upfront Motor/Battery Pairing Cost

- 4.3.2 Supply-Chain Vulnerability for NdFeB Magnets

- 4.3.3 Fire-Safety Recalls Triggering Insurance Premium Hikes

- 4.3.4 National E-Bike Speed-Cap Policy Divergence Delaying Platform Launches

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Motor Type

- 5.1.1 Hub Motor

- 5.1.2 Mid-drive Motor

- 5.2 By E-Bike Type

- 5.2.1 Urban / City

- 5.2.2 E-Mountain / EMTB

- 5.2.3 E-Cargo

- 5.3 By Power Rating

- 5.3.1 Below 250 W

- 5.3.2 250 - 500 W

- 5.3.3 Above 500 W

- 5.4 By Sales Channel

- 5.4.1 OEM / Factory-fit

- 5.4.2 Aftermarket / Retrofit

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Netherlands

- 5.5.3.7 Russia

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Bafang Electric (Suzhou) Co., Ltd.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Shimano Inc.

- 6.4.4 Yamaha Motor Co., Ltd.

- 6.4.5 TDCM Corporation Limited

- 6.4.6 Panasonic Holdings Corporation

- 6.4.7 Nidec Corporation

- 6.4.8 Mahle GmbH

- 6.4.9 Suzhou Xiongda Electric Machine Co., Ltd.

- 6.4.10 Jiangsu Dapu Motor Co., Ltd.

- 6.4.11 TranzX

- 6.4.12 Ananda Drive Techniques (Shanghai) Co., Ltd.

- 6.4.13 Yadea Technology Group Co., Ltd.

- 6.4.14 SportTech GmbH

- 6.4.15 Valeo S.A.

- 6.4.16 Polini Motori S.p.A.

- 6.4.17 Fazua GmbH

- 6.4.18 TQ-Systems GmbH

- 6.4.19 Wuxi Truckrun Motor Co., Ltd.