|

市場調查報告書

商品編碼

1844328

電動自行車驅動裝置市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測E-Bike Drive Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

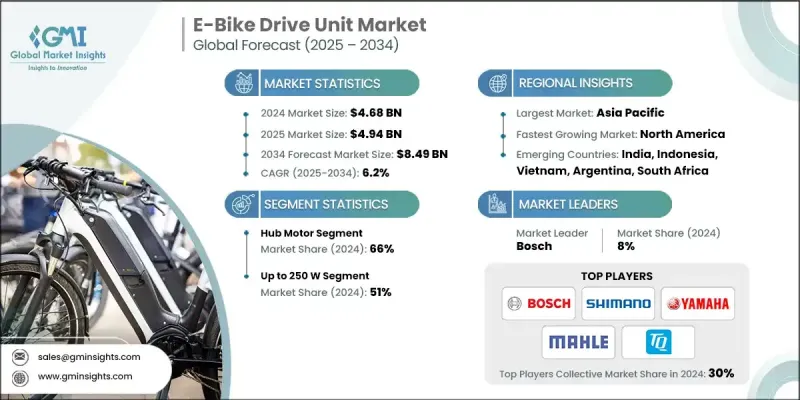

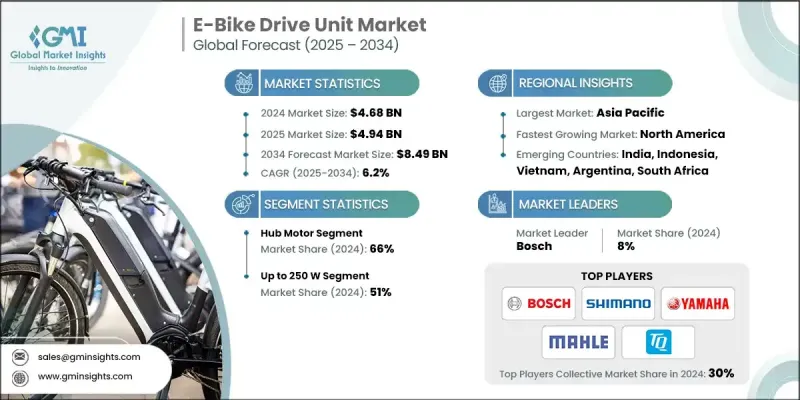

2024 年全球電動自行車驅動裝置市場價值為 46.8 億美元,預計將以 6.2% 的複合年成長率成長,到 2034 年達到 84.9 億美元。

隨著電動車日益成為主流,對高效能智慧驅動系統的需求持續成長。這些驅動裝置結合了馬達、控制系統和感測器,可為電動自行車提供輔助或全程動力,從而提升使用者體驗。多年來,技術已從基本的輪轂馬達發展到整合電子元件和軟體的複雜系統。驅動裝置通常配備扭力感測器、再生煞車和智慧互聯功能,使其高效智慧,適用於各種地形和城市道路。中置驅動裝置因其均衡的重量分佈、更佳的扭矩以及與現有傳動系統的無縫整合,在徒步自行車、山地自行車和貨運自行車中越來越受歡迎。模組化電池設計和互聯功能的改進正在提升這些系統的整體價值。原始設備製造商 (OEM) 主導供應鏈,為自行車製造商提供完整的解決方案,並在產品開發過程中建立重要的合作關係。雖然改裝套件和替換馬達的售後市場存在,但它僅佔總收入的一小部分,大部分銷售額來自OEM製造商主導的製造管道。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46.8億美元 |

| 預測值 | 84.9億美元 |

| 複合年成長率 | 6.2% |

2024年,輪轂馬達市場佔66%的市場佔有率,預計到2034年將以5.5%的複合年成長率成長。輪轂馬達可內建於前輪或後輪,設計簡化,所需組件更少,從而降低生產和維護成本。它們獨立於自行車傳動系統運行,是城市通勤者和入門級騎行者的理想選擇。這種分離有助於減少鏈條和飛輪的磨損,進一步縮短維護週期。其經濟實惠且操作簡便的特點使其非常適合城市騎行應用。

2024年,功率高達250瓦的電動自行車驅動裝置佔了51%的市場佔有率,預計2025年至2034年的複合年成長率將達到5.2%。這些裝置構成了全球電動自行車馬達的主要組成部分,並符合主要地區的監管標準。大多數市場,尤其是北美、日本和歐洲,將電動自行車驅動裝置的連續額定功率限制在250瓦。這種監管協調鼓勵大規模採用,確保合規性,同時滿足大多數騎乘者的動力需求。

亞太地區電動自行車驅動單元市場佔38%的市場佔有率,2024年市場規模達17.8億美元。該地區的政府政策和戰略性城市規劃正在加速電動出行的轉型。在一些國家,電動自行車的待遇與傳統自行車類似,這減少了監管摩擦,並提高了使用者的使用率。旨在補貼電動自行車購買的大規模公共項目也在推動驅動單元需求方面發揮了重要作用,尤其是在廣泛零售網路支持的情況下。

活躍於電動自行車驅動單元市場的主要公司包括禧瑪諾、雅馬哈、八方、通盛電機、博世、博澤、大普電機、TQ集團、法雷奧和馬勒。這些公司正在採取多種策略來鞏固其市場地位。公司專注於研發,以提高扭力響應、電池效率和智慧整合。許多公司已經擴大了與OEM) 的合作夥伴關係,以確保其驅動單元能夠應用於高階高性能電動自行車。針對通勤、健行和貨運等不同用例的可客製化驅動系統正在幫助品牌擴大其消費者群體。應用程式連接和無線更新等智慧功能的整合正成為競爭格局中的關鍵差異化因素。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預報

- 研究假設和局限性

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 城市擁擠和通勤挑戰

- 政府激勵和補貼

- 健身與環保生活方式的興起

- 驅動系統的技術進步

- 擴大電動自行車共享和租賃服務

- 燃油價格和車輛擁有成本上漲

- 產業陷阱與挑戰

- 先進驅動裝置成本高

- 充電基礎設施有限

- 市場機會

- 輕量化、緊湊型驅動裝置的開發

- 智慧互聯技術的融合

- 新興市場的擴張

- 貨運和多功能電動自行車的成長

- 成長動力

- 成長潛力分析

- 專利分析

- 波特的分析

- PESTEL分析

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 人工智慧自適應控制系統

- 機器學習整合能力

- 預測性維護和故障預防

- 能源最佳化和範圍擴展

- 無線充電整合和基礎設施

- 固態電池整合的影響

- 車輛到電網整合和能源服務

- 自主和自平衡系統

- 新興技術

- 當前的技術趨勢

- 價格趨勢

- 按地區

- 按產品

- 投資與融資趨勢分析

- 安全實施策略

- 硬體安全模組整合

- 加密通訊協定

- 安全啟動和韌體保護

- 入侵偵測和回應系統

- 監管格局

- 資料保護法規合規性

- 網路安全框架要求

- 業界特定的安全標準

- 認證和審核要求

- 診斷工具和設備要求

- 製造商特定的診斷系統

- 服務設備標準化

- 永續性和 ESG 影響分析

- 永續性和 ESG 影響分析

- 社會影響力和社區關係

- 治理與企業責任

- 保固服務和成本分析

- 保固範圍比較

- 保固索賠分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 市場進入策略

- 客戶滿意度基準測試

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按馬達支架,2021 - 2034

- 主要趨勢

- 輪轂馬達

- 後部

- 正面

- 中置驅動馬達

第6章:市場估計與預測:依產能,2021 - 2034

- 主要趨勢

- 高達 250 瓦

- 250 瓦 - 550 瓦

- 550瓦以上

第7章:市場估計與預測:按應用,2021 - 2034

- 主要趨勢

- 貨運自行車

- 高達 250W

- 250瓦 - 550瓦

- 550W以上

- 健行自行車

- 高達 250W

- 250瓦 - 550瓦

- 550W以上

- 城市自行車

- 高達 250W

- 250瓦 - 550瓦

- 550W以上

第8章:市場估計與預測:依分佈,2021 - 2034

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 菲律賓

- 泰國

- 韓國

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- 全球參與者

- Bosch

- Shimano

- Brose (Acquired by Yamaha)

- Yamaha

- Valeo

- Mahle

- Dapu Motors

- 區域參與者

- Fazua

- TQ-Group

- Pinion

- Zehus

- SHINWIN

- Ananda Drive Technology

- Bafang

- Tongsheng Motor

- 新興參與者/顛覆者

- To7 Motor

- Tamobyke

- Karmina E-bike

- GOBAO

- Suzhou Shengyi Motor

- SEG Automotive

The Global E-Bike Drive Unit Market was valued at USD 4.68 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 8.49 billion by 2034.

As electric mobility becomes more mainstream, the demand for efficient and intelligent drive systems continues to rise. These drive units combine motors, control systems, and sensors that assist or fully power the e-bike, improving user experience. Over the years, technology has evolved from basic hub motors to sophisticated systems with integrated electronics and software. Drive units often feature torque sensors, regenerative braking, and intelligent connectivity, making them highly efficient and smarter for varied terrains and urban use. Mid-drive units are increasingly popular in trekking, mountain, and cargo bikes due to their balanced weight distribution, better torque, and seamless integration with existing drivetrains. Improvements in modular battery design and connectivity features are driving up the overall value of these systems. OEMs dominate the supply chain, offering complete solutions to bicycle manufacturers and forming critical partnerships during product development. Although the aftermarket for conversion kits and replacement motors exists, it contributes only a small portion to total revenue, with most sales rooted in OEM-led manufacturing channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.68 Billion |

| Forecast Value | $8.49 Billion |

| CAGR | 6.2% |

In 2024, the hub motor segment held a 66% share and is projected to grow at a CAGR of 5.5% through 2034. Built into either the front or rear wheel, hub motors offer a simplified design that requires fewer components, lowering both production and maintenance costs. Their independent operation from the bike's drivetrain makes them ideal for urban commuters and entry-level riders. This separation helps reduce wear on chains and cassettes, further improving maintenance cycles. Their affordability and simplicity keep them highly relevant for city-focused applications.

The e-bike drive units up to 250 W segment held a 51% share in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2034. These units represent the bulk of e-bike motors globally and align with regulatory standards in key regions. Most markets, especially in North America, Japan, and Europe limit e-bike drive units to a continuous power rating of 250 W. This regulatory alignment encourages mass adoption, ensuring compliance while meeting the power needs of most riders.

Asia Pacific E-Bike Drive Unit Market held 38% share and generated USD 1.78 billion in 2024. Government policies and strategic urban planning across the region are accelerating the shift to e-mobility. In several countries, e-bikes are treated similarly to traditional bicycles, reducing regulatory friction and increasing user adoption. Large-scale public programs aimed at subsidizing e-bike purchases have also played a major role in boosting demand for drive units, especially when supported through wide-reaching retail networks.

Key companies active in the E-Bike Drive Unit Market include Shimano, Yamaha, Bafang, Tongsheng Motor, Bosch, Brose, Dapu Motors, TQ-Group, Valeo, and Mahle. These players are adopting multiple strategies to strengthen their market position. Companies are focusing on R&D to improve torque response, battery efficiency, and intelligent integration. Many have expanded OEM partnerships to ensure their units are adopted in premium and performance e-bikes. Customizable drive systems for different use cases, commuting, trekking, and cargo, are helping brands widen their consumer base. Integration of smart features such as app connectivity and over-the-air updates is becoming a key differentiator in a competitive landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Motor mounting

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 Distribution

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future-outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factors affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urban congestion and commuting challenges

- 3.2.1.2 Government incentives and subsidies

- 3.2.1.3 Growth in fitness and eco-conscious lifestyles

- 3.2.1.4 Technological advancements in drive systems

- 3.2.1.5 Expansion of e-bike sharing and rental services

- 3.2.1.6 Rising fuel prices and vehicle ownership costs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced drive units

- 3.2.2.2 Limited charging infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Development of lightweight, compact drive units

- 3.2.3.2 Integration of smart and connected technologies

- 3.2.3.3 Expansion in emerging markets

- 3.2.3.4 Growth of cargo and utility e-bikes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Growth potential analysis

- 3.8 Regulatory landscape

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

- 3.11 Technology and innovation landscape

- 3.11.1 Current technological trends

- 3.11.1.1 AI-powered adaptive control systems

- 3.11.1.2 Machine learning integration capabilities

- 3.11.1.3 Predictive maintenance & failure prevention

- 3.11.1.4 Energy optimization & range extension

- 3.11.1.5 Wireless charging integration & infrastructure

- 3.11.1.6 Solid-state battery integration impact

- 3.11.1.7 Vehicle-to-grid integration & energy services

- 3.11.1.8 Autonomous & self-balancing systems

- 3.11.2 Emerging technologies

- 3.11.1 Current technological trends

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By product

- 3.13 Investment & funding trends analysis

- 3.14 Security implementation strategies

- 3.14.1 Hardware security module integration

- 3.14.2 Encrypted communication protocols

- 3.14.3 Secure boot & firmware protection

- 3.14.4 Intrusion detection & response systems

- 3.15 Regulatory landscape

- 3.15.1 Data protection regulation compliance

- 3.15.2 Cybersecurity framework requirements

- 3.15.3 Industry-specific security standards

- 3.15.4 Certification & audit requirements

- 3.16 Diagnostic tools & equipment requirements

- 3.16.1 Manufacturer-specific diagnostic systems

- 3.16.2 Service equipment standardization

- 3.17 Sustainability & ESG impact analysis

- 3.17.1 Sustainability & ESG impact analysis

- 3.17.2 Social impact & community relations

- 3.17.3 Governance & corporate responsibility

- 3.18 Warranty service & cost analysis

- 3.18.1 Warranty coverage comparison

- 3.18.2 Warranty claim analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Go-to-market strategies

- 4.7 Customer satisfaction benchmarking

- 4.8 Key developments

- 4.8.1 Mergers & acquisitions

- 4.8.2 Partnerships & collaborations

- 4.8.3 New product launches

- 4.8.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Motor Mounting, 2021 - 2034 (USD Bn, Million Units)

- 5.1 Key trends

- 5.2 Hub motor

- 5.2.1 Rear

- 5.2.2 Front

- 5.3 Mid-drive motor

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034 (USD Bn, Million Units)

- 6.1 Key trends

- 6.2 Up to 250 W

- 6.3 250 W - 550 W

- 6.4 Above 550 W

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Bn, Million Units)

- 7.1 Key trends

- 7.2 Cargo bike

- 7.2.1 Up to 250W

- 7.2.2 250W - 550W

- 7.2.3 Above 550W

- 7.3 Trekking bike

- 7.3.1 Up to 250W

- 7.3.2 250W - 550W

- 7.3.3 Above 550W

- 7.4 City/urban bike

- 7.4.1 Up to 250W

- 7.4.2 250W - 550W

- 7.4.3 Above 550W

Chapter 8 Market Estimates & Forecast, By Distribution, 2021 - 2034 (USD Bn, Million Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Bn, Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Indonesia

- 9.4.6 Philippines

- 9.4.7 Thailand

- 9.4.8 South Korea

- 9.4.9 Singapore

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Bosch

- 10.1.2 Shimano

- 10.1.3 Brose (Acquired by Yamaha)

- 10.1.4 Yamaha

- 10.1.5 Valeo

- 10.1.6 Mahle

- 10.1.7 Dapu Motors

- 10.2 Regional Players

- 10.2.1 Fazua

- 10.2.2 TQ-Group

- 10.2.3 Pinion

- 10.2.4 Zehus

- 10.2.5 SHINWIN

- 10.2.6 Ananda Drive Technology

- 10.2.7 Bafang

- 10.2.8 Tongsheng Motor

- 10.3 Emerging Players / Disruptors

- 10.3.1. To7 Motor

- 10.3.2 Tamobyke

- 10.3.3 Karmina E-bike

- 10.3.4 GOBAO

- 10.3.5 Suzhou Shengyi Motor

- 10.3.6 SEG Automotive