|

市場調查報告書

商品編碼

1911294

日本電力:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Japan Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

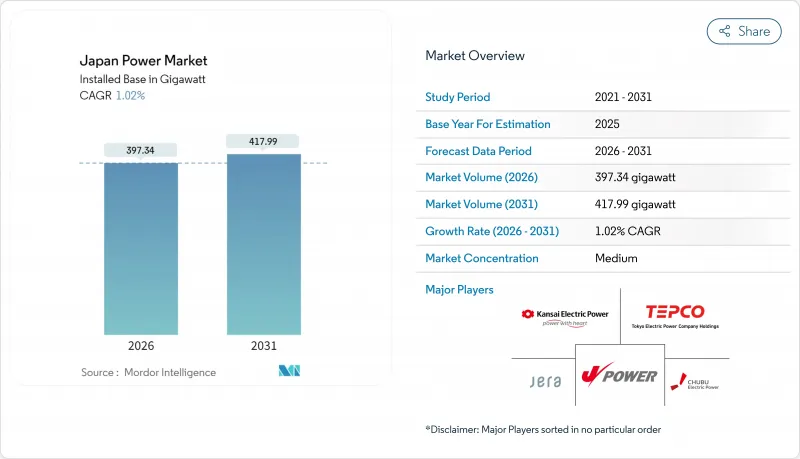

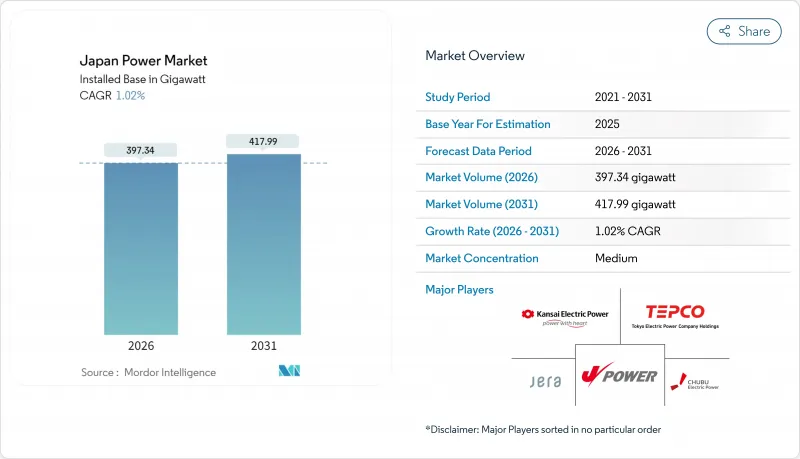

預計到 2026 年,日本電力市場規模將達到 397.34 吉瓦,高於 2025 年的 393.33 吉瓦。

預計到 2031 年,發電量將達到 417.99 吉瓦,2026 年至 2031 年的複合年成長率為 1.02%。

穩定的成長率正在醞釀結構性變革。政府正將1兆美元的綠色轉型(GX)預算用於擴大可再生能源、運作核能發電廠以及建造高壓直流(HVDC)互聯系統,從而將歷史上分散的50Hz和60Hz電網整合到一個統一的商業市場中。太陽能光電(PV)成本的下降、強勁的離岸風競標以及電網級電池部署的加速,都加劇了傳統液化天然氣(LNG)電廠的競爭壓力。同時,一項氫氣-氨氣混燒試點計畫已經啟動,旨在對沖燃料價格風險。此外,日本內閣也設定了2040年可再生能源佔比達到40-50%、核能發電佔比達到20%的目標,以確保高耗能半導體和人工智慧產業叢集的能源供應。在人口減少但用電量高峰仍存在的都市區走廊中,企業對企業購電協議 (PPA)、智慧電錶數據分析和需量反應計畫透過電網柔軟性貨幣化,進一步加速了這些變化。

日本電力市場趨勢與洞察

降低光學模組和安裝成本

組件價格已從2018年的17.6日圓/千瓦時降至2024年多競標後低於8日圓/千瓦時,這使得批發市場無需補貼即可實現競爭。硬體價格的下降和軟成本效率的提高正推動該技術擺脫對上網電價補貼的依賴,轉向基於競價的定價模式。隨著屋頂光電和農光互補系統的普及,競標曲線也不斷演變,這些系統避開了土地稀缺的問題。像村田製作所這樣的製造商已透過虛擬購電協議(PPA)獲得了70兆瓦的裝置容量,以滿足RE100的目標,並將需求錨定在工業園區。電池價格的下降正日益將白天的太陽能用電高峰轉移到晚間,擠壓調峰電廠的利潤空間,並重塑容量市場動態。

擴大離岸風電競標管道

第三競標於2024年12月舉行,最終以每千瓦時3日圓(約30日圓)的價格得標1吉瓦項目,證實了其與傳統發電方式的成本競爭力。浮體式基礎技術繞過了近岸水深限制,實現了深海域開發,而由日本能源研究協會(JERA)主導的團隊正在開發抗颱風平台。政府為保障電網安全制定的指南將海底租賃與電網建設相結合,從而消除了傳統的瓶頸。目前正在開發混合模式,由歐洲開發商轉移在惡劣環境下的專業知識,日本公司提供企劃案融資,從而建立國內供應鏈。能否實現2030年10吉瓦的目標,將取決於與漁業相關人員的談判進度以及港口基礎設施的建設。

液化天然氣價格波動與進口依賴性

日本能源進口依賴高達96%,液化天然氣現貨價格的突然上漲導致隔日電價突破每度1美元,對電力公司的利潤率帶來壓力。儘管自2014年核能發電恢復以來,液化天然氣消費量已下降25%,但日本的能源依賴度仍然很高。公司已開始將已簽訂合約的貨物轉售至海外,這表明需求正在結構性下降。同時,九州電力公司正在美國投資建造出口終端,以對沖價格波動風險。目前,氨和氫的混燒試驗正在進行中,但尚未達到商業規模。

細分市場分析

預計到2025年,可再生能源在日本電力市場的佔有率將達到40.05%,並在2031年之前保持3.72%的複合年成長率,這主要得益於太陽能和離岸風電的快速發展。太陽能光電發電累積裝置容量已達91吉瓦,主要得益於組件價格的下降和商業購電協議(PPA)的普及。離岸風電目前僅有0.3吉瓦的運作資產,但隨著政府設定在2030年達到10吉瓦、到2040年達到45吉瓦的支持目標,預計離岸風電將成為所有能源中絕對成長速度最快的。地熱能和生質能由於許可證限制和進口原料成本較高,目前仍處於小眾市場。

預計到2025年,火力發電在日本電力市場仍佔51.80%的佔有率,但不斷上漲的碳價和強制性氨氣混燒正對其長期經濟可行性構成壓力。日本能源研究機構(JERA)在其裝置容量為4.1吉瓦的碧南燃煤發電廠開展的試點項目成功實現了20%的氨氣混燒率,政府計劃到2030年在所有電廠推廣這項技術,這將需要每年進口300萬噸氨氣。核電預計將於2024年運作,核能發電為826兆瓦,隨著民眾接受度的提高,核電可望逐步實現20%的發電佔有率目標。水力發電裝置容量保持穩定,約50吉瓦,因為新建水壩工程面臨環境法規的限制。這些市場佔有率的波動表明,日本電力市場的投資正在轉移到低碳設施。

日本電力市場報告按能源類型(火力發電、核能、可再生能源)和終端用戶(電力公司、工商業用戶、住宅)進行細分。市場規模和預測以裝置容量(GW)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 降低光學模組和安裝成本

- 擴大離岸風力發電競標管道

- 根據GX政策運作核子反應爐

- 電網級電池成本下降

- 重工業的購電協議(PPA)需求

- 智慧電錶部署和需量反應的潛力

- 市場限制

- 液化天然氣價格波動與進口依賴性

- 公用事業太陽能用地短缺

- 老化的輸電設施和核准程序延誤

- 當地居民反對新建高壓輸電線路

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- PESTEL 分析

第5章 市場規模與成長預測

- 透過電源

- 火力發電(煤炭、天然氣、石油/天然氣、柴油)

- 核能

- 可再生能源(太陽能、風能、水能、地熱能、生質能/廢棄物、潮汐能)

- 最終用戶

- 公用事業

- 商業和工業

- 住宅

- 按輸配電和電壓等級(僅定性分析)

- 高壓輸電(230千伏特或更高)

- 二次輸電(69 至 161 千伏特)

- 中壓輸電(13.2 至 34.5 千伏特)

- 低壓輸電(1千伏特或以下)

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- Tokyo Electric Power Company Holdings(TEPCO)

- Kansai Electric Power Company

- Chubu Electric Power

- Hokkaido Electric Power

- Tohoku Electric Power

- Hokuriku Electric Power

- Chugoku Electric Power

- Shikoku Electric Power

- Kyushu Electric Power

- Okinawa Electric Power

- JERA Co., Inc.

- Electric Power Development Co.(J-POWER)

- Japan Renewable Energy Corporation

- Hitachi Energy

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Sumitomo Corporation(Renewables)

- Marubeni Corporation(Power)

- Mitsubishi Heavy Industries(Energy)

- Orsted Japan KK

第7章 市場機會與未來展望

Japan Power Market size in 2026 is estimated at 397.34 gigawatt, growing from 2025 value of 393.33 gigawatt with 2031 projections showing 417.99 gigawatt, growing at 1.02% CAGR over 2026-2031.

Steady headline growth conceals structural change: policy now channels the USD 1 trillion Green Transformation (GX) budget into renewable build-out, nuclear restarts, and high-voltage direct-current (HVDC) interties that knit the historically fragmented 50 Hz/60 Hz grids into one commercial arena. Declining solar photovoltaic (PV) costs, offshore wind auction momentum, and accelerating grid-scale battery storage sharpen competitive pressure on legacy liquefied natural gas (LNG) plants, while hydrogen and ammonia co-firing pilots begin hedging fuel-price risk. Energy Storage News. At the same time, Japan's Cabinet now targets a 40-50% renewable share and a 20% nuclear contribution by 2040 to secure supply for energy-intensive semiconductor and artificial-intelligence clusters. Corporate power-purchase agreements (PPAs), smart-meter data analytics, and demand-response programs amplify these shifts by monetizing grid flexibility in urban corridors where consumption peaks persist despite population decline.

Japan Power Market Trends and Insights

Declining PV Module & Installation Costs

Module prices fell from 17.6 yen/kWh in 2018 to below 8 yen/kWh for several 2024 bids, letting solar compete in wholesale markets without subsidies. Hardware deflation and streamlined soft costs now move the technology from feed-in-tariff reliance toward auction-based price discovery. This cost curve dovetails with rooftop and agrivoltaic deployment that circumvents land scarcity. Manufacturers such as Murata locked 70 MW through virtual PPAs to meet RE100 goals, anchoring demand in industrial corridors. As battery prices drop, midday solar peaks increasingly shift into evening demand, eroding peaking-plant margins and reshaping capacity-market dynamics.

Offshore Wind Auction Pipeline Expansion

Round-3 tenders in December 2024 awarded 1 GW at JPY 3/kWh, confirming cost parity with conventional generation. Floating foundations unlock deeper waters and sidestep coastal depth constraints, with JERA-led groups targeting typhoon-resilient platforms. Government grid-reservation directives now coordinate seabed leases with transmission build-outs, mitigating a historic bottleneck. European developers transfer harsh-environment know-how, while Japanese trading houses supply project finance in a hybrid model that builds domestic supply chains. Resolution of fishing-industry consultations and port-infrastructure upgrades will decide whether the sector can hit the 10 GW by 2030 milestone.

LNG Price Volatility & Import Reliance

Japan imports 96% of its energy, so LNG spot surges once drove day-ahead power prices above USD 1/kWh, compressing utility margins. Although nuclear restarts cut LNG burn 25% since 2014, residual dependency persists. Trading houses now resell contracted cargoes abroad, signalling structural demand erosion, while Kyushu Electric pursues upstream stakes in US export terminals to hedge volatility. Co-firing ammonia or hydrogen is under trial but lacks commercial scale.

Other drivers and restraints analyzed in the detailed report include:

- Nuclear Reactor Restarts Under GX Policy

- Grid-Scale Battery Storage Cost Declines

- Limited On-Shore Land for Utility Solar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The renewables slice of the Japan power market size climbed to 40.05% in 2025 and is tracking a 3.72% CAGR through 2031 as solar and offshore wind scale rapidly. Solar alone reached 91 GW cumulative capacity, bolstered by low module prices and merchant PPA uptake. Offshore wind holds just 0.3 GW of operating assets but 10 GW of government-backed targets by 2030 and up to 45 GW by 2040, setting the stage for the fastest absolute growth among resources. Geothermal and biomass remain niche due to permitting limits and imported feedstock costs.

Thermal generation defended 51.80% Japan's power market share in 2025, yet escalating carbon prices and ammonia co-firing mandates pressure long-term economics. JERA's pilot at the 4.1 GW Hekinan coal plant blends 20% ammonia, and government policy seeks fleet-wide adoption by 2030, requiring 3 million t of annual imports. Nuclear restarts added 826 MW in 2024 and will climb toward the 20% generation share goal if community consent improves. Hydropower remains flat at roughly 50 GW because new dam sites face environmental limits. Collectively, shifting shares underscore how investment is tilting toward zero-carbon capacity within the Japan power market.

The Japan Power Market Report is Segmented by Power Source (Thermal, Nuclear, and Renewables) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Tokyo Electric Power Company Holdings (TEPCO)

- Kansai Electric Power Company

- Chubu Electric Power

- Hokkaido Electric Power

- Tohoku Electric Power

- Hokuriku Electric Power

- Chugoku Electric Power

- Shikoku Electric Power

- Kyushu Electric Power

- Okinawa Electric Power

- JERA Co., Inc.

- Electric Power Development Co. (J-POWER)

- Japan Renewable Energy Corporation

- Hitachi Energy

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Sumitomo Corporation (Renewables)

- Marubeni Corporation (Power)

- Mitsubishi Heavy Industries (Energy)

- Orsted Japan K.K.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining PV Module & Installation Costs

- 4.2.2 Offshore Wind Auction Pipeline Expansion

- 4.2.3 Nuclear Reactor Restarts Under GX Policy

- 4.2.4 Grid-Scale Battery Storage Cost Declines

- 4.2.5 Corporate PPA Demand from Heavy Industry

- 4.2.6 Smart-Meter Roll-Out & Demand-Response Upside

- 4.3 Market Restraints

- 4.3.1 LNG Price Volatility & Import Reliance

- 4.3.2 Limited On-Shore Land for Utility Solar

- 4.3.3 Ageing Transmission Assets & Permitting Delays

- 4.3.4 Local Opposition to New High-Voltage Lines

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Power Source

- 5.1.1 Thermal (Coal, Natural Gas, Oil and Diesel)

- 5.1.2 Nuclear

- 5.1.3 Renewables (Solar, Wind, Hydro, Geothermal, Biomass & Waste, Tidal)

- 5.2 By End User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By T&D Voltage Level (Qualitative Analysis only)

- 5.3.1 High-Voltage Transmission (Above 230 kV)

- 5.3.2 Sub-Transmission (69 to 161 kV)

- 5.3.3 Medium-Voltage Distribution (13.2 to 34.5 kV)

- 5.3.4 Low-Voltage Distribution (Up to 1 kV)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Tokyo Electric Power Company Holdings (TEPCO)

- 6.4.2 Kansai Electric Power Company

- 6.4.3 Chubu Electric Power

- 6.4.4 Hokkaido Electric Power

- 6.4.5 Tohoku Electric Power

- 6.4.6 Hokuriku Electric Power

- 6.4.7 Chugoku Electric Power

- 6.4.8 Shikoku Electric Power

- 6.4.9 Kyushu Electric Power

- 6.4.10 Okinawa Electric Power

- 6.4.11 JERA Co., Inc.

- 6.4.12 Electric Power Development Co. (J-POWER)

- 6.4.13 Japan Renewable Energy Corporation

- 6.4.14 Hitachi Energy

- 6.4.15 Mitsubishi Electric Corporation

- 6.4.16 Toshiba Energy Systems & Solutions

- 6.4.17 Sumitomo Corporation (Renewables)

- 6.4.18 Marubeni Corporation (Power)

- 6.4.19 Mitsubishi Heavy Industries (Energy)

- 6.4.20 Orsted Japan K.K.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Progress in Japan's Offshore Wind Power Sector

- 7.3 Grid Digitalisation & Advanced Analytics

- 7.4 Hydrogen/Ammonia Co-Firing in Thermal Plants