|

市場調查報告書

商品編碼

1910944

雷射打標:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Laser Marking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

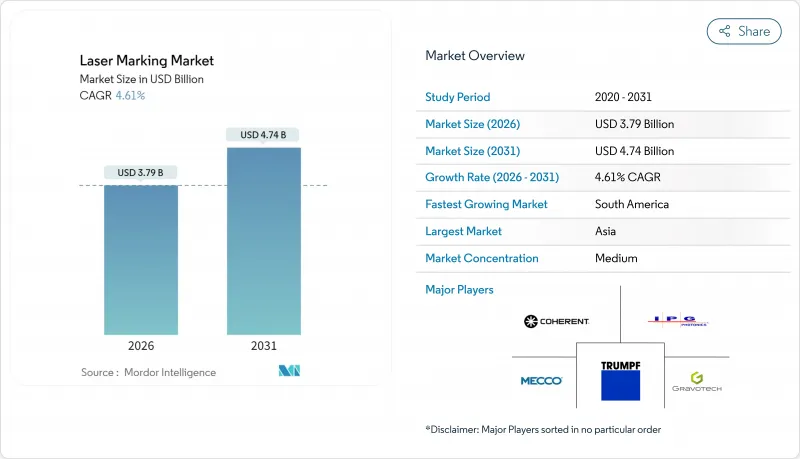

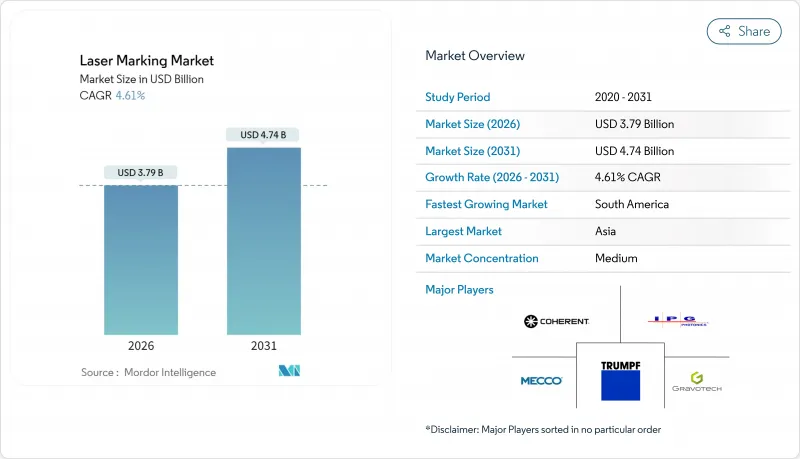

預計雷射打標市場將從 2025 年的 36.2 億美元成長到 2026 年的 37.9 億美元,到 2031 年將達到 47.4 億美元,2026 年至 2031 年的複合年成長率為 4.61%。

全球法規強制要求對設備進行永久性標識,電動車電池生產需求不斷成長,以及微型電子產品和永續封裝對精度要求日益提高,這些因素共同推動了市場成長。由於本土供應商的准入門檻較低,亞洲在裝機量方面繼續佔據主導地位,而以服務主導的經營模式在北美和歐洲正蓬勃發展。來自中國光纖雷射製造商的價格壓力正在擠壓硬體利潤空間,但軟體和預測性維護服務仍然盈利。航太複合材料、珠寶飾品印記和工業自動化等領域的新應用正在擴大基本客群,而高昂的資本投入則限制一些小規模製造商的發展。

全球雷射打標市場趨勢與洞察

醫療設備強制性UDI(唯一設備識別碼)和可追溯性法規推動了永久性標記的普及。

美國FDA和歐盟醫療設備法規(MDR)制定的嚴格的醫療設備標識(UDI)框架,使得永久性、高對比的器材編碼成為一項法律要求。醫院需要反覆對器械進行消毒,因此標記必須能夠承受磨損、化學物質和高溫。光纖和紫外線雷射系統能夠滿足鈦植入、聚合物導管和陶瓷組件的這些耐久性要求。與製造執行系統(MES)的直接連接也簡化了合規性審核。藥品序列化法規正在推動需求成長,進而促進無需耗材即可列印複雜2D矩陣的雷射系統的整體生產線整合。能夠將標記硬體和檢驗軟體結合的供應商可以縮短您的認證週期並降低召回風險。

電動車電池產量快速成長,推動了對非接觸式標記的需求。

目前,超級工廠會在每個電芯、模組和電池組上標記一個唯一的代碼,用於召回和回收管理。雷射技術能夠以生產線速度完成這種識別,且無需接觸敏感的機殼,從而避免顆粒污染和機械應力。光纖雷射用於標記鋁製機殼,而紫外線光束則用於將代碼印刻在聚合物隔膜和軟性電路上。中國、韓國和美國對能夠每小時標記數千件產品的高速視覺引導設備的需求正在迅速成長。電池生產線整合商正擴大將可追溯性模組與焊接和檢測站整合在一起,以實現端到端的流程可視性。

高額資本投資是中小企業進入新興市場的障礙。

整合視覺和物聯網連接的工業級系統通常售價超過15萬美元,這超出了拉丁美洲和非洲小型製造商的現金流能力。匯率波動推高了進口成本,而當地的融資利率又增加了額外的壓力。攜帶式低成本光纖設備雖然入門價格較低,但缺乏汽車和醫療行業所需的精度和運作保證。租賃和按收費付費的合約正變得越來越普遍,但在第三方服務網路成熟之前,預計其普及速度將較為緩慢。

細分市場分析

到2025年,光纖雷射將佔雷射打標市場收入的61.95%,這主要得益於其可靠性、高能效以及高速標記大多數金屬的能力。汽車動力傳動系統部件、外科手術器械和航太緊固件等行業都依賴光纖光束進行深而清晰的標記,這些標記能夠承受惡劣環境的考驗。隨著亞洲和歐洲工業4.0相關維修的加速,光纖雷射打標市場預計將穩定成長。紫外線雷射目前僅佔收入的一小部分,但由於對軟性電路基板和玻璃蓋等精細基材上的微標記的需求不斷成長,預計到2031年,紫外線雷射器的年複合成長率將達到6.6%。隨著家用電子電器產量比率的提高,工廠正在改裝紫外線加工能力,半導體晶圓廠也開始指定使用355nm光源進行晶圓級標識。

綠光雷射和超快脈衝解決方案在矽晶圓加工和玻璃中介層鑽孔領域佔據著獨特的地位。儘管連貫、通快公司和IPG光電不斷改進光束特性,但中國供應商已經縮小了技術差距,並獲得了價格優勢。如今,視覺引導對準和在線連續檢驗軟體整合已成為供應商之間的差異化因素,而不是光束功率本身。

受汽車和航太產業對深度防篡改標記的需求推動,雕刻過程預計到2025年將佔市場收入的38.15%。光纖系統能夠快速去除材料,確保高對比度和耐久性。同時,除塵和視覺檢驗模組可維持生產效率。退火工藝是成長最快的工藝,複合年成長率達6.85%。醫療設備製造商青睞氧化層的顏色變化,這種變化能夠保持表面光滑無菌。不銹鋼工具和植入物零件對完美表面處理的需求將推動退火雷射打標市場佔有率的成長。

蝕刻和發泡仍然是消費品和包裝生產線的主要工藝,尤其適用於淺層標記。碳化仍然是有機材料(特別是瓦楞紙板和工程木材)的主要標記方法。隨著工廠尋求更靈活的生產線,能夠在單一循環中切換雕刻、退火和蝕刻的多進程頭需求量很大。

區域分析

預計到2025年,亞洲將佔全球收入的46.05%,這主要得益於中國電子和汽車產業叢集的蓬勃發展,以及政府對智慧工廠的大規模支持。漢斯雷射和HGTECH等國內供應商提供價格極具競爭力的光纖設備,擴大了區域加工商和一級零件製造商的市場准入。日本和韓國專注於半導體和電動車電池模組等細分精密加工領域,而印度的認證和藥品編碼政策則正在開拓新的中端市場。隨著製造商尋求可預測的成本和合規性,服務合約的增加正在創造持續的收入來源。

北美市場需求成熟且注重質量,主要集中在航太、醫療設備和汽車VIN碼編碼領域。監管和保固風險促使企業採用經過檢驗的流程監控的高階系統。加拿大企業正在利用雷射編碼技術開發採礦設備,而墨西哥汽車出口工廠則透過在線連續標記進行現代化改造,以滿足美國車輛平台可追溯性標準。由於運作合約彌補了勞動力短缺,服務滲透率很高。

歐洲正努力在實現永續性目標的同時,兼顧嚴格的安全法規。德國動力傳動系統和機械製造商正在採用深雕刻技術,而法國航太工廠則採用超短脈衝光束來製造輕質複合材料。英國和北歐地區的品牌選擇雷射編碼,以減少油墨的使用並降低碳排放。隨著GS1數位連結標準的持續普及,歐洲包裝生產線雷射打標市場正穩步擴張。東歐地區也受惠於近岸外包模式,波蘭和捷克共和國都新增了相關設備。

南美洲將成為成長最快的地區,到2031年複合年成長率將達到5.88%,主要得益於巴西汽車出口和智利礦業自動化。高昂的資本成本和熟練工人短缺正在減緩小規模經濟體採用數位化技術的速度,但租賃模式正開始解決這些障礙。隨著宏觀經濟穩定性的改善,阿根廷和哥倫比亞政府對數位製造業的支持預計將加速其普及。中東和非洲地區呈現溫和成長,海灣國家油氣資產的發現和政府支持的工業園區正在形成需求叢集。然而,政治風險限制著該地區的長期發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 醫療設備強制UDI(唯一設備識別)和可追溯性法規(美國、歐盟、中國)

- 電動車電池產量快速成長,帶動了對非接觸式標記的需求增加。

- 小型化家用電子電器推動亞洲微行銷

- 轉型為永續包裝?歐洲從噴墨列印轉向雷射編碼

- 北美汽車工廠工業4.0的在線連續整合

- 印度推動珠寶飾品鑑定政策數位化

- 市場限制

- 新興市場中小企業的大資本投資(超過15萬美元)

- 航太複合材料認證延誤(對熱影響區 (HAZ) 的擔憂)

- 拉丁美洲工廠熟練工人短缺

- 來自低成本中國光纖雷射供應商的利潤壓力

- 產業生態系分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依雷射類型

- 光纖雷射

- 二氧化碳雷射

- 固體(Nd:YAG、Nd:YVO4)

- 紫外線雷射

- 綠光雷射

- 其他(二極體、YAG、混合式)

- 透過標記過程

- 退火

- 蝕刻

- 雕塑

- 發泡

- 碳化

- 報價

- 硬體

- 獨立系統

- 整合/在線連續系統

- 軟體

- 服務

- 硬體

- 按最終用戶行業分類

- 汽車和航太

- 電子和半導體

- 醫療設備和醫療保健

- 食品/飲料包裝

- 工業機械和工具機

- 珠寶飾品和奢侈品

- 其他產業(石油和天然氣、國防等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 其他南美洲

- 亞太地區

- 中國

- 日本

- 印度

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Coherent Corp.

- IPG Photonics Corp.

- TRUMPF Group

- Han's Laser Technology Co. Ltd.

- Keyence Corp.

- Novanta Inc.(FOBA)

- Videojet Technologies Inc.

- Gravotech Group

- Mecco Partners LLC

- Epilog Laser Inc.

- Trotec Laser GmbH

- LaserStar Technologies Corp.

- SIC Marking Group

- Rofin-Sinar UK Ltd.

- Panasonic Connect Co. Ltd.

- Omron Corporation

- Domino Printing Sciences plc

- SATO Holdings Corp.

- TYKMA Electrox Inc.

- Nichia Corp.

- Control Laser Corp.

第7章 市場機會與未來展望

The laser marking market is expected to grow from USD 3.62 billion in 2025 to USD 3.79 billion in 2026 and is forecast to reach USD 4.74 billion by 2031 at 4.61% CAGR over 2026-2031.

Growth is anchored in global regulations that require permanent device identification, expanding demand from electric vehicle battery production, and rising precision needs across miniaturised electronics and sustainable packaging. Asia continues to dominate installations as domestic suppliers cut entry costs, while service-led business models gain traction in North America and Europe. Pricing pressure from Chinese fiber-laser producers compresses hardware margins, but software and predictive-maintenance services preserve profitability. New use-cases in aerospace composites, jewellery hallmarking, and industrial automation widen the customer base even as high capital requirements constrain some small manufacturers.

Global Laser Marking Market Trends and Insights

Mandatory UDI and Traceability Regulations in Medical Devices Drive Permanent Marking Adoption

Stringent UDI frameworks created by the US FDA and the EU MDR make permanent, high-contrast device codes a legal necessity. Hospitals sterilise instruments repeatedly, so marks must resist abrasion, chemicals, and heat. Fiber and UV systems meet these durability needs on titanium implants, polymer catheters, and ceramic components, while direct connectivity to manufacturing execution systems simplifies compliance audits. Pharmaceutical serialization rules add volume, increasing overall line-integration demand for laser systems that print intricate 2D matrices without consumables. Suppliers that couple marking hardware with validation software shorten customer certification cycles and cut recall exposurre.

Surge in EV Battery Production Accelerates Contact-less Marking Demand

Gigafactories now stamp unique codes on every cell, module, and pack to manage recalls and recycling. Laser technology performs this identification at line speed without touching sensitive housings, avoiding particulate contamination and mechanical stress. Fiber lasers mark aluminum casings, while UV beams code polymer separators and flexible circuits. Demand for high-speed, vision-guided units capable of thousands of marks per hour is escalating across China, Korea, and the United States. Battery line integrators increasingly package traceability modules alongside welding and inspection stations for end-to-end process visibility.

High CAPEX Requirements Constrain SME Adoption in Emerging Markets

Industrial-grade systems with integrated vision and IoT connectivity often list above USD 150,000, exceeding the cashflow capacity of smaller Latin American and African manufacturers. Currency volatility inflates import costs, while local financing rates add further burden. Portable low-cost fiber units reduce entry price yet lack the precision and uptime guarantees demanded by automotive or medical lines. Leasing and pay-per-mark contracts are gaining popularity, but adoption remains gradual until third-party service networks mature

Other drivers and restraints analyzed in the detailed report include:

- Miniaturised Consumer Electronics Drive Micro-marking Precision Requirements

- Sustainable Packaging Shift Favors Laser Coding Over Inkjet Systems

- Qualification Delays for Aerospace Composites Create Validation Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber lasers held 61.95% of revenue in 2025, reflecting their reliability, high wall-plug efficiency, and ability to mark most metals at high speed. Automotive powertrain parts, surgical instruments, and aerospace fasteners rely on fiber beams for deep, legible engravings that survive harsh service. The laser marking market size for fiber systems is projected to expand steadily alongside Industry 4.0 retrofits in Asia and Europe. UV lasers, though smaller in revenue today, are advancing at a 6.6% CAGR through 2031 thanks to demand for micro-marking on sensitive substrates such as flexible circuits and glass covers. Rising yields in consumer electronics push factories to retrofit UV capabilities, while semiconductor fabs specify 355 nm sources for wafer-level ID.

Green and ultrashort-pulse solutions occupy niche roles in silicon wafer processing and glass interposer drilling. Coherent, TRUMPF, and IPG Photonics continue to refine beam characteristics, but Chinese vendors narrow the technology gap and undercut on price. Integration of vision-guided alignment and inline verification software now differentiates suppliers more than raw beam power.

Engraving accounted for 38.15% of market revenue in 2025, driven by automotive and aerospace requirements for deep, tamper-proof marks. Fiber systems remove material quickly, ensuring high contrast and durability, while dust extraction and vision verification modules sustain throughput. Annealing is the fastest-expanding process at a 6.85% CAGR because medical device makers prefer oxide-layer color changes that leave surfaces smooth and sterile. The laser marking market share for annealing rises whenever stainless tools or implantables demand pristine finishes.

Etching and foaming continue to support consumer goods and packaging lines where shallow marks suffice. Carbonisation remains a go-to method for organic materials, especially cardboard and engineered wood. Multi-process heads capable of switching between engraving, annealing, and etching in a single cycle gain popularity as factories seek flexible cells.

The Laser Marking Market Report is Segmented by Laser Type (Fiber Laser, CO2 Laser, Solid-State, UV Laser, and More), Marking Process (Annealing, Etching, Engraving, Foaming, and Carbonisation), Offering (Hardware, Software, and Services), End-User Industry (Automotive and Aerospace, Electronics and Semiconductors, Medical Devices and Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia generated 46.05% of global revenue in 2025, anchored by China's electronics and automotive clusters and supported by large state incentives for smart factories. Domestic suppliers such as Han's Laser and HGTECH sell competitively priced fiber units, widening access for regional job shops and tier-one components firms. Japan and South Korea pursue niche precision applications in semiconductors and EV battery modules, while India's hallmarking and pharmaceutical coding policies open new mid-tier opportunities. Rising service contracts create recurring income streams as manufacturers seek predictable costs and regulatory compliance.

North America's demand is mature and quality-driven, centred on aerospace, medical devices, and automotive VIN coding. Regulations and warranty risk drive adoption of high-end systems with validated process monitoring. Canadian firms leverage laser coding for mining equipment while Mexico's automotive export plants modernise with inline marking to satisfy traceability standards for US vehicle platforms. Service penetration is high as uptime contracts offset labour shortages.

Europe balances sustainability objectives with strict safety regulations. German powertrain and machinery builders rely on deep engraving, while French aerospace plants adopt ultrashort-pulse beams for lightweight composites. Brands across the United Kingdom and the Nordic region choose laser coding to eliminate ink and lower carbon footprints. The laser marking market size attributed to European packaging lines grows steadily as GS1 Digital Link rollouts progress. Eastern Europe benefits from near-shoring, prompting new installations in Poland and the Czech Republic.

South America is the fastest-growing region at a 5.88% CAGR to 2031, led by Brazilian automotive exports and Chilean mining automation. High capital costs and a shortage of trained technicians slow the pace in smaller economies, yet leasing models are starting to remove barriers. Government incentives for digital manufacturing in Argentina and Colombia could accelerate adoption once macroeconomic stability improves. The Middle East and Africa register moderate growth, with oil and gas asset identification and government-backed industrial parks in the Gulf creating demand clusters, although political risk tempers longer-term forecasts.

- Coherent Corp.

- IPG Photonics Corp.

- TRUMPF Group

- Han's Laser Technology Co. Ltd.

- Keyence Corp.

- Novanta Inc. (FOBA)

- Videojet Technologies Inc.

- Gravotech Group

- Mecco Partners LLC

- Epilog Laser Inc.

- Trotec Laser GmbH

- LaserStar Technologies Corp.

- SIC Marking Group

- Rofin-Sinar UK Ltd.

- Panasonic Connect Co. Ltd.

- Omron Corporation

- Domino Printing Sciences plc

- SATO Holdings Corp.

- TYKMA Electrox Inc.

- Nichia Corp.

- Control Laser Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory UDI and traceability regulations in medical devices (US, EU, CN)

- 4.2.2 Surge in EV battery production contact-less marking demand

- 4.2.3 Miniaturised consumer electronics driving micro-marking in Asia

- 4.2.4 Sustainable packaging shift ? laser coding over inkjet in Europe

- 4.2.5 Industry 4.0 inline integration in North-American automotive plants

- 4.2.6 Jewellery hallmarking digitisation policy boost in India

- 4.3 Market Restraints

- 4.3.1 High CAPEX (Above USD 150 k) for SMEs in emerging markets

- 4.3.2 Qualification delay for aerospace composites (HAZ concerns)

- 4.3.3 Skilled-operator shortage in Latin-American factories

- 4.3.4 Margin pressure from low-cost Chinese fiber-laser suppliers

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Laser Type

- 5.1.1 Fiber Laser

- 5.1.2 CO? Laser

- 5.1.3 Solid-State (Nd:YAG, Nd:YVO?)

- 5.1.4 UV Laser

- 5.1.5 Green Laser

- 5.1.6 Others (Diode, YB:YAG, Hybrid)

- 5.2 By Marking Process

- 5.2.1 Annealing

- 5.2.2 Etching

- 5.2.3 Engraving

- 5.2.4 Foaming

- 5.2.5 Carbonisation

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.1.1 Stand-Alone Systems

- 5.3.1.2 Integrated/In-line Systems

- 5.3.2 Software

- 5.3.3 Services

- 5.3.1 Hardware

- 5.4 By End-User Industry

- 5.4.1 Automotive and Aerospace

- 5.4.2 Electronics and Semiconductors

- 5.4.3 Medical Devices and Healthcare

- 5.4.4 Food and Beverage Packaging

- 5.4.5 Industrial Machinery and Machine Tools

- 5.4.6 Jewellery and Luxury Goods

- 5.4.7 Other Industries (Oil and Gas, Defence, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Nordics

- 5.5.2.5 Rest of Europe

- 5.5.3 South America

- 5.5.3.1 Brazil

- 5.5.3.2 Rest of South America

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South-East Asia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Gulf Cooperation Council Countries

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Coherent Corp.

- 6.4.2 IPG Photonics Corp.

- 6.4.3 TRUMPF Group

- 6.4.4 Han's Laser Technology Co. Ltd.

- 6.4.5 Keyence Corp.

- 6.4.6 Novanta Inc. (FOBA)

- 6.4.7 Videojet Technologies Inc.

- 6.4.8 Gravotech Group

- 6.4.9 Mecco Partners LLC

- 6.4.10 Epilog Laser Inc.

- 6.4.11 Trotec Laser GmbH

- 6.4.12 LaserStar Technologies Corp.

- 6.4.13 SIC Marking Group

- 6.4.14 Rofin-Sinar UK Ltd.

- 6.4.15 Panasonic Connect Co. Ltd.

- 6.4.16 Omron Corporation

- 6.4.17 Domino Printing Sciences plc

- 6.4.18 SATO Holdings Corp.

- 6.4.19 TYKMA Electrox Inc.

- 6.4.20 Nichia Corp.

- 6.4.21 Control Laser Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment