|

市場調查報告書

商品編碼

1910858

IT人員配備:市場佔有率分析、產業趨勢與統計資料、成長預測(2026-2031年)IT Staffing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

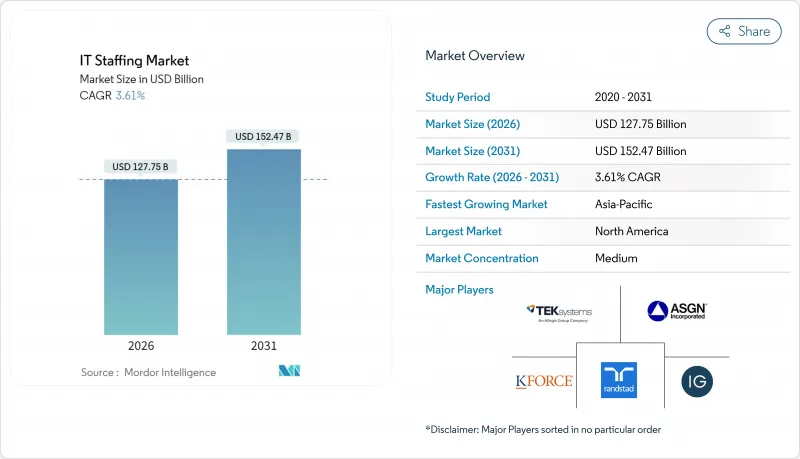

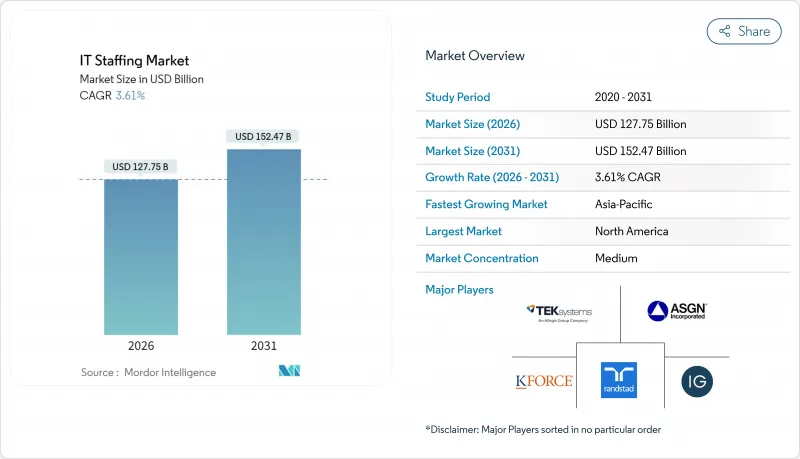

IT 人員配備市場預計將從 2025 年的 1,233 億美元成長到 2026 年的 1,277.5 億美元,預計到 2031 年將達到 1,524.7 億美元,2026 年至 2031 年的複合年成長率為 3.61%。

這種穩定擴張反映出企業正在調整人才策略,從大規模招募轉向專業技能獲取,而雲端運算、人工智慧和網路安全領域的支出重點進一步強化了這一轉變。儘管臨時工和合約工仍然佔據主導地位,但成長正轉向工作說明書(SOW)模式,將交貨風險轉移給服務提供者。對生成式人工智慧工程、邊緣運算和網路彈性的需求正在重塑招聘要求,而持續的全球技能短缺則推高了工資水平。同時,全球2000強企業供應商整合的加劇正在擠壓託管服務供應商的利潤空間,同時又增加了他們在現有客戶中的業務佔有率。

全球IT人才市場趨勢與洞察

加快以人工智慧、雲端運算和物聯網為中心的數位轉型計劃的實施。

在全球科技職位招募中,需要人工智慧或機器學習技能的比例年增了9%至14%。雲端遷移需要專業的DevOps工程師和安全架構師,而預計到2030年將達到1,395.8億美元的邊緣運算投資,則需要能夠整合基礎設施和物聯網技術的人才。 NTT DATA計畫培訓20萬名員工掌握生成式人工智慧技術,進一步顯示了目前技能提升工作的規模。連接人工智慧演算法、雲端資源和設備網路的跨學科企劃團隊正在推動IT人才市場的持續擴張。

不斷擴展的遠距和混合辦公模式需要分散的員工。

戴爾科技公司65%的員工擁有正式的彈性工作安排,顯示基於地理的招募模式將成為常態。雖然雇主可以接觸到更廣泛的人才庫,但他們也必須應對跨國合規問題以及日益成長的薪資平等期望。根據萬寶盛華集團發布的《2025年展望》,41%的公司計劃增加員工,其中技術崗位的需求最為旺盛。競標競標正在全球蔓延,推高了薪資水平,並迫使招聘機構在薪資之外加強人才保留激勵措施。

小眾技術領域持續存在全球技能短缺

預計到2034年,數位技能短缺問題將對全球經濟造成損失,凸顯了量子技術、先進人工智慧和零信任安全等領域專業人才供應的結構性瓶頸。大學在課程更新方面進展緩慢,導致應屆畢業生進入這些專業領域需要數年時間。人才短缺推高了薪資水平,延長了計劃週期,迫使企業投入大量資金進行舉措再培訓,從而削弱了短期投資收益率。

細分市場分析

到2025年,軟體開發人員將佔IT人才市場的37.05%,反映出應用現代化計劃的持續推進。生成式人工智慧工程師預計到2031年將以11.75%的複合年成長率成長,顯示市場對大型語言模型(LLM)的快速設計、模型審核和微調的需求日益成長。隨著邊緣雲端管道的擴展,數據和人工智慧工程領域的IT人才市場規模預計將呈指數級成長。薪資水準表明,企業在提供混合人工智慧開發的專業知識時可以收取較高的溢價。

傳統測試和品質保證人員的角色正面臨自動化帶來的挑戰,許多專業人士正在轉向使用人工智慧驅動的檢驗工具。系統分析師正在提升整合架構方面的技能,而網路專家則在提升人工智慧驅動的威脅監控方面的技能。新興技能(量子開發、區塊鏈架構、物聯網設備安全)正成為IT人才市場中一個規模雖小但成長迅速的細分領域。

到2025年,銀行、金融和保險(BFSI)產業仍將是最大的招募垂直產業,市佔率達24.15%,這主要得益於開放銀行計畫和金融科技平台的升級。醫療保健產業預計將成為成長最快的垂直產業,複合年成長率(CAGR)將達到10.25%,這主要得益於電子健康記錄的現代化和人工智慧輔助診斷技術的應用。遠端醫療和病患資料互通性標準的採用預計將進一步擴大醫療保健計劃IT人才的市場規模。

在製造業領域,智慧工廠部署是重中之重,需要物聯網和預測性維護的人才。零售和電子商務持續建立全通路解決方案,而公共部門機構則為網路安全數位化公民服務撥出預算。能源、汽車和智慧城市計畫屬於「其他產業」類別,每個產業都需要專業技能,並為IT人才市場提供多元化的人才儲備。

區域分析

北美地區預計到2025年將維持44.05%的市場佔有率,這得益於其先進的技術生態系統、大規模的數位化預算和嚴格的安全要求。簽證政策的持續變化和工資的上漲導致人才短缺,進而促使更多業務轉移到加拿大和拉丁美洲。美國主要依靠矽谷的軟體計劃和華爾街的雲端運算革命,而加拿大則在多倫多和蒙特婁等地提供成本優勢。

亞太地區將以8.15%的複合年成長率實現最快成長,主要得益於印度IT服務的擴張、日本的技能提升計劃以及新加坡吸引區域總部入駐。隨著跨國公司採購管道多元化,預計到2024年,該地區年度管理服務合約價值將成長32%。中國的平台復甦和韓國的半導體研發進一步推動了對專業人才的需求。

在歐洲,德國和英國的需求持續穩定,而東歐國家正從單純的成本優勢轉型為專業技術中心。 GDPR合規性使得網路安全需求居高不下。中東和非洲的需求雖然落後,但也呈現穩定成長態勢,其中沙烏地阿拉伯的智慧城市計劃和南非的英語服務中心是顯著的需求來源。經匯率調整後,這些市場之間的薪資差異正在影響全球IT人才市場中供應商的利潤率策略。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場促進因素

- 加快以人工智慧、雲端運算和物聯網為中心的數位轉型計劃的實施。

- 不斷擴展的遠距和混合辦公模式需要分散的員工。

- 強制性網路保險導致對網路安全人才的需求激增。

- 疫情後數位轉型預算的復原將推動對更多人才的需求。

- 生成式人工智慧監理角色(提示工程師、模型審核)的出現

- 全球2000強企業間的供應商整合推動了MSP主導的大宗交易

- 市場限制

- 小眾技術領域持續存在全球技能短缺

- 薪資上漲給託管服務提供者的計費利潤率帶來壓力

- 基於人工智慧的自助招聘平台將淘汰招聘機構。

- 加強數據主權法律將限制跨境人員流動

- 價值鏈分析

- 監管環境

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業生態系分析

- 主要用例和案例研究

- 宏觀經濟趨勢評估

- 投資分析

第5章 市場區隔

- 按技能集

- 軟體開發者

- 測試人員和品質保證工程師

- 系統分析師/業務分析師

- 技術支援專業人員

- 網路與安全專業人員

- 數據與人工智慧工程師

- 其他技能

- 按最終用戶行業分類

- 溝通

- 銀行、金融服務和保險(BFSI)

- 醫療保健和生命科學

- 製造業

- 零售與電子商務

- 政府和公共部門

- 其他行業

- 按服務類型

- 臨時工/合約工

- 全職工作

- 工作說明書(SOW)/企劃為基礎

- 託管服務供應商(MSP)/外包人員

- 按公司規模

- 主要企業

- 小型企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 新加坡

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- TEKsystems Inc.(Allegis Group Holdings Inc.)

- ASGN Incorporated

- Insight Global LLC

- Randstad NV

- Kforce Inc.

- Artech Information Systems LLC

- Consulting Solutions International Inc.

- MATRIX Resources Inc.

- NTT DATA Corporation

- Beacon Hill Staffing Group LLC

- Experis IT(ManpowerGroup Global Inc.)

- Akkodis(Adecco Group AG)

- Kelly Services Inc.

- Motion Recruitment Partners LLC

- Robert Half International Inc.

- Genesis10 Inc.

- Collabera LLC

- PERSOL Holdings Co., Ltd.

- Aquent LLC

- CGI Inc.

第7章 市場機會與未來展望

The IT staffing market is expected to grow from USD 123.30 billion in 2025 to USD 127.75 billion in 2026 and is forecast to reach USD 152.47 billion by 2031 at 3.61% CAGR over 2026-2031.

This steady expansion reflects enterprises realigning talent strategies toward specialized skill acquisition rather than volume hiring, a change reinforced by cloud, artificial intelligence, and cybersecurity spending priorities. Temporary and contract engagements remain the dominant hiring mechanism, yet growth is gravitating toward Statement-of-Work models that shift delivery risk to providers. Generative-AI engineering, edge computing, and cyber-resilience needs are reshaping job requisitions, while persistent global skill shortages sustain upward wage pressure. At the same time, vendor consolidation across Global-2000 clients compresses margins for managed service providers but also deepens their wallet share with retained customers.

Global IT Staffing Market Trends and Insights

Accelerated Adoption of AI-, Cloud- and IoT-Centric Digital-Transformation Projects

Fourteen percent of global tech job postings now demand AI or machine-learning skills, up from 9% a year earlier . Cloud migrations call for specialized DevOps engineers and security architects, while edge-computing investments that are projected to reach USD 139.58 billion by 2030 require blended infrastructure-plus-IoT talent. NTT DATA's program to train 200,000 employees in generative AI further underscores the scale of reskilling underway . Interdisciplinary project teams that connect AI algorithms, cloud resources, and device networks are therefore driving sustained expansion in the IT staffing market.

Expansion of Remote and Hybrid Work Models Requiring Distributed Talent

Sixty-five percent of Dell Technologies personnel use formal flexibility arrangements, signaling lasting normalization of location-agnostic hiring. Employers gain access to broader talent pools, yet must navigate cross-border compliance and rising pay parity expectations. ManpowerGroup's 2025 outlook shows 41% of firms plan to add headcount, with technology roles topping demand charts. Competitive bidding now spans continents, increasing compensation levels and compelling agencies to enhance retention packages that extend beyond salary.

Persistent Global Skill Shortages in Niche Technologies

It is estimates that unresolved digital-skills gaps could cost the global economy by 2034, underscoring structural supply constraints for quantum, advanced AI, and zero-trust security expertise. Universities have not kept curriculum pace, creating multiyear lags before new graduates enter these specializations. The scarcity elevates compensation packages and lengthens project timelines, compelling enterprises to bankroll intensive reskilling initiatives that erode near-term ROI.

Other drivers and restraints analyzed in the detailed report include:

- Surging Demand for Cyber-Resilience Staff Driven by Cyber-Insurance Mandates

- Digital-Transformation Budget Rebound Post-Pandemic Fuels Staff-Augmentation Demand

- Wage Inflation Compressing MSP Bill-Rate Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software developers accounted for 37.05% of IT staffing market share in 2025, reflecting entrenched application modernization projects. Generative-AI engineers are projected to register a 11.75% CAGR through 2031, underscoring growing demand for prompt design, model auditing, and LLM fine-tuning. The IT staffing market size for data and AI engineering is projected to escalate sharply as edge-cloud pipelines scale. Salary corridors signal premium pricing that providers can command when supplying hybrid AI-development expertise.

Traditional testers and QA roles face automation headwinds, pushing many professionals toward AI-enabled verification tools. Systems analysts are pivoting to integration architecture, and network specialists are upskilling in AI-driven threat monitoring. Emerging skills-quantum development, blockchain architecture, and IoT device security-collectively remain a small but rapidly expanding slice of the IT staffing market.

BFSI remained the largest adopter with 24.15% share in 2025, driven by open-banking compliance and fintech platform upgrades. Healthcare emerges as the fastest-growing vertical at 10.25% CAGR, propelled by electronic-health-record modernization and AI-assisted diagnostics. The IT staffing market size for healthcare projects is expected to widen as telemedicine and patient-data interoperability standards take hold.

Manufacturing prioritizes smart-factory deployments requiring IoT and predictive-maintenance talent. Retail and e-commerce continue omnichannel build-outs, while public sector agencies earmark cybersecurity and citizen-service digitization budgets. Energy, automotive, and smart-city programs fill the "Other Industries" category, each demanding bespoke skill combinations and feeding diverse pipelines for the IT staffing market.

IT Staffing Market Report is Segmented by Skill Set (Software Developer, Testers and QA Engineers, Systems Analyst, Technical Support Professionals, Networking and Security Experts, and More), End-User Industry (Telecom, BFSI, and More), Staffing Service Type (Contract Staffing, and More), Enterprise Size (Large Enterprises, and SMEs), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 44.05% share in 2025, supported by deep tech ecosystems, large digital budgets, and rigorous security mandates. Continuous visa policy shifts and wage escalation challenge talent availability, prompting more near-shoring to Canada and Latin America. The United States leads demand due to Silicon Valley software projects and Wall Street cloud overhauls, while Canada provides cost-advantaged hubs in Toronto and Montreal.

Asia-Pacific is the fastest-growing region at an 8.15% CAGR, buoyed by India's IT services scale-up, Japanese reskilling initiatives, and Singapore's regional headquarters attraction. Managed-services annual contract value in the region rose 32% in 2024 as multinationals diversified sourcing. China's platform rebound and Korea's semiconductor R&D add further pull on specialist headcount.

Europe posts stable demand in Germany and the United Kingdom, even as Eastern European destinations evolve from pure cost-arbitrage to niche specialist centers. GDPR compliance maintains high cybersecurity uptake. Middle East and Africa trail but register steady growth; Saudi Arabia's smart-city projects and South Africa's English-language service hubs are notable demand pockets. Currency-adjusted wage differentials across these markets shape provider margin strategies within the global IT staffing market.

- TEKsystems Inc. (Allegis Group Holdings Inc.)

- ASGN Incorporated

- Insight Global LLC

- Randstad N.V.

- Kforce Inc.

- Artech Information Systems LLC

- Consulting Solutions International Inc.

- MATRIX Resources Inc.

- NTT DATA Corporation

- Beacon Hill Staffing Group LLC

- Experis IT (ManpowerGroup Global Inc.)

- Akkodis (Adecco Group AG)

- Kelly Services Inc.

- Motion Recruitment Partners LLC

- Robert Half International Inc.

- Genesis10 Inc.

- Collabera LLC

- PERSOL Holdings Co., Ltd.

- Aquent LLC

- CGI Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated adoption of AI-, Cloud- and IoT-centric digital-transformation projects

- 4.2.2 Expansion of remote and hybrid work models requiring distributed talent

- 4.2.3 Surging demand for cyber-resilience staff driven by cyber-insurance mandates

- 4.2.4 Digital-transformation budget rebound post-pandemic fuels staff-augmentation demand

- 4.2.5 Generative-AI supervision roles (prompt engineers, model auditors) emerge

- 4.2.6 Vendor consolidation among Global-2000 clients boosts MSP-led volume deals

- 4.3 Market Restraints

- 4.3.1 Persistent global skill shortages in niche technologies

- 4.3.2 Wage inflation compressing MSP bill-rate margins

- 4.3.3 AI-based self-service hiring platforms disintermediate agencies

- 4.3.4 Tightening data-sovereignty laws restrict cross-border staff deployment

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porterss Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Skill Set

- 5.1.1 Software Developers

- 5.1.2 Testers and QA Engineers

- 5.1.3 Systems Analysts / Business Analysts

- 5.1.4 Technical Support Professionals

- 5.1.5 Networking and Security Experts

- 5.1.6 Data and AI Engineers

- 5.1.7 Other Skill Sets

- 5.2 By End-User Industry

- 5.2.1 Telecom

- 5.2.2 Banking, Financial Services and Insurance (BFSI)

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Manufacturing

- 5.2.5 Retail and e-Commerce

- 5.2.6 Government and Public Sector

- 5.2.7 Other Industries

- 5.3 By Staffing Service Type

- 5.3.1 Temporary / Contract Staffing

- 5.3.2 Permanent Placement

- 5.3.3 Statement-of-Work (SOW) / Project-based

- 5.3.4 Managed Service Provider (MSP) / Outsourced Staffing

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TEKsystems Inc. (Allegis Group Holdings Inc.)

- 6.4.2 ASGN Incorporated

- 6.4.3 Insight Global LLC

- 6.4.4 Randstad N.V.

- 6.4.5 Kforce Inc.

- 6.4.6 Artech Information Systems LLC

- 6.4.7 Consulting Solutions International Inc.

- 6.4.8 MATRIX Resources Inc.

- 6.4.9 NTT DATA Corporation

- 6.4.10 Beacon Hill Staffing Group LLC

- 6.4.11 Experis IT (ManpowerGroup Global Inc.)

- 6.4.12 Akkodis (Adecco Group AG)

- 6.4.13 Kelly Services Inc.

- 6.4.14 Motion Recruitment Partners LLC

- 6.4.15 Robert Half International Inc.

- 6.4.16 Genesis10 Inc.

- 6.4.17 Collabera LLC

- 6.4.18 PERSOL Holdings Co., Ltd.

- 6.4.19 Aquent LLC

- 6.4.20 CGI Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment