|

市場調查報告書

商品編碼

1910468

冷媒:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Refrigerants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

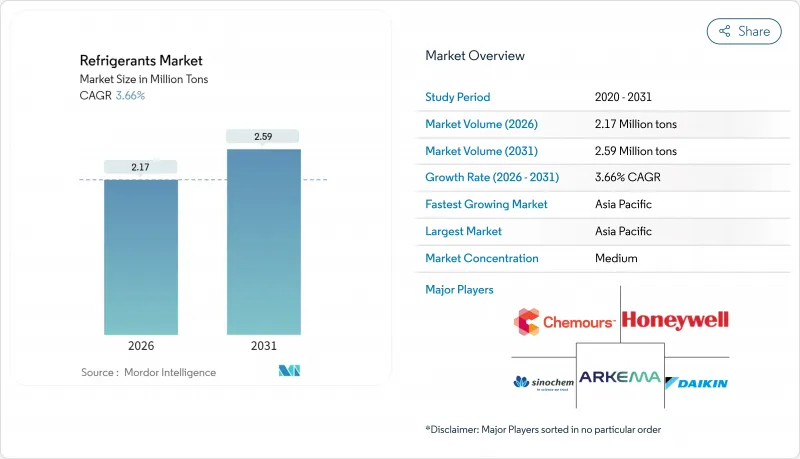

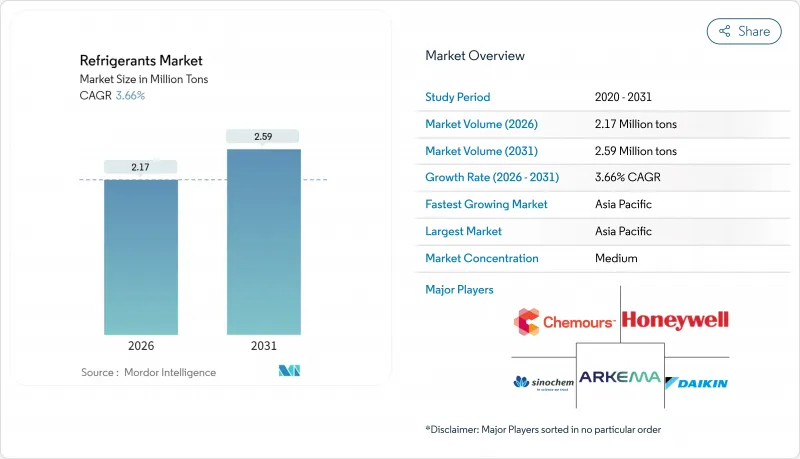

預計冷媒市場將從 2025 年的 209 萬噸成長到 2026 年的 217 萬噸,預計到 2031 年將達到 259 萬噸,2026 年至 2031 年的複合年成長率為 3.66%。

推動冷媒市場成長的關鍵因素包括:低全球暖化潛勢(GWP)配方的加速普及、氫氟碳化合物(HFCs)的強制淘汰,以及冷凍、運輸和低溫運輸物流領域對溫度控管日益成長的需求。監管產品替代、電動車中熱泵的整合以及多溫區醫藥物流的擴張,都在擴大冷媒市場的機遇,同時也加速了對天然冷媒和氫氟烯烴(HFO)替代品的需求。同時,原物料成本的波動以及配額導致的供應瓶頸加劇了價格波動,迫使製造商最佳化產能並調整產品系列。中游經銷商正與領先的化學企業建立策略採購合作夥伴關係,以確保在區域監管過渡期限之前獲得符合規定的分子。同時,下游設備製造商正在快速重新設計其系統,以符合A2L和A3分類標準。預計這些協同效應將推動冷媒市場在2030年之前保持個位數的溫和成長。

全球冷媒市場趨勢與洞察

新興亞洲地區對室內空調和汽車空調的需求不斷成長

快速的都市化正推動住宅冷凍設備進入二、三線城市的千家萬戶,同時,汽車產業正從內燃機平台轉型為電動驅動系統。預計到2030年,中國熱泵的年出貨量將達到5,000萬台,而印度家用空調的普及率仍低於10%,顯示市場存在巨大的潛在需求。日本修訂的《氟碳化合物法》和韓國的能源效率管理計畫對全球暖化潛值(GWP)設定了上限,從而推動了丙烷、R-32和特定HFO混合物的採購。區域汽車製造商正在將R-1234yf作為車廂和電池迴路應用的標準冷媒,加速了亞太全部區域的分子轉型。住宅的普及以及電動車的推廣,將在預測期內推動冷媒市場實現最大的絕對噸位成長。

電動車的溫度控管要求

電動車 (EV) 電池化學體系對工作溫度範圍的要求很高,以確保電池壽命和充電速度。 R-1234yf 冷媒在美國95% 的新型輕型車輛中使用,目前全球已有 2.2 億輛汽車安裝了該冷媒。同時,改裝套件正被應用於現有車輛,以 R-1234yf 取代 R-134a。整合車廂供暖和電池冷卻功能的熱泵架構在量產車領域日益普及,推動了針對 -30°C 至 +45°C 效率曲線最佳化的 A2L 混合冷媒的消費。壓縮機製造商透過機殼設計和變頻器調校,將渦旋噪音降低了 6 分貝,這對於高階電動車車型而言是一項關鍵指標。這些協同效應將推動冷媒在行動出行應用領域的潛在市場在 2020 年代中期持續成長。

嚴格在全球逐步淘汰氫氟碳化合物(《基加利協議》、歐盟氟碳化合物法規)

歐盟第2024/573號法規將氫氟碳化合物(HFC)配額從2025年基準值的60%降至2036年的15%,目標是在2050年之前完全淘汰。基加利修正案中類似的生產凍結措施將同時給所有生產商帶來壓力,導致供應緊張,並推高冷媒市場的現貨價格。新系統的安裝商將被要求在容量超過500噸二氧化碳當量(tCO2e)的系統上使用自動洩漏檢測設備,這將增加合規預算,並將資金從銷售成長轉移到其他方面。這種不確定性將延緩大型安裝專案的決策週期,使過渡期中期的預期複合年成長率(CAGR)下降約2個百分點。

細分市場分析

到2025年,碳氫化合物將佔據冷媒市場49.02%的佔有率,這主要得益於其不受多項氟碳化合物監管規定的約束以及具有優勢的擁有成本。市場領導報告稱,住宅熱泵和商用即插即用型空調機組的出貨量實現了兩位數的成長,而R-290分離式空調機組在全球採用MEPS修正案的地區正加速部署。氫氟烯烴將以9.86%的複合年成長率成為成長最快的冷媒,這主要得益於汽車和固定式空調產業的新應用,這兩個產業即將禁止使用全球暖化潛勢(GWP)超過750的冷媒。這兩個低GWP冷媒細分市場將共同抵消氟碳冷媒噸位的下降,從而支撐整個冷媒市場的成長。

在下游市場,氨和二氧化碳等無機製冷劑在大型食品加工廠和超級市場的應用持續成長。為了提高效率,工程師們正在採用低壓級二氧化碳與高壓級合成冷媒結合的系統,近期針對不同級聯組合的性能係數(COP)對比測試證實了這一優勢。雖然資料中心浸沒式冷卻和製藥冷凍庫正在成為二氧化碳冷媒的成長領域,但氨冷媒在倉庫冷庫中仍然佔據著穩固的地位。天然冷媒的排碳權計畫進一步增強了其商業價值,推動市場佔有率持續從傳統的氫氟碳化合物(HFC)冷媒轉移到天然冷媒。

此冷媒市場報告按類型(氟碳化合物、無機化合物、碳氫化合物、其他)、應用(製冷、空調、其他)、終端用戶行業(住宅和商業建築、食品和飲料加工、製藥和醫療保健、汽車和電動汽車、其他)以及地區(亞太地區、北美、歐洲、南美、中東和非洲)進行分析。

區域分析

亞太地區預計到2025年將佔據全球冷媒市場50.10%的佔有率,這反映了該地區龐大的製造業基礎、不斷上升的都市區氣溫以及有利的政策框架。由於國內需求的成長,中國室內空調出口量不斷增加,並透過其垂直整合的供應鏈確保了R-32和R-290冷媒的批量供應。印度針對白色家電的生產關聯激勵計畫(PLI)包含對低全球暖化潛值(GWP)冷媒研發的津貼,加速了本地零件生態系統的建構。日本和韓國在A2L混合冷媒的先進材料開發方面處於領先地位,全部區域輸出配方技術。東南亞國家也紛紛效仿,投資低溫運輸基礎設施,進一步鞏固在主導地位。

北美正處於平衡發展階段,美國《AMIM法案》逐步實施氫氟碳化合物(HFC)消費量上限,同時推動暖通空調維修中氫氟烯烴(HFO)需求快速成長。科慕公司(Chemours)2025年第一季Option銷售量成長40%,主要得益於其位於科珀斯克里斯蒂工廠的產能提升。加拿大的碳定價機制進一步推動食品零售業的設備規格向天然冷媒傾斜,而墨西哥的工業區則在過渡性全球暖化潛值(GWP)上限的限制下,要求製程冷卻使用含氟冷媒。

歐洲正處於最嚴格的法律規範之下。 2024 年 F-Gas 法規的配額和生態設計規則正推動原始設備製造商 (OEM) 大規模採用 R-290 熱泵,德國和法國的補貼計劃也為此提供了支持。高溫最佳化包裝的普及使得超臨界二氧化碳冷媒成為超級市場的標配,即使在氣候溫暖的地區也是如此。歐洲各地的冷媒市場前景趨於一致,英國在遵守歐盟時間表的同時,也維持自己的配額制度。

整個南美洲以及中東和非洲的新興地區構成了冷媒市場的長尾部分。淘汰計畫的延遲將繼續推動氫氟碳化合物(HFC)的需求,但人均製冷需求的成長將為未來引進週期基礎。多邊開發銀行專案正在透過結合低溫運輸物流和農業生產力提升的專案來彌補基礎設施方面的不足。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲新興地區對室內空調和汽車空調的需求量大

- 擴大冷藏倉庫和第三方物流低溫運輸站點

- 電動汽車溫度控管要求

- 用於mRNA疫苗的超低溫冷凍庫

- 天然冷媒排碳權貨幣化

- 市場限制

- 更嚴格的全球氫氟碳化合物淘汰計畫(《基加利議定書》、歐盟氟碳化合物法規)

- A3/A2L 易燃氣體的初始成本高且處理風險大

- 下一代HFO分子的價格波動迅速。

- 價值鏈分析

- 監管環境

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 氟化合物

- 氟烴塑膠(HCFCs)

- 氫氟碳化合物(HFCs)

- 無機化學品

- 氨

- 二氧化碳

- 其他無機化合物

- 碳氫化合物

- 異丁烷

- 丙烷

- 其他碳氫化合物

- 其他類型(氫氟烯烴(HFO))

- 氟化合物

- 透過使用

- 冷凍

- 國內的

- 商業的

- 運輸

- 產業

- 空調

- 固定/軟體包類型

- 冷卻器

- 移動的

- 其他用途

- 冷凍

- 按最終用戶行業分類

- 住宅及商業建築

- 食品/飲料加工

- 製藥和醫療保健

- 汽車和電動旅行

- 化工/石油化工

- 其他行業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率/排名分析

- 公司簡介

- A-Gas International Ltd

- AGC Inc.

- Arkema

- Brothers Gas

- Daikin Industries, Ltd.

- Dongyue Group

- Gulfcryo.

- Harp International Ltd

- Honeywell International Inc

- Linde PLC

- Messer SE & Co. KGaA

- Navin Fluorine International Ltd

- Orbia

- Shandong Yuean Chemical Industry Co., Ltd

- Sinochem Holdings Corporation Ltd

- SRF Limited

- The Chemours Company

- Zhejiang Juhua Co. Ltd.

第7章 市場機會與未來展望

The Refrigerants market is expected to grow from 2.09 million tons in 2025 to 2.17 million tons in 2026 and is forecast to reach 2.59 million tons by 2031 at 3.66% CAGR over 2026-2031.

The core growth engines are the accelerated adoption of low-global-warming-potential (GWP) formulations, mandatory phase-downs of hydrofluorocarbons (HFCs), and expanding thermal-management needs across cooling, transport, and cold-chain logistics. Regulation-driven product substitutions, electrified-vehicle heat-pump integration, and multi-temperature pharmaceutical logistics expand the refrigerant market opportunity while intensifying demand for natural and hydrofluoro-olefin (HFO) alternatives. At the same time, raw-material cost swings and quota-induced supply bottlenecks keep price volatility high, prompting manufacturers to optimize capacity footprints and portfolio mixes. Midstream distributors are forming strategic sourcing alliances with chemical majors to secure compliant molecules ahead of regional cut-off dates, while downstream equipment makers fast-track system redesigns compatible with A2L and A3 classifications. These converging forces collectively reinforce a medium-single-digit growth trajectory for the refrigerant market through 2030.

Global Refrigerants Market Trends and Insights

High Demand for Room and Car Air-Conditioners in Emerging Asia

Rapid urbanization is pushing residential cooling deeper into tier-2 and tier-3 city households while the automotive sector simultaneously swaps internal-combustion platforms for electric drivetrains. China's heat-pump shipments are projected to hit 50 million units annually by 2030, and India's household air-conditioner penetration remains under 10%, underscoring significant latent demand. Japan's revised F-Gas Law and South Korea's efficiency management program impose GWP ceilings that funnel procurement toward propane, R-32, and shortlisted HFO blends. Vehicle OEMs in the region are standardizing R-1234yf for cabin and battery loops, accelerating molecule transition volumes throughout Asia-Pacific. Together, residential uptake and e-mobility adoption underpin the largest absolute tonnage additions in the refrigerant market during the forecast window.

Electrified-Vehicle Thermal-Management Requirements

Electric vehicle (EV) battery chemistries demand narrow temperature windows for longevity and charging speed. R-1234yf enjoys 95% penetration in new U.S. light-duty vehicles, with 220 million cars worldwide now equipped, while legacy fleets adopt retrofit kits that swap out R-134a for the same molecule. Heat-pump architectures unifying cabin heating and battery cooling are spreading into mass-market segments, spurring consumption of blended A2L fluids optimized for -30 °C to +45 °C efficiency curves. Compressor suppliers have cut scroll noise by 6 dBA through housing and inverter tuning, a key specification for premium EV models. The aggregate effect widens the addressable refrigerant market for mobility applications through mid-decade.

Stringent Global HFC Phase-Down (Kigali, EU F-Gas)

EU Regulation 2024/573 cuts HFC quotas from 60% of baseline levels in 2025 to 15% in 2036, with full phase-out targeted by 2050. Similar freezes under the Kigali Amendment pressure all producers simultaneously, tightening supply and elevating spot prices across the refrigerant market. Operators installing new systems must adopt automated leak detection above 500 tCO2e capacity, raising compliance budgets and reallocating capital away from volume growth. The resulting uncertainty slows decision cycles for large installations, shaving nearly two percentage points from projected CAGR during mid-transition years.

Other drivers and restraints analyzed in the detailed report include:

- Ultralow-Temperature Freezers for mRNA-Type Vaccines

- Carbon-Credit Monetization for Natural Refrigerants

- High First-Cost and Handling Risk of Flammable A3/A2L Gases

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydrocarbons commanded 49.02% refrigerant market share in 2025 on the back of exemption status under multiple F-Gas schedules and compelling cost-of-ownership economics. Market leaders report double-digit shipment growth into residential heat-pumps and plug-in commercial cabinets, while global roll-outs of R-290 split units accelerate in regions adopting MEPS revisions. Hydrofluoro-olefins are delivering the fastest 9.86% CAGR, propelled by automotive and stationary HVAC debuts where regulatory cut-off dates for GWP greater than 750 fluids are imminent. Collectively, these two low-GWP segments offset contracting fluorocarbon tonnage, anchoring overall refrigerant market growth.

Downstream, the refrigerant market size for inorganic options such as ammonia and CO2 continues to expand in large food-processing plants and big-box supermarkets. Engineers pair CO2 in low-stage loops with synthetic high-stage fluids for efficiency gains, an architecture validated by recent COP comparisons across cascade permutations. Data-center immersion cooling and pharma freezers add pocket growth for CO2, while ammonia remains entrenched in warehouse chillers. Natural-refrigerant carbon-credit programs further sweeten the business case, ensuring sustained share migration away from legacy HFCs.

The Refrigerants Market Report is Segmented by Type (Fluorocarbons, Inorganics, Hydrocarbons, Other Types), Application (Refrigeration, Air-Conditioning, Other Applications), End-User Industry (Residential and Commercial Buildings, Food and Beverage Processing, Pharmaceuticals and Healthcare, Automotive and E-Mobility, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa).

Geography Analysis

Asia-Pacific's 50.10% refrigerant market share in 2025 reflects the region's outsized manufacturing base, urban temperature spikes, and supportive policy frameworks. China's room-air-conditioner exports grow with domestic uptake, locking in bulk R-32 and R-290 flows through vertically integrated supply chains. India's Production Linked Incentive (PLI) scheme for white goods includes grants for low-GWP refrigerant R&D, expediting local component ecosystems. Japan and South Korea anchor advanced-material development for A2L blends, exporting formulation know-how across the region. Southeast Asian economies follow with cold-chain infrastructure funding, reinforcing Asia-Pacific's reinforced leadership of the refrigerant market.

North America tracks a balanced path as the U.S. AIM Act mandates an HFC consumption-cap glide path while simultaneously turbo-charging demand for HFOs in HVAC retrofits. Chemours logged a 40% surge in Opteon sales during Q1 2025, enabled by its Corpus Christi capacity expansion. Canada's carbon-pricing architecture further skews equipment specifications toward natural refrigerants in food retail, whereas Mexico's industrial corridor demands process-cooling fluorocarbons under transitional GWP ceilings.

Europe navigates the tightest regulatory straitjacket. F-Gas 2024 quotas and eco-design rules push OEMs to deploy R-290 heat-pumps at scale, supported by German and French subsidy pools. Transcritical CO2 has become the default supermarket specification even in southern climates thanks to high-ambient optimization packages. The United Kingdom maintains an independent quota system but mirrors EU timelines, keeping the refrigerant market outlook convergent across the continent.

Emerging regions across South America and Middle East & Africa constitute the long-tail of the refrigerant market. Delayed phase-down schedules prolong HFC demand, yet rising per-capita cooling expectations seed future low-GWP adoption cycles. Infrastructure gaps are being addressed through multilateral development-bank programs that bundle cold-chain logistics with agricultural productivity mandates.

- A-Gas International Ltd

- AGC Inc.

- Arkema

- Brothers Gas

- Daikin Industries, Ltd.

- Dongyue Group

- Gulfcryo.

- Harp International Ltd

- Honeywell International Inc

- Linde PLC

- Messer SE & Co. KGaA

- Navin Fluorine International Ltd

- Orbia

- Shandong Yuean Chemical Industry Co., Ltd

- Sinochem Holdings Corporation Ltd

- SRF Limited

- The Chemours Company

- Zhejiang Juhua Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High demand for room and car air-conditioners in emerging Asia

- 4.2.2 Expansion of refrigerated warehousing and 3PL cold-chain nodes

- 4.2.3 Electrified-vehicle thermal-management requirements

- 4.2.4 Ultralow-temperature freezers for mRNA-type vaccines

- 4.2.5 Carbon-credit monetisation for natural refrigerants

- 4.3 Market Restraints

- 4.3.1 Stringent global HFC phase-down (Kigali, EU F-Gas)

- 4.3.2 High first-cost and handling risk of flammable A3/A2L gases

- 4.3.3 Boom-bust price swings for next-gen HFO molecules

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Fluorocarbons

- 5.1.1.1 Hydrochlorofluorocarbons (HCFC)

- 5.1.1.2 Hydrofluorocarbons (HFC)

- 5.1.2 Inorganics

- 5.1.2.1 Ammonia

- 5.1.2.2 Carbon Dioxide

- 5.1.2.3 Other Inorganics

- 5.1.3 Hydrocarbons

- 5.1.3.1 Isobutane

- 5.1.3.2 Propane

- 5.1.3.3 Other Hydrocarbons

- 5.1.4 Other Types (Hydrofluoro-olefins (HFO))

- 5.1.1 Fluorocarbons

- 5.2 By Application

- 5.2.1 Refrigeration

- 5.2.1.1 Domestic

- 5.2.1.2 Commercial

- 5.2.1.3 Transportation

- 5.2.1.4 Industrial

- 5.2.2 Air-Conditioning

- 5.2.2.1 Stationary Room/Packaged

- 5.2.2.2 Chillers

- 5.2.2.3 Mobile

- 5.2.3 Other Applications

- 5.2.1 Refrigeration

- 5.3 By End-user Industry

- 5.3.1 Residential and Commercial Buildings

- 5.3.2 Food and Beverage Processing

- 5.3.3 Pharmaceuticals and Healthcare

- 5.3.4 Automotive and e-Mobility

- 5.3.5 Chemicals and Petrochemicals

- 5.3.6 Other Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 A-Gas International Ltd

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 Brothers Gas

- 6.4.5 Daikin Industries, Ltd.

- 6.4.6 Dongyue Group

- 6.4.7 Gulfcryo.

- 6.4.8 Harp International Ltd

- 6.4.9 Honeywell International Inc

- 6.4.10 Linde PLC

- 6.4.11 Messer SE & Co. KGaA

- 6.4.12 Navin Fluorine International Ltd

- 6.4.13 Orbia

- 6.4.14 Shandong Yuean Chemical Industry Co., Ltd

- 6.4.15 Sinochem Holdings Corporation Ltd

- 6.4.16 SRF Limited

- 6.4.17 The Chemours Company

- 6.4.18 Zhejiang Juhua Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment