|

市場調查報告書

商品編碼

1910434

氣體檢測:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Gas Detectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

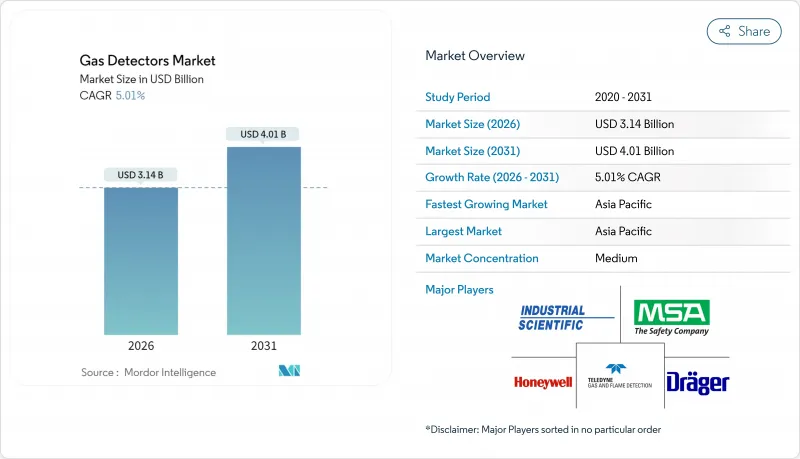

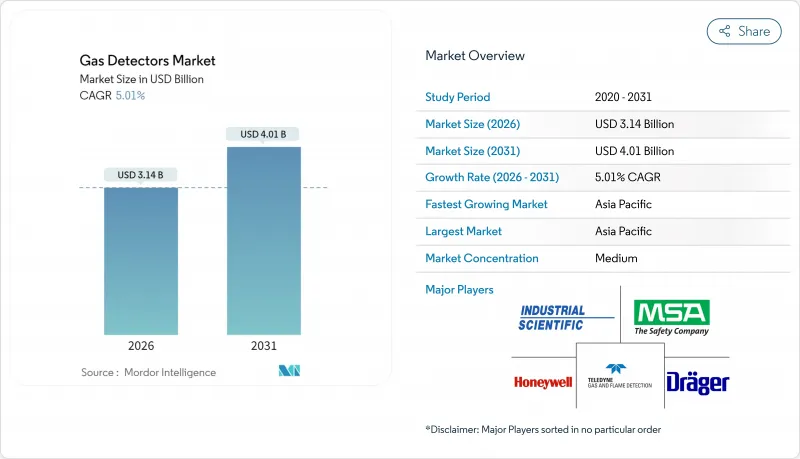

2025年氣體檢測市場價值為29.9億美元,預計到2031年將達到40.1億美元,而2026年為31.4億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.01%。

這一成長軌跡反映了對即時工人安全解決方案的資本投資不斷增加、現有工廠維修需求日益成長,以及為預測分析引擎提供資訊的互聯感測平台的整合。美國職業安全與健康管理局 (OSHA)、美國消防協會 (NFPA) 72 和美國礦業法規的嚴格執行正在推動設備更新換代,而中游液化天然氣樞紐、氫氣生產設施和鋰離子電池生產線的持續擴張則推動了對可燃性氣體和有毒氣體監測基礎設施的需求。更美國的網路安全法規正在推動對能夠將認證感測器硬體與安全物聯網軟體堆疊相結合的供應商的需求。雖然有線網路在現有(棕地)設施中仍然佔據主導地位,但無線網狀拓撲結構和多年電池模組的進步正在降低總安裝成本,並開闢尚未開發的市場領域,例如遠端井口和臨時檢修區。隨著成熟的全球供應商尋求捍衛其市場佔有率,以應對擁有專業能力、承諾低漂移率、氫氣特異性或基於訂閱的校準服務的新興參與企業,競爭日益激烈。

全球氣體檢測市場趨勢與洞察

危險產業嚴格的工人安全法規

監管機構強制要求採用即時環境遙測技術而非定期抽查,促使礦場、煉油廠和化工廠部署連續監測網路。美國職業安全與健康管理局 (OSHA) 的「2025 年數據驅動檢查計畫」鼓勵營運商將傳統的單氣體偵測儀升級為連網的多氣體陣列,以便將測量數據傳輸到中央控制面板。美國煤炭法規強制要求對礦井排水通道 (MDR) 進行認證,這導致防爆固定式通風口和用於地下甲烷3D測繪的無人機載感測器訂單激增。地方政府供水事業必須遵守 NFPA 820閾值中關於硫化氫的門檻規定,這促使數千家維修對濕式泵房通風系統進行改造。領先的供應商正在透過預測分析軟體來應對這一挑戰,該軟體能夠在警報觸發之前檢測異常模式,從而符合「零傷害」目標,例如 Industrial Scientific 提出的「到 2050 年消除職場死亡事故」目標。單一煉油廠的年度遵循成本可能超過 10 萬美元,這導致了固定的續約週期和服務合約。

智慧互聯探測器的應用日益普及

物聯網連接正在將氣體檢測市場從產品銷售模式轉變為資訊服務生態系統。 Blackline 的 EXO 8 單次充電即可將資料傳輸到雲端長達 100 天,讓遠端安全團隊能夠即時監控暴露趨勢。霍尼韋爾的 Sensepoint XCL 透過低功耗藍牙連接到智慧型手機,為技術人員提供逐步指導,並將校準時間縮短高達 30%。預測性儀表板可自動安排感測器更換,從而緩解技術純熟勞工短缺問題並減少非計劃性停機時間。 Industrial Scientific 的 iNet Exchange 等訂閱方案將硬體、耗材和分析功能整合到多年合約中,使採購從資本支出轉變為營運支出。自動化合規性記錄將審核準備時間從數週縮短至數小時,這對於需要應對不同地區法規的跨國公司而言極具吸引力。

初始成本高,產品差異化程度低。

工業用多氣體攜帶式檢測儀的單價在500美元到1500美元之間,如果包含安裝、試運行和用戶培訓,價格則翻倍。聲稱無需校準的產品價格更高,例如AimSafety PM400售價558.57美元,Gas Clip的免維護MGC Simple售價697.07美元。低成本的亞洲仿製品價格比知名品牌低50%,這擠壓了利潤空間,並延緩了預算緊張的工廠的升級計劃。在中型煉油廠,安裝一套固定系統(包括認證管道、控制面板和功能測試)的成本通常超過100萬美元。在監管執法不力的地區,價格敏感度更高,這使得一些業者能夠推遲升級。

細分市場分析

到2025年,有線解決方案將佔總收入的50.35%,這主要得益於現有煉油廠、液化天然氣工廠和化工園區等場所採用符合危險區域標準的成熟有線迴路。在這些傳統環境中,防爆接線盒和抗電磁干擾的鎧裝電纜仍然是氣體偵測市場的首選。然而,由於鑽井成本高昂和臨時停機計畫等因素,無線解決方案預計將在2031年之前以7.05%的複合年成長率成長,從而推動快速部署。早期無線計劃電池續航力有限,而第二代網狀網路設計單次充電即可運作長達100天,並且可以透過多個閘道器中繼數據,最終接入工廠的監控網路。新建設的氫氣樞紐和電池儲能工廠正擴大將預算分配給混合架構,在這種架構中,無線節點將資料傳輸到有線安全區域閘道器,從而兼顧柔軟性和確定性運作。監管機構已開始批准具有適當冗餘的無線生命安全迴路,這項政策演變正在消除歐盟和美國部分地區等國家採用該技術的傳統障礙。為此,設備製造商正將研發重點放在基於韌體的網路安全、OT網路分段以及符合美國美國標準與技術研究院 (NIST) 指南的無線感測器校準程序上。這種轉變推高了整體解決方案的平均售價 (ASP),並為供應商帶來了遠端監控網路狀況的訂閱收入。這將擴大氣體檢測市場的價值池,即使在未來五年內,有線節點在感測器數量上仍將佔據主導地位。

無線技術的廣泛應用也得益於數位轉型預算,這些預算旨在將分散的現場設備整合到通用的資產績效儀錶板下。採購團隊在計算總體擁有成本時,淘汰導管、電纜配線架和動火作業許可證等要求通常可以抵消無線分析儀的溢價。此外,更高的移動性還能在檢修作業期間擴大安全覆蓋範圍,因為臨時管線變更每天都會產生新的洩漏路徑。一家下游石化公司在2024年的檢修季試用了無線偵測包,結果顯示密閉空間違規事件減少了15%,維護間隔縮短了8%。這些營運成果強化了投資回報模型,鞏固了經營團隊的支持,並進一步加速了無線技術在整體氣體檢測市場佔有率的成長。

區域分析

預計到2025年,亞太地區將佔全球收入的48.60%,維持6.92%的最快複合年成長率,這主要得益於中國煤化工聯合企業的蓬勃發展、印度新建煉油廠的建設以及東南亞電池供應鏈投資的成長。中國國家緊急管理部頻繁的安全審核迫使設施營運商從未經認證的低成本進口設備轉向符合ATEX和IECEx標準的設備。韓國和日本正在加快氫氣加註網路的建設,並按照消防安全法規的要求,在每個泵浦中安裝雙冗餘氫氣感測器。印度的「Jal Jeevan Mission」(飲用水生命線計畫)正在推動數千家水處理廠升級氯氣和臭氧監測系統,進一步刺激了市場需求。國內電子製造商正在擴大氮化鎵功率開關的生產,為專用氨氣和氯化氫檢測設備創造了新的機會。

北美在收入方面佔據第二大市場佔有率,這主要得益於日益嚴格的職業安全與美國)法規、頁岩氣加工以及墨西哥灣沿岸液化天然氣出口終端的發展。紐約市第 157 號地方法律強制要求在 2025 年 5 月前安裝住宅天然氣探測器,這將在住宅和小規模商業領域催生數百萬台氣體探測器的需求。在美國,根據《基礎設施投資與就業法案》設立的氫能樞紐計畫需要建造一個多氣體固定網路,並配備加密無線骨幹網,訂單。加拿大的油砂開採作業指定使用可在低至 -40°C 的溫度下保持精度的加熱器和分析儀,這使得擁有耐極寒設備系列的供應商佔據優勢。墨西哥的蒙特雷和巴希奧工業走廊正在將揮發性有機化合物 (VOC) 探測器整合到汽車噴漆車間,以支援原始設備製造商 (OEM) 的永續性審核。

在歐洲,嚴格的ATEX合規性、能源性能指令(EPBD)下的室內空氣品質法規以及脫碳目標共同推動了設備的持續升級。德國萊茵河沿岸的一個大型化學工業區正在投資苯和丁二烯監測,以減少逸散性排放。同時,英國強制要求商業辦公室進行二氧化碳監測,以促進員工健康。北海的近海平台要求使用經認證的硫化氫濃度超過100ppm的偵測器,以及覆蓋平台上部結構200公尺的開放式紅外線裝置。東歐成員國正在利用歐盟凝聚基金對區域供熱廠進行現代化改造,將一氧化碳和甲烷感測器整合到熱電聯產模組中。地中海地區的液化天然氣進口碼頭正在採用無線火焰和氣體檢測裝置,以在不中斷營運的情況下對現有碼頭維修。

儘管中東和非洲地區的收入佔有率較小,但該地區在綠色氫氣先導工廠、液化工廠和礦山擴建走廊等領域的應用卻十分強勁。海灣合作理事會(GCC)地區的煉油廠正在維修加氫裂解裝置以符合歐VI硫排放標準,並在此過程中升級觸媒珠珠式低爆炸極限(LEL)檢測頭。南非礦產資源部加強監管,強制要求在金礦深層隧道中進行連續固定監測。在拉丁美洲,巴西鹽層下海上油田需要高規格的偵測器來檢測高濃度硫化氫,而智利的鋰鹵水加工廠正在部署氯化氫分析儀以符合環境法規。預計這些區域趨勢將推動氣體檢測市場在預測期內實現多層次的均衡成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 危險產業嚴格的工人安全法規

- 智慧連網探測器的安裝量不斷增加

- 即時多氣體監測的需求日益成長

- 中游液化天然氣和氫能基礎設施擴建

- 智慧建築如何滿足室內空氣品質法規要求

- 鋰離子電池工廠的氣體洩漏監測

- 市場限制

- 初始成本高,產品差異化程度低。

- 維護和校準負擔

- 工業物聯網偵測器的網路安全隱患

- 半導體感測器週期性供不應求

- 供應鏈分析

- 監管環境

- 技術展望

- 影響市場的宏觀經濟因素

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依溝通類型

- 有線

- 無線的

- 按最終用戶行業分類

- 石油和天然氣

- 化學品和石油化工

- 供水和污水處理

- 金屬和採礦

- 公用事業

- 其他終端用戶產業

- 檢測器類型

- 固定的

- 電化學

- 半導體

- 光電離

- 催化劑

- 紅外線的

- MEMS

- 可攜式可攜式

- 多氣體

- 單氣體

- 固定的

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Honeywell International Inc.

- Dragerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Emerson Electric Co.

- Industrial Scientific Corporation

- Teledyne Gas & Flame Detection(Teledyne Technologies Inc.)

- Riken Keiki Co., Ltd.

- Crowcon Detection Instruments Ltd.

- Hanwei Electronics Group Corp.

- Trolex Ltd.

- Sensidyne LP

- New Cosmos Electric Co., Ltd.

- SENSIT Technologies LLC

- International Gas Detectors Ltd.

- GfG Gesellschaft fur Geratebau mbH

- GASTEC Corporation

- Yokogawa Electric Corp.

- Siemens AG-Process Safety Division

- Pem-Tech Inc.

- RKI Instruments Inc.

- WatchGas BV

- Ion Science Ltd.

- Ametek-Sensor Electronics

第7章 市場機會與未來展望

The gas detectors market was valued at USD 2.99 billion in 2025 and estimated to grow from USD 3.14 billion in 2026 to reach USD 4.01 billion by 2031, at a CAGR of 5.01% during the forecast period (2026-2031).

The trajectory reflects rising capital investment in real-time worker-safety solutions, growing retrofit demand across legacy plants, and the integration of connected detection platforms that feed predictive analytics engines. Strict enforcement of OSHA, NFPA 72, and regional mining codes is stimulating equipment replacement cycles, while sustained buildouts of midstream LNG hubs, hydrogen production assets, and lithium-ion battery lines elevate baseline demand for combustible and toxic-gas monitoring. Intensifying cybersecurity rules for safety systems is steering procurement toward vendors that can combine certified sensor hardware with secured IoT software stacks. Although wired networks still dominate brownfield installations, advances in wireless mesh topologies and multiyear battery modules are lowering total installed cost and unlocking untapped niches such as remote wellheads and temporary turnaround zones. Competitive activity is accelerating as incumbent global suppliers defend share against specialist entrants promising lower drift rates, hydrogen specificity, or subscription-based calibration services.

Global Gas Detectors Market Trends and Insights

Stringent Worker-Safety Mandates in Hazardous Industries

Regulators now require live environmental telemetry rather than periodic spot checks, compelling mines, refineries, and chemical complexes to deploy continuous monitoring networks. OSHA's 2025 program of data-driven inspections is motivating operators to replace legacy single-gas units with networked multigas arrays that transmit readings into centralized dashboards. Australian coal legislation mandates mine-drained-roadway (MDR) certification, prompting orders for explosion-proof fixed heads and UAV-mounted sensors that map underground methane in three dimensions. Municipal water utilities must comply with NFPA 820 thresholds for hydrogen sulfide, leading to multi-thousand-unit retrofits of wet-well ventilated spaces. Leading vendors respond with predictive analytics software that flags abnormal patterns before alarms trigger, aligning with zero-harm directives such as Industrial Scientific's vision to eliminate workplace fatalities by 2050. Annual compliance spending can top USD 100,000 for a single refinery, locking in replacement cycles and service contracts.

Rising Installation of Smart, Connected Detectors

IoT connectivity converts the gas detectors market from product sales to data-service ecosystems. Blackline's EXO 8 streams to the cloud for 100 days on a single charge, allowing remote safety teams to watch exposure trends in real time. Honeywell's Sensepoint XCL pairs with smartphones through Bluetooth Low Energy, guiding technicians step-by-step and shortening calibration windows by up to 30%. Predictive dashboards schedule sensor replacement automatically, mitigating skilled-labor shortages and cutting unplanned downtime. Subscription bundles such as Industrial Scientific's iNet Exchange shift procurement from capex to opex, bundling hardware, consumables, and analytics in multi-year contracts. Automated compliance logs shave audit preparation from weeks to hours, an attractive benefit for multinationals juggling disparate regional regulations.

High Upfront Cost and Limited Product Differentiation

Industrial-grade multigas portables range from USD 500 to USD 1,500 per unit, figures that double once installation hardware, commissioning, and user training are included. The AimSafety PM400 lists at USD 558.57 while Gas Clip's maintenance-free MGC Simple commands USD 697.07, highlighting price premiums linked to no-calibration claims. Low-cost Asian clones undercut established brands by up to 50%, compressing margins and delaying replacement programs in budget-constrained plants. Fixed-system installs often exceed USD 1 million for a mid-size refinery section once certified conduit, control cabinets, and functional testing are included. Price sensitivity is amplified in regions where enforcement remains inconsistent, enabling some operators to defer upgrades.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Real-Time Multigas Monitoring

- Expansion of Midstream LNG and Hydrogen Infrastructure

- Maintenance-Calibration Burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wired segment held 50.35% of 2025 revenue as established refineries, LNG trains, and chemical parks rely on proven hardwired loops that meet hazardous-area standards. In these legacy environments, the gas detectors market continues to favor flameproof junction boxes and armored cable runs that withstand electromagnetic interference. However, wireless solutions are on a 7.05% CAGR through 2031, buoyed by projects where trenching costs or temporary turnaround schedules favor rapid deployment. Early-generation radio systems suffered from limited battery life, yet second-generation mesh designs now deliver up to 100 days of uptime on a single charge and can hop data through multiple gateways to reach a plant's supervisory control network. New-build hydrogen hubs and battery plants increasingly budget for hybrid architectures in which wireless nodes feed hardwired safe-area gateways, blending flexibility with deterministic uptime. Regulators are beginning to clear suitably redundant wireless life-safety loops, a policy evolution that removes a historic adoption barrier in jurisdictions such as the European Union and parts of the United States. Equipment manufacturers thus channel research and development into firmware-based cybersecurity, OT network segmentation, and over-the-air sensor calibration routines that align with National Institute of Standards and Technology guidelines. The shift lifts overall solution ASPs and introduces subscription revenue as vendors monitor network health remotely, thus enlarging the gas detectors market value pool even though absolute sensor counts continue to favor wired nodes for the next five years.

Wireless uptake also benefits from digital transformation budgets that seek to unify disparate field instruments under common asset-performance dashboards. When procurement teams tally the total cost of ownership, the elimination of conduit, cable trays, and hot-work permits often offsets the premium list price of wireless analyzers. Added mobility widens safety coverage during turnaround events, where temporary pipework changes create fresh leak paths each day. Downstream petrochemical players that trialed wireless packs during 2024 turnaround seasons report 15% fewer confined-space entry violations and 8% shorter maintenance windows. These operational wins reinforce payback models and solidify management buy-in, further accelerating wireless share gains within the broader gas detectors market.

The Gas Detectors Market Report is Segmented by Communication Type (Wired, and Wireless), Detector Type (Fixed - Electrochemical, Semiconductor, and More), End-User Industry (Oil and Gas, Chemicals and Petrochemicals, Water and Wastewater, Metal and Mining, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 48.60% of global revenue in 2025 and is forecast to maintain the fastest 6.92% CAGR, anchored by China's surge in coal-to-chemicals complexes, India's new-build refineries, and Southeast Asia's battery-supply-chain investment wave. Frequent safety audits under China's Ministry of Emergency Management are compelling facility operators to replace uncertified low-cost imports with ATEX and IECEx-compliant equipment. South Korea and Japan accelerate hydrogen refueling networks, each pump incorporating dual redundant hydrogen sensors as mandated by fire codes. India's Jal Jeevan Mission triggers upgrades in chlorine and ozone monitoring across thousands of water plants, further widening demand. Domestic electronics firms ramp gallium-nitride power-switch fabrication, creating fresh opportunities for specialty ammonia and hydrogen chloride detection.

North America ranks second by revenue share, driven by OSHA enforcement, shale gas processing, and liquid-natural-gas export terminals along the Gulf Coast. New York City's Local Law 157 requires residential natural-gas detectors by May 2025, injecting multi-million-unit volume into the residential and light-commercial slice of the gas detectors market. U.S. hydrogen hubs funded under the Infrastructure Investment and Jobs Act prescribe multigas fixed networks with encrypted wireless backbones, stimulating orders for hydrogen-specific sensors. Canada's oil sands operations specify heaters and analyzers that remain accurate at -40 °C, favoring vendors with arctic-rated equipment lines. Mexico's industrial corridors around Monterrey and Bajio integrate VOC detectors in auto-paint shops to meet OEM sustainability audits.

Europe maintains strict ATEX compliance, EPBD indoor-air-quality mandates, and decarbonization targets that collectively sustain steady upgrades. Germany's large chemical basin along the Rhine invests in benzene and butadiene monitoring to cut fugitive emissions, while the United Kingdom enforces CO2 monitoring in commercial offices to improve occupant well-being. Offshore North Sea platforms demand detector heads certified for hydrogen sulfide concentrations exceeding 100 ppm, alongside open-path infrared units that span 200 metres across platform topsides. Eastern European member states leverage EU cohesion funds to modernize district-heating plants, integrating carbon-monoxide and methane sensors into combined-heat-and-power modules. Mediterranean LNG import terminals adopt wireless flame and gas packages to retrofit legacy jetties without disrupting operations.

The Middle East and Africa region captures a smaller revenue share but sees robust adoption in green-hydrogen pilot plants, liquefaction trains, and mining expansion corridors. GCC refiners retrofit hydrocracker units to meet Euro VI sulfur limits, upgrading catalytic bead LEL heads in the process. South African gold mines face stricter Department of Mineral Resources oversight that mandates continuous fixed monitoring in deep-level shafts. In Latin America, Brazil's pre-salt offshore fields require high-specification detectors rated for high hydrogen-sulfide concentrations, while Chile's lithium brine processors install hydrogen-chloride analyzers to comply with environmental statutes. Collectively, these regional dynamics sustain balanced multilayer growth in the gas detectors market across the forecast horizon.

- Honeywell International Inc.

- Dragerwerk AG & Co. KGaA

- MSA Safety Incorporated

- Emerson Electric Co.

- Industrial Scientific Corporation

- Teledyne Gas & Flame Detection (Teledyne Technologies Inc.)

- Riken Keiki Co., Ltd.

- Crowcon Detection Instruments Ltd.

- Hanwei Electronics Group Corp.

- Trolex Ltd.

- Sensidyne LP

- New Cosmos Electric Co., Ltd.

- SENSIT Technologies LLC

- International Gas Detectors Ltd.

- GfG Gesellschaft fur Geratebau mbH

- GASTEC Corporation

- Yokogawa Electric Corp.

- Siemens AG - Process Safety Division

- Pem-Tech Inc.

- RKI Instruments Inc.

- WatchGas B.V.

- Ion Science Ltd.

- Ametek - Sensor Electronics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent worker-safety mandates in hazardous industries

- 4.2.2 Rising installation of smart, connected detectors

- 4.2.3 Growing demand for real-time multigas monitoring

- 4.2.4 Expansion of midstream LNG and hydrogen infrastructure

- 4.2.5 Indoor air-quality compliance in smart buildings

- 4.2.6 Lithium-ion battery plants' gas-leak scrutiny

- 4.3 Market Restraints

- 4.3.1 High upfront cost and limited product differentiation

- 4.3.2 Maintenance-calibration burdens

- 4.3.3 Cyber-security concerns in IIoT-enabled detectors

- 4.3.4 Periodic semiconductor-sensor supply shortages

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Communication Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By End-User Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemicals and Petrochemicals

- 5.2.3 Water and Wastewater

- 5.2.4 Metal and Mining

- 5.2.5 Utilities

- 5.2.6 Other End-User Industries

- 5.3 By Detector Type

- 5.3.1 Fixed

- 5.3.1.1 Electrochemical

- 5.3.1.2 Semiconductor

- 5.3.1.3 Photo-ionization

- 5.3.1.4 Catalytic

- 5.3.1.5 Infra-red

- 5.3.1.6 MEMS

- 5.3.2 Portable and Transportable

- 5.3.2.1 Multi-Gas

- 5.3.2.2 Single-Gas

- 5.3.1 Fixed

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Dragerwerk AG & Co. KGaA

- 6.4.3 MSA Safety Incorporated

- 6.4.4 Emerson Electric Co.

- 6.4.5 Industrial Scientific Corporation

- 6.4.6 Teledyne Gas & Flame Detection (Teledyne Technologies Inc.)

- 6.4.7 Riken Keiki Co., Ltd.

- 6.4.8 Crowcon Detection Instruments Ltd.

- 6.4.9 Hanwei Electronics Group Corp.

- 6.4.10 Trolex Ltd.

- 6.4.11 Sensidyne LP

- 6.4.12 New Cosmos Electric Co., Ltd.

- 6.4.13 SENSIT Technologies LLC

- 6.4.14 International Gas Detectors Ltd.

- 6.4.15 GfG Gesellschaft fur Geratebau mbH

- 6.4.16 GASTEC Corporation

- 6.4.17 Yokogawa Electric Corp.

- 6.4.18 Siemens AG - Process Safety Division

- 6.4.19 Pem-Tech Inc.

- 6.4.20 RKI Instruments Inc.

- 6.4.21 WatchGas B.V.

- 6.4.22 Ion Science Ltd.

- 6.4.23 Ametek - Sensor Electronics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment