|

市場調查報告書

商品編碼

1801888

氣體分析系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gas Analyzer Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

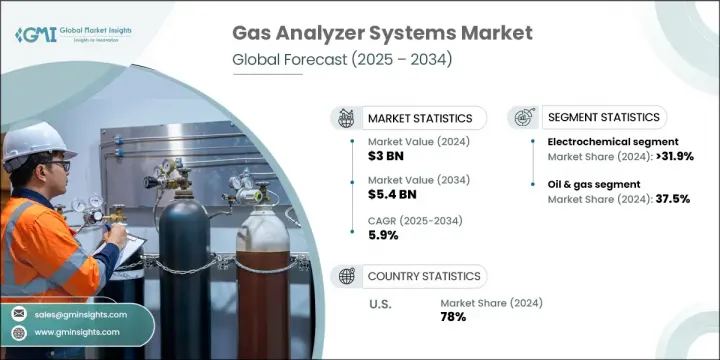

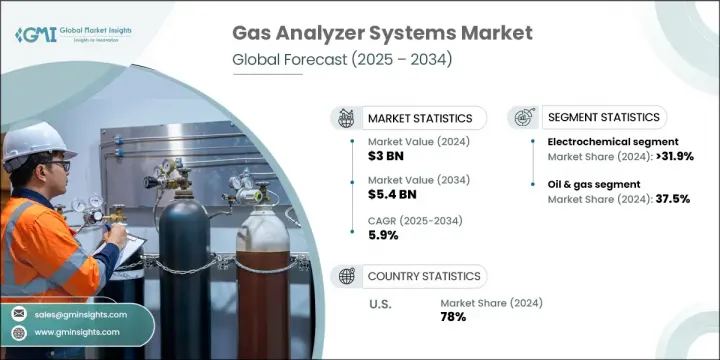

2024年,全球氣體分析系統市場規模達30億美元,預計2034年將以5.9%的複合年成長率成長,達到54億美元。工業自動化的蓬勃發展和對精確空氣品質監測需求的不斷成長,是推動先進氣體分析系統應用的關鍵驅動力。由於嚴格的排放法規、對環境合規性的日益重視以及對工作場所安全日益成長的需求,這些系統在多個行業中日益重要。技術進步和即時監測能力正在使氣體分析設備更加高效可靠。

隨著人們對環境影響和工業安全意識的不斷增強,食品飲料、製藥和能源等行業正轉向使用氣體分析儀來確保合規性和營運效率。政府強制實施的排放控制政策也推動了產業的採用,而感測器技術的持續改進也促進了創新和市場擴張。在快速發展的工業環境中,提高能源效率、檢測有害氣體混合物和預防環境危害的需求進一步增強了這種需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 5.9% |

電化學氣體分析儀系統在2024年佔據了31.9%的市場佔有率,預計到2034年將以5.6%的複合年成長率成長。由於工業排放量的增加以及對精確靈敏的氣體監測工具的需求不斷成長,這項技術正日益受到重視。這些系統廣泛應用於製造部門、實驗室和其他需要強大氣體檢測能力來維持營運標準的工業環境,以最佳化流程並滿足安全合規要求。

石油和天然氣領域在2024年佔據37.5%的市場佔有率,預計到2034年將以5.5%的複合年成長率成長。該領域的成長主要歸因於碳氫化合物加工作業中對危險氣體即時監測的迫切需求。氣體分析儀系統在檢測腐蝕性混合物和水蒸氣方面至關重要,有助於增強系統完整性,防止腐蝕相關損壞,並維護煉油廠和天然氣廠的安全工作環境。

美國氣體分析儀系統市場佔78%的市場佔有率,2024年市場規模達7.98億美元。能源基礎設施、製造業現代化和工業安全的強勁投資支撐了這一成長。監管部門強制實施排放監測,以及工業流程自動化和永續發展,正推動美國各行業更廣泛地部署高性能氣體分析儀。

影響全球氣體分析系統市場的關鍵市場參與者包括富士電機、ABB、西門子、艾默生電氣和橫河電機。氣體分析系統市場的領先公司正在透過研發投資來增強其競爭優勢,旨在提高感測器的精度、耐用性和即時監控功能。與工業自動化公司的策略合作有助於將氣體分析系統整合到更廣泛的控制架構中。為了滿足合規性要求,企業正在根據不同地區不斷變化的監管標準客製化解決方案。此外,參與者正在透過緊湊、方便用戶使用且支援物聯網的系統來擴展其產品組合,以滿足下一代工業需求。向工業基礎不斷成長的新興市場進行地理擴張也是一項優先事項。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料可用性和採購分析

- 影響價值鏈的關鍵因素

- 中斷

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

- 氣體分析儀系統成本結構分析

- 新興機會和趨勢

- 利用物聯網技術進行數位轉型

- 新興市場滲透

- 投資分析及未來展望

第4章:競爭格局

- 介紹

- 按地區分析公司市場佔有率

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 策略舉措

- 重要夥伴關係與合作

- 重大併購活動

- 產品創新與發布

- 市場擴張策略

- 競爭基準測試

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 電化學

- 順磁性

- 氧化鋯(ZR)

- 非色散紅外線(NDIR)

- 其他

第6章:市場規模及預測:依最終用途,2021 - 2034

- 主要趨勢

- 石油和天然氣

- 化工和石化

- 衛生保健

- 研究

- 水和廢水

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 俄羅斯

- 挪威

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

第8章:公司簡介

- ABB

- Advanced Micro Instruments, Inc.

- AVL List GmbH

- Buhler Technologies GmbH

- DAIICHI NEKKEN CO., LTD.

- DURAG GROUP

- Ecotech

- Emerson Electric Co.

- ENVEA

- Fuji Electric Co., Ltd

- Hiden Analytical

- HORIBA Group

- Leybold

- M&C TechGroup Germany

- METTLER TOLEDO

- Nova Analytical Systems

- Servomex

- Shimadzu Corporation

- SICK AG

- Siemens

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

The Global Gas Analyzer Systems Market was valued at USD 3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 5.4 billion by 2034. The surge in industrial automation and the rising demand for precise air quality monitoring are key drivers fueling the adoption of advanced gas analyzer systems. These systems are increasingly essential across multiple industries due to strict emissions regulations, heightened focus on environmental compliance, and a growing need for workplace safety. Technological advancements and real-time monitoring capabilities are making gas analysis equipment more effective and reliable.

As awareness around environmental impact and industrial safety increases, industries such as food and beverage, pharmaceuticals, and energy are turning to gas analyzers to maintain compliance and ensure operational efficiency. Government policies enforcing emissions control are also propelling industry adoption, while continuous improvements in sensor technologies support innovation and market expansion. The demand is further reinforced by the need to improve energy efficiency, detect harmful gas mixtures, and prevent environmental hazards across rapidly evolving industrial landscapes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 5.9% |

Electrochemical gas analyzer systems captured a 31.9% share in 2024 and is forecast to grow at a CAGR of 5.6% through 2034. This technology is gaining prominence due to the rising industrial emissions and the increasing demand for accurate and sensitive gas monitoring tools. These systems are widely utilized in process optimization and safety compliance across manufacturing units, laboratories, and other industrial environments that require robust gas detection capabilities to maintain operational standards.

The oil & gas segment held a 37.5% share in 2024 and is projected to grow at a CAGR of 5.5% through 2034. The segment's growth is largely attributed to the critical need for real-time monitoring of hazardous gases in hydrocarbon processing operations. Gas analyzer systems are pivotal in detecting corrosive mixtures and water vapor, helping to enhance system integrity, prevent corrosion-related damage, and maintain safe working environments across oil refineries and gas plants.

United States Gas Analyzer Systems Market held 78% share, generating USD 798 million in 2024. Robust investments in energy infrastructure, manufacturing modernization, and industrial safety are supporting this growth. Regulatory efforts mandating emissions monitoring and the push toward automation and sustainability in industrial processes are encouraging broader deployment of high-performance gas analyzers across US industries.

Key market players shaping the Global Gas Analyzer Systems Market include Fuji Electric, ABB, Siemens, Emerson Electric, and Yokogawa Electric. Leading companies in the gas analyzer systems market are strengthening their competitive edge through R&D investments aimed at enhancing sensor accuracy, durability, and real-time monitoring features. Strategic collaborations with industrial automation firms help integrate gas analysis systems into broader control architectures. To meet compliance demands, businesses are tailoring solutions based on evolving regulatory standards across different regions. Additionally, players are expanding their product portfolios with compact, user-friendly, and IoT-enabled systems to cater to next-generation industrial needs. Geographic expansion into emerging markets with growing industrial bases is also a priority.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of gas analyzer systems

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Electrochemical

- 5.3 Paramagnetic

- 5.4 Zirconia (ZR)

- 5.5 Non-Dispersive IR (NDIR)

- 5.6 Others

Chapter 6 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Oil & Gas

- 6.3 Chemical & Petrochemical

- 6.4 Healthcare

- 6.5 Research

- 6.6 Water & Wastewater

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Norway

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Mexico

- 7.6.3 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Advanced Micro Instruments, Inc.

- 8.3 AVL List GmbH

- 8.4 Buhler Technologies GmbH

- 8.5 DAIICHI NEKKEN CO., LTD.

- 8.6 DURAG GROUP

- 8.7 Ecotech

- 8.8 Emerson Electric Co.

- 8.9 ENVEA

- 8.10 Fuji Electric Co., Ltd

- 8.11 Hiden Analytical

- 8.12 HORIBA Group

- 8.13 Leybold

- 8.14 M&C TechGroup Germany

- 8.15 METTLER TOLEDO

- 8.16 Nova Analytical Systems

- 8.17 Servomex

- 8.18 Shimadzu Corporation

- 8.19 SICK AG

- 8.20 Siemens

- 8.21 Thermo Fisher Scientific Inc.

- 8.22 Yokogawa Electric Corporation