|

市場調查報告書

商品編碼

1907344

日本電動車充電設備市場佔有率分析、產業趨勢及統計、成長預測(2026-2031)Japan Electric Vehicle Charging Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

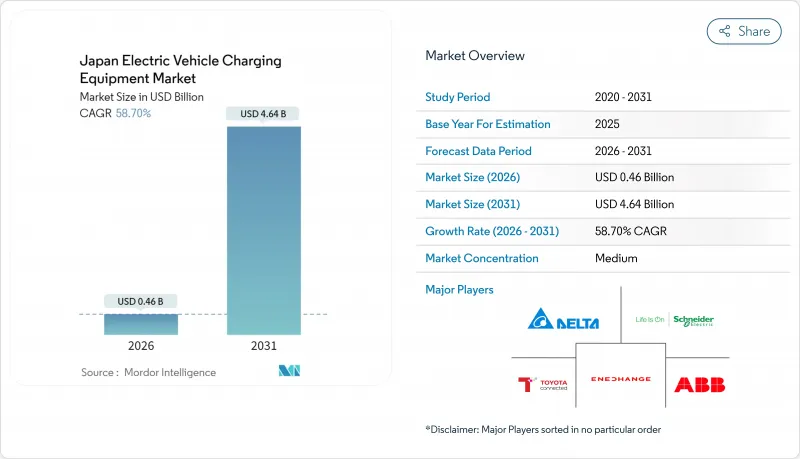

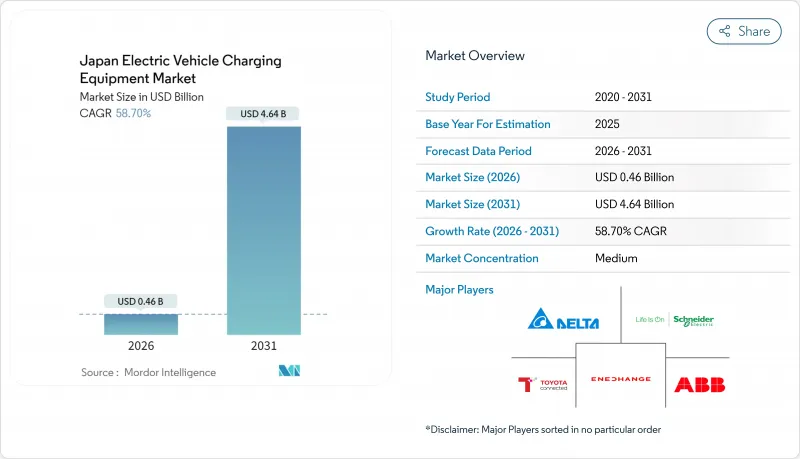

日本電動車充電設備市場預計到 2025 年將價值 2.9 億美元,從 2026 年的 4.6 億美元成長到 2031 年的 46.4 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 58.70%。

日本電動車充電設備市場的發展主要得益於2035年禁止銷售汽油動力車的政策、大規模的綠色成長投資以及雙向充電樁在全國電力系統中的普及。大型企業集團推行的強制性電氣化政策為日本電動車充電設備市場創造了高度可預測的需求基礎,使得網路建設速度更快,規模經濟效益也比消費者主導型模式更早實現。技術創新(特別是液冷充電線、複合電纜和新一代CHAdeMO/ChaoJi通訊協定)正將充電設備定位為電網資產,而不僅僅是硬體的「燃料補給」。各部會和都道府縣之間的政策協調維持了補貼制度並縮短了投資回收期,而零件技術的創新則降低了總體擁有成本。儘管日本電動車充電設備市場仍處於一定程度的分散狀態,但電力公司正開始在整個生態系統中扮演關鍵的協調者角色,並透過需量反應計畫開發新的收入來源。

日本電動車充電設備市場趨勢及洞察

由於2035年禁止銷售汽油車,因此需要推廣向電動車轉型。

這項禁令消除了政策上的不確定性,刺激了資本投資,因為日本充電設備市場的供應商可以更有信心地預測未來十年的現金流。日本政府已撥款數兆日圓用於擴大充電基礎設施,並設定了2030年建成30萬個公共充電樁的目標(增加八倍)。商用車輛也將受到限制,這將即時產生對充電樁的需求,從而支撐日本電動車充電設備市場的高複合年成長率。東京及其周邊地區吸引了大部分初始資金,這反映了這些地區人口密度高,且企業總部集中。

凱雷茨集團主導的企業ESG和車隊電氣化舉措

日本獨特的企業集團(keiretsu)體系已將電動車的普及從消費者的選擇轉變為統一的企業策略,從而形成了西方市場所不具備的獨特基礎設施需求模式。一些日本企業已承諾在2030年前實現其商用車輛的全面電氣化,並為工廠和物流中心簽訂了長期充電樁合約。規模經濟將降低每個港口的安裝成本,並加快投資回報,尤其是在關東-關西經濟特區。

根據《建築物管理法》,公寓維修核准出現延誤。

日本《建築物管理法》規定,公寓大樓內任何重大電氣設備改造都必須獲得所有業主的同意。這項規定對住宅充電站的安裝構成重大障礙,尤其是在公寓大樓普遍存在的都市區。該法的製定主要針對傳統的建築維修,未能充分考慮電動車基礎建設所面臨的獨特挑戰。業主個人的決定將對建築物的電力容量和整體安全系統產生深遠影響。隨著電動車的普及,這些限制日益嚴格,造成了基礎設施瓶頸。因此,許多新電動車車主被迫依賴公共充電設施,增加了營運成本,降低了電動車的吸引力。

細分市場分析

到2025年,乘用車將佔日本電動車充電設備市場佔有率的93.48%,成為大多數公共電網的基礎負載。同時,商用車的複合年成長率將達到64.30%,這將促使設備製造商轉向大規模直流模組和先進的負載調度軟體。車隊電氣化合約通常為期多年,使供應商能夠確保持續的維護收入並更準確地預測零件需求。像大和運輸和佐川急便這樣的物流公司正在部署兆瓦級樞紐作為微電網,利用固定式電池來降低高峰需求,並向電力公司出售輔助服務。這些大型設施也對個人駕駛員產生了連鎖反應,因為營運商會在夜間向公眾開放剩餘的電力容量。

企業級應用的興起也推動了連接器耐用性和支付整合的創新,因為車隊應用場景需要數千次的連接循環和集中收費。處理能力的提升加快了硬體更換週期,擴大了電纜、密封件和開關設備的售後市場。將硬體與SaaS車隊管理儀錶板捆綁銷售的供應商,由於整合到物流工作流程中的軟體客戶解約率較低,可以穩定利潤率。隨著企業級應用的普及,即使乘用車仍保持銷售優勢,商用車在日本電動車充電設備市場的佔有率預計也將成長。

預計到2025年,其他類別(例如接線端子、電能表、安全裝置等)將佔日本電動車充電設備市場佔有率的33.62%,而線纜預計將以63.90%的複合年成長率成長。輕量複合複合材料鞘套將電纜重量減輕40%,從而減輕工作量並減少因連接器脫落而導致的維修次數。日本國內企業正與樹脂供應商合作開發這些設計,並簽訂獨家供應協議以提高利潤率。零件的規模經濟顯著降低了單位成本,從而提高了小規模獨立營運商的採用率。

傳統的桿式充電樁在都市區面臨面積限制,促使供應商推出纖薄的壁掛式充電樁,可直接安裝在現有的停車場燈桿上。電源和控制面板的更新換代與日本電動車充電設備市場的整體成長趨勢相符,碳化矽MOSFET的採用顯著提高了轉換效率,並帶來了額外的成長潛力。 CHAdeMO的「超快」藍圖推動了互通性的改進,確保新硬體能夠向下相容舊款車輛。提供端到端硬體套件的供應商透過捆綁銷售策略簡化採購審核,從而贏得市政競標。這場組件之爭表明,在快速擴張的市場中,技術的漸進式改進如何能顯著影響收入來源。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 日本計劃於2035年禁止銷售汽油動力汽車,這將促進向電動車的轉型。

- 企業環境、社會及治理(ESG)及集團公司強制要求車隊電氣化

- 經濟產業省綠色成長基金提供的高功率充電器補貼

- 電力公司對車輛到家庭(V2H)的附加費

- 太陽能資源豐富的地區對併網雙向充電器的需求

- 配合2025年大阪世博會試行引進道路充電樁

- 市場限制

- 根據《建築物管理法》,公寓維修核准出現延誤。

- 高速公路沿線公共快速充電設施的土地租金高昂

- CHAdeMO/CCS/NACS 標準的持續分類

- 本地充電站利用率低(低於8%)

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模和成長預測(價值和數量)

- 按車輛類型

- 搭乘用車

- 商用車輛

- 透過充電設備

- 支柱

- 電線和電纜

- 基板

- 充電控制器

- 電源

- 其他

- 透過充電方法

- 交流充電站

- 直流充電站

- NACS(北美充電系統)

- 透過使用

- 家用充電

- 公共充電

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Panasonic Corporation

- Denso Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Delta Electronics

- Nichicon Corporation

- Fujikura Ltd.

- Toshiba Corporation

- NEC Corporation

- Sumitomo Electric Industries, Ltd.

- Tokyo Electric Power Company Holdings(TEPCO)

- ENECHANGE Ltd.

- Terra Motors Corporation

- Envision AESC Group

第7章 市場機會與未來展望

The Japan EV charging equipment market was valued at USD 0.29 billion in 2025 and estimated to grow from USD 0.46 billion in 2026 to reach USD 4.64 billion by 2031, at a CAGR of 58.70% during the forecast period (2026-2031).

The Japan EV charging equipment market is propelled by the 2035 gasoline-vehicle sales ban, heavy green-growth spending, and nationwide integration of bidirectional chargers into the power system. Corporate electrification mandates issued by major keiretsu groups give the Japan EV charging equipment market an unusually predictable demand base, allowing faster network build-outs and earlier scale economies than consumer-led models. Technology advances-especially liquid-cooled cords, composite cables, and next-generation CHAdeMO/ChaoJi protocols-position equipment as grid assets rather than simple refueling hardware. Policy coherence between ministries and prefectures sustains subsidy pipelines that narrow payback periods, while component innovation drives total cost of ownership down. Although the Japan EV charging equipment market remains moderately fragmented, utilities have emerged as pivotal ecosystem orchestrators that unlock new revenue through demand-response programs

Japan Electric Vehicle Charging Equipment Market Trends and Insights

EV-Shift Stimulus From Japan's 2035 Gasoline-Car Sales Ban

The ban removes policy ambiguity and accelerates equipment investment because Japanese EV charging equipment market suppliers can confidently model ten-year cash flows. The Japanese government has earmarked trillions for charging build-outs and set a 300,000-public-port target by 2030, an almost eight-fold expansion. Commercial fleets must also comply, triggering immediate depot-charging demand that underpins the Japan EV charging equipment market's significant CAGR. Tokyo and adjacent prefectures attract the bulk of early funding, reflecting population density and corporate head-office concentration.

Corporate ESG-Fleet Electrification Mandates By Keiretsu Groups

In Japan, the distinctive keiretsu system shifts electric vehicle (EV) adoption from mere consumer choices to unified corporate strategies, leading to unique infrastructure demand patterns not seen in Western markets. Some Japanese companies have pledged to have fully electrified commercial fleets by 2030, locking in long-term charger contracts at factories and logistics hubs. Scale advantages lower per-port installation costs and accelerate return on investment, especially in the Kanto and Kansai economic belts.

Slow Condominium Retrofit Approvals Under the Building Management Act

Japan's Building Management Act mandates unanimous consent from all condominium owners for major electrical modifications. This requirement poses significant hurdles for installing residential charging stations, especially in urban areas dominated by condominium living. While the Act was crafted for traditional building modifications, it fails to address the nuances of EV infrastructure deployment. Here, decisions made by individual owners can have far-reaching implications on the building's overall electrical capacity and safety systems. As EV adoption surges, these constraints intensify, leading to infrastructure bottlenecks. Consequently, many new EV owners are pushed towards public charging solutions, which inflate operational costs and dampen the appeal of EV adoption.

Other drivers and restraints analyzed in the detailed report include:

- Subsidized High-Power Charger Grants Under METI's Green Growth Fund

- V2H Tariff Premiums from Power Utilities

- High Land-Lease Costs for Public Fast-Charging Sites Near Expressways

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars held a 93.48% Japan EV charging equipment market share in 2025, furnishing the baseline load for most public networks. Commercial vehicles, however, post a 64.30% CAGR that pulls equipment makers toward depot-grade DC blocks and advanced load-scheduling software. Fleet electrification contracts are typically multi-year, letting suppliers lock in recurring maintenance revenue and forecast parts demand more accurately. Logistics firms like Yamato and Sagawa deploy megawatt hubs that double as micro-grids, using stationary batteries to shave peak demand and sell ancillary services to utilities. These large installations create spillover benefits for retail drivers when operators open excess nighttime capacity to the public.

The corporate pivot also drives connector durability and payment integration innovation because fleet use cases require thousands of mating cycles and centralized billing. Higher throughput accelerates hardware replacement cycles, expanding the aftermarket for cables, seals, and switchgear. Suppliers that bundle hardware with SaaS fleet dashboards gain margin insulation because software churn remains low once integrated into logistics workflows. As corporate adoption scales, the commercial share of the Japan EV charging equipment market size is expected to rise, even if passenger cars remain numerically dominant.

The Others (terminal blocks, energy meters, safety mechanisms, etc.) category held 33.62% of the Japan EV charging equipment market share in 2025, but cords and cables are forecast to grow at a 63.90% CAGR. Lightweight composite sheathing cuts cable mass by 40%, mitigating ergonomic strain and reducing maintenance calls linked to dropped connectors. Domestic firms co-develop these designs with resin suppliers, securing exclusive supply contracts that shore up margins. Component scale economies lower per-unit cost significantly, widening adoption among small independent operators.

Traditional pedestal pillars face urban footprint constraints, prompting vendors to roll out slimline wall-mounts that bolt onto existing parking-lot lighting poles. Power supplies and control boards track the overall growth of Japan's EV charging equipment market size but gain an incremental bump from silicon-carbide MOSFET adoption, significantly improving conversion efficiency. Interoperability upgrades follow CHAdeMO's ChaoJi roadmap, ensuring new hardware remains backward-compatible with earlier vehicles. Suppliers that offer end-to-end hardware suites win municipal tenders because bundling simplifies procurement audits. The component race thus underscores how incremental engineering tweaks can swing large revenue pools in a fast-scaling market.

The Japan Electric Vehicle Charging Equipment Market Report is Segmented by Vehicle Type (Passenger Cars and Commercial Vehicles), Charging Equipment (Pillar, Cord and Cable, Control Boards, Charging Controllers, and Others), Charging Type (AC Charging Station, DC Charging Station, and NACS), and Application Type (Home Charging and Public Charging). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Panasonic Corporation

- Denso Corporation

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Delta Electronics

- Nichicon Corporation

- Fujikura Ltd.

- Toshiba Corporation

- NEC Corporation

- Sumitomo Electric Industries, Ltd.

- Tokyo Electric Power Company Holdings (TEPCO)

- ENECHANGE Ltd.

- Terra Motors Corporation

- Envision AESC Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-Shift Stimulus from Japan's 2035 Gasoline-Car Sales Ban

- 4.2.2 Corporate ESG-Fleet Electrification Mandates by Keiretsu Groups

- 4.2.3 Subsidized High-Power Charger Grants Under METI's Green Growth Fund

- 4.2.4 V2H (Vehicle-To-Home) Tariff Premiums From Power Utilities

- 4.2.5 Grid-Balancing Demand for Bidirectional Chargers at Solar-Rich Prefectures

- 4.2.6 On-Street Charger Pilots Tied to 2025 World Expo Osaka

- 4.3 Market Restraints

- 4.3.1 Slow Condominium Retrofit Approvals Under Japan's Building Management Act

- 4.3.2 High Land-Lease Costs for Public Fast-Charging Sites Near Expressways

- 4.3.3 Persistent CHAdeMO / CCS / NACS Standards Fragmentation

- 4.3.4 Low Utilisation Rates (Below 8%) at Rural Charging Stations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Charging Equipment

- 5.2.1 Pillar

- 5.2.2 Cord and Cable

- 5.2.3 Control Boards

- 5.2.4 Charging Controllers

- 5.2.5 Power Supplies

- 5.2.6 Others

- 5.3 By Charging Type

- 5.3.1 AC Charging Station

- 5.3.2 DC Charging Station

- 5.3.3 NACS (North American Charging System)

- 5.4 By Application Type

- 5.4.1 Home Charging

- 5.4.2 Public Charging

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Panasonic Corporation

- 6.4.2 Denso Corporation

- 6.4.3 Mitsubishi Electric Corporation

- 6.4.4 Hitachi, Ltd.

- 6.4.5 Delta Electronics

- 6.4.6 Nichicon Corporation

- 6.4.7 Fujikura Ltd.

- 6.4.8 Toshiba Corporation

- 6.4.9 NEC Corporation

- 6.4.10 Sumitomo Electric Industries, Ltd.

- 6.4.11 Tokyo Electric Power Company Holdings (TEPCO)

- 6.4.12 ENECHANGE Ltd.

- 6.4.13 Terra Motors Corporation

- 6.4.14 Envision AESC Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment