|

市場調查報告書

商品編碼

1885866

超快速電動車充電(350kW+)系統市場機會、成長促進因素、產業趨勢分析及2025-2034年預測Ultra-Fast EV Charging (350kW+) Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

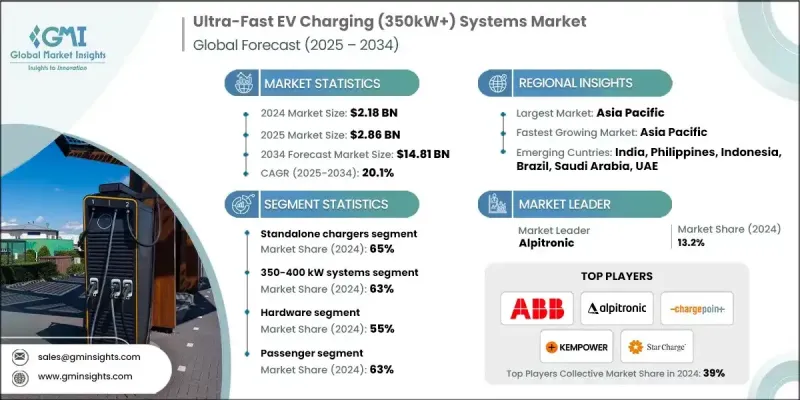

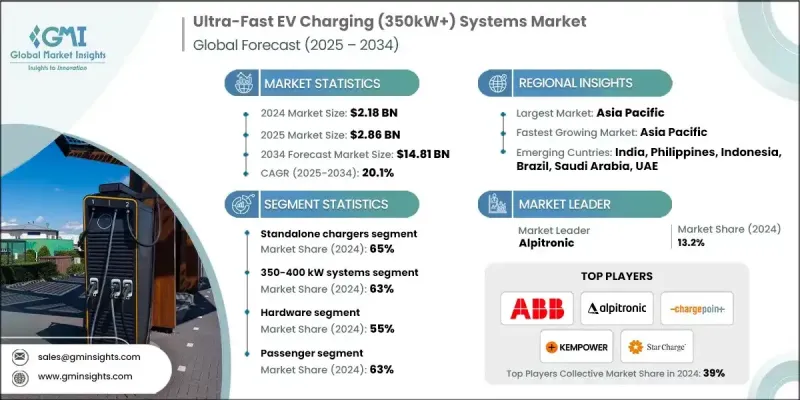

2024 年全球超快速電動車充電(350kW+)系統市值為 21.8 億美元,預計到 2034 年將以 20.1% 的複合年成長率成長至 148.1 億美元。

全球對超快速電動車充電器(350kW+)的需求激增,正在重塑全球電動車基礎設施。這些高功率充電器可使相容車輛在20分鐘內將電池電量充至80%,大幅減少停機時間,加速電動車的普及。它們對於乘用車和商用車電動車領域都至關重要,提供高壓運轉、可擴展的模組化設計和先進的熱管理。充電器製造商、電力電子供應商和電力合作夥伴正在進行策略性投資,以簡化技術整合、降低安裝成本並提高系統可靠性。新冠疫情間接推動了基礎設施投資,因為各國政府強調低排放出行、永續性和清潔交通,並推出激勵措施以擴大高功率充電網路。電動車普及率的不斷提高進一步增加了對能夠高效服務於商用車和乘用車的350kW+充電系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21.8億美元 |

| 預測值 | 148.1億美元 |

| 複合年成長率 | 20.1% |

2024年,獨立式充電樁市佔率達到65%,預計到2034年將以20.5%的複合年成長率成長。獨立式充電樁憑藉其部署靈活性、較低的安裝複雜性以及對公共和高速公路網路的適用性,佔據了市場主導地位。它們可以獨立運行,安裝在服務站、零售中心和休息區等場所,並提供350千瓦以上的超快速充電,滿足電動車用戶日益成長的快速充電需求。

2024年,350-400千瓦系統市佔率達到63%,預計2025年至2034年間將以20.5%的複合年成長率成長。這些系統因其性價比高且相容於大多數800伏特電動車架構而備受青睞。它們可在20分鐘內將電池容量充至70-80%,是乘用車和輕型商用車的理想選擇。其廣泛的電動車相容性推動了全球公共和高速公路充電網路的普及。

中國超快速電動車充電(350kW+)系統市場佔40%的佔有率,市場規模達3.666億美元。中國在該市場的領先地位歸功於其大規模的電動車生產、政府支持的基礎設施項目以及成本效益高的製造生態系統。 「新能源汽車(NEV)」政策的訂定,以及超過150億美元的充電基礎設施投資,加速了超快充電樁在各大城市和高速公路的部署。

超快速電動車充電(350kW+)系統市場的主要參與者包括西門子、ABB、Alpitronic、台達、華為、ChargePoint、Heliox、Kempower、StarCharge 和 Tritium。市場參與者正大力投資研發,以提高充電器的效率、模組化程度和熱管理能力,同時降低安裝和維護成本。各公司正與電力公司、電動車製造商和基礎設施開發商建立戰略合作夥伴關係,以擴展充電網路並確保與各種電動車型號的兼容性。地理擴張,尤其是在電動車普及率高的地區,有助於鞏固市場地位。併購使公司能夠整合技術並提升服務能力。此外,各公司也正在整合數位平台,以實現即時監控、預測性維護和便利的支付解決方案,進而提升客戶體驗。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 全球乘用車和商用車領域電動車普及率激增

- 政府加大資金投入和基礎設施激勵措施,以促進超快速充電設施的部署

- OEM與充電網路業者合作進行大規模推廣活動

- 電力電子、轉換器和熱管理技術的進步

- 車隊電氣化計畫的增加推動了高吞吐量充電需求。

- 產業陷阱與挑戰

- 超快速充電基礎設施的高昂資本支出和安裝成本

- 多個地區電網容量有限,面臨能源供應挑戰

- 市場機遇

- 提高儲能和再生能源與超快速充電器的整合度

- 新興市場和發展中市場超快速充電部署的增加

- 對專用車隊和物流充電中心的需求不斷成長

- 模組化、多埠和可擴展充電系統的發展突飛猛進

- 企業和政府永續發展措施的增加促進了基礎設施投資。

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 價格趨勢

- 按地區

- 按組件

- 成本細分分析

- 永續性和環境影響分析

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 投資和融資分析

- 政府資助計劃

- NEVI 公式計劃(50億美元)

- 歐盟連接歐洲設施(CEF)

- 替代燃料基礎設施設施(AFIF)

- 中國新能源汽車補貼計劃

- 州和省級激勵措施

- 私人投資趨勢

- 公私合作模式

- 綠色債券與永續金融

- 基礎建設基金與房地產投資信託基金

- 政府資助計劃

- 商業模式分析

- CPO自有營運模式

- OEM自有充電網路

- 公用事業公司擁有的基礎設施

- 零售和商業房東

- 計費即服務 (CaaS) 模式

- 混合及新興模型

- 安裝調試過程

- 安裝前規劃

- 土建工程及場地準備

- 電氣安裝

- 調試與測試

- 按功率位準進行時間軸分析

- 安裝成本明細

- 未來展望與機遇

- 新興應用

- 下一代創新

- 投資機會

- 風險評估

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估算與預測:依組件分類,2021-2034年

- 主要趨勢

- 硬體

- 電源模組

- 電纜和連接器

- 冷卻系統

- 外殼和安裝支架

- 軟體

- 能源管理系統

- 支付和存取控制

- 遠端監控與分析

- 服務

- 安裝與調試

- 維護與升級

- 網管

第6章:市場估計與預測:依安裝量分類,2021-2034年

- 主要趨勢

- 獨立式充電器

- 整合系統

第7章:市場估算與預測:依功率等級分類,2021-2034年

- 主要趨勢

- 350-400千瓦系統

- 400-500千瓦系統

- 500千瓦以上的系統

第8章:市場估算與預測:依配置分類,2021-2034年

- 主要趨勢

- 單埠系統

- 多埠系統(2-4個連接埠)

- 模組化可擴充系統

第9章:市場估計與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 公共充電站

- 商業車隊充電

- 住宅/私人充電

- 高速公路和長途充電網路

第10章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車輛

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第11章:市場估計與預測:按地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 菲律賓

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- 全球參與者

- ABB

- Alpitronic

- ChargePoint

- Delta

- Enel X

- Exicom Power Solutions

- Huawei

- Kempower

- Phoenix Contact

- StarCharge

- Webasto

- 區域玩家

- BTC Power

- Circontrol

- Compleo Charging Solutions

- EVTEC

- Heliox

- Ingeteam

- Phihong

- SK Signet

- TELD (TGood Electric)

- Tritium DCFC

- 新興參與者

- Blink Charging

- Designwerk Technologies

- Gravity

- HICI Digital Power Technology

- Nxu

- Qingdao Hardhitter Electric

- Rhombus Energy Solutions (BorgWarner)

- Shijiazhuang Tonhe Electronics

- Zerova (Noodoe EV)

The Global Ultra-Fast EV Charging (350kW+) Systems Market was valued at USD 2.18 billion in 2024 and is estimated to grow at a CAGR of 20.1% to reach USD 14.81 billion by 2034.

The surge in demand for ultra-fast EV chargers (350kW+) is reshaping the electric vehicle infrastructure worldwide. These high-power chargers allow compatible vehicles to reach 80% battery capacity in under 20 minutes, significantly reducing downtime and accelerating EV adoption. They are essential for both passenger and commercial EV segments, offering high-voltage operation, scalable modular designs, and advanced thermal management. Charger manufacturers, power electronics suppliers, and utility partners are investing strategically to simplify technology integration, lower installation costs, and enhance system reliability. The COVID-19 pandemic indirectly boosted infrastructure investments, as governments emphasized low-emission mobility, sustainability, and clean transportation, introducing incentives to expand high-power charging networks. Rising EV adoption has further increased the demand for 350 kW+ charging systems capable of servicing both commercial and passenger vehicles efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.18 Billion |

| Forecast Value | $14.81 Billion |

| CAGR | 20.1% |

The standalone chargers segment held a 65% share in 2024 and is expected to grow at a CAGR of 20.5% through 2034. Standalone chargers dominate the market due to their deployment flexibility, lower installation complexity, and suitability for public and highway networks. Operating independently, they can be installed across service stations, retail hubs, and rest areas while providing ultra-fast 350 kW+ charging, meeting the growing demand for rapid turnaround among EV users.

The 350-400 kW systems segment captured 63% share in 2024 and is anticipated to grow at a CAGR of 20.5% between 2025 and 2034. These systems are favored for their cost-performance balance and compatibility with most 800 V EV architectures. They can recharge 70-80% of battery capacity in under 20 minutes, making them ideal for passenger and light commercial vehicles. Their broad EV compatibility has driven adoption across public and highway charging networks globally.

China Ultra-Fast EV Charging (350kW+) Systems Market held a 40% share, generating USD 366.6 million. The country's dominance is attributed to its large-scale EV production, government-supported infrastructure programs, and cost-effective manufacturing ecosystem. Policy initiatives under the "New Energy Vehicle (NEV)" program, coupled with investments exceeding USD 15 billion in charging infrastructure, have accelerated the deployment of ultra-fast chargers across major cities and highways.

Key players in the Ultra-Fast EV Charging (350kW+) Systems Market include Siemens, ABB, Alpitronic, Delta, Huawei, ChargePoint, Heliox, Kempower, StarCharge, and Tritium. Market players are investing heavily in R&D to improve charger efficiency, modularity, and thermal management while reducing installation and maintenance costs. Companies are forming strategic partnerships with utility providers, EV manufacturers, and infrastructure developers to expand charging networks and ensure compatibility with diverse EV models. Geographic expansion, particularly in regions with high EV adoption, strengthens market presence. Mergers and acquisitions allow firms to consolidate technology and enhance service capabilities. Companies are also integrating digital platforms for real-time monitoring, predictive maintenance, and user-friendly payment solutions to enhance customer experience.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Installation

- 2.2.3 Power rating

- 2.2.4 Component

- 2.2.5 Vehicle

- 2.2.6 Application

- 2.2.7 Configuration

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in global EV adoption across passenger and commercial segments

- 3.2.1.2 Increase in government funding and infrastructure incentives for ultra-fast charging deployment

- 3.2.1.3 Rise in OEM and charging network collaborations for large-scale rollouts

- 3.2.1.4 Growth in advancements of power electronics, converters, and thermal management technologies

- 3.2.1.5 Increase in fleet electrification initiatives driving high-throughput charging demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital expenditure and installation costs for ultra-fast charging infrastructure

- 3.2.2.2 Limited grid capacity and energy supply challenges in several regions

- 3.2.3 Market opportunities

- 3.2.3.1 Increase in integration of energy storage and renewables with ultra-fast chargers

- 3.2.3.2 Rise in ultra-fast charging deployment across emerging and developing markets

- 3.2.3.3 Growth in demand for dedicated fleet and logistics charging hubs

- 3.2.3.4 Surge in development of modular, multi-port, and scalable charging systems

- 3.2.3.5 Increase in corporate and government sustainability initiatives boosting infrastructure investment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Investment and funding analysis

- 3.13.1 Government funding programs

- 3.13.1.1 NEVI formula program ($5 billion)

- 3.13.1.2 EU connecting Europe facility (CEF)

- 3.13.1.3 Alternative fuels infrastructure facility (AFIF)

- 3.13.1.4 China NEV subsidy programs

- 3.13.1.5 State and provincial incentives

- 3.13.2 Private investment trends

- 3.13.3 Public-private partnership models

- 3.13.4 Green bonds and sustainable finance

- 3.13.5 Infrastructure funds and REITs

- 3.13.1 Government funding programs

- 3.14 Business model analysis

- 3.14.1 CPO-owned & operated model

- 3.14.2 OEM-owned charging networks

- 3.14.3 Utility-owned infrastructure

- 3.14.4 Retail & commercial host-owned

- 3.14.5 Charging-as-a-service (CaaS) model

- 3.14.6 Hybrid & emerging models

- 3.15 Installation & commissioning process

- 3.15.1 Pre-installation planning

- 3.15.2 Civil works & site preparation

- 3.15.3 Electrical installation

- 3.15.4 Commissioning & testing

- 3.15.5 Timeline analysis by power level

- 3.15.6 Installation cost breakdown

- 3.16 Future outlook & opportunities

- 3.16.1 Emerging Applications

- 3.16.2 Next-Generation Innovations

- 3.16.3 Investment Opportunities

- 3.16.4 Risk Assessment

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Power modules

- 5.2.2 Cables & connectors

- 5.2.3 Cooling systems

- 5.2.4 Enclosures & mounts

- 5.3 Software

- 5.3.1 Energy management systems

- 5.3.2 Payment & access control

- 5.3.3 Remote monitoring & analytics

- 5.4 Services

- 5.4.1 Installation & commissioning

- 5.4.2 Maintenance & upgrades

- 5.4.3 Network management

Chapter 6 Market Estimates & Forecast, By Installation, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Standalone chargers

- 6.3 Integrated systems

Chapter 7 Market Estimates & Forecast, By Power rating, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 350-400 kW systems

- 7.3 400-500 kW systems

- 7.4 500+ kW systems

Chapter 8 Market Estimates & Forecast, By Configuration, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Single-port systems

- 8.3 Multi-port systems (2-4 ports)

- 8.4 Modular expandable systems

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Public charging stations

- 9.3 Commercial fleet charging

- 9.4 Residential / private charging

- 9.5 Highway and long-distance charging networks

Chapter 10 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Passenger vehicles

- 10.2.1 Hatchbacks

- 10.2.2 Sedans

- 10.2.3 SUV

- 10.3 Commercial vehicles

- 10.3.1 Light commercial vehicles (LCV)

- 10.3.2 Medium commercial vehicles (MCV)

- 10.3.3 Heavy commercial vehicles (HCV)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 ABB

- 12.1.2 Alpitronic

- 12.1.3 ChargePoint

- 12.1.4 Delta

- 12.1.5 Enel X

- 12.1.6 Exicom Power Solutions

- 12.1.7 Huawei

- 12.1.8 Kempower

- 12.1.9 Phoenix Contact

- 12.1.10 StarCharge

- 12.1.11 Webasto

- 12.2 Regional Players

- 12.2.1 BTC Power

- 12.2.2 Circontrol

- 12.2.3 Compleo Charging Solutions

- 12.2.4 EVTEC

- 12.2.5 Heliox

- 12.2.6 Ingeteam

- 12.2.7 Phihong

- 12.2.8 SK Signet

- 12.2.9 TELD (TGood Electric)

- 12.2.10 Tritium DCFC

- 12.3 Emerging Players

- 12.3.1 Blink Charging

- 12.3.2 Designwerk Technologies

- 12.3.3 Gravity

- 12.3.4 HICI Digital Power Technology

- 12.3.5 Nxu

- 12.3.6 Qingdao Hardhitter Electric

- 12.3.7 Rhombus Energy Solutions (BorgWarner)

- 12.3.8 Shijiazhuang Tonhe Electronics

- 12.3.9 Zerova (Noodoe EV)