|

市場調查報告書

商品編碼

1907333

個人護理包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

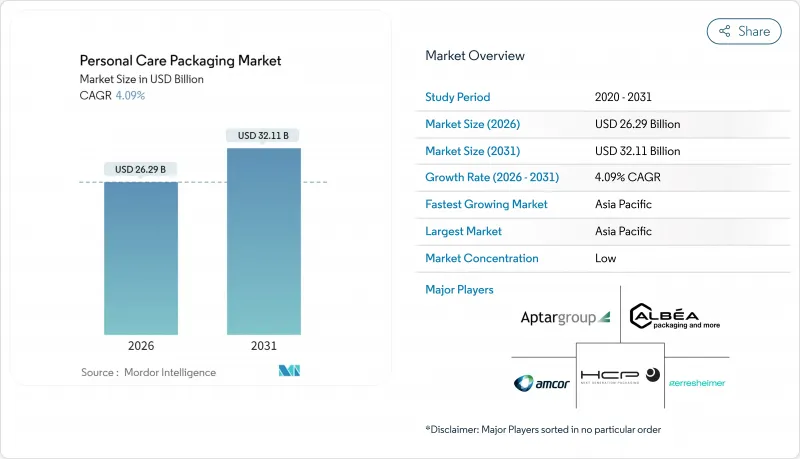

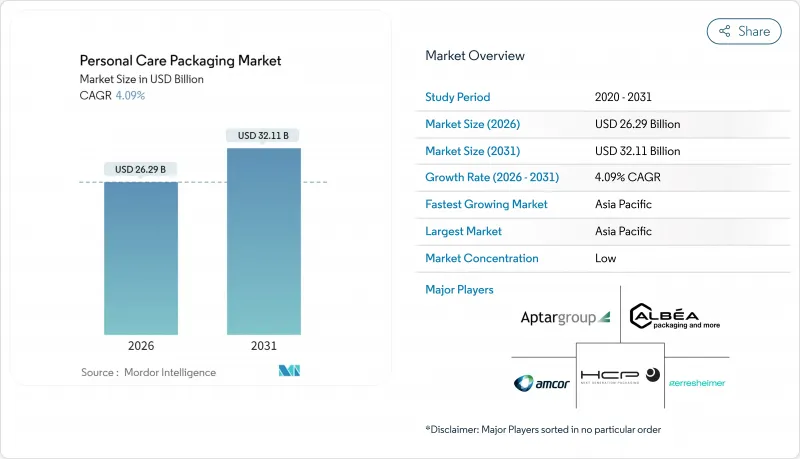

個人護理包裝市場預計將從 2025 年的 252.6 億美元成長到 2026 年的 262.9 億美元,到 2031 年將達到 321.1 億美元,2026 年至 2031 年的複合年成長率為 4.09%。

持續成長與新興市場的優質化、至少30%的消費後回收(PCR)成分要求以及需要高防護性、即用型包裝的全通路模式密切相關。以PCR PET、生物基聚合物和海洋塑膠原料為核心的材料創新,降低了監管風險並促進了產品差異化。邊緣人工智慧填充線降低了單品生產成本,而家用可重複填充分配器則提升了消費者的便利性並減少了材料消耗。這些因素共同增強了北美和歐洲個人護理包裝市場對樹脂價格波動和一次性使用法規的抵禦能力。

全球個人護理包裝市場趨勢與洞察

新興市場美妝產品SKU的高階化

優質化透過金屬光澤、壓紋和多組件配置等技術,向注重性價比的消費者傳遞獨特性,從而提升本土和國際品牌的品牌形象,使其成為消費者嚮往的品牌。數位裝飾技術實現了經濟高效的小批量生產,使得頻繁推出限量版產品成為可能,這些產品的價格通常比普通產品高出20%至40%。護膚品的成功經驗正推動護髮和除臭劑領域採用類似的策略,強化了消費者對包裝精緻度與產品功效和安全性之間關係的認知。

全通路支援有助於提供保護和便於交付的包裝。

電子商務的快速發展要求包裝既要能承受單小包裹運輸的衝擊,又要保持商店市級的品牌形象。整合緩衝層、防篡改瓶蓋和經過跌落測試的結構設計,無需二次包裝,在某些情況下可減少高達 30% 的材料消費量。自動化技術能夠實現零售和線上 SKU 之間的快速切換,隨著各類別電子商務滲透率每年成長超過 25%,生產週期也得以縮短。

聚烯和PET原料價格波動

樹脂成本一年內波動幅度可能超過40%,擠壓加工業者的獲利空間,促使他們採取動態定價和避險策略。供應限制進一步加劇了再生樹脂價格的波動,推動垂直採購和長期合約的簽訂,以保障盈利。

細分市場分析

塑膠因其成本效益和可適應的阻隔性能,預計到2025年將佔據個人護理包裝市場58.22%的佔有率。聚乙烯和聚丙烯將成為該領域的主要生產驅動力,而聚對苯二甲酸乙二醇酯(PET)則因一次性使用法規的影響而落後。生物基樹脂和聚合再生樹脂(PCR)在2031年之前將維持4.22%的複合年成長率,從而緩解法規對個人護理包裝市場規模的影響。玻璃將繼續作為高階香水的優質包裝材料,而金屬氣霧劑將繼續在髮膠噴霧和除臭劑領域佔據一席之地。紙板在對防潮性能要求不高的二級包裝領域需求不斷成長。

對先進回收技術和相容劑化學的持續投入,使加工商能夠在不影響透明度和保存期限的前提下,滿足消費後回收物(PCR)標準。各大品牌正嘗試使用無母粒和無添加劑配方,以最大限度地提高產品報廢後的可回收性。這些進展表明,在政策壓力日益增大的情況下,塑膠仍然處於行業前沿,而創新正在穩定個人護理包裝市場。

到2025年,硬質容器將佔據個人護理包裝市場80.96%的佔有率,預計年複合成長率將達到5.51%,這主要得益於消費者對產品耐用性和品牌價值的重視。真空罐、玻璃滴管和帶致動器的寶特瓶符合高階護膚和護髮產品的定位。雖然軟包裝袋憑藉旅行裝和填充用填充包裝正在逐漸佔據市場,但品牌商仍依賴硬質主包裝來提升產品在商店的吸引力和感知價值。

輕量化和模組化組裝在保持剛性的同時減少了材料用量。混合解決方案將堅固的外殼與軟性補充容器相結合,在提供熟悉的用戶體驗的同時,永續性。隨著業界對具備NFC認證功能的智慧封蓋的廣泛應用,硬質包裝在數位化消費者互動策略中也繼續發揮關鍵作用。

區域分析

亞太地區預計到2025年將佔據個人護理包裝市場41.62%的佔有率,並預計在2031年之前以5.18%的複合年成長率成長,這主要得益於可支配收入的成長、都市區化進程的推進以及男士護理市場的活性化。中國憑藉其一體化的供應鏈和快速成長的電子商務,將持續維持銷售主導地位;而印度則因現代分銷方式的興起,銷售量也呈現快速成長。日本和韓國引領全球智慧包裝的潮流,將NFC標籤和熱敏油墨應用於產品互動和真偽檢驗。

在北美,個人護理包裝市場依然龐大,這主要得益於護膚和護髮品類的高階需求和品牌忠誠度。日益嚴格的再生塑膠(PCR)含量法規迫使加工商擴大機械和化學回收利用,鞏固了該地區作為創新試驗場的地位。在美國,對防篡改和兒童安全包裝的需求推動了市場成長,而加拿大也呈現類似的趨勢,並更加重視雙語標籤。墨西哥的貿易協定以及其接近性原料產地的地理優勢,為出口生產提供了成本效益高的基礎。

歐洲的趨勢正受到嚴格的減廢棄物政策的影響。德國和法國正在量販店中試行設立補充裝站點,加速可重複使用包裝的普及。英國在應對脫歐後複雜的清關程序的同時,也維持其高階香水玻璃容器的生產。南歐正利用其在高階硬包裝領域的設計傳統,而北歐市場則在推動使用紙盒作為二次包裝,以滿足循環經濟指標的要求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 新興市場美妝產品優質化

- 全通路支援推動了保護性包裝和運輸包裝的發展

- 永續性規則:要求至少含有 30% 的再生塑膠 (PCR) 成分

- 家用可重複填充分配器迅速普及

- 配備邊緣人工智慧的填充線可降低 SKU 成本

- 東南亞男士護理市場快速成長

- 市場限制

- 聚烯和PET原料價格波動

- 歐盟及美國部分州已禁止使用一次性塑膠製品。

- 鋁和玻璃供應鏈瓶頸

- 由於固態洗漱用品的興起,初級包裝被取代

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 聚乙烯

- 聚丙烯

- PET和PVC

- 聚苯乙烯

- 生物基塑膠

- 其他塑膠材料類型

- 玻璃

- 金屬

- 紙和紙板

- 塑膠

- 按包裝類型

- 柔軟的

- 難的

- 依產品類型

- 瓶子和罐子

- 管子和棍子

- 泵浦和分配器

- 小袋和包裝袋

- 瓶蓋和封口

- 其他產品類型

- 透過使用

- 護膚

- 護髮

- 口腔護理

- 化妝品

- 除臭劑和香水

- 嬰兒護理

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Albea SA

- HCP Packaging Group

- Gerresheimer AG

- Amcor plc

- AptarGroup, Inc.

- Cosmopak USA LLC

- Quadpack Industries, SA

- Libo Cosmetics Co., Ltd.

- Mpack Poland sp. z oo

- POLITECH SP. Z OO

- Rieke Corporation(TriMas Corporation)

- Berlin Packaging LLC

- MKTG INDUSTRY SRL

- Silgan Holdings, Inc.

- Stoelzle Oberglas GmbH

- EPL Limited

- Verescence Inc.

- Apackaging Group LLC

- Heinz-Glass GmbH & Ko. KGaA

- Roetell Group

- Vitro SAB De CV

- Vidraria Anchieta Ltda.

- Lumson SpA

第7章 市場機會與未來展望

The personal care packaging market is expected to grow from USD 25.26 billion in 2025 to USD 26.29 billion in 2026 and is forecast to reach USD 32.11 billion by 2031 at 4.09% CAGR over 2026-2031.

Sustained growth is linked to premiumization in emerging economies, the enforcement of a minimum 30% post-consumer recycled (PCR) content, and omni-channel fulfilment models that require ship-ready packs with high protective performance. Material innovation centered on PCR PET, bio-based polymers, and ocean-plastic feedstock mitigates regulatory risk and fuels product differentiation. Edge-AI filling lines are cutting SKU production costs, while refill-at-home dispensing formats broaden consumer convenience and lower material intensity. Together, these factors strengthen the personal care packaging market's resilience against volatile resin prices and single-use restrictions in North America and Europe.

Global Personal Care Packaging Market Trends and Insights

Premiumization of Beauty SKUs in Emerging Markets

Premiumization elevates local and global brands to aspirational status through metallic finishes, embossed textures, and multi-component assemblies that convey exclusivity to value-oriented consumers. Digital embellishment enables economically viable short runs, encouraging frequent limited-edition launches that command 20-40% price premiums. Success in skin care drives similar strategies in hair care and deodorants, reinforcing consumer perception that package sophistication signals efficacy and safety.

Omni-Channel Fulfillment Driving Protective and Ship-Ready Packs

E-commerce acceleration compels packages to survive single-parcel distribution while projecting shelf-quality branding. Integrated cushioning, tamper-evident closures, and drop-test-rated structures remove secondary boxes and trim material consumption by 30% for some adopters. Automation supports rapid line changeovers between retail and online SKUs, tightening production cycles as category e-commerce penetration exceeds 25% annually.

Volatile Polyolefin and PET Feed-Stock Prices

Resin costs swing more than 40% within a year, compressing converter margins and prompting dynamic pricing and hedging programs. Recycled resin prices fluctuate even more due to limited supply, driving vertically integrated sourcing and long-term contracts to shield profitability.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability Rules Mandating More than 30% PCR Content

- Rapid Adoption of Refill-At-Home Dispensing Formats

- Supply-Chain Chokepoints in Aluminium and Glass

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic held 58.22% of the personal care packaging market share in 2025, supported by cost efficiency and adaptable barrier performance. Within the segment, polyethylene and polypropylene led volumes, while PET trailed under scrutiny from single-use restrictions. Bio-based and PCR resins underpin a 4.22% CAGR to 2031, cushioning regulatory impacts on the personal care packaging market size. Glass retained its luxury positioning for prestige fragrances, whereas metal aerosols sustained their niche in hair sprays and deodorants. Paperboard gains traction in secondary packs where moisture barriers are non-critical.

Continued investment in advanced recycling and compatibilizer chemistry allows converters to meet PCR thresholds without sacrificing clarity or shelf life. Brands experiment with colorless masterbatches and additive-free formulations to maximize end-of-life recyclability. These developments keep plastic at the forefront even as policy pressure intensifies, demonstrating how innovation stabilizes the personal care packaging market.

Rigid formats represented 80.96% of the personal care packaging market size in 2025 and are forecast to expand at a 5.51% CAGR, driven by consumer perception of durability and brand prestige. Airless jars, glass droppers, and PET bottles with spray actuators satisfy premium skin and hair care positioning. Flexible pouches penetrate travel sizes and refill pods, but brand owners still rely on rigid primary containers for shelf presence and perceived value.

Light-weighting and modular assemblies help offset material intensity while preserving rigidity. Hybrid solutions pair rigid outer shells with flexible refills, merging user familiarity with sustainability gains. Industry adoption of smart closures capable of NFC authentication keeps rigid packaging relevant in digital consumer engagement strategies.

The Personal Care Packaging Market Report is Segmented by Material Type (Plastic, Glass, Metal, and Paper and Paperboard), Packaging Format (Flexible and Rigid), Product Type (Bottles and Jars, Tubes and Sticks, Pumps and Dispensers, Pouches and Sachets, and More), Application (Skin Care, Hair Care, Oral Care, Make-Up Products, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 41.62% of the personal care packaging market share in 2025 and will expand at a 5.18% CAGR to 2031, lifted by rising disposable incomes, urban migration, and vibrant male grooming uptake. China sustains volume leadership on the back of integrated supply chains and surging e-commerce, while India registers rapid unit growth as modern trade formats multiply. Japan and South Korea steer global smart-packaging trends, embedding NFC tags and heat-sensitive inks for product interaction and authenticity verification.

North America maintains a sizeable personal care packaging market due to premiumization and brand loyalty in skin and hair care. Regulatory emphasis on PCR content pushes converters to scale mechanical and chemical recycling, cementing the region's role as an innovation testbed. The United States drives demand for tamper-resistant, child-safe packs, whereas Canada mirrors these tendencies with an additional focus on bilingual labeling. Mexico offers cost-effective production hubs for export-oriented runs, benefiting from trade agreements and proximity to raw material suppliers.

Europe's profile is shaped by stringent waste-reduction mandates. Germany and France pilot refill stations in mass retail, accelerating uptake of reusable packs. The United Kingdom navigates post-Brexit customs complexities yet retains high-value niche production in luxury fragrance glass. Southern Europe leverages design heritage in premium rigid formats, while Northern European markets advance carton-based secondary packs to satisfy circularity metrics.

- Albea S.A.

- HCP Packaging Group

- Gerresheimer AG

- Amcor plc

- AptarGroup, Inc.

- Cosmopak USA LLC

- Quadpack Industries, S.A.

- Libo Cosmetics Co., Ltd.

- Mpack Poland sp. z o.o.

- POLITECH SP. Z O.O.

- Rieke Corporation (TriMas Corporation)

- Berlin Packaging LLC

- MKTG INDUSTRY SRL

- Silgan Holdings, Inc.

- Stoelzle Oberglas GmbH

- EPL Limited

- Verescence Inc.

- Apackaging Group LLC

- Heinz-Glass GmbH & Ko. KGaA

- Roetell Group

- Vitro SAB De CV

- Vidraria Anchieta Ltda.

- Lumson S.p.A

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization of Beauty SKUs in Emerging Markets

- 4.2.2 Omni-Channel Fulfilment Driving Protective and Ship-Ready Packs

- 4.2.3 Sustainability Rules Mandating more than 30 % PCR Content

- 4.2.4 Rapid Adoption of Refill-At-Home Dispensing Formats

- 4.2.5 Edge-Ai Enabled Filling Lines Cutting SKU Cost

- 4.2.6 Explosive Growth of Male Grooming in Southeast Asia

- 4.3 Market Restraints

- 4.3.1 Volatile Polyolefin and PET Feed-Stock Prices

- 4.3.2 Single-Use-Plastics Bans Across the EU and Select US States

- 4.3.3 Supply-Chain Chokepoints in Aluminium and Glass

- 4.3.4 Rise of Solid-Format Toiletries Replacing Primary Packs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Polyethylene

- 5.1.1.2 Polypropylene

- 5.1.1.3 PET and PVC

- 5.1.1.4 Polystyrene

- 5.1.1.5 Bio-Based Plastics

- 5.1.1.6 Other Plastic Material Types

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.1 Plastic

- 5.2 By Packaging Format

- 5.2.1 Flexible

- 5.2.2 Rigid

- 5.3 By Product Type

- 5.3.1 Bottles and Jars

- 5.3.2 Tubes and Sticks

- 5.3.3 Pumps and Dispensers

- 5.3.4 Pouches and Sachets

- 5.3.5 Caps and Closures

- 5.3.6 Other Product Types

- 5.4 By Application

- 5.4.1 Skin Care

- 5.4.2 Hair Care

- 5.4.3 Oral Care

- 5.4.4 Make-Up Products

- 5.4.5 Deodorants and Fragrances

- 5.4.6 Baby Care

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN Countries

- 5.5.4.6 Australia and New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Albea S.A.

- 6.4.2 HCP Packaging Group

- 6.4.3 Gerresheimer AG

- 6.4.4 Amcor plc

- 6.4.5 AptarGroup, Inc.

- 6.4.6 Cosmopak USA LLC

- 6.4.7 Quadpack Industries, S.A.

- 6.4.8 Libo Cosmetics Co., Ltd.

- 6.4.9 Mpack Poland sp. z o.o.

- 6.4.10 POLITECH SP. Z O.O.

- 6.4.11 Rieke Corporation (TriMas Corporation)

- 6.4.12 Berlin Packaging LLC

- 6.4.13 MKTG INDUSTRY SRL

- 6.4.14 Silgan Holdings, Inc.

- 6.4.15 Stoelzle Oberglas GmbH

- 6.4.16 EPL Limited

- 6.4.17 Verescence Inc.

- 6.4.18 Apackaging Group LLC

- 6.4.19 Heinz-Glass GmbH & Ko. KGaA

- 6.4.20 Roetell Group

- 6.4.21 Vitro SAB De CV

- 6.4.22 Vidraria Anchieta Ltda.

- 6.4.23 Lumson S.p.A

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment