|

市場調查報告書

商品編碼

1851460

美國個人護理包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)US Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

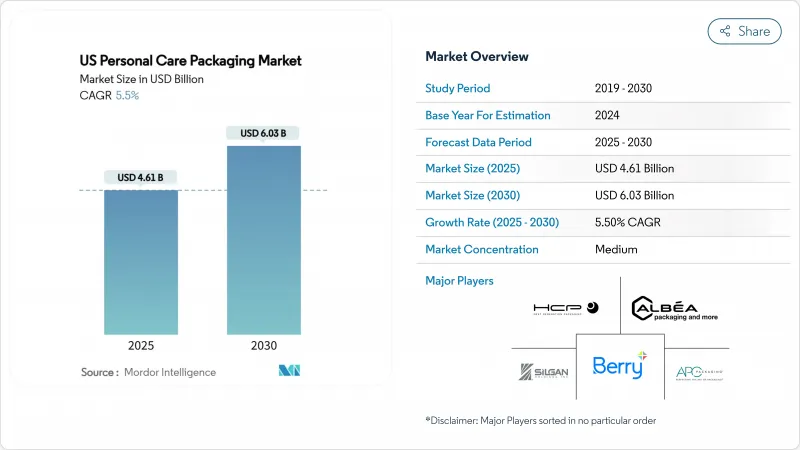

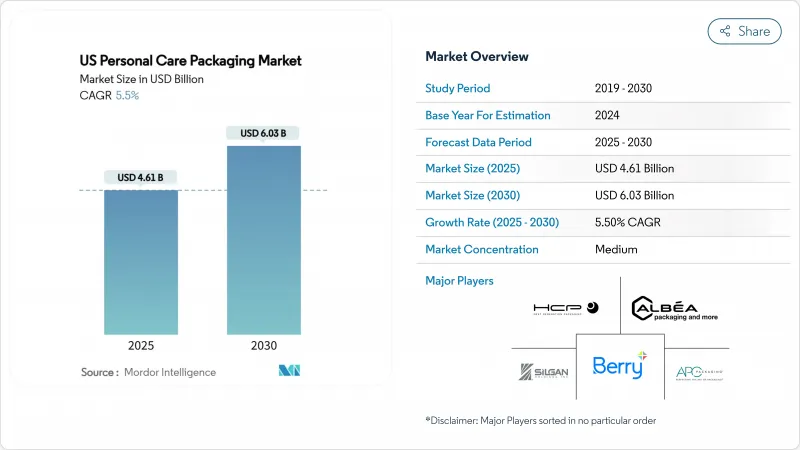

據估計,2025 年美國個人護理包裝市場規模為 46.1 億美元,預計到 2030 年將達到 60.3 億美元,預測期(2025-2030 年)複合年成長率為 5.5%。

全氟烷基和多氟烷基物質(PFAS)的持續淘汰、永續性指令以及社交媒體主導的對吸睛包裝的追求,正在重塑材料選擇和設計理念。明尼蘇達州嚴格的州法規規定,2025年禁止在化妝品中故意添加PFAS,促使加工商探索新的阻隔化學技術併升級回收基礎設施。美國西部家庭每年在個人保養用品上的支出為1,038美元,遠高於908美元的全國平均。這一趨勢在安姆科(Amcor)與貝瑞全球(Berry Global)於2025年4月進行的全股票合併中得到了體現,預計此次合併將產生6.5億美元的協同效應,並在2028年之前帶來超過30億美元的現金流。這些因素正在推動美國個人護理包裝市場價值的穩定成長,提高產品種類(SKU)的普及率,並促進對可重複填充包裝設計的需求。

美國個人護理包裝市場趨勢與洞察

可支配收入的增加推動了對包裝產品的需求。

到2024年,個人照護支出將達到每戶908美元,歐洲和美國的成長速度將更快,平均年支出為1,038美元。強勁的工資成長將推動產品種類多樣化、高階包裝和特色配方的發展,從而刺激美國個人護理包裝市場的需求成長。玻璃和金屬材質的包裝將受益最大,因為消費者普遍認為玻璃和金屬與品質和永續性有關。

適合在Instagram上分享的美感加速了優質化。

如今,設計本身也成為了一種行銷管道,促使品牌投資於引人注目的造型、壓花工藝和上鏡的客製化色彩。玻璃瓶和拉絲鋁製氣霧劑比傳統的HDPE瓶表現更佳,因為它們更符合環保訊息,也更適合在社群平台上進行視覺敘事。歐萊雅與IBM合作,利用人工智慧訓練永續配方,這清楚地展現了科技的融合如何兼顧外觀和功能。

高昂的研發和模具成本限制了創新。

開發新型吹塑成型模具和精密幫浦的成本可能超過每條生產線100萬美元。規模較小的加工商難以承擔多次試驗的費用,尤其是在生物基樹脂需要專用設備和漫長的資質認證流程時。折疊式施用器的專利申請表明,差異化點膠技術背後蘊含著複雜性和高資本投入。

細分市場分析

由於成本低、設計靈活且供應鏈成熟,塑膠包裝預計在2024年仍將佔據美國個人護理用品包裝市場50.6%的佔有率。然而,受PFAS(全氟烷基和多氟烷基物質)污染治理以及消費者對可再生基材支援的影響,預計到2030年,紙和紙板包裝市場將以9.5%的複合年成長率成長。各大品牌正在嘗試使用阻隔塗佈紙盒和纖維模塑罐,這些產品能夠通過水分測試,且不會影響保存期限。再生PET的整合以及試驗化學回收工廠的建設,有助於緩解人們對循環利用的擔憂,並保護塑膠的鉛含量。

循環經濟政策正推動加工商提高消費後再生樹脂(PCR)的含量並建立回收計劃。同時,玻璃和金屬因其奢侈品定位而受益。高階護膚品牌紛紛採用厚壁瓶身和帶刷頭的鋁製包裝,並宣稱其可無限循環利用,以此來證明其溢價的合理性。垂直整合也推動了材料創新,例如安姆科(Amcor)對樹脂採購的投資,確保了不斷成長的美國個人護理包裝市場所需的消費後再生樹脂供應。

由於瓶裝產品具有知名度、貨架吸引力以及適用於乳液、洗髮精、沐浴乳露等多種產品的多功能性,預計到2024年,瓶裝產品將占美國個人護理包裝市場38.2%的佔有率。然而,受電商空間利用率高和材料用量低的推動,軟包裝袋預計將以11.2%的複合年成長率成長。可重複使用的吸嘴和自立袋提升了消費者的便利性,而超薄膜則減輕了運輸重量。

軟管、棒狀包裝和精密泵頭分別適用於不同的應用場景,例如防曬棒用於防曬護理,無氣泵頭用於視網醇精華液,在這些應用中,劑量精準度比單價更為重要。隨著品牌轉向單一材料紙質解決方案以簡化路邊回收,可折疊紙盒正日益普及。在所有包裝形式中,NFC晶片和QR碼將包裝轉變為互動中心,這在競爭激烈的美國個人護理包裝市場中成為一項關鍵的差異化優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 由於可支配所得增加,個人護理用品SKU消費量也隨之增加。

- 對高階、適合在Instagram上曬照的包裝美學的需求

- 電子商務的蓬勃發展需要一種便於運輸且安全的格式。

- 訂閱和補充裝模式推動耐用/可重複使用包裝的發展

- 符合美國運輸安全管理局 (TSA) 標準的旅行包裝,適合經常出遊的消費者。

- 智慧/物聯網賦能的包裝,用於互動和可追溯性

- 市場限制

- 新型材料和製程的研發和模具成本高昂

- 美國收緊塑膠和 PFAS 法規

- 再生樹脂價格和供應品質不穩定

- 補貨和退貨計劃中的逆向物流摩擦

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙和紙板

- 依產品類型

- 瓶子

- 管子和棍子

- 泵浦和分配器

- 小袋

- 折疊式紙盒

- 其他

- 透過使用

- 護膚

- 護髮

- 口腔護理

- 化妝品和彩妝品

- 除臭劑和香水

- 除毛膏

- 其他

- 按永續性屬性

- 可回收(單一材料)

- 消費後回收 (PCR) 成分

- 可填充/可重複使用

- 可堆肥/生物基

第6章 競爭情勢

- 市場集中度

- 策略舉措與發展

- 市佔率分析

- 公司簡介

- Albea Services SA

- HCP Packaging Co. Ltd

- Berry Global Group Inc.

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Kaufman Container

- AptarGroup Inc.

- Amcor PLC

- Cosmopak USA LLC

- APC Packaging

- Rieke Corp(Trimas)

- Berlin Packaging LLC

- Glenroy Inc.

- TricorBraun

- Quadpack

- ProAmpac

- WestRock Company

- Gerresheimer AG

- Sonoco Products Co.

- International Paper Co.

第7章 市場機會與未來展望

The US Personal Care Packaging Market size is estimated at USD 4.61 billion in 2025, and is expected to reach USD 6.03 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Persistent PFAS phase-outs, mounting sustainability mandates and the social-media driven quest for eye-catching packs are reshaping material selection and design philosophies. Tight state rules Minnesota's 2025 ban on intentionally added PFAS in cosmetics among them push converters to explore new barrier chemistries and upgrade recycling infrastructure. Regional spending patterns amplify these shifts: households in the West devote USD 1,038 each year to personal-care items, well above the USD 908 national average, which explains the region's early uptake of premium, sustainable formats. Brand owners also intensify vertical integration to lock in packaging innovation capacity, a trend underscored by Amcor's all-stock combination with Berry Global in April 2025, expected to generate USD 650 million in synergies and more than USD 3 billion in cash flow by 2028. Together, these forces support steady value growth, SKU proliferation and rising demand for refill-ready designs across the US personal care packaging market.

US Personal Care Packaging Market Trends and Insights

Rising Disposable Income Fuels Pack Demand

Personal-care outlays reached USD 908 per household in 2024 and climb even higher in the West, where annual spending averaged USD 1,038. Steady wage gains translate into greater SKU variety, premium pack finishes and niche formulations, which in turn boost unit-volume requirements across the US personal care packaging market. Glass and metal formats benefit the most because consumers associate them with quality and sustainability.

Instagram-Ready Aesthetics Accelerate Premiumization

Design now doubles as a marketing channel, prompting brands to invest in striking shapes, embossing and custom colorways that photograph well. Glass jars and brushed-aluminum aerosols outperform conventional HDPE bottles because they align with eco-messaging and visual storytelling on social platforms. L'Oreal's partnership with IBM to train AI on sustainable formulations underscores how tech convergence supports both look and function.

High R&D and Tooling Costs Limit Innovation

Developing a new blow-mold or precision pump can exceed USD 1 million per line. Small converters struggle to fund multiple trials, particularly when bio-based resins demand specialized machinery and extended qualification. Patent filings for collapsible applicators illustrate the complexity as well as the capital intensity behind differentiated dispensing technology.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Drives Ship-Ready Protective Formats

- Subscription and Refill Models Favor Durable Solutions

- State-Level PFAS Rules Add Compliance Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained 50.6% US personal care packaging market share in 2024 thanks to low cost, design flexibility and well-established supply chains. Yet the paper and paperboard segment is projected to log a 9.5% CAGR through 2030, buoyed by PFAS crackdowns and consumer favor for renewable substrates. Brands experiment with barrier-coated cartons and molded-fiber jars that pass moisture tests without compromising shelf appeal. Recycled PET integration and pilot chemical recycling plants help plastics defend their lead by easing circularity concerns.

Circular-economy policies push converters to raise post-consumer-resin (PCR) content and build take-back schemes. Simultaneously, glass and metal profit from luxury positioning: prestige skin-care labels deploy heavy-walled flacons and brushed-aluminum sticks to justify price premiums while touting infinite recyclability. Material innovation is also spurred by vertical integration, exemplified by Amcor's resin-sourcing investments that safeguard PCR supply for the expanding US personal care packaging market.

Bottles commanded 38.2% of the US personal care packaging market size in 2024 due to familiarity, shelf impact and versatility across lotions, shampoos and body washes. However, flexible pouches are projected to log an 11.2% CAGR, propelled by e-commerce cube-efficiency and lower material usage. Reclosable spouts and stand-up formats bolster consumer convenience, while ultra-thin films curb shipping weight.

Tubes, sticks and precision pumps cater to targeted applications think SPF sticks for sun-care or airless pumps for retinol serums where dosing accuracy matters more than unit cost. Folding cartons gain ground as brands migrate to mono-material paper solutions that simplify curbside recycling. Across all formats, NFC chips and QR codes elevate packs into engagement hubs, a key differentiator in the crowded US personal care packaging market.

US Personal Care Packaging Market Report is Segmented by Material Type (Plastic, Glass, Metal, Paper and Paperboard), Product Type (Bottles, Tubes and Sticks, Pumps and Dispensers, Pouches and More), Application (Skin Care, Hair Care, Oral Care, and More), Sustainability Attribute (Recyclable, Post-Consumer-Recycled Content, Refillable/Reusable, Compostable/Bio-based). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Albea Services SA

- HCP Packaging Co. Ltd

- Berry Global Group Inc.

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Kaufman Container

- AptarGroup Inc.

- Amcor PLC

- Cosmopak USA LLC

- APC Packaging

- Rieke Corp (Trimas)

- Berlin Packaging LLC

- Glenroy Inc.

- TricorBraun

- Quadpack

- ProAmpac

- WestRock Company

- Gerresheimer AG

- Sonoco Products Co.

- International Paper Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising consumption of personal-care SKUs on higher disposable income

- 4.2.2 Demand for premium, "Instagram-ready" pack aesthetics

- 4.2.3 E-commerce boom needing ship-ready protective formats

- 4.2.4 Subscription and refill models driving durable / reusable packs

- 4.2.5 TSA-size travel packs for on-the-go consumers

- 4.2.6 Smart / IoT-enabled packs for engagement and traceability

- 4.3 Market Restraints

- 4.3.1 High RandD and tooling costs for novel formats and materials

- 4.3.2 Tightening U.S. plastics and PFAS regulations

- 4.3.3 Volatile recycled-resin price and supply quality

- 4.3.4 Reverse-logistics friction for refill / return programs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Tubes and Sticks

- 5.2.3 Pumps and Dispensers

- 5.2.4 Pouches

- 5.2.5 Folding Cartons

- 5.2.6 Others

- 5.3 By Application

- 5.3.1 Skin Care

- 5.3.2 Hair Care

- 5.3.3 Oral Care

- 5.3.4 Makeup and Color Cosmetics

- 5.3.5 Deodorants and Fragrances

- 5.3.6 Depilatories

- 5.3.7 Others

- 5.4 By Sustainability Attribute

- 5.4.1 Recyclable (mono-material)

- 5.4.2 Post-consumer-recycled (PCR) Content

- 5.4.3 Refillable / Reusable

- 5.4.4 Compostable / Bio-based

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albea Services SA

- 6.4.2 HCP Packaging Co. Ltd

- 6.4.3 Berry Global Group Inc.

- 6.4.4 Silgan Holdings Inc.

- 6.4.5 DS Smith PLC

- 6.4.6 Graham Packaging Company

- 6.4.7 Kaufman Container

- 6.4.8 AptarGroup Inc.

- 6.4.9 Amcor PLC

- 6.4.10 Cosmopak USA LLC

- 6.4.11 APC Packaging

- 6.4.12 Rieke Corp (Trimas)

- 6.4.13 Berlin Packaging LLC

- 6.4.14 Glenroy Inc.

- 6.4.15 TricorBraun

- 6.4.16 Quadpack

- 6.4.17 ProAmpac

- 6.4.18 WestRock Company

- 6.4.19 Gerresheimer AG

- 6.4.20 Sonoco Products Co.

- 6.4.21 International Paper Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment