|

市場調查報告書

商品編碼

1851383

中國個人護理包裝:市場佔有率分析、產業趨勢、統計數據及成長預測(2025-2030)China Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

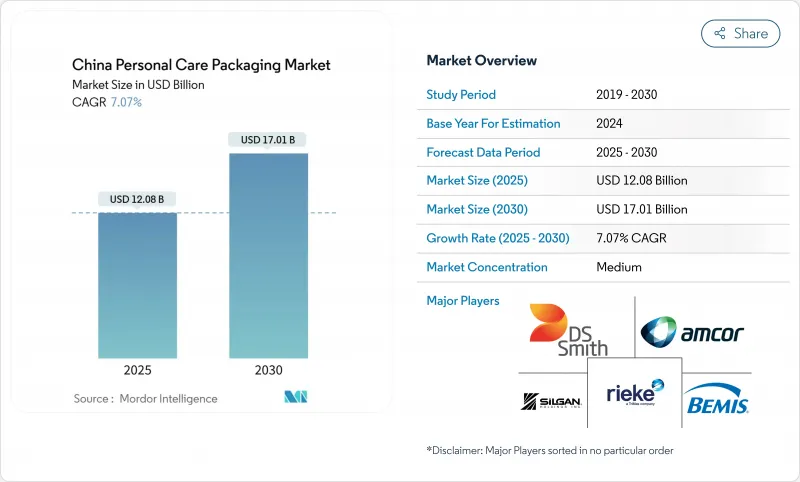

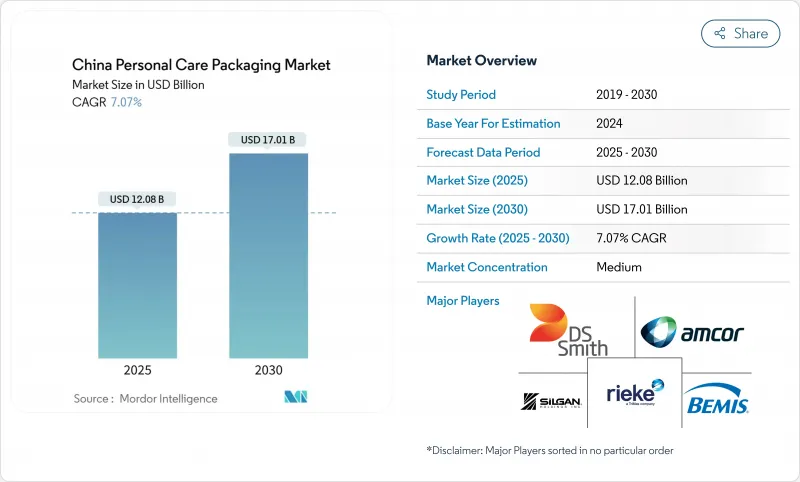

中國個人護理包裝市場預計到 2025 年將達到 120.8 億美元,到 2030 年將擴大到 170.1 億美元。

這一發展趨勢的驅動力包括:旨在遏制過度包裝的監管措施、美妝購物迅速向社交電商管道轉移,以及品牌對碳中和營運的承諾。永續材料創新、電商賦能的結構設計以及高階產品的推出正在共同重塑整個價值鏈的競爭格局。品牌正投資於人工智慧輔助原型製作以縮短開發週期,而包裝加工商則在全國末端配送的輕量化和耐用性之間尋求平衡。 GB 23350-2021標準的強化執行、中國國家碳排放交易體系的推行以及即時社群媒體回饋機制將繼續影響中國個人護理包裝市場的材料選擇和設計參數。

中國個人護理包裝市場趨勢與洞察

美容及個人護理電商蓬勃發展

社群電商的爆炸性成長迫使品牌設計出既能經得起大規模履約考驗,又能營造出上鏡開箱體驗的包裝。抖音美妝商品交易總額在2021年至2023年間加倍以上,該平台的演算法趨勢幾乎瞬間就為包裝設計商提供了需求。如今,品牌對包裝的抗衝擊性、體積重量和上鏡美觀都同樣重視。隨著履約中心在沿海地區以外地區迅速擴張,軟包裝袋和輕質紙板在中國個人護理包裝市場越來越受歡迎,它們憑藉良好的緩衝性和節省運輸成本的特性而備受青睞。

可重複灌裝零售業態的興起

高階美妝品牌的循環經濟目標加速了可重複填充膠囊、濃縮小袋和店內散裝分配器的試驗。資生堂的目標是到2025年實現100%永續包裝,將可填充用選項擴展到主打產品,並鼓勵本地ODM廠商改造射出成型線,以生產插入式墨盒。上海購物中心的早期試點計畫表明,當填充站靠近收銀台時,消費者更容易接受可重複使用的芯體,從而提高複購率並減少材料消耗。

樹脂和鋁價格不穩定

受油價波動和地緣政治不確定性的影響,原料供應不穩定,擠壓了加工商的利潤空間。像萬凱這樣的PET切片生產商正在將2024年下半年的運轉率下調至76%,導致供應趨緊,迫使加工商透過簽訂個多月合約進行避險,或轉向生產HDPE和PP共混物。難以承受額外費用的小公司正成為收購目標,這可能會推動中國個人護理包裝市場逐步整合。

細分市場分析

由於成本效益和製程彈性,塑膠包裝預計到2024年將佔據中國個人護理包裝市場58.47%的佔有率。然而,GB23350-2021標準對包裝間隙比的限制促使品牌商降低包裝壁厚,並探索使用紙板套作為二次包裝。紙和紙板包裝被視為成長的主要動力,複合年成長率高達8.23%,這主要得益於消費者將纖維基包裝與環保聯繫起來。玻璃包裝在高階護膚銷售中保持穩定,重量象徵著奢華;而金屬氣霧劑包裝在高階除臭劑市場則憑藉其無限可回收的特性而日益普及。樹脂價格的波動進一步凸顯了在中國個人護理包裝市場採用混合基材策略的必要性。

儘管生物基聚合物的研發管線正在穩定成長,但許多混合材料需要工業堆肥條件,而這種條件目前仍然十分稀缺。因此,生產商正投資研發單一材料聚丙烯(PP)管材和富含消費後回收材料(PCR)的聚對苯二甲酸乙二醇寶特瓶,這些產品既能滿足可回收性閾值,又不影響阻隔性能。來自國有銀行的綠色融資有望降低生產線改造以處理再生材料的資本成本,並將材料選擇與永續發展評分卡和投入成本對沖緊密聯繫起來。

2024年,塑膠瓶罐將佔銷售額的41.63%,這得益於成熟的吹塑成型製程和消費者對其的熟悉度。然而,隨著品牌方為減輕產品重量而降低宅配成本,預計軟包裝塑膠袋的複合年成長率將達到8.07%。防篡改拉鍊和風琴式底部設計如今已成為標配,其平整的正面在網紅影片的特寫鏡頭中隨處可見,並且能夠承受多節點運輸。隨著男士護理產品的蓬勃發展,管狀和棒狀產品也越來越受歡迎,填充用的包裝盒則有助於減少高階護膚的碳足跡。泵頭、滴管和致動器雖然面臨金屬彈簧部件帶來的成本壓力,但得益於中國個人護理包裝市場對優質化計量的重視,這些產品也從中受益。

紙板包裝箱正從空白的牛皮紙立方體演變為可按需印刷、聯名品牌的社交媒體故事講述平台。然而,它們必須符合GB 43352-2023快遞包裝法規,該法規限制重金屬含量,促使加工商轉向水性油墨和澱粉黏合劑。氣霧罐和特殊玻璃包裝雖然銷售小眾,但價值卻遠高於平均售價,這主要得益於香水和水療級護理產品的平均高售價。

中國個人護理包裝市場按材料類型(塑膠、玻璃、金屬、紙和紙板、生物基和可堆肥塑膠)、包裝類型(塑膠瓶和罐、管和棒、泵、噴霧器和滴管、其他)、產品類型(護膚、頭髮護理品、口腔護理品、其他)和永續性屬性(可回收、消費後回收 (PCR) 永續性)。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 美容及個人護理電商蓬勃發展

- 可重複灌裝零售業態的興起

- 護膚和化妝品SKU的優質化

- 改善低收入城市男性的整裝儀容

- 人工智慧驅動的設計和快速原型製作

- 強制遵守「過度包裝」(GB 23350-2021)

- 市場限制

- 樹脂和鋁價格不穩定

- 多層複合材料回收能力瓶頸

- 更嚴格的塑膠碳排放強度配額

- 二級包裝中的仿冒風險

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員影響評估

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙和紙板

- 生物基和可堆肥塑膠

- 按包裝類型

- 寶特瓶和罐子

- 管子和棍子

- 泵浦、噴霧器、滴管

- 氣霧罐和金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 軟塑膠(包裝袋、小袋、包裝膜)

- 瓶蓋和塞子

- 補充/重複使用系統

- 依產品類型

- 護膚

- 護髮

- 口腔護理

- 彩妝品

- 男士理容

- 除臭劑和香水

- 嬰兒護理

- 按永續性屬性

- 可回收(單一材料)

- 消費者回收率(PCR)

- 可生物分解/可堆肥

- 可補充裝/可回收

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Albea SA

- Amcor plc

- Silgan Holdings Inc.

- HCP Packaging(Shanghai)Co., Ltd.

- Berry Global Group, Inc.

- Gerresheimer AG

- AptarGroup, Inc.

- RPC Group Ltd(Berry Consumer Packaging Intl.)

- DS Smith Plc

- Huhtamaki Oyj

- Quadpack Industries, SA

- Rieke Packaging Systems Ltd.

- Shanghai Luxe-Pack Co., Ltd.

- Zhejiang Jinsheng New-Material Holding Group Co., Ltd.

- Shandong Yuhua Packing Products Co., Ltd.

- Guangzhou Beauty Packaging Co., Ltd.

- Xiamen Hexing Packaging Co., Ltd.

- Taizhou Forest Color Printing Packing Co., Ltd.

- Yunnan Yuxi Paper Co., Ltd.

- Ningbo NBG Plastic Packaging Co., Ltd.

第7章 市場機會與未來展望

The China personal care packaging market reached USD 12.08 billion in 2025 and is forecast to expand to USD 17.01 billion by 2030, reflecting a 7.07% CAGR over the period.

This trajectory is propelled by regulatory measures that curb excessive packaging, the rapid migration of beauty shopping to social-commerce channels, and brand commitments to carbon-neutral operations. Sustainable material innovation, e-commerce-ready structural designs, and premium-tier product launches are converging to redefine competitive positioning across the value chain. Brands are investing in AI-assisted prototyping to trim development cycles, while packaging converters balance lightweighting with durability demands for nationwide last-mile delivery. Heightened enforcement of the GB 23350-2021 standard, the roll-out of China's national carbon trading scheme, and real-time social media feedback loops will continue to shape material choices and design parameters for the China personal care packaging market.

China Personal Care Packaging Market Trends and Insights

E-commerce boom for beauty and personal care

Explosive social-commerce growth is forcing brands to engineer packs capable of surviving wide-radius fulfilment while staging a photogenic unboxing moment. Douyin's beauty GMV more than doubled between 2021 and 2023, turning platform algorithm trends into near-instant packaging briefs for converters. Brands now weigh impact resistance, dimensional weight, and camera-ready aesthetics in equal measure. As fulfillment centers proliferate outside coastal provinces, flexible pouches and lightweight corrugates gain favor for their cushioning and freight-saving attributes, reinforcing the momentum of the China personal care packaging market.

Rise of refill-ready retail formats

Circularity targets from premium beauty houses accelerated trials of refill pods, concentrate sachets, and in-store bulk dispensers. Shiseido aims for 100% sustainable packaging by 2025 and has extended refill options to hero SKUs, prompting local ODMs to retool injection-molding lines for plug-in cartridges. Early pilots in Shanghai malls show consumers accepting reusable cores when refill stations are adjacent to point-of-sale, unlocking repeat-purchase stickiness and trimming material footprints.

Volatile resin and aluminum prices

Feedstock swings, driven by oil price gyrations and geopolitical uncertainty, are compressing converter margins. PET chip producers such as Wankai trimmed operating rates to 76% in late 2024, tightening supply and pushing converters to hedge through multi-month contracts or diversify into HDPE and PP blends. Smaller firms struggling to absorb surcharges may become acquisition targets, spurring gradual consolidation within the China personal care packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization of skincare and cosmetic SKUs

- Male grooming uptake in lower-tier cities

- Recycling capacity bottlenecks for multi-layer laminates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic retained 58.47% of the China personal care packaging market share in 2024 owing to cost efficiency and process agility. Yet the GB 23350-2021 interspace ratio cap is prompting brands to trim wall thickness and explore paperboard sleeves for secondary packs. Paper and paperboard's 8.23% CAGR positions it as the standout growth engine, propelled by consumers equating fiber-based packs with environmental stewardship. Glass volumes are stabilizing in prestige skincare where weight signals luxury, while metal aerosols gain favor in premium deodorants as they align with infinitely recyclable narratives. Volatile resin prices further amplify the case for blended substrate strategies across the China personal care packaging market.

A steady pipeline of bio-based polymers has emerged, but many blends require industrial composting conditions that remain scarce. Consequently, producers are investing in mono-material PP tubes and PCR-rich PET bottles that meet recyclability thresholds without compromising barrier performance. State-owned banks' green finance instruments are expected to lower capital costs for retrofitting lines capable of handling recycled content, keeping material decisions tightly linked to both sustainability scorecards and input-cost hedging.

Plastic bottles and jars controlled 41.63% of 2024 revenues, backed by entrenched blow-molding assets and consumer familiarity. Flexible plastic pouches, however, are clocking an 8.07% CAGR as brands exploit weight savings that translate into lower courier tariffs. Tamper-evident zippers and gusseted bases are now standard to survive multi-node delivery routes while presenting flat fronts for influencer video close-ups. Tubes and sticks gain incremental traction alongside the male grooming boom, while refill cartridges enable footprint reduction in top-shelf skincare. Pumps, droppers, and actuators face cost pressure from metal spring components but benefit from premiumization that values dosage accuracy within the China personal care packaging market.

Corrugated shippers are evolving from plain kraft cubes into co-branded, print-on-demand canvases for social-media storytelling. Yet they must still comply with the GB 43352-2023 express-pack regulation limiting heavy-metal content, nudging converters toward water-based inks and starch adhesives. Aerosol cans and specialty glass remain niche by volume but over-index in value due to fragrance and spa-grade treatments that command higher averaged selling prices.

The China Personal Care Packaging Market is Segmented by Material Type (Plastic, Glass, Metal, Paper and Paperboard, and Bio-Based and Compostable Plastics), Packaging Type (Plastic Bottles and Jars, Tubes and Sticks, Pumps, Sprayers and Droppers, and More), Product Type (Skincare, Haircare, Oral Care, and More), and Sustainability Attribute (Recyclable, Post-Consumer Recycled (PCR) Content, Biodegradable, and More).

List of Companies Covered in this Report:

- Albea S.A.

- Amcor plc

- Silgan Holdings Inc.

- HCP Packaging (Shanghai) Co., Ltd.

- Berry Global Group, Inc.

- Gerresheimer AG

- AptarGroup, Inc.

- RPC Group Ltd (Berry Consumer Packaging Intl.)

- DS Smith Plc

- Huhtamaki Oyj

- Quadpack Industries, S.A.

- Rieke Packaging Systems Ltd.

- Shanghai Luxe-Pack Co., Ltd.

- Zhejiang Jinsheng New-Material Holding Group Co., Ltd.

- Shandong Yuhua Packing Products Co., Ltd.

- Guangzhou Beauty Packaging Co., Ltd.

- Xiamen Hexing Packaging Co., Ltd.

- Taizhou Forest Color Printing Packing Co., Ltd.

- Yunnan Yuxi Paper Co., Ltd.

- Ningbo NBG Plastic Packaging Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom for beauty and personal care

- 4.2.2 Rise of refill-ready retail formats

- 4.2.3 Premiumisation of skincare and cosmetic SKUs

- 4.2.4 Male grooming uptake in lower-tier cities

- 4.2.5 AI-enabled design and rapid prototyping

- 4.2.6 Mandatory "excessive-packaging" compliance (GB 23350-2021)

- 4.3 Market Restraints

- 4.3.1 Volatile resin and aluminum prices

- 4.3.2 Recycling capacity bottlenecks for multi-layer laminates

- 4.3.3 Stricter carbon-intensity quotas for plastics

- 4.3.4 Counterfeiting risk in secondary packaging

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Glass

- 5.1.3 Metal

- 5.1.4 Paper and Paperboard

- 5.1.5 Bio-based and Compostable Plastics

- 5.2 By Packaging Type

- 5.2.1 Plastic Bottles and Jars

- 5.2.2 Tubes and Sticks

- 5.2.3 Pumps, Sprayers and Droppers

- 5.2.4 Aerosol Cans and Metal Containers

- 5.2.5 Folding Cartons

- 5.2.6 Corrugated Boxes

- 5.2.7 Flexible Plastic (Pouches, Sachets, Wraps)

- 5.2.8 Caps and Closures

- 5.2.9 Refillable / Reuse Systems

- 5.3 By Product Type

- 5.3.1 Skincare

- 5.3.2 Haircare

- 5.3.3 Oral Care

- 5.3.4 Color Cosmetics

- 5.3.5 Men's Grooming

- 5.3.6 Deodorants and Fragrances

- 5.3.7 Baby Care

- 5.4 By Sustainability Attribute

- 5.4.1 Recyclable (Mono-material)

- 5.4.2 Post-Consumer Recycled (PCR) Content

- 5.4.3 Biodegradable / Compostable

- 5.4.4 Refillable / Returnable

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Albea S.A.

- 6.4.2 Amcor plc

- 6.4.3 Silgan Holdings Inc.

- 6.4.4 HCP Packaging (Shanghai) Co., Ltd.

- 6.4.5 Berry Global Group, Inc.

- 6.4.6 Gerresheimer AG

- 6.4.7 AptarGroup, Inc.

- 6.4.8 RPC Group Ltd (Berry Consumer Packaging Intl.)

- 6.4.9 DS Smith Plc

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Quadpack Industries, S.A.

- 6.4.12 Rieke Packaging Systems Ltd.

- 6.4.13 Shanghai Luxe-Pack Co., Ltd.

- 6.4.14 Zhejiang Jinsheng New-Material Holding Group Co., Ltd.

- 6.4.15 Shandong Yuhua Packing Products Co., Ltd.

- 6.4.16 Guangzhou Beauty Packaging Co., Ltd.

- 6.4.17 Xiamen Hexing Packaging Co., Ltd.

- 6.4.18 Taizhou Forest Color Printing Packing Co., Ltd.

- 6.4.19 Yunnan Yuxi Paper Co., Ltd.

- 6.4.20 Ningbo NBG Plastic Packaging Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment