|

市場調查報告書

商品編碼

1907331

歐洲作物保護化學品:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Europe Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

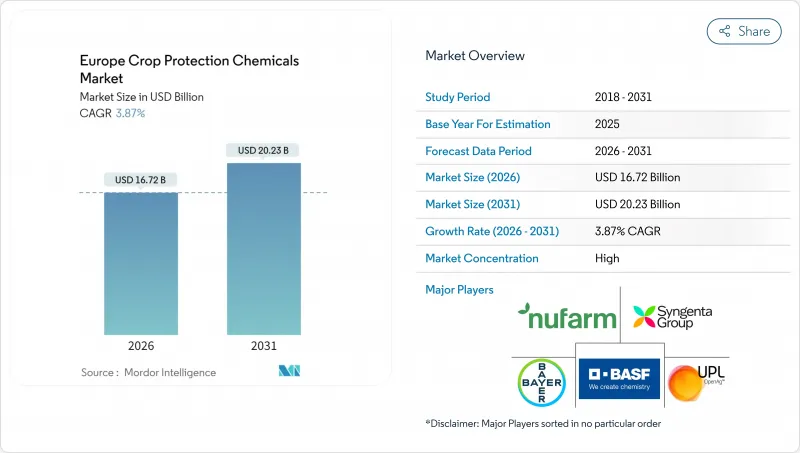

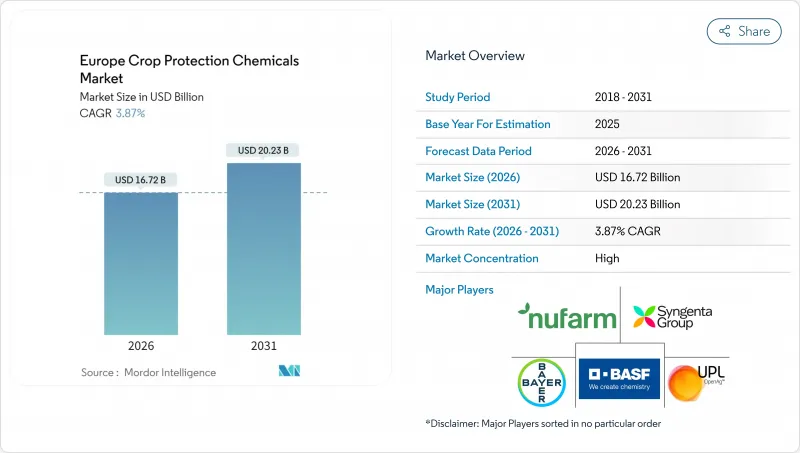

2025年歐洲作物保護化學品市場價值為161億美元,預計2031年將達到202.3億美元,高於2026年的167.2億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.87%。

持續的監管壓力、氣候變遷導致的蟲害加劇以及向高價值、低風險配方的轉變,共同推動了這個市場的穩定擴張。全部區域的農民持續投資於綜合蟲害管理 (IPM) 工具和數位化諮詢平台,以平衡盈利和合規性。領先的生產商正在調整其產品組合,轉向生物促效劑-殺蟲劑複配配方,而經銷商則將基於人工智慧 (AI) 的決策支援整合到其服務包中。同時,東歐對價格敏感的細分市場正在採用經濟實惠的非專利藥,鞏固了歐洲作物保護化學品市場的雙層需求結構。隨著化學品註冊、評估、授權和限制 (REACH) 成本的不斷上漲,主要企業的規模經濟效益日益增強,市場競爭仍然激烈。然而,擁有RNA干擾(RNAi) 技術和微生物解決方案的新興參與企業正為市場帶來創新潛力。

歐洲作物保護化學品市場趨勢與洞察

擴大綜合蟲害管理(IPM)的採用

綜合蟲害管理(IPM)的普及率不斷提高,農民的採購標準也從大量採購轉向精準防治。歐洲食品安全局(EFSA)的數據顯示,到2024年,IPM的實施率將成長23%,荷蘭商業種植者的IPM採用率將達到89%。這種轉變推動了對監測設備、選擇性化學藥劑和生物防治劑的需求,這些產品的價格溢價高達15-30%。數位化監測和感測器網路可以將活性成分的使用量減少高達40%,使歐洲作物保護化學品市場的供應商能夠從以銷售量為基礎的收入模式轉向以服務為導向的收入模式。

保護性耕作技術的普及

根據歐盟委員會聯合研究中心的數據,包括犁地和條耕在內的保護性耕作方式已涵蓋歐盟19%的耕地,高於2023年的14%。農民採用這些耕作方式是為了控制土壤侵蝕、節省用水和降低柴油成本,但雜草壓力的增加推動了除草劑的需求。高殘留圓盤播種機和耐除草劑作物等設備的升級換代,也促進了選擇性除草劑和精準施藥服務的銷售。

迅速禁用關鍵活性成分(例如Glyphosate)

對傳統農藥成分的加速審查,例如關於2024年逐步淘汰Glyphosate的討論,正在造成投資的不確定性。新菸鹼種子處理劑的突然禁用,導致每年13億美元的銷售額損失,迫使企業進行配方調整和庫存減損。雖然多元化的產品系列可以減輕這種影響,但依賴單一活性成分的小型公司正被迫退出歐洲作物保護化學市場。這種監管轉變有利於擁有多元化產品系列的公司,而不利於依賴特定活性成分的公司,這為靈活的競爭對手重新分配市場佔有率創造了機會。

細分市場分析

由於傳統活性成分面臨監管限制,先進的雜草抗性管理正在推動除草劑創新。到2025年,除草劑將佔據35.01%的市場佔有率,而殺蟲劑則展現出更強的成長潛力,到2031年複合年成長率將達到4.45%,這反映了氣候變遷帶來的病蟲害壓力以及精準施藥技術的廣泛應用。除草劑市場面臨雙重壓力:一方面是Glyphosate的逐步淘汰計劃,另一方面是雜草抗性的進化,導致現有化學物質在40%的歐洲農田中失效。由於氣候變遷帶來的病害壓力,殺菌劑的需求將保持穩定,而貝類殺蟲劑和殺線蟲劑則佔據著成長潛力有限的特定市場領域。

永續使用法規 (SUR) 的合規性為開發新型作用機制的公司創造了機會。歐洲藥品管理局 (EMA) 對低風險物質的快速核准流程為投資RNA干擾技術和微生物解決方案的公司提供了競爭優勢。精準施用技術使除草劑生產商能夠在限制使用的情況下,透過靶向遞送系統最佳化藥效,從而在保持雜草控制作用的同時減少環境暴露,進而維持市場佔有率。

歐洲作物保護化學品市場按功能(殺菌劑、除草劑、殺蟲劑等)、施用方法(化學灌根、葉面噴布、燻蒸等)、作物類型(經濟作物、水果和蔬菜、穀類等)以及地區(法國、德國、荷蘭、俄羅斯、西班牙、烏克蘭等)進行細分。市場預測以價值(美元)和數量(公噸)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

- 調查方法

第2章 報告

第3章執行摘要和主要發現

第4章:主要產業趨勢

- 每公頃農藥用量

- 活性成分價格分析

- 法律規範

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 價值鍊和通路分析

- 市場促進因素

- 擴大綜合蟲害管理(IPM)的採用

- 保護性耕作技術的普及

- 氣候變遷導致害蟲壓力增加

- 生物表面活性劑-殺蟲劑組合製劑的快速市場推廣

- 人工智慧驅動的處方噴灑平台

- 東歐穀物種植面積擴大

- 市場限制

- 早期禁用關鍵活性成分(例如Glyphosate)

- REACH法規下的報名費用不斷上漲

- 假農藥透過灰色進口管道滲透

- 素食/有機消費族群的影響力日益增強

第5章 市場規模和成長預測(價值和數量)

- 功能

- 殺菌劑

- 除草劑

- 殺蟲劑

- 殺軟體動物劑

- 殺線蟲劑

- 如何申請

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 穀類和雜糧

- 豆類和油籽

- 草坪和觀賞植物

- 國家

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲地區

第6章 競爭情勢

- 重大策略舉措

- 市佔率分析

- 企業趨勢

- 公司簡介

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Rovensa(Bridgepoint Group plc)

- Belchim Crop Protection(Mitsui and Co.)

- Koppert BV

- Sipcam SpA

- Zhejiang Wynca Chemical Group Co., Ltd.

第7章:CEO們需要思考的關鍵策略問題

The Europe crop protection chemicals market was valued at USD 16.1 billion in 2025 and estimated to grow from USD 16.72 billion in 2026 to reach USD 20.23 billion by 2031, at a CAGR of 3.87% during the forecast period (2026-2031).

Sustained regulatory pressure, climate-driven pest incidence, and the premiumization of low-risk formulations together underpin this steady expansion. Farmers across the region continue to invest in integrated pest management (IPM) tools, and digital advisory platforms that balance profitability with compliance. Large manufacturers are reshaping portfolios toward biostimulant-pesticide co-formulations, while distributors integrate artificial-intelligence (AI) decision support into service packages. At the same time, price-sensitive segments in Eastern Europe adopt cost-effective generics, anchoring a two-tiered demand structure within the Europe crop protection chemicals market. Competitive intensity remains high as rising Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) costs elevate scale advantages for the top players, yet novel entrants armed with RNA interference (RNAi) and microbial solutions introduce disruptive possibilities.

Europe Crop Protection Chemicals Market Trends and Insights

Expanding Integrated Pest Management Adoption

Integrated pest management adoption is rising, shifting farmer purchasing criteria from bulk volume toward targeted efficacy. The European Food Safety Authority (EFSA) recorded a 23% increase in IPM implementation during 2024, with Dutch commercial growers achieving 89% adoption. This shift increases demand for monitoring devices, selective chemistries, and biological control agents that command 15-30% price premiums. Digital scouting and sensor networks reduce active ingredient use by up to 40%, allowing suppliers to transition from volume-driven to service-oriented revenue models within the Europe crop protection chemicals market.

Surge in Conservation-Tillage Practices

Conservation tillage, including no-till and strip-till, now covers 19% of the European Union's arable land, up from 14% in 2023, according to the Joint Research Centre of the European Commission. Farmers adopt these practices to reduce soil erosion, retain moisture, and lower diesel costs, though increased weed pressure boosts herbicide demand. Equipment upgrades like high-residue disc drills and herbicide-tolerant crops drive sales of selective chemistries and precision spraying services.

Fast-track Bans on Key Actives (e.g., Glyphosate)

Accelerated reviews of legacy molecules, exemplified by the 2024 glyphosate phase-out debate, inject investment uncertainty. Sudden neonicotinoid seed-treatment bans removed USD 1.3 billion in annual sales, forcing reformulation cycles and inventory write-downs. Diversified portfolios cushion impact yet smaller firms reliant on single actives face market exit in the Europe crop protection chemicals market. This regulatory volatility favors companies with diversified product portfolios but penalizes firms dependent on specific active ingredients, creating market share redistribution opportunities for agile competitors.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Change-Driven Pest Pressure

- Rapid Biostimulant Pesticide Co-formulation Launches

- Escalating Registration Costs Under REACH

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Advanced weed resistance management drives herbicide innovation as traditional active ingredients face regulatory restrictions. Herbicides command 35.01% market share in 2025, yet insecticides demonstrate superior growth dynamics with 4.45% CAGR through 2031, reflecting climate-driven pest pressure and precision application adoption. The herbicide segment confronts dual pressures from glyphosate phase-out timelines and evolved weed resistance that renders established chemistries ineffective across 40% of European agricultural land. Fungicides maintain steady demand driven by climate-induced disease pressure, while molluscicides and nematicides serve specialized market niches with limited growth potential.

Regulatory compliance under the Sustainable Use Regulation creates opportunities for companies developing novel modes of action. The European Medicines Agency's expedited review process for low-risk substances provides competitive advantages for firms investing in RNA interference technologies and microbial-based solutions. Precision application technologies enable herbicide manufacturers to maintain market share despite volume restrictions by optimizing efficacy through targeted delivery systems that reduce environmental exposure while preserving weed control effectiveness.

The Europe Crop Protection Chemicals Market is Segmented by Function (Fungicide, Herbicide, Insecticide, and More), Application Mode (Chemigation, Foliar, Fumigation, and More), Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, and More), and Geography (France, Germany, Netherlands, Russia, Spain, Ukraine, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Rovensa (Bridgepoint Group plc)

- Belchim Crop Protection (Mitsui and Co.)

- Koppert B.V.

- Sipcam SpA

- Zhejiang Wynca Chemical Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Expanding Integrated Pest Management adoption

- 4.5.2 Surge in conservation-tillage practices

- 4.5.3 Climate-change-driven pest pressure

- 4.5.4 Rapid biostimulant pesticide co-formulation launches

- 4.5.5 AI-based prescription spraying platforms

- 4.5.6 Rising cereal acreage in Eastern Europe

- 4.6 Market Restraints

- 4.6.1 Fast-track bans on key actives (e.g., glyphosate)

- 4.6.2 Escalating registration costs under REACH

- 4.6.3 Counterfeit pesticide penetration via gray imports

- 4.6.4 Growing vegan / organic consumer lobby

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Russia

- 5.4.6 Spain

- 5.4.7 Ukraine

- 5.4.8 United Kingdom

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level overview, Core Business Segments, Financials, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Syngenta Group

- 6.4.2 Bayer AG

- 6.4.3 BASF SE

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 UPL Limited

- 6.4.7 Nufarm

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 Albaugh LLC

- 6.4.10 Rovensa (Bridgepoint Group plc)

- 6.4.11 Belchim Crop Protection (Mitsui and Co.)

- 6.4.12 Koppert B.V.

- 6.4.13 Sipcam SpA

- 6.4.14 Zhejiang Wynca Chemical Group Co., Ltd.