|

市場調查報告書

商品編碼

1906908

作物保護化學品:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

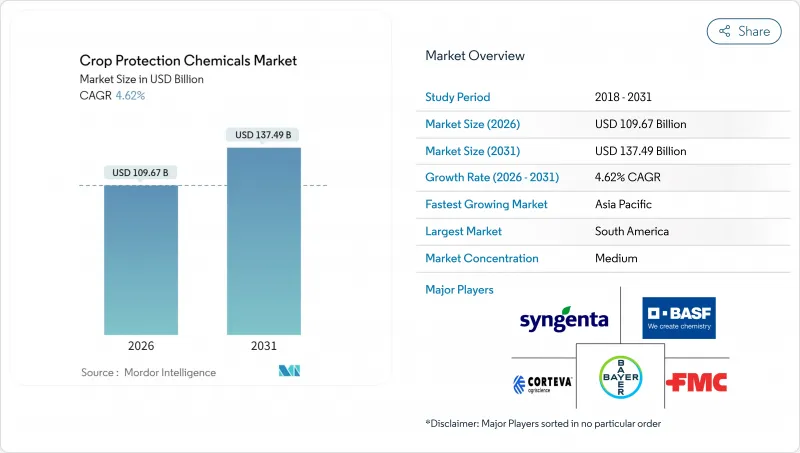

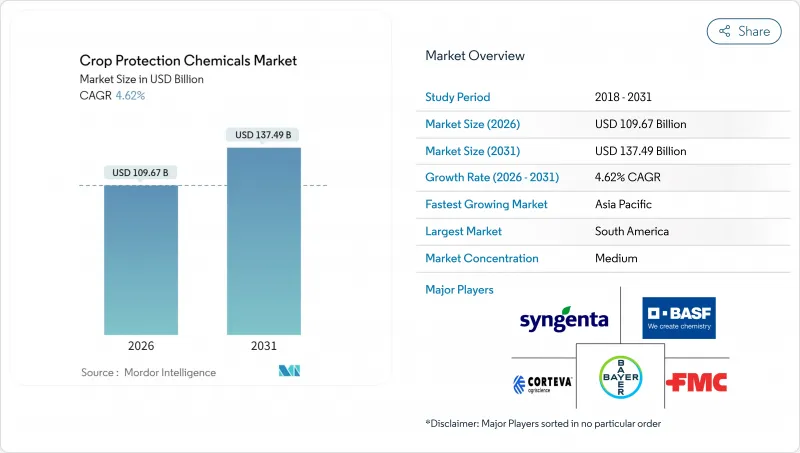

預計農業化學品市場規模將從 2025 年的 1,048.3 億美元成長到 2026 年的 1,096.7 億美元,到 2031 年將達到 1,374.9 億美元,2026 年至 2031 年的複合年成長率為 4.62%。

儘管監管日益嚴格,但對高除草劑用量基因改造作物的穩定需求、精密農業的普及以及氣候變遷導致的害蟲遷移,仍支撐著農化市場的成長。精準噴霧器、無人機點噴和變數施藥系統使種植者能夠在保持藥效的同時減少廢棄物,幫助農化市場即使在勞動力短缺的地區也能實現生產力提升。南美洲佔據最大市場佔有率,這主要歸功於巴西大豆產量的不斷成長;而亞太地區則保持著最高的複合年成長率,這主要歸功於印度和中國商業農業的整合。葉面噴施仍然是最常見的施藥方式,但土壤施用正呈現最高的成長速度,而再生農業實踐正在推動芽前除草劑的使用。

全球作物保護化學品市場趨勢與洞察

擴大基改作物的種植面積

如今,抗除草劑大豆、玉米和棉花在美洲的種植決策中佔據主導地位,即使耕地總面積不斷擴大,每公頃的化學品用量也隨之增加。在巴西,到2024年,95%的種植面積將種植基改大豆,這將推動Glyphosate和麥草畏的銷售量創下歷史新高。種植者正在結合多種作用機制的除草劑以延緩抗藥性的發展,並傾向於選擇提供種子和農藥一體化組合的供應商,以確保整個種植季節的盈利能力。阿根廷核准耐旱大豆「HB4」的種植進一步擴大了面積,尤其是在歷史上受缺水限制的邊緣地區。隨著專利即將到期,品牌藥生產商正在加速開發增強型化學製劑組合以維持利潤率。同時,非專利生產商則專注於擴大專利到期活性成分的供應。基因改造技術的浪潮正在維持除草劑的整體需求,支撐組合產品的溢價,並鼓勵對專注於特殊性能組合的配方技術進行更多投資。

抗除草劑雜草增多

抗Glyphosate除草劑的莧菜已蔓延至美國27個州,並正在南美洲蔓延,迫使種植者輪換使用除草劑並增加施藥頻率。抗性生物型如今對ALS抑制劑構成威脅,兩到四種產品的混合使用成為新的標準。這場抗藥性競賽推動了對具有新型作用機制的除草劑和簡化管理的優質預混合料的需求。在經歷了停滯十年之後,化學創新研發的重要性日益凸顯,數位化田間巡查工具也越來越受歡迎,成為在雜草失控前辨識蟲害的有效手段。每英畝除草劑成本的上漲以及潛在產量損失帶來的經濟負擔,促使種植者願意投資於能夠恢複雜草控制的解決方案,這為創新者在不久的將來創造了明確的收入來源。

嚴格禁止使用農藥並收緊殘留基準值(重點關注歐盟)

歐洲當局持續審查活性成分,預計2024年,將有15種關鍵化學品失去續約資格。同時,殘留基準值也不斷降低。南美和非洲的出口型生產商即使銷往其他地區,也面臨著為滿足歐盟標準而產生的合規成本,因為全球糧食買家遵循著最嚴格的標準。小型生產商難以資金籌措新的數據包,這加速了有能力投資毒理學和環境影響評估的大型公司的市場佔有率成長。種植者開始轉向使用殘留量更低、價格更高的新型農藥,但儘管每公頃的支出增加,疲軟的商品價格卻擠壓了利潤空間。由於缺乏有效的農藥,一些農民被迫重新使用傳統產品或增加施藥頻率,導致化學品總用量異常成長,這與政策初衷背道而馳。研究重點正轉向生物基或低殘留分子,這延長了研發週期,並提高了進入門檻。監管和商業性壓力的綜合影響將使預測的複合年成長率下降0.8個百分點,預計到2027年寬限期到期時,收入受到的影響最為嚴重。擁有強大的歐盟監管團隊和具有快速核准潛力的在研活性物質的公司,在新規下將具有相對優勢。

細分市場分析

到2025年,除草劑將佔作物保護化學品市場的42.35%,佔據市場規模的最大佔有率,並貢獻大部分新增收入。長芒莧和飛蓬屬植物持續存在的抗藥性問題使得多點處理成為必要,促使種植者採用價格較高的複配製劑。雖然Glyphosate在銷售方面仍然佔據主導地位,但市場需求正轉向HPPD抑制劑、PPO抑制劑以及用於抗藥性後期控制的新型專利化學製劑。這種產品組合的持續豐富支撐了到2031年5.02%的強勁複合年成長率預測。

基因改造作物性狀的持續應用導致每公頃除草劑用量居高不下,尤其是在巴西和阿根廷。種子和作物保護一體化解決方案使主要供應商能夠將性狀與客製化應用相結合,從而保護智慧財產權和毛利率。殺菌劑的市佔率大致相當,這得益於與天氣相關的病害發生率的增加以及2024年巴西上市的Revysol(一種具有新型大豆銹病防治機制的殺菌劑)。殺蟲劑的需求會隨著氣候相關害蟲的入侵而出現間歇性高峰。殺線蟲劑和殺軟體動物劑雖然屬於小眾市場,但在高價值園藝領域至關重要,因為即使是微小的產量損失也會侵蝕盈利。

作物保護化學品市場報告按功能(殺菌劑、除草劑、殺蟲劑、殺貝劑等)、施用方法(化學灌根、葉面噴布、種子處理等)、作物類型(經濟作物、水果和蔬菜、穀物、豆類和油籽等)以及地區(非洲、歐洲、北美等)進行結構分類。市場預測以價值(美元)和數量(公噸)為單位。

區域分析

到2025年,南美洲將佔據全球作物保護化學品市場41.85%的佔有率,這主要得益於巴西塞拉多草原地區大豆和玉米的大規模生產。僅巴西一國就消耗了該地區總量的60%以上,主要得益於2024年連續種植週期中農藥採購量的創紀錄成長。出口導向農場也促進了阿根廷的成長,該國基因改造作物種植面積佔全國種植面積的95%以上,強化了以除草劑為主導的農業模式。儘管港口偶爾會出現物流方面的挑戰,但有利的氣候條件和政府優先考慮外匯收入的政策,共同支撐著南美洲的穩定成長。

亞太地區是成長最快的市場,預計到2031年將以4.73%的年複合成長率(CAGR)成長。印度、中國和東南亞國家農業集約化和機械化程度的提高是推動這一成長的主要因素。印度大力發展商業化農業,預計2024年農藥使用量將成長15%,這主要是由於規模較大的農場需要貫穿整個生長季的病蟲害防治計畫。中國的環境政策推動了農藥工廠的密集生產,同時推廣使用符合國家食品安全標準的高效低殘留農藥。此外,印尼、泰國和越南棕櫚油和密集水稻種植系統的擴張,在潮濕氣候下需要使用專門的殺菌劑和殺蟲劑來保護作物,也促進了農藥需求的成長。

北美佔全球消費量的大部分,這得益於精密農業的普及(35%的大型農場採用精準農業來最佳化施藥時間)。在美國,基改作物種植面積的擴大和雜草抗藥性的增強,使得每英畝除草劑支出在利潤率較低的情況下仍然保持穩定。歐洲也佔了很大一部分需求,但嚴格的法規和殘留限量促使投資轉向低劑量化學品和生物解決方案。儘管有這些限制,特色果蔬產業仍保持著較高的市場價值。非洲仍然是最小的區域市場,但南非的商業農業計劃和西非新興農業中心正在開始實施現代作物保護方案,這表明長期需求將逐步成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

- 調查方法

第2章 報告

第3章執行摘要和主要發現

第4章:主要產業趨勢

- 每公頃農藥消費量

- 活性成分價格分析

- 法律規範

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 智利

- 中國

- 法國

- 德國

- 印度

- 印尼

- 義大利

- 日本

- 墨西哥

- 緬甸

- 荷蘭

- 巴基斯坦

- 菲律賓

- 俄羅斯

- 南非

- 西班牙

- 泰國

- 烏克蘭

- 英國

- 美國

- 越南

- 價值鍊和通路分析

- 市場促進因素

- 擴大基改作物的種植面積

- 抗除草劑雜草增多

- 精密農業技術的應用

- 亞太和南美洲商業農業的快速發展

- 再生農業傾向於使用選擇性化學物質

- 氣候變遷導致害蟲向溫帶地區遷移

- 市場限制

- 更嚴格的農藥禁令和更嚴格的最大基準值(MRL)(重點關注歐盟)

- 加速雜草對Glyphosate和ALS抑制劑的抗藥性

- 中國技術級供應鏈不穩定

- 生物農藥的迅速普及蠶食了合成農藥的市佔率。

第5章 市場規模和成長預測(價值和數量)

- 功能

- 消毒劑

- 除草劑

- 殺蟲劑

- 軟體動物殺蟲劑

- 殺線蟲劑

- 應用模式

- 化學灌溉

- 葉面噴布

- 燻蒸

- 種子處理

- 土壤處理

- 作物類型

- 經濟作物

- 水果和蔬菜

- 穀物和穀類

- 豆類和油籽

- 草坪和觀賞植物

- 地區

- 非洲

- 南非

- 其他非洲地區

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 緬甸

- 巴基斯坦

- 菲律賓

- 泰國

- 越南

- 亞太其他地區

- 歐洲

- 法國

- 德國

- 義大利

- 荷蘭

- 俄羅斯

- 西班牙

- 烏克蘭

- 英國

- 其他歐洲地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

- 南美洲

- 阿根廷

- 巴西

- 智利

- 其他南美洲

- 非洲

第6章 競爭情勢

- 關鍵策略舉措

- 市佔率分析

- 公司概況

- 公司簡介

- BASF SE

- Bayer AG

- Corteva Inc.

- FMC Corporation

- Jiangsu Yangnong Chemical Group Co., Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta Group Co., Ltd.

- UPL Ltd.

- Lallemand Inc.(Animal Nutrition)

- EW Nutrition GmbH

- Kemin Industries Inc.

- Novus International Inc.

- Vitafor NV

第7章:CEO們需要思考的關鍵策略問題

The crop protection chemicals market is expected to grow from USD 104.83 billion in 2025 to USD 109.67 billion in 2026 and is forecast to reach USD 137.49 billion by 2031 at 4.62% CAGR over 2026-2031.

Steady demand for herbicide-intensive, genetically modified crops, the adoption of precision agriculture, and climate-driven pest migration continue to sustain the growth curve, despite tighter regulatory oversight. Precision sprayers, drone-based spot treatments, and variable-rate application systems enable growers to cut waste while maintaining efficacy, helping the crop protection chemicals market capture productivity gains even in regions facing labor shortages. South America accounts for the largest share, driven by Brazil's expansion of soybean production, while the Asia-Pacific region records the fastest CAGR, largely due to commercial farming consolidation in India and China. Foliar treatments remain the most common delivery mode, yet soil treatments post the highest growth, and regenerative practices encourage pre-emergent chemistries.

Global Crop Protection Chemicals Market Trends and Insights

GM-Crop Acreage Expansion

Herbicide-tolerant soybeans, corn, and cotton now dominate planting decisions in the Americas, lifting per-hectare chemical intensity even as overall farmland expands. Brazil planted GM soybeans on 95% of its area in 2024, which propelled glyphosate and dicamba sales to record highs. Growers stack multiple modes of action to delay resistance, favoring suppliers with integrated seed and chemical bundles that lock in season-long revenue. Argentina's approval of HB4 drought-tolerant soybeans further broadens the addressable acreage, especially in marginal regions that have been historically constrained by water stress. As patents expire, branded players accelerate the development of trait-plus-chemistry packages to protect their margins, while generic manufacturers focus on increasing volume in off-patent actives. Collectively, the GM wave sustains herbicide demand, supports premium pricing on combination products, and drives incremental investments in formulation technologies tailored to trait packages.

Rising Herbicide-Resistant Weeds

Glyphosate-resistant Palmer amaranth has spread to 27 U.S. states and is advancing across South America, forcing growers to rotate chemistries and increase application frequency. Resistant biotypes now challenge ALS inhibitors as well, making two- to four-way tank mixes the new norm. This resistance arms race elevates demand for novel modes of action and premium premixes that simplify stewardship. Chemical innovation pipelines regain urgency after a slow decade, while digital scouting tools gain traction to pinpoint outbreaks before they become unmanageable. The economic burden of higher herbicide costs per acre and potential yield loss keeps growers willing to pay for solutions that restore control, giving innovators a clear revenue runway in the near term.

Stringent Pesticide Bans and MRL Tightening (European Union focus)

European authorities continue to review active ingredients, with 15 key chemistries set to lose renewal in 2024, while maximum residue limits are being steadily lowered. Export-oriented producers in South America and Africa now face compliance costs to meet EU tolerances, even when selling to other destinations, because global grain buyers conform to the strictest standards. Smaller manufacturers struggle to finance new data packages, accelerating market share gains for top-tier firms that can invest in toxicology and environmental dossiers. Growers switch to newer, more expensive actives that carry lower residue profiles, lifting per-hectare spend but squeezing margins when commodity prices soften. Missing tools force some farmers to revert to older, more frequent applications, paradoxically increasing the overall chemical load despite the policy intent. Research priorities shift toward bio-based or low-residue molecules, lengthening development timelines and raising the bar for entry. The combined regulatory and commercial pressure subtracts 0.8 percentage points from the forecast CAGR, with the sharpest revenue impact projected to arrive before 2027 as grace periods expire. Companies with robust EU regulatory teams and pipeline actives positioned for fast approval gain a relative advantage under the new rules.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Precision-Ag Technologies

- Rapid Growth of Commercial Farming in Asia-Pacific and South America

- Fast Uptake of Biologicals Cannibalizing Synthetic Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Herbicide captured a 42.35% market share of the crop protection chemicals market in 2025, representing the largest slice of the market size and generating the bulk of incremental revenue growth. Persistent resistance in Palmer amaranth and Conyza species necessitates multi-site programs, prompting growers to adopt stacked formulations that carry premium price points. Glyphosate still dominates the volume, but demand is increasingly shifting to HPPD inhibitors, PPO inhibitors, and new proprietary chemistries positioned for post-resistance control. The resulting mix upgrade underpins a robust 5.02% CAGR forecast to 2031.

Continued GM trait adoption, especially in Brazil and Argentina, sustains high herbicide intensity per hectare. Integrated seed-and-chemical offerings allow leading suppliers to bundle traits with tailored sprays, protecting both intellectual property and gross margins. Fungicides hold roughly significant share, supported by weather-linked disease flare-ups and the 2024 launch of Revysol in Brazil, which offers a new mode of action against soybean rust. Insecticides are seeing sporadic spikes when climate-driven pest incursions occur. Nematicides and molluscicides remain niche but essential for high-value horticulture, where even minor yield losses undermine profitability.

The Crop Protection Chemicals Market Report is Segmented by Function (Fungicide, Herbicide, Insecticide, Molluscicide, and More), Application Mode (Chemigation, Foliar, Seed Treatment, and More), Crop Type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, and More), and Geography (Africa, Europe, North America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

South America accounted for 41.85% of the crop protection chemicals market share in 2025, driven by Brazil's extensive soybean and corn production in the Cerrado savanna. Brazil alone consumed over 60% of the regional volume, supported by record pesticide purchases for consecutive planting cycles during the 2024 season. Argentina's export-focused farms contributed to growth, with genetically modified (GM) crop adoption surpassing 95% of national acreage, reinforcing herbicide-intensive farming practices. Favorable weather conditions and government policies prioritizing foreign exchange earnings have supported steady growth in South America, despite occasional logistical challenges at ports.

The Asia-Pacific region is the fastest-growing market, with a compound annual growth rate (CAGR) of 4.73% projected through 2031. Growth is driven by land consolidation and increased mechanization in countries such as India, China, and Southeast Asia. In India, commercial farming initiatives led to a 15% increase in chemical usage in 2024, as larger field sizes required season-long pest control programs. In China, environmental policies have prompted pesticide plant consolidation while encouraging the use of higher-efficacy, lower-residue chemicals that align with national food safety standards. Additionally, Indonesia, Thailand, and Vietnam have contributed to incremental demand through expanding palm oil and intensive rice farming systems, which rely on specialized fungicides and insecticides to protect crops in humid climates.

North America represents a significant portion of global consumption, supported by the adoption of precision agriculture, which now covers 35% of large farms and optimizes application timing. In the United States, high GM-crop acreage and increasing weed resistance have sustained per-acre herbicide expenditures, despite tight profit margins. Europe accounts for a substantial share of demand, but stringent regulations and residue limits have shifted investments toward low-dose chemistries and biological solutions. Despite these restrictions, the specialty fruit and vegetable segments maintain high market value. Africa remains the smallest regional market; however, commercial farming projects in South Africa and emerging hubs in West Africa are beginning to adopt modern crop protection programs, indicating a gradual increase in long-term demand.

- BASF SE

- Bayer AG

- Corteva Inc.

- FMC Corporation

- Jiangsu Yangnong Chemical Group Co., Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta Group Co., Ltd.

- UPL Ltd.

- Lallemand Inc. (Animal Nutrition)

- EW Nutrition GmbH

- Kemin Industries Inc.

- Novus International Inc.

- Vitafor N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 Report Offers

3 Executive Summary and Key Findings

4 Key Industry Trends

- 4.1 Consumption of Pesticide per Hectare

- 4.2 Pricing Analysis for Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Italy

- 4.3.12 Japan

- 4.3.13 Mexico

- 4.3.14 Myanmar

- 4.3.15 Netherlands

- 4.3.16 Pakistan

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Ukraine

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 GM-crop acreage expansion

- 4.5.2 Rising herbicide-resistant weeds

- 4.5.3 Adoption of precision-ag technologies

- 4.5.4 Rapid growth of commercial farming in Asia-Pacific and South America

- 4.5.5 Regenerative agriculture favoring selective chemistries

- 4.5.6 Climate-driven pest migration into temperate zones

- 4.6 Market Restraints

- 4.6.1 Stringent pesticide bans and MRL tightening (European Union focus)

- 4.6.2 Accelerating weed resistance to glyphosate and ALS inhibitors

- 4.6.3 Volatile Chinese technical-grade supply chain

- 4.6.4 Fast uptake of biologicals cannibalizing synthetic sales

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Geography

- 5.4.1 Africa

- 5.4.1.1 South Africa

- 5.4.1.2 Rest of Africa

- 5.4.2 Asia-Pacific

- 5.4.2.1 Australia

- 5.4.2.2 China

- 5.4.2.3 India

- 5.4.2.4 Indonesia

- 5.4.2.5 Japan

- 5.4.2.6 Myanmar

- 5.4.2.7 Pakistan

- 5.4.2.8 Philippines

- 5.4.2.9 Thailand

- 5.4.2.10 Vietnam

- 5.4.2.11 Rest of Asia-Pacific

- 5.4.3 Europe

- 5.4.3.1 France

- 5.4.3.2 Germany

- 5.4.3.3 Italy

- 5.4.3.4 Netherlands

- 5.4.3.5 Russia

- 5.4.3.6 Spain

- 5.4.3.7 Ukraine

- 5.4.3.8 United Kingdom

- 5.4.3.9 Rest of Europe

- 5.4.4 North America

- 5.4.4.1 Canada

- 5.4.4.2 Mexico

- 5.4.4.3 United States

- 5.4.4.4 Rest of North America

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Chile

- 5.4.5.4 Rest of South America

- 5.4.1 Africa

6 Competitive Landscape

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Inc.

- 6.4.4 FMC Corporation

- 6.4.5 Jiangsu Yangnong Chemical Group Co., Ltd.

- 6.4.6 Nufarm Limited

- 6.4.7 Sumitomo Chemical Co., Ltd.

- 6.4.8 Syngenta Group Co., Ltd.

- 6.4.9 UPL Ltd.

- 6.4.10 Lallemand Inc. (Animal Nutrition)

- 6.4.11 EW Nutrition GmbH

- 6.4.12 Kemin Industries Inc.

- 6.4.13 Novus International Inc.

- 6.4.14 Vitafor N.V.