|

市場調查報告書

商品編碼

1907326

歐洲3D列印市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Europe 3D Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

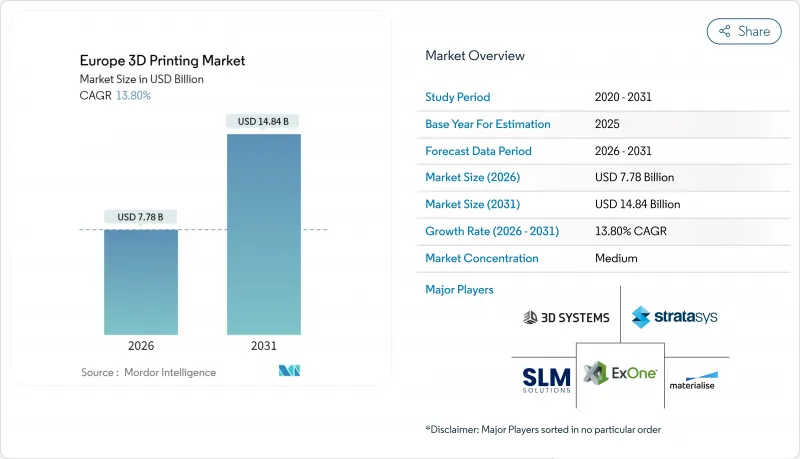

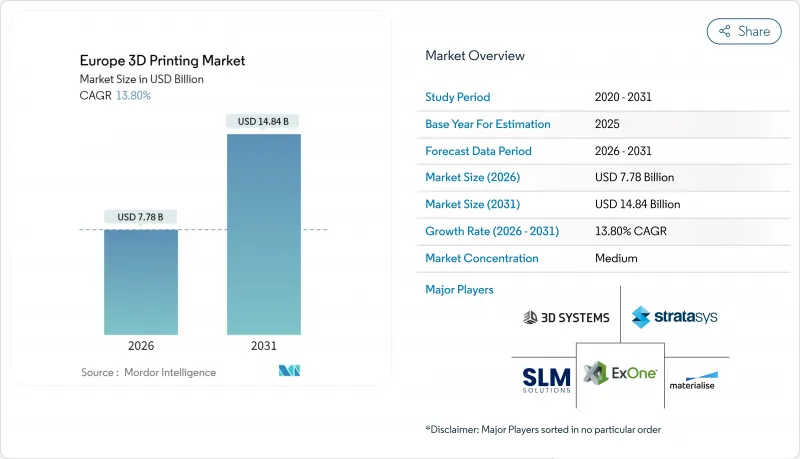

歐洲 3D 列印市場預計將從 2025 年的 68.4 億美元成長到 2026 年的 77.8 億美元,到 2031 年達到 148.4 億美元,2026 年至 2031 年的複合年成長率為 13.8%。

這項擴張的驅動力來自全部區域製造商加速推進分散式生產策略,從而縮短前置作業時間,應對供應鏈中斷,並滿足鼓勵本地生產的碳邊境調節措施的要求。快速的創新週期、金屬3D列印機成本的下降以及人工智慧驅動的製程控制的整合,都促進了汽車、醫療和海事行業生產級應用案例的擴展。儘管硬體銷售仍然佔據收入的大部分,但面向服務的「製造即服務」(MaaS)模式正在迅速發展,反映出用戶希望在無需大規模支出的情況下獲得靈活的生產能力。各國的發展趨勢各不相同。德國憑藉其深厚的專利基礎和自動化技術專長,保持著主導地位;而擁有世界一流物流和海事叢集的荷蘭,則實現了最快的成長速度。隨著現有企業進行垂直整合,新進業者致力於開發新材料,以及歐盟協調技術標準以簡化跨境運營,競爭日益激烈。

歐洲3D列印市場趨勢與洞察

政府對工業4.0和積層製造業的主導和資金支持

歐洲各國政府正投入大量資金,以促進積層製造技術的廣泛應用。法國耗資540億歐元的「法國2030」計畫為先進製造平台撥款,而「地平線歐洲」計畫則進一步支持「製造即服務」試點項目,將跨境設施整合到雲端管理的生產線中。在德國,積層製造企業將銷售額的30.6%投入研發,並得到國家和歐盟津貼的進一步支持,鞏固了在金屬系統領域的領先地位。這種聯合資助模式促進了科技從實驗室到實際應用的轉化,並建構了一個符合通用技術標準的供應商體系。因此,歐洲3D列印市場受益於規模經濟,並降低了中型企業的進入門檻。

汽車製造商對輕量化原型製作和模具製造的需求

汽車製造商正在將積層製造技術應用於初始原型製作以外的領域。歐盟資助的Multi-FUN計劃發現了一種複合材料列印技術,可將線束和感測器整合到輕量化結構中。德國供應商正在列印用於小批量生產的模具,以便在無需高成本庫存的情況下管理特定車型的零件。透過利用無需焊接和螺栓的整體式組件,企業正在減輕重量並縮短生產週期,從而保持3D列印市場在歐洲主要汽車市場的成長勢頭。

高昂的資本投資和維修成本

工業級印表機的價格高達六位數,使用者還需要添置粉末處理、後處理和品質保證設備。儘管硬體價格不斷下降,中小企業往往仍會推遲採購。醫療設備法規要求嚴格的文件記錄和上市後監管,這增加了醫療保健使用者的營運成本。鐵路、航太和能源產業的認證體系分散,導致測試預算增加,並縮小了歐洲3D列印市場的潛在基本客群,直到租賃和服務模式能夠抵消這些風險。

細分市場分析

隨著企業將柔軟性置於優先地位,服務供應商正佔據越來越大的收入佔有率。儘管到2025年,硬體仍將佔歐洲3D列印市場67.62%的佔有率,但隨著越來越多的企業將設計最佳化、建置準備和後處理外包,以服務為導向的模式正以15.97%的複合年成長率快速擴張。 K3D和FKM等契約製造製造商正在部署由多台印表機組成的列印集群,使客戶能夠及時獲得零件,而無需在設備上投入大量資金。這種轉變降低了實驗成本,並將風險分散到不同的客戶通路。

同時,硬體供應商將軟體、維護和培訓訂閱服務捆綁銷售,模糊了設備銷售和後續服務之間的界線。雲端控制面板整合了整個設備群的數據,並支援預測性維護和耗材補充。這些整合服務正在推動3D列印技術的普及,並引領歐洲3D列印市場朝著基於結果的採購模式發展。

到2025年,FDM將維持29.12%的最大市場佔有率,這主要得益於成熟的材料、低廉的營運成本以及廣泛的用戶認知。同時,DLP將達到14.42%的顯著複合年成長率,這主要得益於其50微米以下的微加工能力,該技術適用於正畸矯正器、助聽器和組織支架研究等領域。植物來源光敏聚合物的進步在提升永續性。 SLA和SLS滿足了航太和汽車行業對耐熱部件的需求,而電子束熔化仍然是製造用於整形外科植入的鈦晶格結構的主流技術。

如今,差異化技術依賴自動化和封閉回路型控制。人工智慧驅動的體素級校正可減少支撐材料用量並簡化除粉過程,進而提高歐洲3D列印市場的運轉率。粉末層系統中的多雷射協同技術實現了生產效率和表面光潔度之間的平衡,使製造商能夠更有信心地對零件進行生產認證。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府主導的工業4.0及積層製造政策及經費支持

- 汽車原始設備製造商對輕量化原型製作和模具製造的需求

- 醫療領域中病患專用醫療設備的現狀

- 金屬3D列印機和材料成本下降

- 歐盟碳邊境調節措施促進了本地生產

- 鐵路和海運行業的按需零件需求

- 市場限制

- 高昂的資本投資和維護成本

- 從設計階段開始就缺乏積層製造人員

- 歐盟認證和標準體系的碎片化現狀

- 金屬粉末供應不穩定和回收障礙

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 硬體

- 服務

- 透過技術

- 立體光刻技術(SLA)

- 熔融沈積成型(FDM)

- 選擇性雷射燒結(SLS)

- 電子束熔化(EBM)

- 數位光處理(DLP)

- 其他技術

- 材料

- 聚合物

- 金屬和合金

- 陶瓷

- 複合材料及其他

- 按最終用戶行業分類

- 車

- 航太與國防

- 衛生保健

- 建築/建築設計

- 能源與公共產業

- 食品/飲料

- 其他行業

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- General Electric Company(GE Additive)

- Hoganas AB(Digital Metal(R))

- Sisma SpA

- ExOne Company

- SLM Solutions Group AG

- HP Inc.

- Ultimaker BV

- Materialise NV

- voxeljet AG

- Renishaw plc

- Prodways Group SA

- Arcam AB

- Carbon, Inc.

- Markforged Holding Corp.

- XJet Ltd.

- Photocentric Ltd.

- Desktop Metal, Inc.

- BEAMIT SpA

- DWS Systems Srl

- Farsoon Technologies Europe GmbH

- B9Creations, LLC

第7章 市場機會與未來展望

The Europe 3D printing market is expected to grow from USD 6.84 billion in 2025 to USD 7.78 billion in 2026 and is forecast to reach USD 14.84 billion by 2031 at 13.8% CAGR over 2026-2031.

This expansion occurs as manufacturers across the region accelerate distributed-production strategies to cut lead times, hedge against supply-chain shocks and meet carbon-border adjustment requirements that reward localized output. Fast innovation cycles, falling metal-printer costs and the integration of artificial-intelligence process control underpin a widening set of production-grade use cases across automotive, healthcare and maritime industries. Hardware sales still dominate revenue, yet service-oriented "manufacturing as a service" models are scaling quickly, reflecting user preference for flexible capacity without large capital outlays. Country-level momentum is uneven: Germany leverages patent depth and automation expertise to safeguard its leadership position, while the Netherlands deploys world-class logistics and maritime clusters to register the highest growth pace. Competitive intensity rises as incumbents integrate vertically, newer entrants push novel materials and the European Union harmonizes technical standards to ease cross-border operations.

Europe 3D Printing Market Trends and Insights

Government Initiatives and Funding for Industry 4.0 and AM

European governments deploy sizeable capital to speed additive-manufacturing adoption. France's EUR 54 billion "France 2030" program earmarks funds for advanced manufacturing platforms. Horizon Europe further backs "manufacturing as a service" pilots that network equipment across borders into cloud-managed production lines. In Germany, additive-manufacturing firms invest 30.6% of turnover in research, amplified by national and EU grants, cementing leadership in metal systems. The shared funding model drives technology transfer from laboratories to shop floors and builds a cadre of suppliers aligned to common technical standards. As a result, the Europe 3D printing market secures economies of scale that lower entry barriers for mid-sized enterprises.

Automotive OEM Demand for Lightweight Prototyping and Tooling

Automotive manufacturers now pursue additive-manufacturing beyond early prototyping. The EU-funded Multi-FUN project reveals multi-material builds that embed wiring and sensors into lightweight structures. German suppliers print low-volume production tooling to manage model-specific parts without storing costly inventory. By exploiting single-build assemblies that cut welds and bolts, companies save weight and shorten production cycles, sustaining momentum for the Europe 3D printing market in core automotive corridors.

High Capital Investment and Maintenance Costs

Industrial-grade printers carry six-figure price tags, and users must add powder-handling, post-processing, and quality-assurance gear. Small and medium-sized enterprises often defer purchases even as hardware prices decline. Compliance with the EU Medical Device Regulation imposes rigorous documentation and post-market surveillance, inflating overhead for healthcare adopters. Fragmented certification regimes for rail, aerospace, and energy sectors multiply testing budgets, narrowing the addressable base of the Europe 3D printing market until rental or service models offset risk.

Other drivers and restraints analyzed in the detailed report include:

- Healthcare Adoption for Patient-Specific Devices

- Declining Cost of Metal Printers and Materials

- Shortage of Design-for-AM Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Service providers captured a growing slice of revenue as enterprises prioritize flexibility. Although hardware still anchored 67.62% of the Europe 3D printing market in 2025, service-oriented models are scaling at 15.97% CAGR as firms outsource design optimization, build preparation and post-processing. Contract manufacturers such as K3D and FKM deploy multi-printer farms, giving customers just-in-time parts without locking capital into machines. This transition lowers the cost of experimentation and spreads risk across diverse client pipelines.

In parallel, hardware vendors bundle software, maintenance, and training subscriptions, blurring lines between equipment sales and recurring services. Cloud dashboards aggregate fleet-wide data, enabling predictive maintenance and consumable replenishment. These integrated offers reinforce adoption, propelling the Europe 3D printing market toward outcome-based procurement norms.

FDM maintained the largest share in 2025 at 29.12% thanks to mature materials, low operating costs, and broad user familiarity. Yet DLP is registering an impressive 14.42% CAGR, propelled by sub-50-micron feature capability that suits dental aligners, hearing aids, and tissue-scaffold research. Advances in plant-based photopolymers reinforce sustainability credentials while widening the bio-compatibility palette. SLA and SLS cater to aerospace and automotive requirements for heat-resistant components, whereas electron-beam melting remains the go-to for titanium lattice structures in orthopedic implants.

Technology differentiation now hinges on automation and closed-loop control. AI-driven voxel-level correction trims support mass and eases depowdering, elevating utilization rates across the Europe 3D printing market. Multi-laser coordination in powder-bed systems balances productivity and surface finish, giving manufacturers confidence to qualify parts for serial production.

The Europe 3D Printing Market Report is Segmented by Component (Hardware and Services), Technology (Stereolithography, Fused Deposition Modeling, and More), Material (Polymers, Metals and Alloys, and More), End-User Industry (Automotive, Aerospace and Defense, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Stratasys Ltd.

- 3D Systems Corporation

- EOS GmbH

- General Electric Company (GE Additive)

- Hoganas AB (Digital Metal(R))

- Sisma S.p.A.

- ExOne Company

- SLM Solutions Group AG

- HP Inc.

- Ultimaker B.V.

- Materialise N.V.

- voxeljet AG

- Renishaw plc

- Prodways Group SA

- Arcam AB

- Carbon, Inc.

- Markforged Holding Corp.

- XJet Ltd.

- Photocentric Ltd.

- Desktop Metal, Inc.

- BEAMIT S.p.A.

- DWS Systems S.r.l.

- Farsoon Technologies Europe GmbH

- B9Creations, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government initiatives and funding for Industry 4.0 and AM

- 4.2.2 Automotive OEM demand for lightweight prototyping and tooling

- 4.2.3 Healthcare adoption for patient-specific devices

- 4.2.4 Declining cost of metal printers and materials

- 4.2.5 EU carbon-border adjustment boosting localized production

- 4.2.6 On-demand spare-parts needs in rail and maritime sectors

- 4.3 Market Restraints

- 4.3.1 High capital investment and maintenance costs

- 4.3.2 Shortage of design-for-AM talent

- 4.3.3 Fragmented EU certification and standards landscape

- 4.3.4 Metal-powder supply volatility and recycling hurdles

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Services

- 5.2 By Technology

- 5.2.1 Stereolithography (SLA)

- 5.2.2 Fused Deposition Modeling (FDM)

- 5.2.3 Selective Laser Sintering (SLS)

- 5.2.4 Electron Beam Melting (EBM)

- 5.2.5 Digital Light Processing (DLP)

- 5.2.6 Other Technologies

- 5.3 By Material

- 5.3.1 Polymers

- 5.3.2 Metals and Alloys

- 5.3.3 Ceramics

- 5.3.4 Composites and Others

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Healthcare

- 5.4.4 Construction and Architecture

- 5.4.5 Energy and Utilities

- 5.4.6 Food and Beverage

- 5.4.7 Other Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Stratasys Ltd.

- 6.4.2 3D Systems Corporation

- 6.4.3 EOS GmbH

- 6.4.4 General Electric Company (GE Additive)

- 6.4.5 Hoganas AB (Digital Metal(R))

- 6.4.6 Sisma S.p.A.

- 6.4.7 ExOne Company

- 6.4.8 SLM Solutions Group AG

- 6.4.9 HP Inc.

- 6.4.10 Ultimaker B.V.

- 6.4.11 Materialise N.V.

- 6.4.12 voxeljet AG

- 6.4.13 Renishaw plc

- 6.4.14 Prodways Group SA

- 6.4.15 Arcam AB

- 6.4.16 Carbon, Inc.

- 6.4.17 Markforged Holding Corp.

- 6.4.18 XJet Ltd.

- 6.4.19 Photocentric Ltd.

- 6.4.20 Desktop Metal, Inc.

- 6.4.21 BEAMIT S.p.A.

- 6.4.22 DWS Systems S.r.l.

- 6.4.23 Farsoon Technologies Europe GmbH

- 6.4.24 B9Creations, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment