|

市場調查報告書

商品編碼

1907324

歐洲發泡聚苯乙烯(EPS)市場佔有率分析、產業趨勢、統計和成長預測(2026-2031)Europe Expanded Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

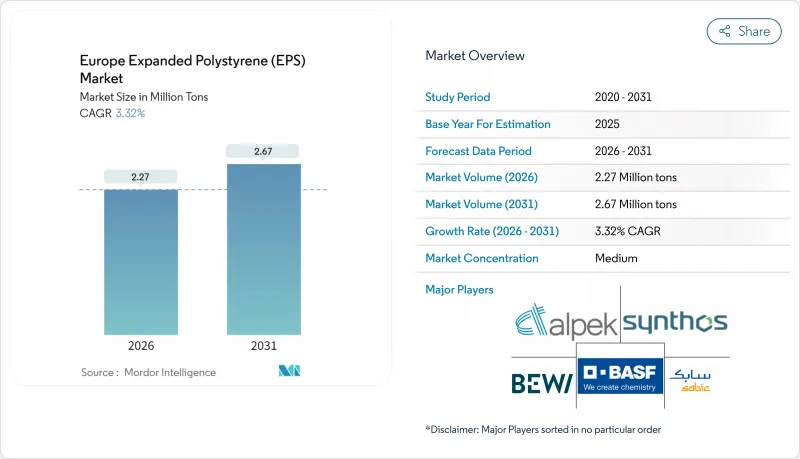

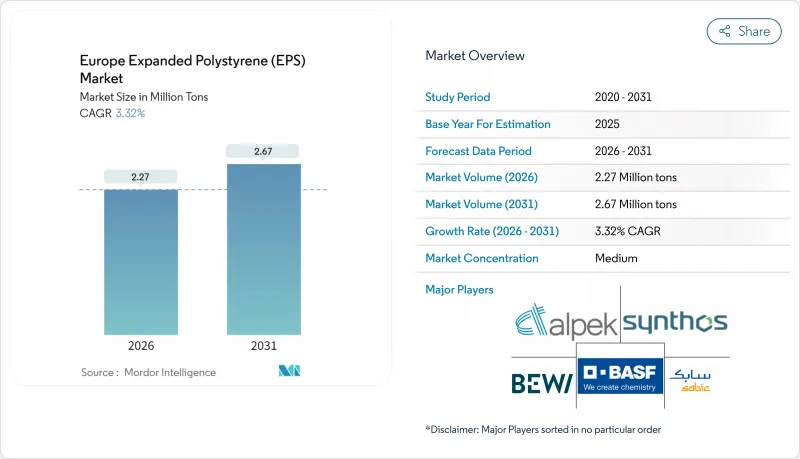

2025年歐洲發泡聚苯乙烯(EPS)市場價值為220萬噸,預計2031年將達到267萬噸,高於2026年的227萬噸。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.32%。

需求主要由建築保溫維修和精密設備的防護包裝驅動,強大的國內供應鏈、不斷提高的回收率以及技術創新帶來的碳排放減少,都增強了產業的韌性。歐盟《建築能源性能指令》(將於2025年生效)等監管因素將強制要求新建和維修建築提高隔熱性能(R值),從而在替代材料佔有率不斷成長的情況下,保持隔熱材料需求的穩定。同時,mRNA生物製劑物流的激增和家用電器生產回流將支撐包裝需求,緩衝苯乙烯價格波動對大宗商品利潤率的影響。然而,歐洲發泡聚苯乙烯市場仍需應對許多挑戰,例如原料價格波動風險增加、人口密集都市區消防安全法規以及客戶對紙基、紙漿基和菌絲基替代品的測試。

歐洲發泡聚苯乙烯(EPS)市場趨勢與洞察

建築能效標準決定了隔熱性能要求。

更嚴格的國家和歐盟能源標準迫使開發商設計更低的牆體、屋頂和地板的U值,提高了隔熱材料厚度要求,並支撐了歐洲市場對EPS保溫解決方案的穩定需求。德國《建築能源法》(Gebaudeenergiegesetz)規定外牆的U值約為0.20 W/(m²K),這通常需要12-16公分厚的EPS隔熱材料。儘管存在基於高度的防火限制,但這仍然有助於發泡聚苯乙烯在德國外牆系統中保持了約40%的市場佔有率。法國和北歐國家也正在擴大類似的性能要求,計劃於2024年實施的修訂版《建築能源性能指令》將透過對2030年及以後新建建築強制執行淨零能耗標準,鎖定長期的隔熱材料需求。歐盟的維修計畫「翻新浪潮」(Renovation Wave)也推動了維修需求的成長,該計畫透過補貼鼓勵住宅選擇更有效率、更經濟的系統。為了應對這一監管趨勢,製造商正在擴大其 Neopor 和石墨增強產品線,以在不進行昂貴的結構改造的情況下提供卓越的絕緣性能(R 值)。

擴大mRNA生物製劑的低溫運輸

mRNA疫苗和先進療法的快速商業化要求從工廠到臨床的運輸溫度保持在2°C至8°C之間。 EPS(聚苯乙烯泡沫塑膠)運輸容器是該領域的主流選擇,因為其閉孔結構能夠為長途和最後一公里配送提供可預測的隔熱和緩衝性能。像Cold Chain Technologies這樣的製造商已在荷蘭布雷達建立了新的歐洲生產基地,專門針對覆蓋歐盟80%核心GDP且位於六小時車程範圍內的藥品分銷網路。歐洲藥典補充11.7的日益嚴格的法規迫使包裝供應商對可萃取物和可浸出物進行檢驗,這使得具有良好合規記錄的現有EPS配方更受青睞。低溫運輸市場盈利豐厚,部分抵銷了苯乙烯價格波動對建築發泡材市場的影響。

原料成本波動會對利潤率造成壓力。

苯乙烯佔EPS現金成本的70%之多,因此盈利極易受到苯和石腦油價格波動的影響。 Trinseo宣布將其2025年1月合約的價格上調55歐元/噸,顯示生產商正試圖捍衛其利潤率。 Versalis將於2025年4月關閉其位於布林迪西的裂解裝置,這將加劇結構性壓力,增加該地區對進口的依賴,並放大運費和外匯風險。原料成本的波動與固定價格的建設合約之間的不匹配正在擠壓轉化裝置的現金流,並給西北歐各地的小規模裝置帶來挑戰。

細分市場分析

歐洲白色發泡聚苯乙烯(EPS)市場佔總消費量的70.86%。白色EPS繼續用於中空牆、樓板式樓板和周邊排水板,在這些應用中,成本仍然是關鍵的選擇標準,並且需要足夠薄的厚度以滿足監管標準。然而,預計黑色和銀色EPS將最快成長,到2031年複合年成長率將達到3.74%。這主要歸功於黑色EPS中含有紅外線反射石墨顆粒,這些顆粒可將導熱係數(λ值)降低至約0.030 W/(m·K)。在外部保溫複合系統中,黑色EPS可以將層厚從16厘米減少到12厘米,同時保持相同的保溫性能(U值),從而實現空間有限的都市區的建築幕牆維修。 BEWI的CIRCULUM產品系列將性能優勢與再生珠粒含量結合,幫助建築師平衡節能和循環經濟的目標。製造商正在投資在線連續發泡回收技術和連續塊狀成型技術,以提高回收成分含量,同時又不影響機械性能。灰色 EPS 在歐洲發泡聚苯乙烯市場被定位為一種可以提高技術和環境價值的產品。

歐洲發泡聚苯乙烯(EPS)市場報告按產品類型(白色EPS、灰色和銀色EPS)、終端用戶產業(建築與施工、電氣與電子、包裝及其他終端用戶產業)和地區(德國、英國、法國、義大利、西班牙、挪威、瑞典、丹麥、芬蘭及其他歐洲地區)進行細分。市場預測以噸為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 到2025年,建築節能標準將要求更高的隔熱性能(R值)。

- 提高基於mRNA的生技藥品的關鍵低溫運輸能力

- 家用電器重返日本市場提振了國內對防護包裝的需求

- 歐盟「維修新浪潮」維修計劃中灰色EPS的應用

- 低成本模組化住宅計劃

- 市場限制

- 苯乙烯單體價格波動與原油價差相關

- 菌絲體和模塑紙漿替代品的商業化。

- 碳定價會加劇石油基聚合物的範圍3排放。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

第5章 市場規模與成長預測

- 依產品類型

- 白色 EPS

- 灰色和銀色 EPS

- 按最終用戶行業分類

- 建築/施工

- 電氣和電子設備

- 包裝

- 其他終端用戶產業(農業和汽車)

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 挪威

- 瑞典

- 丹麥

- 芬蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Alpek SAB de CV

- Austrotherm

- BASF

- BEWi

- Epsilyte LLC

- Ineos

- Kaneka Corporation

- Ravago

- SABIC

- SIBUR International GmbH

- Sunde Group

- Sunpor

- Synthos

- TotalEnergies

- Versalis SpA

第7章 市場機會與未來展望

The Europe Expanded Polystyrene Market was valued at 2.20 million tons in 2025 and estimated to grow from 2.27 million tons in 2026 to reach 2.67 million tons by 2031, at a CAGR of 3.32% during the forecast period (2026-2031).

Demand flows primarily from building insulation upgrades and protective packaging for sensitive goods, while sector resilience is reinforced by robust domestic supply chains, incremental recycling gains, and technology upgrades that lower embodied carbon footprints. Regulatory drivers such as the EU Energy Performance of Buildings Directive, effective from 2025, compel higher R-values across new builds and retrofits, keeping insulation volumes stable even as substitutes gain share. Simultaneously, the surge in mRNA biologic logistics and appliance reshoring sustains packaging volumes, helping buffer commodity segments against margin compression from styrene volatility. Nevertheless, the Europe Expanded Polystyrene market negotiates mounting headline risk tied to feedstock price swings, fire-safety regulations in dense urban cores, and customer trials of paper-, pulp-, and mycelium-based alternatives.

Europe Expanded Polystyrene (EPS) Market Trends and Insights

Building Energy Codes Drive Thermal Performance Requirements

Stricter national and EU-wide energy codes compel developers to design walls, roofs, and floors with lower U-values, lifting insulation thickness requirements and supporting steady volume demand for Europe's Expanded Polystyrene market solutions. Germany's Gebaudeenergiegesetz already specifies exterior wall U-values near 0.20 W/(m2K), which typically necessitates 12-16 cm of EPS, cementing roughly 40% share for the foam in German facade systems despite height-based fire-safety limits. France and the Nordics extend similar performance stipulations, and the 2024 recast of the Energy Performance of Buildings Directive sets a net-zero mandate for new structures from 2030, locking in long-range insulation demand. Retrofit volumes also rise under the EU Renovation Wave, with grants steering homeowners toward thermally efficient yet affordable systems. Producers broaden their Neopor and graphite-enriched lines in this compliance-driven landscape to deliver superior R-values without costly structural modifications.

mRNA Biologics Cold Chain Expansion

Rapid commercialization of mRNA vaccines and advanced therapeutics requires 2 °C-to-8 °C stability from factory to clinic. EPS shippers dominate this lane because the material's closed-cell matrix provides predictable insulation and cushioning over long-haul flights and last-mile parcels. Manufacturers such as Cold Chain Technologies have added European capacity in Breda, Netherlands, specifically to serve pharma corridors reaching 80% of EU GDP centers within a six-hour drive. Regulatory tightening under European Pharmacopoeia Supplement 11.7 pushes packaging suppliers to validate extractables and leachables, favoring incumbent EPS formulations with proven compliance records. The cold-chain opportunity carries premium margins that partially offset styrene spread volatility in commodity construction foam.

Feedstock Cost Volatility Pressures Margins

Styrene accounts for up to 70% of EPS cash costs, making profitability sensitive to benzene-and naphtha swings. January 2025 contract hikes of EUR 55 per ton announced by Trinseo illustrate producer attempts to defend margins. Structural tightness deepens as Versalis shutters its Brindisi cracker in April 2025, widening the region's import dependency and magnifying freight and currency risks. The mismatch between volatile raw-material outlays and fixed-price construction contracts squeezes converter cash flows, challenging smaller plants across Northwest Europe.

Other drivers and restraints analyzed in the detailed report include:

- Appliance Manufacturing Reshoring Momentum

- EU Renovation Wave Accelerates Gray EPS Adoption

- Sustainable Alternatives Gain Market Traction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Europe's Expanded Polystyrene market size for white grades accounted for 70.86% share of overall consumption. White EPS persists in cavity walls, slab-on-grade floors, and perimeter drainage boards where cost remains the critical selector and modest panel thicknesses suffice for code compliance. However, gray and silver grades register the fastest 3.74% CAGR to 2031 as graphite's infrared-reflective particles lower λ-values to around 0.030 W/(m*K). In external thermal insulation composite systems, gray EPS reduces layer thickness from 16 cm to 12 cm for the same U-value, unlocking facade renovation in urban districts with tight lot lines. BEWI's CIRCULUM line couples the performance edge with recycled bead content, helping architects reconcile energy and circularity targets. Producers invest in in-line blowing-agent recovery and continuous block molding to embed more reclaim without sacrificing mechanical properties, positioning gray EPS as a technical and eco-credential upgrade within the Europe Expanded Polystyrene market.

The Europe Expanded Polystyrene (EPS) Market Report is Segmented by Product Type (White EPS, Gray and Silver EPS), End-User Industry (Building and Construction, Electrical and Electronics, Packaging, Other End-User Industries), and Geography (Germany, United Kingdom, France, Italy, Spain, Norway, Sweden, Denmark, Finland, Rest of Europe). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Alpek SAB de CV

- Austrotherm

- BASF

- BEWi

- Epsilyte LLC

- Ineos

- Kaneka Corporation

- Ravago

- SABIC

- SIBUR International GmbH

- Sunde Group

- Sunpor

- Synthos

- TotalEnergies

- Versalis S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Building-energy codes mandating higher R-values from 2025

- 4.2.2 Mandatory cold-chain capacity additions for mRNA-class biologics

- 4.2.3 Re-shoring of appliance production boosting domestic protective packaging

- 4.2.4 Grey-EPS adoption in EU "Renovation Wave" retrofit projects

- 4.2.5 Low-cost modular housing programmes

- 4.3 Market Restraints

- 4.3.1 Styrene monomer price volatility tracking crude-oil spreads

- 4.3.2 Commercialisation of mycelium and moulded-pulp substitutes

- 4.3.3 Carbon-pricing schemes inflating Scope-3 footprints of petro-polymers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Import-Export Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 White EPS

- 5.1.2 Gray and Silver EPS

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Other End-user Industries (Agriculture and Automotive)

- 5.3 By Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Norway

- 5.3.7 Sweden

- 5.3.8 Denmark

- 5.3.9 Finland

- 5.3.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Alpek SAB de CV

- 6.4.2 Austrotherm

- 6.4.3 BASF

- 6.4.4 BEWi

- 6.4.5 Epsilyte LLC

- 6.4.6 Ineos

- 6.4.7 Kaneka Corporation

- 6.4.8 Ravago

- 6.4.9 SABIC

- 6.4.10 SIBUR International GmbH

- 6.4.11 Sunde Group

- 6.4.12 Sunpor

- 6.4.13 Synthos

- 6.4.14 TotalEnergies

- 6.4.15 Versalis S.p.A.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment